Roku Surges 15% on Narrower Q4 Loss and Strong Revenue Growth

Roku (NASDAQ:ROKU) soared more than 15% intra-day today after posting a smaller-than-expected fourth-quarter loss and strong revenue growth, driven by expanding subscriber numbers and increased advertising demand.

For Q4, the streaming platform company reported a loss of $0.24 per share, significantly narrower than analysts’ expected $0.42 loss. Revenue climbed to $1.2 billion, surpassing the $1.15 billion consensus estimate, reflecting healthy demand across its platform segment.

Roku’s platform revenue, which includes ad sales and subscription revenue, surged 25% year-over-year to $1.04 billion. Growth was particularly strong in political advertising, but even excluding that factor, the segment still expanded by 19%.

Looking ahead, Roku expects Q1 2025 revenue of $1.01 billion, in line with Wall Street projections. The company also issued full-year 2025 revenue guidance of $4.61 billion, aligning with analyst expectations. Platform revenue is projected to grow 15% for the year, reflecting continued strength in advertising and subscriptions.

| Symbol | Price | %chg |

|---|---|---|

| MSIN.JK | 515 | -0.97 |

| FILM.JK | 2060 | 1.46 |

| CNMA.JK | 154 | -2.6 |

| 352820.KS | 275500 | -5.44 |

Roku Inc. (NASDAQ:ROKU) Sees Notable Stock Increase and Partners with Amazon Ads

Roku Inc. (NASDAQ:ROKU) is a leading figure in the streaming industry, recognized for its innovative digital media players that facilitate access to streaming content on televisions. Competing against giants like Amazon Fire TV and Apple TV, Roku has recently been in the spotlight due to an upgrade by Needham to a "Buy" rating, with the stock priced at $81.36 at the time of the announcement.

The company's stock has witnessed a significant uptick, with shares increasing by 10.4% in the last trading session, closing at $82.17. This rise is attributed to a higher-than-average trading volume, as reported by Zacks. Over the past four weeks, the stock has seen a gain of 4.3%. The recent boost in Roku's share price comes on the heels of its announcement of a new partnership with Amazon Ads, aiming to revolutionize the way advertisers connect with Connected TV (CTV) audiences.

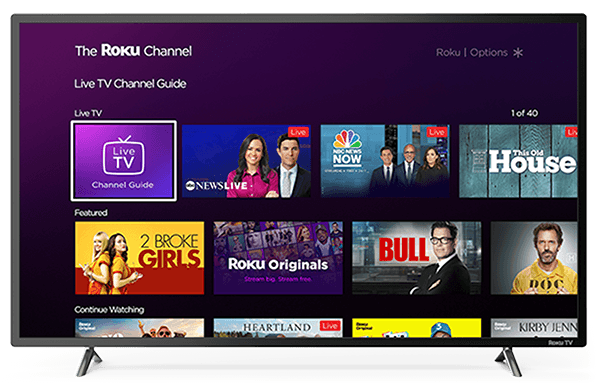

Through this collaboration, advertisers leveraging Amazon's demand-side platform (DSP) can now reach an estimated 80 million U.S. CTV households within the Roku and Fire TV ecosystems. This partnership merges two of the largest CTV platforms, providing advertisers with an extensive reach to a broad and highly targetable audience across connected devices. The partnership enables advertisers to execute targeted campaigns across major streaming services, including The Roku Channel, Prime Video, and other platforms available on Roku and Amazon Fire TV devices.

Furthermore, third-party apps such as Disney+, Paramount+, and Tubi are also included in this expansive network. A custom identity resolution system supports this integration, allowing Amazon DSP to accurately identify viewers logged into Roku devices. Throughout the day, the stock fluctuated between a low of $80.88 and a high of $85.40. Over the past year, Roku has reached a peak of $104.96 and a trough of $48.33. The company's market capitalization is currently around $11.93 billion, with a trading volume of 2,941,754 shares.

Roku, Inc. (NASDAQ:ROKU) Sees Positive Analyst Coverage and Stock Upgrade

- Compass Point upgraded Roku's stock to a "Buy" rating, highlighting the company's growth path towards GAAP profitability by 2026.

- Roku reported a 17% year-over-year increase in gross profit in the fourth quarter, with management providing guidance for continued growth in 2025.

- Despite competitive risks, Roku's valuation is attractive, with Guggenheim Securities noting a potential 50% upside and a positive business outlook for 2025.

Roku, Inc. (NASDAQ:ROKU) is a prominent player in the streaming industry, known for its digital media players and smart TV operating systems. The company competes with other streaming giants like Amazon and Apple. On March 23, 2025, Compass Point upgraded Roku's stock to a "Buy" rating, with the stock priced at $78.29 at the time of the announcement.

Roku is on a growth path, aiming for GAAP profitability by 2026. The company has a strong net cash balance and a low valuation, which supports its growth ambitions. In the fourth quarter, Roku reported a 17% year-over-year increase in gross profit, indicating strong financial performance. Management has also provided guidance for continued growth in 2025.

Despite competitive risks, Roku's valuation is attractive, with a potential 50% upside. The company is well-positioned to benefit from the growth of smart TV and digital advertising. As highlighted by Guggenheim Securities, positive analyst coverage has contributed to a significant surge in Roku's stock, with a 9.2% increase as of 3:15 p.m. ET, and a peak increase of 10.5% earlier in the day.

Guggenheim analyst Michael Morris remains optimistic about Roku's business outlook for 2025, despite lowering the one-year price target from $115 to $110 per share. This adjustment reflects a cautious approach to valuations in the sector, not a negative view of Roku's performance. The new price target suggests a potential upside of 36% for the stock.

Roku's stock has seen a positive change of $4.47, a 6.06% increase, with a trading range between $72.02 and $78.68 during the day. Over the past year, the stock has reached a high of $104.96 and a low of $48.33. With a market capitalization of approximately $11.43 billion and a trading volume of 5,833,409 shares, Roku continues to capture investor interest.

Roku, Inc. (NASDAQ:ROKU) Sees Positive Analyst Coverage and Stock Upgrade

- Compass Point upgraded Roku's stock to a "Buy" rating, highlighting the company's growth path towards GAAP profitability by 2026.

- Roku reported a 17% year-over-year increase in gross profit in the fourth quarter, with management providing guidance for continued growth in 2025.

- Despite competitive risks, Roku's valuation is attractive, with Guggenheim Securities noting a potential 50% upside and a positive business outlook for 2025.

Roku, Inc. (NASDAQ:ROKU) is a prominent player in the streaming industry, known for its digital media players and smart TV operating systems. The company competes with other streaming giants like Amazon and Apple. On March 23, 2025, Compass Point upgraded Roku's stock to a "Buy" rating, with the stock priced at $78.29 at the time of the announcement.

Roku is on a growth path, aiming for GAAP profitability by 2026. The company has a strong net cash balance and a low valuation, which supports its growth ambitions. In the fourth quarter, Roku reported a 17% year-over-year increase in gross profit, indicating strong financial performance. Management has also provided guidance for continued growth in 2025.

Despite competitive risks, Roku's valuation is attractive, with a potential 50% upside. The company is well-positioned to benefit from the growth of smart TV and digital advertising. As highlighted by Guggenheim Securities, positive analyst coverage has contributed to a significant surge in Roku's stock, with a 9.2% increase as of 3:15 p.m. ET, and a peak increase of 10.5% earlier in the day.

Guggenheim analyst Michael Morris remains optimistic about Roku's business outlook for 2025, despite lowering the one-year price target from $115 to $110 per share. This adjustment reflects a cautious approach to valuations in the sector, not a negative view of Roku's performance. The new price target suggests a potential upside of 36% for the stock.

Roku's stock has seen a positive change of $4.47, a 6.06% increase, with a trading range between $72.02 and $78.68 during the day. Over the past year, the stock has reached a high of $104.96 and a low of $48.33. With a market capitalization of approximately $11.43 billion and a trading volume of 5,833,409 shares, Roku continues to capture investor interest.

Roku Upgraded to Neutral as Analyst Sees Near-Term Strength

MoffettNathanson analysts upgraded Roku (NASDAQ:ROKU) from Sell to Neutral, adjusting the price target to $70.00. The shift in rating reflects confidence in Roku’s near-term performance, despite maintaining a cautious long-term outlook.

Earlier in January, the firm had downgraded Roku to Sell, arguing that its stock was trading at an unjustified multiple, even as near-term estimates remained ahead of consensus. However, the latest upgrade acknowledges that the company’s upcoming results are likely to exceed expectations, suggesting strong momentum in the immediate future.

The analysts believe that 2025 could unfold as a "beat-and-raise" story for Roku, with the potential for performance surpassing initial projections. While the firm’s long-term concerns about the company’s valuation persist, the near-term outlook appears more promising, warranting a more neutral stance on the stock.

Roku Upgraded to Neutral as Analyst Sees Near-Term Strength

MoffettNathanson analysts upgraded Roku (NASDAQ:ROKU) from Sell to Neutral, adjusting the price target to $70.00. The shift in rating reflects confidence in Roku’s near-term performance, despite maintaining a cautious long-term outlook.

Earlier in January, the firm had downgraded Roku to Sell, arguing that its stock was trading at an unjustified multiple, even as near-term estimates remained ahead of consensus. However, the latest upgrade acknowledges that the company’s upcoming results are likely to exceed expectations, suggesting strong momentum in the immediate future.

The analysts believe that 2025 could unfold as a "beat-and-raise" story for Roku, with the potential for performance surpassing initial projections. While the firm’s long-term concerns about the company’s valuation persist, the near-term outlook appears more promising, warranting a more neutral stance on the stock.

Roku, Inc. (NASDAQ:ROKU) Maintains Strong Position in Streaming Industry

- JMP Securities reaffirmed a "Market Outperform" rating for Roku, Inc. (NASDAQ:ROKU), with a stock price of $99, indicating confidence in Roku's future performance.

- Roku's fourth-quarter results for 2024 showcased a narrower-than-expected loss and a 22% increase in revenue to $1.2 billion, with platform revenue exceeding $1 billion for the first time.

- The company's stock surged approximately 14% in early trading following the earnings announcement, with projections of $1 billion in revenue for the first quarter and $4.61 billion for the full year of 2025.

Roku, Inc. (NASDAQ:ROKU) is a prominent player in the streaming industry, providing devices and content that allow users to access a wide range of streaming services. Competing with giants like Netflix, Roku has carved out a significant niche, ranking third in the movies industry group. The company's stock performance has been noteworthy, with a strong relative strength line reaching a 52-week high.

On February 14, 2025, JMP Securities maintained its "Market Outperform" rating for Roku, with the stock priced at $99. This rating suggests confidence in Roku's future performance, encouraging investors to hold their positions. This decision aligns with Roku's recent financial achievements, as highlighted by its fourth-quarter results for 2024.

Roku's fourth-quarter results for 2024 exceeded expectations, with a narrower-than-expected loss and a 22% increase in revenue to $1.2 billion. The company's platform revenue surpassed $1 billion for the first time, driven by growth in streaming households and hours on The Roku Channel. This positive performance contributed to a significant stock surge, reaching a new high.

The company's operating loss narrowed to $39.1 million, a substantial improvement from the $104.2 million loss in the same period in 2023. Analysts had anticipated a loss of 41 cents per share, but Roku reported a loss of only 24 cents per share. This better-than-expected outcome has bolstered investor confidence, as highlighted by JPMorgan's decision to maintain its outperform rating and raise its price target from $92 to $115.

Roku's stock rose approximately 14% in early trading following the earnings announcement, reflecting renewed investor interest. The company projects first-quarter revenue of $1 billion and full-year 2025 revenue of $4.61 billion, aligning with estimates. With over 90 million streaming households, Roku's growth trajectory remains strong, despite a 4% decline in shares over the past year.