AST SpaceMobile, Inc. (ASTS) on Q2 2024 Results - Earnings Call Transcript

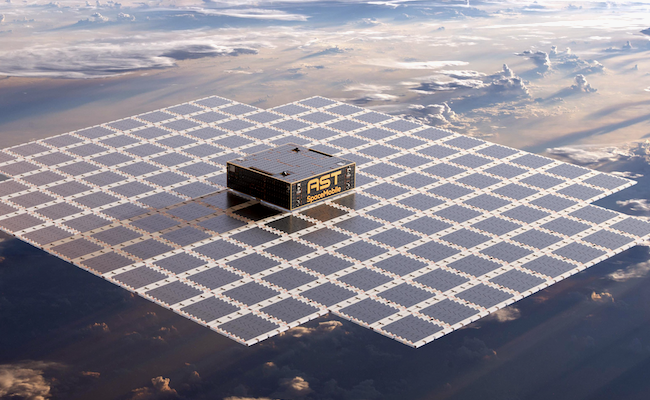

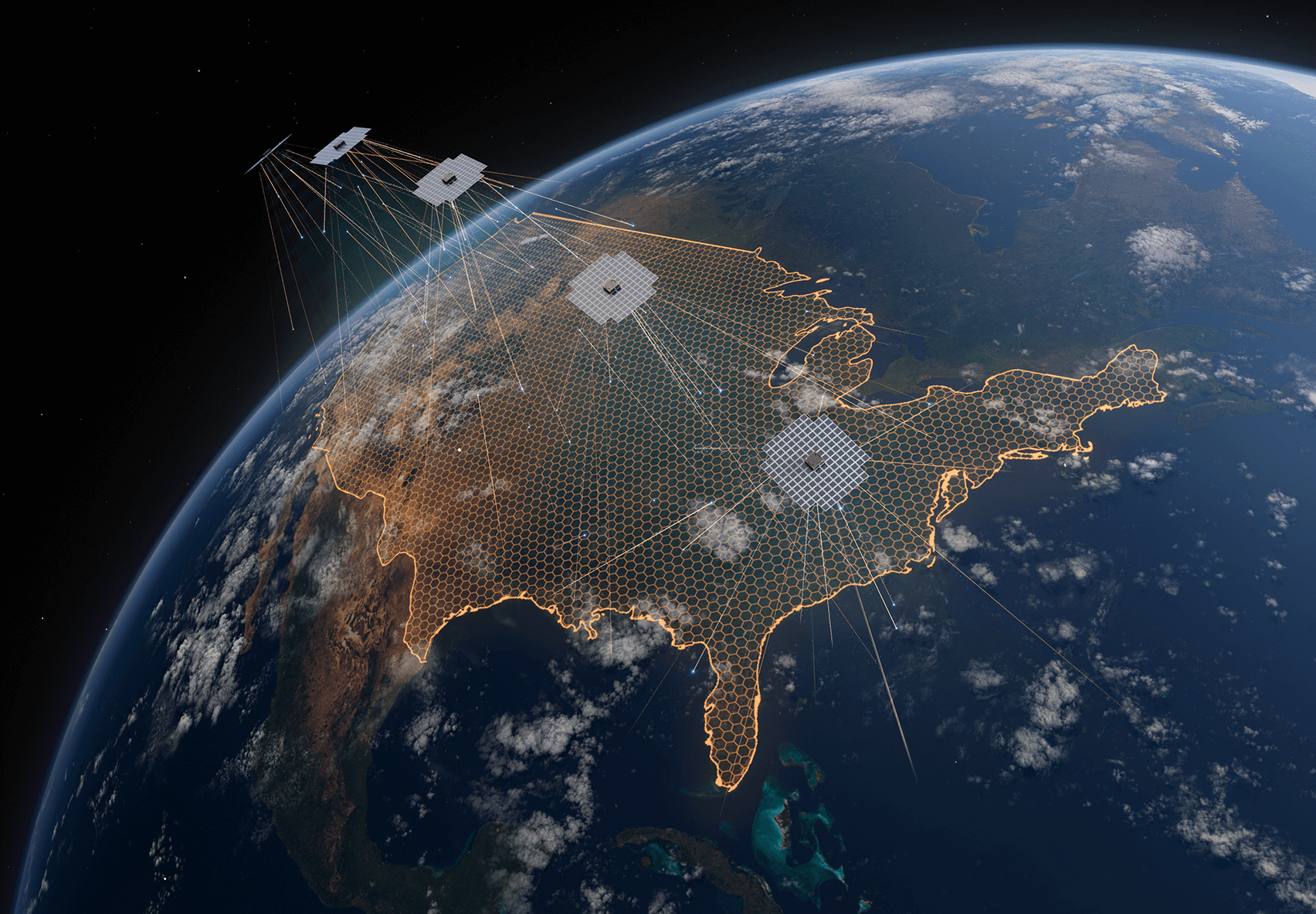

Operator: Good day, and thank you for standing by. Welcome to the AST SpaceMobile Second Quarter 2024 Business Update Call. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your host today, Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Please go ahead. Scott Wisniewski: Thank you, and good afternoon, everyone. Let me refer you to Slide 2 of the presentation, which contains our Safe Harbor disclaimer. During today's call, we may make certain forward-looking statements. These statements are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST SpaceMobile's Annual Report on 10-K for the year that ended December 31, 2023, with the Securities and Exchange Commission and other documents filed by AST SpaceMobile with the SEC from time to time. Also, after our initial remarks, we will begin the Q&A section with questions submitted by our shareholders. Welcome, everyone. For those of you who may be new to our company and mission, there are over 5 billion mobile phones in use today around the world, but many of us still experience gaps in coverage as we live, work, and travel. There are also still billions of people without cellular broadband and who remain unconnected to global economy. The markets we are pursuing are massive, and the problem we are solving is important and touches nearly all of us. In this backdrop, AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with every day mobile phones supported by our extensive IP and patent portfolio. It is now my pleasure to pass it over to Chairman and CEO, Abel Avellan. Abel Avellan: Thank you, Scott. Good day, everyone. The hard work of the past few years is culminating in a period of tremendous activity and excitement for AST SpaceMobile. We have moved past a primary focus on improving our technology and funding our growth into the next phase of executing our vision and operationalizing our business. We are shifting from R&D to full scale production and commercialization of our Space-Based cellular broadband network. Our technology is proven, patented and validated. Our commercial ecosystem is in place and growing. We are funded to achieve our near-term goals and reach initial revenue. Our business is now accelerating. Just last week, our first five commercial satellites called BlueBird’s arrived in Cape Canaveral, Florida, after completing final assembly at our manufacturing facilities in Texas. These satellites are now undergoing final preparation for integration with Falcon 9 launch vehicle for a dedicated mission. We have seven-day contracted orbit and launch window in the first half of September. Our current expectation is that we will launch in the first half of September. So this is ultimately based on a variety of factors outside our control, including the weather conditions. As the target date is finalized, we will communicate this with the public. To put our first commercial satellite into orbit, release a culmination of significant progress to the date. I am incredibly proud of our team. We have spent over seven years and over $1 billion investment to get to this point, along the way generating over 3,400 patent and patent pending claims, completing the assembly, testing, and other logistics to ensure that our BlueBird were ready to transport to Florida and were ready to launch is a major milestone for our company and mission. These BlueBird's will each be the largest communications array ever to be deployed commercially into loaded orbit. These arrays provide a strong signal that can reach standard smartphones directly to provide cellular broadband service and other non-communication government applications. With these initial commercial satellites, we are targeting nearly 100% geographical coverage for the continental United States using premium 850 MHz low-band spectrum, which offers superior signal penetration in the low-band spectrum range. Low-band frequencies travel longer distances and penetrate deeper into buildings and through foliage compared to higher frequencies. These first five satellites will provide non-continuous cellular broadband service nationwide across the United States. After a few months of in-orbit service activation, this initial service for AT&T and Verizon beta test users will start with 5,600 sales across the country. This progress was made possible in large part due to the continued and growing support of our strategic partners. During the second quarter, we secured another major strategic financing partner and customer, adding Verizon to a top tier group that also include AT&T, Vodafone, Google, American Tower, Rakuten, Bell Canada and others. This 100 million commitments from Verizon, including 65 million of commercial prepayments and 35 million convertible notes just a few months after strategic financing with AT&T, Google and Vodafone. It's another powerful validation of our technology and our business model. This investment closely followed the definitive and commercial agreement announced with AT&T in May. Bringing on Board two major U.S. mobile operators in the most valuable wireless market in the world was a transformational commercial milestone for us. During the last few months, we shifted our manufacturing focus to increase Block 2 production, incorporating the lesson learned from manufacturing of the first five commercial satellites. We are continue planning and initial production for the first 17 Block satellites to rebuilding phases within the initial launch in Q1 of 2025. These satellites, when equipped with our ASIC will be approximately 2,400 square feet in size and are expected to support up to 10 fold improvement of processing bandwidth per satellite compared to Block 1 satellite that we are launching this September. We expect to start using our ASIC on our six Block 2 satellite and we can use existing FPGA configuration for as long as it's required. Alongside this activity, we have not lost sight of our technology roadmap. We can now report that we have completed the ASIC chip tape out with the S&C. This technology is the cornerstone of our Bloomberg Block 2 programs. The AST5000 ASIC is a novel, constant low power architecture developed to enable up to a 10 fold improvement in processing bandwidth on each satellite, unlocking opportunity for seamless Space-Based cellular broadband services worldwide. With the 3 bits per hertz that we have demonstrated using BlueWalker 3 and our planning commercial satellite capacity of up to 40 megahertz per beam, this translating to performance of up to 120 megahertz peak data rates. The completion of the tape out is a milestone that marked the culmination of five years of dedicated research, development and engineering expertise with approximately 45 million all developed. In summary, we want to change the world. We're seeking to connect the billions of people who are not connected, improving public safety, enabling global commerce and for the average user who can see fewer drop calls, frustrating dead zones and missing connections. This has not been easy, as we enter a new phase for our company and deeply proud of the team we have assembled and confident in the plan ahead of us. I will now pass to Scott to provide more details on our commercial and regulatory process. Scott Wisniewski: Thank you, Abel. As we accelerate the commercialization of our network, I wanted to spend a few moments to go through the commercial and regulatory progress during the quarter, including some early wins to the first five commercial satellites. Earlier this month, we received an initial license for Space-Based operations in the U.S. from the FCC. This initial license authorizes AST SpaceMobile to operate using V, F and UHF frequencies to support our gateway, theater link, and telemetry tracking and control operations for the first five commercial BlueBird satellites. This license will serve as our primary license for operations in the U.S. over the life of the constellation. So it was a big deal for the company and our commercialization both in the U.S. and as a blueprint globally. Going forward, we continue to work with the FCC as well as our partners AT&T and Verizon to apply for upgrades and modifications to this license to facilitate full scale commercial operations on wireless frequencies and to expand the license to support our operations over time. This FCC authorization followed the March 2024 update of our constellation filings with the International Telecommunication Union and related filings with the FCC that placed our planned commercial satellites under the jurisdiction of the United States. This initiative represented a closer strategic alignment of our network build-out and future network operations with the United States and is a key piece of our overall regulatory strategy. In addition to the progress Abel reported with AT&T and Verizon, we continue to believe our patented technology, including our large phased array antenna technology in space, creates significant opportunities for new mission-critical capabilities in the government sector. We are moving forward with these dual use capabilities on our constellation and expect to generate revenue from both commercial and government applications. To this effect, earlier this year, we announced that AST SpaceMobile had been awarded a new contract through a prime contractor working with the United States government. This initial phase contract, which covers the use of BlueWalker 3 as well as the first five commercial satellites, is well underway and during the second quarter, we completed successful in orbit and ground tests, resulting in completed contractual milestones and top-line revenue. This government sector strategy continues to show additional early signs of strength with two new U.S. government contract awards in recent months to one of our prime contractors. Like the February contract, these awards represent relatively small revenue by themselves, but seek to evaluate potential for full scale, multi-year contracted services in the future. As is customary, contracts for these two new opportunities are still being finalized and we will provide detail if and when it becomes available. Our primary commercialization strategy is to position for significant revenue opportunities as we scale the constellation, but this initial progress is encouraging and we believe the progress represents an upgraded outlook for additional and larger signed contract awards over time. With that, I will now pass it to Andy Johnson, our new Chief Financial Officer, to take you through the financial update. Andy Johnson: Thanks, Scott, and good afternoon, everyone. I joined AST this past May because I believe wholeheartedly in the company's mission to close the digital divide by connecting young connected and was convinced that this was a once in a lifetime opportunity after visiting the manufacturing facilities in Midland, Texas. There I saw firsthand the sophistication of the company's technology and most importantly, the incredible commitment of our team, led by Abel, and producing the world's first Space-Based cellular broadband service satellites. This is a seminal moment in the history of AST SpaceMobile, and I want to personally thank all of my teammates for their dedication to our mission and delivering our first five commercial BlueBird satellites for launch in just a few short weeks. I also want to thank Sean Wallace, our former CFO, who continues to consult for us for his leadership, service to the company and partnership in making my transition seamless. It's a fantastic time to be a part of the AST SpaceMobile ecosystem, which includes our shareholders, our talented employees across the globe, and our mobile network operator partners. We are at the forefront of our commercial constellation deployment and I deeply appreciate those of you who are on this life changing journey with us. Let's review the key operating metrics for the second quarter that are displayed on Slide 10. On the first chart, we see for the second quarter of 2024, we had non-GAAP adjusted cash operating expenses of $34.6 million versus $31.1 million in the first quarter. Non-GAAP adjusted operating expenses excludes certain non-cash operating costs, including depreciation and amortization and stock-based compensation. These expenses are up slightly from the first quarter due to final Block 1 expenses as we neared the finish line of producing five of the largest satellites ever to be deployed in low Earth orbit, including required travel expenses to the production site in Texas, expedited hiring of engineering talent in connection with our Block 2 mechanical work, as we ramp up production of our next satellites and the impact of an approximately 1 million one-time G&A expense reversal in Q1 that affects the quarter-over-quarter comparison. Turning towards the second chart in this page, our capital expenditures for the second quarter were $21.2 million versus $26.6 million for the first quarter. The figure was made up of capitalized direct materials and labor for Block 1 and Block 2 satellites and additional facility and production equipment for our 185,000 square foot assembly, integration and test facilities in Midland. As expected, capital expenditures trended down in connection with the completion of the Block 1 satellites ahead of ramping Block 2 production. By the end of the second quarter, we incurred and paid all amounts for the five Block 1 satellites. Total spend for those satellites did not materially exceed our prior estimate of $115 million. The design, integration, testing, and launch of satellites and related ground infrastructure is capital intensive. We do expect our experience completing Block 1 will allow us to leverage our learnings to improve and optimize manufacturing costs for our Block 2 satellites. And on the final chart on this slide, we ended the second quarter with $287.6 million in cash, up from $212.4 million at the end of the first quarter. This increase includes $55 million of previously announced investment from our valued M&O partner Verizon, inclusive of a $20 million prepayment for future cellular broadband service. Our strengthened cash position at the end of Q2 also reflects our disciplined and effective use of our now completed at-the-market or ATM equity facility, from which we raised approximately $80 million during the quarter at increasing market prices for our common stock. As of the end of July, we completed the two-year use of the existing ATM facility and the existing common stock purchase facility with $164 million of total raise to support operating expenses and preserve our capital for building the constellation. During this two-year period, we were prudent in our timing and use of these facilities, consuming less than 75% of the combined facility's capacity and raising capital at more than a 50% premium to our stock's volume weighted average price. We continue to consider using the balance of our senior credit facility, which has a gross amount available to us of $51.5 million. Today, however, our efforts around raising strategic capital, including non-dilutive prepayments from our M&O partners as we ready for service are taking precedence over the senior credit facility, which in turn continues to reduce negative carry we would have incurred if we had accessed the facility earlier. Our ability to access this facility remains subject to certain conditions and approvals. I'd like to reiterate that we currently have no plans for the remainder of this year to pursue an underwritten public equity offering. We previously provided guidance on our expected operating expense levels. We have been supporting the development and production efforts of our two critical satellite designs, Block 1 and Block 2, our ASIC chip design, and the five Block 1 satellites. The completion of this Block 1 work and a significant portion of the Block 2 development and ASIC tape out completion is expected to result in a reduction in our adjusted operating expenses and capital expenditures in future periods. Consistent with the first and second quarters of 2024, we continue to project that our adjusted cash operating expenses for the remainder of the year will come in within a range of $30 million to $35 million per quarter based on business conditions and speed of constellation deployment and as the Block 2 design approaches completion and our focus turns to scaled production. We believe efforts to optimize our OpEx will result in a run rate at the low end of that range. These figures will vary depending upon manufacturing activity in each period. This guidance does not include the expected costs of approximately $15 million related to the tape out and initial production of our ASIC chips. These ASIC-related costs will be recognized as an R&D expense in subsequent quarters in 2024 as milestones are completed. Timing of the changes in our adjusted operating expenditures and capital expenditures as I have just described could be delayed or may not be realized due to a variety of factors. Finally, we continue to work on developing a financing package from export credit agencies to source cost effective long-term debt funding of large projects. We will keep you abreast of our progress. It's been a fantastic first 90 days. I look forward in the future to getting to know many of you and working hard to drive value for our shareholders as we position AST for full scale commercial operations. And with that, this completes the presentation component of our earnings call and I pass it back to Scott. Scott Wisniewski: Thank you, Andy. Before we go to the queue of analyst questions, we'd like to address a few of the questions submitted by our investors. Operator, could you please start us off with the first question. Operator: Tanner asks, will you wait until the first BB Block 2 is launched and unfolded before working on additional BB? Abel Avellan: Thanks, Tanner for the question. No, the answer is no. We're already working on the next build of the subsequent satellites. We are actually in the process of building parts for the next 17 satellites. The main mechanical system is changes and upgrades, but it's basically the same as BlueWalker 3 and Block 1 and we will not wait for that deployment to continue building. So we're in the process of building we actually started a few months back our next satellites built. With the next satellite, we have a satellite that will be equipped with the FPGA and a satellite that will be equipped with the ASIC. And the first launch of four will be based on FPGAs, and the subsequent satellites will be Block 2 -- first four Block 2 and the subsequent after that will be all based on ASIC, which is a 10 fold improvement compared to the FPGA. And we're fully focused on -- in building our next batch of satellites and to get them on the air as soon as possible. Operator: Matt asked, you mentioned that full U.S. coverage is the first priority. What regions will you look to fulfill next and in what timeframe? Abel Avellan: Hey Matt, thank you for the question. Yes, our -- obviously the U.S. market is the largest a more developed wireless market. In this market we have AT&T and Verizon and yet, we will be prioritizing deployment for the U.S. market. Then we will prioritize investors and M&Os that are paying prepaid revenue. That includes Vodafone markets, that include Rakuten in Japan and then new M&Os that are going to be prepaid for initialization of the service as a priority. We are launching on a 50 degree of inclination. So basically we can cover all the latitudes from 59 degrees north to 59 degrees south. So we have the benefit of being able to select the regions that we prioritize according to prepayment priorities set by new investors. Operator: Cody asked, what concerns does the company have being that we are currently in a solar maximum. How susceptible are your satellites to solar storms? Abel Avellan: Thank you, Cody for the question. Well, first of all, before I answer the question, let me remind everybody about how we design these satellites. These satellites -- they're big, they are built out of identical modules that we call microns that make this satellite system very resilient and it's built out of a distributed system that no one single part can make the satellite to fail and that make it very resilient to the space weather, including solar storms and other conditions. We had all the data that we have collected over two years operating BlueWalker 3 and we really -- of course, we have needed a time to react to solar activities but never having a failure caused by it. So we are very confident on our satellites resilient is where need to be as it relates to weather conditions. Operator: Tanner asked after the first BB Block 2, how many at a time will be launched? Abel Avellan: Okay. Well we have decided -- thank you, Tanner for the question. But we have decided the system to be launch agnostic. So we basically envelop our profile to able to support basically every large or medium launch service provider, launch systems. And depending on the size of the launch, I mean on Block 1 we're launching five satellites in a Falcon 9. And depending on the launch configuration and the launch vehicle, it will be anywhere between four per launch for the new larger Block 2s or eight per launch depending on the launch vehicles. Scott Wisniewski: And with that, I'd like to thank our shareholders for submitting these questions. Operator, let's open the call to analyst questions now. Operator: Thank you. We will now be conducting a question-and-answer session. [Operator Instructions]. And our first question comes from the line of Griffin Boss with B. Riley Securities. Please proceed with your question. Griffin Boss: Hi, good afternoon. Thanks for taking my questions. So first for me, the 17 satellites under construction is certainly more than what we expected. How would you characterize your current production capacity? I know in the past, you've discussed expectations to reach something, I think equivalent to six satellite per month cadence. Have you reached that? Are you tracking better? Any more color would be helpful. Abel Avellan: Yes. I mean, when we say 17 satellites that referred to the subsystem that we are producing. They don't need to be all produced at the same time. So we actually time them. So we start with the long lead items. We start them first. The parts that take more time to get out of the factory, they are being produced for 17 units. And for that, we buy parts in advance. We start manufacturing them way in advance. And as we need it, so we keep ordering the different parts for the system. Yes, we're ramping up. We are accelerating our production cadence. Going through the five first commercials that we're launching now in September has helped us to expand our production capacity. Also going forward, we have work on vertically integrating around 95% of the subsystems. So we either control the IP, manufacture by ourselves, and control the manufacturing process for around 95% of the satellites that are on build going forward. Griffin Boss: Great. Thanks, Abel, for that color. Appreciate it. And in terms of the initial Block 2 satellite launch, are you still tracking for the late 4Q, early 2025, kind of launch window there? Are there any delays or issues you're seeing with the launch provider? Abel Avellan: No, we're still tracking for Q1 2025. Griffin Boss: Okay. Great, great. Glad to hear it. And then, so Scott, there was sort of an informal interview with you recently on a financial blog where you cited some ARPU assumptions for the U.S. I can't recall hearing the company formally mention potential ARPU in the past. So I would love it if there are any assumptions or expectations for ARPU you can share it today, especially now that you've got two definitive agreements under your belt? Scott Wisniewski: Hey Griffin, how you're doing? No, we've been making a lot of progress with commercial agreements, and alongside that, been advancing our go-to-market strategies, as you would expect. We don't have any pricing or go-to-market strategies to report at this time. And I think that article was misquoted. But we're very excited about the revenue share model that we've been pushing for a long time, and we're very excited about the adoption rates and the ability to command a good wallet on this service. So no pricing guidance at this time, but I would say that go-to-market planning has definitely accelerated. Griffin Boss: Okay. Got it. Understood. Thanks, Scott. And last for me, very quickly, I'll pass it off; I just want to confirm that this new contract liabilities line item we're seeing in the statement of cash flows is that reflecting the Verizon revenue commitment? Or is that something else? Andy Johnson: Yes, this is Andy, Griffin. I do think it's the revenue commitments against the prepayments and so forth, so none of that's revenue at this point yet until the services are initiated. Griffin Boss: Got it. Okay. Thanks, Andy, and welcome to the company, and thanks for taking my questions, everyone. Operator: Thank you. Our next questions come from the line of Benjamin Soff with Deutsche Bank. Please proceed with your question. Benjamin Soff: Yes. Hey guys, thanks for taking the question. Exciting quarter with a lot of interesting development. I was wondering, now that the satellites are on-site in Florida, can you walk us through the timeline and key milestones between launching in early September until you get to commercial service? Abel Avellan: Yes, we actually -- hi, Ben, how are you? So we actually indicate now, we were on final preparation for launch. The plan is to launch early September, first half of September. We anticipate few months to basically activate service on those first five satellites. We have two type of users already booked on them. One is a Gorman user, and then we have our MNOs. We are prioritizing U.S., Vodafone, and our investors and people that have an MNOs that are preparing or are going to prepare for services. So in terms of timeline is, we launch a few months to activate services, and then we are already preparing and have prepared all the ground infrastructure to start connecting to the spacecraft. So we will have some early usage immediately after for the Gorman, in parallel with the MNOs. Benjamin Soff: Okay. Great. And then just going back to the 17 Block 2 satellites, do you have any updated thoughts on the cost per satellite and the timing to launch those? Abel Avellan: Yes. We are maintaining our guidance on cost. Actually, we continue to look for ways to continue to improve our cost basis, as we are getting close to 95% vertical integration, but the guidance per satellite remain the same. And as I said, we're starting a launch campaign, starting in Q1 and then following-up with additional launches as the satellites are ready and the launches are available. Benjamin Soff: Okay. Great. Thanks, guys. Operator: Thank you. Our next question comes from the line of Chris Schoell with UBS. Please proceed with your question. Chris Schoell: Great. Thank you. We've seen a number of regulatory milestones here in recent months. Can you help us think through your remaining approval process here in the U.S. and the likely timeline for that? And I think there was general optimism previously that other countries could follow suit with similar rulemaking to the U.S. Have you seen any evidence of that to-date? Scott Wisniewski: Hey Chris, it's Scott here. Yes, so clearly, we're happy with the progress this year on the regulatory front, as we mentioned in our remarks. And the FCC does truly play a leadership role globally with other countries. So in our initial markets, we're working with our close partners on moving all the regulatory processes forward. We've been relatively pleased with how that's progressed with no showstoppers, really. We really view it as a process that we go through diligently and that the FCCs demonstrated a lot of leadership this year with developing new rules for supplemental coverage from space and things like that. So for us, I think initial markets are trending positively in the U.S. Next milestones to look for, there'll be a lot of filings going forward. I think part of commercial service is just there's a lot of regular filings that come. So there'll be filings about gateways on the ground. There'll be filings about test campaigns on when we first start getting Block 1 going. And then the big one is SCS rights in the U.S. with the FCC. So that's something that will be -- they'll start seeing filings on that with us and with our two partners in the U.S. Chris Schoell: Okay. Great. And if I can just fit in one more, I think you mentioned no public equity offering this year, but as you look toward Block 2 and beyond, can you just help us think through the timing of additional funding requirements and how do you think about the trade-offs for different capital sources going forward? Thank you. Andy Johnson: Sure. This is Andy. Chris, thanks for the question. So as we noted, I think our priority right now is to continue our current operating model of working on prepayment relationships with our MNO partners. That's been a very effective way to raise required capital. And we have a number of MNO partners that we're making progress with in that respect. So non-dilutive approach is sort of how we're viewing our near-term opportunity. We also have, in that same vein, we have the opportunity to realize certain milestones in connection with the launch with respect to our existing MNO partners among Vodafone and AT&T and Verizon, which could be meaningful capital. And we'll continue to analyze what's available to us. We're very cognizant of different capital structures, debt, equity opportunities, but we wanted to reiterate the fact that we are focused on being good custodians and weighing the capital needs that are inherent to a satellite business that's as capital-intensive as we are with the fact that our shareholders expect us to be responsible as it relates to dilution. So I reiterated our point from last quarter that we have no current plans to do a public security equities offering. And that's our plan for the end of 2024. And that we think we have a lot of opportunity to continue to make progress on cash as we optimize some of our expenses and turn toward a real focus on Block 2 for the remaining four or five months of the year. Chris Schoell: Great. Thank you very much. Operator: Thank you. Our next question comes from the line of Chris Quilty with Quilty Analytics. Please proceed with your question. Chris Quilty: Thank you. So, I noted that in the press release, you mentioned that there is an outlook for larger size government contract awards. And I mean, are we talking kind of like Phase 3 or some OTAs or a budget line item in terms of the types of programs that you might be able to participate in? Scott Wisniewski: Hey Chris, yes, Scott here. I think all of the above are on the table, Chris, over time, right? The contracts that we announced earlier in the year and then the awards we referenced on this call, these are all, like I said, early opportunities, small revenue, kind of the fewer Phase 1 type of stuff that you referred to. But as you know, the intent of programs like that is not to do a science project, but rather to build out a capability. And so that's what we're referring to in our remarks that initial tests are going well. Other initial contracts awards have been made through our prime contractor partners. And the outlook for those has improved. Chris Quilty: Got you. And mentioning your prime contractors, some of those are involved in the PLEO contract. Is it fair to assume that that could be a potential vehicle for funding or --? Scott Wisniewski: We don't want to comment on specific programs at this time, Chris. Chris Quilty: Also, just back to the ASIC, I mean, is it fair to assume that the ASIC production or delivery into production is sort of the gating factor for -- scaling up to the full Block 2 satellites? Abel Avellan: No, Chris. I mean, the size of the satellite, the 2,400 square feet, the largest size for Block 2 is independent, if they are equipped with FPGA or ASIC. We have completed the ASIC FPGA tape out. The first launches will be still on an FPGA configuration, but we can keep launching on FPGA for as long as is needed. So there is not a prerequisite for launches. But of course, we want to incorporate the ASIC as that is a 10x increase in capacity per satellite. And we're very happy to conclude the tape out. It's -- we received the first dive several weeks back, and we're incorporating into our micron design as we continue to build the next batch of satellites. Chris Quilty: Great. Thanks for all the details. Operator: Thank you. At this time, I'm showing no further questions. I would like to turn the call back over to management for closing remarks. Scott Wisniewski: Thank you, Operator. We're building a Space-Based cellular broadband network designed for the use of the phone in your pocket today, and other government applications. We want to thank all of our shareholders and the research analysts for joining the call and everyone's continued strong support of our mission, and we look forward to the upcoming launch. Thank you. Operator: And this concludes today's conference. You may disconnect your lines at this time. Thank you for your participation.

AST SpaceMobile's Market Position and Recent Downgrade

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.