AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

| Symbol | Price | %chg |

|---|---|---|

| SUPR.JK | 43875 | 0 |

| KETR.JK | 600 | 0 |

| 4333.HK | 400 | 0 |

| 178320.KQ | 24450 | 8.59 |

AST SpaceMobile's Market Position and Recent Downgrade

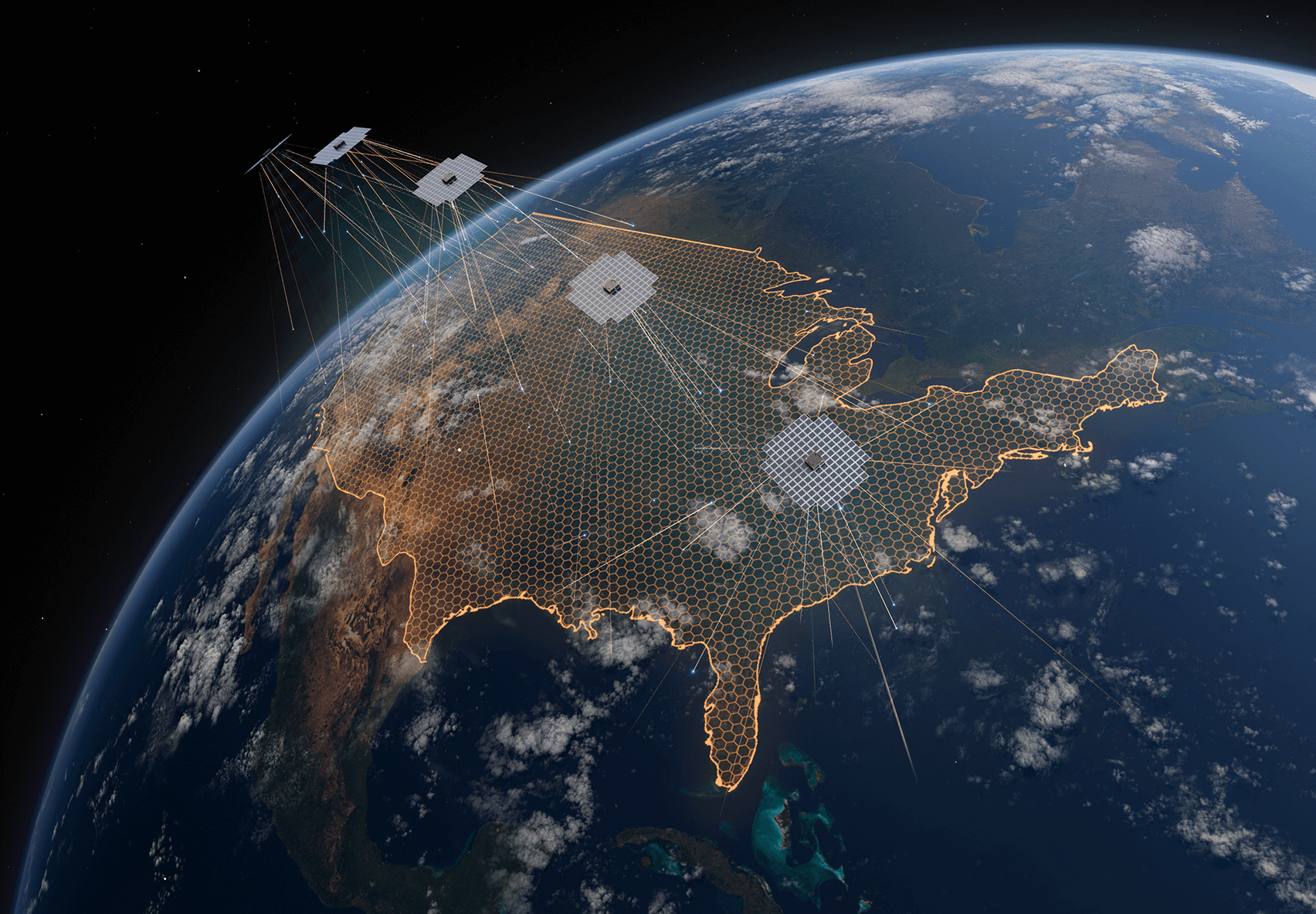

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

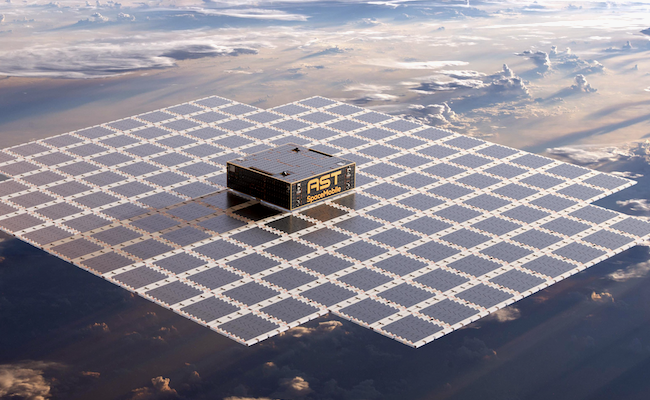

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.