AST SpaceMobile, Inc. (ASTS) on Q3 2022 Results - Earnings Call Transcript

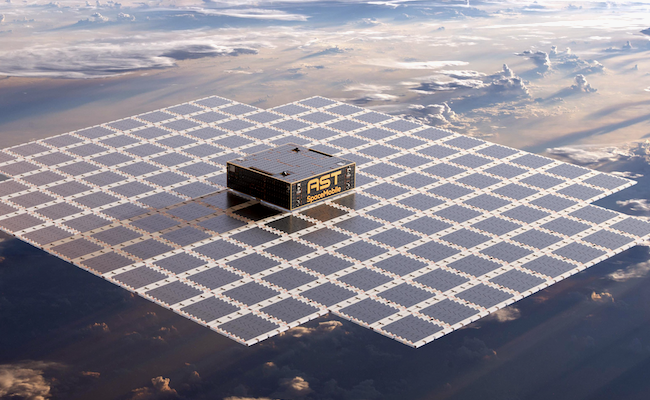

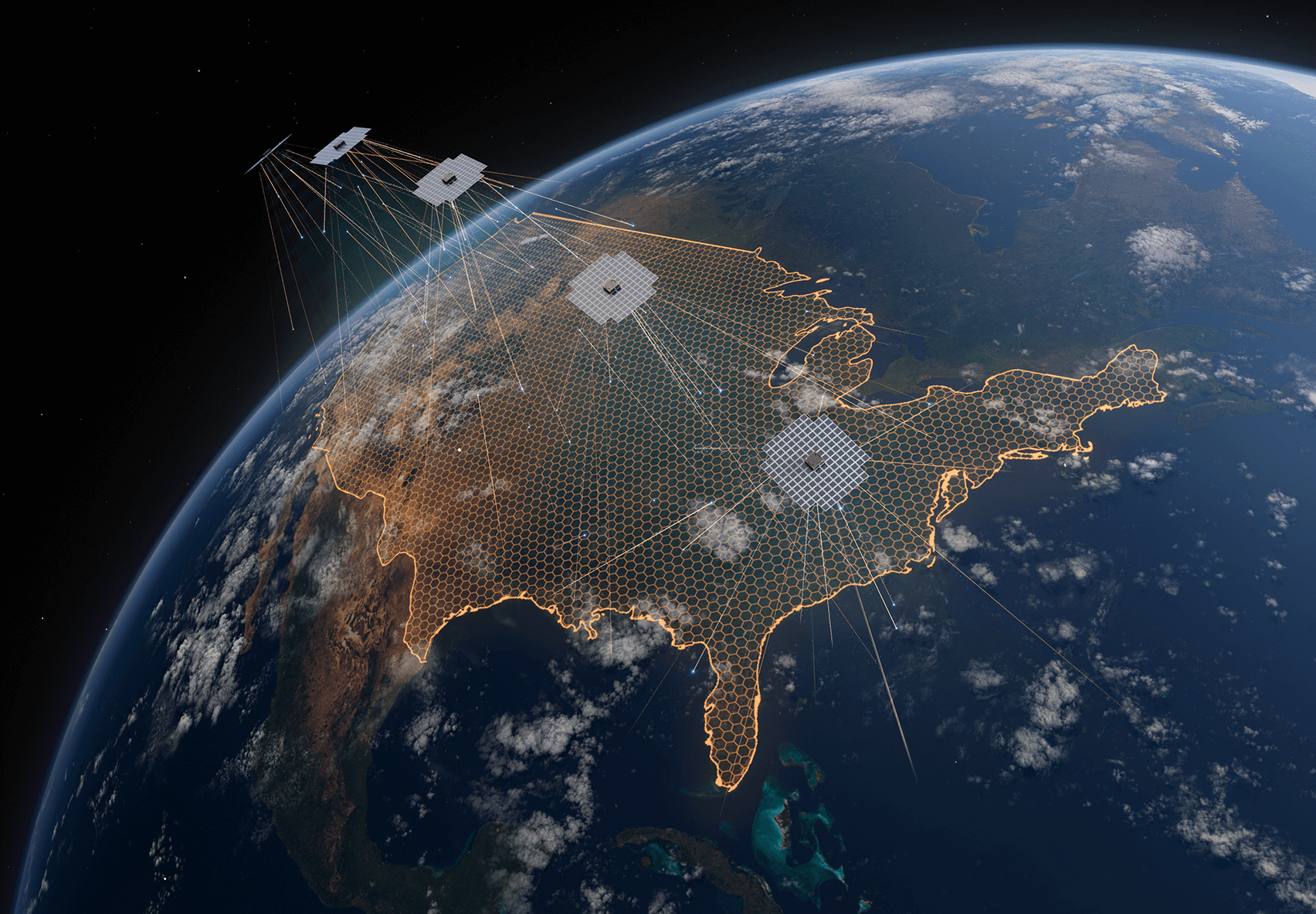

Operator: Good day, and thank you for standing by. Welcome to the AST SpaceMobile Third Quarter 2022 Business Update Call. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your speaker today, Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Please go ahead. Scott Wisniewski : Thank you, and good afternoon, everyone. Let me refer you to Slide 2 of the presentation, which contains our safe harbor disclaimer. During today's call, we may make certain forward-looking statements. These statements are based on current expectations and assumptions, and as a result, are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST SpaceMobile's annual report on Form 10-K for the year that ended December 31, 2021, and with the Securities and Exchange Commission and on other documents filed by AST SpaceMobile with the SEC from time to time. Readers are cautioned not to put undue reliance on forward-looking statements, and the company specifically disclaims any obligation to update the forward-looking statements that may be discussed during the call. Also, after our initial remarks, we will be starting our Q&A session with questions submitted in advance by our shareholders. Now referring to Slide 3. For those of you who may be new to our company in mission, there are over 5 billion mobile phones in use today around the world, but many of us still experience gaps in coverage as we live, work and travel. In this backdrop, AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard unmodified mobile devices based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today's 5 billion mobile subscribers and finally bring broadband to billion to remain unconnected. Since our last quarterly business update, we have made strong progress, including the achievement of several critical technology milestones. It is my pleasure to now pass it over to Chairman and CEO, Abel Avellan, who will take you through that now. Abel? Abel Avellan : As we announced this morning, I am super excited to report that Blue Wacker successfully involved in 690 square foot array input. Andes Satellite is operating normally in his new deployed configuration. Why this is extremely important? First, largest space-based arrays are the key technology that support direct-to-home broadband connectivity from the space. In order to provide broadband to regular phone from space, we believe large face arrays are the key and essential technology necessary for this type of communication. Now we are the first and only company that has mastered not only how to build them at low cost, but also how to fly them in low orbit at approximately 70,000 miles per hour, which we think it is critical for the capability to connect to regular phones as they fly. Second, the years of R&D and hundreds of millions invested in this technology are starting to pay off, and they have now resulted in a deep portfolio of IP of more than 2,400 patent and patent pending claims. Third, the successful execution of unfolding of 690 square feet array designed for several low-band communication validating key assets of our satellite design and pave the way for us to build our next budget satellite. We plan to incorporate these essential learnings and improvement, not only in how we build them at a lower cost, but also how we fly them in the space that can only be achieved by actually going through the complete process of building and flying in orbit. This is a process with this achievement, we consider substantially complete. Fourth, our patented satellite architecture is fundamentally different approach to the one taken by the assay satellite industry. Now we have invented, patented, built and flown a new satellite architecture that now we own and one we think will change what has been possible to do with satellite up to this point in terms of capability and cost. Fifth, this architecture prove that we have the capability to build fly and operate the largest commercial communications array, the key enabler to provide to regular cell phone connectivity from the space, an extremely large market where we have a clear technological and timing advantage as it relates to our planned several global network for space. This is of successfully unfolding the system, we consider the major derisking impact for our technology and approve of our satellite architecture. Now we look forward to continuing our collaboration with MNOs around the world, including Vodafone, AT&T, Rakuten Mobile, Bell's Canada, MTN Group, Orange, Telefonica, Etisalat, Indosat, Smart, Globe Telecom, Millicon, Esperance, Telecom Argentina, Telstra, Africell and Liberty Latin America among others. And with that, I'm happy to pass it to Sean. Sean Wallace : Thanks, Abel. Good afternoon, everyone. The third quarter was another period of milestone achievements and execution, and I want to congratulate the entire AST SpaceMobile team for their efforts on the successful launch of the Blue Walker 3 test satellite and the unfolding of the largest communications array ever deployed commercially in low earth orbit. This infrastructure currently orbiting the earth, represents an important step forward in our efforts to demonstrate that cellular subscribers can enjoy cellular coverage around the globe at 5G speeds. This technology is designed to eventually erase those mobile phone dead zones that we all suffer through. And more importantly, provide the productivity-enhancing technology of mobile communications to billions of currently unconnected people. Let me move on to a discussion about some of our key operating metrics that are presented on Slide 6. Looking at the first chart, we see for the third quarter of 2022, we had non-GAAP adjusted operating expenses of $38.6 million versus $31.8 million in the second quarter. Non-GAAP adjusted operating expenses exclude noncash operating costs including depreciation and amortization and stock-based compensation totaling $3.6 million and $3.6 million in the third quarter and second quarter, respectively. Our third quarter non-GAAP adjusted operating expenses increased by $6.8 million versus the second quarter. This increase is mostly a result of the achievement of certain milestones in our R&D projects, which brought forward certain milestone payments and an increase in engineering services costs due to an increase in head count. Our research and development expenses consisted principally of nonrecurring development activities for which we typically engage third-party vendors and payments are based on completion of milestones. After evaluating future R&D milestones over the next few quarters, we expect that the level of non-GAAP adjusted operating expenses will remain in the high 30s for the next 2 quarters as we continue to pursue important R&D projects for our bluebird satellite and decline to the low 30s thereafter. Our other components of non-GAAP adjusted operating expenses, namely Engineering Services and GA is expected to remain in about the same range for the next 2 quarters and will trend up slightly over time as a result of growing operations. Turning towards the second chart, our capital expenditures for the third quarter was $11.3 million versus $9.4 million for the second quarter. We expect our levels of capital expenditures, which include direct material costs, capital improvements of AIT facilities and ground infrastructure will average around $12 million over the next 4 quarters. And on the final chart on the slide, we ended the second quarter just shy of $200 million in cash on hand. We believe this cash is sufficient to support our cash expenditures for the next 12 months, including completing the construction of our next 5 Black 1 Satellites. In addition to this cash on hand, we've been working hard to develop other sources of cash and liquidity to supplement our activities. We understand the capital-intensive nature of our project, and we are highly focused on exploring a wide range of options in order to efficiently fund our efforts. If we are successful in attracting additional capital, we would look to reevaluate our business plan and might further accelerate certain R&D expenditures and other investments designed to enable us to achieve our goal of global coverage more rapidly. As Blue Walker 3 continues to perform as expected, we are now focusing our investments towards the production of our bluebird satellites in the latter half of 2023 and setting up ground infrastructure to connect to the terrestrial network of the MNOs supported by technology and infrastructure partners such as American Tower, Rakuten, Symphony and Nokia. We believe a key advantage of the Space Mobile System is its ability to be deployed in a phased manner, where we can target a modest number of satellites to provide limited coverage in specific countries. We believe this ability to phase in our coverage will provide us a first-to-market advantage and enable us to work with MNOs to introduce services and develop the market. We continue to project that our materials and launch costs for our first 20 satellites remains at between $300 million to $340 million with a midpoint per satellite cost of $16 million. The projected cost of these satellites could be adversely affected by a number of factors including inflation, supply chain disruptions, design changes and increases in the cost of electronic components, assembly equipment, launch costs, salaries and other aspects of our satellite design and assembly activities has increased the cost to design, assemble and launch our satellites. These estimated costs are preliminary estimates and based on certain assumptions and information currently available to us and are subject to change based on numerous factors described earlier as well as delays in the development of components and materials, launch costs and other factors. I am encouraged by the progress that the team has made, and I'm excited about the company's future as we transition from the development phase to commercial satellite production. Thank you for your continued support of the Space Mobile mission. And with that, I'll turn it back to Scott. Scott Wisniewski: Thanks, Sean. Before we go to the queue of analyst questions, I would like to address a few of the questions submitted ahead of the call by our investors. Operator, could you please start us off with the first question? Operator: Damian from England asks, could you provide some key milestones during the 6-month testing program, so that we can have a feel when to expect certain types of results during the program. Abel Avellan: Thank you, Damian, for the question. Well, first of all, let me say, having had deployed the phase array, it is a major milestone for us as was the step left that was not completely testable on the ground. And now having that behind us that give us a very good path forward on how to complete our test program. So what is left is basically connecting the array, which had been deployed, directly to cell phones and something that we advanced a lot with first, we will Blue Walker 1, then everything that we have done on the ground with our partners like Nokia and Rakuten and that will be the next step. So by completing the deployment now we have all the learnings required for storing, launching, operating, testing and flying and satellite. And that had been accumulated over the last 2 months of flying this spacecraft. So we're very confident with the architecture that we have. We don't foresee any changes to our next batch of satellites, which we call block 1. In term of next steps for Blue Walker 3, we plan to do testing with many of our mobile network operators and technology and infrastructure partners. In order to commercialize our ground network capabilities, and we expect that time line to occur over the next several months into 2023. So for that, we have an incremental license together with AT&T to start testing in the U.S., Texas and Hawaii. In parallel, we will be working with Rakuten in Japan, Vodafone in Europe and Africa, among other MNOs, where we would plan testing virtually in every continent. Operator: Steve from Arizona asks, how is the bill for the first 5 Blue Birds progressing? Is it still on schedule for a second half of 2023 launch? Abel Avellan: Yes, we believe they are. We're targeting for launching the first Blue Birds in in late 2023, second half of 2023. We have been making all the necessary investments in site 2, our second site in Midland. We have so far invested $50 million to the day at the location, and we have only $5 million to go. Also, we have been buying all the equipment in order to support the assembly integration and testing of the Blue Bird program, including his one-part assemblies, which we have in-sourced. And the learnings to the day from Blue Walker 3 are well contracted with our supply base and early inventory build of long lead items, this gives us confidence on the planned time line for the next much of satellite in 2023. Operator: Jay, from California asks what happens to bluebirds transferring to ships in the middle of Pacific when there isn't a gateway in its line of sight to relay back to the network. Can you elaborate on how that works? Abel Avellan: Yes. We had a very large field of view per satellite is given to the geometry, also their size. So we can cover up to 2,800 kilometers. So there is 490458-degree of latitude. There's always land mass, where we can place our gateways and then be able to cover all the oceans. I mean having said that, our main market is is where people live and work outside their regular locations in cities and populated areas, but we have the full capability to cover in populated areas and autos, desserts, national parks on a global basis. Operator: Carl from Sweden asks, will you test some measures to reduce brightness perceived by astronomers on the next set of satellites? Scott Wisniewski: Thanks, Carl. Our network is being designed to support a universal good cellular broadband for more people globally helps address poverty, support economic development and build a diverse digital society. And our network is designed to connect hundreds of millions of devices. So the scope for impact is quite attractive. The brightness issue has been a long-standing complaint for objects and below our bid and we're eager to use the latest innovations to manage the issue. To do that, we're actively working with industry experts on the latest innovations, including next-generation antireflective materials. We're also engaged with NASA and certain working groups within the astronomy community to participate in and advance industry solutions. And lastly, compared to other constellations that require thousands of satellites because of the size of our satellite and its aperture and field of view. We require much fewer satellites to achieve global coverage for cellular broadband. And we think that, that, together with the scope of our impact is very important. Operator: Our final question comes from Tom. Tom asks, you always mentioned that you're ahead of competition. How many years ahead do you think you are? Abel Avellan: Well, we think that we are many years ahead. And in the last few months, we have seen a lot of attention into the market of connecting direct to cellphone. We obviously were not surprised by that given the size and the large opportunity that we are playing in. But ultimately, connecting regular modified devices to space is a challenging problem, one that we have been actively working for many years with best partners around the world. We had a patented and now launched and operated a new architecture that is supported by 200 patents and patent pending claims. And as of today, we do not see anyone else who is pursuing cellular broadband solution to modify phones. SOS solutions or very low data point solutions, we ultimately don't see them as competitors or direct competitors as our solution is providing direct connectivity to handsets at 5G -- through 5G broadband. Scott Wisniewski: And with that, I'd like to thank our shareholders for submitting these questions. Operator, let's open the call to analyst questions now. Operator: Our first question will be coming from the line of Griffin Boss with B. Riley. Griffin Boss: So in reference to some of the language from the 8-K this morning, just curious to what extent are you already manufacturing your bluebird satellites versus waiting for data from the Blue Walker 3 testing to determine if any modifications are going to be needed? Or are there certain aspects of production that you're waiting on until you get more data from Blue? Abel Avellan: Yes, let me clarify that. So no, we have not been waiting for the data. The productions are ongoing. Parts start to being received and be manufactured in our factories. This reconfirmed that our architecture do not need any unification, and we were able to very successfully deploy, stabilize and fly the satellite on the design that is basically making a cross over to the next batch of satellite. So of course, there is a lot of learnings by flying operating the satellite that we are applying that they have to do with the software, and how the satellite is operated. But in essence, the plan and the manufacturing of all next satellite is ongoing, nothing has been modified on them based on the schedule that we have presented. Griffin Boss: Okay, Abel. And then -- so I haven't seen the Q released yet. I was just curious how many shares of Class A stock were issued in that $16.9 million number that you guys gave for 17.0? Scott Wisniewski: Brian, I think we'll have to come back to you offline with that. We don't have that on hand. Griffin Boss: Okay. No problems. And then just last one clarification for me for Sean. Did you say â I just want to clarify on the OpEx guidance, you said non-GAAP adjusted OpEx will remain in the high 30s over the next 2 quarters before declining. Did I hear that right? A âSean Wallace: That is correct. It will be about the same level it was this quarter. That increases all R&D milestone related, and weâll go back down to around the 30 level in the following 2 quarters. Operator: Thank you. Our next question is from the line of Bryan Kraft with Deutsche Bank. Bryan Kraft : I had a few, if you don't mind. I guess, first, it's great to see that you've unfolded the array successfully on Blue Walker I guess the question there is how much of a proof point is that for the successful unfolding of the bluebird arrays? I understand that the BlueBird arrays are larger than Blue Walker 3, so just trying to understand how much of a read-through of the success with the Blue Walker array is into the probability of also having success with the BlueBirds and how much that technology or design risk has been minimized now? And then I guess the next question is, how should we think about the pace of launches in 2024 off of the 5 satellites by the end of 2023 guide. And yes, just trying to understand that velocity of launch going into '24 and how quickly the revenue ramp would there be in '24 based on the number of launches. Abel Avellan: Brian, let me answer that. For the next batch of satellites basically what we call Block 1 is identical architecture. The same architecture same mechanism, same technology for doing the deployment and also very importantly, same software, manancontrol and operate these spacecraft. So we will basically repeating what we just did on the first block of satellites. As it relates to your question on the first 5 satellites, we disclosed that we will be launching in the second half of 2023, the next budget satellite 5 of them. And during 2024, we will be ramping up our production to get eventually to 6 satellites per month. That's -- we're not giving guidance yet exactly how many in 2024, but that's what we have done in preparation to get to the cadence, and that's what we had in 2 sites, Site 1 and Site 2 in Texas, and that how we automated to get to that pace. Bryan Kraft : So just to be clear, the 6 satellites will be the manufacturing base in '24. And then I guess the launches would be on a little bit of a lag from that. Is that the right way to think about it? Abel Avellan: Yes. That's the right way to think about it. 5 in '23 and ramping up during 2024 for up to 6 satellites per month. Bryan Kraft : Got it. Okay. And if I could ask you one other one. How do you think that the announced StarLink relationship with T-Mobile and the Globalstar relationship with Apple will affect your business, if at all, long term. I know that initially, those are pretty limited capability services. But I guess I was just wondering what your perspective is on their ability to maybe evolve those into something that's more competitive with what you're offering. Abel Avellan: Well, our focus, it has been from the very, very beginning, is that we are the only broadband space-based cellular broadband network. All these other architectures are limited to SOS or very, very limited amount of capacity. We believe that people will be selecting and usage services based on access through the carrier that we have access now to 1.8 billion subscribers through a significant number of the top global telcos around the globe. So we do not see that yet as a direct competition to what we're doing. Our proposition is broadband, broadband everywhere, without dedicating spectrum to the phone, basically reducing the spectrum of the operator on a global basis in partnership with the operator accessing 5 billion subscribers around the globe as they move in and out of the service and always in partnership with the telcos. So we believe that or very limited connectivity of a few megabits per cell is not a direct competitor to what we're doing. Operator: The next question is from the line of Caleb Henry with Quilty Analytics. Caleb Henry: Congratulations on the antenna deployments. There was a big milestone. I had a question on -- what about the first 5 satellites? So I think there was some discussion last quarter about switching those from equatorial to a mid-inclination. Has that been -- or are inclined orbit, I should say. Has that been finalized where those 5 satellites will go? Scott Wisniewski: Caleb, this is Scott. We've retained flexibility on that point. So we have not given guidance on incline versus equatorial at this time. Caleb Henry: Okay. And then also for the Block 1 satellites, those were originally supposed to be 20 satellites. And I think the recent discussion is centered on 5, what's the plan for the other 15 that are going to be part of Block 1? Will those also look like clones of the Blue Walker? Scott Wisniewski: Yes. So to clarify, for us to build out our network, we've talked about 20 satellites on equatorial to get global coverage and then another 58 on top of that for MIMO. And so those are intentionally phased, right, so that we can build out our network as we go and retain flexibility. So that's how we think about our network build and our network design over time. As it relates to the 5 satellites that we've given guidance on for next year, those are satellites that could play in either of those networks, quite frankly. So the satellites to come beyond it don't necessarily fill out the 20 or the 90. Those are just how we have designed the first 5 with is nearly identical to the Blue Locker III design as possible in order to accelerate their development and construction. And so that's how we've thought about the next 5, and how it links to the other network builds that we've talked about. Caleb Henry: Okay. For the 2 phases, do you have a sense of the time line for when you'd have, I guess, 110 satellites in orbit? Scott Wisniewski: Yes. The guidance we've given on time line is those 5 satellites for late 2023. And then in 2024, we're going to be building as fast as we can, ramping into that 6 per month cadence. So at what point do we get to those total completed numbers, we haven't given guidance on that. But our objective is to build and launch 5 as quickly as possible and follow the more satellites being on top of that. Caleb Henry: Okay. And then just my last question. Earlier in the call, there was mention of an interest in accelerating some R&D goals or projects that the funding can be secured for those, can you give more color on what exactly -- what kind of R&D you hope to do and what impact that might have on the constellation or service rollout? Sean Wallace: I'll start and then Abel will add some things. We have a variety of R&D projects, whether it's in the RF side or solar or some of the components of the satellite. So we're going to continue to spend money because we are going to continue to improve the power of the satellite, the RF capacity, and that will continue on what my point was that we might bring some of those expenditures forward so we could accelerate the launch of the constellation in order to get to market sooner. So we just want to give you a update -- good guidance for how much we're going to spend over the next 4 quarters, we had more money . Abel? Abel Avellan: Yes. I mean the primary areas of R&D, we have our own ASIC. The ASIC will be part of the upgrade as we move forward. So we can continue to use this architecture for the first 20 satellites. And we continue to progress on our AC development manufacturing, which is entered into the last phase of production. We will be completed that R&D phase. We also on pretty much all major subsystems have been internally developed in order to make them at a cost that is not available in the market today, including our own solar panels, our own reaction wheels, our own avionics, our own fly system. So there is a number of -- and then the whole system is fully integrated in our own facility. So that's what we refer to as an R&D and that we will continue to lower because of our satellites. Operator: At this time, I'm showing no further questions. I would like to turn the call back over to management for closing remarks. Scott Wisniewski : Thank you, operator. Our company is building a space-based cellular broadband network designed for the use of the phone in your pocket today. And with today's announcement, we're very happy to speak to you, and I want to thank everyone for joining both the shareholders and analysts for their questions, and wish everybody a great week. Operator: This concludes today's conference. You may disconnect your lines at this time. Thank you for your participation.

AST SpaceMobile's Market Position and Recent Downgrade

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.