Telefonaktiebolaget LM Ericsson (publ) (ERIC) on Q3 2021 Results - Earnings Call Transcript

Peter Nyquist : Hello, and good morning. And welcome to the Ericsson's 3rd Quarter 2021 Call. Today's call will be a little different from others. We will start with the normal procedures going through the Q4 numbers. The second part, we will actually spend a little bit on strategic topics. One, addressing the path to profitability introducer services by call, and then we will address the opportunities that we see in enterprise by Borje. And with me here today, as usual, I have our President and CEO, Borje Ekholm and our CFO, Carl Mellander. So hopefully anyway, even though we will have its little longer presentation, hopefully you can spend the second part of this hour on Q&A. And in order to ask these questions, you need to contact or connect to the conference via a telephone. And you could find all the details in the press release on or -- on ericsson.com. During today's presentation, we will making forward-looking statements. These statements are based on our current expectation and certain planning assumptions, which are subject to risks and uncertainties. The actual results may differ materially due to factors mentioned in today's press release, and dus -- and discussed in this conference call. We encourage you all to read about these risks and uncertainties in our earnings report, as well as in our annual report. With that said, I will like to hand over to our President, CEO, Borje Ekholm, please Borje. Borje Ekholm : Thank you, Peter. And of course, welcome everyone and very happy to have everyone joining us for this call. So the third quarter, we're very happy about the performance that we can deliver based basically on us winning footprint across our portfolio, leveraging our strong 5G portfolio. And I would say that this would be literally to gain footprint. It's clearly based on our investments in technology leadership and the substantial commitments we have made to growing our R&D efforts over the last few years. But I would say it's also show of the commitment our people show to deliver a performance that actually are on the path to becoming a really strong performance in the future. Today, we have 95 live 5G networks, we have 149 commercial 5G agreements across our portfolio, with unique operates as I should say. But you have also seen that we have decided to delay our capital market or postpone our Capital Markets Day or Investor Update to instead, next year, have a full Capital Markets Day with a full management team to participate and update you more in details of the plans we see going forward. We will spend, as Peter said, a little bit of time on updating you all on our strategic thinking at the end of this presentation. But Carl and I will focus the first-part here on the Q3 performance and go through a bit more in detail. So if we look at the quarter, we continue to see very good momentum in the U.S. and it's underpinned by our reason signing of a 5G contract with AT&T, which now means that we have 5G contracts with all three Tier-1 U.S. operators. And these contracts are by the way, the largest in our history at Ericsson. We also continue to gain market share over one. However, it's quite clear that our market share in Mainland China has been reduced, and this is a consequence or for lucid decisions Sweden took to exclude Chinese vendors in the build-out of 5G networks in Sweden. And this is fully in line with the guidance we have offered before. But we also see that we've been able to partly offset that loss of market share by growth in other markets during the quarter. We have seen good growth in Europe and Latin America, as well as North America. But I also want to highlight that also Africa 's slow growth following a very difficult period during the pandemic. But of course, it's quite clear the loss of sales in China hurts our sales volume in total. And we have -- we need to invest even more to regain that loss of volume by growing in other markets. This quarter also, I would highlight the impact on disruptions to our supply chains that we -- I would say impact many companies across many different industry sectors alike. So for us, we have had very limited to no impact on our customers up until the end of the third quarter. We've taken very proactive efforts and we have built inventory and created in a way a flexible supply situation. But late in the third quarter, we saw saw some impact on shortages of individual components. Basically that resulted to loss of some sales, but it resulted also in higher inventory. And this is a risk that we see, can have a bit of impact also on the fourth quarter. Of course it -- or it's highly unlikely would have no impact, but it will have some impact, we think is likely. Despite the share gains we've had outside of China, the reduced market share in China, and the supply issues and lower sales in manual services led to a slight negative organic growth rate. Overall, software minus 1%. But if we exclude China, we saw a 6% organic growth year-over-year. We also continue to deliver strong profitability. Gross margin improved sequentially as well as year-over-year. And it reached 44% and our EBITDA margin increased to 15.7%. On IPR, we saw also good progress and we increased our IPR revenues to 2.6%. This was driven by new agreements, as well as dispute settlement. Both have some retroactive financial impact as we have said before. And what we see also is that, the significant value of our product portfolio and strong technology position in 5G. And that position says very well to conclude on future ongoing as well as future patent license renewal. So we see quite strongly about our position in IPR. However, you all know that timing of these license agreements may cause temporary gaps in our overall IPR revenues. But we will not waiver from trying to maximize the value of our existing patent portfolio. We have a very strong cash flow, and the free cash flow before M&A was 13 billion during the quarter. And I would say this is primarily a result of the investments and the commitment we have done in our strategy to improve flexibility, reduce sensitivity to business mix, as well as lower our working capital needs. We have now build to robust cash position and gives us a strong foundation to grow by investing further in technology leadership, but also from inorganic moves. We have a strong commitment to sustainability, you all know that, and it continues to deliver good value for us, but also for our customers. And you saw that we just recently launched a new massive MIMO portfolio that has gains on energy efficiency. It's much less heavy and it has a lower wind factor, all in all providing clear values to our customers. But we also saw that during the quarter, we signed a $2 billion sustainability linked revolving credit facility. And finally, I want to say our commitment to strengthening our ethics and compliance program continue. This is a longer-term journey, we are committed to invest what it takes and we have -- we are increasing and carrying significant costs in improving our ethics and compliance programs. But it's also a cultural journey for us as a Company. And here we are firmly committed to ensuring that we have created a culture built on integrity as a fundamental value. Now, let's move on to the market area performance. Sales in Northeast Asia fell by 33%. That is, of course, due to the significantly lower market share in Mainland China. But sales in other parts of the market area, actually improved during the quarter. And as a consequence of the loss of sales in China, we have to right size our sales and delivery organizations in China, and that will start in Q4. And we will have some structural cost or restructuring cost to that. In Southeast Asia, Oceania, and India, sales decreased by 16%. This is really due to a lot of accelerated rollouts in the end of last year for network, but also some timing of orders and projects in digital services. If you look at Middle East and Africa, sales declined by 8%. In networks, we saw the primarily impact of timing of 5G contracts in Middle East. But I would also say that Africa clearly return to growth. And we see primarily in digital services, we saw actually a strong software upgrades in the African markets. In Europe and Latin America, we saw Europe -- or in total sales increased by 9%. And if we look at the parts here, Europe grew by 5%, basically on the back of market share gains. And the same thing in Latin America, we saw a 29% growth. Of course, it's coming off a very difficult period in COVID, but it's still growing very strongly on the back of our share gains. And we see that in both networks, as well as in digital services. And 5G momentum in North America continued and sales increased by 13% and clearly, this demand is driven by the demand for 5G solutions. So let's now move on to the business segments. So if we start with networks, of course, sales was hit by China. But if we adjust for Mainland China, sales actually grew by 8% year-over-year. And this reflects clear gains in other markets that will -- had that have been possible, thanks to a strong product portfolio. And we continue to see very good momentum in deployment of 5G around the world. Of course, the impact on the supply chain from the disturbances also, of course, hit networks, and we expect that to pose a challenge as well during the fourth quarter. Nevertheless, we saw gross margin strengthened to 47.8% compared to 46.7% last year. In digital services. It's very encouraging that we now are starting to see revenues from the 5G contract and that's of course, helping them to achieve some growth. We saw the segments grow by 1% in the quarter, and that's despite the significant reduction in Mainland China. If we exclude China, sales actually grew by 6% year-over-year. Gross margin was 42.3% compared to 43.5%. And going forward, we expect profitability to improve gradually. And it's going to exceed our initial target of an EBIT margin of 10% to 12%. Sales and managed services fell by or decreased by 7% organically. And clearly here, Q3 was impacted by reduced variable sales, contract rescoping, as well as some plan they exceeds mainly in Europe. We also saw that network optimization grew primarily Europe. And we continue to invest in developing our portfolio with AI and automation to further strengthen our competitiveness. Gross margin decreased to 18.7% compared to 20.1 last year. In emerging business and others, sales grew by 4% organically and gross margin actually increased very strongly to 39.4% compared to 13 and 1/2 last year. Reported sales grew by 26%, and that's of course, mainly due to the acquired Cradlepoint business. What I would say here is this strengthening of the gross margin actually came out of where is to a very large degree explained by Cradlepoint. And it's even encouraging to see that Cradlepoint is one of the key drivers of the overall strength and gross margin for Ericsson ESG Group. With that, I want to go over to Carl to go through more details on the report and give some more perspectives on our path to profitability in these services. Carl. Carl Mellander: Thank you, Borje. Thank you. And let's have a closer look at the numbers then. So reported sales, SEK56.3 billion, negative organic development and of 1%, as per described. And this is following four consecutive quarters of organic growth. And you saw the two largest market areas presented growth in the quarter and the remaining three months, saw a decline. We had some disturbances of course, in the supply chain as Borje also mentioned, but the big factor here when it comes to topline, is clearly Mainland China, and the reduced market share there. And in addition to what Borje said that we would have grown 6% in the quarter if we excluded Mainland China. Year -- the corresponding year-to-date number is 10% growth if China is excluded. On IPR then, 2.6 billion in revenue. Out of that, we have certain retroactive benefits from the contracts or -- and agreements that we signed in the quarter. It is an increase of 0.5 year-over-year in IPR revenue. As you see here now on a rolling four-quarter basis, our sales is now tracking around 231 billion. Borje showed the gross margin numbers per segment. We'll drill a little bit further into this. 44% on the group level, that's up 80 basis points. Really based on continued improvements both in the network s, and as well as the emerging business and other segments. And in networks, pleased and encouraged to see continued operational leverage contributing to the margin here. But also the higher IPR revenues as we said before, and gross margin in networks then, now it's 47.8% compared with 46.7%. In digital services, gross margin and excluding restructuring again declined 120 basis points. And this is really connected again to what we have discussed before; the higher costs for initial deployment in the 5G Core contracts. And sales there, I must say, and again I emphasize, sales in 5G Core is really progressing well and we will come back to a little bit of a deep dive into that a bit later in the call. On managed services, gross margin, again, excluding restructuring, declined by 140 basis points, and this mainly comes from a reduction of variable sales on a few customer accounts. And that's with an emerging business up 9 percentage points and gross margin, fueled by, to a large extent, development in Cradlepoint. Of course, Cradlepoints did not exist in our numbers a year ago. So OpEx, as you see, SEK16.4 billion up from SEK15.9 billion a year ago. Again, mainly related to the addition of Cradlepoint business, both in R&D and SG&A. When it comes to R&D, the increase there, in addition to Cradlepoints, comes from more investments into the 5G core portfolio and digital services as we have reported on before as well. We -- there is one line of this a bit on the slide here, but it's on other income and other operating income and expenses, where we had a positive development in the Ericsson Ventures investment portfolio this quarter. And the net of that positive development and an impairment contributed with 0.4 billion to EBITDA. And this is all in emerging business and other segments. EBITDA and ending up at 8.8 billion or a margin of 15.7% in the quarter, which is up 10 basis points year-over-year. And this, remember, is in spite of the lower sales volume. EBITDA, as you know, our EBITDA long-term target is 15% to 18% of net sales. And we are now -- if we look at the rolling four quarter basis, hitting 14% EBITDA margin. Taxes, 2.5 billion in the quarter, and an effective tax rate to 30%, this is also effective tax rate for the full year to date. And now let's look into how these profits converted into cash flow. So operating activities cash flow increased by 9.4 billion to a total of 14.7. And we can also remember that last year, Q3 was impacted by a SEK2 billion contribution to the Swedish pension fund. But we worked a lot with working capital in our Company. We focus a lot on lead times and efficiencies. And you can see that also this quarter, the resulting free cash flow benefited from the working capital work that we put in. We had good collection from customers, including some prepayments as well. And as Borje also mentioned, we did increase inventory again. This is something we have talked about on previous calls also, in order to create even higher resilience in the supply chain. But that was actually offset partially at least with higher trade payables, so the impact on cash flow was not that big. Capex net and other investing activities was relatively stable year-over-year, so that all resulted in a free cash flow 13 billion up more than 200% year-over-year. And maybe again on the rolling four quarter basis, free cash flow before M&A was now 31.3 billion Swedish Kroner, which corresponds to 13.6%. And again, that's big thing than our long-term free cash flow generation target, which is 9% to 12% of net sales. This all meant that our gross cash and net cash increased by 11 billion and 12 billion respectively. If we move on to planning assumptions here, finally, on the quarter then, first of all starting with the market that we operate in, Dell'Oro now expect the RAN markets to grow by 13% in 2021, which is up then from the 10% that was estimated in the May report. And if we break that down by region, some of the regions than a China 13%, North America 15, Europe 10%. Looking ahead into 2022, the Dell'Oro forecast for the RAN market is to grow by 2% or 3% if we exclude China. Second point on the supply chain, we see -- saw some disturbances in the third quarter as mentioned, including some individual component shortages. And we continue to see this as a risk going into the 4th quarter as well for networks sales. Over to IPR. We have the run rate in the current portfolio of SEK7 billion. This is the same number as we stated in the Q2 report as well. And it is a contract portfolio currently on an annualized basis. And again, as we have discussed many times before, as these key IPR contracts are approaching expiry, we may see an impact on revenues until those contracts are actually renewed. Lastly, then on Digital Services, we expect to reach break even in the fourth quarter. Now having gone through the quarter as such, I would like to shift gear and say a few words about digital services and the road back to profitability in this segment. And to start with us, we communicated already in the second quarter report. Now we expect unlimited loss in 2022. One impacting factor is again the decreased market share in Mainland China. But the long-term target, 10% to 12%, remains. And of course, our ambition is to even exceed that over the longer term. Before diving in, really, I just wanted to start here by emphasizing, again, the strength in our 5G Core portfolio and the business momentum is really here. The standalone 5G Core market window is open. Customers now make long-term commitments in their choice of vendors here, and we'll come back to our track record so far, but we are winning a lot of this, the incentive. This is really a cornerstone in our journey here in Digital Services, 5G Core contracts and what we call attached sales around that. And hence the investment in R&D in this area. If you look at the chart here, starting on the left side and with our investments in R&D. Though earlier in this year, and we have talked about this before, we decided to really prioritize long-term ambitions here. And rather than going for, for short-term results. So we have increased R&D significantly when it comes to 5G Core and orchestration. It adds expenses in the P&L, of course, short-term, but builds value clearly for the mid and long-term. Very similar to the development we've seen in networks as well. So we also continue to make R&D investments in automation. And this is really more to drive efficiency in our delivery of software and to become more efficient in our own R&D. And thirdly, we also invest going forward now for the future in service orchestration, and in evolving now the portfolio to enable our customers to serve not listed enterprise customers, including 5G network slicing and edge solutions. Looking at gross margin here, a couple of aspects. First, just to put in perspective the packet core area, including 5G Core that we talk so much about now. That represents about 20%, 25% of the total revenue in the digital services. The other 75 or 80% of revenue is delivered from the other areas which all have a clear trajectory towards improved profitability. And this is underpinned by the transformation that we are driving here toward more software-based content and more industrialized solutions. One area, which I think is worth to call out here, is the BSS, because we're actually pleased to see that the BSS strategy that we revised in 2018 is delivering, it's been executed, and now the BSS area is delivering gross margins in line with group average levels. And other aspects impacting gross margin also positively now is that we are managing all of these 45 critical contracts that we talked about and started to mention back in 2017. However then, the gross margin improvements that I just mentioned and the things we do coming out of technology investment are then partially offset by the initial 5G Core deployment cost for new product introduction. And that's why we see an improved gross margin up to 2022, but not yet enough. However, beyond 2022, we see then that we continue the transformation towards software-based solutions to customers, and this is going to contribute to the improved gross margin that you can see here to the right on the slide. Software share will increase and the recurring element of software will also grow in our digital services business. And you can see here that this really the most significant contribution to our long term profitability target. Finally then, if we turn to net sales. The way the 5G core contracts work is that we start to see revenue in the P&L when the networks go live. And then the net -- the revenue from those contracts grow than with added subscribers to those networks. This means that revenue from those would start now, start towards the end of the year, and then continue to grow over time. To continue then on the markets, on the sales piece, of course, the Mainland China reduction has costs us quite a bit of top line, and that's what you can see in the thin sales line leading up to 2022. But of course, our ambition here is to compensate that with market share gains in other markets, and this we already saw actually in even in the third quarter that this is happening. Finally, when it comes to our ambitions then on CSP enterprise and service orchestration portfolios, we expect those to start to be visible in terms of revenue by 2023 and onwards. And this is then as the things like dedicated network start to scale up. Edge, as I mentioned in network slicing components, are being commercialized. Next slides, and I will finish off with this, shows a bit about the momentum in this one. So far, we have landed 45 standalone 5G Core contracts. We can see that on the left here. And 15 of those are added since October last year, and 8 of them are live and generating revenue. And it's really based on our containerized Cloud native technology that we win these deals and we anticipate that we will continue to lead the 5G Core market and more -- add more customers to this list as well. But as mentioned before, it's not only about 5G Core. To the right here you see examples from the other parts of the portfolio in, in digital services. Starting with BSS, we have 17 new deals in 2021, all in line with the BSS strategy that we have put in place. And actually our customers need to modernize their BSS to become more agile in the consumer business, but also to meet the enterprise customers requirements. 5G Core as said drives attached sales as well. And a good example of that this year, what you see on OSS where network orchestration is a good example. And last year we celebrated more than 100 customers here in our Ericsson Orchestrator. And since then, we have added another 30 customers on top of that. Cloud communication, more than 160 customers have chosen our Volt Solutions for their voice offerings. Over it's about 20s or 20 new customers on Eu since last year. And then on Cloud infrastructure, we have about 230 customers already and 29 new customers added so far in 2021. So I hope that gave a little bit more meat on the bone on DGS or Digital Services segment and the role to profitability. Essentially, it's about investing in technology leadership, winning as market share, and improving the margins through a shift to higher software content. Thank you and back to you, Borje. Borje Ekholm : Thank you, Carl. So now, I'd like to shift gear a bit and talk more about our overall strategy as well as what the opportunities we see that we can grow in enterprises. But starting here and really saying as a result of the focused strategy we launched in 2017, we have now delivered in a way a clearly improved performance, including cash-flow performance. And it's all based on a very strong commitment to R&D to be technology leaders. But this has also established a strong platform to make strategic choices from going forward. The basis for our performance and the basis for us as a Company is, of course, a competitive product portfolio. And that today is built upon the leadership in RAN, Core, as well as management and orchestration, and we can deliver those at a very competitive cost. For us, continue to drive the performance in the core business is going to be critical and it's actually the fundamental -- call this, ingredient that allow us now to make strategic choices for the future. But I think it's also fair to recognize, and you all do that, that the 5G deployment curve, even though it's been growing sharply now and growing great now, it will flatten out or it's at least likely to flatten out. And you see that in the blue bars here, the darker blue bars on this chart. And we see that happening in the years ahead. This is a pattern we've seen in other G's before. But I would also say that the previous generations of mobile technology really only address the consumer market. What is actually different with 5G, is that it's also addressing enterprise needs. And it was actually designed to fulfill enterprise needs. So we believe that is going to drive traffic into the networks and actually provide a much longer investment cycle in the networks. But it will also start to open up for new segments to be attacked with mobile communication. So we believe that focusing on maximizing the value in our Core mobile networks is the fundamental focus going forward. But we also see that we can make a focused expansion into enterprises. This will open up higher growth markets as well as new value streams that we can realize here. What we see with the new future with 5G is that businesses are increasingly making choices where wireless be a primary access technology. This is very different and we believe this opens up new markets for us that could be worth up to $25 billion by 2025. And this is maybe more importantly, a market that is growing very fast already today, achieving growth rates well above 20% per year. But it also offers good gross margin as well as operating margin opportunities for us. The last 18 months, we have seen the importance of mobile network to manage during the COVID situation. And mobile networks now play a key role in societies as well as allowing many people around the world to work remotely. But there is no question that with 5G, we're lifting the performance to completely new level where we will have much higher bandwidth, lower latency and much higher capacity. And we think that also will offer new opportunities, basically to specify quality of service that in addition to enterprise or consumer applications, we'll start to allow enterprises to take advantage of the wireless networks. We see that we are already being able to unlock value for enterprises with 5G, as we can adjust in a way the digital infrastructure based on the needs, and Carl mentioned it already. We start to see network slicing gaining momentum. We see orchestration and edge clouds. And that is something we are developing together with leading partners in the whole ecosystem. And we see that we are only at the beginning of that development and the opportunities are clearly ahead of us. We see that there is a long-term value for us that can be captured by being an enabler, as well as orchestrator of that ecosystem that's going to come. What we also know is that, from the 4G experience is that, really the developers that develop applications on top of the networks, they're actually realizing value that's multiples of the investments that goes into the network itself. And we believe with 5G, that will be even more the case. So let me give a couple of examples. One is, for example, on quality of service, where you can have network performance adjusted in real time. These basically enables us to differentiate the service to customers, recognizing each customer may have different quality needs, or performance needs. Think for example, Telemedicine or think for example, a sensitive video conference where you need to adjust and rely on very high quality performance or high-quality networks. I think this is an opportunity for sustainable growth for us. And I'm very excited about driving this strategy into the future. We're of course are going to see that we're already today, starting to offer dedicated enterprise offerings. So we have our dedicated networks, we have mission-critical networks, IOT. But we also have of course, network near solutions. And here, one that we're clearly investing in is Cradlepoint. It's a network near it in a way is grow or it helps. Not only does it provide us with the market opportunity, it actually generates revenues also for the CSPs because with every Cradlepoint installation, there is a network need as well. We see this to be a win-win together with our CSP customers, but we're also very encouraged about the performance we see in those enterprise applications, where we can provide a very high growth. For example, we see Cradlepoint growing very rapidly, following well, on our plans. But most importantly, we're also seeing the gross margin performance of that business to contribute to us as a Company now. And that shows that to succeed in the enterprise area, we know already that we need to, of course, build on what we have to develop them organically. But we also need to rely on inorganic opportunities.And with the capital situation we have, we have the opportunity to make the acquisitions we need to strengthen our offering in enterprises. But now let's move on to the summary slide. I'm putting another, I will say, strong quarter to our track record. We continue to be well-positioned to take advantage of the market opportunities as 5G continues to be deployed globally. We continue to take proactive steps to manage the supply situation. But we had some impact this quarter, and we think it could pose a risk for the 4rth quarter. The C-Band rollout continues in North America, and that's a key opportunity for our customers, and therefore, also for us. But based on a very competitive 5G portfolio, we continue to see a path towards winning more 5G contracts as we move along both in North America and in the world. So when we look ahead, we do feel that we're in a good position where we are -- where we can take the next step strategically. But we are, of course, as an interim step, going to deliver on the 2022 targets as long term -- as a group target. But we're also very committed to our long-term targets for the group. With that, I give the word back to Mr. Nyquist. Peter Nyquist : Thank you. Mr. Ekholm for that presentation. I thank you, called for the presentation that was more of a strategic focus. With that, we have still have 20 minutes and maybe a little bit more to answer your questions here. So I would like to give the word to Mark. Can you hear me? Operator: Thank you. Just as a reminder of conference if you do wish to ask a question, . Now, first question comes from the line of Edward Snyder at Charter Equity Research. Please go ahead. Your line is open. Carl Mellander: Hello, Edward. Edward Snyder : Thank you very much. Good morning. How are you? Carl Mellander: How are you? Edward Snyder : Good. Congratulations on the gross margin performance, which was very impressive. I believe that's the highest we've seen since we started covering Ericsson in 1999. That's a lot to recommend you -- your turnaround strategy. I have a question on gross margin. As the mix of 5G deployment SKUs even further from China, especially towards North America, why shouldn't we put in upward -- why should not put upward pressure on margins if 5G systems have a higher software content than in past systems and your chip strategy is proving more successful than any of your competitors? So I'm just curious about why coverage projects wouldn't run close to these levels and then densification perhaps raise them further, and I have a follow-up. Borje Ekholm : Do you want to take it? Carl Mellander: Yeah. I think we are seeing in the gross margin. Thank you for the comments by the way, on the gross margin and what we're seeing is the fruit of the whole strategy and the entire work we have put in actually, since 2017, I would say. I mean, investing in leading technology, that's gaining us market share and that's also now translating in an ever improved gross margin. And I think our job is to obviously continue on that path and continue to design cost out of our product at the same time, make it more and more attractive for customers to win further share. Borje Ekholm : I would only say Ed, thanks for -- thanks again. As Carl said before, your comment, first. We have spent quite a big effort in actually -- in a way, removing the exposure to business mix a bit. But what you see, our leaner cycle is of course, more hardware. So we do believe there is -- we're quite comfortable about the future gross margin development, I would say. Carl Mellander: Yeah. Borje Ekholm : And see that to be providing an attractive basis for our future performance clearly. Edward Snyder : Great. And then you've mentioned that IPO annual run rate will be around $7 billion for existing contracts. Is it possible to get back to $10 billion without China or should we expect this to remain where it is until some other resolution sure occurs. And then if we could, please remind us of the foreign exchange impact or your exposure to the U.S. dollar. It's also a concern what would we -- what should we expect for say 10% decline a $1.00 over there due to revenue and cost? Thanks. Borje Ekholm : If we start on the IPR and then Carl comments on there, on the sensitivity to currency, the -- we -- we're -- let's not speculate about how future contracts are going to look like. So we'll communicate once we know how they will be and when we have landed them. But clearly, we're very -- we have a strong portfolio, we have a good IPR portfolio that allows us to negotiate with license partners, and hopefully, we can realize a good value going forward. That's at least our ambition. But let's not go into the details yet. Carl Mellander: Right. And on FX, if we -- at least, if we generalize a bit, our rule of thumb is that 10% change in the U.S.dollar CX rates translates into about 5% on topline and one percentage point on EBIT. Now, this quarter, the impact was not that large from currency. Previous quarters we have seen a quite, more dramatic change of course. Peter Nyquist : Great, thanks, Ed for the questions. Edward Snyder : Thank you very much. Peter Nyquist : We'll move to the next question, which is from Aleksander Peterc at Societe Generale. Hi, Alex. Aleksander Peterc : Yes. Hi, good morning. Good morning to all of you. Peter Kurt Nielsen : Morning. Aleksander Peterc : I just have a question on the supply chain risks that you see. I just like to understand what kind of visibility you have for the supply chain. Do you have good visibility for the next, let's say, 3 months and so, you might have some impact but nothing really, really major. And then if you could tell maybe giving more detail on what you're missing exactly in terms of components, or is it logistics, whether there is a problem. And does that also lead to any tangible increase in your input costs? And if so, can that affect your gross margins or your pricing going forward. Thanks a lot. Borje Ekholm : What we see during the end of the third quarter is actually its individual components. That's been missing. So that has been a way driven up our -- we pay inventory and resulted in some lost sales. Basically, that's what happened. We think these are disturbances that could happen. I wouldn't exaggerate them because we have reasonably good visibility and we have quite, quite good management of the supply chain. But these were late in the quarters, decommits that resulted in this disturbance. I wouldn't exaggerate the risk going forward but it post some threat, put it that way. It's very hard to tell you exactly how Q4 is going to look now. But we feel quite comfortable about our supply situation going into the quarter. If you look at logistics cost, etc., we -- of course, you have some upward pressure there. But we also think those are manageable as we see today. It's -- we're actually benefiting a bit from our supply chain, which we have created with some flexibility, with some new facilities around the world to reduce our exposure a bit to logistics costs. But of course, we need to always be vigilant. That's how we manage our Core structure and manage our deliveries to customers. But so far that has had some but very limited impact on our margins and we absorbed that in the margin sectioning. You see they are developing quite well anyway. Peter Nyquist : Thanks, Alex. Aleksander Peterc : That's great. Thanks a lot. Peter Nyquist : Thank you. We'll move to Francois Bouvignies from UBS. Hello, Francois. Francois Xavier Bouvignies : Hello. Thank you very much. So my first question is on the global one market that you expect, or maybe Dell'Oro expect to grow 2% in 2022 and 3% excluding China. What I wanted to ask you is how you feel Ericsson can be versus this target today. And we saw a stronger market in the U.S., obviously, in the last six months, we've twice upgraded, your numbers for '21. So how much do you think is a preliminary, is it something that you also the strong market that you see towards the end of the year is also going to into 2022? So just try to clarify a bit on the 2022 outlook and how Ericsson is comparing to. And my quick follow-up is on the IPR just a clarification, so you have like 2.6 billion this quarter. So how should we think about Q4? Because I don't understand how much is a 104 catch up among if you just clarify. I'm sorry if I missed it. So how much we should think about Q4, please. Thank you. Peter Kurt Nielsen : Can you take? Carl Mellander: Yeah. Okay. Now, on the ran market, I think obviously Dell'Oro expects now, as you said, 2% growth in 2022, 3% excluding China. Our ambition remains to grow faster than the market s and I think we have proven that in the past that we are gaining share.And of course, some of the deals that we have won, contracts that we have landed are not yet visible in the sales numbers either, so that remains to be seen. Carl Mellander: U.S., of course, being a very big component here that we have very good momentum. And as Borje mentioned before in our the C-band buildouts, we are seeing good capex levels from our customers, and we expect that to continue as well. But we have decided to look at the Dell'Oro and talk about the Dell'Oro forecast for the future market development, so we'll stick to that, and then try to grow faster than that number. Borje Ekholm : IPR. Carl Mellander: On the IPR. Yeah. So we -- and we haven't disclosed exactly the retroactive element there. But as you know, it's 7 billion on an annualized basis.There is certain retractive element here in Q3, but I think that's as far as we can go. So the IPR revenue should come down a little bit from the Q3 numbers because of the retractive element included in Q3 numbers. Borje Ekholm : I know -- I just want to comment on -- because I know everybody wants to know a lot more about details on IPR. But there is a commercial element here that we also need to make sure that we maximize the value of the quality of our patent portfolio. So disclosing too many of the terms in individual contracts just simply gets too sensitive, and may actually hurt our ability for the future. So that's why we're a bit restrictive here, but I'm trying to provide the guidance that at least can make you form some sort of opinion about each quarter. I know we might be a bit unsatisfactory, but it's really to -- it's not for lack of willing, it's actually to try to run a better business. Francois Xavier Bouvignies : No. Making sense.Thank you. Peter Nyquist : Thank Borje. And thanks Francois. we will move to Morgan Stanley and Dominik Olszewski. Hi, Dom. Dominik Olszewski : Hi, Peter. Hi, everyone. Peter Nyquist : Hi. Borje Ekholm : Hi. Dominik Olszewski : So two questions. Firstly, o Digital Services, could you just talk about what drove better EBITDA performance in Q3 specifically. When you're saying it did better than the comparable performance that you talked about when you're talking about Q2 and Q2 into Q3 being they're same level of possibility. So what was the deal -- what was it different than anything in the customer portfolio or product signs. And then second question is on Cradlepoint. Can you talk about the success so far you've had and basically immediately adding value to that acquisition. One of the elements I remember was going international and you acquired the Company, I think 90% of revenues was in North America. So how much success have you had in actually growing that into the rest of the world, and are you still expecting the 25% to 30% top line growth in that business and over 60% gross margins that you talked about before? Borje Ekholm : Should I tackle the Cradlepoint and then I give you the Digital Services. So if you look at Cradlepoint, we have started now to gain success in the international markets. It's still early in the days, but we're starting to see that to pan out. And the investments we've made in SG&A have actually started to contribute today. The gross margin is actually better than what we predicted when we made the acquisition. So we are thereby feeling that we are delivering even a little bit better than we had in our own plans a year-ago, when we made the acquisition. We have not disclosed all details here. But as we build out the enterprise, we will of course, see how we're going to disclose more and more of the activities we do in there. So bear with us a bit there. But at least you can -- we can see that we're going in the right direction both on top line, as well as the bottom line. Growth rates going forward should be at least in the what we think the market is -- if the market is 2025, we believe we should be able to grow a bit faster than that because we can add value of international exposure as well. Carl Mellander: Good. And Dom, on Digital Services why did it turn out better? It's a combination actually of higher sales volumes than expected. And as you saw, even after the decline in China, we actually grew on that segment for 1%. So that exceeded our expectation. And secondly, gross margin was stronger and that has to do with the software share of sales, which again is exactly in line with our strategy to drive up software. But it came out stronger in this quarter. So therefore, we beat the expectations. It's very encouraging, by the way. Peter Nyquist : Thanks, Carl. Great. You have it up, Dom? Dominik Olszewski : Yes, probably. Thank you. Peter Nyquist : We'll move to Daniel Djurberg at Handelsbanken. Good morning, Daniel. Daniel Djurberg : Good morning and thank you for taking my question and also acquisition on solid gross margin and cash flow, truly impressive. I would like to start again on the supply chain constraints that could pose a risk that you mentioned. And my question is really if you expect the impact to the lost revenues or more of a deferred revenues into future development or deployment, I should say. That is the first question. And then if I may on the data to services, you comment that 75% roughly less outside packet core. And those suggested to good momentum here with 30 plus fields on BSS, and some 30 plus on OSS so far. But can you comment a little bit on the revenue model for those? Because I just can 't see the full impact from those quite high numbers, to me at least. If you can comment more on what we should expect given the 75% sales being outside of packet core and if possible also comment on the percentage of OpEx being tilted to those 75% of sales. That would be great. That is my questions. Thank you very much. Borje Ekholm : I'll take the supply chain. Maybe you'll take the DDS question. Carl Mellander: Yeah. Borje Ekholm : On supply chain, yes, we have seen some disturbances. Our ambition is to work with the customer, of course, to make sure that we fulfill their needs. That's ultimately the only way for us to be successful. And if we can do that, it really will end up being delayed sales and we can realize it later on. So that's what we're trying to work towards. But it's always a risk when you have a supply disturbance that you can 't satisfy the customer. But we're going to do what we can. And so far we have not seen that we have low sales and our ambition is to keep it that way. Carl Mellander: Okay. And Daniel, on DGS, or Digital Services, yeah. I would say when it comes to the revenue models and so on, it's really similar to the rest. Of course it's a change towards -- it's a change versus what we had years ago where we went in, for example, in the BSS area with the services led scope, sometimes a little bit undefined. And as you know, we had more than 40 contracts of that nature that we have now worked hard to get back to a decent profitability level. Now instead, of course, we lead instead with software, with the product. And that goes for all of these categories. As a start in elemental system integration, of course, in there as well, and we charge as we go. But mainly, it's a software business now. And this is also what we're driving for in all of these areas. And that's also as you saw on the graph before, what is going to improve our overall profitability the most. OpEx percentage, I don't have on top of my mind actually, so that I think we can leave that for now or maybe come back to it. Sorry. Daniel Djurberg : Yeah. May I give a short follow-up on the same topic just. On your assumption that you're -- thank you for giving this call. But can you comment on your run rate, IPR assumption, for Digital Services in 2022. Is it 7 billion that you talked about or is it something else, because of the litigation ongoing? Carl Mellander: On IPR what we have said earlier actually is that we assume IPR to stay flat in our business planning activities. Daniel Djurberg : Okay. Carl Mellander: Yeah. Daniel Djurberg : Thank you. Peter Nyquist : Thanks, Daniel. And we'll move to the next question. I know we're running over -- over the hour, but I will take two more questions because we had a little bit of a longer presentation. So next one is from Peter Kurt Nielsen, ABG. Hello, Peter Kurt. Peter Kurt Nielsen : Thank you very much. Hello. Thank you for taking my question. Can I just turn towards the sales side, the top line side, please. If we look at networks, even adjusted for the lower sales in China, the organic growth in networks appears to be a bit below the market growth forecast for the growing market so that overall, and even for the regions, the Europe and North America and you are talking about gaining market share. So could you elaborate a bit on why we're not seeing better sales momentum given the strong overall momentum in the market? And then just referring to your comments about the three large contracts in North America. Should we expect to see a step-up here from next quarter and next year on which -- please, and if I may add a follow-up on Digital Services as was highlighted in a previous question. EBITDA losses significantly lower than you expected three months ago, you're still anticipating to break even in Q4. Why is that given the positive trends? Thank you very much. Carl Mellander: Should I start with the second one, Borje? Borje Ekholm : You can do that. Carl Mellander: Okay. Borje Ekholm : Take the third one also. Carl Mellander: Okay. I can take. Yeah on Digital Services. Yes, we maintained the guidance there or the anticipation on break even in the fourth quarter. And the way to look at it, I think, is to look at the second half then that will perform significantly better. Thanks to the improvement now that we saw in Q3. But we still maintain the break even ambition and guidance for Q4. Look at the full 6 months and it's then substantially improved. Peter Kurt Nielsen : Okay. Borje Ekholm : If you take the topline, I think it's a couple of different factors to keep in mind here. One, is the supply chain disturbances we had that have had an impact on network sales in the third quarter. But we should also remember that what we have tried to do is to -- Some part of the gain in footprint have been how or have very limited attached services. So as we see going forward, is that we will have a little bit less of attached services. And thereby, you're going to see sales maybe not developing as fast as necessary the growth in the underlying market. But at the same time, we do believe our product sales is a longer-term and much more attractive business than selling the services. So when you look at the growth rate, you need to adjust for that as well. Peter Nyquist : Great. peter Kurt? Peter Kurt Nielsen : Thank you for that. Peter Nyquist : We would actually normal to the last question of this section and that is, Sebastien Sztabowicz from Kepler Cheuvreux. Hello, Sebastien. Sebastien Sztabowicz: Yes. Hello, everyone. And thanks for taking the question. One that we had in China because your top-line is dropping fast and you now plan to attack a little bit because there's to protect your margins. Do you see any opportunity to come back in the country at some point with some additional contracts? That will be the first question. The second one the rise of key input cost are everywhere in the market, chips, logistics and so on. Do you see any room to increase the price of shore-based station in some specific contracts, in order protect some of the margins? Thanks Borje Ekholm : I like to think when you lose a contract the day after you start to fight to win it back, the same, it's the thing with China. I do believe we have a chance to win back the trust to deliver products in the future. So we're focused on regaining that. But, of course, short-term, we just simply need to adjust the cost structure to right size that as much as we possibly can. But we're going to try to be there. I think it's important to remember, yes, we see cost pressure upwards as you indicate, but what we are also seeing as we counter balance that is actually that we -- this is an industry where it moves very fast on generations as well. And we're actually introducing new products at a higher pace than we have ever done. That's also a way to combat call it input price increases. So we feel quite comfortable about our gross margin profile and the way we run the business right now. Peter Nyquist : Great, Sebastian. Sebastien Sztabowicz: Okay. Thank you. Peter Nyquist : With that actually we had -- that was the last question. I see you have more questions on the list there, please contact the IR team and we will set up meetings and we can discuss those. But before closing Borje, maybe a remark from your side. Borje Ekholm : Just want to say that we continue to execute on our strategy. It is built upon. winning in the Core mobile network business. And here we continue to have a very high intensity on our R&D that helps us to do two things. One, is to offer competitive solutions to our customers. But equally important, it also addresses the cost structure and we can actually continuously become more efficient by investing in R& D. So we feel that we, the targets we're committed to for 2022, as well as the long-term targets. We're very comfortable about our ability to deliver on those. Peter Nyquist : Thank you, Borje. And have a great day. Carl Mellander: Thank you all. Borje Ekholm : Thank you.

Ericsson's Strong Earnings and Strategic Moves Bolster Market Position

- Ericsson (NASDAQ:ERIC) reported earnings per share of $0.35, surpassing estimates and highlighting the effectiveness of its strategic operational improvements and cost-saving measures.

- Despite a slight miss in revenue, Ericsson's focus on operational excellence has led to sustainable gross margins and strong commercial momentum through significant customer agreements in key markets.

- The company's financial metrics, including a favorable price-to-earnings (P/E) ratio of approximately 14.92 and a solid earnings yield of about 6.70%, reflect its robust performance and attractive market valuation.

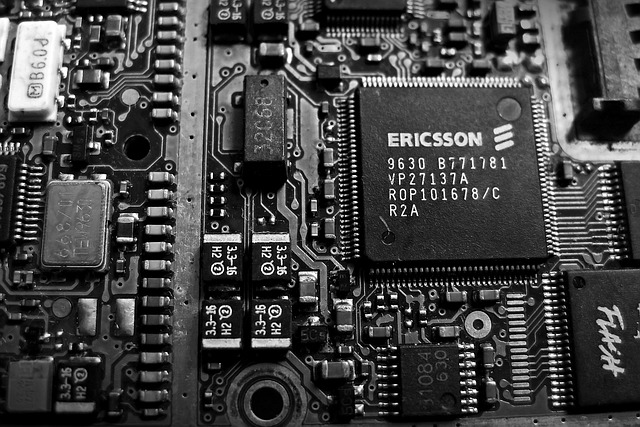

Ericsson, trading as NASDAQ:ERIC, is a leading Swedish telecom equipment manufacturer. The company is known for its innovative solutions in the telecommunications industry, providing services and products that enhance connectivity worldwide. Ericsson competes with other major players like Nokia and Huawei in the global market.

On October 14, 2025, Ericsson reported earnings per share of $0.35, exceeding the estimated $0.14. This strong performance is attributed to strategic operational improvements and cost-saving measures. Despite revenue slightly missing estimates at $5.91 billion, the company's focus on operational excellence has driven its gross margins to sustainable levels.

Ericsson's strategic efforts have resulted in strong commercial momentum, with significant customer agreements in key markets such as India, Japan, and the UK. These agreements have bolstered the company's financial flexibility, allowing it to enhance profitability and consider increased shareholder returns. The $1 billion sale of its Iconectiv connectivity services business further strengthened its financial position.

The company's financial metrics reflect its robust performance. With a price-to-earnings (P/E) ratio of approximately 14.92 and a price-to-sales ratio of about 1.05, Ericsson's market valuation is favorable. Its enterprise value to sales ratio of around 1.07 and enterprise value to operating cash flow ratio of approximately 6.48 indicate a strong valuation relative to revenue and cash flow.

Ericsson maintains a moderate debt-to-equity ratio of approximately 0.42, suggesting a balanced approach to leveraging debt. The current ratio of about 1.09 indicates a slightly higher level of current assets compared to liabilities, showcasing the company's ability to meet short-term obligations. With an earnings yield of about 6.70%, Ericsson offers a solid return on investment for shareholders.

Ericsson's Strong Q2 2025 Performance: A Deep Dive into Financials and Strategic Focus

- Ericsson reported earnings per share of $0.14, surpassing estimates and indicating strong profitability.

- The company achieved a 48% adjusted gross margin and a three-year high in its adjusted EBITA margin, showcasing operational efficiency.

- Ericsson is increasing investments in artificial intelligence, aiming to drive future growth and innovation in 5G technology and beyond.

Ericsson, listed as ERIC on NASDAQ, is a leading Swedish telecom equipment maker renowned for its innovative solutions in the telecommunications industry, particularly in 5G technology. Competing with giants like Nokia and Huawei, Ericsson has recently showcased its strong strategic and operational execution through its second-quarter results for 2025.

On July 15, 2025, Ericsson reported earnings per share of $0.14, surpassing the estimated $0.12, indicating a positive performance in terms of profitability. The company generated a revenue of approximately $5.84 billion, which was below the estimated $6.21 billion. Despite this, Ericsson achieved a 48% adjusted gross margin and reached a three-year high in its adjusted EBITA margin, highlighting its operational efficiency.

Börje Ekholm, President and CEO of Ericsson, emphasized the company's solid execution of strategic and operational priorities. The company has structurally lowered its cost base and is focused on delivering further efficiencies. Growth in the Americas is encouraging, while Europe has stabilized. Globally, fixed wireless access customers have surpassed 160 million, driving significant network traffic.

Ericsson's financial metrics reflect its market position. The company has a price-to-earnings (P/E) ratio of approximately 156.38, indicating a high valuation relative to its earnings. Its price-to-sales ratio stands at about 1.04, suggesting that investors are paying $1.04 for every dollar of sales. The enterprise value to sales ratio is around 1.03, reflecting the company's valuation in relation to its revenue.

Looking forward, Ericsson is increasing its investments in artificial intelligence, including its involvement in the Sweden AI factory consortium. AI is seen as crucial for accelerating innovation, especially in supporting AI use cases at the edge, which require ultra-low latency and enhanced uplink performance. This strategic focus on AI is expected to drive future growth and innovation for Ericsson.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson Shares Rise on Better-Than-Expected Q2 Earnings Amid Cost-Cutting

Ericsson AB (NASDAQ:ERIC) saw its shares rise more than 2% pre-market today after surpassing Q2 earnings expectations, benefiting from cost-cutting measures despite a challenging market. Adjusted earnings before interest and taxes climbed 14% year-over-year to 3.23 billion kronor ($307 million), surpassing the 2.7 billion kronor forecasted by Wall Street analysts.

CFO Lars Sandstrom emphasized the ongoing need for cost reduction, noting that a significant portion of expenses is related to personnel. Ericsson's net sales for the quarter fell by 7% to 59.8 billion kronor, exceeding analyst expectations of 58.5 billion kronor. The adjusted earnings did not include a previously announced impairment concerning its Vonage business.

The company reported an 11.4 billion kronor non-cash impairment due to the declining performance of the Vonage unit, leading to a net loss of 11 billion kronor for the period. This is the second writedown for the asset since Ericsson agreed to purchase it in 2021.