Telefonaktiebolaget LM Ericsson (publ) (ERIC) on Q1 2023 Results - Earnings Call Transcript

Peter Nyquist: Hello, everyone, and welcome to today's presentation of the first quarter in 2023. With me today here in the studio, I have Carl Mellander, our Chief Financial Officer; and with me on a link from North America, I have Börje Ekholm, our President and CEO. So as usual, we will start this session with a presentation, and then we will end the hour with a Q&A session. And in order to ask questions, you have to join this conference by phone. Details on that can be found in today's press release as well as on our website, ericsson.com/investors. Please also be advised that today's conference call is recorded. Before handing over to Börje and Carl, I would like to say the following. During today's presentation, we will be making forward-looking statements. These statements are based on our current expectations and certain planning assumptions, which are subject to risks and uncertainties that actual results may differ materially due to factors mentioned in today's press release and discussed in this conference call. We encourage you all to read about these risks and uncertainties in the earnings report published today as well as in our annual report. With that, I would like to hand over to you, Börje. So please, Börje. Börje Ekholm: Okay. Thank you, Peter, and good morning, everyone. And a big thank you for joining us today. So we're excited to present the quarter in which we're executing on our strategy and we're making progress on our strategic goals, while at the same time delivering on what we set out as expectations for this first quarter. But before I go into the quarterly results, let me take this opportunity to just comment a bit on the news that we sent out last night. After having been almost 7 years on Ericsson's executive team and 25 years with Ericsson, Carl will actually be leaving our company. And it's no exaggeration to say that Carl has been critical in the turnaround of Ericsson and in laying the foundation for the next chapter of our strategy. And he's also been a great colleague and, of course, a great friend. Now we have come to a mutual agreement that it's a good time or as good as any for a change at Ericsson as we continue, I'll call it a next chapter in our strategic journey. But I'm, of course, very happy that he will stay on in his role until the end of Q1 next year. And of course, that will ensure that we can execute on our cost savings but also a smooth transition. So really a big thank you to Carl for all his achievements and contributions here at Ericsson. You will be truly missed not only by me but all my colleagues at Ericsson. So a big thank you. And anything, Carl, at this point, you would like to comment on? Carl Mellander: Thanks a lot, Börje, and thanks, very kind words also. As you said, I mean, there's not really a good time to leave a fantastic company like Ericsson or a position like the one I've had the privilege or having now for almost 7 years. But we find it's the right time now, and let's see what the future brings. It's been an incredible journey and a fantastic privilege to work with all the great people in Ericsson and of course outside our company with partners, customers and the investors and analysts as well on this call. So thanks all. But luckily, I will be here for almost another year. So we shall see each other again. Thank you, Börje. Börje Ekholm: Thank you, Carl. So back to Q1. So the quarter developed in line with what we communicated during our Q4 report. As we expected, Q1 has been a challenging quarter due to slower deployment pace in some early 5G markets. But this has, of course, been compounded with the fact that customers in those markets are lowering their inventories. And so that's the reason the impact on our sales is bigger than the slowdown in the underlying deployment phase. We will continue to see inventory adjustments during Q2, but we expect less impact after that, but there could be some smaller effect during Q3. As the inventory adjustments will be completed, we also expect a recovery during the second half, but second half will also be supported by our cost savings initiatives, clearly. So this development impacts growth in Networks negatively as we saw the early 5G market slowdown, we now see a buildup of the next wave of markets. And here, margins are a bit lower due to large service content. We could see that growth in other segments offset the slower -- or the lower sales in networks, but all in all in line with our expectations and what we communicated during the Q4 report. But let me start now by giving some highlights from the quarter. So we're making progress on our strategy to strengthen our leadership in Mobile Networks, grow our Enterprise business and drive a continued cultural transformation. As you saw and as you all know, in the quarter we reached a resolution with the DOJ regarding contractual noncriminal breaches of our 2019 deferred prosecution agreement. This was, of course, a critical step for us, allowing us to move forward, and we can now continue to make great progress on our compliance program. Overall, financial performance was in line with what we expected and what we've communicated. So while overall sales were flat, we saw an organic growth of 5% in Cloud Software and Services and 19% in Enterprise. And notably now, the Enterprise segment now represents almost 10% of sales. So we completed also the divestiture of our IoT platform business. This will reduce quarterly losses by about SEK 250 million going forward. As expected, in Networks, we saw strong growth in India, where we continue to roll out 5G at pace. This growth, however, did not fully offset the slower deployment pace, compounded by the inventory adjustments in the early 5G markets. We see that some customers are reducing the rollout pace somewhat, but the big effect really comes from the ongoing inventory adjustments, and that comes because they build up large inventories when supply chain was tight and those inventory levels are now normalizing. We expect these adjustments to be completed during Q2, but some could slip into Q3 clearly. In Cloud Software and Services, we continue to execute on our revised strategy and reduced our losses a bit ahead of our plan. So while results would vary between quarters, we are on track to reach our target of breakeven in 2023. We're also making good progress on our cost efficiency initiatives, and we have identified additional savings opportunities of about SEK 2 billion. And now we plan to reduce cost run rate by SEK 11 billion by year-end. The best indicator of cost savings is that we get external and internal headcount down. During the first quarter, overall workforce fell by about 800. But if we adjust for adjustment -- for investments in Enterprise as well as India, the reduction was about 1,700 internal and external headcount. But of course, this is something that we continue to work on and we expect to accelerate during the coming quarters. In a situation with a choppy outlook, we need of course to focus on what we can impact and cost efficiency is crucial to manage the uncertainties during 2023. But I will also say cost efficiency is critical for our long-term competitiveness. And we will continue to track our development on the cost savings and we'll report on our progress as we move along. Carl will cover more of the financial performance shortly, but let me touch upon some of the critical steps we took in our strategic ambitions in Enterprise. We are in the midst of a journey where we're leveraging our capabilities in Mobile Networks to shape the future industry landscape by creating network API platform, which will redefine our addressable market and actually redefine our industry. In Q1, it was exciting to see a couple of tangible steps in this ambition. So last year, you all know we tested Ericsson Dynamic and User Boost with SmarTone in Hong Kong, which gave indications of it can be done and it gives -- or which showed that it can be done and gave indications of users' willingness to pay for network API. And at this year's Mobile World Congress in Barcelona, we showcased the world's first multi-operator, quality of service network API together with Telefonica, Orange and Vodafone on their commercial networks. And this allowed us to demonstrate how advanced mobile network functionality can be exposed to and easily consumed by the global developer community. This was truly a critical step showcasing our ability to drive the evolution of this market, and we actually see a great interest from enterprises as well as operators. So network APIs were really a big topic at the Mobile World Congress, and we are at the forefront of this new market, which we are defining together with our customers and especially front running customers. The winners in this evolution will be those that are able to first scale their platform. We anticipate the first revenues late this year, which will position us for a revenue ramp and growth during 2024 and '25 as our transformation into a platform company accelerates. Like all new markets, it will take some time to build this new market as well, but we believe it can actually develop faster and grow bigger than the market for traditional communication APIs and it will position Ericsson for a long-term growth and profitability. Let me now comment a bit on the Enterprise Wireless Solutions as well, which is the other pillar in our Enterprise strategy. Today, all of our losses in Enterprise segment really comes from Enterprise Wireless Solutions. And that's expected for a couple of reasons. First of all, Cradlepoint has a subscription business model with upfront payments for an average 3-year contracts. Revenues and gross profits are deferred and recognized monthly over the contract period. This leads to an initial negative impact on EBITDA as a large part of the gross profit is deferred while the absolute majority of OpEx investments are taken directly in the P&L, and OpEx being both offerings, cost for R&D as well as the go-to-market organization. As we grow, this will basically mean that we will generate a loss for accounting reasons, but long-term, business area -- this business area has a very attractive profitability profile. But we're also incurring some investments, we're scaling our go-to-market organization globally. We believe it's critical to establish a dedicated go-to-market towards enterprises to be successful in this area but also to leverage the technology we developed in the Mobile Networks business. But we're also investing in new product solutions. And as an example, you saw in this quarter, we acquired Ericom, which we will use to accelerate our security offerings. So we now have the capabilities to build a full stack security solution optimized for 5G. We continue to see good traction with Cradlepoint, showing good organic growth as we work to fully scale this business. And we are starting to see some very interesting use cases for our dedicated networks in manufacturing. But I would still say that's a rather early market and not particularly big yet. With that, let me hand over to you, Carl, for drilling down into the numbers. Carl Mellander: Thank you, Börje. And again, very good morning to everyone. Thanks for joining the call. So I thought just to reiterate a couple of the key points regarding the business and the result, we can stay perhaps on this title slide for a second while I do that. First of all, this sales mix shift in Networks that we have, so clearly guided for, continued than in the first quarter. And customer CapEx as well as inventory adjustments happened as we forecasted there in some of these early adopter, early 5G markets. At the same time, we had strong growth in markets where the massive 5G rollouts have begun more recently. And of course, we have a big share of services also in this large rollout projects. And when it comes to this inventory adjustment, we saw a big impact in the first quarter. That's clear. We expect continued inventory adjustments in the second quarter. But now with the visibility we have with customers, not least North America, we expect this then to flatten out or normalize from Q3 and onwards. And then, of course, a negative impact of this on Networks gross margin was as we expected and as we guided for as well. But I think it's worth noticing the incredible speed of rollout in India. And for us, India now is the second largest market for Ericsson in terms of sales numbers. It has grown by 5x year-over-year, so now almost SEK 7 billion in revenue in India in the first quarter. At the same time, North America decreased by SEK 4 billion. So there you can clearly see the shift in the business mix. Cloud Software and Service is then better than expectation. That's good. It's really a stepping stone towards the breakeven target for the full year. And then within Enterprise, global communication platform, that's where Vonage belongs. That delivered sales of SEK 3.9 billion in the quarter and a breakeven result of 0 EBITDA from that part. And then the other section of Enterprise, Enterprise Wireless Solutions where Cradlepoint is a part, grew by 60% in the quarter. That's going well. With the loss, as Börje explained then, it's SEK 0.8 billion in the quarter for the reasons that Börje said, and thoughtful investment both in product and go-to-market. If we go to the next slide and look a little bit at the geographies then. You can very clearly here see what we're talking about in the shift. You see 132% growth in our market area, Southeast Asia, Oceania and India, primarily, of course, driven by the market share gains in India but also other project milestone completions in other -- in Southeast Asian markets there. The decline, on the other hand, then in North America, you see was 26% as a consequence of what we just described. And of course, coming from elevated investment levels both in 2021 but notably in 2022. Europe declined by 16% organically, also high -- following high investments in 2022. But encouraging to see the growth in Latin America, where we grew by 6% driven by 5G deployments across the continent. Northeast Asia declined organically then by 19%, also compared with elevated 5G investment levels happening this time last year. And then lastly, Middle East and Africa, a decrease of 8%, partly driven by timing of 5G investments but also by some economic challenges in some parts of the African countries. If we look at how this then came out in the group P&L, you see the sales number here, SEK 62.6 billion. And that's a flat growth organically, and with organic now, I mean excluding investments, acquisitions and divestments but also adjusted for currency fluctuations. But underneath the growth of Enterprise of 19%, a growth in Cloud Software and Services by 5%, but then again 2% down in the Networks for the reasons discussed earlier. And the impact of this shift is visible also on the gross margin. You see down 250 basis points to 39.8% excluding restructuring charges for the same reason. Gross margin, however, was positively impacted, I should also say, in the quarter by higher IPR revenues, where we have good expectations for the future as well, we can come back to that, and also higher software share in the sales mix. In Cloud Software and Services here, we had a gross margin, excluding restructuring again, 36.1%. That's up from 35% a year ago. And this was supported by a higher share of software, which is obviously exactly in line with our strategy there. And then on Enterprise, gross margin was 47.6%, down from 55%. But that's really due to the consolidation of Vonage into the Ericsson books. But sequentially, and I think that's important, gross margin improved in this segment, not least by improving margins in the Global Communication Platform, which again includes Vonage. Both R&D and SG&A increased year-over-year. But again, key to understand here is the consolidation of Vonage into the numbers. Obviously, Vonage was not here last Q1. So that needs to be understood. And about 70% of the increase you see here on these 2 OpEx lines comes from the Vonage consolidation. There's also an FX component, and the remainder is really, as discussed before then, the Enterprise Wireless Solution investment we do in future growth of that business. In the first quarter, we recorded restructuring charges of material size for the first time in a long time, about SEK 1 billion, obviously related to the cost actions that we are taking. So all in all, this resulted in an EBITA excluding restructuring of SEK 4.8 billion, which is in line with the guidance and our expectations there. On the next slide, we can have a look at how these earnings then convert into cash flow. And you all remember, in Q4, we had an exceptionally strong free cash flow before M&A. Now as expected, Q1 was weaker at minus SEK 8 billion of free cash flow before M&A. A couple of things there that explains this. First of all, as a seasonal effect during the first quarter every year, we do pay out incentives to staff from accrued employee expenses the quarter before. But more importantly and more related to business, the business mix shift that we talk about also comes through in working capital, hence, in cash flow as well. And there are a couple of effects there, of course, with large rollout, projects -- project inventory goes up. But we also have some extended payment terms, and that shows up on customer financing line in the balance sheet. But -- and we also have larger payments to suppliers related to these contracts than in other places of the world. So the mix shift also impacted working capital and therefore cash flow. I can mention also just for planning purposes, the DOJ payment of USD 207 million was made in Q2. It was on April 6, so that's not included in Q1, but in Q2 numbers. On a rolling basis, though, free cash flow before M&A was SEK 15.8 billion. But still at 5.7% of net sales versus our target of 9% to 12% for the long term, is, of course, not where we want to be both from a profitability point of view leading into cash flow, but also the working capital situation. And we are working very hard to restore this back to improved levels in line with our target. And of course, our focus on managing working capital continues with full force going forward as well. But again, with large rollout projects and the shifts that we talk about, we do build working capital temporarily. We will, of course, keep the machinery as efficient as we ever can in Ericsson. And I think we have proven that before that we can do that. If we move now to the outlook for the future, not least second quarter here. And as we have said, and Börje expressed this also, 2023 has some uncertainty. In the second quarter, we expect operators to remain cautious with CapEx similar to Q1 and continue with the inventory adjustment that we have described. On top line, we expect this to be offset to a large extent by these large new rollout projects in 5G, but with a dilutive impact on gross margins short term. Enterprise segment is, of course, a high-growth area with a very strong long-term trajectory. But also that sector is impacted by macroeconomic factors, and we see that continuing in Q2 like it did in the first quarter. But to mitigate all of this, of course, we are working on what we can control, as Börje said. And we have increased the cost-out effort and ambition from SEK 9 billion to SEK 11 billion as a run rate as we exit 2023. And given now this restructuring program or cost-out program, we have restructuring charges SEK 1 billion in the quarter, as I said. Going forward for the full year, early estimates are that it could amount to about SEK 7 billion, of which half or even more than half might be booked in the second quarter in the books. But we will come back to that, of course. Next year, though, restructuring charges will normalize around 0.5% of net sales according to the plan. The P&L effect of cost-out will take time to see. We know that from experience, and that's how it works. So of course, we will report on the progress of this every quarter, but expect limited impact in the P&L in the beginning and then a gradual impact over time. Continuing on this slide, and I'll wrap up soon. Average net sales seasonality from Q1 to Q2 is a growth of 12% if you look at the last 3 years' average. This is applicable both for Networks and Cloud Software and Services. However, this time for Networks, we expect Q2 sales to be in line with Q1, and for Cloud Software and Services, we expect the seasonality to be somewhat lower this year than the normal 12%. Next, on gross margin, we are specific in the guidance here for Networks, And we say we expect gross margin in Networks to be between 37% and 39% in the second quarter, mainly as a result of the business mix that we have talked about. But we expect a gradual recovery going forward in the second half regarding that gross margin. OpEx, the typical increase Q1 to Q2 is SEK 1.5 billion up, large variations between quarters but that's a reference. And then the result of all of this EBITA excluding restructuring or EBITA margin, I should say, for Q2, we are -- we expect now and we guide for mid-single-digit as a result of this declining margins in Networks due to the changing business mix. To close off, I want to end with this slide. This is taken from our Capital Markets Day we had in December, updated with actuals though. And this shows the components in the path towards the 2024 target, an EBITDA margin of 15% to 18%, you're well familiar with that already. So uncertainty on 2023, we've said that. But we do believe that the underlying traffic growth in Networks will stimulate and drive continued investments. That's one strong factor here. And therefore, we expect this gradual recovery in 2023 second half and into 2024. And this path, as you see here and know already, is also supported by higher IPR revenues. And then finally, in the other bucket that we have combined a lot of effects, both pluses and minuses there. But we have, of course, changing market mix from footprint gains but also countered by improved profitability across all segments with operational leverage from growth, et cetera. So in total, we remain steadfast in this target to reach the lower end by 2024 of the target EBITDA margin, 15% to 18%. With that, thank you so much. And I hand back to you, Börje. Börje Ekholm: Thank you, Carl. So our strategy we continue to implement, and we're starting to see the positive signs that it's working. So we're well positioned now to capture the full value of 5G and to create a stronger and more profitable Ericsson with a larger addressable market. And it's critical for our long-term success that we build out a profitable enterprise business. Executing on our strategy to build technology leadership in Mobile Networks, establish an Ericsson -- or an enterprise business for Ericsson and driving a cultural change are our 3 main priorities going forward. So we are confident in our strategic position, but we also see that 2023 will be a choppy year, as we have earlier said. We expect a gradual recovery in the second half as we expect the inventory adjustments at our customers to be completed and that we start to see the benefit of our, call it, cost savings initiatives flow through the -- or gradually flow through the P&L. Longer term, based on historic experiences, we also expect to see investments or network investments recover as the underlying traffic growth continues at a very high rate and more capacity will be needed. So if we look beyond 2023, we see that the expected normalization or recovery of the Mobile Networks market, we see the turnaround of Cloud Software and Services that we can continue to grow our IPR revenues as well as reap the full benefit of the cost initiatives and the other actions we're driving puts us on track to reach the lower end of our long-term targets by 2024. So with that, I just want to end by thanking all the fantastic people at Ericsson, who made this position possible. A big thank you from me. With that, over to you, Peter. A - Peter Nyquist: Thanks, Börje, and thank you, Carl, for the presentation. So it's now time for the question-and-answer session. [Operator Instructions] And if you are streaming the webcast, please mute the webcast audio whilst asking questions to minimize any audio feedback. So I'm now ready for the first question. And with that, I would like to welcome Aleksander Peterc. So Aleksander? Carl Mellander: Thank you all. Börje Ekholm: Thank you.

Ericsson's Strong Earnings and Strategic Moves Bolster Market Position

- Ericsson (NASDAQ:ERIC) reported earnings per share of $0.35, surpassing estimates and highlighting the effectiveness of its strategic operational improvements and cost-saving measures.

- Despite a slight miss in revenue, Ericsson's focus on operational excellence has led to sustainable gross margins and strong commercial momentum through significant customer agreements in key markets.

- The company's financial metrics, including a favorable price-to-earnings (P/E) ratio of approximately 14.92 and a solid earnings yield of about 6.70%, reflect its robust performance and attractive market valuation.

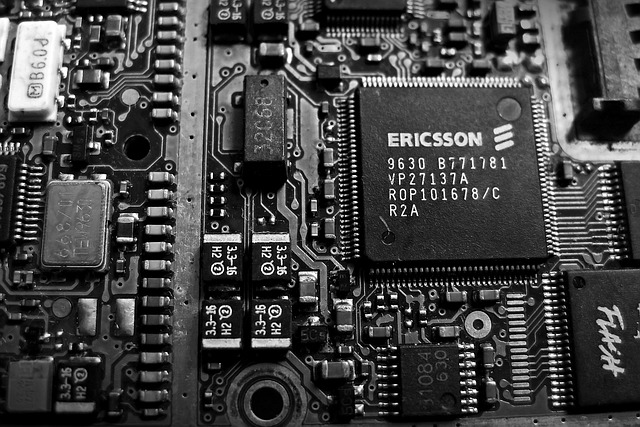

Ericsson, trading as NASDAQ:ERIC, is a leading Swedish telecom equipment manufacturer. The company is known for its innovative solutions in the telecommunications industry, providing services and products that enhance connectivity worldwide. Ericsson competes with other major players like Nokia and Huawei in the global market.

On October 14, 2025, Ericsson reported earnings per share of $0.35, exceeding the estimated $0.14. This strong performance is attributed to strategic operational improvements and cost-saving measures. Despite revenue slightly missing estimates at $5.91 billion, the company's focus on operational excellence has driven its gross margins to sustainable levels.

Ericsson's strategic efforts have resulted in strong commercial momentum, with significant customer agreements in key markets such as India, Japan, and the UK. These agreements have bolstered the company's financial flexibility, allowing it to enhance profitability and consider increased shareholder returns. The $1 billion sale of its Iconectiv connectivity services business further strengthened its financial position.

The company's financial metrics reflect its robust performance. With a price-to-earnings (P/E) ratio of approximately 14.92 and a price-to-sales ratio of about 1.05, Ericsson's market valuation is favorable. Its enterprise value to sales ratio of around 1.07 and enterprise value to operating cash flow ratio of approximately 6.48 indicate a strong valuation relative to revenue and cash flow.

Ericsson maintains a moderate debt-to-equity ratio of approximately 0.42, suggesting a balanced approach to leveraging debt. The current ratio of about 1.09 indicates a slightly higher level of current assets compared to liabilities, showcasing the company's ability to meet short-term obligations. With an earnings yield of about 6.70%, Ericsson offers a solid return on investment for shareholders.

Ericsson's Strong Q2 2025 Performance: A Deep Dive into Financials and Strategic Focus

- Ericsson reported earnings per share of $0.14, surpassing estimates and indicating strong profitability.

- The company achieved a 48% adjusted gross margin and a three-year high in its adjusted EBITA margin, showcasing operational efficiency.

- Ericsson is increasing investments in artificial intelligence, aiming to drive future growth and innovation in 5G technology and beyond.

Ericsson, listed as ERIC on NASDAQ, is a leading Swedish telecom equipment maker renowned for its innovative solutions in the telecommunications industry, particularly in 5G technology. Competing with giants like Nokia and Huawei, Ericsson has recently showcased its strong strategic and operational execution through its second-quarter results for 2025.

On July 15, 2025, Ericsson reported earnings per share of $0.14, surpassing the estimated $0.12, indicating a positive performance in terms of profitability. The company generated a revenue of approximately $5.84 billion, which was below the estimated $6.21 billion. Despite this, Ericsson achieved a 48% adjusted gross margin and reached a three-year high in its adjusted EBITA margin, highlighting its operational efficiency.

Börje Ekholm, President and CEO of Ericsson, emphasized the company's solid execution of strategic and operational priorities. The company has structurally lowered its cost base and is focused on delivering further efficiencies. Growth in the Americas is encouraging, while Europe has stabilized. Globally, fixed wireless access customers have surpassed 160 million, driving significant network traffic.

Ericsson's financial metrics reflect its market position. The company has a price-to-earnings (P/E) ratio of approximately 156.38, indicating a high valuation relative to its earnings. Its price-to-sales ratio stands at about 1.04, suggesting that investors are paying $1.04 for every dollar of sales. The enterprise value to sales ratio is around 1.03, reflecting the company's valuation in relation to its revenue.

Looking forward, Ericsson is increasing its investments in artificial intelligence, including its involvement in the Sweden AI factory consortium. AI is seen as crucial for accelerating innovation, especially in supporting AI use cases at the edge, which require ultra-low latency and enhanced uplink performance. This strategic focus on AI is expected to drive future growth and innovation for Ericsson.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson (NASDAQ: ERIC) Quarterly Earnings Preview

- Ericsson is set to release its quarterly earnings with an estimated EPS of $0.09 and projected revenue of $55.33 billion.

- Ericsson's debt-to-equity ratio is 0.48, suggesting a moderate level of debt management.

Ericsson (NASDAQ: ERIC) is a leading telecommunications company known for its innovative solutions in mobile networks, digital services, and emerging technologies. As a major player in the industry, Ericsson competes with other giants like Nokia and Huawei. On April 15, 2025, Ericsson is set to release its quarterly earnings before the market opens, with Wall Street estimating an earnings per share (EPS) of $0.09 and projected revenue of approximately $55.33 billion.

The financial report will be released at 7:00 AM CEST, followed by a live webcast for analysts, investors, and journalists at 9:00 AM CEST. This event will provide insights into the company's performance and future outlook. The report will be accompanied by a press release containing the complete financial details in PDF format, ensuring transparency and accessibility for stakeholders.

The company's price-to-sales ratio and enterprise value to sales ratio both stand at 0.88, suggesting that the market values its sales at less than one times its revenue. This could indicate that investors see potential in Ericsson's sales growth or efficiency. Additionally, the enterprise value to operating cash flow ratio is 4.74, showing how many times the operating cash flow can cover the enterprise value, which is a measure of the company's financial health.

Ericsson's debt-to-equity ratio is 0.48, showing a moderate level of debt compared to its equity. This suggests that the company is managing its debt responsibly, maintaining a balance between leveraging for growth and financial stability. The current ratio of 1.17 indicates that Ericsson has a slightly higher level of current assets compared to its current liabilities, suggesting a reasonable level of short-term financial health.

Ericsson Shares Rise on Better-Than-Expected Q2 Earnings Amid Cost-Cutting

Ericsson AB (NASDAQ:ERIC) saw its shares rise more than 2% pre-market today after surpassing Q2 earnings expectations, benefiting from cost-cutting measures despite a challenging market. Adjusted earnings before interest and taxes climbed 14% year-over-year to 3.23 billion kronor ($307 million), surpassing the 2.7 billion kronor forecasted by Wall Street analysts.

CFO Lars Sandstrom emphasized the ongoing need for cost reduction, noting that a significant portion of expenses is related to personnel. Ericsson's net sales for the quarter fell by 7% to 59.8 billion kronor, exceeding analyst expectations of 58.5 billion kronor. The adjusted earnings did not include a previously announced impairment concerning its Vonage business.

The company reported an 11.4 billion kronor non-cash impairment due to the declining performance of the Vonage unit, leading to a net loss of 11 billion kronor for the period. This is the second writedown for the asset since Ericsson agreed to purchase it in 2021.