Telefonaktiebolaget LM Ericsson (publ) (ERIC) on Q4 2021 Results - Earnings Call Transcript

Peter Nyquist: Hello, everyone. And welcome to today's Ericsson's Fourth Quarter Result as well as the Full-Year Result for 2021. With me here today, I have our CEO, Börje Ekholm, and our CFO, Carl Mellander. So, as usual, we will start with a presentation from Börje Ekholm con and then we will end the session with a Q&A. More information on that you will find on our website, but you have to join the call via telephone to be to ask questions. So, during today's presentation, we will make forward-looking statements. These statements are based on our current expectation and certain planning assumptions, which are subject to risk and uncertainties. The actual results may differ materially due to factors mentioned in today's report or press release and discussed in this conference call. We encourage you to read about these risks and uncertainties in our earnings report, as well as in our annual report. So, today, we're not only presenting, as I said, the fourth quarter result, we're also presenting actually the full year of 2021, an eventful year for Ericsson. But before starting presentation, I would like to ask one question to both Börje and Carl, the sort of the event that stays in your mind when you think about 2021. So, I'll start with you, Börje, what's sort of the situation event that you will think about when thinking back on 2021? Börje Ekholm : I think of a couple of things actually. The first one is really the accelerated rollout we've seen on 5G around the world. And cell phone technology has been a fast scaling technology. 5G is the fastest scaling cell phone technology so far, and it's quite impressive to see. I think that's an important part. We have seen our investments in technology and R&D actually paying off and gaining market share as well. The next part, which I think is equally important, is the step we took with the announced acquisition of Vonage, which will allow us to build an enterprise business where we can monetize together with our customers to CSPs on the capabilities of 5G network by providing the developer community with exposure to the API's we can actually develop in the 5G network. I think that's very exciting for the future. Peter Nyquist: An eventful full year. So, no opportunities to improve your golf handicap, I guess. Carl, what do you think about if you think about 2021? Carl Mellander : I think it's a great testament to the collaboration efforts. The whole team, 100,000 employees in the company, actually delivered on all the things that Börje talked about. And the outcome is so strong. Everything from top line, pleasing the customers and so on, the improved profitability, but also cash flow, of course, which I think is maybe the ultimate testimony here to performance in the business, a record high cash flow for the year, the best we've seen in the history of Ericsson. So, I think that's – it's strong and it's a great team effort in Ericsson. Peter Nyquist : Great. Thanks, Carl. Thanks, Börje. With that starter, I will actually leave the word to you, Börje, to start your presentation. So please, Börje. Börje Ekholm : Thanks, Peter. And I hope your golf handicap has improved more than mine. Anyhow, good morning, everyone. And welcome to this presentation. I'm very happy that so many of you could join. So, thanks for being with us. I am very proud to present a good ending of 2021 as well as a very strong fourth quarter. I would say today's report is really a direct result of executing on the strategy we put in place to focus on extending our leadership in the mobile infrastructure business. And we do that by investing in R&D for technology leadership, but also that we can leverage this position we have in the mobile infrastructure business to establish and grow into an enterprise business. But more on that later on in the presentation. I also want to take this opportunity to thank all my colleagues at Ericsson for a very strong job done this past year. We faced pandemic challenges, but we've also faced supply chain challenges as well as inflationary pressures. But I must say it's a true testament to their ability to execute, basically great achievement on their part. 5G, as I said before, is the fastest scaling mobile technology we have seen, and deployments around the world have truly accelerated this past year. And we have been able to achieve a leadership position. So, today, we have 109 live 5G networks, we have 170 agreements or contracts with customers on 5G networks. And we have been able to capitalize on this leadership position to gain market share as well. We can also see that the investments we made in technology leadership actually results in a performance of the network, of the deployed networks for our customers, and we have recently seen basically in three different independent benchmarks that the winners in each of the benchmarks have one thing in common, they actually rely on Ericsson for their primary vendor relationships. So, it shows that while the measurements always vary by benchmark and the standards vary by benchmark, we can see that we can deliver network performance that's second to none. And that's ultimately what's going to drive our business going forward. Now, let's hit on a couple of key benchmarks from the fourth quarter. The momentum in our core mobile infrastructure business continued throughout the quarter. This is, of course, something that's basically the cornerstone of the company. We're not going to lose focus on that even as we expand into enterprises. We offset the impact from the reduced market share in Mainland China by growing elsewhere. So, organically, total growth was 2%, but if we exclude China for just comparisons, our organic growth was 5%. For the whole of 2021, we saw an 8% growth if we exclude China. Profitability remained very strong. And we had the gross margin in the fourth quarter of 43.5% versus 40.6% the year before. And basically, that's the result of improvements in all segments. EBIT margin reached 17.3% and free cash flow before M&A was SEK 13.5 billion. For the full year, our gross margin was also 43.5%; EBIT margin, 13.9%; and free cash flow, SEK 32.1 billion. And I will say all of them are indicators of the resiliency and strength of our underlying business. In our Q3 call, I shared a little bit more about our thoughts on our growth plans into enterprise. And of course, I'm delighted about the step we took during the fourth quarter with the announcement of our intent to acquire Vonage. Based on learnings from our past acquisitions, Vonage will remain a standalone entity in Ericsson and operate with limited integration. This is the module we deployed actually for Cradlepoint and the integration of Cradlepoint. And there, we have been able to execute in line with our investment case. And that's despite supply challenges as well as a relatively slow pickup of 5G modems in the beginning of the year. So, the light integration will allow Vonage to continue to execute on growing the business as well as on the financial performance. But in parallel, with that, we will also start to invest in our global network platform that basically will allow CSPs as well as ourselves to monetize the features of the 5G network, or call it, the performance characteristics or APIs of the 5G network. So, by developing the APIs, we can actually, through the Vonage acquisition, expose the APIs to the Vonage developer ecosystem to drive completely new applications on to digitalizing enterprises, but also for consumers. And of course, in addition to Vonage, our enterprise business consists of our dedicated networks, as well as Cradlepoint and IoT. That's part of the more wireless mobile networks that we are focusing on as well. We expect Vonage to close here during Q1 or possibly into Q2, depending on regulatory approvals and shareholder votes. I would also just touch upon the correspondence that we received from the DOJ during the fourth quarter where there is a breach in the deferred prosecution agreement as Ericsson basically failed to provide certain documents and factual information. I'm sorry to say, but at this point in time, we will have no further information to share. But I will say that we will update the market as soon as we have additional information about the matter and then we will share it, of course. But in the meantime, I would also say that we continue to invest very heavily in building a world class compliance program and, basically, a culture of integrity at the company. We're taking significant investments. We took them already last year and we will continue to do that during 2022. Our commitment to be world class in compliance stands firm. We reached also our targets, financial performance targets for 2022 of 12% to 14% of EBIT margin, basically, one year early. I remain very confident about the future growth of our core business, the core mobile infrastructure business. So, for 2022, we see the targets to remain in place, i.e. 12% to 14% if we exclude the Vonage acquisition. However, we also see that when we determined the target for 2022 – that's back in 2018 – our business mix looked a bit different and our investment mix looked a bit different. So what we see now, while we are, of course, committed to the target, we see an opportunity to develop a very strong enterprise business. And that, we see, will allow us to also improve profitability over time. So, our focus now is, therefore, to accelerate the achievement of what we said would be the long-term target of 15% to 18% EBITDA margin, and we should be able to do that no later than two to three years out. So, we're very excited about the opportunities we see in enterprise, but it's also important that we make sure to accelerate to reach the long-term target, as I think that will put us on a very different growth trajectory as well as profitability development. In the last few years, we've also taken steps to improve the capital efficiency of the company. And basically, we see today that we can operate the company with much less capital than we could before. And basically, that allows us to pay cash for the Vonage acquisition. And at the same time, it does not impede our ability to invest in growing the rest of our company and the rest of our business. So, when we take all these factors into account, the Board has decided to propose a dividend of SEK 2.50 per share. That's an increase of 25% compared to last year, and it reflects the confidence that we have and stability we see in our business. So, now, moving on to market area performance for the fourth quarter. So, starting with Europe and Latin America, sales increased by 12%. Breaking that down, we can see that Europe grow 11% and Latin America 17% in organic growth. And this strong development was driven by growth in both networks as well as digital services, and it's really on the back of market share gains. 5G momentum continues in North America where we saw very good development. Sales increased by 15%, driven by strong demand for 5G. And it's worth remembering, in the year, we've actually signed now 5G contracts with all tier 1 operators, representing the biggest contracts in our company's history. And that's been done in North America, of course, or in the US. In Middle East and Africa, sales increased by 5%, and largely driven by growth in Africa where digital services, in particular, saw a strong demand for software upgrades. Sales in Northeast Asia decreased by 22% year-over-year, and that's on the back of materially lower market share in Mainland China. Finally, in Southeast Asia, Oceania and India, their sales decreased by 13% versus 2020. And that's really a tough comparison in the fourth quarter, primarily for networks. So, networks actually shrank, but we saw a good development in digital services instead. So, let's look now at the market segments or business segments. If we start with Networks, sales adjusted for comparable units and excluding Mainland China grew by 6% and we saw double-digit growth in North America, Europe and Latin America. Gross margin increased to 46.4% compared to 43.5% year-over-year, and that's really due to operational leverage. In Digital Services, sales adjusted for Mainland China increased 3%. Gross margin increase to 43.4%, driven by increased software sales, which is actually in line with the strategy we have for digital services. So, Digital Services continues to develop according to the plan. And what we are starting to see, though, is that as 5G core at least starts to go live with customers, we are starting to see revenues being generated from those contracts. So, for 2022, we expect a limited loss for Digital Services, but the improvement is going to be tilted towards the second half of the year, and that is due to the 5G networks are increasingly starting to carry traffic throughout 2022. So, Managed Services sales declined year-over-year, basically as new deals could not fully offset lower customer demand. And we also had contract rescoping as well as planned exits. To grow profits, we will accelerate the ongoing transformation towards a more software driven offering with higher margin potential. In Emerging Business and Other, we're seeing increasing momentum for our 5G portfolio in dedicated networks as well as Cradlepoint. Both sales and gross margin improved with Cradlepoint as the main contributor. The development of Cradlepoint, as I said before, is well in line with our acquisition plan. With that, I'm going to leave the word over to Carl to go through a little bit more of the details in the report. Carl Mellander : Thank you, Börje. So, good morning, everyone. And thanks for joining. And first, I just wanted to also echo what Börje said earlier. We're very proud of this result. And it's really the result of strategy execution. But let's have a look at the numbers then. So, net sales, SEK 71.3 billion with an organic growth of 2% for the group. And if we then adjust for the drop in Mainland China, where we have lost market share, as we have discussed many times, we have an organic growth of 5%, just as a reference then. And as you saw in Börje's graph of market areas, of course, this growth is really underpinned by our two largest market areas, being North America growing at 15% currency adjusted and Europe and Latin America 12%. This is a clear result in these cases by market share gains with the customer. So, that's encouraging to see. Börje also alluded to the global supply disturbances that remained during the quarter, but really thanks to the supply organization and all the hard work that we managed to continue to build resilience in the supply chain and deliver to customers according to their demand. And in fact, if we look at 2021, we have managed to increase the number of delivered radios every quarter sequentially. And in Q4, that's also true year-over-year. IPR revenues, SEK 2.4 billion in the quarter, including a portion of retroactive revenue from one contract that we signed, somewhat smaller contract that we signed during the quarter. And next quarter, IPR revenues will be impacted by several expiring patent renewal discussions and 5G license negotiations. So, assuming we don't sign those during the quarter, we estimate IPR revenues to be between SEK 1 billion and SEK 1.5 billion in the first quarter 2022. Börje showed us earlier the graph on gross margin numbers, the rolling four quarter profile there. And as you saw, gross margin then excluding restructuring charges amounted to 43.5%, which is an improvement of 290 basis points year-over-year with improvement in every segment. In Networks, we saw continued operational leverage. And in Digital Services, the share of software as a portion of total sales increased. And, of course, both of these fully in line with strategy. And in Digital Services again, the 5G core sales started now to progress well and we saw revenues increasing in the quarter as we deliver on these contracts. And of course, this will continue going forward as well. To date, we have landed 50 5G core contracts. R&D expenses, as you see, now SEK 11.7 billion, up from SEK 1.5 bk. And this is really following our decisions to invest across the group in the 5G portfolio, but also the addition of Cradlepoint if we make the year-over-year comparison. EBIT then at SEK 12.3 billion or an improvement of 12% versus last year. And, of course, this represents then an EBIT margin of 17.3%, as Börje mentioned as well, which is 150 basis point improvement year-over-year. I wanted to point out net income as well. Strong growth for net income level, 41% up year-over-year to SEK 10.1 billion. Of course, it's a result of the improved earnings as such, but also reduced taxes. And we'll come back to taxes a little bit more when we look at the full year performance in a moment here and free cash flow as well. So, let's do exactly that. Let's turn over to the next slide and look at the full year in numbers. So, reported sales, as you see, then SEK 232.3 billion, which is a rather flat report then compared with last year, but organically it's a growth of 4%. And again, if we were to exclude China, it's a growth of 8%. Hardware now actually consists of 46% of the sales mix in the group. That's up from 41% in 2020, which is a strong development as well. It shows the demand for our offering. Gross margin improved 290 basis points again to 43.5%. Continued improvements across the board in spite, actually, of the drop of IPR revenues of about SEK 1.8 billion less than last year. In Networks, continued operational leverage. I said that before also commenting on the quarter, but that's also true for the full year. The gross margin in Networks was 47%, improvement of 320 basis points in Networks. Digital Services, 42% gross margin, impacted, of course. As we have discussed quite a lot in these calls earlier, impacted by the initial costs for 5G core contract deployment. But as I said, during the year, we have seen a good increase in revenues from the 5G core contracts and we expect that to continue as the traffic in 5G network grows. OpEx, as you see here, SEK 68.8 million. SG&A, rather flat. And there, on SG&A, we continue to focus on efficiency and tight cost control throughout the organization. R&D, on the other hand, grew because we are investing in the 5G portfolio. So, you see growth by SEK 2.6 billion year-over-year here. We invest in cloud native 5G portfolio in the Digital Services. And in Networks, of course, in our 5G portfolio, plus the Cradlepoint acquisition which also contributes here. EBITDA margin came out at 14.6%. And as you know, this is the metric we use for the long term target. And as Börje now said and this is important piece of the report today that we say that the long-term target is now going to be reached. That's our expectation and ambition within two three years. So, continuing down the P&L and the EBIT margin here, SEK 32.3 billion excluding restructuring, up from SEK 29.1 billion. This is then an EBIT margin of 13.9%, which is just at the upper part of the range for the 2022 target, which thereby is reached one year earlier, as Börje said already. Also, a few comments on tax. So, as now our profitability grew, we were also able to utilize a bit more of the tax assets we have, the withholding tax assets. And effective tax rate now came out at 21% compared actually with 35% in 2020. But there was a one-off benefit from impaired withholding tax assets that we were now able to utilize in the fourth quarter. So, if we add that back as a bit of a one-off, the effective tax rate would be at 25%, still down 10 percentage units then from 2020. Earnings per share fully diluted, SEK 6.81. And I want to mention return also, return on capital employed came out at 18.4%, which is an increase from 17% last year. And both of these numbers include the cash position to the full extent. But we can also calculate excluding cash and then our OCE would then have been 37%. So, let's move from P&L metrics into cash flow and look at how the earnings translated into free cash flow then. First of all, on cash flow from operating activities increased to SEK 15.2 billion in the quarter. And that led us to a full-year outcome of SEK 39.1 billion. And this is about SEK 10 billion better than 2020. We do put a lot of focus on working capital in our company end to end and we have seen the curve improve over all these years since 2017. And, of course, this year, I can say the working capital was – or this quarter, I should say, the working capital was helped by certain prepayments also by customers. And the other important factor that happened in working capital is really the increased investments in inventory levels to manage the supply situation. But on the other hand, that was offset at least partly by an increase in accounts payable during the quarter. So, if you continue down this table, then you see the free cash flow of SEK 13.5 billion. And this is really the key metric for us, free cash flow before M&A. And that led us to a free cash flow before M&A for the full year of SEK 32.1 billion, which is an increase of SEK 10 billion from the year before. And that in turn was actually an increase of about SEK 15 billion from the previous year, 2019. And this translates for the full year into 13.8% free cash flow as a percentage of net sales. And as you know, we have talked about the long-term target on this metric between 9% and 12%. So, we clearly beat that target also in 2021. And on the back of this strong cash flow generated during the year and in the quarter, we managed to increase our net cash position with SEK 10 billion. It now amounts to SEK 65.8 billion and the gross cash position is SEK 97.6 billion, up around SEK 26 billion if you compare with a year ago. And the majority of that increase comes from cash flow that we have generated in the business and a smaller part, say about SEK 2 billion, comes from net activities from long term debt. And we have checked the history books of Ericsson. And so far, we haven't found a higher net cash position than the SEK 65.8 billion in the history of the company. Vonage – mentioned already by Börje – expected to close now Q1 or Q2, and that's, as you know, a US$6.2 billion acquisition. And of course, as we have continued to build up the cash position now compared with when we announced the acquisition, we are going to be able to fund this with cash at hand. So that's good. And before handing back to you, Börje, here, I just wanted to point you in the direction of page 13 in the report where we had included certain key data points, including the Dell'Oro market forecast, for example, and some data on seasonality, et cetera. But with that, thank you. And I hand back to you, Börje. Börje Ekholm: Thank you, Carl. So to sum up, we're proud to report a solid quarter to complete a very strong year for Ericsson. We continue to be well positioned to take advantage of the market growth opportunities as 5G continues to ramp globally. The business momentum remains very strong. With a strong core mobile infrastructure business, we can now take advantage of growth opportunities in the enterprise segment. Our expansion into enterprise is focused on leveraging our capabilities from the core mobile infrastructure business. In a few years, we will have fundamentally shifted our business mix towards much higher portion of revenues coming from enterprises, with a higher growth potential as well as profit potential. Our strategy is on track. We invest in R&D to deliver technology leadership, which in turn can drive incremental growth in our core business. In wireless enterprise growth, we're committed to closing, of course, the Vonage transaction, and thereby we can continue the excellent work already begun by Rory and the rest of the Vonage team. And we hope they will join us very shortly. In the longer term, we see here that we will also leverage the platform we get through Vonage to create new, very valuable APIs for wireless communication and network capabilities. And that's going to be delivered through our global network platform. All of this means better monetization potential for both our customers to CSPs as well as Ericsson BY providing the 5G APIs to Vonage global developer community. I'm truly excited of what lies ahead As we gear up for growth where we expect the enterprise segment, as I said, to provide higher growth potential, as well as profitability than our core infrastructure business. This makes it now our key focus to really achieve the long-term target of EBITDA margin of 15% to 18%. And we should be able to do that no later than two to three years out. And at that point in time, we will have a better profit potential or profit mix as well as growth potential in the company. So with that, I would like to conclude this part of the presentation and give the word back to you, Peter, for questions. Peter Nyquist: Thank you, Börje. So we will enter to the second part of this session, and that will be the Q&A. So, operator, can you please kick off that session please? Operator: . Peter Nyquist: The first question is from Alex Duval at Goldman Sachs. Alexander Duval: Congrats on the strong results. Firstly, you delivered another quarter of very strong gross margins, both in the quarter, but also on a trailing four quarter basis. Understand you talk about investment in product quality. But I'm just curious to what extent this could be due to having less of a position in China and how much of a structural benefit that is? And more broadly, what are the key drivers of your strong gross margins and how sustainable should we expect that to be in 2022? A lot of investors interested in that, just given one of your competitors appears to be executing better on product quality. Carl Mellander: I can start, for sure. I think what we see now when it comes to gross margin, first of all, it's across the board. So, we see improvement in all segments. That's encouraging for us. Not just one part, but all parts. When it comes to the key drivers for gross margin, I think it's really the technology level that we are able to offer to customers in combination with a constant improvement of the cost position also of the product or the offerings. And I think our R&D team is doing a great job in improving the product, designing it for a better cost position, but also actually better and better serviceability, installability in the field, which means a lot as well for the customer satisfaction, of course, for lead times, but also for our gross margins. I think therein lies the key drivers of gross margin. Anything to add, Börje? Börje Ekholm: I would only say that the reality is also that we have actually taken market share, which we should remember – and we've said that before, actually, it's more than dilutive in the short term, but very margin enhancing long term. And if you look at the numbers, you see actually quite a lot of headwind coming that way. So we feel quite comfortable about the gross margin going forward, to be clear on that. Peter Nyquist: Move forward to Aleksander Peterc at Société Générale. Aleksander Peterc: I have actually two. One is just in terms of regions. Very strong growth in Europe and LatAm. And you commented on that already in your opening remarks. But could you perhaps tell us where you are now in terms of market share gains, momentum there? Is there still more to come in this region due to geopolitical shifts? And where we are in terms of 5G rollouts? Have we seen the peak here? Or do you still see strong growth going forward there? And then the second question is more on targets. So, on meeting or exceeding them nearly on all counts. But don't you think there's now time to have a new set of comprehensive and more relevant targets beyond just the EBITDA, 15% to 18% goal? When do you intend to update us comprehensively on that front? Börje Ekholm: We think we're still relatively early in the 5G rollouts if you look on the globe. So, we will continue to see good demand for 5G going forward. That's for sure. But I would also say one more thing – and that's on market share gains. Your question kind of hinted towards the geopolitical situation being a key driver of the market share gains. I will say it's not. So, in the markets where we have gained footprint, part of it can be explained by geopolitics, but most of it actually is perfectly competitive markets and open markets. So I would say the market share gains in reality comes much more out of it compared to the product portfolio and the big investments we made in R&D to make sure that we are on the forefront of performance. And that's why I want to reiterate that, when we start to look at infield performance of our equipment and networks, we see that we actually have – we come out with very high performance rankings, wherever we do them across the board. And that's something we don't take lightly. It's something we invest for and something that we're committed to deliver to our customers. You take the goal question on target. Carl Mellander: Yeah, exactly. Aleksander, you asked about the targets also. I think what is important here is that, first of all, that we exceeded – or sorry, we reached the 2022 target one year early. And, of course, also we do have a different mix. We are investing in enterprise in a way that was not visible back in 2018, when we put up this 2022 target. So, it becomes a little bit less relevant then. What we really want to – the message we really want to send today is that we increased the ambition when it comes to the long term EBITDA, 15% to 18%. And we move it towards us in time and saying that we will have the ambition to reach that already in two to three years, as opposed to a more diffuse or abstract long term time horizon. So, I think that's the key here and we haven't spent time on the particular parts of 2022 targets. Now we look ahead, it's the 15% to 18% EBITDA that will guide us going forward. Peter Nyquist: We'll move to Dominik Olszewski at Morgan Stanley. Dominik Olszewski: Two of them. The first one is on the Networks outlook. So, if we look at Dell'Oro, they've recently upgraded the outlook for RAM spending cumulatively out to 2025 by about 4%. And roughly half of that is from improving pricing. So, could you comment specifically on your ability to price favorably and maybe tie that into what sounds like more limited supply chain disruptions that you've seen recently? So that's the first question. And the second question is just more briefly, the margin performance in 2021 is strong given that you have 5% increase in the hardware mix. So, could you maybe just directionally give us a perspective on how the mix shift between hardware, software and services for 2022? Obviously, at this point, let's exclude Vonage from our conversation? Börje Ekholm: Should I maybe start with the second one around the mix question there. And it's right, we saw an increase of the hardware mix, which is actually very good because it means that we are shipping a lot of 5G equipment to customers as they build out the networks. Of course, and this is fully in line with what we want to do and our strategy. At the same time, over time, software will increase its share as well as Networks capacities is increased. That's true for Networks. It's true for Digital Services. It's even true for managed services where we're moving towards more of a software like model. And, of course, as well in the emerging business, which is a lot around scalable software solutions. So, I think without going into the specific metrics there, I think we're very happy about hardware having such a big part of the mix now today. And you see that we deliver great margins, even with such a high part of hardware, which means – and it's another proof point of what we've said many times before that the differences in margin between services, hardware and software has actually decreased quite a lot over time. Used to be very large differences. But now we're able to deliver both services, hardware and software, with decent profitability levels and we are very happy with that. But overall, I would say the overriding strategy is to increase the software share, which we also see, for example, in Digital Services in this quarter. When it comes to your question on the market and the Dell'Oro outlook, yeah, I think we can repeat when it comes to 2021. The market outlook has constantly increased, the projections have increased. Now Dell'Oro is looking back at 2021, looks at 13% growth 2021, and now it's 3% or 4% for next year, depending on if China is included or not. Let's see what will happen with the market. We clearly see very good momentum. That's for sure. And very high demand from the customers as evidenced in the fourth quarter then. You mentioned the supply. I think we said everything we could around that we managed to navigate through these disturbances in the fourth quarter. And we will certainly continue to monitor that very carefully going forward. Carl Mellander: Just to comment also on the mix question, one thing that we have worked quite a lot on is to improve the resilience in the company. One important part of that is to reduce the exposure to business mix, as well as geographic mix. So, you'll see us talk a lot less about the mix questions today than we did before. And the reason is that resiliency, and that's why we also feel more comfortable about operating the company with a lower, call it, capital or cash position going forward. And I think that's important to keep in mind. Peter Nyquist: We'll move further to the next question. It's from Francois Bouvignies at UBS. Francois-Xavier Bouvignies: I have two quick questions, if I may. One clarification, actually. First is, on your 2022 targets, what's the IPR run rate do you assume in terms of sales for the full year 2022? And when you look at your EBITDA target in the two to three years' time, what is the IPR as well that you have in this forecast? i.e. the recent negotiations, do you take that into account or not would be helpful. And the second question is on the OpEx. Maybe Carl, we have many questions around inflation and the impact and the supply chain. Can you help us understand what the OpEx run rate in 2022 may be that you see because you saw some seasonality, which is helpful, but I guess with the current environment, seasonality might be a bit different this time. So, just trying to understand the OpEx run rate in 2022 would be great. Carl Mellander: On the OpEx side, and as you know, we refrain from guiding on specific individual lines too much on the P&L. It's really about the bigger value creation picture. But of course, there are inflationary pressures going on. And I can just say that our job when it comes to SG&A is, of course, to keep at cost discipline and efficiency to counter that, to counter salary increase pressures and other inflations. Of course, having said that, there are certain investments that we decide to make. They have to do with compliance and security, digitization as we have discussed before as well. But separate from SG&A, we have R&D. And there, of course, we will invest. If we see long-term value from R&D investments, we will certainly do that. And we will see both in the core business and in the enterprise side, of course, that we increase investments there. When it comes to IPR, I don't want to get into too much of specifics there. Of course, now we are in the situation here with certain renewals going on. So, I'll refrain from talking about the amounts there. But, of course, what we try to do is to maximize the IPR revenues that we have. We had historically a level of SEK 10 billion with a different currency rate perhaps, but this is, of course, the level that we strive to reach and then exceed over time. That's what I can say about IPR. Francois-Xavier Bouvignies: And, Carl, when you say that your mid-term target is to reach SEK 10 billion or so on the IPR, is it what you assume for your long term targets of EBITDA then of 15% to 18%? Is that what you apply? Or do you assume – yeah, just trying to understand your long-term forecast there. Carl Mellander: Yeah, I understand your question. We haven't broken down the 15% to 18% in the components as such. We more see that as what we as a group will achieve in two, three years from now. Of course, there is a desire and ambition to grow the IPR revenues, but also margins in other parts of the business are expected to improve. So, it's going to be a mix, and we don't single out individual components at this stage. Peter Nyquist: We'll move to Sebastien Sztabowicz at Kepler Chevreux. Sebastien Sztabowicz: One question around China. How do you see the revenue trending in the coming quarters in China? And also, could you please make an update on the actions you have been taking in the country to system profitability, so far where we're staying right now? And the second one would be on the US market. I'm looking at Dell'Oro's forecast for the US, calling for only 3% growth in North America in 2022. But when I'm listening to management of AT&T and Verizon, they seems much more bullish than that in terms of mobile investment for the coming quarters with C-band spectrum deployment picking up. What is your personal view on the US market outlook for the coming quarters? Carl Mellander: Should I start with China and you take US perhaps, Börje? On China, we see now that the reduced market share that was announced is the one we have basically in the business. We had some uptick in the fourth quarter, but that's more related to seasonality. So, we can expect that we will keep this level, around 3% market share. Of course, an ambition is to always stay close to customers and try to regain business and regain market share. But for planning purposes, I think we can assume that we will stay on that level for now. We have taken some actions in China to reduce cost and to right-size the organization in relation to this new volume that we see in China. And that's already done. And we've taken that, also restructuring cost associated with that already in Q4. So, that's basically done already. On US? Börje Ekholm: If we look at the Dell'Oro forecast, and I think it's often hard to predict how the ramp up of a new technology would look like and I think that's what we've seen for 5G as well. So, Dell'Oro has been a little bit behind. What is the reality when we look around the world is a very strong demand for 5G and it's on the back of demand from, in a way, consumers and the enterprises to deploy the technology. We see a growing interest from pretty much across the industry sectors being in mining, being manufacturing, being in logistics. So, we see this demand for 5G picking up. That's why I'm, on a more personal level, more optimistic about the growth forecast for 5G as well as the longevity of the investment cycle. Because, of course, you will first have to build coverage, you will have to build performance in dense urban areas, then you're going to build them in suburban, then you're going to build it on the countryside. So, we're going to see – at least, this is my view – a little longer investment cycle than we've seen before. Because the characteristics of 5G is so different from any other mobile technology that, in reality, was only consumer-centric. With 5G, we're opening up one completely new field or new segment, being enterprises. So I think we're underestimating the growth potential in 5G rollout. But we have also said that, not to be caught in our own Kool Aid, it's better to take an external forecast. It will suffer from shortcomings, et cetera, but as you asked, I think it's fair to say that we are more optimistic near term and even more optimistic long term. Peter Nyquist: We'll move to Frank Maaø at DnB. Frank Maaø: My question is really, first, how should we think about the target range that you will drive this for in Networks? I accept the fact that you say that the 2022 targets for the group is no longer very relevant due to changes in the business mix. But if we zoom in on Networks for a moment, Networks, there's a pretty large discrepancy between the target range and what you actually have delivered. So, my questions would be then, is there any key reasons for any margin erosion year-on-year in 2022? For instance, raw material inflation, component prices sort of rising and so on. Or do you expect that to basically be offset by the efficiencies that you pursue in design and R&D and so on? So, that's kind of my first question. And then, if I may, a quick clarification, actually, if I understood Börje's statement on the DPA breach issue correctly. Did you say that there actually has been a DPA breach? Or was that a misunderstanding on my part? Börje Ekholm: On the DPA, it's a correspondence from the DOJ that there is a breach, and they can determine that – that's kind of their determination. When we have something more to talk about here, we will come back. I just literally – will be inappropriate to discuss any of the details. Carl Mellander: Frank, on the question of the target, I think the real focus here is to move now to this long-term two to three year out EBITDA targets. And so far, we haven't broken that down as to segments. Some point, we might come back with that. But so far, that is the group target. 2022 targets were, of course, broken down by segments. And if we look, historically, then at Networks, we have been in this range or even above this range that we provided. We are not here today to guide specifically on Networks for 2022. But the targets remain. That's what we say. Of course, our entire job is to deliver as good a profitability and growth as we possibly can in Networks for this year, but also going forward. So I think that that's about as much as we can say about this. But let's shift focus now to this two to three-year out EBITDA targets. That's really what's going to power our company now. Peter Nyquist: We'll move to Daniel Djurberg at Handelsbanken. Daniel Djurberg: Congratulations. Two questions, if I may. The first to call, on the tax rate effective at 25%, can you give any guidance or some kind of ballpark would be prudent for 2022 to use, given the mix that you expect? And also, to Börje, except for this cellular enterprise private networks opportunity, a difference that we see at least between 3G, 4G and 5G is this fixed wireless access, first responder network, et cetera. Can you comment a little bit on your view on these markets, if it can also help to prolong the five year cycle? Carl Mellander: On the tax rate, I would say the 25% that we have now for 2021, that is a good indication of where we should be with the current mix, geographical mix and so on and the profitability levels we have. I think it's a fairly good assumption to use going forward as well. As you know, we come from much, much higher levels. And it's really how the company is set up. We do have tax losses from past history, as you know, which means that as we become more profitable, the tax rate actually comes down. This is exactly what we see happening now. Then, of course, there will be changes over time in terms of geographical mix. Let's say if we increase the presence strongly in the US, for example, for the enterprise side or other changes that could that could impact this percentage as well. But again, if you look at the underlying business today, this is a fair representation of where we should be. Börje Ekholm: And you're absolutely right, we were a little bit brushing away some of the actually very big opportunities, like fixed wireless access, like first responders. Just as a small comparison, what we see in 4G where actually fixed wireless access have been rolled out in certain countries around the world, we see a very rapid uptake of that service. And that is nowhere near where it will be on a 5G network. So, we're actually very optimistic that we will start to see fixed wireless access to be rolled out across the world, in many geographies and actually provide an additional market segment that today is rather limited. And the interesting thing, when you look at – many countries have a commitment to build out broadband to the consumer and to households and provide 98% coverage and some say 100%, et cetera. Actually, wireless is a much faster way to do that. And you can almost, in most countries, build out the 5G coverage that will give you a true broadband experience for the consumer in much shorter time at a much lower cost than you can do with a fixed network. So, I'm actually convinced that we're going to see fixed wireless access becoming a large submarket in the 5G consumer market. Then we're going to see the enterprises, which clearly has a lot of interest. It's probably going to take a little bit longer for that to materialize than, I think, fixed wireless access. We see first responders around the world, they have already migrated over to 4G, to some extent, but we see an increasing interest to go over to 5G as well. So, there are a number of, call them, new segments, which have not really been factored into the market forecast for 5G. And that's why I say that my perspective is we will see higher growth much longer than anyone predicts today. Peter Nyquist: We'll move into this session's last question. But I see I have a quite a long line here. And please reach out to either the IR team or the media team, so we can answer those questions. So, the last question is from Peter Kurt Nielsen at ABG. Peter Kurt Nielsen: A question on Digital Services, please. You reiterate your expectations for 2022, with a positive tilt towards the second half of the year. Your comments on your long-term margin potentially exceeding those in Digital Services, would it be correct to interpret your view on Digital Services that once the business turns breakeven, positively impacted by the growing 5G core revenues, the curve towards those profitability targets will perhaps be steeper than initially thought? And the route approached, breakeven to those targets will be quite quick. Would that be a correct interpretation? Börje Ekholm: The reality is that turnaround of Digital Services will be on the back of better software revenues. And that's why I would also say that my prediction is that we will – as soon as reach breakeven and reach the volume to be at breakeven, it's actually a smoother development and faster development to reach the higher margins. But it requires us to gain the volume, the software volume, to reach the breakeven. That's going to take a bit of time, especially when we lost China. And as you know, China is really the first country to roll out any massive traffic on 5G networks. So, that's why it's so meaningful that we lost that. But now, we see that the rest of the world will start to generate those revenues, but they come in the back of this year. Peter Nyquist: Before ending today's Q&A session and presentation over the Q1 – sorry, Q4 results for 2021, short closing remark from you, Börje. Börje Ekholm: Thanks, Peter. And thanks, everyone, for listening in. We feel that we're continuing to execute on our strategy to extend the leadership in the core mobile infrastructure business, where we see very strong demand for 5G as we have discussed now, but we also see a great opportunity to pivot the company towards an enterprise business, which we will establish over the coming few years. And in two to three years, it will be a meaningful contributor to reaching the long term target of an EBITDA margin of 15% to 18%. And we see that we should be able to do that in the next two to three years. And we're, at least on this side, extraordinary excited about the outlook for the 5G market, but also what we can do in the enterprise field. Carl Mellander: Thank you. Börje Ekholm: Thank you.

Ericsson's Strong Earnings and Strategic Moves Bolster Market Position

- Ericsson (NASDAQ:ERIC) reported earnings per share of $0.35, surpassing estimates and highlighting the effectiveness of its strategic operational improvements and cost-saving measures.

- Despite a slight miss in revenue, Ericsson's focus on operational excellence has led to sustainable gross margins and strong commercial momentum through significant customer agreements in key markets.

- The company's financial metrics, including a favorable price-to-earnings (P/E) ratio of approximately 14.92 and a solid earnings yield of about 6.70%, reflect its robust performance and attractive market valuation.

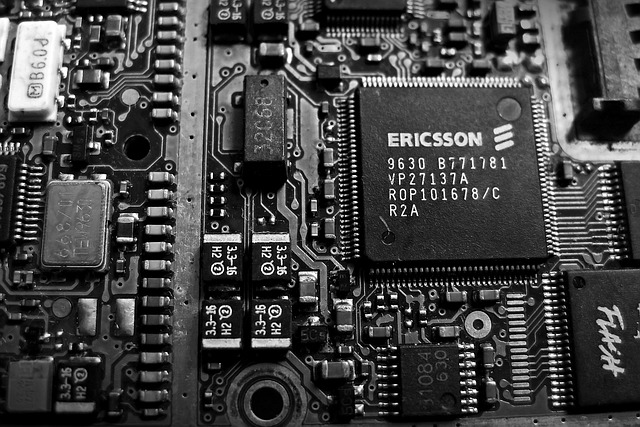

Ericsson, trading as NASDAQ:ERIC, is a leading Swedish telecom equipment manufacturer. The company is known for its innovative solutions in the telecommunications industry, providing services and products that enhance connectivity worldwide. Ericsson competes with other major players like Nokia and Huawei in the global market.

On October 14, 2025, Ericsson reported earnings per share of $0.35, exceeding the estimated $0.14. This strong performance is attributed to strategic operational improvements and cost-saving measures. Despite revenue slightly missing estimates at $5.91 billion, the company's focus on operational excellence has driven its gross margins to sustainable levels.

Ericsson's strategic efforts have resulted in strong commercial momentum, with significant customer agreements in key markets such as India, Japan, and the UK. These agreements have bolstered the company's financial flexibility, allowing it to enhance profitability and consider increased shareholder returns. The $1 billion sale of its Iconectiv connectivity services business further strengthened its financial position.

The company's financial metrics reflect its robust performance. With a price-to-earnings (P/E) ratio of approximately 14.92 and a price-to-sales ratio of about 1.05, Ericsson's market valuation is favorable. Its enterprise value to sales ratio of around 1.07 and enterprise value to operating cash flow ratio of approximately 6.48 indicate a strong valuation relative to revenue and cash flow.

Ericsson maintains a moderate debt-to-equity ratio of approximately 0.42, suggesting a balanced approach to leveraging debt. The current ratio of about 1.09 indicates a slightly higher level of current assets compared to liabilities, showcasing the company's ability to meet short-term obligations. With an earnings yield of about 6.70%, Ericsson offers a solid return on investment for shareholders.

Ericsson's Strong Q2 2025 Performance: A Deep Dive into Financials and Strategic Focus

- Ericsson reported earnings per share of $0.14, surpassing estimates and indicating strong profitability.

- The company achieved a 48% adjusted gross margin and a three-year high in its adjusted EBITA margin, showcasing operational efficiency.

- Ericsson is increasing investments in artificial intelligence, aiming to drive future growth and innovation in 5G technology and beyond.

Ericsson, listed as ERIC on NASDAQ, is a leading Swedish telecom equipment maker renowned for its innovative solutions in the telecommunications industry, particularly in 5G technology. Competing with giants like Nokia and Huawei, Ericsson has recently showcased its strong strategic and operational execution through its second-quarter results for 2025.

On July 15, 2025, Ericsson reported earnings per share of $0.14, surpassing the estimated $0.12, indicating a positive performance in terms of profitability. The company generated a revenue of approximately $5.84 billion, which was below the estimated $6.21 billion. Despite this, Ericsson achieved a 48% adjusted gross margin and reached a three-year high in its adjusted EBITA margin, highlighting its operational efficiency.

Börje Ekholm, President and CEO of Ericsson, emphasized the company's solid execution of strategic and operational priorities. The company has structurally lowered its cost base and is focused on delivering further efficiencies. Growth in the Americas is encouraging, while Europe has stabilized. Globally, fixed wireless access customers have surpassed 160 million, driving significant network traffic.

Ericsson's financial metrics reflect its market position. The company has a price-to-earnings (P/E) ratio of approximately 156.38, indicating a high valuation relative to its earnings. Its price-to-sales ratio stands at about 1.04, suggesting that investors are paying $1.04 for every dollar of sales. The enterprise value to sales ratio is around 1.03, reflecting the company's valuation in relation to its revenue.

Looking forward, Ericsson is increasing its investments in artificial intelligence, including its involvement in the Sweden AI factory consortium. AI is seen as crucial for accelerating innovation, especially in supporting AI use cases at the edge, which require ultra-low latency and enhanced uplink performance. This strategic focus on AI is expected to drive future growth and innovation for Ericsson.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson Shares Rise on Better-Than-Expected Q2 Earnings Amid Cost-Cutting

Ericsson AB (NASDAQ:ERIC) saw its shares rise more than 2% pre-market today after surpassing Q2 earnings expectations, benefiting from cost-cutting measures despite a challenging market. Adjusted earnings before interest and taxes climbed 14% year-over-year to 3.23 billion kronor ($307 million), surpassing the 2.7 billion kronor forecasted by Wall Street analysts.

CFO Lars Sandstrom emphasized the ongoing need for cost reduction, noting that a significant portion of expenses is related to personnel. Ericsson's net sales for the quarter fell by 7% to 59.8 billion kronor, exceeding analyst expectations of 58.5 billion kronor. The adjusted earnings did not include a previously announced impairment concerning its Vonage business.

The company reported an 11.4 billion kronor non-cash impairment due to the declining performance of the Vonage unit, leading to a net loss of 11 billion kronor for the period. This is the second writedown for the asset since Ericsson agreed to purchase it in 2021.