PNC to acquire FirstBank for $4.1B, expanding presence in Colorado and Arizona

- PNC Financial Services Group Inc (NYSE:PNC) announced a definitive agreement to acquire Colorado-based FirstBank Holding Company, including its banking subsidiary FirstBank, in a $4.1 billion deal. The acquisition will expand PNC's footprint in Colorado and Arizona, adding to its retail and commercial banking presence in these fast-growing markets.

- 09/08/2025

|

PNC Financial to buy smaller rival FirstBank in $4.1 billion deal

- U.S. bank PNC Financial said on Monday it will buy Colorado-based FirstBank Holding in a $4.1 billion cash-and-stock deal.

- 09/08/2025

|

The market will continue higher, but expect September to be choppy, says PNC's Yung-Yu Ma

- Yung-Yu Ma, PNC Asset Management chief investment strategist, joins 'Money Movers' to discuss his market outlook amid weak job data and tariff uncertainty.

- 09/05/2025

|

The PNC Financial Services Group Announces Third Quarter Conference Call Details

- PITTSBURGH , Sept. 3, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the third quarter 2025 at approximately 6:30 a.m.

- 09/03/2025

|

Top 10 High-Yield Dividend Stocks For September 2025

- My watchlist outperformed SPY and VYM since July 1st, offering higher yield and competitive total returns, despite trailing benchmarks year-to-date. The strategy focuses on high-quality, attractively valued, high-yield stocks, aiming for a long-term CAGR of 12% and strong dividend growth. Since inception, the watchlist achieved a 15.61% CAGR and an 83.5% success rate in positive returns, validating the stock selection process.

- 08/31/2025

|

Large Cap Dividend-Paying Banks Exploding Higher on Rate Cut Hopes

- One very positive item for investors when earnings season rolls around every quarter is that the big money center and investment banks are always among the first to report.

- 08/29/2025

|

PNC Bank Survey Offers Insights, Analysis on Financial Wellness Mindset Among U.S. Workers and Employers

- The survey reveals that benefits built for multigenerational workers can help them prepare for the future they envision. PITTSBURGH , Aug. 27, 2025 /PRNewswire/ -- PNC Bank today released findings from its third annual Financial Wellness in the Workplace Report entitled, "What today's workers value most, across generations," which summarizes survey data and in-depth interviews from more than 1,000 U.S. workers and more than 500 U.S. employers to better understand the financial health and wellness of today's workforce.

- 08/27/2025

|

PNC Executives To Speak At Barclays Global Financial Services Conference

- PITTSBURGH , Aug. 26, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today that Chairman and Chief Executive Officer William S. Demchak and Executive Vice President and Chief Financial Officer Robert Q.

- 08/26/2025

|

Why The PNC Financial Services Group, Inc (PNC) is a Great Dividend Stock Right Now

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group (PNC) have what it takes?

- 08/20/2025

|

PNC Bank Announced as Gold Sponsor for the 2025 National Mutt Strut Benefiting Guardian Angels Medical Service Dogs

- Pittsburgh, PA, Aug. 14, 2025 (GLOBE NEWSWIRE) -- Guardian Angels Medical Service Dogs is proud to announce PNC Bank as the Gold Sponsor of the 2025 National Mutt Strut, a virtual event launching on World Mental Health Day, October 10, 2025, and running through October 22, 2025. This inspiring nationwide initiative raises critical awareness and funds to support Guardian Angels' mission of pairing life-saving service dogs with veterans, first responders, and civilians living with invisible disabilities such as PTSD and trauma.

- 08/14/2025

|

New York AG James sues Zelle parent company for alleged fraud

- New York Attorney General Letitia James sued the parent company of payment network Zelle for allegedly enabling fraud. James alleged that the company knew about ongoing fraud between 2017 and 2023 and did not take actionable steps to resolve it.

- 08/13/2025

|

New York sues Zelle, says security lapses led to 'rampant' consumer fraud

- Zelle was sued on Wednesday by New York Attorney General Letitia James, who said the electronic payment platform's refusal to adopt critical safety features enabled fraudsters to steal more than $1 billion from consumers.

- 08/13/2025

|

NCFL, PNC Grow Up Great Team Up to Pilot Outdoor Learning Program for Families

- Let's Learn Together Outside launches this summer in Kentucky and Alabama; Texas planned next year. LOUISVILLE, Ky.

- 08/13/2025

|

MSCI Forges Strategic Collaboration with PNC Bank to Expand Personalized Wealth Management

- NEW YORK--(BUSINESS WIRE)--MSCI Inc. (NYSE: MSCI) and PNC Bank have entered into a strategic collaboration to provide financial advisors of PNC with access to MSCI Wealth Manager – a fully integrated digital platform with robust analytics, portfolio management tools, institutional-grade research and solutions to help advisors create more personalized experiences for end-investors. From high-net-worth and emerging-affluent individuals to large, sophisticated institutional investors, asset and we.

- 08/13/2025

|

The market will continue to bump past minor disruptions, says PNC's Yung-Yu Ma

- Yung-Yu Ma, PNC Asset Management chief investment strategist, joins 'Money Movers' to discuss the market reaction to the latest round of tariff announcements and his outlook for the Fed and economy.

- 08/07/2025

|

The PNC Financial Services Group, Inc (PNC) Could Be a Great Choice

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group (PNC) have what it takes?

- 08/04/2025

|

These 2 Powerhouse Banks Just Declared Dividend Raises, and You Can Still Take Advantage of 1

- It's a good time to be an investor in U.S. banks. Two months or so after the latest round of the Federal Reserve's (Fed) bank stress tests -- in which 22 prominent lenders in the country were put through their paces to judge how they'd fare in adverse economic circumstances -- several have declared dividends recently (after all, every tested bank passed).

- 08/04/2025

|

Bank of America vs. PNC Financial: Which Bank Stock Has More Upside?

- Bank of America BAC and PNC Financial Services PNC are two prominent U.S. banks with broad national reach. BAC leverages its massive scale and diversified financial services, while PNC is distinguished by its prudent growth strategy and targeted regional expansion.

- 07/29/2025

|

PNC Bank Announces Integration with Oracle Fusion Cloud ERP for Embedded Banking

- Connection Enables PNC PINACLE Connect® Clients to Seamlessly Access Treasury Services Within Market-leading Cloud ERP PITTSBURGH , July 29, 2025 /PRNewswire/ -- PNC Bank today announced the integration of its award-winning embedded banking platform, PINACLE Connect®, with Oracle Fusion Cloud Enterprise Resource Planning (ERP). PNC corporate and commercial banking clients now have seamless connectivity to key banking services directly within Oracle Cloud ERP, helping streamline financial operations and enhance overall efficiency.

- 07/29/2025

|

PNC Financial: Limited Upside In 2025

- PNC Financial delivered decent Q2 results, beating earnings and revenue expectations, with solid loan and deposit growth. Despite recent performance, PNC trades near its historical valuation, limiting upside potential, especially as rate cuts loom. The likely Federal Reserve rate cuts in the second half of the year pose a significant risk to PNC's future net interest income.

- 07/27/2025

|

PNC Reports 5% Revenue Gain in Q2

- PNC Financial Services (PNC -0.01%), one of the largest diversified financial institutions in the United States, released its second quarter 2025 earnings on July 16, 2025. The company reported earnings per share of $3.85, which was above analyst expectations of $3.55.

- 07/23/2025

|

PNC taps Coinbase to create crypto trading offering for bank customers

- PNC Bank is working with cryptocurrency exchange Coinbase to offer crypto trading to the bank's customers, the companies said on Tuesday, in a sign that crypto is moving toward becoming increasingly interconnected to mainstream finance.

- 07/22/2025

|

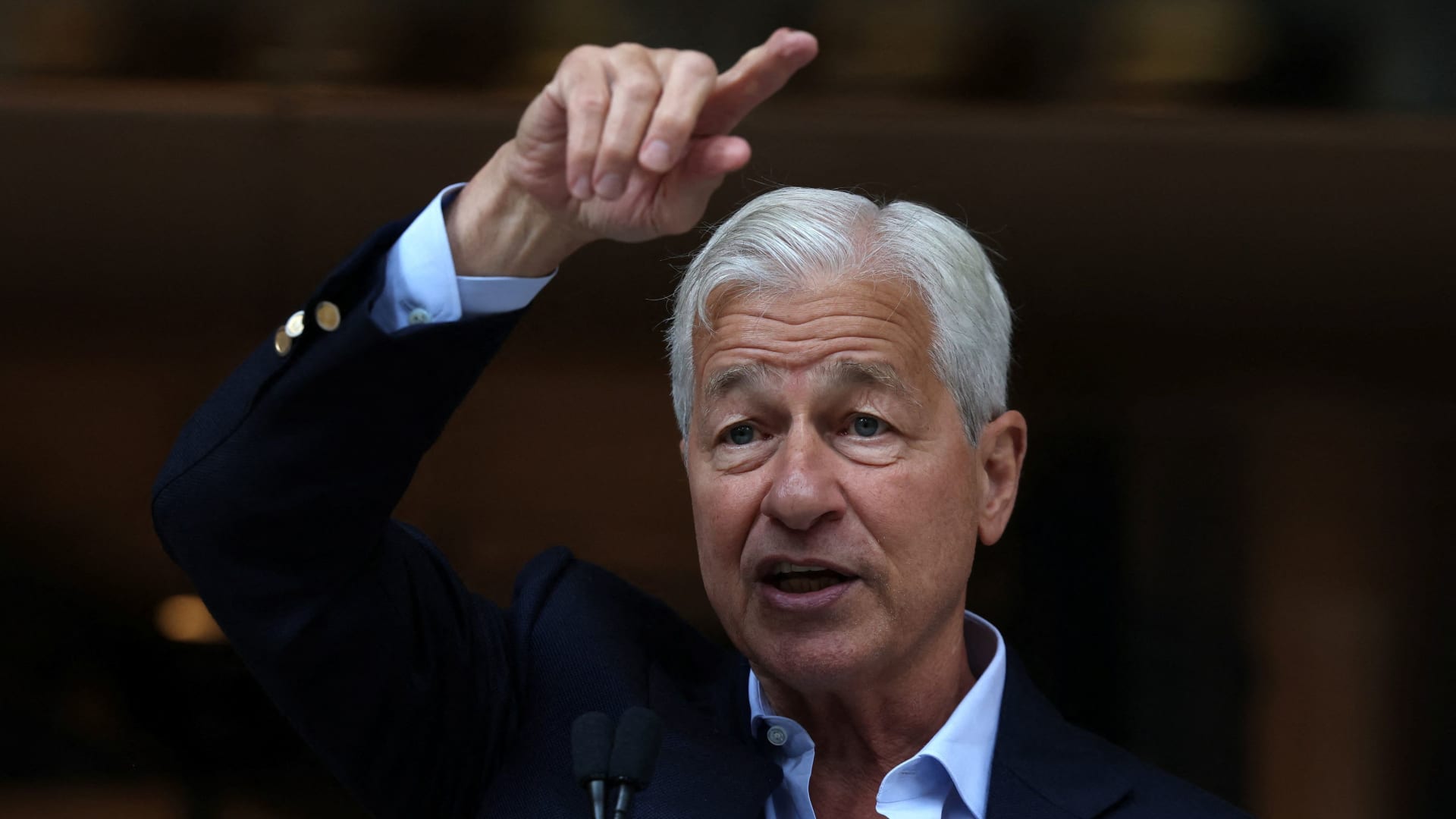

PNC CEO on new partnership with Coinbase

- PNC CEO Bill Demchak said Tuesday that the bank is partnering with Coinbase to enable digital payments, acting as "a wallet, a provider for any coin that any of our clients want to use," without producing its own stablecoin.

- 07/22/2025

|

PNC and Coinbase Partner to Develop Crypto Financial Solutions

- PNC Bank and Coinbase have partnered to develop a solution that will allow the bank's clients to buy, hold and sell cryptocurrencies.

- 07/22/2025

|

PNC CEO on partnership with Coinbase: We'll be a wallet for any coin our clients want to use

- CNBC's Leslie Picker sits down with Bill Demchak, CEO of PNC, to discuss the bank's strategic partnership with Coinbase, how the partnership will be structured, and more.

- 07/22/2025

|

PNC announces strategic partnership with Coinbase

- CNBC's Leslie Picker joins 'Squawk on the Street' with the latest news on PNC's partnership with Coinbase, how banking executives are thinking about stablecoin, and more.

- 07/22/2025

|

PNC Bank, Coinbase Announce Strategic Partnership to Advance Digital Asset Solutions and Expand Banking Services

- PITTSBURGH , July 22, 2025 /PRNewswire/ -- PNC Bank today announced a strategic partnership with Coinbase aimed at expanding access to trusted, secure, and innovative digital asset solutions to PNC's banking clients and institutional investors. PNC will also provide select banking services to Coinbase, reflecting both companies' commitment to a more resilient digital financial system.

- 07/22/2025

|

PNC Financial Vs. U.S. Bancorp: A Dividend Investor's Dilemma

- PNC Financial and U.S. Bancorp are the largest regional banks in the U.S. Both are solid options for dividend growth investors. Both banks reported good Q2 results with stable credit trends. U.S. Bancorp is currently trading at lower valuation multiples, offers a higher total shareholder yield, and has attractive fee income diversification.

- 07/18/2025

|

PNC & AIR are 2 Top Stocks to Watch After Earnings

- In a busy week that included much-anticipated quarterly reports, these standouts among the finance and aerospace sectors shouldn't be overlooked.

- 07/17/2025

|

Are You Looking for a High-Growth Dividend Stock?

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group (PNC) have what it takes?

- 07/17/2025

|

PNC Financial Analysts Increase Their Forecasts After Strong Earnings

- The PNC Financial Services Group, Inc. PNC reported better-than-expected earnings for the second quarter on Wednesday.

- 07/17/2025

|

PNC Financial: Stunning Q2 With Brighter Net Interest Income Outlook (Rating Upgrade)

- I am upgrading PNC Financial from 'hold' to 'buy', due to strong Q2 earnings, robust loan growth, and improved asset quality. PNC raised its net interest income and loan growth guidance for FY 2025, reflecting higher commercial loan utilization and resilient credit quality. Despite shares now being fairly valued after a 30% rally, PNC's fundamentals and capital efficiency justify its current valuation, versus peers.

- 07/17/2025

|

The PNC Financial Services Group, Inc. (PNC) Q2 2025 Earnings Call Transcript

- The PNC Financial Services Group, Inc. (NYSE:PNC ) Q2 2025 Earnings Conference Call July 16, 2025 10:00 AM ET Company Participants Bryan K. Gill - EVP, Director of Investor Relations Robert Q.

- 07/16/2025

|

PNC Financial Q2 Earnings Beat Estimates on NII & Loan Growth

- PNC's Q2 earnings beat estimates, as higher net interest income and loan growth offset weaker fee income and rising credit provisions.

- 07/16/2025

|

PNC Says Growth Markets and ‘Tariff-Related Considerations' Drive Surge in Commercial Loans

- PNC Financial Services Group generated its highest level of new commercial loan production in 10 quarters during the second quarter, PNC Chairman and CEO William S. Demchak said Wednesday (July 16) during the bank's quarterly earnings call.

- 07/16/2025

|

Live: Goldman Sachs (NYSE: GS) & PNC Financial Services (NYSE: PNC) Earnings Coverage

- Live Updates Live Coverage Updates appear automatically as they are published. Goldman Sachs Results Are out 7:54 am by Eric Bleeker Need-to-Know Numbers: Revenue: $14.58 billion (tops estimates of $13.58 billion) EPS: $10.91 (tops estimates of $9.62) Goldman Sachs reported its second quarter 2025 earnings, revealing net revenues of $14.58 billion and net earnings of $3.72 billion. The diluted earnings per share (EPS) for the quarter was $10.91, a notable increase from $8.62 in the same quarter last year, but a decrease from $14.12 in the previous quarter. The firm also announced an increase in its quarterly dividend to $4.00 per common share, effective in the third quarter. The annualized return on average common shareholders’ equity was 12.8% for the quarter. The company’s book value per common share rose by 1.6% during the quarter to $349.74. Despite a slight decline in net revenues compared to the first quarter of 2025, Goldman Sachs showed a strong performance in its Global Banking & Markets division, which saw a 24% increase in net revenues year-over-year. PNC Beats on NII 7:52 am by Eric Bleeker As we highlighted in the prior update, PNC beat on net interest income which is helping fuel its premarket gains. The stock is still up 1.8% in premarket trading. PNC Results 7:50 am by Eric Bleeker PNC Financial Services Group reported a net income of $1.6 billion for Q2 2025, translating to a diluted EPS of $3.85, surpassing the estimated EPS of $3.56. The company experienced a 4% increase in total revenue to $5.7 billion, driven by growth in both noninterest and net interest income. The net interest income rose by 2% to $3.6 billion, supported by loan growth and the repricing of fixed-rate assets. Noninterest income increased by 7% to $2.1 billion, with notable contributions from card and cash management revenue. PNC’s credit quality remained stable, with a provision for credit losses of $254 million. The company also increased its quarterly dividend by 10 cents to $1.70 per share. PNC maintained a strong capital position with a CET1 capital ratio of 10.5%. Still no Goldman Sachs Earnings / PNC Is Up 1.8% Premarket 7:45 am by Eric Bleeker Goldman Sachs has yet to release its earnings but PNC is up 1.8%. The company’s NII came in especially strong which is fueling early gains. How Did Goldman Sachs Perform in Q1? 07/15/2025 7:15 am by Eric Bleeker Here’s a summary of how Goldman Sachs performed in Q1. As we noted below, analysts are expecting $13.581 billion in sales and a normalized EPS of $9.62 this quarter. The Goldman Sachs Group, Inc. Q1’25 Earnings Highlights: • Adj. EPS: $14.12 ; UP +22% YoY • Revenue: $15.06B ; UP +9% YoY • Adj. Gross Margin: 60.6% ; DOWN -30 bps YoY • Net Income: $4.74B ; UP +15% YoY Q1 Segment Performance: • Global Banking & Markets Revenue: $10.71B ; UP +10% YoY • Asset & Wealth Management Revenue: $3.68B ; DOWN -3% YoY • Platform Solutions Revenue: $676M ; DOWN -3% YoY Other Key Q1 Metrics: • Adj. Operating Income: $5.65B ; UP +7% YoY • Adj. Operating Expenses: $9.13B ; UP +5% YoY • Provision for Credit Losses: $287M; DOWN -10% YoY • Effective Tax Rate: 16.1% (vs. 22.4% YoY) • Book Value Per Share: $344.20; UP +2.2% YoY • Common Share Repurchases: 7.1 million shares for $4.36B • Declared Quarterly Dividend Per Common Share: $3.00 • Average Global Core Liquid Assets: $441B CEO Commentary: – David Solomon: “Our strong results this quarter have demonstrated that in times of great uncertainty, clients turn to Goldman Sachs for execution and insight. While we are entering the second quarter with a markedly different operating environment than earlier this year, we remain confident in our ability to continue to support our clients.” Strategic Updates: – The Board approved a share repurchase program authorizing repurchases of up to $40 billion of common stock, reflecting the firm’s commitment to returning capital to shareholders. Earnings season kicked off yesterday with major banks like Wells Fargo (NYSE: WFC) and JPMorgan Chase (NYSE: JPM) reporting. Financial companies are front and center once again this morning. Bank of America (NYSE: BAC), Morgan Stanley (NYSE: MS), and M&T Bank Corporation (NYSE: MTB) are some of the biggest names reporting before the bell. In this live blog, we’ll be analyzing this morning’s earnings release from Goldman Sachs (NYSE: GS) and PNC Financial Services (NYSE: PNC). PNC Financial Services Q2 Expectations Here’s the key figures PNC is expected to post when it reports shortly. All figures are sourced from S&P Capital IQ: Revenue: $5.603 billion EPS (normalized): $3.56 Book Value/Share: $131.19 Net Income (GAAP): $1.423 billion Goldman Sachs Q2 Expectations Revenue: $13.581 billion EPS (normalized): $9.62 Book Value/Share: $348.02 Net Income (GAAP): $3.119 billion Conference Call Times Both Goldman Sachs and PNC Financial Services will host conference calls after their earnings release. Goldman Sachs conference call is expected to begin at about 9:30 a.m. ET. PNC Financial Services conference call is expected to start at 10:00 a.m. ET. The post Live: Goldman Sachs (NYSE: GS) & PNC Financial Services (NYSE: PNC) Earnings Coverage appeared first on 24/7 Wall St..

- 07/16/2025

|

The PNC Financial Services Group (PNC) Reports Q2 Earnings: What Key Metrics Have to Say

- The headline numbers for The PNC Financial Services Group (PNC) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

- 07/16/2025

|

PNC Financial's quarterly profit rises on higher interest income, fees

- U.S. bank PNC Financial reported an 11.2% rise in second-quarter profit on Wednesday, aided by higher interest and fee income.

- 07/16/2025

|

PNC Reports Second Quarter 2025 Net Income of $1.6 Billion, $3.85 Diluted EPS

- Strong loan growth; 4% positive operating leverage; stable credit quality Quarterly common stock dividend increased 10 cents to $1.70 per share on July 3, 2025 PITTSBURGH , July 16, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today reported: For the quarter In millions, except per share data and as noted 2Q25 1Q25 2Q24 Second Quarter Highlights Financial Results Comparisons reflect 2Q25 vs. 1Q25 Net interest income (NII) $ 3,555 $ 3,476 $ 3,302 Income Statement ▪ Generated 4% positive operating leverage; PPNR increased 10% ▪ Revenue increased 4% – NII increased 2%; NIM expanded 2 bps to 2.80% – Fee income increased 3% – Other noninterest income of $212 million ▪ Noninterest expense was stable – Efficiency ratio improved to 60% Balance Sheet ▪ Average loans increased $6.1 billion, or 2%, driven by 4% growth in commercial and industrial loans ▪ Average deposits grew $2.3 billion ▪ Net loan charge-offs were $198 million, or 0.25% annualized to average loans ▪ AOCI improved $0.6 billion to negative $4.7 billion ▪ TBV per share increased 4% to $103.96 ▪ Maintained strong capital position – CET1 capital ratio of 10.5% – Returned $1 billion of capital through common dividends and share repurchases – Strong Federal Reserve stress test results; Stress capital buffer will remain at the regulatory minimum of 2.5% Fee income (non-GAAP) 1,894 1,839 1,777 Other noninterest income 212 137 332 Noninterest income 2,106 1,976 2,109 Revenue 5,661 5,452 5,411 Noninterest expense 3,383 3,387 3,357 Pretax, pre-provision earnings (PPNR) (non-GAAP) 2,278 2,065 2,054 Provision for credit losses 254 219 235 Net income 1,643 1,499 1,477 Per Common Share Diluted earnings per share (EPS) $ 3.85 $ 3.51 $ 3.39 Average diluted common shares outstanding 397 398 400 Book value 131.61 127.98 116.70 Tangible book value (TBV) (non-GAAP) 103.96 100.40 89.12 Balance Sheet & Credit Quality Average loans In billions $ 322.8 $ 316.6 $ 319.9 Average securities In billions 141.9 142.2 141.3 Average deposits In billions 423.0 420.6 417.2 Accumulated other comprehensive income (loss) (AOCI) In billions (4.7) (5.2) (7.4) Net loan charge-offs 198 205 262 Allowance for credit losses to total loans 1.62 % 1.64 % 1.67 % Selected Ratios Return on average common shareholders' equity 12.20 % 11.60 % 12.16 % Return on average assets 1.17 1.09 1.05 Net interest margin (NIM) (non-GAAP) 2.80 2.78 2.60 Noninterest income to total revenue 37 36 39 Efficiency 60 62 62 Effective tax rate 18.8 18.8 18.8 Common equity Tier 1 (CET1) capital ratio 10.5 10.6 10.2 See non-GAAP financial measures in the Consolidated Financial Highlights accompanying this release.

- 07/16/2025

|

Rise in NII & Fee Income to Aid PNC Financial's Q2 Earnings

- PNC's second-quarter results are likely to reflect the benefits of a rise in net interest income and fee revenues, offsetting expense pressure.

- 07/11/2025

|

PNC Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

- The PNC Financial Services Group, Inc. PNC will release earnings results for the second quarter, before the opening bell on Wednesday, July 16.

- 07/11/2025

|

The PNC Financial Services Group (PNC) Q2 Earnings Preview: What You Should Know Beyond the Headline Estimates

- Besides Wall Street's top-and-bottom-line estimates for The PNC Financial Services Group (PNC), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended June 2025.

- 07/11/2025

|

PNC Launches New Digital Direct Deposit: A Move to Boost Fee Income?

- Can PNC Financial's new mobile direct deposit feature boost fee income and strengthen customer relationships? Read on to explore more.

- 07/09/2025

|

The PNC Financial Services Group, Inc (PNC) Earnings Expected to Grow: Should You Buy?

- The PNC Financial Services Group (PNC) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

- 07/09/2025

|

PNC Bank Introduces New Digital Direct Deposit Manager

- New PNC Mobile App functionality provides seamless client experience to manage direct deposit preferences PITTSBURGH , July 8, 2025 /PRNewswire/ -- PNC Bank today announced the launch of a new feature, PNC Direct Deposit, that provides clients with the ability to easily set up direct deposits for payroll, Social Security payments or other regular income, directly from the PNC Mobile app. "This integrated direct deposit solution is just another example of how PNC is continuously enhancing and improving the client experience," said Alex Overstrom, head of Retail Banking.

- 07/08/2025

|

PNC Financial Rewards Shareholders With a 6% Dividend Hike

- PNC hikes its quarterly dividend by 6% to $1.70 per share after clearing the Fed's 2025 stress test with strong capital ratios.

- 07/07/2025

|

Why The PNC Financial Services Group (PNC) is Poised to Beat Earnings Estimates Again

- The PNC Financial Services Group (PNC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

- 07/03/2025

|

PNC Raises Common Stock Dividend To $1.70 Per Share

- PITTSBURGH , July 3, 2025 /PRNewswire/ -- The board of directors of The PNC Financial Services Group, Inc. (NYSE: PNC) declared a quarterly cash dividend on the common stock of $1.70 per share, an increase of $0.10 cents per share, or 6%, from the second quarter dividend of $1.60 per share. The dividend will be payable Aug. 5, 2025, to shareholders of record at the close of business July 15, 2025.

- 07/03/2025

|

Tariffs are unlikely to cause as much consumer disruption as feared, says PNC's Yung-Yu Ma

- Yung-Yu Ma, PNC Asset Management chief investment strategist, joins 'Money Movers' to discuss his market outlook, Trump's recent announcement of a trade deal with Vietnam and

- 07/02/2025

|

PNC Announces Stress Capital Buffer (SCB) and Planned Capital Actions

- PITTSBURGH , July 1, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) last week received the results of the Federal Reserve's 2025 Comprehensive Capital Analysis and Review (CCAR). The Federal Reserve's CCAR disclosure included its estimate of PNC's minimum capital ratios for the period from the first quarter of 2025 through the first quarter of 2027 under the hypothetical Supervisory Severely Adverse scenario.

- 07/01/2025

|

Top 10 High-Yield Dividend Stocks For July 2025

- My July 2025 watchlist focuses on high-yield, attractively valued stocks, aiming for a 12% long-term CAGR and outperforming benchmarks. Since its inception, my watchlist has a CAGR of 15.11%, performing in-line with SPY and VYM, while providing a superior dividend yield. The June 2025 watchlist includes 10 stocks with an average forward dividend yield of 3.54% and an expected return of 13.62%.

- 07/01/2025

|

PNC Multifamily Capital Announces $208 Million Affordable Housing Fund, Increasing Access to Affordable Housing Across the U.S.

- PITTSBURGH , June 18, 2025 /PRNewswire/ -- PNC Bank, N.A., a tax credit syndication leader, today announced the closing of Low-Income Housing Tax Credit (LIHTC) Fund 98, which is investing more than $208 million in the development and rehabilitation of affordable rental housing across the U.S. The fund includes investments from PNC and seven other financial services and insurance companies, including two investors that are new to PNC's LIHTC funds.

- 06/18/2025

|

TFC vs. PNC: Which Regional Bank is Poised for More Growth?

- PNC leans into growth with new branches and acquisitions, while Truist makes efforts to enhance non-interest revenue sources.

- 06/17/2025

|

PNC Financial: Long-Term Investors Should Wait For A Pullback

- PNC Financial boasts strong geographic and business diversification versus peers, but near-term growth prospects remain muted. Sizable exposure to commercial real estate, especially office loans, poses ongoing risks despite recent improvements in asset quality. Profitability and capital ratios are acceptable but not industry-leading; dividend growth is expected to be modest going forward.

- 06/12/2025

|

The PNC Financial Services Group, Inc. (PNC) Presents at Morgan Stanley US Financials, Payments & CRE Conference (Transcript)

- The PNC Financial Services Group, Inc. (NYSE:PNC ) Morgan Stanley US Financials, Payments & CRE Conference June 11, 2025 1:45 PM ET Company Participants Robert Q. Reilly - EVP, CFO & Director William S.

- 06/11/2025

|

PNC Bank Launches PNC Mobile Accept®, A New Pay-As-You-Go Payment Processing Solution for Micro Businesses

- New solution enables small businesses to securely accept card payments via the PNC Mobile Banking App PITTSBURGH , June 11, 2025 /PRNewswire/ -- PNC Bank today announced the launch of PNC Mobile Accept® , a fully integrated payment solution that provides its micro business clients with the ability to accept in-person credit and debit card payments directly within the PNC Mobile app. Designed for businesses processing less than $300,000 in credit and debit card transactions annually, PNC Mobile Accept is a self-service solution that gives business owners fast, secure access to accept funds directly from their phone or tablet with no monthly fee.

- 06/11/2025

|

Profound Medical (NASDAQ:PROF) Shares Up 17.4% – What’s Next?

- Profound Medical Corp. (NASDAQ:PROF – Get Free Report) shares shot up 17.4% during mid-day trading on Tuesday . The stock traded as high as $6.90 and last traded at $6.75. 139,248 shares traded hands during trading, an increase of 117% from the average session volume of 64,191 shares. The stock had previously closed at $5.75. Analyst Upgrades and Downgrades Several brokerages have recently issued reports on PROF. Raymond James cut shares of Profound Medical from a “strong-buy” rating to a “moderate buy” rating in a research report on Friday, May 9th. Lake Street Capital reduced their price target on shares of Profound Medical from $17.00 to $11.00 and set a “buy” rating on the stock in a research report on Wednesday, April 23rd. Read Our Latest Stock Analysis on PROF Profound Medical Price Performance The firm has a market cap of $202.86 million, a price-to-earnings ratio of -5.04 and a beta of 0.48. The company has a quick ratio of 5.16, a current ratio of 6.12 and a debt-to-equity ratio of 0.11. The company’s 50-day moving average price is $4.95 and its 200-day moving average price is $6.33. Profound Medical (NASDAQ:PROF – Get Free Report) last issued its earnings results on Thursday, May 8th. The company reported ($0.36) earnings per share for the quarter, missing the consensus estimate of ($0.29) by ($0.07). The firm had revenue of $2.62 million during the quarter, compared to analyst estimates of $4.78 million. Profound Medical had a negative net margin of 349.41% and a negative return on equity of 85.22%. On average, equities research analysts forecast that Profound Medical Corp. will post -1.12 EPS for the current year. Insider Activity at Profound Medical In other news, CEO Arun Swarup Menawat bought 10,003 shares of Profound Medical stock in a transaction that occurred on Thursday, May 15th. The shares were purchased at an average price of $4.33 per share, with a total value of $43,312.99. Following the completion of the acquisition, the chief executive officer now directly owns 575,062 shares in the company, valued at $2,490,018.46. The trade was a 1.77% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. 1.52% of the stock is owned by corporate insiders. Hedge Funds Weigh In On Profound Medical Several hedge funds have recently added to or reduced their stakes in PROF. PNC Financial Services Group Inc. purchased a new position in Profound Medical in the first quarter valued at approximately $64,000. XTX Topco Ltd purchased a new position in Profound Medical in the fourth quarter valued at approximately $114,000. MTM Investment Management LLC increased its stake in Profound Medical by 10.4% in the fourth quarter. MTM Investment Management LLC now owns 18,575 shares of the company’s stock valued at $139,000 after purchasing an additional 1,750 shares during the last quarter. Marshall Wace LLP increased its stake in Profound Medical by 201.6% in the fourth quarter. Marshall Wace LLP now owns 36,216 shares of the company’s stock valued at $272,000 after purchasing an additional 24,208 shares during the last quarter. Finally, Northwest & Ethical Investments L.P. increased its stake in Profound Medical by 94.9% in the fourth quarter. Northwest & Ethical Investments L.P. now owns 46,200 shares of the company’s stock valued at $346,000 after purchasing an additional 22,500 shares during the last quarter. 47.86% of the stock is currently owned by hedge funds and other institutional investors. Profound Medical Company Profile (Get Free Report) Profound Medical Corp., together with its subsidiaries, operates as a commercial-stage medical device company that develops and markets incision-free therapeutic systems for the image guided ablation of diseased tissue in Canada, Germany, the United States, and Finland. Its lead product TULSA-PRO system combines magnetic resonance imaging(MRI), robotically-driven transurethral sweeping action/thermal ultrasound and closed-loop temperature feedback control to provide precise, flexible, and durable ablation of a surgeon defined region of prostate and protect the urethra and rectum. See Also Five stocks we like better than Profound Medical How to trade using analyst ratings AppLovin Dips on S&P 500 Snub, Morgan Stanley Lifts Target Anyway How to Use the MarketBeat Dividend Calculator Casey’s Surges on Strong Q4, More Gains Likely Ahead Retail Stocks Investing, Explained Government Mandate Sends eVTOL Stocks Flying

- 06/11/2025

|

3 Passive 'SWAN' Stocks (Hint: They're Not REITs)

- Buying and holding companies that provide reliable streams of passive income can help an investor stay one step ahead of bills. In today's article, I'll highlight a major midstream player, an electric and gas utility, and a super-regional bank/financial services company. Relative to my fair value estimates, the stocks vary from 9% to 16% discounted.

- 06/06/2025

|

PNC Announces Redemption of 5.812% Fixed Rate/Floating Rate Senior Notes Due June 12, 2026

- PITTSBURGH , June 4, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today announced the redemption of, on June 12, 2025, all outstanding 5.812% Fixed Rate/Floating Rate Senior Notes due June 12, 2026, issued by PNC in the amount of $1,000,000,000 (CUSIP 693475 BQ7). The securities have an original scheduled maturity date of June 12, 2026.

- 06/04/2025

|

PNC Financial Gains 17% in a Year: How to Approach the Stock Now?

- PNC stock moves up 17% in a year, but rising expenses and rate pressure are concerning. Read on to know if it is the right time to buy.

- 06/03/2025

|

The PNC Financial Services Group Announces Second Quarter Conference Call Details

- PITTSBURGH , June 3, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the second quarter 2025 at approximately 6:30 a.m. (ET), Wednesday, July 16, 2025, as previously announced.

- 06/03/2025

|

Top 10 High-Yield Dividend Stocks

- The liberation day market selloff has been entirely recovered during the month of May. Since inception, my watchlist has a CAGR of 14.81%, performing in-line with SPY and VYM, while providing a superior dividend yield. The June 2025 watchlist includes 10 stocks with an average forward dividend yield of 3.62% and an expected return of 13.63%.

- 06/01/2025

|

PNC Executives to Speak at Morgan Stanley US Financials Investor Conference

- PITTSBURGH , May 28, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today that Chairman and Chief Executive Officer William S. Demchak and Executive Vice President and Chief Financial Officer Robert Q.

- 05/28/2025

|

PNC Financial: Still Cheap After The Recent Rally

- PNC is a buy due to its strong fundamentals, improving external environment, and attractive valuation relative to historical averages and return on equity. Recent earnings showed resilient net interest margins and stable asset quality, despite minor declines in deposits and loans from select segments. Management's guidance remains confident, expecting stable loan growth, modest deposit increases, and expanding net interest income as rate cuts lower funding costs.

- 05/22/2025

|

The PNC Financial Services Group Provides Quarterly 2026 Earnings Release Dates

- PITTSBURGH , May 22, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today it expects to issue 2026 quarterly earnings releases pre-market open and hold conference calls at 10 a.m. (ET) on the following dates: First Quarter – Wednesday, April 15, 2026 Second Quarter – Wednesday, July 15, 2026 Third Quarter –Thursday, October 15, 2026 Fourth Quarter – Friday, January 15, 2027 A link to the live audio webcast, presentation slides, earnings release and supplementary financial information will be made available at www.pnc.com/investorevents, and dial-in information will be provided at a later date.

- 05/22/2025

|

Wells Fargo Vs PNC Financial: Which Stock Has More Upside in 2025?

- WFC and PNC are making efforts to grow strategically. Read on to know which has more upside potential in 2025.

- 05/21/2025

|

PNC Financial's Arm Enters Deal to Acquire Aqueduct Capital Group

- PNC's subsidiary enters an agreement to acquire Aqueduct Capital Group, which will enhance the former's primary fund placement capabilities.

- 05/21/2025

|

PNC to Expand Primary Fund Placement Capabilities With Aqueduct Acquisition

- PNC Bank plans to acquire Aqueduct Capital Group to enhance the primary fund placement capabilities of PNC subsidiary Harris Williams. The bank has entered into a definitive agreement for the acquisition, and the transaction is expected to close in midsummer, subject to customary closing conditions, PNC Bank said in a Tuesday (May 20) press release.

- 05/20/2025

|

PNC Bank Agrees to Acquire Aqueduct Capital Group to Complement Harris Williams Capabilities

- Transaction furthers collective value proposition in primary fund placement PITTSBURGH , May 20, 2025 /PRNewswire/ -- PNC Bank today announced entry into a definitive agreement to acquire Aqueduct Capital Group, a placement agent focused on raising capital for private equity, private credit and real asset managers through its broad access to sophisticated, global pools of capital. Founded in 2003, Aqueduct has built a strong reputation advising its clients on a variety of fundraising solutions.

- 05/20/2025

|

PNC Bank Introduces PNC Spend Wise℠, A No Annual Fee Credit Card Offering A Purchase APR Reduction to Encourage Responsible Credit Habits

- New card incentivizes good financial practice via a suite of competitive features PITTSBURGH , May 12, 2025 /PRNewswire/ -- PNC Bank announced today the launch of its latest credit card, PNC Spend Wise℠ Visa® , designed to reward clients' responsible and healthy financial habits. This unique credit card is built to encourage responsible financial management through its associated purchase APR reduction program for eligible cardholders who meet timely payment and spend requirements.

- 05/12/2025

|

5 Relatively Secure And Cheap Dividend Stocks, Yields Up To 9% (May 2025)

- This article is part of our monthly series where we highlight five large-cap, relatively safe, dividend-paying companies offering significant discounts to their historical norms. We go over our filtering process to select just five conservative DGI stocks from more than 7,500 companies that are traded on U.S. exchanges, including OTC networks. In addition to the primary list that yields about 3.74%, we present two other groups of five DGI stocks each, from moderate to high yields of up to 9%.

- 05/03/2025

|

Top 10 High-Yield Dividend Stocks To Consider In May 2025

- Q2 2025 began with market volatility due to tariff announcements, resulting in SPY losing 0.87% and VYM declining by 3.54%. Since inception, my watchlist has a CAGR of 14.61%, outperforming SPY and VYM, and providing higher yields. The May 2025 watchlist includes 10 stocks with an average forward dividend yield of 3.59% and an expected return of 14.78%.

- 05/01/2025

|

Big Financial Companies That Pay Dependable High-Yield Dividends Can Survive Tariffs

- President Trump has set the stage for the beginning of the end of the world, taking advantage of unlimited largess from the United States, a practice that began after World War II and has been in place ever since.

- 04/30/2025

|

Bank of America Bullish on Blue-Chip Dividend Banks: 4 Strong Buy Stock Picks

- One very positive item for investors when earnings season rolls around every quarter is that the big money center and investment banks are always among the first to report.

- 04/28/2025

|

PNC Financial Q1: 2025 Guidance Reaffirmed; Stock Undervalued

- PNC Financial reported Q1 earnings with a slight revenue miss but a 12-cent EPS beat, showing 13.2% YoY growth despite a -6.9% QoQ decline. Management reaffirmed guidance for modest loan growth and net interest income increase but flagged potential tariff impacts on non-interest income. PNC's stock is undervalued, trading at 1.4x price-to-tangible book value, with a 4.20% dividend yield.

- 04/19/2025

|

PNC Leverages Technology to Help Clients Manage Uncertainty

- PNC Financial Services Group is leveraging technology and its other strengths as it helps clients manage the uncertainty caused by tariffs, executives said Tuesday (April 15) during the bank's quarterly earnings call.

- 04/15/2025

|

The PNC Financial Services Group, Inc. (PNC) Q1 2025 Earnings Call Transcript

- The PNC Financial Services Group, Inc. (NYSE:PNC ) Q1 2025 Earnings Conference Call April 15, 2025 10:00 AM ET Company Participants Bryan Gill - EVP and Director of IR Bill Demchak - Chairman and CEO Rob Reilly - EVP and CFO Conference Call Participants John Pancari - Evercore Bill Carcache - Wolfe Research Betsy Graseck - Morgan Stanley Scott Siefers - Piper Sandler Ebrahim Poonawala - Bank of America Mike Mayo - Wells Fargo Ken Usdin - Autonomous Research Erika Najarian - UBS Gerard Cassidy - RBC Capital Markets John McDonald - Truist Securities Matt O'Connor - Deutsche Bank Operator Greetings, and welcome to The PNC Financial Services Group First Quarter 2025 Earnings Conference Call. At this time all participants are in a listen-only mode.

- 04/15/2025

|

PNC Financial Q1 Earnings Top Estimates on Rise in NII & Fee Income

- PNC's first-quarter 2025 results reflect a rise in fee income and NII. Yet, increased expenses act as headwinds.

- 04/15/2025

|

The PNC Financial Services Group (PNC) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

- While the top- and bottom-line numbers for The PNC Financial Services Group (PNC) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

- 04/15/2025

|

The PNC Financial Services Group, Inc (PNC) Surpasses Q1 Earnings and Revenue Estimates

- The PNC Financial Services Group, Inc (PNC) came out with quarterly earnings of $3.51 per share, beating the Zacks Consensus Estimate of $3.40 per share. This compares to earnings of $3.36 per share a year ago.

- 04/15/2025

|

PNC Financial first-quarter profit rises on higher interest income

- U.S. bank PNC Financial reported a rise in first-quarter profit on Tuesday, helped by a boost in interest income.

- 04/15/2025

|

PNC Reports First Quarter 2025 Net Income of $1.5 Billion, $3.51 Diluted EPS

- Expanded NIM; increased capital and TBV; maintained solid credit quality metrics PITTSBURGH , April 15, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today reported: For the quarter In millions, except per share data and as noted 1Q25 4Q24 1Q24 First Quarter Highlights Financial Results Comparisons reflect 1Q25 vs. 4Q24 Net interest income $ 3,476 $ 3,523 $ 3,264 Income Statement ▪ Net interest income decreased 1% driven by two fewer days in the quarter, partially offset by the benefit of lower funding costs and fixed rate asset repricing – NIM expanded 3 bps to 2.78% ▪ Fee income decreased 2% due to a slowdown in capital markets activity and seasonality ▪ Other noninterest income of $137 million included negative $40 million of Visa derivative adjustments ▪ Noninterest expense decreased 3% as a result of 4Q24 asset impairments and seasonality Balance Sheet ▪ Average loans decreased $2.4 billion, or 1% – Spot loans increased $2.4 billion, reflecting $4.7 billion, or 3%, growth in commercial and industrial loans ▪ Average deposits decreased $4.6 billion, or 1% ▪ Net loan charge-offs were $205 million, or 0.26% annualized to average loans ▪ AOCI improved $1.3 billion to negative $5.2 billion reflecting the movement of interest rates ▪ TBV per share increased 5% to $100.40 ▪ Maintained strong capital position – CET1 capital ratio of 10.6% – Repurchased approximately $200 million of common shares Fee income (non-GAAP) 1,839 1,869 1,746 Other noninterest income 137 175 135 Noninterest income 1,976 2,044 1,881 Revenue 5,452 5,567 5,145 Noninterest expense 3,387 3,506 3,334 Pretax, pre-provision earnings (non-GAAP) 2,065 2,061 1,811 Provision for credit losses 219 156 155 Net income 1,499 1,627 1,344 Per Common Share Diluted earnings per share (EPS) $ 3.51 $ 3.77 $ 3.10 Average diluted common shares outstanding 398 399 400 Book value 127.98 122.94 113.30 Tangible book value (TBV) (non-GAAP) 100.40 95.33 85.70 Balance Sheet & Credit Quality Average loans In billions $ 316.6 $ 319.1 $ 320.6 Average securities In billions 142.2 143.9 135.4 Average deposits In billions 420.6 425.3 420.2 Accumulated other comprehensive income (loss) (AOCI) In billions (5.2) (6.6) (8.0) Net loan charge-offs 205 250 243 Allowance for credit losses to total loans 1.64 % 1.64 % 1.68 % Selected Ratios Return on average common shareholders' equity 11.60 % 12.38 % 11.39 % Return on average assets 1.09 1.14 0.97 Net interest margin (NIM) (non-GAAP) 2.78 2.75 2.57 Noninterest income to total revenue 36 37 37 Efficiency 62 63 65 Effective tax rate 18.8 14.6 18.8 Common equity Tier 1 (CET1) capital ratio 10.6 10.5 10.1 See non-GAAP financial measures in the Consolidated Financial Highlights accompanying this release.

- 04/15/2025

|

Regional bank reporting will be better reflection of economic uncertainty: RBC's Gerard Cassidy

- Gerard Cassidy, RBC Capital Markets Managing Director, joins 'Closing Bell Overtime' to talk quarterly banking results.

- 04/11/2025

|

Lower NII and Fee Income to Hurt PNC Financial's Q1 Earnings

- A decline in NII and fee income and a rise in provisions are expected to have hurt PNC's Q1 earnings.

- 04/10/2025

|

What Analyst Projections for Key Metrics Reveal About The PNC Financial Services Group (PNC) Q1 Earnings

- Evaluate the expected performance of The PNC Financial Services Group (PNC) for the quarter ended March 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

- 04/10/2025

|

PNC Financial names former BlackRock executive as president

- PNC Financial Services Group on Monday appointed former BlackRock executive Mark Wiedman as president, effective immediately.

- 04/07/2025

|

Mark Wiedman Joins PNC As President

- Finance Executive to Accelerate Growth and Extend Strong Leadership Team PITTSBURGH , April 7, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today announced that its Board of Directors has unanimously appointed Mark Wiedman as president of the corporation and its wholly owned banking subsidiary, PNC Bank, National Association, effective immediately. Wiedman will report to PNC Chairman and Chief Executive Officer William S.

- 04/07/2025

|

PNC Taps Ex-BlackRock Star Mark Wiedman as President

- Once an heir apparent for Larry Fink, Wiedman now tops the list of potential successors to PNC CEO Bill Demchak.

- 04/07/2025

|

Why The PNC Financial Services Group (PNC) Could Beat Earnings Estimates Again

- The PNC Financial Services Group (PNC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

- 04/03/2025

|

PNC Declares Dividend of $1.60 on Common Stock

- PITTSBURGH , April 3, 2025 /PRNewswire/ -- The board of directors of The PNC Financial Services Group, Inc. (NYSE: PNC) declared a quarterly cash dividend on the common stock of $1.60 per share. The dividend will be payable May 5, 2025, to shareholders of record at the close of business April 16, 2025.

- 04/03/2025

|

My Top 10 High-Yield Dividend Stocks For April 2025

- Q1 2025 ended negatively for SPY and VYM, but my watchlist outperformed, limiting losses to 1.38% and achieving a YTD gain of 1.89%. Since inception, my watchlist has a CAGR of 15.83%, outperforming SPY and VYM, and providing higher yields. The April 2025 watchlist includes 10 stocks with an average forward dividend yield of 3.48% and an expected return of 15.43%.

- 04/01/2025

|

Why The PNC Financial Services Group, Inc (PNC) is a Great Dividend Stock Right Now

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group, Inc (PNC) have what it takes?

- 03/27/2025

|

PNC Financial: A Smart Deposit After 21% Drop

- PNC Financial Services is slightly less efficient than peers, but its stock has dropped 20%+ since November, presenting a potential value opportunity. Strengths include corporate banking operations and deposit stability, but PNC lacks clear growth catalysts beyond branch expansion. Valuation metrics suggest PNC is favorably priced, with a 27% margin of safety based on Wall Street's consensus price target.

- 03/15/2025

|

Why The PNC Financial Services Group, Inc (PNC) is a Top Dividend Stock for Your Portfolio

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group, Inc (PNC) have what it takes?

- 03/11/2025

|

Down -11.58% in 4 Weeks, Here's Why The PNC Financial Services Group (PNC) Looks Ripe for a Turnaround

- The heavy selling pressure might have exhausted for The PNC Financial Services Group (PNC) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

- 03/07/2025

|

Down -9.26% in 4 Weeks, Here's Why The PNC Financial Services Group (PNC) Looks Ripe for a Turnaround

- The PNC Financial Services Group (PNC) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

- 03/06/2025

|

The PNC Financial Services Group Announces First Quarter 2025 Earnings Conference Call, Virtual-Only Annual Shareholders Meeting Details

- PITTSBURGH , March 4, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the first quarter of 2025 at approximately 6:30 a.m. (ET), Tuesday, April 15, as previously announced.

- 03/04/2025

|

Business Owners Optimistic on National and Local Economy

- 78% of small and mid-sized business owners are optimistic about prospects for their own business, near the 23-year survey high mark of 79% recorded a year ago. Half of owners are optimistic about the national economy, just under the survey-high level of 56% recorded last fall.

- 03/03/2025

|

My Top 10 High-Yield Dividend Stocks For March 2025

- SPY stumbles in February, erasing some of its year-to-date gains. VYM is running strong and extends its lead over SPY in 2025. The top 10 stocks on the watchlist for March 2025 offer a 3.56% dividend yield, nearly triple that of the S&P 500. My top 10 list of high dividend yield stocks has generated an annualized rate of return of 16.53% since its inception in November 2020.

- 03/03/2025

|

PNC vs. TW: Which Stock Should Value Investors Buy Now?

- Investors looking for stocks in the Financial - Investment Bank sector might want to consider either The PNC Financial Services Group, Inc (PNC) or Tradeweb Markets (TW). But which of these two stocks presents investors with the better value opportunity right now?

- 02/24/2025

|

Here's Why You Should Add PNC Financial to Your Portfolio Now

- PNC's strong liquidity position, strategic initiatives and solid growth trajectory look encouraging.

- 02/20/2025

|

The PNC Financial Services Group, Inc (PNC) Could Be a Great Choice

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group, Inc (PNC) have what it takes?

- 02/20/2025

|

My Top 10 High Dividend Yield Stocks For February 2025: Two Yield Over 7%

- Implementing a high dividend yield strategy can provide substantial income and stability during market volatility, supporting long-term investment goals without selling during declines. The selected 10 companies offer Dividend Yields [FWD] between 3.22% and 8.06%, with attractive Dividend Growth Rates and appealing valuations, enhancing portfolio sustainability. Each company exhibits a P/E [FWD] Ratio below 20, which reflects their attractive valuation.

- 02/13/2025

|

Big bank CEOs to meet with lawmakers on solutions to debanking

- A group of CEOs from leading U.S. banks are meeting with the Senate Banking Committee to discuss potential solutions to regulatory issues related to debanking decisions.

- 02/13/2025

|

PNC or TW: Which Is the Better Value Stock Right Now?

- Investors interested in stocks from the Financial - Investment Bank sector have probably already heard of The PNC Financial Services Group, Inc (PNC) and Tradeweb Markets (TW). But which of these two stocks presents investors with the better value opportunity right now?

- 02/07/2025

|

PNC Appoints Douglas Dachille to Board of Directors

- PITTSBURGH , Feb. 3, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) appointed Douglas Dachille to its board of directors effective today. He has also been appointed to the board's risk committee.

- 02/03/2025

|

Are You Looking for a High-Growth Dividend Stock?

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group, Inc (PNC) have what it takes?

- 02/03/2025

|

My Top 10 High-Yield Dividend Stocks For February 2025

- SPY kicks off 2025 with a gain of 2.67% in January. VYM is off to an even better start with a gain of 3.75%. The top 10 stocks on the watchlist for February 2025 offer a 3.43% dividend yield, nearly triple that of the S&P 500. My top 10 list of high dividend yield stocks has generated an annualized rate of return of 15.95% since its inception in November 2020.

- 02/03/2025

|

Steven Cress' Top 10 Dividend Stocks For 2025

- Steven Cress talks to Kim Khan about his top dividend stocks for the year. Diversification and strong fundamentals are key strategies for investors.

- 01/29/2025

|

PNC Executive to Speak at UBS Financial Services Conference

- PITTSBURGH , Jan. 28, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today that Executive Vice President and Chief Financial Officer Robert Q. Reilly will discuss business performance and strategy at 11:20 a.m.

- 01/28/2025

|

PNC Looks Good Now, And Loan Growth Reacceleration Would Make It Even Better

- Despite some weaknesses in loan growth and deposit performance, PNC's Q4 results were among the best of its peers, with impressive net interest income and margin improvements. PNC's growth outlook is robust, with management expecting stable loan balances and significant net interest income growth, driven by controlled deposit costs and strategic market expansion. PNC is a conservatively-run commercial-focused bank with solid earnings growth, low downside risk, and a strong management team, with less of its upside tied to rebounding from prior underperformance.

- 01/25/2025

|

President Michael P. Lyons to Depart PNC

- Will Assume President & CEO-Elect Role at Fiserv PITTSBURGH , Jan. 23, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today that President Michael P. Lyons is departing PNC to assume the President & CEO-Elect role at Fiserv.

- 01/23/2025

|

PNC vs. TW: Which Stock Is the Better Value Option?

- Investors interested in stocks from the Financial - Investment Bank sector have probably already heard of The PNC Financial Services Group, Inc (PNC) and Tradeweb Markets (TW). But which of these two stocks presents investors with the better value opportunity right now?

- 01/22/2025

|

PNC Financial: Likely Fairly Valued Now

- PNC Financial reported strong Q4 earnings, with a 4% Y/Y increase in net interest income and an 84% surge in profitability. The absence of FDIC assessment fees and lower credit provisions contributed significantly to PNC Financial's improved earnings and balance sheet quality. PNC Financial's FY 2025 guidance projects a 6-7% growth in net interest income, reflecting continued strength in its core lending business.

- 01/21/2025

|

PNC Financial Positioned For Strong Loan Expansion And Yield Curve Benefits, Analyst Predicts Net Interest Income Growth Through 2026

- PNC Financial Services Group PNC reported fourth-quarter results last week. Revenue increased 4% year-over-year to $5.57 billion, beating the consensus of $5.50 billion.

- 01/21/2025

|

The PNC Financial Services Group, Inc (PNC) is a Great Momentum Stock: Should You Buy?

- Does The PNC Financial Services Group, Inc (PNC) have what it takes to be a top stock pick for momentum investors? Let's find out.

- 01/21/2025

|

4 Stocks to Buy for "Higher for Longer" Interest Rates

- Markets tumbled this week as a number of factors came into focus, pointing toward rates that would remain higher for longer. A hot jobs report sent stocks plummeting as the economy added 256,000 jobs vs 155,000 expected, dampening the prospects of multiple rate cuts in 2025.

- 01/17/2025

|

Why The PNC Financial Services Group, Inc (PNC) is a Great Dividend Stock Right Now

- Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group, Inc (PNC) have what it takes?

- 01/17/2025

|

PNC to Complement Branch Expansion With New Online Banking Platform

- PNC Financial Service Group will soon roll out a new online banking platform that will complement its investment in new branch locations and renovations, bank executives said Thursday (Jan. 16).

- 01/16/2025

|

The PNC Financial Services Group, Inc. (PNC) Q4 2024 Earnings Call Transcript

- The PNC Financial Services Group, Inc. (NYSE:PNC ) Q4 2024 Earnings Conference Call January 16, 2025 10:00 AM ET Company Participants Bryan Gill - EVP and Director of IR Bill Demchak - Chairman and CEO Rob Reilly - EVP and CFO Conference Call Participants John McDonald - Truist Securities Scott Siefers - Piper Sandler Erika Najarian - UBS John Pancari - Evercore Mike Mayo - Wells Fargo Betsy Graseck - Morgan Stanley Gerard Cassidy - RBC Capital Markets Bill Carcache - Wolfe Research Matt O'Connor - Deutsche Bank Ebrahim Poonawala - Bank of America Operator Greetings, and welcome to the PNC Financial Services Group Fourth Quarter 2024 Earnings Conference Call. At this time, all participants are in a listen-only mode.

- 01/16/2025

|

PNC Financial Q4 Earnings Beat Estimates, NII & Fee Income Rise Y/Y

- Strong fee income, higher deposit balances, along with lower expenses, support PNC's Q4 earnings. Yet, a decline in loan balance remains a near-term concern.

- 01/16/2025

|

Compared to Estimates, The PNC Financial Services Group (PNC) Q4 Earnings: A Look at Key Metrics

- While the top- and bottom-line numbers for The PNC Financial Services Group (PNC) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

- 01/16/2025

|

The PNC Financial Services Group, Inc (PNC) Q4 Earnings and Revenues Surpass Estimates

- The PNC Financial Services Group, Inc (PNC) came out with quarterly earnings of $3.77 per share, beating the Zacks Consensus Estimate of $3.30 per share. This compares to earnings of $3.16 per share a year ago.

- 01/16/2025

|

PNC Financial's profit rises on interest income growth, lower rainy-day funds

- PNC Financial on Thursday reported a higher fourth-quarter profit as it earned more in interest payments and set aside less capital to cover potential loan defaults.

- 01/16/2025

|

PNC Reports Full Year 2024 Net Income of $6.0 Billion, $13.74 Diluted EPS

- Generated Positive Operating Leverage Fourth Quarter 2024 net income was $1.6 billion, $3.77 diluted EPS Grew NII and NIM; increased deposits and capital PITTSBURGH , Jan. 16, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today reported: For the quarter For the year In millions, except per share data and as noted 4Q24 3Q24 2024 2023 Fourth Quarter Highlights Financial Results Comparisons reflect 4Q24 vs. 3Q24 Net interest income (NII) $ 3,523 $ 3,410 $ 13,499 $ 13,916 Income Statement ▪ Net interest income increased 3% and NIM expanded 11 bps ▪ Fee income decreased 4%, due to elevated 3Q24 residential mortgage and capital markets activity ▪ Other noninterest income of $175 million ▪ Noninterest expense increased 5% and included $97 million of asset impairments and the benefit of an $18 million FDIC special assessment reduction.

- 01/16/2025

|

PNC Financial Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

- The PNC Financial Services Group, Inc. PNC will release earnings results for its fourth quarter, before the opening bell on Thursday, Jan. 16, 2025.

- 01/15/2025

|

Jim Cramer Positive on Top Blue Chip Bank Dividend Stocks: Buy These 4 Right Now Before Earnings

- We have covered Jim Cramer for almost 20 years here at 24/7 Wall St.

- 01/13/2025

|

Wall Street's Insights Into Key Metrics Ahead of The PNC Financial Services Group (PNC) Q4 Earnings

- Beyond analysts' top -and-bottom-line estimates for The PNC Financial Services Group (PNC), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2024.

- 01/13/2025

|

NII Growth to Aid PNC Financial's Q4 Earnings, High Costs to Hurt

- PNC's Q4 2024 results are likely to benefit from a rise in NII. However, rising costs and lower fee income are concerns.

- 01/10/2025

|

Options Corner: BAC, PNC, XLF

- Today's Options Corner looks at real-life trades in Bank of America (BAC), PNC Financial (PNC), and the SPDR S&P Financial Sector ETF (XLF) ahead of big banks reporting earnings next week. Rick Ducat walks through the options strategies and what the traders might be thinking.

- 01/09/2025

|

The PNC Financial Services Group, Inc (PNC) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

- The PNC Financial Services Group (PNC) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

- 01/09/2025

|

JP Morgan's Best 2025 Stock Ideas Include 5 Blue-Chip Dividend Giants

- With all of the major indices making solid moves higher in 2024, we were very interested to see what the top prognosticators across Wall Street think is in store for 2025 as we start the second quarter of the new century.

- 01/08/2025

|

PNC Financial: A Stable Dividend Grower Struggling With Loan Growth And Loan Losses

- PNC Financial gets its prior hold rating reaffirmed, as its stable dividend growth is overshadowed by weak loan growth and rising loan loss provisions. Macro factors like credit card demand could be a boost, but the risk of rising loan delinquencies and high-interest rates could have an impact. A strong profit margin vs similar banking peers is a plus.

- 01/07/2025

|

PNC Declares Dividend of $1.60 on Common Stock

- PITTSBURGH , Jan. 3, 2025 /PRNewswire/ -- The board of directors of The PNC Financial Services Group, Inc. (NYSE: PNC) declared a quarterly cash dividend on the common stock of $1.60 per share. The dividend will be payable Feb. 5, 2025, to shareholders of record at the close of business Jan. 15, 2025.

- 01/03/2025

|

Will The PNC Financial Services Group (PNC) Beat Estimates Again in Its Next Earnings Report?

- The PNC Financial Services Group (PNC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

- 01/02/2025

|

My Top 10 High-Yield Dividend Stocks For January 2025

- SPY ends 2024 on a sour note but with a total gain of 24.89%. The top 10 stocks on the watchlist for January 2025 offer a 3.45% dividend yield, nearly triple that of the S&P 500. My top 10 list of high dividend yield stocks has generated an annualized rate of return of 16.33% since its inception in November 2020.

- 01/01/2025

|

PNC Financial Stock Gains 26.8% in 6 Months: Should You Buy for 2025?

- PNC rises 26.8% in six months. Let us find out the reasons behind the bullish investor sentiments and analyze if the stock is worth buying for 2025.

- 12/26/2024

|

PNC Bank, N.A. Changes Prime Rate

- PITTSBURGH , Dec. 18, 2024 /PRNewswire/ -- PNC Bank, N.A. announced a decrease in its prime lending rate.

- 12/18/2024

|

The PNC Financial Services Group, Inc. (PNC) Goldman Sachs 2024 U.S. Financial Services Conference Transcript

- The PNC Financial Services Group, Inc. (NYSE:PNC ) Goldman Sachs 2024 U.S. Financial Services Conference Transcript November 10, 2024 1:00 PM ET Company Participants William Demchak - CEO and Chairman Robert Reilly - Vice President & Chief Financial Officer Conference Call Participants Richard Ramsden - Goldman Sachs Richard Ramsden Okay, so I'm delighted to be joined by Bill Demchak. Bill is the CEO and Chairman of PNC.

- 12/10/2024

|

PNC says banks with core retail deposits could be M&A targets

- PNC Financial Services Group would look at banks with core retail deposits in the right markets for mergers and acquisitions, but would avoid lenders with heavy real estate exposure, its CEO said on Tuesday.

- 12/10/2024

|

November jobs report shows hiring and consumers are in 'good shape,' says PNC's Gus Faucher

- Gus Faucher, chief economist at PNC, joins CNBC's 'Power Lunch' to discuss the latest jobs report, economic outlooks, and more.

- 12/06/2024

|

The PNC Financial Services Group Announces Fourth Quarter and Full Year Conference Call Details

- PITTSBURGH , Dec. 5, 2024 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the fourth quarter and full year 2024 at approximately 6:30 a.m. (ET), Thursday, Jan. 16, 2025, as previously announced.

- 12/05/2024

|

My Top 10 High-Yield Dividend Stocks For December 2024

- SPY continues its strong run in 2024 with a gain of +5.96% in November. The top 10 stocks on the watchlist for December 2024 offer a 3.34% dividend yield, more than double the S&P 500. My top 10 list of high dividend yield stocks has generated an annualized rate of return of 18.61% since its inception in November 2020.

- 12/01/2024

|

PNC Executives to Speak at Goldman Sachs Financial Services Conference

- PITTSBURGH , Nov. 26, 2024 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today that Chairman and Chief Executive Officer William S. Demchak and Executive Vice President and Chief Financial Officer Robert Q.

- 11/26/2024

|

Tax Fight With Clarendon Hills Appears Over

- HINSDALE, IL – Hinsdale High School District 86 officials sounded satisfied Thursday with a downsized tax district in Clarendon Hills. For months, the district had opposed a larger tax increment financing district, or TIF. "From where we started with this TIF proposal, this is pretty fantastic news for the district," said District 86 board President Catherine Greenspon. "I would agree it's a pretty significant change from what was originally proposed, so good progress," said Josh Stephenson, District 86's top finance official. On Monday, the Clarendon Hills Village Board unanimously approved the tax district along 55th Street to spur development. In doing so, the village made major concessions to District 86, Hinsdale District 181 and Maercker District 60, all of which criticized the larger district. Under state law, a tax district's growth in property tax income for 23 years would be diverted for use in the district itself, rather than taxing bodies such as schools. Last week, Clarendon Hills publicly unveiled its proposal to send the tax money from most of the properties in the TIF, including Jewel and PNC Bank, to other taxing bodies. But the village would keep the tax district's income from the vacant property that was once the site of Tracy's Tavern, which officials hope to see developed. With the changes, the village's expected TIF budget is down by half, to $12.6 million. "It's come down precipitously," District 86 board member Jeff Waters said. The District 86 board plans to vote next month on an agreement with the village on the tax district. Other local government bodies are expected to do the same.

- 11/25/2024

|

PNC Financial & GTreasury Team Up to Boost Digital Treasury Services

- PNC announces partnership with GTreasury to streamline treasury operations, increase efficiencies and reduce the complexities of managing multiple platforms.

- 11/22/2024

|

PNC Christmas Price Index Increases 5.4%, Significantly More Than The U.S. Consumer Price Index

- PNC calculates the cost of Christmas from the holiday song "The Twelve Days of Christmas" Recent inflation trends are repeating, much like the verses of the song itself Five of the 12 gifts had no increase compared to 2023 PITTSBURGH , Nov. 21, 2024 /PRNewswire/ -- National inflation levels may be on the decline, but when it comes to True Loves' gifts, the price of decking the halls keeps rising. Now in its 41st year, PNC Bank's annual Christmas Price Index® (PNC CPI) rose 5.4% — doubling last year's 2.7% increase and surpassing the Bureau of Labor Statistics' Consumer Price Index (BLS CPI) October year-over-year reading of 2.6%.

- 11/21/2024

|

GTreasury, PNC Bank Introduce Embedded Banking Integration Through PINACLE® Connect

- The new integration and user experience provides shared clients with workflow efficiencies, real-time balances, transactions, and payments automation The new integration and user experience provides shared clients with workflow efficiencies, real-time balances, transactions, and payments automation

- 11/21/2024

|

Why Is The PNC Financial Services Group (PNC) Up 10.2% Since Last Earnings Report?

- The PNC Financial Services Group (PNC) reported earnings 30 days ago. What's next for the stock?

- 11/14/2024

|

PNC Financial to Invest Additional $500M to Double Branch Openings

- PNC plans to invest an additional $500 million to double its branch openings and renovate 1,400 locations over the next five years.

- 11/11/2024

|

PNC Bank Increases Investment in New Branch Locations and Renovations

- PNC Bank increased the number of new branch locations and renovations it plans to complete over the next five years. The bank plans to open 200 new branch locations in 12 cities and renovate 1,400 existing branches during that time, investing $1.5 billion in these projects, it said in a Friday (Nov. 8) press release.

- 11/08/2024

|

The PNC Financial Services Group, Inc. (PNC) BancAnalysts Association of Boston Conference Transcript

- The PNC Financial Services Group, Inc. (NYSE:PNC ) BancAnalysts Association of Boston Conference November 8, 2024 8:15 AM ET Company Participants Dick Manuel - Columbia Threadneedle Investments, Equity Research Analyst Rob Reilly - Vice President & Chief Financial Officer Mike Lyons - President Conference Call Participants Mike Mayo - Wells Fargo Ryan Kenny - Morgan Stanley Joe Capone - Soros Fund Management Dick Manuel We're going to get going here. My name is Dick Manuel, Equity Research Analyst with Columbia Threadneedle Investments.

- 11/08/2024

|

PNC doubles down on branch expansion plan with additional $500 mln investment

- PNC Bank said on Friday it will increase its investment in branch expansion by an additional $500 million to open over 100 new locations and renovate 200 existing ones, doubling down on efforts to reach customers through physical locations.

- 11/08/2024

|

PNC Bank to Double Planned Branch Openings to More Than 200 Across Six States

- Company increases branch investment by $500 million with plans to build new locations in 12 cities PITTSBURGH , Nov. 8, 2024 /PRNewswire/ -- PNC Bank announced today it is increasing its branch investment by $500 million to open more than 100 additional new branches and renovate 200 more existing locations across the country. These plans expand upon the 100 new locations and 1,200 branch renovations the company announced in February.

- 11/08/2024

|

PNC Bank, N.A. Changes Prime Rate

- PITTSBURGH , Nov. 7, 2024 /PRNewswire/ -- PNC Bank, N.A. announced a decrease in its prime lending rate.

- 11/07/2024

|

The PNC Financial Services Group, Inc (PNC) Just Reclaimed the 20-Day Moving Average

- After reaching an important support level, The PNC Financial Services Group, Inc (PNC) could be a good stock pick from a technical perspective. PNC surpassed resistance at the 20-day moving average, suggesting a short-term bullish trend.

- 11/07/2024

|

What Makes The PNC Financial Services Group, Inc (PNC) a Strong Momentum Stock: Buy Now?

- Does The PNC Financial Services Group, Inc (PNC) have what it takes to be a top stock pick for momentum investors? Let's find out.

- 11/06/2024

|

Strategic Expansion Supports PNC Financial Amid Higher Expenses

- PNC benefits from balance sheet strength and strategic growth initiatives. Rising expenses remain a concern.

- 11/06/2024

|

My Top 10 High-Yield Dividend Stocks For November 2024

- SPY's 5 month positive streak comes to an end in October as it posts a loss of 0.89%. The top 10 stocks on the watchlist for November 2024 offer a 3.61% dividend yield, more than double the S&P 500. My top 10 list of high dividend yield stocks has generated an annualized rate of return of 17.27% since its inception in November 2020.

- 11/03/2024

|

Are Finance Stocks Lagging The PNC Financial Services Group (PNC) This Year?

- Here is how The PNC Financial Services Group, Inc (PNC) and The Bank of New York Mellon Corporation (BK) have performed compared to their sector so far this year.

- 10/31/2024

|

PNC Announces Redemption Of All Depositary Shares Representing Interests In Series R Preferred Stock

- PITTSBURGH , Oct. 30, 2024 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today announced the redemption on Dec. 2, 2024, of $500,000,000 of Depositary Shares (CUSIP: 693475AM7) (the "Depositary Shares") representing interests in PNC's Fixed-To-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series R (the "Series R Preferred Stock"). Each Depositary Share represents a 1/100th interest in a share of the Series R Preferred Stock.

- 10/30/2024

|

Economic experts share 2025 outlook at 61st Annual ASU/PNC Bank Luncheon

- Top economists provide insights on U.S. recession risks, Arizona growth, and global uncertainties. TEMPE, Ariz.

- 10/29/2024

|

PNC Executives to Speak at BancAnalysts Association of Boston Conference

- PITTSBURGH , Oct. 25, 2024 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) announced today that President Michael P. Lyons and Executive Vice President and Chief Financial Officer Robert Q.

- 10/25/2024

|

PNC vs. TW: Which Stock Should Value Investors Buy Now?

- Investors looking for stocks in the Financial - Investment Bank sector might want to consider either The PNC Financial Services Group, Inc (PNC) or Tradeweb Markets (TW). But which of these two stocks is more attractive to value investors?

- 10/23/2024

|

PNC Announces Redemption of Senior Floating Rate Bank Notes Due Dec. 2, 2024 and 5.671% Fixed Rate/Floating Rate Senior Notes Due Oct. 28, 2025

- PITTSBURGH , Oct. 22, 2024 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) today announced the redemption of, on Nov. 4, 2024, all outstanding Senior Floating Rate Bank Notes due Dec. 2, 2024 issued by PNC Bank, National Association in the amount of $200,000,000 (CUSIP 69353RFV5). The securities have an original scheduled maturity date of Dec. 2, 2024.

- 10/22/2024

|

2 Finance Stocks to Buy After Q3 Earnings: PGR & PNC

- Insurance giant Progressive Corporation (PGR) and banking leader PNC Financial Services Group (PNC) are two top-rated finance stocks to consider after exceeding their Q3 expectations on Tuesday.

- 10/17/2024

|

Here's Why The PNC Financial Services Group, Inc (PNC) is a Great Momentum Stock to Buy