Ericsson's Strong Q2 2025 Performance: A Deep Dive into Financials and Strategic Focus

- Ericsson reported earnings per share of $0.14, surpassing estimates and indicating strong profitability.

- The company achieved a 48% adjusted gross margin and a three-year high in its adjusted EBITA margin, showcasing operational efficiency.

- Ericsson is increasing investments in artificial intelligence, aiming to drive future growth and innovation in 5G technology and beyond.

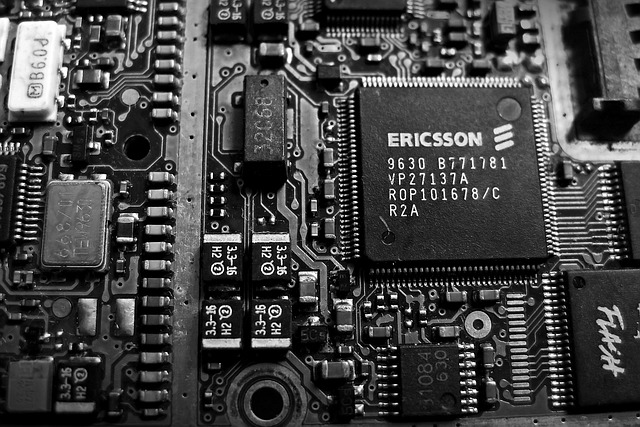

Ericsson, listed as ERIC on NASDAQ, is a leading Swedish telecom equipment maker renowned for its innovative solutions in the telecommunications industry, particularly in 5G technology. Competing with giants like Nokia and Huawei, Ericsson has recently showcased its strong strategic and operational execution through its second-quarter results for 2025.

On July 15, 2025, Ericsson reported earnings per share of $0.14, surpassing the estimated $0.12, indicating a positive performance in terms of profitability. The company generated a revenue of approximately $5.84 billion, which was below the estimated $6.21 billion. Despite this, Ericsson achieved a 48% adjusted gross margin and reached a three-year high in its adjusted EBITA margin, highlighting its operational efficiency.

Börje Ekholm, President and CEO of Ericsson, emphasized the company's solid execution of strategic and operational priorities. The company has structurally lowered its cost base and is focused on delivering further efficiencies. Growth in the Americas is encouraging, while Europe has stabilized. Globally, fixed wireless access customers have surpassed 160 million, driving significant network traffic.

Ericsson's financial metrics reflect its market position. The company has a price-to-earnings (P/E) ratio of approximately 156.38, indicating a high valuation relative to its earnings. Its price-to-sales ratio stands at about 1.04, suggesting that investors are paying $1.04 for every dollar of sales. The enterprise value to sales ratio is around 1.03, reflecting the company's valuation in relation to its revenue.

Looking forward, Ericsson is increasing its investments in artificial intelligence, including its involvement in the Sweden AI factory consortium. AI is seen as crucial for accelerating innovation, especially in supporting AI use cases at the edge, which require ultra-low latency and enhanced uplink performance. This strategic focus on AI is expected to drive future growth and innovation for Ericsson.

| Symbol | Price | %chg |

|---|---|---|

| SUPR.JK | 43875 | 0 |

| KETR.JK | 610 | -1.64 |

| 4333.HK | 400 | 0 |

| 178320.KQ | 25450 | 3.93 |

Ericsson's Strong Earnings and Strategic Moves Bolster Market Position

- Ericsson (NASDAQ:ERIC) reported earnings per share of $0.35, surpassing estimates and highlighting the effectiveness of its strategic operational improvements and cost-saving measures.

- Despite a slight miss in revenue, Ericsson's focus on operational excellence has led to sustainable gross margins and strong commercial momentum through significant customer agreements in key markets.

- The company's financial metrics, including a favorable price-to-earnings (P/E) ratio of approximately 14.92 and a solid earnings yield of about 6.70%, reflect its robust performance and attractive market valuation.

Ericsson, trading as NASDAQ:ERIC, is a leading Swedish telecom equipment manufacturer. The company is known for its innovative solutions in the telecommunications industry, providing services and products that enhance connectivity worldwide. Ericsson competes with other major players like Nokia and Huawei in the global market.

On October 14, 2025, Ericsson reported earnings per share of $0.35, exceeding the estimated $0.14. This strong performance is attributed to strategic operational improvements and cost-saving measures. Despite revenue slightly missing estimates at $5.91 billion, the company's focus on operational excellence has driven its gross margins to sustainable levels.

Ericsson's strategic efforts have resulted in strong commercial momentum, with significant customer agreements in key markets such as India, Japan, and the UK. These agreements have bolstered the company's financial flexibility, allowing it to enhance profitability and consider increased shareholder returns. The $1 billion sale of its Iconectiv connectivity services business further strengthened its financial position.

The company's financial metrics reflect its robust performance. With a price-to-earnings (P/E) ratio of approximately 14.92 and a price-to-sales ratio of about 1.05, Ericsson's market valuation is favorable. Its enterprise value to sales ratio of around 1.07 and enterprise value to operating cash flow ratio of approximately 6.48 indicate a strong valuation relative to revenue and cash flow.

Ericsson maintains a moderate debt-to-equity ratio of approximately 0.42, suggesting a balanced approach to leveraging debt. The current ratio of about 1.09 indicates a slightly higher level of current assets compared to liabilities, showcasing the company's ability to meet short-term obligations. With an earnings yield of about 6.70%, Ericsson offers a solid return on investment for shareholders.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson Shares Rise on Better-Than-Expected Q2 Earnings Amid Cost-Cutting

Ericsson AB (NASDAQ:ERIC) saw its shares rise more than 2% pre-market today after surpassing Q2 earnings expectations, benefiting from cost-cutting measures despite a challenging market. Adjusted earnings before interest and taxes climbed 14% year-over-year to 3.23 billion kronor ($307 million), surpassing the 2.7 billion kronor forecasted by Wall Street analysts.

CFO Lars Sandstrom emphasized the ongoing need for cost reduction, noting that a significant portion of expenses is related to personnel. Ericsson's net sales for the quarter fell by 7% to 59.8 billion kronor, exceeding analyst expectations of 58.5 billion kronor. The adjusted earnings did not include a previously announced impairment concerning its Vonage business.

The company reported an 11.4 billion kronor non-cash impairment due to the declining performance of the Vonage unit, leading to a net loss of 11 billion kronor for the period. This is the second writedown for the asset since Ericsson agreed to purchase it in 2021.