Telefonaktiebolaget LM Ericsson (publ) (ERIC) on Q1 2021 Results - Earnings Call Transcript

Peter Nyquist: Good morning and good afternoon and welcome to this webcast covering the First Quarter of 2021. With me here in the studio in Chintsa, I have our CEO, Börje Ekholm; and our CFO, Carl Mellander. It's great to see you here Börje. I guess you've been working quite a lot from home recently. Börje Ekholm: It's great to be here Peter. Yes as everyone knows, we migrated to work-from-home more than a year ago. So this is in reality the fifth quarter of reporting virtually. So, of course, it takes a strain on the organization. And on a personal note I must say I'm immensely proud of the team at Ericsson and the way we've stepped up and actually deliver on customer commitments and performed so well in a very, very challenging environment. So I want to just start by acknowledging that a lot of people have worked hard. Peter Nyquist: Exactly. And you, Carl, you have actually now closed your fifth quarter remotely, which is fantastic. Carl Mellander: That's true. And not only as Börje said how we delivered to customers and so on during this period, but also all the internal processes work really well. So, yeah, we closed the books in same time as usual in spite of everyone working from home. So I share your pride Börje actually in our great people. Peter Nyquist: Great. So we'll have this presentation and then we will have a Q&A session after the presentations from Börje and Carl. And people that will ask questions have to join the conference by phone. First, I will just start by reading this text. During today's presentation, we will be making forward-looking statements. These statements are based on our current expectation and certain planning assumptions, which are subject to risks and uncertainties. The actual results may differ materially due to factors mentioned in today's press release and discussed in this conference call. We encourage you all to read about these risks and uncertainties in our earnings report or as in our annual report for 2020. With that said, I would like to leave the word to you Börje to start the webcast. Börje Ekholm: Great. Thank you, Peter, and good morning and welcome everyone to this earnings call of the first quarter. So thanks for joining. At the year-end result in January, we could actually then show that we had finally completed our turnaround. And what we also saw was that now invested -- return on invested capital is actually higher than the cost of capital. And that allows us now to focus on growing the business. And as we said, we're focused on growing in our core business call it networks, digital services, as well as managed services, but we're also focused on building an enterprise business and driving growth in the enterprise space. And during the first quarter, we continued to execute on this strategy and it includes as always investing in R&D for technology leadership and that is really giving us at the same time a cost leadership. So there is no conflict between technology leadership and cost leadership. They go hand-in-hand. And with that we're able to strengthen our market positions substantially and gain footprint. Of course the pandemic has meant a lot. It has -- but it has also fast-forwarded digitalization. It's clear we have to recognize that there is substantial human suffering in the wake of the pandemic. Societies have closed down impacting the economy. But also we see the importance of high speed Internet connectivity and connectivity overall. And that's where we come in. And we're, of course, very encouraged to see the process here of building out strong coverage in the world where we are a key contributor. And we hope that we will see part of the recovery programs around the world being allocated to high-speed mobile broadband, because ultimately that's a faster way to build out coverage. Over the last few years, I also want to say that we have invested quite substantial amounts in the constraining our supply chain. That gives us increased flexibility. You've seen, for example, the factory we've built in the U.S. But we have also focused on increasing the flexibility in other parts of the supply chain. So even though we're in a pandemic with a very tight supply chain for example on semiconductors, we've been able to complete all customer deliveries on the committed time frames and according to schedules, as well as running our internal operations. So a big kudos to the organization for that. But let me jump into the business. We have continued to consolidate our position as market leader in 5G with 136 commercial contracts and 85 live networks in 42 countries. What's also encouraging is that organically FX adjusted we saw sales grew 10% during the first quarter. And if we actually add or adjust for the IPR revenues, organic growth was 14% in our business. So that is really driven by a strong growth in networks that again if you would adjust for IPR actually grew 19% in the quarter, which is fairly significant growth. It's also clear we exited the quarter on a very good footing and feel very good about 2021. We had a strong development in the second part of the quarter after a bit softer in the middle. Despite the reduction in IPR revenues that we have guided about, we saw that the gross margin actually improved year-over-year to 42.9%. And that is the growth that we saw in all segments. So gross margin strengthened across the board. EBIT margin was up to 10.7% and that is despite significant cost to improve the business, significant cost to grow footprint as well as a negative currency movement. And you know 2021 is overall an investment year for us possibly more so in Digital Services so here we're increasing the investments we do in R&D to have a competitive 5G cloud-native portfolio. And we're making great progress. We see good traction with customers with many customer wins. But what's also clear is that we are incurring costs ahead of revenues. So we are seeing R&D expenses increase. We're seeing costs for new product introductions coming up, while revenues are not coming until later in the year, I would say at the earliest in Q4, but we're really going to see revenues coming in 2022. So this is a year of investments, but it's a year of investments according to the plan we have put out for Digital Services. If we look also on the cash flow it's very strong. The -- if we adjust again for IPR revenues, which typically are paid -- a large part, majority are paid in the first quarter. So if we were to look beyond that the underlying cash flow improved quite substantially. And it's actually one of the best Q1s we have in our history. We also invest substantial effort in making sure that we have an ethically responsible business and we conduct our business in an ethical way. This is built upon individual accountability as well as integrity. So here we are spending a lot of our time in the organization to make sure that we incorporate all lessons learned from the past troubles we've had and make sure we have a state-of-the-art really great compliance program. But more importantly that everyone has compliance as an integrated part in the way they behave and in the way we conduct business. And winning business that's all what it's all about, but we are going to win business make sure to play by the rules, fair and square and no debate about that. If we look at the market areas, we saw good growth in four out of five market areas. Northeast Asia, we grew by 80%, which is really driven by the non-Chinese markets primarily. If we look at -- the next one is Southeast Asia, Oceania and India where we saw good growth driven by 5G in Australia as well as 4G rollout in India of a little touch more than 20%. Moving on to Europe where we had good growth 15% in Europe, but that was partly offset by more flattish development in Latin America. And, of course, Latin America suffers from the pandemic and the macroeconomic effects following the tough situation with the COVID-19. If we then look MANA had a strong development based on continued rollout of 5G. And there we see actually good progress also on our cloud-native portfolio in Digital Services. So we had a growth of 10% -- more than 10% organically. And we've been able to also strengthen our market position, which is long-term going to be very attractive for us. We also saw the completion of the C-band auction. So we expect that to result in deployments during the second half of the year. And if we look then at our last market area, Middle East and Africa, we saw sales falling by 16% that is really an effect of the pandemic in Africa, impacting the macroeconomic and the spend environment, but we're also seeing a slowdown in Middle East following the large investments last year. So one of the cornerstones of our strategy has been to grow gross margin, and it's a fundamental indicator of success or progress on the focused strategy. So it is encouraging that we continue to see our gross margin strengthen in the business, and we are able to see that strengthening despite lower IPR revenue. As a matter of fact, we fully compensate for the lower IPR revenue in the gross margin development. We're all – and by growing gross margin, we can continue to sustain a very high R&D expenses. And we're doing that in order to make sure that our portfolio is competitive from a future performance point of view, but also cost competitive. Of course, we continue to invest in the 5G rollout, and that's where we see benefit in our core business. But we're also seeing a very strong development, strong demand for 5G and enterprise applications. We're convinced here that, with the 5G cycle is going to be a different cycle than the traditional, or more call it consumer-driven cycle that we've seen in the past. And we believe the 5G cycle will be both longer and bigger due to entering a complete new application area with enterprise applications. What's encouraging is the progress we're making on our portfolio. And in Q1, we announced the ultra lightweight high-performance Massive MIMO radio portfolio. We also continued to strengthen our position with the Cloud RAN. So we are continuing to invest in technology leadership for the benefit of our customers. Again, we have invested quite substantial amounts in making our supply chain resilient, and that pays off right now in having a good delivery performance with our customers, and we're keeping customer commitments. If we look at the R&D investments we're doing in Digital Services has built a very competitive portfolio and they will continue at a high level, because ultimately we are going to see the cloud-native portfolio be an increasing part of revenues. But again, it's encouraging to see that, the overall business currency adjusted in Digital Services grew by 3% in the first quarter. Managed Services, we also continue to develop the business growing gross margin, but we're also continuing the investments in automation, and AI in order to develop new solutions for our customers, where we see increasing traction that will over time change the margin profile of the business. With that, I'm going to give the word over to our CFO, Carl. Carl Mellander: Thank you, Börje. Thank you, and good morning, again everyone. Thanks for your time. So let's dive in a bit more to the numbers. And you can see that, our strategy execution that Börje talked about really show in our financials here in the first quarter. Net sales then came out at SEK49.8 billion, which is a 10% organic FX-adjusted growth for the group, mainly driven then by networks, with very high growth numbers as quoted by Börje, of course based on continued demand for our 5G portfolio. IPR revenues declined by SEK1.6 billion year-over-year due to these expired contracts that we are negotiating for renewal currently. And if we adjust for that, again, the organic growth is actually up to 14% for the group. If you see – if you look at the rolling four quarter basis here, our sales is now tracking at just above SEK232 billion. Gross margin then 42.9%, which is an improvement of 250 basis points year-over-year with improvements in all four segments, which is very encouraging indeed. Within both Networks and Digital Services, we saw a good operational leverage contributing to these higher margins and despite the lower IPR as we talked about. And I think it's always good to look at the rolling 4-quarter basis. Börje showed it earlier that where gross margin comes in at 41.2% steadily improving since 2017. OpEx was SEK 16 billion, out of which SEK 15.7 billion as you see here in the table for R&D and SG&A. SG&A was stable year-over-year. R&D saw a certain increase about SEK 0.4 billion. This is a result of the increased investment we do now in the cloud-native 5G portfolio in Digital Services mainly. But also we have now of course incorporated Cradlepoint -- the Cradlepoint business into our numbers. So that also added some to the R&D investment line here. So this results then in an EBIT of SEK 5.3 billion. This is 10.7% and 140 basis points improvement year-over-year. And I wanted to point out here that we are changing terminology from operating income and operating margin to EBIT and EBIT margin. And the main reason why we do that is that, we are now introducing EBITA as you know for the long-term target. And speaking of which then the EBITA on a rolling 4-quarter basis came out now at 13.3% compared then with a long-term target of 15% to 18%. So if we move from P&L and look a bit more at the cash flow, how profits have been turned into cash. You see here the free cash flow before M&A is at SEK 1.6 billion. And on a rolling 4-quarter basis again cash flow -- free cash flow comes out at SEK 21.5 billion which is then 9.3% of net sales. And we can also put that in relation to the long-term target we have set up for free cash flow before M&A as a percentage of sales which is 9% to 12%. So we are in that range here on a rolling 4-quarter basis. A few words on the net operating assets or call it working capital development in the quarter. We continue with strict discipline here. What we saw now in the quarter was a trade payables affected cash flow negatively with about SEK 4 billion. This is really the result of a decision we have made to derisk the supply chain in this situation to buffer up a bit on critical components, but it's also an evidence of -- yes that we're handling the semiconductor situation and ensuring that we can meet customer delivery deadlines. Inventory increased partly for the same reason, but also because we see rollout projects going on and we're building of course new radios to be delivered to customers in the coming quarters as well. Trade receivables decreased a bit and that's I would say, along with the seasonal pattern after very strong sales in the fourth quarter. So I really wanted to point it out again what Börje said regarding the free cash flow that the majority of IPR cash payments -- incoming payment, normally happens in the first quarter. So now of course having these renewal negotiations ongoing that cash flow did not come in. And if we add that back then this Q1 is the strongest -- at least since Q1 2014 which was actually also a bit out of the ordinary because then we received large license payments incoming in that specific quarter. So net cash then increased by SEK 1.1 billion in the quarter bringing the net cash position to SEK 43 billion as you can see here. And during the quarter we repaid €500 million bond. You can see that in the gross cash, we did this with cash on hand. So now the maturity profile of our debt portfolio is three years, up from 2.7 years at year-end. To round-off, if we take the next slide just to highlight a few of the planning assumptions. And as usual I want to refer you to the report for the full set of assumptions. But if we first of all look at the market that we operate in Dell'Oro, now estimates the RAN market to grow by 3% in 2021, of which China 4%; North America 2%; and Europe by 3%. And if we look at our own reality regarding top line to start with, historically, if we look at the three-year average, the seasonality on top line is plus 13% from Q1 to Q2. And as you know though, and I really want to point that out that we can see large variations around this average number in reality. Then, in segment Networks, we want to point out that gross margin can be negatively impacted by a higher share of rollout projects now, which we have in the pipeline for the second quarter. And moreover, when it comes to OpEx, we have a certain seasonality between Q1 and Q2. So, OpEx typically increase from Q1 to Q2, and also here with the word of caution that that can vary quite substantially between the quarters depending on timing. On IPR. In Q1, our IPR revenue was SEK 0.8 billion. And this volume we can say reflects very well the contract portfolio that we have. So we can assume similar in the second quarter until -- and as we go along until expired contracts are negotiated or renewed. Lastly then within Digital Services, 2021 will indeed be an investment year with front-loaded costs and majority of the revenues from the new 5G core contracts coming late in the year. And now for the second quarter for these reasons, we expect a similar earnings level second quarter as the first quarter. So with that, thanks a lot and I hand back to you Börje. Börje Ekholm: Thanks, Carl. So to conclude, the investments we made in a competitive product portfolio, together with the cost position we have, have actually created a strong platform to grow in our core business, Networks, Digital Services and Managed Services, but it also creates an opportunity to accelerate our Enterprise applications business and developing new solutions for enterprise. As we have said, 2021 is an investment year. We're taking the cost for Cradlepoint acquisition. We're increasing our spend on compliance as well as security. We're also increasing investments in the supply chain. I would also say, there is here an element of investments to gain the footprint that we have invested in this quarter, but we are expecting to continue to do that going forward. I would also say at the same time that we're managing on the overall P&L level, but we have as we've been clear seeing an investment to position ourselves even better for 2022 and beyond in order to reach the long-term targets. What we also see is a very good order intake that we feel positions us very well for the full year as well as for 2022. And of course, that's what we build the business progress on. In Enterprise, we're starting to see a good progress on our 5G IoT offering, but we're also seeing that Cradlepoint becomes integrated into our business and seeing the growth opportunities now materializing in the numbers from Cradlepoint. So, that's encouraging to see. Again, thank you all for joining this morning. And with that, I give the word back to you Peter. Peter Nyquist: Thank you, Börje. So, we will now start the Q&A session. And -- so, I would like to welcome the operator. Acasa, do you hear me? Operator: Yeah. Ladies and gentlemen, at this time we will begin the question-and-answer session. Peter Nyquist: So, let's see here. Do we have anyone on the call for questions? Operator, can you see anyone on... Operator: Yes. Peter Nyquist: Yes. Let's see. Yes, present please. Operator: Our first question comes from Predrag Savinovic from Carnegie. Please go ahead. A – Peter Nyquist: Hi, Predrag. Predrag Savinovic: Thank you. Hi, good morning, all. Thank you for taking my questions. A – Peter Nyquist: Thank you. Predrag Savinovic: I hear some audio feedback here. A – Peter Nyquist: I guess you need to turn off your... Börje Ekholm: Computer. A – Peter Nyquist: Computer at the same time. And then... Predrag Savinovic: No, no. Yes, I am unmuted -- or muted on the computer, but I'll just go ahead in the time. A – Peter Nyquist: Please do. Predrag Savinovic: So, on seasonality in Q4 to Q1, I think in the last quarter you said, the effect would be less pronounced now it is more. And given your comments Börje on very strong order intake as well it seems that there is a timing effect. Shouldn't the seasonality effect be less pronounced than from this quarter to the second quarter? And my second question is on the margin side, which I mean both the gross and EBIT margins there they're undoubtedly quite impressive here, so up year-over-year despite an IPR decline. Are there any temporary effects? Any onetime capacity upgrades or anything that we should be aware of that lifts the margin here? Or should we basically expect a higher base level going forward? Thank you. Börje Ekholm: If we start with the second part, we have -- we've spent and you know that focused on investing in R&D for technology leadership and cost leadership. And that's really the key driver of the gross margin. So it's in that sense a very clean and straightforward gross margin. And based on the strength of the underlying business what we see is that we're going to have the rollout networks like Carl described in Q2 in networks that will temporarily affect the gross margin in networks. But the journey we're on with continuously strengthening our gross margin that continues. So that is no change and really no major in that sense onetime effects or temporarily positives. We have though a very big negative, which is we have no -- or very limited IPR revenues as you know. So the strong performance is despite that. If you look at the -- the reality is our business it's a bit hard to predict exactly when deliveries happen and deployments happen. What we saw in the first quarter was a bit softer in the middle of the quarter, while it continued at a very good pace in the end of the quarter. So we're comfortable with what we're entering into, but we're not going to change the seasonality pattern. I think we're better off just saying what we see rather than trying to be detailed in our guidance. A – Peter Nyquist: Okay. Predrag, you're good with that? Predrag Savinovic: Very good, very clear. Thank you, guys. A – Peter Nyquist: I think, we have the next question coming from Alexander Duval from Goldman Sachs. Hello Alexander. Alexander Duval: Hello. Yes. Hello, good morning, everyone and many thanks for the question. It looks like the third-party forecast you referenced in your report talk about sort of 3% RAN market growth this year. I was just wondering to what extent you might see potential upside risks to market growth? And if so what could be potential drivers of upside? Just listening to your commentary now Börje, it looks like you're emphasizing potential for growth. And clearly you've got a very strong order intake. Obviously, part of that is due to share gain, but just curious if there could be some update in terms of the end market? And then secondly, a quick one on Japan. Clearly, that's an area of strength within Asia. I wondered if you could talk a bit more about how you're positioned on 5G in the country now versus what you saw in the 4G cycle? And should we be looking at that as being prolonged for a few quarters? Many thanks. Börje Ekholm: Thanks, Alexander. Yes, if we look at the overall market forecast, I would be remised not to say that we see a very strong market development overall, probably on the more positive side than what the third party is kind of indicating or Dell'Oro's forecasts are indicating. I will -- I think that's fair to say. What we see driving of our growth primarily though is share gains. So we do believe that we have made substantial gains in market share that started a few years back and actually have continued during the first quarter. And we will not stop at that. We will continue to invest in our product portfolio to have the solutions that allow us to gain footprint in the market. We think that's important, so that we target to continue. How Dell'Oro will revise the market forecast, I really don't know. But I wouldn't be surprised if it's more on the positive side than the negative side, so put it that way. Japan. We have over the last few years gradually strengthened our position in Japan. And so far it's, -- 5G rollout have started, but we think we have the big bulk ahead of us there. So we continue to work with our customers to make sure that they rollout or have the products from us to rollout in the market and build their business. So we're -- we see positive signs on the Japanese market, I would say. They are one of the front-runner markets on 5G. So I believe that, we have to be strengthening our position and take advantage of that. Peter Nyquist: You good with that, Alex? Alexander Duval: Many thanks. Peter Nyquist: Thanks, Alex. Alexander Duval: That's great. Thank you. Peter Nyquist: We'll move to the next question. It's from Aleksander Peterc from Societe Generale. Hello, Aleksander? Aleksander Peterc: Yes. Good morning. And thank you for taking my questions. And congratulations on keeping the gross margins, at a really healthy level. So forgive me to focus a little bit on the negatives I'd just like to understand the moving parts here. So first on IPR, it does seem that at SEK100 million per quarter were going to be the run rate for the full year which is going to be a little bit below what you originally guided. So I wondered if there's any structural change there. Or is it just the temporary fall off? You do mention one licensee being lower. So I wonder if that's, due to geopolitical reasons or anything like that? And then, secondly, just on the second quarter you mentioned a 13% growth quarter-on-quarter with large variations. But I'd just like to understand, if there's a risk more to the upside or to the downside? Or is it symmetrical as you see it right now? Thanks a lot. Börje Ekholm: Yeah. That's a clever way to ask the question to get more guidance by the way. But let's start with the other one on IPR. The reality is we have contract renegotiation. It's with a couple of different parties. Those we expected to impact. They have also impacted, but we also have one licensee that actually have significantly lower volume in the market, and that results in much less royalty revenues for us and whether that to -- partly of course that's an effect of geopolitics. So you can safely assume that. Where that will end up in the end of the year? We don't know. But that's the effect we see. So we are saying, as a guidance going forward look at Q1 as a good indicator for the future right now, until we have renegotiated new contract terms with. And there are again several licensees we're renegotiating with in parallel. So, how that is exactly going to pan out for the full year, we'll report on that in I guess, Q1. We're not going to be forced by either timeline or anything else to that extent to close early. We will only agree to terms that maximizes the value for us and not to self-induced time line. So that's why I'm going to leave it open on the time line question. Then on the seasonality, I think the best guidance is clearly to look at the history. And then, I think what you hear us saying is that, we see a very strong positive momentum in the business. We should recognize we had growth in the first quarter of 10%. So, similar seasonality would kind of give you a fairly healthy growth in the second quarter as well. But of course we're very encouraged with the order intake the way we see in the market now. So you have to make a bit of a judgment call. We always know it's fluctuations in delivery schedule, deployment schedules et cetera. But we're very optimistic about Q2. Peter Nyquist: Great. Thanks, Aleksander for those questions. We will then move to the next question from Daniel Djurberg at Handelsbanken. Good morning, Daniel. Daniel Djurberg: Congrats to stellar network performance in the quarter. I was wondering if you could talk a little bit -- you mentioned about the network deployments in Q2 that possibly could hit gross margins they will come. To me, I read this like potentially large 5G deployments in China that could pickup. So my question is really what kind of insight do you currently have on current -- on future volumes? And also if you see any risk in the inventory, because, I guess, you have needed to build inventory on the China deployment already. If you can comment anything on this would be great. Thank you. Börje Ekholm: The reality is, the China market, there was a big tender last year that we entered into and won an increased market share. The next tender will probably come in the next few months. That's a bit unpredictable. So with that you can conclude that we have no insight into how that would look like. These are driven by other market gains actually, where we see that we are going to have larger share of rollout contracts in the near term, that's going to impact our Q2 in networks for sure. We shouldn't exaggerate it, but we're trying to say that, that portion is a bit larger than normally. The second question maybe you should take. Carl Mellander: Yes. You asked about the risk in inventory. But I would say, no, I mean, we -- this is business as usual, of course, to assess the inventory and every closing. And we take the measures we have to, given the risks that we sit on. Börje Ekholm: Yes. It's nothing extraordinary. Carl Mellander: No nothing extraordinary. Börje Ekholm: Nothing special. Carl Mellander: We deal with that as we go along. Peter Nyquist: Okay. Great, Daniel. We'll then move to the next question from Frank Maaø at DNB. Good morning, Frank. Frank Maaø: Good morning. Thanks for taking my question. And just wanted to clarify a little bit there on the last question, also on China, which actually was -- my question was also relating to. So Mainland China was flat for you year-on-year. And you mentioned the tender that will probably come in a couple of months. We don't have any particular insight on them. But, exactly, could you repeat what you said about a portion being a bit larger than normally? I didn't fully get that? Do you mean the portion that you have -- that you expect of the rollout in China, which is really my question, give a lot more -- further to China, do you see any mix changes on what's going on in terms of the plans that operators have there? I know that there seems to be a certain skew towards 700 megahertz rollout in China, rather than perhaps that much Massive MIMO this year, would that impact you and your competitiveness in any particular way in China? And finally, if I may, on the Massive MIMO -- second-generation Massive MIMO product that you've mentioned, could you give us some color on that, has been received by customers who also are evaluating the Chinese lenders Massive MIMO products, which were pretty light weight for the 64TRX something like that, even that was launched one year ago. So, if you could give us some color on the reception there, please? Thank you. Börje Ekholm: If we start -- just to be clear, the rollout in China during the first quarter, we don't see that to increase, right, during the second quarter. And we don't know anything about new contracts. So with that, you must conclude that it's not China-related. It's actually other markets where we see that we will have large rollout or we know we will have large rollout contracts in the second quarter. And the proportion will be slightly higher. So you need to think about then the scale of that deployment and you will probably realize where it is. But that is going to impact. The impact is not super large, but it's still going to impact. And we can absorb quite a lot in our new cost structure. So with the cost structure we have on products, as well as on services, we can absorb those large rollout contracts. But we want to be clear that we see those coming and they are going to impact earnings slightly in the near term. It's very temporary, but it's a very large size at the same time. Then looking at China, yes, how the deployment schedule is going to look like, how the tender structure is going to look like is unclear today. Clearly, our competitiveness in Massive MIMO is good and the reception on our new generation Massive MIMO is very positive from customers, and we're starting to see that gaining increasing momentum and we will start to see that rolled out in the -- or starting to be rolled out in the next few months. So, we're very encouraged with what we see, and we do see that the customers are putting us at a very good competitiveness with this new generation Massive MIMO. And I would say that, we clearly have a significant step on weight compared to where we were and compared to where competition was on their former generations. So, we're very encouraged about that competitiveness. Peter Nyquist: Okay Frank, thank you for your questions. We will move to the next question from Sébastien Sztabowicz from Kepler Chevreux. Hello Sébastien. Sébastien Sztabowicz: Yes, hello, thanks for taking the question. On Digital Services, you are running the business on rather elevated level of losses in the first half of the year with the acceleration of the R&D investment in cloud-native 5G portfolio. How should we think about the spending or the level of loss in the back half of the year? Do you see any improvement coming in? Or should we assume that the improvement will only income by 2022? And also, on the IPR litigation with Samsung, could you remind us a little bit, the process and where you are standing into the litigation process with Samsung? Thank you. Börje Ekholm: If we start on the second one, with the Samsung process, yes, we have multiple lawsuits going between the companies in several different jurisdictions. So of course, it's very hard to comment on detail of that. So, I just want to say that, we're going to be focused on reaching a -- call it, we are going to focus on maximizing the value of our IPR portfolio, as much as we can, and as much as we possibly can. That's what we're doing. And I feel it's in the interest of us as a company to make sure that we don't self-impose deadlines or self-impose restrictions on those, both litigation strategies and negotiation strategies. So, let's -- when we have some material developments i.e. if we would agree for example of course we'll update the market at that point in time. But making predictions here and self-imposing constraints, I think, would not be right for our negotiating position. So we're going to continue to run it like we do. And I apologize, I know, it's hard to be on the outside asking for information and getting nothing really. So I recognize that and I feel that pain as well. But we -- I think we have to run the negotiation in the way we do right now in order to keep our ability to negotiate. Carl Mellander: Digital, should I take that one? Börje Ekholm: Yes, you can take digital. Carl Mellander: Yes, I say that. Okay. Sébastien yes, so you saw the EBIT on the Digital Services minus SEK 1.5 billion now in the first quarter. And we -- now we say that, it's going to be on a similar level for the second quarter, for the reasons that we talk about with early cost and the revenues in the 5G contracts coming much late in the year. So, from that, you can deduce that the second half will improve. And as you know, the fourth quarter is typically the strong -- clearly the strongest for Digital Services also because of seasonality topline being at the highest. So, second half of course that's our ambition clearly is going to be better than the first half for those reasons. Peter Nyquist: Thank you, Carl, and thank you Sébastien for that. And we will move to the next question from Dominik Olszewski at Morgan Stanley. Dominik, can you hear us? Dominik Olszewski: Yes. Good morning everyone. Thanks for taking the questions. So, maybe a shorter-term question and a longer-term question. So in the shorter term, maybe you could just update us on your thoughts around the OpEx trajectory into the rest of the year. Obviously, you described 2021 as an investment year, so interested in your thoughts there. And also particularly, obviously one quarter further, so we have perhaps better visibility on employees returning to office and how that affects your thinking on those costs? And then secondly, longer term, there have been some recent reports about challenges for Chinese equipment vendors in serving markets like in India. So I'm very curious about your thoughts and plans around growth in India and whether that presents a mix market share opportunity for Ericsson? Thanks. Carl Mellander: Börje, I'll take OpEx. Yes. No, I would say we won't see any major changes. As you know we are continuing the investments in R&D, and we've been clear on that. We can also look at the seasonality that we talked about in planning assumptions where OpEx typically comes up in the second quarter. Then of course, it's a special year when it comes to work from home and virtually no traveling except of course in certain customer delivery cases and so on. So, therefore, of course, there's a big saving going on from that point of view. And let's see how that develops. I mean, nobody really knows how that will develop during the year. But we will -- as it looks like now, we will as employees in Ericsson continue to work from home during the rest of the year and we will not be resuming traveling as it looks right now. But other than that no major impact other than the R&D investments that we do and increase in Digital Services. Börje Ekholm: What you may add is that of course we need to learn from this period. Carl Mellander: Yes. Oh, yes. Börje Ekholm: So, we can probably save on a lot of the other costs, because we can work remotely. Carl Mellander: Definitely. So the ambition is, of course, even when we resume life as normal the new normal or the now normal as we say travel will of course be lower than they were pre-pandemic, because we have learned so much in how to interact both with customers and internally. Börje Ekholm: As well as most likely other costs like real estate will -- they haven't been lower yet, right? Carl Mellander: No. Börje Ekholm: Now the office space are completely empty, but most likely these will be lower as we return after the pandemic. So I think when you think about cost structures and cost levels, there are many opportunities and lessons learned from this period that we can actually reduce the run rate going forward. That's not happened yet. Your India question, I think, it's a very interesting question. Without getting into geopolitics that's a lot of speculation about us and let others do that part. But India is a very big market clearly and a market where we have strengthened our position over the last few years and it's something we continue to do. And one of the reasons why we're growing in the market area Southeast Asia, Oceania and Australia is actually India. So for us that is a major focus market because that can give us scale. So that is an important area where we prioritize growing our footprint. Peter Nyquist: Great. Dom, thank you for your questions. And then we'll move to the next question from Richard Kramer at Arete. Hi, Richard can you hear me? Richard Kramer: Yes. Can you hear me okay? Peter Nyquist: Perfectly. Good morning. Richard Kramer: Okay. So Börje, I have two basic questions. One about the structure of the industry, because you've spoken about gaining market share. And the message from the operator is the desire to preserve supplier diversity. And with the geopolitical situation you've referenced many times with the limitations on one of your principal competitors and the introduction of a new large competitor in the US, how do you think about your customers looking at your market share and thinking that it needs to be limited that they want to preserve more than just a few other options in the marketplace and maybe that's what's driving them to look at new modes of supply like Open RAN? And then I have a follow-up question about the enterprise business. It seems -- it feels like it's a bit the tail wagging the dog, because it's still a very tiny percentage of your sales. Can you flesh out a little bit more what your plans might be in the next few years to build out an enterprise sales channel and to build out the range of products that you would need to have a complete offer for enterprises beyond selling through the telco channel? Thanks. Börje Ekholm: It's a good question. I think what we need to recognize on the structure of the industry, it's clearly a desire to have multiple choices for our customers. And I think that we are going to see that and we plan accordingly. But I'm also convinced that if we can offer the best solutions for the market, the competitive product portfolio and cost structure we can continue to gain footprint as we see it right now. We are never going to be 100% of the market or even remotely close to that. So, I do think that we actually even in today's market structure still have an opportunity to continue to gain not across the board, not everywhere, but I think we have a chance to gain footprint based on the portfolio we have. But as you say there are going to be other competitors and I think that's healthy. I actually believe competition is maybe tough short-term, but actually longer term is good for the industry. So, I don't see that to be anything different moving forward than it's been in the past. And actually it's interesting to look at the consolidation in the market that was clearly the case with other vendors that have reached way beyond 50% market share in many countries for example in Europe and around the world. So, I don't see where that limit really is on market share. I don't think we're there yet. But at some point in time, it will be there for sure. Enterprise, I want to just draw your attention to a very simple fact. If you start building out something it will by nature be small in the beginning. It's kind of unavoidable unless we would do a very big acquisition for example. So, if you think that's tail wagging the dog yes its -- but it's unavoidable starting point unless you do that big acquisition. We're not going to make that. That's not the plan. Our plan is instead to build out use cases and applications starting with the IoT global connectivity, starting with our dedicated networks that we're investing quite heavily developing solutions for the market including the CBRS spectrum in the US, but we're also seeing with our wireless ONE offering that we can create a very different network architecture to work from home, for example, or remote working. That has allowed us to launch one which we call wireless office which allow you to have full connectivity as a small and medium-sized company and run all your applications without having a local area network. And we think that is a major opportunity for us in enterprises. I would also say our enterprise investments are always serving the benefit of kind of two masters in that sense, i.e. it's going to grow the revenues for the service provider as well. So, whether we have to develop a full independent go-to-market to enterprise it's a different story, but what we want to make sure is that it drives revenues for our service providers. If you look at Cradlepoint, they actually have a channel structure channel go-to-market and that's something we're leveraging also for our dedicated network as well as longer-term IoT solutions. So, we are trying to do a lot of demand creation through the go-to-market organization. Peter Nyquist: Thanks Richard for those two questions. We actually turn now to Jens Nordström at TV4. Jens can you hear us? Jens Nordström: Yes, I can. Thanks very much. Börje you have not been particularly keen on addressing friction between China and the Western world previously. But as we can see there's a number of cases where this friction generates real sports at the moment. Does this worry you that Ericsson might increasingly get caught up in this friction with China? Börje Ekholm: There is a lot of geopolitics going on and it relates of course to China-US situation as well. So, with all of that kind of moving pieces it clearly can affect us as well. It's no question. Of course for us what we can do is to work on our own flexibility the way we drive the business that will probably be the only way we can really truly impact these trends. But I think it is concerning what we're seeing right now. And I want to just say one thing we're in an ecosystem where we actually have a global standard. It allows us on the call here to travel globally with one device. But the reality is what it does even more is it can allow less fortunate countries to have a full connectivity. So, what we see now is that we have 8 billion subscribers around the world being able to connect on one standard and one structure and that's something I think is important that we preserve. Peter Nyquist: Thanks Jens. Jens Nordström: A quick follow-up. China is preparing for new 5G auctions, is there a risk that Ericsson might be impacted badly in these auctions by being a Swedish company due to diplomatic tension between the two countries? Börje Ekholm: It's -- I want to say it very simple. There is always a risk that were impacted in auctions in different countries. But what we are going to do is we're going to work on our competitiveness, our competitive product portfolio, our competitive cost structure and we are going to try as hard as we can to gain an increasing footprint in the Chinese market. It's an important market for us. It's -- of course, it's a volume question, but actually it's also a leading deployment market. So it's an important way for us to learn what technologies are going to be needed for the future. Peter Nyquist: Thanks, Jens. Jens Nordström: Do you feel you have to tread very carefully here? Börje Ekholm: We are running a company and we're trying to do that to the best of our ability. I focus on running that as well as we can. Of course, the geopolitical situation is a very difficult situation. And we are working on the areas we can impact. I often say and I think I said that to you before Jens that the reality is, the world falls down in two buckets, one bucket that you can impact and one bucket that you can't impact. So I focus the attention on the part that can impact, our products, our solutions to customers, our cost structure etcetera. Peter Nyquist: Thank you, Jens for those questions. We are getting closer to the hour. So we have time for one final question and that is from Johanna Ahlqvist at SEB. So hello, Johanna? Johanna Ahlqvist: Hello. Thank you for the being the final want to ask a question. I think if I may two ones. The first one relates to working capital. And you mentioned Carl in the quarter trade payables impacted by SEK4 billion to derisk the supply chain. I'm just wondering if you can give us any guidance what you predict for the full year? Will there be more of those type of actions? Or have you taken the ones necessary now? And then on competition, you mentioned in the report that you are sort of investing to take market share. I'm just wondering how is the price competition currently? Because it seems like you're growing pretty nicely in Europe now with market share gains. Do you need to price yourselves into gain contracts is that still the case? And that -- is it the fact that for instance Samsung has taken over Huawei's price pressuring role in a sense? Or how is price competition in the market currently? Thank you. Carl Mellander: I'll take the first one. Thank you, Johanna on working capital then. I would say -- of course, we can optimize different parameters here. And for us, it's more important to secure that we can deliver to customers on time. That's also by the way good for working capital because you get to accept the milestones on time and then you can invoice and get paid also. And what we have decided to do is to invest so that we can meet those milestones in sometimes challenging supply situation globally. And we saw a bit of that in the first quarter. We will continue to balance this as good as we can. And I would say we prioritize of course always the customer delivery. So make sure that we have the inventory, we need the components, we need on especially this critical component, so that we can meet those delivery deadlines. That's a fairly easy trade-off at the end of the day. Exactly how it plays out, it depends on I would say the rollout pace, the delivery pace over the year. And -- but we'll do our best to manage working capital and continue the discipline we have now I must say throughout the organization. Börje Ekholm: On competition, I would say over the last several years, it has remained a very competitive industry and that has really not changed. So that's what we base our plans on what we have seen over the past few years and continue to see. Peter Nyquist: Thanks Johanna. Johanna Ahlqvist: Okay. Thank you. Peter Nyquist: And before we end this webcast maybe some final remarks from your side Börje. Börje Ekholm: Thanks, Peter. Yeah, I would just summarize and say that we continue to execute on our focused strategy. It is to invest in R&D for technology and cost leadership. That allows us to be competitive and grow our core business and that's what we are going to continue to do. We do believe there will be an inherent growth in the 5G market because 5G goes after both the consumer mobile broadband as well as enterprises. So we see that growth to continue a bit longer than normal and a bit faster and bigger than normal. So we are very excited about those opportunities. We continue to invest for market share gains that we have done over the past few years and we continue to see those opportunity on the back of a strong portfolio, but we're also very excited about the enterprise opportunities. It's still small in size, but we see here with the offerings we are getting together that we're starting to see a healthy growth rate where we will pursue both organic growth as well as inorganic opportunities. So with that, thank you very much for listening in. And thank you very much for your interest. Peter Nyquist: Thank you, Börje. And by that we will conclude this webcast. Carl Mellander: Thank you. Börje Ekholm: Thank you.

Ericsson's Strong Earnings and Strategic Moves Bolster Market Position

- Ericsson (NASDAQ:ERIC) reported earnings per share of $0.35, surpassing estimates and highlighting the effectiveness of its strategic operational improvements and cost-saving measures.

- Despite a slight miss in revenue, Ericsson's focus on operational excellence has led to sustainable gross margins and strong commercial momentum through significant customer agreements in key markets.

- The company's financial metrics, including a favorable price-to-earnings (P/E) ratio of approximately 14.92 and a solid earnings yield of about 6.70%, reflect its robust performance and attractive market valuation.

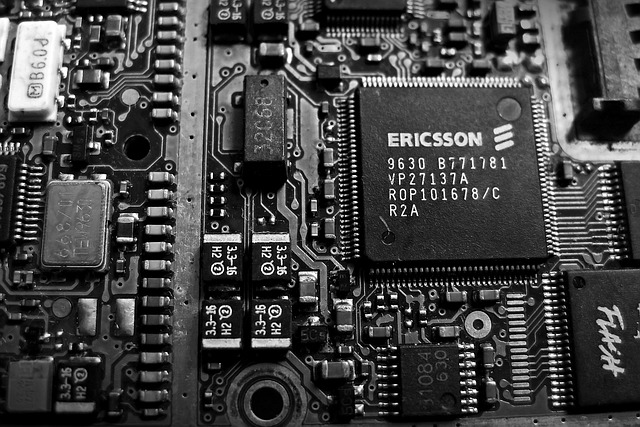

Ericsson, trading as NASDAQ:ERIC, is a leading Swedish telecom equipment manufacturer. The company is known for its innovative solutions in the telecommunications industry, providing services and products that enhance connectivity worldwide. Ericsson competes with other major players like Nokia and Huawei in the global market.

On October 14, 2025, Ericsson reported earnings per share of $0.35, exceeding the estimated $0.14. This strong performance is attributed to strategic operational improvements and cost-saving measures. Despite revenue slightly missing estimates at $5.91 billion, the company's focus on operational excellence has driven its gross margins to sustainable levels.

Ericsson's strategic efforts have resulted in strong commercial momentum, with significant customer agreements in key markets such as India, Japan, and the UK. These agreements have bolstered the company's financial flexibility, allowing it to enhance profitability and consider increased shareholder returns. The $1 billion sale of its Iconectiv connectivity services business further strengthened its financial position.

The company's financial metrics reflect its robust performance. With a price-to-earnings (P/E) ratio of approximately 14.92 and a price-to-sales ratio of about 1.05, Ericsson's market valuation is favorable. Its enterprise value to sales ratio of around 1.07 and enterprise value to operating cash flow ratio of approximately 6.48 indicate a strong valuation relative to revenue and cash flow.

Ericsson maintains a moderate debt-to-equity ratio of approximately 0.42, suggesting a balanced approach to leveraging debt. The current ratio of about 1.09 indicates a slightly higher level of current assets compared to liabilities, showcasing the company's ability to meet short-term obligations. With an earnings yield of about 6.70%, Ericsson offers a solid return on investment for shareholders.

Ericsson's Strong Q2 2025 Performance: A Deep Dive into Financials and Strategic Focus

- Ericsson reported earnings per share of $0.14, surpassing estimates and indicating strong profitability.

- The company achieved a 48% adjusted gross margin and a three-year high in its adjusted EBITA margin, showcasing operational efficiency.

- Ericsson is increasing investments in artificial intelligence, aiming to drive future growth and innovation in 5G technology and beyond.

Ericsson, listed as ERIC on NASDAQ, is a leading Swedish telecom equipment maker renowned for its innovative solutions in the telecommunications industry, particularly in 5G technology. Competing with giants like Nokia and Huawei, Ericsson has recently showcased its strong strategic and operational execution through its second-quarter results for 2025.

On July 15, 2025, Ericsson reported earnings per share of $0.14, surpassing the estimated $0.12, indicating a positive performance in terms of profitability. The company generated a revenue of approximately $5.84 billion, which was below the estimated $6.21 billion. Despite this, Ericsson achieved a 48% adjusted gross margin and reached a three-year high in its adjusted EBITA margin, highlighting its operational efficiency.

Börje Ekholm, President and CEO of Ericsson, emphasized the company's solid execution of strategic and operational priorities. The company has structurally lowered its cost base and is focused on delivering further efficiencies. Growth in the Americas is encouraging, while Europe has stabilized. Globally, fixed wireless access customers have surpassed 160 million, driving significant network traffic.

Ericsson's financial metrics reflect its market position. The company has a price-to-earnings (P/E) ratio of approximately 156.38, indicating a high valuation relative to its earnings. Its price-to-sales ratio stands at about 1.04, suggesting that investors are paying $1.04 for every dollar of sales. The enterprise value to sales ratio is around 1.03, reflecting the company's valuation in relation to its revenue.

Looking forward, Ericsson is increasing its investments in artificial intelligence, including its involvement in the Sweden AI factory consortium. AI is seen as crucial for accelerating innovation, especially in supporting AI use cases at the edge, which require ultra-low latency and enhanced uplink performance. This strategic focus on AI is expected to drive future growth and innovation for Ericsson.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson Shares Rise on Better-Than-Expected Q2 Earnings Amid Cost-Cutting

Ericsson AB (NASDAQ:ERIC) saw its shares rise more than 2% pre-market today after surpassing Q2 earnings expectations, benefiting from cost-cutting measures despite a challenging market. Adjusted earnings before interest and taxes climbed 14% year-over-year to 3.23 billion kronor ($307 million), surpassing the 2.7 billion kronor forecasted by Wall Street analysts.

CFO Lars Sandstrom emphasized the ongoing need for cost reduction, noting that a significant portion of expenses is related to personnel. Ericsson's net sales for the quarter fell by 7% to 59.8 billion kronor, exceeding analyst expectations of 58.5 billion kronor. The adjusted earnings did not include a previously announced impairment concerning its Vonage business.

The company reported an 11.4 billion kronor non-cash impairment due to the declining performance of the Vonage unit, leading to a net loss of 11 billion kronor for the period. This is the second writedown for the asset since Ericsson agreed to purchase it in 2021.