Telefonaktiebolaget LM Ericsson (publ) (ERIC) on Q2 2022 Results - Earnings Call Transcript

Peter Nyquist: Hello, everyone and welcome to today's presentation of Ericsson's Second Quarter Result 2022. Together here in the studio, I have our CFO, Carl Mellander; and our CEO, Börje Ekholm. As usual, we will start this session with a presentation of around 20 minutes and then we will have the Q&A session. More details around that you will be able to find on our web page, ericsson.com/investors. During today's presentation, we will be making forward-looking statements. These statements are based on our current expectation and certain planning assumptions which are subject to risks and uncertainties. The actual result may differ materially due to factors mentioned in today's press release and discussed in this conference call. We encourage you to read about these risks and uncertainties in our earnings report as well as in our annual report. With that said, I would like to start with giving the word to you, Börje. Please, Börje. Börje Ekholm: Thank you, Peter and good morning, everyone and welcome to today's presentation. And a big thank you for joining us, of course. I'm pleased to present another quarter where we continue to see a strong business performance. We are growing driven by the global rollout of 5G Networks as well as market share gains. Today, we have a 39% RAN market share and that's, of course, excluding Mainland China and that's up from 33% in 2017. Today, 50% of the world's 5G traffic outside of China is carried over Ericsson radio Networks and 80% of the top 20 operators in the world are using our 5G Core. Fundamental to our strategy is technology leadership. And since 2017, we have increased our investments in R&D significantly and we're committed to continuing this journey of innovation. This includes investments in our mobile infrastructure business but also developing a leading offering in the enterprise space. In the quarter, we announced some changes to our structure and that will allow us to speed up and accelerate the execution of our strategy. With 5G, anything that can go wireless will go wireless. This puts Ericsson in a very good position as 5G is rolled out and transform every sector of the society. So now let me go through some of the key takeaways from the quarter. We see good business momentum and our underlying business is developing well. We continue to drive improvements through the introduction of new innovative solutions and continues to improve our underlying operation. In the quarter, we saw organic sales growth of 5%, with gross income reaching SEK26.3 billion. This is driven by strong 5G momentum in North America as well as in Europe. Our EBITDA margin for rolling 4 quarters were 14%. That's tracking close to our long-term target of a margin of 15% to 18%. And that's a target where committed to reaching in the next 2 to 3 years, while we establish also Ericsson on a stronger long-term growth trajectory. This is a testament to the hard work and commitment from our colleagues across the company who has continued to deliver to our customers in spite of a very challenging supply situation and a big thank you to our team out in the world. You all know the global supply chain situation remains really challenging and inflationary pressures are significant. We're investing and we have been investing, actually dating back several years, to derisk our supply chain to build resiliency. This has included creating a more flexible manufacturing footprint but we have also invested in building buffer inventories. And this, of course, leads to a larger inventory situation in the company. Ensuring supply in a difficult supply environment is associated with extra costs. However, we see this as a key driver of our ability to actually expand the footprint and strengthen our scale. And from a long-term perspective, we believe this is critical. I remain convinced that actually lost sales cost more from a long-term perspective than carrying a bit of extra inventory short term or for a few quarters. That's basically like an insurance premium for the future. So this ability to deliver despite a very challenging supply situation we believe is critical to establish a stronger footprint and thus a bigger scale which will drive our long-term profitability. To handle these extra costs, of course, we're going to see compensation as contracts expire. But we believe that the key drivers to combat the cost increases will be to continuously launch new innovative products and solutions with new features as well as lower costs. And that's what we have used the last few years to turn around the company and we continue to use that in order to actually combat the cost inflation and we have continued to do that during the quarter. The gross margin came in at 42.2%, excluding restructuring and that's lower than what it was last year, 43.4%. The decline in gross margin is largely attributed to lower IPR revenues in the quarter. That means we've been able to mitigate a large part of the cost inflation with the continuous improvement of the business as well as product substitution. IPR revenues are affected by several expiring patent license agreements and that we are renegotiating and also some other 5G license negotiations. And we're confident in our strong 5G patent portfolio and we will seek to optimize the return from that portfolio. And here, we believe, we're in a strong position to negotiate, of course, good future license deals. So we will seek the right deal rather than -- or that will lead maybe to slippage in time because it's more important for us to have the right deal than do it fast. Gross income improved by SEK2.4 billion and EBIT by SEK1.5 billion compared to Q2 last year. We also continue to engage with the U.S. authorities, the DOJ as well as SEC in relation to the 2019 Iraq investigation and the DPA breaches. At this point in time, we cannot assess how these matters will be resolved. We remain, however, fully committed to cooperating with the authorities as this process goes on. We also continue to increase our investments in ethics and compliance. Actually, a large part of the increase in our SG&A during the quarter is attributed to investments in ethics and compliance. We further need to make sure that we have integrity in all decision-making in the company, as well as we have a prudent approach to risk taking and risk measurements in the company. And we believe that all of those investments that we do in changing the culture as well as our processes and procedures will make Ericsson a stronger and more resilient company in the future. Let me now turn to the customer and market side of our business, where we continue to see strong traction across the business, with organic growth in 4 out of 5 market areas. Our strong momentum in North America continues, where sales were up 12% year-over-year, FX adjusted, of course and that's driven by continued high demand for 5G solutions in Networks. And the U.S. customers continue to be at the forefront of 5G deployment and the introduction of new use cases. Overall sales in Southeast Asia, Oceania and India increased by 6%. This was driven by Networks and Digital Services, where we saw market share gains. Sales in Northeast Asia had a small decline of 1% year-over-year. That was mainly due to the timing of 5G rollouts. In Middle East and Africa, sales increased by 8% year-over-year. That's predominantly driven by Africa, with 4G rollouts as well as software upgrades in digital services. Overall, we continue to see a very encouraging momentum in the market. And finally, in Europe and Latin America, sales increased by 4% year-over-year and that is thanks to growth in Europe, while Latin America was stable. Overall, we continue to see very good momentum on market share gains in Europe, with Networks showing double-digit growth despite sales being affected, of course, by the invasion of Ukraine and Russia impacted sales by SEK1.2 billion -- or lost sales by SEK1.2 billion during the quarter. So let me now move over to our strategy and that's based on leadership in Mobile Networks as well as a focused expansion into enterprise. In the quarter, we took a key step to accelerate our strategy execution by introducing a new group structure. On the Mobile Networks side, we've introduced a new segment, Cloud Software and Services by merging Digital Services and Managed Services. This will allow us to capitalize on the convergence of Cloud Software and Services and grow our core mobile infrastructure business. And we, of course, remain very committed to turn around the business as quickly as possible in that segment in order to support us reaching the long-term group targets. On the Enterprise side, we formed a new segment -- that's a new segment where we have one business area called Enterprise Wireless Solutions which is the combination of Cradlepoint and Dedicated Networks. Cradlepoint continues to strengthen its position in the market and shows building growth in excess of 40% this past quarter. The Enterprise segment will also include the global network platform. which create -- which we believe will drive a paradigm shift in the industry. And that's because the network will be a horizontal platform whose capabilities will be exposed, consumed and paid for through global network APIs. The global developer community can therefore start to innovate on top of the network and really leverage all the capabilities of the network. This would be very important in establishing 5G as the strongest innovation platform the history has ever seen. We believe this will inspire innovation. But most importantly, it will actually give our customers, the service providers, another avenue to monetize the network investments. And here, we are working very closely with front-runner customers and we see a very strong response from our customers supporting the introduction of the global network platform. The intended acquisition of Vonage is an important building block to execute on the global network platform and we are working to secure approval and close the transaction before the end of July. Our strategy builds on technology leadership and we continue to invest in R&D so we can launch new and innovative products in the future as well. Of course, this includes investments both in our Mobile Networks business as well as in Enterprise and we will spare no resources in strengthening our position in those areas. Now, let me give the word over to our CFO, Carl Mellander. Carl Mellander: Thank you, Börje. Excellent. And good morning, everyone. Thanks for taking the time. And first of all, I wanted to say that this then will be the last quarter we report according to the existing current structure of segments. And from the quarter 3 report then, we will report in the new structure with the 4 segments: Networks, Cloud Software and Services, Enterprise and Other and we will provide a restate also for -- from first quarter 2021 until second quarter '22 and also the full year 2020 in this new structure and we will do that in September, well in time for the Q3 reports. So if we look at the numbers then and starting with net sales. We -- the set sales amounted to SEK62.5 billion, with organic growth in 4 out of the 5 market areas. So organic growth of 5% despite then a couple of items that Börje touched on, the suspended business volume in Russia, that's SEK1.2 billion in top line drop due to that; and also the IPR revenue which is SEK0.9 billion lower year-over-year. So this growth was really driven by the 5G deployment in 2 of the largest market areas we have, of course, North America growing 12%, as you saw and Europe and Latin America growing 4% organically as well, especially driven by Europe. We continue to win market shares, not least in Europe and now we see the fruit of that in the top line growth. So reported sales grew by 14%. And clearly, we have quite a strong FX tailwind here due to the weakened Swedish krona. So IPR, we talked about it a bit, it was SEK1.4 billion in the quarter, decreased SEK0.9 billion, as said. And it can be noted that this is in line with the guidance that we had provided in the Q1 report for Q2, when we said that we would end up between SEK1 billion and SEK1.5 billion in the quarter, we came out at 1.4%. And the same guidance now, we maintain also for the third quarter. That's important to say. Of course, the actual outcome will depend on timing and terms and conditions of any new agreements. Gross margin then, excluding restructuring, came out at 42.2%. And I'll drill more into gross margin in a moment, so we can continue talking about the R&D expenses. Now we -- it amounted to SEK11.5 billion, that's an increase with SEK1 billion, of which around 40% relates to FX movements. But we have increased R&D in mainly Networks. Two areas to mention, the Ericsson Silicon which is the next-generation ASIC but also in Cloud RAN. And of course, the silicon piece is to enable really industry-leading radio performance energy savings, not least and the Cloud RAN has to do with more flexible deployment options for our customers. We will continue with this increased R&D for value-creating purposes. SG&A also increased SEK0.9 billion to SEK7.9 billion. A portion of that has also to do with FX, of course. But other than that, it's related to legal and compliance costs and expenses that we have. So EBIT then, excluding restructuring charges, was SEK7.4 billion in the quarter. That's a year-over-year improvement of SEK1.5 billion and that corresponds then to an EBIT margin of 11.8%. That in itself is a year-over-year improvement of 1.2 percentage points. And then further down the P&L, net income, I should mention also SEK4.7 billion in the quarter versus SEK3.9 million, as a result, of course, of the improved EBIT. And I would say despite a more negative finance net driven by FX hedge results. And then free cash flow, we drilled a bit more into it in a minute but it came out, as you see here, SEK4.4 billion versus SEK4.1 billion a year ago despite then a significant buildup of inventory to secure deliveries to customers, as Börje outlined earlier. EBITDA is the key metric now for profitability going forward, given the long-term target we have of to 15% to 18% and excluding restructuring that on a rolling 4-quarter basis, came out at 14.1%. But let's have a look at gross margin and drill into that a bit more here. And you can see, again, the more longer-term perspective on gross margin. We think this is more valuable and meaningful. And you can see now on a rolling 4-quarter basis, gross margin, excluding restructuring, as said, at 43%. And basically, the improvement you see here since beginning of 2020, this is the rolling line is the blue line here. is really driven by the investments in innovation in R&D that we have done since we started in 2017. And that, of course, has enabled better product offering, better features, et cetera. This is what we continue to do as well now in the inflationary environment. So we see how this has had a positive effect on the gross margin over time, despite increasing at the same time the market share which sometimes can have a slightly dilutive effect on margin. So big reason here for the year-over-year comparison on gross margin is the IPR revenue, of course, where we had a catch-up effect in Q2 last year from the IPR side. And this is really explaining the biggest part of the change in gross margin. Secondly, we did see increased cost for component and logistics. That's also clear. And this proactive investments that we make in supply chain resilience in Networks, Clearly, the right thing to do because we are able to deliver to customers which you see in the top line development. And most of that impact, we are able to offset by other factors. We had a large software contract we talked about in Q1. But of course, also and this is important, the underlying improvements in our business as well which is a continuous aspects we work on. So all in all, you could say we were able to absorb a lot of the cost pressure, with higher sales on the one hand, if you look at the absolute margin number. And of course, our whole strategy is to continue to improve margins every day, every month, every quarter and into the long term via product substitution and other means. Okay. Digital Services then, gross margin came out at 39.9%, affected by initial deployment costs for some of the cloud-native 5G Core contracts that we have. We have talked about that before as well. And also here a lower share of IPR. We are encouraged, though, by in digital services by the win rate of 5G Core contracts. Managed Services then, gross margin increased by 4 percentage points to 23%. Mainly driven by 2 things, one is the network optimization business which grew; and the other one is the variable -- so-called variable sales in Managed Services, both of which contributed to the good gross margin improvement here. And on Managed Services, because this is now the last time Managed Services will be reported in this structure, at least it's a good thing to note that rolling for quarter EBIT margin was 9.5%. So that is within the range that we set up for 2022, 9% to 11%, basically 2 quarters ahead of plan. And as we mentioned earlier then, next quarter, we will report according to the new structure with Digital Services, Managed Services combined in segment Cloud Software and Services. And that we will follow up in a transparent way going forward as well. Lastly then, Emerging Business and Other. Gross margin was 35.8%. Certain year-over-year decline and that relates to Cradlepoint but mainly accounting-wise, because last quarter 2 in 2021, we had positive one-off effect which had to do with the final PPA, purchase price allocation, from that acquisition. So in essence, in the actual business, Cradlepoint performs really well with the growth, that Börje mentioned, over 40% and a gross margin which is well above group average. I will now move over to cash flow real quick before I hand back to Börje. So free cash flow before M&A, SEK4.4 billion versus SEK4.1 billion a year ago, mainly driven by the EBIT improvements, of course. But if we look at the working capital development -- and I can tell you and repeat that we focus a lot on cash flow in Ericsson. And the fact that we were able to deliver the SEK4.4 billion here, in spite of what we're talking about the proactive investment in supply chain, reflects, I think, very well on the team's effort here to generate cash flow. And you can see that in the operating net assets here. It's a certain increase due to inventory. But to a large extent, offset by very strong customer collections as well. So as we say in the report, based on the current visibility, we expect the inventory levels to gradually reduce during the rest of the year towards the end. So all in all, this leads to a solid cash position ahead of the Vonage acquisition. Gross cash now at a bit more than SEK100 billion and net cash at SEK70 billion. And final comment here is that when we look at free cash flow before M&A, on a rolling 4-quarter basis which I think is important, then we are hitting our long-term target. Because it comes out at a bit more than SEK29 billion which is 12% of net sales. And as you know, our long-term target when it comes to cash generation is 9% to 12%. We are at 12% now. With that, I hand back to our CEO, Mr. Börje Ekholm. Börje Ekholm: Thanks, Carl. Now to sum up, then we had another quarter with solid business performance. We're able to largely offset, like Carl described and I said in the beginning, the challenging supply situation we're facing as well as cost increases through our investments in the geo resilient supply chain and underlying margins improvements that actually come from product substitution as well as gradual improvements of our operations. And we continue to believe, as we have shown in the past, that innovation is going to be the most important way and the best way to offset inflationary pressures. But of course, we're also going to look at adjusting contract terms as they expire. We're well positioned to capture the opportunity of digitalization of the consumer enterprises and society based on wireless connectivity as well as 5G. 5G is, by far, the fastest scaling mobile technology ever. However, global penetration is still in an early phase. Mid-band penetration remains low across the world. We foresee that global 5G build-out will be larger and actually continue for longer than previous mobile generations, with evolving new use cases for consumers, enterprises as well as governments and society at large. We remain determined to reach our long-term target of an EBITDA margin of 15% to 18% no later than 2 to 3 years, while we also established Ericsson on a higher growth trajectory. I'm very proud to work with colleagues whose dedication and commitment actually have ensured that we can keep on delivering products to our customers in spite of the global supply challenges. So a big thank you to all of my colleagues. Well, before starting with the Q&A, I would like to mention that we are planning for a Capital Markets Day on December 15, we'll come back with more details where and venue, et cetera and lay out but we will focus, of course, on describing our strategy as well as the opportunities for growth that we see going forward. But now over to you, Peter, for questions. Peter Nyquist: Thanks, Börje. So I would like to call out Mark and inform the audience that we will start now the Q&A and how to proceed. Operator: Peter Nyquist: Thank you, Mark. And we'll start with Francois Bouvignies from UBS. Hello, Francois. Francois Bouvignies: So I have 2 quick questions. if I may. So the first one is on inflation. I mean obviously, it's one of the main highlights for this quarter. And I just wanted to know if it's possible to quantify the impact you saw this quarter. And in the release, Börje, in your presentation, you said that you -- as contracts expire, you're going to try to adjust pricing. So my understanding is that the prices are mostly fixed until the end of the year. So should we expect this drag of inflation to carry on until the end of the year? Or is there anything you can do before that? So that's my first question. And I have a quick follow-up. Peter Nyquist: You can start, Börje . Carl Mellander: Okay. Börje Ekholm: I can take the latter part of that question. Well, the key for us to fight inflation and you see -- you know the inflationary pressures, they've been very large on components as well as the whole supply chain, transportation, wages, et cetera, during the both first and second quarter. The key way for us to short-term combat inflationary pressures is actually by introducing or coming with product substitution. We spoke about that in the first quarter. That continues to be the key driver, because that allows us to both start to discuss the price of new features but also to actually lower the cost of the product. And we remain very committed to that model that's been with us since 2017 and we continue to see the benefits of that. Then contracts, they're typically could be 1 to 3, 4 years in this industry. And so they are regularly renewed. And as they are renewed, we can adjust terms but it's -- and I would say in between, we, of course, on service components, on certain components, we have ability to adjust. But I think our key way to adjust prices will be through product substitution and will continue to be that. Carl Mellander: Maybe I can add when it comes to prediction of this, of course, that's going to be hard for this type of macro factors. But I think more important for us is to plan for this and to continue with the mitigation that we're doing. And I really want to emphasize again what we said initially that this is something -- not something new, we have been working at least since 2017 with exactly this strategy. We invest to innovate, to launch new products, please the customers, of course and then price accordingly over time. So that's really our big focus here. And better to plan for a continuation of this situation, that's what we are doing in the supply chain than to assume that it will be improving very soon. But on the inventory side as such, we do say, as you see in the report that we believe that inventory will come down towards the end of the year. So that has, of course, also to do with our supply and delivery planning to customers as well. Börje Ekholm: And I would say, we should also remember the gross margin impact from IPR, that's -- we're going to make sure we get the right deal rather than optimize an individual quarter's performance. So that is a key reason why you see the gross margin drop year-over-year. Peter Nyquist: You had a follow-up as well, Francois? Francois Bouvignies: Yes, as a quick follow-up, Peter. So you mentioned, Börje, as well in the presentation, this impressive market share on the 5G traffic outside China, on the RAN side and 80% of the top 20 operators are using your 5G Core which obviously shows you that time to market and add more advanced products when the 5G ramp. But as we see a bit forward, do you -- and based on your deals win rate today, do you see this market share sustainable as the 5G market is growing? Or should we expect a normalization of this market share? Or do you still see the same similar market share as we move into next 1 year or so based on your other behavior? Börje Ekholm: If you look on the 5G Core there, the key part that will help us improve performance is when traffic starts to pick up on the 5G networks. So that's still -- it's mostly, I would say, system integration revenues today. And there, as I believe Carl said, we have some extra costs on the initial deployment. So that is a bit living in that type of environment. So there, it depends on how traffic picks up, et cetera. On the RAN side, yes, we have strengthened our market share from 33% to 39% over the past 5 years, where we believe we have a strong competitive position. So we -- our ambition is to continue to actually gain some footprint going forward because we believe long term scale in this industry is critical. That's the way to make sure we can remain a technology leader as well. So our ambition is to hold and gradually strengthen our market share as well. Carl Mellander: I can add one more to that, Börje, on market share. Of course, we talk a lot about the RAN market. and that's about USD 41.5 billion, USD 43 billion, maybe, market. But we are not only addressing that, obviously. And what we say about the 5G Core win rate is separate from that. And also now to create new growth in the company, we are focusing on the enterprise side. And for example, the Cradlepoint business comes on top of the RAN market and other things that we will do within the enterprise space, such as the global network platform also partly is added to that market, as such, So when we talk growth, it's not only the RAN market, that's my point there. Peter Nyquist: Thanks, Carl. And thanks, Francois, for those questions. We'll move to the next question from Alex Duval, Goldman Sachs. Alex Duval: You talked about a solid 5G backdrop this year and you've actually adopted a raised growth forecast for North America. I wondered if you could talk a little bit about how you're feeling about sustainability of RAN demand into next year. Obviously, you have a discussion about challenging macro backdrop and the consumers' disposable income, so how should we think about that? And then secondly, on Digital Services, it seems like you had solid organic growth but then it also looks like there were some deployment costs involved in initial stages of 5G Core projects. So do you think those kind of costs are going to persist? Will more profitable software revenues be coming through? Overall, it would just be great to get a perspective on how you can get more margin leverage out of that business. Börje Ekholm: Yes, I can start with the first one. So if we look at the 5G market, we see, given that largely 4G has been focused on the consumer. And what we see with 5G is, structurally, we're adding both new segments, so think about the enterprises. But we're also going to add a lot of new segments like cloud gaming, XR, et cetera. All of that will drive further traffic growth in the Networks. That will mean, over time -- of course, there is an efficiency. It's not a one-to-one relationship. So let's not kid ourselves on that. But the growing traffic will need to be carried with an increasing portion of active components in the network and that's where we are. So we see, from a longer-term perspective, that 5G will be both having a higher peak than any of the preceding wireless generations but it will also last longer because it addresses so much more. Then there is, in your question, there's also a short-term element, what's going to happen rest of this year and into next year. That's in a way harder to predict because it will depend on specific investment environment that each country has, et cetera. So I think, yes, if we get into, of course, bigger recession, we know from history that telecom is much more insulated than other sectors in the industry. But predicting the exact demand on a quarter-by-quarter basis is hard. But what I would say, though, is when we look at penetration of mid-band, for example, it's less -- if we look at Europe and the U.S., it's less than 25% of sites. In Europe, it's typically less than even 15%. So it's a low penetration of 5G of, what I would say, the 5G that actually gives the user experience that matters. So penetration remains very low. And we see that the operators are now starting to build out a deeper coverage and deeper part of their 4G sites converting them into 5G. This will -- and I know, if you look on a typical deployment, a large part of the CapEx for a wireless operator is in establishing new sites. So it's a lot of concrete, steel and fiber, et cetera. We believe, over time, there is an opportunity for the wireless operators to actually lower CapEx, while the active part of the network will increase in importance. So there is a mix shift going on here where we see that our -- the market we address actually can continue to grow even though CapEx in the industry probably will start to taper off in the next few years. So we remain very, in that sense, confident that we're going to see a long-term growing market for 5G. But then, of course, short-term fluctuations but that should shrink through good demand. Carl Mellander: Should I take the second one there? Alex, you asked about DGS or Digital Services there. And I would maybe start on the big picture there. The customers now are moving into -- obviously, into 5G and it's about cloud technologies and what we call intelligent automation. And 5G Core, of course, plays such a critical part in that as well to enable, if you will, the full potential of 5G networks. That's exactly where we play. And that's where you see the 5G core contracts coming in and we have gained so many of them, even 80%, as we said. So that's really the big picture. And then, now we are in implementation of those initial contracts. It takes a bit of initial cost. But of course, as soon as we -- as those networks go live and we start to -- customers start to migrate subscribers over there, we will see revenue take off. And actually, we saw strong growth of the 5G Core contracts in this quarter already. But still, there's much more to come, obviously, on that side. And that is one of the key pillars in the entire turnaround here of Digital Services going forward. Peter Nyquist: Thanks, Carl and thanks, Alex. We will move to the next question which comes from Peter Kurt Nielsen at ABG. Peter Kurt Nielsen: Just a question, Carl, if I can stay with Digital Services. You spoke extensively at Q1 about the need to -- for improving sales execution. And as has just been highlighted, you are seeing organic growth in Q2. Is that simply, Carl, a function of the better market and the 5G Core market picking up, as you said? Or have you seen early signs of your own execution improving here? And are you sort of confident that you can improve that going forward? And to what degree do you expect the new structure and the merger with Managed Services will help you on that? Any color here would be appreciated. And perhaps if you could talk a bit about how you see -- how we should view seasonality for the second half of the year. Carl Mellander: And maybe on the first point, I mean as we get further and further into this initial contracts, we also -- we learn and we improve and we get to the milestones in the projects and that's then reflected in the growth we see in those contracts. And that will, of course, continue. 16 out of the 20, as you know, of the largest operators have chosen Ericsson for 5G Core and we are in the midst of implementing those contracts now. Of course, that is going to drive revenue and profitability for the period -- for the coming periods. That's quite clear. Then when it comes to the new structure, maybe would you like to take this one? Because of course, there we see a clear benefit in merging the Managed Services and the Digital Services part. Börje Ekholm: Yes. And the key here is there are increasing convergence between Managed Services and Digital Services in sense of automation, orchestration of the network. And we believe we can get both -- or call it some -- there are going to be some cost synergies, clearly and some synergies from consolidating our offerings and focusing really just having one solution, so to say. But we think also that's going to lead to better sales execution. It's easier to go to customers with a clear solution argument when we can offer an orchestration solution and automation solution combined with how we manage that. So we believe we are going to see both cost benefits, efficiency benefits, maybe better to call it, as well as sales execution benefits. Peter Nyquist: We'll move to . Unidentified Analyst: I want -- the Enterprise segment, it's, of course, something you are focusing a lot on and putting a lot of kind of enthusiasm into that segment. And I never -- despite where you look, I think it's going to be a large market in just a few years' time. In your numbers, we mainly see it in the Cradlepoint and those numbers look very good. But you are now shifting to reporting segment called down Enterprise. Can you just tell us something about if you see any pickup outside of Cradlepoint, on Enterprise business or any leads kind of? When will that segment really start to take up? When will we see kind of fully dedicated private networks kind of grow as a separate line item or drive absolute numbers? That's my first question. Börje Ekholm: Yes, I can take that. It's a great question. So far, we see most of the growth, as you highlight, in Cradlepoint. We are starting to see growth in Dedicated Networks. It's from a low starting point. What we see is encouraging feedback from customers, where we're seeing a competitive solution. We still have more to do in order to really grow, call it, the presence in Dedicated Networks. It includes, for example, strengthening our go-to-market and that's why this formation of an enterprise wireless solutions business area is so important. Because what we do is we are going to leverage the go-to-market from Cradlepoint to help drive the growth of dedicated networks. And we believe that, that should start to contribute maybe not during the fall as much as we would really like to see but into next year, we should start to see that we actually can leverage that go to market. Because I think that's the most important part of enterprises, is that we need to build a not necessarily direct but rather an indirect multichannel go-to-market structure and that's why we're focusing our attention on right now, while we maintain the growth rate of Cradlepoint and drive product development in Dedicated Networks. So bear with us a bit before you see the real growth take off here. Peter Nyquist: Thanks, Börje and thanks for that question. Unidentified Analyst: Can I have another question or... Peter Nyquist: Sure, please. I think was cut off here. But then we'll move to... Börje Ekholm: We'll come back to... Peter Nyquist: Come back -- you can move up and see if we can take after. The next question from Stefan Slowinski and then we'll come back to . So Stefan, please, at BNP Paribas. Stefan Slowinski: Two quick ones. Just on the supply chain side. It sounds like you have managed that well in terms of getting the actual supply even if you're seeing the inflation. But can you just confirm that you didn't have any negative impact on revenues in terms of being able to secure the supply that you needed? And then the second follow-up question is just on the higher costs that you're seeing. I understand you want to push through some of those component inflation costs over time. It sounds like you also have some more costs associated with maybe moving away from just-in-time delivery, so more costs around warehousing and so on. How much of those are going to be permanent and is it material? Does it have an impact on your longer-term margin potential as you maybe change the model a little bit? Börje Ekholm: Will you take that? Carl Mellander: Yes. No, we haven't seen any material or any revenue impact, actually. I think this is one of the strong points here. We're quite proud actually over how our supply teams have and the organization has handled the delivery situation in spite of these challenges. So I think customers have -- we have delivered to customers on time and on the quantities required; so that's good. When it comes to the longer-term perspective, I think we plan for what we can see right now and that is a supply chain which is more resilient, not as just in time, as you said which were -- was more the case, say, pre-pandemic and pre this whole situation that we are in. If that would ease over time, fine but it's nothing we plan for. I think it's better to be agile here and make sure that we put absolute priority on delivering to customers and the rest will follow. Börje Ekholm: And I would say that the higher -- I think this you're going to see in many industries, you will have higher cost of supply chain. Because we come from a supply chain that was optimized based on cost and now it's going to have higher cost due to -- you basically have to reset global supply chains due to the geopolitical uncertainty. What we feel, though, is that we will be able to offset that with product substitution over time, i.e., continue to focus and drive and increase the cadence of introducing new solutions, leveraging the scale we have in Ericsson Silicon to drive new cost-efficient solutions that will help us basically to sustain and handle these higher costs. So as I see it, it's always going to be a bit fluctuations quarter-by-quarter. But over time, the trajectory we've been on, we will continue to execute on. Peter Nyquist: Thanks. And thanks, Stefan. Next question is from Daniel Djurberg at Handelsbanken. Daniel Djurberg: And my first question would be a little bit on the cost side. And in fact, we have the enterprise opportunity and the fixed value success versus one network, et cetera, that might prolong the 5G cycle but all these are still quick with some uncertainty on the large volumes that will be. And given the inflationary times we see, my question is, if you will need to address your underlying OpEx base, i.e. and very pleased to secure your long-term margins before we see these segments really taking off? And also a question on the R&D hike you see on silicon, for example and Cloud RAN, should we think of some of these investments being more of a temporary nature? Or will it more be a new base? Börje Ekholm: I mean I do believe that we see actually -- first of all, on the 5G market, I suspect many of the outside analyst firms are going to raise the size of the market. The -- I think we've seen a journey here where many of the outside analysts and industry analysts have been a bit behind the takeoff in 5G. I think that is likely to continue. And I think we actually underestimate the new type of applications we're going to see. They may not come 2022 or 2023 but they're going to come 2024 or 2025, that will require a densification of the 5G network to launch these new type of use cases. So I'm actually believing, yes, there can be always a bit fluctuations but we see that 5G will be such a central piece of society going forward to drive digitalization that it will have to be built out longer and more dense than we've seen in the past. And that's why we're very -- we're believing in that future. We're also going to invest correspondingly. That means that as we look today, we're going to continue to invest in technology for technology leadership and we're going to make sure that we are a technology leader. If we are -- can retain that position, we have a value proposition to our customers. So in reality, that's going to be front and center. Of course, if the world would come into a situation where the outlook changes, i.e., that we have to adjust, we would, of course, adjust. But what we believe is, for example, take Cloud RAN, we think that's going to be deployed going forward also in Enterprise segment. So we invest today fairly significant amount of money. And of course, we believe that the market here is going to come. It may take 2 years before it comes. But we think therefore by investing now, we'll be very well positioned when that market takes off. So we are continuing to invest for the long run. At the same time, you've seen us in the past, we've been committed to achieving our targets overall. We remain committed to achieving the target. So we will adjust and run the company in that way. But rest assured that technology leadership that will feature as a prominent part. So maybe investments in Cloud RAN will taper off but then we're going to see investments in some other areas that's going to drive revenue growth. But the reason why we talk about Cloud RAN and, to some extent, Ericsson Silicon, as well is that it has cost today but we're not going to see revenues until 1 to 2 to possibly 3 years out. But that's what we invest for and that's what we are going to continue to invest for. Peter Nyquist: Thanks, Daniel. We'll move to the next question. Börje Ekholm: Maybe we should add there. You made the point before, Carl, it's important to remember the growth potential in Enterprises. And sometimes we focus only on the infrastructure market. That's going to be the core of our company. It's the bulk of our company. We're going to make sure that we perform there. That's for sure. But we also see the applicability of our technology in Enterprises. And that's a segment that is going to be very large, can possibly be even larger than the infrastructure business in a few years' time. So the investments we make now should be financed, of course, by our infrastructure business and that's what you see we try to do. But the applicability will allow us also to capture the enterprise segment going forward. Peter Nyquist: Thanks, Börje and thanks, Daniel. The next question is from Andrew Gardiner from Citi. Andrew Gardiner: Just another couple on sort of the inflation side, component cost inflation side. Firstly, in terms of what you're saying about the sort of investing in product and, therefore, getting a better price and gross margin, even with cost inflation, clearly, that's the strategy that has worked well for you guys over the last 5 years. I guess the point of what you're saying, it's almost like you think maybe if you can increase the cadence of product introductions to make it faster than you can -- that can help to offset some of this cost increase. So my first question is, do you think the operators are willing to accept that in terms of introduction of services -- sorry, solutions faster than we have done in the past? Are they willing to pay for that? Or perhaps because more and more is being driven by software, it's actually -- it is something that's quite feasible? And then secondly, perhaps one for you, Carl, on the cash flow comment, where you're saying you work the inventory down later in the year. I suppose normally, we would expect that on sort of a 4Q budget flush in sort of deployment schedule. We've often seen that. But my question is why in a market where you're expecting further component cost inflation, if the components are available today and if they're standardized and therefore usable next year, why not buy as much as you can today at the current prices rather than wait until next year when prices are likely to rise yet again? Why not use that cash flow strength that you've got to build the inventory rather than run it down later this year? Carl Mellander: Should I take the second part to start with. No, this is -- I mean this is how we think. We try to optimize for the deliveries we have, of course. And what you see in the inventory is partly what -- how you describe it, that we are investing today. And it's -- I think the most important priority here is to secure deliveries, secure the components we need to actually ship product to customers and that is the recipe. And it means an elevated inventory level now. And we are securing as much as we can and as much as we need. We are entering into longer-term contracts with suppliers also to make sure that we get the allocation that we need from them in a scarce environment. So I think we are on to more or less what you're talking about here and that's why you see the inventory go up. Then when we look at how deliveries will go out to customers during the second half of the year, versus the inflow of components and how that will play out in inventory, we see that it's a net-net positive when it comes to the inventory level as such. But again, I mean, we're not optimizing on that really. We're optimizing on customer delivery. We think that's the real price here and that's what's going to create the growth and the resilience of our company as well. Börje Ekholm: And I think on the -- what you've seen in this industry and this is nothing new, it has a deflationary element in the price for equipment. And that's because traffic growth is exponential, right? So otherwise, there will be no money left for the operator. So that's what we have seen historically. We will continue to see that. But what's important with our product substitution is that we can actually substitute a high-cost product with lower-cost products for us to manufacture and supply. That's really where you see the product substitution. But the good thing is when you can introduce new features, then you have a new chance to discuss pricing as well. And if you introduce prices that lowers the cost for our customers, it can be energy, for example, or automation or new type of solutions of running the network, then we have a discussion about the value of the product. And that's why the whole increase in the cadence of the product can kind of help us on both the, call it, a discussion with the customer to be forward-looking and focus on the value of the features and help us lower the cost of the solution. Peter Nyquist: Thanks, Börje. Carl Mellander: Andrew, you mentioned also software, maybe we should add that also. That, of course, the software share of the business is increasing. And that's, of course, as Börje said, to create more value for the customer. But different margin profile. And obviously, software is not impacted by those inflationary pressures. So that's another factor here to consider, a positive one. Positive factor, sorry. Börje Ekholm: We should say this is not new, we've been doing this since 2017. So the whole, call it, improvement of gross margin really comes from this strategy. Now we have cost inflation, that's why we feel we need to increase the cadence of new products to be able to execute and continue to execute on that strategy. Peter Nyquist: Thanks, Börje. Thanks andrew. And as the last question, we'll just move back to at SEB to give an opportunity to ask the question that he was aiming for. So expectations are high. Unidentified Analyst: Sorry. Now this is -- I think it's important to talk a bit about because the IPR revenues, everybody knows about them, everybody they are -- but they are accruing in the background. And you have a very kind of a take in multi-pronged process to arrive at an end point there. And I don't think it's very easy to follow for most participants exactly what you're doing there, because it's multiple jurisdictions and it's kind of two-pronged going for legal road forward and then also kind of negotiation road forward. But those -- I mean, the gross margin is there somewhere even though we don't see it at the moment, I think it's important. But if you can describe quickly your confidence in that process. Börje Ekholm: Yes. I -- first of all, it starts with the value of the 5G patent portfolio. And if we look at third-party analysts,that have looked and tried to assess -- and this is a hard thing to do. So -- but there we come out with a very strong 5G portfolio. So that's really the basics. And we're talking about the standard essential patents here. So we come out with a very strong position there. We have also some strong implementation patents. So we feel that we have a very strong portfolio that we've invested in. And that's why we spent SEK40 billion, SEK45 billion per year on R&D. That is one area where it shows up, is actually the patent portfolio. So we have a strong position. So now it's all about how do we create the right value here of that portfolio, how do we capture that value. That includes negotiations. It includes, as you note, some litigation as well. But we are -- we believe that we're well positioned to actually achieve some attractive outcomes in our contract renewals based on the portfolio as well as the way we execute on that. But we're going to work hard. We're not going to go into a deal fast to trade off the right value of our portfolio. So we'll work on that. We know we'll lose some gross margin in the meantime -- or lose, we delay it. It's going to come back when we close the deals. We're very certain, we will, like we have done in the past. And we continue to sign up other 5G licenses. So, I'm -- I have a great belief in our team's ability to execute on the strategy we're embarking on. I would say we have a great IPR team and they're working on this. I'm confident we will get there. I'm not going to predict the timing but I'm comfortable we'll be there. Peter Nyquist: Thanks, Börje. Thanks, . That was the last question. But before closing the call, a last remark from your side, Börje. Börje Ekholm: Thanks, Peter and thank you, everyone, for participating and thank you for all the questions. It's another quarter where we have shown that we execute on our strategy to be a leader in the mobile infrastructure business and also start to build a focused presence in the enterprise market. And we saw that we could, despite a very difficult environment with supply change challenges as well as geopolitical issues, we could actually keep on growing the company. We could do that by delivering to customers, so we had growth of 5%. And we have also seen that the strategy of product substitution can help us fend off the cost increases. Today, we're at an EBITDA margin of 14% on rolling 12 months or 4 quarters and that's getting fairly close now to the long-term target of 15% to 18%. But we're committed to reaching the 15% to 18% within the next 2 to 3 years and, at the same time, putting Ericsson on a higher growth trajectory. So we're very excited about the future. Our technology has broad applicability, both for the mobile operator but also for enterprises as they move on to digitalize their business. So with that, thank you very much for listening in and I wish you a good summer. Peter Nyquist: Thank you. Carl Mellander: Thank you.

Ericsson's Strong Earnings and Strategic Moves Bolster Market Position

- Ericsson (NASDAQ:ERIC) reported earnings per share of $0.35, surpassing estimates and highlighting the effectiveness of its strategic operational improvements and cost-saving measures.

- Despite a slight miss in revenue, Ericsson's focus on operational excellence has led to sustainable gross margins and strong commercial momentum through significant customer agreements in key markets.

- The company's financial metrics, including a favorable price-to-earnings (P/E) ratio of approximately 14.92 and a solid earnings yield of about 6.70%, reflect its robust performance and attractive market valuation.

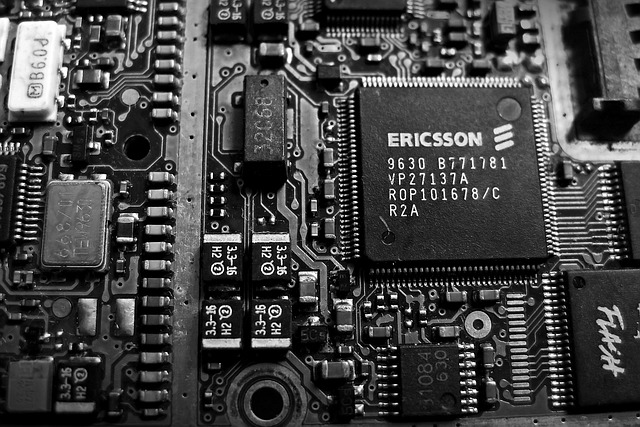

Ericsson, trading as NASDAQ:ERIC, is a leading Swedish telecom equipment manufacturer. The company is known for its innovative solutions in the telecommunications industry, providing services and products that enhance connectivity worldwide. Ericsson competes with other major players like Nokia and Huawei in the global market.

On October 14, 2025, Ericsson reported earnings per share of $0.35, exceeding the estimated $0.14. This strong performance is attributed to strategic operational improvements and cost-saving measures. Despite revenue slightly missing estimates at $5.91 billion, the company's focus on operational excellence has driven its gross margins to sustainable levels.

Ericsson's strategic efforts have resulted in strong commercial momentum, with significant customer agreements in key markets such as India, Japan, and the UK. These agreements have bolstered the company's financial flexibility, allowing it to enhance profitability and consider increased shareholder returns. The $1 billion sale of its Iconectiv connectivity services business further strengthened its financial position.

The company's financial metrics reflect its robust performance. With a price-to-earnings (P/E) ratio of approximately 14.92 and a price-to-sales ratio of about 1.05, Ericsson's market valuation is favorable. Its enterprise value to sales ratio of around 1.07 and enterprise value to operating cash flow ratio of approximately 6.48 indicate a strong valuation relative to revenue and cash flow.

Ericsson maintains a moderate debt-to-equity ratio of approximately 0.42, suggesting a balanced approach to leveraging debt. The current ratio of about 1.09 indicates a slightly higher level of current assets compared to liabilities, showcasing the company's ability to meet short-term obligations. With an earnings yield of about 6.70%, Ericsson offers a solid return on investment for shareholders.

Ericsson's Strong Q2 2025 Performance: A Deep Dive into Financials and Strategic Focus

- Ericsson reported earnings per share of $0.14, surpassing estimates and indicating strong profitability.

- The company achieved a 48% adjusted gross margin and a three-year high in its adjusted EBITA margin, showcasing operational efficiency.

- Ericsson is increasing investments in artificial intelligence, aiming to drive future growth and innovation in 5G technology and beyond.

Ericsson, listed as ERIC on NASDAQ, is a leading Swedish telecom equipment maker renowned for its innovative solutions in the telecommunications industry, particularly in 5G technology. Competing with giants like Nokia and Huawei, Ericsson has recently showcased its strong strategic and operational execution through its second-quarter results for 2025.

On July 15, 2025, Ericsson reported earnings per share of $0.14, surpassing the estimated $0.12, indicating a positive performance in terms of profitability. The company generated a revenue of approximately $5.84 billion, which was below the estimated $6.21 billion. Despite this, Ericsson achieved a 48% adjusted gross margin and reached a three-year high in its adjusted EBITA margin, highlighting its operational efficiency.

Börje Ekholm, President and CEO of Ericsson, emphasized the company's solid execution of strategic and operational priorities. The company has structurally lowered its cost base and is focused on delivering further efficiencies. Growth in the Americas is encouraging, while Europe has stabilized. Globally, fixed wireless access customers have surpassed 160 million, driving significant network traffic.

Ericsson's financial metrics reflect its market position. The company has a price-to-earnings (P/E) ratio of approximately 156.38, indicating a high valuation relative to its earnings. Its price-to-sales ratio stands at about 1.04, suggesting that investors are paying $1.04 for every dollar of sales. The enterprise value to sales ratio is around 1.03, reflecting the company's valuation in relation to its revenue.

Looking forward, Ericsson is increasing its investments in artificial intelligence, including its involvement in the Sweden AI factory consortium. AI is seen as crucial for accelerating innovation, especially in supporting AI use cases at the edge, which require ultra-low latency and enhanced uplink performance. This strategic focus on AI is expected to drive future growth and innovation for Ericsson.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson Shares Rise on Better-Than-Expected Q2 Earnings Amid Cost-Cutting

Ericsson AB (NASDAQ:ERIC) saw its shares rise more than 2% pre-market today after surpassing Q2 earnings expectations, benefiting from cost-cutting measures despite a challenging market. Adjusted earnings before interest and taxes climbed 14% year-over-year to 3.23 billion kronor ($307 million), surpassing the 2.7 billion kronor forecasted by Wall Street analysts.

CFO Lars Sandstrom emphasized the ongoing need for cost reduction, noting that a significant portion of expenses is related to personnel. Ericsson's net sales for the quarter fell by 7% to 59.8 billion kronor, exceeding analyst expectations of 58.5 billion kronor. The adjusted earnings did not include a previously announced impairment concerning its Vonage business.

The company reported an 11.4 billion kronor non-cash impairment due to the declining performance of the Vonage unit, leading to a net loss of 11 billion kronor for the period. This is the second writedown for the asset since Ericsson agreed to purchase it in 2021.