Brookfield Property REIT Inc. Announces Final Results of Tender Offer

- BROOKFIELD NEWS, Aug. 18, 2020 (GLOBE NEWSWIRE) -- Brookfield Property REIT Inc. (NASDAQ: BPYU) announced today the final results of its tender offer (the “Offer”) to purchase up to 9,166,667 shares of its Class A Stock for cash at a price of $12.00 per share. The Offer expired at 5:00 p.m. (Eastern time) on August 12, 2020. Based on the final count by the paying agent and depositary for the Offer, a total of 7,321,155 shares of Class A Stock were properly tendered and not properly withdrawn, for an aggregate cost of approximately $87.9 million. The 7,321,155 shares of Class A Stock to be accepted for purchase represent approximately 13% of BPYU’s issued and outstanding shares of Class A Stock as of August 14, 2020. Following settlement of the Offer, BPYU will have approximately 47.9 million shares of Class A Stock outstanding.The preliminary results of the Offer as reported by BPYU on August 13, 2020 indicated an oversubscription in which case tendering shareholders would have only had their pro-rata share (81.2%) of tendered units accepted. Upon completion of the confirmation process, it was determined that approximately 4 million shares that were submitted via the Guaranteed Delivery method did not ultimately complete the tendering process, rendering those shares ineligible for participation in the Offer. BPYU shareholders are reminded that they have the right to convert any BPYU shares not tendered in this Offer, including any shares deemed ineligible due to incompletion of the Guaranteed Delivery method described above, into Brookfield Property Partners L.P. units (Nasdaq: BPY; TSX: BPY.UN) (“BPY units”) and subsequently submit those BPY units for tender at $12.00 per unit prior to the expiration of a similar and concurrent bid that BPY has outstanding until August 28, 2020. Instructions on how to convert Class A Stock for BPY Units can be accessed at the following weblink: https://bpy.brookfield.com/bpyu/stock-and-dividends/exchange-bpyu-for-bpy.Payment for the shares of Class A Stock accepted for purchase under the Offer will occur promptly.This press release is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any shares of Class A Stock.About Brookfield Property REIT Inc.Brookfield Property REIT Inc. is a subsidiary of Brookfield Property Partners L.P., (NASDAQ: BPY; TSX: BPY.UN) one of the world’s premier real estate companies, with approximately $86 billion in total assets. Brookfield Property REIT Inc. was created as a public security that is intended to offer economic equivalence to an investment in Brookfield Property Partners L.P. in the form of a U.S. REIT stock. Brookfield Property Partners L.P. and its subsidiary Brookfield Property REIT Inc. own and operate iconic properties in the world’s major markets, and its global portfolio includes office, retail, multifamily, logistics, hospitality, self-storage, triple net lease, manufactured housing and student housing.Contact: Matt Cherry Senior Vice President, Investor Relations Tel: 212-417-7488 Email: matthew.cherry@brookfield.com Forward-Looking StatementsThis press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws and regulations. Forward-looking statements include statements that are predictive in nature or depend upon or refer to future events or conditions, include statements regarding our operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects,” “anticipates,” “plans,” “believes,” “estimates,” “seeks,” “intends,” “targets,” “projects,” “forecasts,” “likely,” or negative versions thereof and other similar expressions, or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.”Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: BPYU’s ability to complete the anticipated Offer in a timely manner or at all; risks incidental to the ownership and operation of real estate properties including local real estate conditions; the impact or unanticipated impact of general economic, political and market factors in the countries in which we do business, including as a result of the recent global economic shutdown; the ability to enter into new leases or renew leases on favorable terms; business competition; dependence on tenants’ financial condition; the use of debt to finance our business; the behavior of financial markets, including fluctuations in interest and foreign exchange rates; uncertainties of real estate development or redevelopment; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; risks relating to our insurance coverage; the possible impact of international conflicts and other developments including terrorist acts; potential environmental liabilities; changes in tax laws and other tax related risks; dependence on management personnel; illiquidity of investments; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits therefrom; operational and reputational risks; catastrophic events, such as earthquakes, hurricanes or pandemics/epidemics; and other risks and factors detailed from time to time in our documents filed with the SEC. In addition, our future results may be impacted by risks associated with the global economic shutdown caused by a novel strain of coronavirus, COVID-19 and the related global reduction in commerce and travel and substantial volatility in stock markets worldwide, which may result in a decrease of cash flows and impairment losses and/or revaluations on our investments and real estate properties, and we may be unable to achieve our expected returns.We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

- 08/18/2020

|

2 Mall Owners Are Poised to Win the Bidding for J.C. Penney: Here's Why

- Simon Property Group and Brookfield Property Partners have the most riding on the outcome of J.C. Penney's bankruptcy.

- 08/15/2020

|

Good News Is Bad News

- U.S. equity markets flirted with fresh all-time highs this week following a slate of better-than-expected economic data, which has ironically thrown a political curveball into the now-stalled fiscal stimulus negotiations.

- 08/15/2020

|

Simon Property Group and Brookfield Are Leading Bidders to Buy Bankrupt J.C. Penney

- Mall operators Simon Property Group (NYSE: SPG) and Brookfield Property Partners (NASDAQ: BPY) joined forces to present a bid to buy J.C. Penney (OTC: JCPN.Q) out of bankruptcy, and theirs has reportedly emerged as the leading offer. While private equity firm Sycamore Partners was offering a somewhat higher amount, Simon and Brookfield are jointly willing to offer concessions on the department store's leases that have led the company and its lenders to view their bid as a better option. Simon is the country's largest mall operator, and J.C. Penney has a presence in about half of its malls, or some 63 locations.

- 08/13/2020

|

Brookfield Optimistic, Moody’s Not So Much

- While the landlord said things were looking up, the debt watchdog offered a decidedly more dour take.

- 08/06/2020

|

Brookfield Property Partners Reports Second Quarter 2020 Results

- All dollar references are in U.S. dollars, unless noted otherwise. BROOKFIELD NEWS, Aug. 06, 2020 (GLOBE NEWSWIRE) -- Brookfield Property Partners L.P. (NASDAQ: BPY; NASDAQ: BPYU; TSX: BPY.UN) (“BPY”) today announced financial results for the quarter ended June 30, 2020.“The second quarter of 2020 brought unprecedented challenges to the commercial real estate industry, in addition to the broader economy and society as a whole. I am extremely proud of the thousands of dedicated Brookfield real estate employees around the globe who all played an integral role in preparing our properties for safe re-opening, and it's gratifying to see our tenants return to their buildings and resume operations,” said Brian Kingston, Chief Executive Officer. Financial ResultsCompany FFO (CFFO) was $178 million for the quarter ended June 30, 2020, compared to $335 million in the prior-year period. CFFO was impacted significantly this quarter by the widespread closures of our Hospitality and Retail assets due to the global economic shutdown, and the prior-year period benefited from a transaction gain of $38 million. In the prior-year period, CFFO and realized gains benefited from higher realizations in our LP investment strategy.Net income for the quarter ended June 30, 2020 was a loss of $1,512 million ($(1.26) per LP unit) versus a gain of $23 million ($0.12 per LP unit) for the same period in 2019. The decrease in net income over the prior year period is primarily attributable to an unrealized reduction in asset values across the portfolio. Three months ended Jun. 30, Six months ended Jun. 30, (US$ Millions, except per unit amounts) 2020 2019 2020 2019 Net income(1) $(1,512) $23 $(1,885) $736 Company FFO and realized gains(2) $178 $362 $501 $729 Company FFO(2) $178 $335 $487 $642 Net income per LP unit(3)(4) $(1.26) $0.12 $(1.74) $0.44 Company FFO and realized gains per unit(4)(5) $0.18 $0.38 $0.51 $0.76 (1) Consolidated basis – includes amounts attributable to non-controlling interests. (2) See "Basis of Presentation" and “Reconciliation of Non-IFRS Measures” in this press release for the definition and components. (3) Represents basic net income attributable to holders of LP units. IFRS requires the inclusion of preferred shares that are mandatorily convertible into LP units at a price of $25.70 without an add-back to earnings of the associated carry on the preferred shares. (4) Net income attributable to holders of LP units and Company FFO and realized gains per unit are reduced by preferred dividends of $11 million and $20 million for the three and six months ended June 30, 2020, respectively, in determining per unit amounts. (5) Company FFO and realized gains per unit are calculated based on 935.6 million (2019 – 952.1 million) and 939.5 million (2019 – 961.4 million) units outstanding for the three and six months ended June 30, 2020, respectively. Operating Highlights Our Core Office business generated CFFO of $126 million for the quarter ended June 30, 2020 compared to $187 million in the same period in 2019. The decrease in CFFO is primarily attributable to a transaction gain of $38 million recognized in the prior-year period, and a decrease this quarter in contributions from our parking and retail operations. Rent collections in our office portfolio in the second quarter were largely uninterrupted and consistent with historical periods.Despite a challenging operating environment resulting from the global economic shutdown, Core Office leasing activity in the second quarter totaled 0.7 million square feet spread across all of our major markets, executed at rents 16% higher on average than expiring leases in the period. Occupancy in the portfolio decreased 20 basis points to 92.3%, with a remaining weighted average lease term of 8.6 years. Our Core Retail operations generated CFFO of $140 million for the quarter ended June 30, 2020 compared to $170 million in the comparable period in 2019. The current quarter results were impacted significantly by widespread mandated closures in our U.S. retail portfolio related to the global economic shutdown, which caused a decline in mall revenues, fee income, and an increase in credit loss reserves.Our Core Retail business leased approximately 7.4 million square feet over the past 12 months with suite-to-suite rent spreads of 7%. Our same-store properties were 95% leased for the quarter ended June 30, 2020, consistent with the prior year. On a year-over-year basis, in-place rents were up 1.1%1. Rent collections in this portfolio in the second quarter were approximately 34%, with July collections trending significantly stronger.Our LP Investments generated CFFO and realized losses of $8 million for the quarter ended June 30, 2020, compared to earnings of $106 million in the comparable period in 2019. Results in the current quarter were negatively impacted by a year-over-year decrease in earnings from our Hospitality investments of $78 million ($0.08 per unit) due to property closures, and a decline in transaction gains. Three months ended Jun. 30, Six months ended Jun. 30, (US$ Millions)2020 2019 2020 2019 Company FFO and realized gains: Core Office $126 $187 $261 $327 Core Retail$140 $170 $335 $354 LP Investments$(8) $106 $68 $252 Corporate$(80) $(101) $(163) $(204) Company FFO and realized gains(1)$178 $362 $501 $729 (1) See "Basis of Presentation" and "Reconciliation of Non-IFRS Measures" below in this press release for the definitions and components. Dispositions In the second quarter, we completed $63 million of gross asset dispositions at our share, at prices that were 3% higher than our IFRS carrying values. These sales generated approximately $21 million in net proceeds to BPY.New Investments * Restructured joint venture at Water Tower Place in Chicago to increase ownership from 43% to 94% through assumption of partner's proportionate debt liability ($153 million). * Subsequent to quarter-end, committed €100 million ($112 million) to the Brookfield European Real Estate Partnership, a new Brookfield Asset Management (BAM)-sponsored open-ended private real estate fund focused on acquiring a diversified collection of high-quality properties and portfolios in Western Europe. This fund closed on its maiden investment in the second quarter with the acquisition of 42 Paridis, a 66,000-square-foot office building in central Paris for €102 ($111) million (€14 ($15) million at BPY's share).____________________________ 1 In-place rents reflect retail tenants <10K square feet Balance Sheet UpdateTo increase liquidity and extend the maturity of our debt, during the second quarter we executed the following financing transactions: * Refinanced 655 New York Ave. in Washington, DC for $494 million with a two-year (five years fully extended) mortgage at a floating interest rate of LIBOR +2.25%, generating net proceeds of $106 million. * Refinanced Silver Spring Metro Plaza in Maryland for $110 million with a five-year mortgage at a floating interest rate of LIBOR +2.25%, generating net proceeds of $2 million. * Financed first phase of Halley Rise — a 352-unit high-rise multifamily building in Reston, VA — with a three-year (five years fully extended) construction loan totaling $111 million at a floating interest rate of LIBOR +2.75%. * Financed 1100 Avenue of the Americas in New York for $171 million with a five-year construction loan at a floating interest rate of LIBOR +1.95%. * Extended mortgage maturities for an average of one year on five Core Retail assets totaling approximately $1.2 billion.Ended the quarter with $6.0 billion of group-wide liquidity, including $1.5 billion of cash on hand, $2.8 billion of corporate and subsidiary credit facilities and $1.7 billion of undrawn construction facilities.Substantial Issuer BidOn July 6, 2020, we launched a substantial issuer bid ("SIB") to purchase up to 74,166,670 of BPY’s limited partnership units from public unitholders for a price of $12.00 per unit, for a total value of approximately $890 million. The SIB is being funded by Brookfield Asset Management and certain of its institutional clients and is set to expire on August 28, 2020. Unit Repurchase ProgramUtilizing our in-place normal course issuer bid (“NCIB”), we purchased 2,641,196 of BPY units in the second quarter of 2020 at an average price of $8.45 per unit. COVID-19 Relief As an organization, we are continuing to utilize our various real estate locations, human and financial resources to do our part in contributing to the COVID-19 relief efforts around the globe. To date, Brookfield's global real estate business has donated over $4 million in either cash or supplies to various relief efforts. We have also expanded our employee matching gift program from a 1:1 to a 2:1 match for employees' donations directed toward pandemic relief efforts. Our efforts to mitigate the pandemic are ongoing and we continue to identify opportunities to contribute.Distribution Declaration The Board of Directors has declared a quarterly distribution on the partnership’s LP units of $0.3325 per unit payable on September 30, 2020 to unitholders of record at the close of business on August 31, 2020.The quarterly distributions on the LP units are declared in U.S. dollars. Registered unitholders residing in the United States shall receive quarterly cash distributions in U.S. dollars and registered unitholders not residing in the United States shall receive quarterly cash distributions in the Canadian dollar equivalent, based on the Bank of Canada exchange rate on the record date.

- 08/06/2020

|

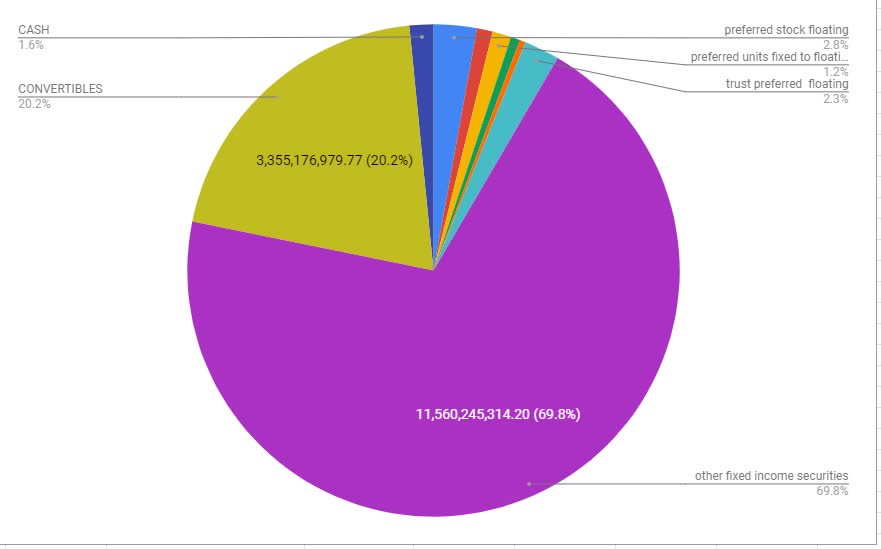

Not So Common Fixed Income Preview

- A review of all floating-rate preferred stocks, third-party trust preferred securities, trust preferred stocks, and preferred units.

- 07/29/2020

|

Sycamore Partners Could Acquire J.C. Penney. Its Stock Soared on the News.

- Sycamore Partners is said to be on the verge of acquiring the department store out of bankruptcy, with plans to merge it with troubled peer Belks.

- 07/29/2020

|

Could ABG Snap Up Bankrupt Ann Taylor Parent?

- Private equity firm Sycamore Partners is also reportedly mulling the purchase.

- 07/28/2020

|

Brookfield Announces Initial Close of First European Core-Plus Real Estate Fund

- BROOKFIELD NEWS, July 16, 2020 -- Brookfield Asset Management Inc. (“Brookfield”) (NYSE: BAM, TSX: BAM.A) today announced the initial closing of its first European core-plus.

- 07/16/2020

|

WFRBS Commercial Mortgage Trust 2012-C7 -- Moody's affirms seven and downgrades six classes of WFRBS 2012-C7

|

WFRBS Commercial Mortgage Trust 2012-C8 -- Moody's downgrades one, confirms one and affirms eleven classes of WFRBS 2012-C8

|

Brookfield Property Partners to Hold Conference Call & Webcast of Second Quarter 2020 Financial Results Thursday, August 6, 2020 at 11:00 AM (ET)

- BROOKFIELD NEWS, July 14, 2020 -- Brookfield Property Partners L.P. (NASDAQ: BPY, TSX: BPY.UN) announced today that its second quarter 2020 financial results will be released.

- 07/14/2020

|

Brookfield Property Partners to Hold Conference Call & Webcast of Second Quarter 2020 Financial Results Thursday, August 6, 2020 at 11:00 AM (ET)

- BROOKFIELD NEWS, July 14, 2020 (GLOBE NEWSWIRE) -- Brookfield Property Partners L.P. (NASDAQ: BPY, TSX: BPY.UN) announced today that its second quarter 2020 financial results will be released before the market open on Thursday, August 6, 2020. Analysts, investors and other interested parties are invited to participate in the company’s live conference call reviewing the results on Thursday, August 6, 2020 at 11:00 AM (ET). Scheduled speakers are Chief Executive Officer Brian Kingston and Chief Financial Officer Bryan Davis. Along with the earnings news release, an updated supplemental information package will be available on the company’s website, bpy.brookfield.com, before the market open on August 6, 2020.To participate in the conference call, please dial +1 (844) 358-9182 toll-free in the U.S. and Canada or +1 (478) 219-0399 for overseas calls, conference ID: 4575078, five minutes prior to the scheduled start of the call. Live audio of the call will also be available via webcast at bpy.brookfield.com.A replay of this call can be accessed through August 13, 2020 by dialing +1 (855) 859-2056 toll-free in the U.S. and Canada or +1 (404) 537-3406 for overseas calls, conference ID: 4575078, A replay of the webcast will be available on the company’s website.Brookfield Property PartnersBrookfield Property Partners, through Brookfield Property Partners L.P. and its subsidiary Brookfield Property REIT Inc., is one of the world’s premier real estate companies, with approximately $87 billion in total assets. We own and operate iconic properties in the world’s major markets, and our global portfolio includes office, retail, multifamily, logistics, hospitality, self-storage, triple net lease, manufactured housing and student housing.Brookfield Property Partners is the flagship listed real estate company of Brookfield Asset Management, a leading global alternative asset manager with over $515 billion in assets under management. More information is available at www.brookfield.com.Brookfield Property Partners L.P. is listed on the Nasdaq stock market and the Toronto stock exchange. Brookfield Property REIT is listed on the Nasdaq stock market. Further information is available at bpy.brookfield.com.Brookfield Contact:Matthew Cherry Senior Vice President, Investor Relations Tel: (212) 417-7488 Email: matthew.cherry@brookfield.com

- 07/14/2020

|

Why Brookfield Property Partners Units Rocketed 12% at the Open On July 2

- Brookfield Property Partners' parent came forward with a "deal" for unit holders, and the price took off accordingly.

- 07/02/2020

|

Dividend Challenger Highlights: Week Of June 28

- A weekly summary of dividend activity for Dividend Challengers. Companies which changed their dividends. Companies with upcoming ex-dividend dates. Companies wi

- 06/27/2020

|

Brookfield Property Partners is vulnerable to a red-ink tsunami

- Let’s take Brookfield Property Partners (BPY), the Bermudan-Canadian-global, Reit-like, income vehicle managed by Brookfield Asset Management. BPY is best known for its investments in “trophy” office properties, such as Canary Wharf in London or Lever House in New York, as well as its “core retail” malls with storied tenants such as JC Penney. One might think that given coronavirus and recession headlines, BPY’s management would have visibly furrowed brows.

- 06/26/2020

|

Not So Common Fixed-Income Preview

- A review of all floating-rate preferred stocks, third-party trust preferred securities, trust preferred stocks, and preferred units. Almost all securities are t

- 06/24/2020

|

J.C. Penney's Landlords May Be Buying the Retailer to Keep It Afloat

- According to sources said to have direct information, J.C. Penney (NYSE: JCP) may be currently working out a deal to be bought out by its own landlords, Brookfield Property Partners (NASDAQ: BPY) and Simon Property Group (NYSE: SPG). A third company, privately held Authentic Brands Group, LLC, is apparently in alliance with the retailer's landlords to work out an acquisition deal. J.C. Penney recently declared Chapter 11 bankruptcy after store closures from the COVID-19 pandemic sent its already struggling operations into a tailspin.

- 06/15/2020

|

Mall Landlords, Authentic Brands in Talks to Buy J.C. Penney

- (Bloomberg) -- The two largest mall landlords and Authentic Brands Group LLC are in talks to buy bankrupt department-store chain J.C. Penney Co., according to people familiar with the matter.Authentic Brands may team up with Simon Property Group Inc. and Brookfield Property Partners LP to acquire the retailer as part of its court reorganization, said the people, who asked not to be identified because the talks are private. The discussions are still fluid and may ultimately end without a deal.J.C. Penney, which filed for Chapter 11 protection in May, has been racing to firm up a business plan by a July 14 deadline, after which the company risks running out of cash to finance its reorganization and emerge from bankruptcy court. The company’s proposed exit plan involves creating two new publicly traded entities, including a real estate investment trust that would hold some of the retailer’s property.For the landlords, buying J.C. Penney would ensure the survival of one of their most ubiquitous tenants amid a wave of retail distress that has seen thousands of stores close permanently. That’s in addition to the pandemic lockdown that shuttered most retailers for months nationwide.Authentic teamed up with Simon and Brookfield to buy teen clothing chain Forever 21 out of bankruptcy earlier this year. And Authentic and Simon are also in discussions with Brooks Brothers Inc. on a joint bid that would be part of a potential bankruptcy filing by that clothing retailer, Bloomberg News reported last week.Brookfield, the second-largest U.S. mall operator after Simon, in May announced the creation of a $5 billion fund to buy stakes in retailers.Authentic also owns Aeropostale after teaming up with the mall landlords to buy that brand out of bankruptcy in 2016. Its growing portfolio could be a boon to J.C. Penney if licensed product from those retailers were added to the department store’s lineup.Private equity firm Sycamore Partners has also held preliminary talks to buy J.C. Penney, weighing an acquisition outright or making an investment in the retailer, Reuters reported earlier this month.J.C. Penney’s remaining value includes its owned real estate and intellectual property from its private brands, according to David Silverman, a retail analyst at Fitch Ratings.“The different companies that are potentially looking into J.C. Penney have different capabilities and options given the real estate that J.C. Penney has and the suitors’ potential use with it,” Silverman said.(Adds context on company’s reorganization plan in third paragraph and commentary from an analyst in the last paragraph. A prior version of this story corrected timing of Brookfield fund announcement in the sixth paragraph)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.

- 06/15/2020

|

J.C. Penney in Talks to Be Bought by Simon Property, Brookfield

- Mall owners Simon Property Group and Brookfield Property Partners are reportedly negotiating to purchase bankrupt department-store chain J.C. Penney . Authentic Brands, which owns more than 50 consumer brands, might join the two real estate companies in their bid, knowledgeable sources told Bloomberg. Simon is the biggest mall owner in the country, and Brookfield, a unit of Brookfield Asset Management , is No. 2.

- 06/15/2020

|

3 “Strong Buy” Dividend Stocks Yielding at Least 7%

- Volatility is the name of the game right now. Last week, markets had their worst close since March, despite a Friday rally. The S&P; 500 lost 6% on Thursday, the index’s worst trading day in three months, and finished the week down 4.8%.Worries about a new spike in coronavirus cases, along with racially charged urban rioting, have put investors in a selling mood. But remember the old cliché, that the Chinese word for crisis is composed of the symbols for ‘danger’ and ‘opportunity?’ The market’s gyrations these last few trading sessions have given income-minded investors an opportunity, if they are willing to shoulder some risk.The question for investors, of course, is where will the market head next? Are the gains returning, or is this just the next hill of the roller coaster? Uncertainty is the only certainty, making defensive moves, toward dividend stocks, a smart play for investors. Using the TipRanks database, we’ve pulled up three Strong Buy stocks that show a combination of dividend yields from 7% to 11% and considerable upside potential. While buying into stocks during a downturn is inherently risky, the upside on these three – and their high-yielding dividends – makes the risk worthwhile.Brookfield Property Partners (BPY)We’ll start in the real estate business, where Brookfield holds one of the world’s largest portfolios in office, retail, multifamily dwellings, industrial parks, hospitality, student housing – there is hardly a sector that Brookfield does not have a finger in. The company owns high-end office space in New York and Los Angeles, as well as London, Sydney, and Toronto. The student housing portfolio includes 5,700 beds in the UK university system. The retail segment includes Saks Fifth Avenue in downtown Manhattan.So, Brookfield is not an ordinary real estate company. Its highly diversified portfolio provided some insulation from the COVID-19 pandemic, and the company reported $309 million in total Funds From Operations (FFO) in Q1 – in line with the year-ago results. General depreciation in the real estate market pushed the net income into negative territory, and BPY showed a loss of 49 cents per share for the quarter.At the same time, Brookfield has maintained its dividend payment. Even facing a severe net loss, management remains committed, for the time being, to its shareholder return policy. The current dividend, at 33.25 cents per share quarterly, gives an annualized payment of $1.33 and an impressive yield of 11.9%. Compare this to the 2.2% average yield among financial sector peer companies, or the 2% average yield found on the S&P; 500, and the attraction is clear.CIBC analyst Dean Wilkinson acknowledges Brookfield’s tough business landscape during the pandemic – but points out that “April rent collections in the office and multifamily portfolios averaged above 90%. While retail collections were about 20%, it is important to note that lease obligations are contractual agreements; retailers cannot simply walk away from rental payments, and we expect that a material portion of the 80% of uncollected rent to date will, in time, be honoured through payment plans that are currently in negotiation.”Wilkinson's $18 price target on BPY stock implies a one-year upside potential of 62%, and fully supports his Buy rating on the stock. (To watch Wilkinson’s track record, click here)Overall, Wall Street appears to agree with Wilkinson here. BPY shares have 5 recent analyst reviews, and of those 4 are Buy and only 1 a Hold – making the analyst consensus view a Strong Buy. Shares are priced at $11.13, and the average price target of $15.05 suggests the stock has room for 35% upside growth in the coming year. (See Brookfield stock analysis on TipRanks)Brigham Minerals (MNRL)The next stock on our list, Brigham Minerals, is mineral rights acquisition company focused on the oil and gas sector in the US. Brigham’s portfolio includes large acreage in the Bakken Shale of North Dakota, as well as the Delaware and Midland basins of Texas. These are the formations that put North American hydrocarbons on the map in the last decade, and their output has transformed the US into a major energy exporter.MNRL saw earnings dip in Q1, mainly due to the coronavirus-inspired shutdowns, but EPS remained positive at 14 cents per share. Quarterly production rose by 8% sequentially, to 10,400 barrels of oil equivalent (BOE) per day. The company saw royalty revenue of $28.4 million, with nearly two-thirds of that total coming from Permian holdings. Brigham has been adjusting its dividend over the past year, with the current quarterly payment set at 37 cents per share. This annualizes to $1.48, and gives the stock a dividend yield of 11.5%. Peer companies in the energy sector average a yield of just 1.9%, while Treasury bonds, the traditional ‘safe’ investment, are yielding below 1% up to 10-year terms. MNRL’s return simply blows away the alternatives.SunTrust analyst Welles Fitzpatrick sees MNRL as a clear choice for investors. He writes, “MNRL turned in a 1Q beat on higher than expected lease bonuses, and in contrast to the rest of the industry paid out all its discretionary cashflow. The company's timely offering in 4Q allows the unlevered balance sheet to shine. While MNRL will see declines in rigs and production this year the company should be able to maintain a high percent of CF distributed.”Fitzpatrick’s Buy rating on the stock is supported by his $16 price target, suggesting a solid 24% upside potential. (To watch Fitzpatrick’s track record, click here.)The analyst consensus here, at Strong Buy rating, is based on 6 Buy and 2 Hold reviews set in recent weeks. MNRL shares are trading for $12.85; the average price target, at $14.57, indicates a 20% upside for the stock. (See Brigham Minerals stock analysis on TipRanks)Umpqua Holdings (UMPQ)Last on our list for today is Umpqua, a holding company based in Portland, Oregon. Umpqua’s main subsidiary is Oregon’s Umpqua Bank. The bank provides asset management, mortgage banking, and general financial services in commercial and retail banking for corporate, institutional, and individual customers. The bank has locations across Oregon, as well as Washington State, Idaho, Nevada, and California.The first quarter – the coronavirus quarter – was hard on Umpqua. The company reported a net loss of $28.3 million, or 13 cents per share. Management laid the loss – the company’s worst report after a two-year run of profitable quarters – squarely on the COVID-19 pandemic and crisis. The company has been able to switch many non-customer-facing employees to remote work, while keeping over 95% bank branches open. Looking ahead, UMPQ is expected to show a 17-cent EPS profit in Q2.Through the coronavirus crisis, UMPQ has kept up its dividend. The company has a 7-year history of reliable dividend growth, and announced its most recent dividend payment back in March. They payment, made in April, was 21 cents per share. At 84 cents annualized, this gives UMPQ shares a dividend yield of 7.15%. This is more than 3.5x the average found among S&P; listed companies, and also significantly higher than most peer companies’ payments.Reviewing the stock for SunTrust Robinson was analyst Michael Young. He backed his Buy rating on the stock with a $13 price target, showing confidence in a 11% upside potential. (To watch Young’s track record, click here)Backing his stance, Young looked closely at the bank’s loan portfolio, writing, “Very granular portfolio, average loan size is under $1 million. The loan portfolio consists of very low leverage clients relative to competitors according to management... We do note that UMPQ has a larger multifamily loan concentration, but this is also likely one of the best performing CRE asset classes through a recession.” Overall, Wall Street analysts are thoroughly impressed with UMPQ. It boasts 100% Street support, or 3 Buy ratings in the last three months, making the consensus a Strong Buy. Meanwhile, the $13.67 average price target implies that shares could surge nearly 22% in the next twelve months. (See Umpqua stock-price forecast on TipRanks)To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

- 06/15/2020

|

Do Hedge Funds Love Brookfield Property Partners LP (BPY)?

- Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds' and successful investors' positions as of the end of the first quarter. You can find articles about an individual hedge fund's trades on numerous financial […]

- 06/13/2020

|

Jason Mudrick Was Right About The Secular Decline Of Malls

- I reflect back on an April 4, 2017 piece about Jason Mudrick's bold call that malls were in a forever decline. A lot of money has been lost because investors th

- 04/20/2020

|

Good News And Bad News For REIT Investors

- Bad news: REITs have dropped so much that many are priced for bankruptcy. Good news: Most REITs will survive and recover to even higher levels than before the c

- 04/11/2020

|

Maximizing Your Income In A Dislocated Market

- Fear, uncertainty, and doubt have taken over the market. Normally low-volatility investments were sold off in force last week. Fixed-income investments usually

- 04/08/2020

|

The Retail Apocalypse Is Accelerating

- Store closings outnumber store openings by a wide margin. 2020 will be a year where store closings rise well above average levels, we could see 15,000 stores be

- 04/07/2020

|

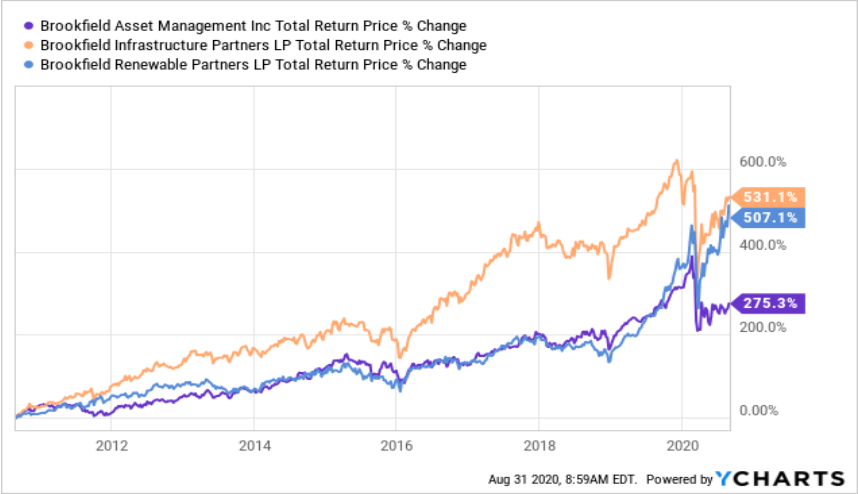

Brookfield Property Partners: A Bulletproof 10% Yield

- Brookfield Property Partners has been one of the worst-performing stocks in the REIT sector. The retail side is suffering for sure, and the office concentration

- 04/07/2020

|

Forget About The Rule Of 72, For At Least 90 Days

- The way the “Rule of 72” works is that you can compute annual rate of return and how many years it will take to double your investment. I would like to see a 90

- 04/06/2020

|

Brookfield Property Partners: Iconic Assets At Iconic Discount

- Panic selling has caused massive outflows from real estate and opened up opportunities to buy high-quality assets at deep discounts. We believe Brookfield Prope

- 03/30/2020

|

Dividend Challenger Highlights: Week Of March 29

- A weekly summary of dividend activity for Dividend Challengers. Companies which declared increased dividends. Companies with upcoming ex-dividend dates. Compani

- 03/28/2020

|