AST SpaceMobile, Inc. (ASTS) on Q4 2023 Results - Earnings Call Transcript

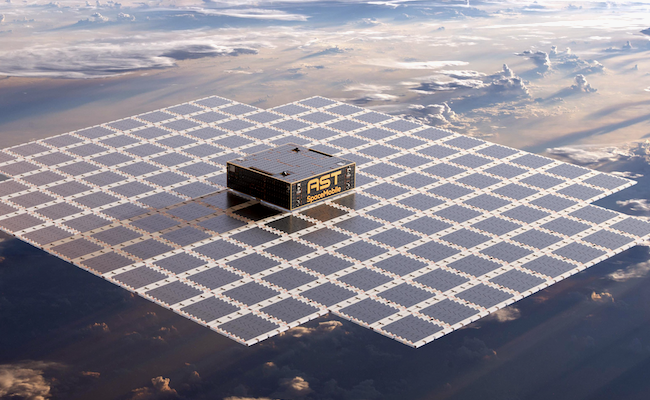

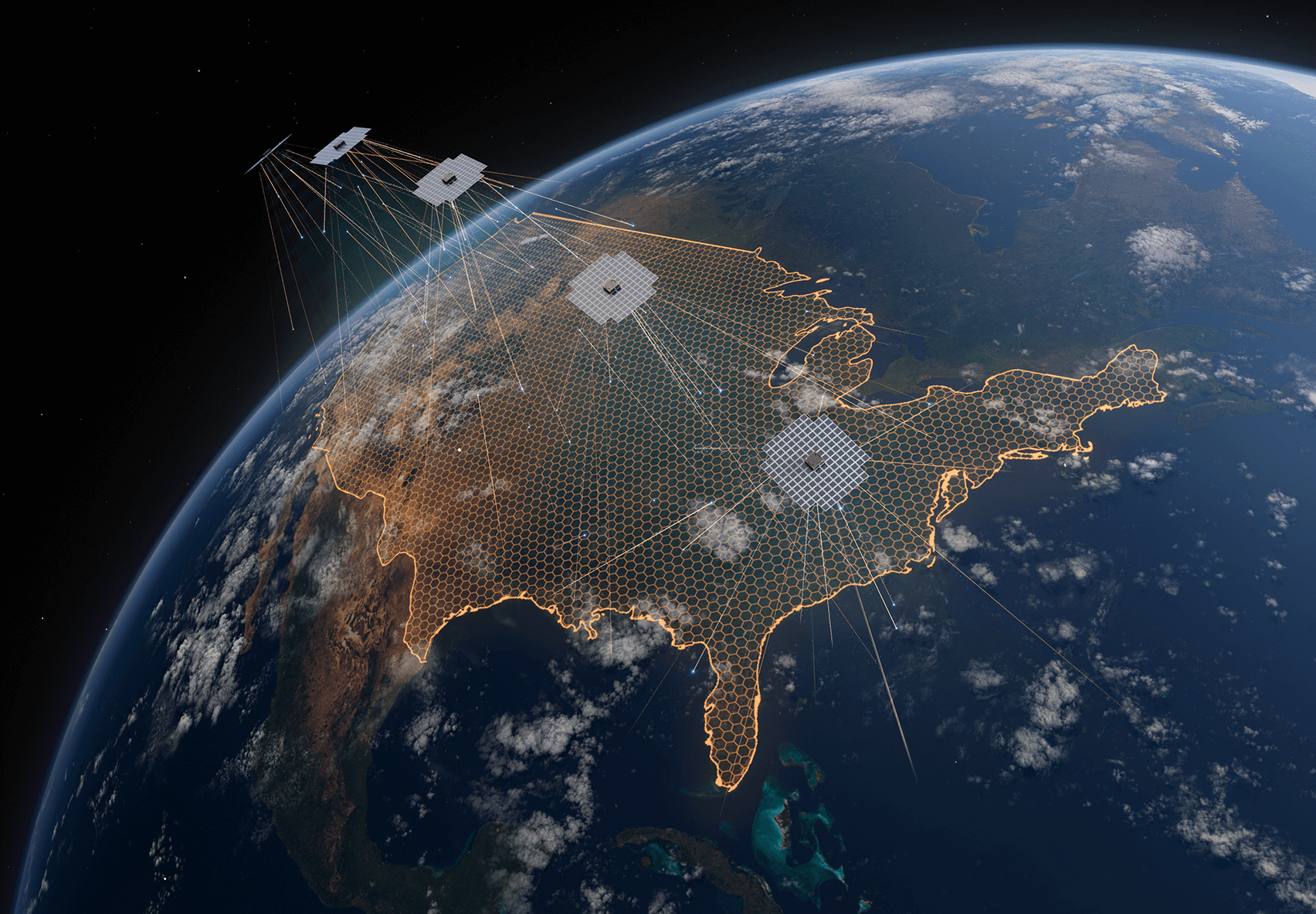

Operator: Good day, and thank you for standing by. Welcome to the AST SpaceMobile Fourth Quarter 2023 Business Update Call. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your host today, Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Please go ahead. Scott Wisniewski: Thank you, and good afternoon, everyone. Let me refer you to Page 2 of the presentation, which contains our safe harbor disclaimer. During today's call, we may make certain forward-looking statements. These statements are based on current expectations and assumptions, and as a result, are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST SpaceMobile's annual report on Form 10-K for the year ended December 31, 2023, with the Securities and Exchange Commission and other documents filed by AST SpaceMobile with the SEC from time to time. Readers are cautioned not to put undue reliance on forward-looking statements, and the company specifically disclaims any obligation to update the forward-looking statements that may be discussed during this call. Also, after our initial remarks, we will be starting our Q&A section with questions submitted in advance by our shareholders. Now referring to Page 3. For those of you who may be new to our company and our mission, there are over 5 billion mobile phones in use today around the world, but many of us still experience gaps in coverage as we live, work, and travel. Additionally, there are billions of people without cellular broadband who remain unconnected to the global digital economy. These markets that we are pursuing are massive, and the problem we are solving is important and touches nearly all of us. In this backdrop, AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with everyday unmodified mobile devices, supported by our extensive IP and patent portfolio and design for both commercial and government use. With that, I would like to introduce Chairman and CEO, Abel Avellan. Abel Avellan: Thank you, Scott. I would like to welcome everybody to our Q4 2023 business update call. It has been an incredibly busy few months here at AST SpaceMobile, and I will walk you through updates on our key areas of focus today. First, at the start of the year, we announced strategic investments from AT&T, Google, and Vodafone, which represent a vote of confidence in our technology and business model. With this, we have the necessary funding on hand to execute near-term strategic plans for the launch of Five 700 square foot Block 1 BlueBird satellites and the initial next-generation 2,400-square-foot Bluebirds, which will surpass Block 1 as the largest phased array in low Earth orbit. We’re also very excited to continuing to advance this caution with additional strategic partners following the blueprint of strategic investment alongside commercial payments. Another great development on our commercialization was the new contract award we announced with the United States government through a prime contractor, which we believe will open the door for dual-use commercial and government applications of our satellites. On the regulatory front, we have received great news recently with the new FCC rules, which will provide a pathway to log over 200 megahertz of a spectrum for direct-to-device to support the rollout of our technology. The FCC voted March 14 to approve the supplemental coverage from this space, which was published in February. This should facilitate AST’s SpaceMobile FCC application to provide commercial services in the U.S. This will simplify the overall application process by making the standard rules, which will cover the majority of AST SpaceMobile applications. We anticipate many regulatory entities globally will follow the new U.S. regulatory regime to regulate our services. We’re starting to see this in large countries like Brazil. Moving to manufacturing, our 185,000-square-foot Texas facilities are fully operational with production, assembly, and testing. Unfortunately, production was negatively impacted primarily by two suppliers, leading to delays in integration and testing for these five 700-square-foot Block I Bluebirds, while we have also faced initial challenges on the manufacturing of our new upgrade Microns to be used for Block I and Block II. In order to accelerate production of our next satellites and reduce dependency on outside suppliers, we acquired a license to manufacture one of the components and replace the other supplier with our own IP and design. At the same time, while rapidly stabilizing our Micron production line, this is important because these are the same Micron building blocks for our next satellite launch. With the supplier fixes, we will be able to manufacture in-house and through our third parties of our own IP approximately 95% of all satellites subsystems for our next generation Block II Bluebird satellite, securing our supply chain further. Next, I can share updates on our orbital launches to provide a near-term timeline. We expect that the five 700-foot Block I Bluebird satellite will be transported from our assembly facility to the launch site between July and August 2024. And looking ahead, we have secured an additional launch contract for the first 2400-square-foot next generation Block II Bluebird satellite with a contract launch window from December 2024 to March 2025, which will surpass Block I as the largest phase array in loaded orbits. Also, as we announced last week, our Custom ASIC entered the Tape-Out phase, which is planned to enable 120 megabits peak data rate on 40-megahertz spectrum channels. This novel custom and low-power architecture was developed to enable up to tenfold improvement in processing bandwidth on each next generation 2400-square-foot Block II Bluebird satellite. The design of our Custom ASIC with a processing bandwidth of approximately 10,000 megahertz per satellite along with the large phase array is the enabler of true space-based cellular broadband with a relatively small number of satellites. This effort represents over four years equivalent to an estimated 150 man-years of intensive work, as well as approximately 45 million of development on the ASIC alone. And lastly, in addition to the strategic discussion referred earlier, we are very excited to have received three non-binding letters of interest for non-deluded quasi-governmental funding. As a result, we have initiated the process with these funding sources. And Sean will be explaining more to you about this. Turning to page five, the investment from AT&T, Google, and Vodafone are of great significance for us as they are some of our largest prospective customers alongside the U.S. government. With Google in particular, the agreement to collaborate on product development will be a great benefit for our prospective MNO customers. We had agreements and understanding with more than 40 mobile network operators globally which have over 2 billion existing subscribers globally. AT&T and Google joined Vodafone, Rakuten, American Tower, and Bell Canada as investors. I could not be more proud to have these great organizations alongside us on the execution of our mission. And as I stated before, we continue to advance discussion with additional strategic partners following the blueprint of strategic investments alongside commercial payments. Turning to page six, a few weeks ago, we announced a new contract award with the United States government through a prime contractor. I want to take a step back on what is the opportunity here. Our large phase array antenna technology in space is able to address many potential opportunities for mission-critical capabilities in the government sector. The large aperture and high power delivered into orbit at a low cost compared with historical benchmark fit the desired governmental model for capturing commercial networks with dual-use capabilities. And while we remain focused on a large commercial opportunity for our business, we’re excited about initiatives underway with the U.S. government as well. We have begun recording initial revenue under this contract in Q1 2024. Also, there are potential other awards including additional phases of this contract available to us in calendar year 2024. Turning to page seven, I want to take a moment to walk through why having our own ASIC is really a big deal and is critical to achieve true broadband from space. Our novel custom and low-power architecture was developed to enable up to tenfold improvement in processing bandwidth on each satellite. Satellites will be lighter, cheaper to produce, and will require less mass to orbit. The tape-out will be completed with TSMC, the world’s leading foundry following work with leaders in the semiconductor industry over the last years. For those of you who are not familiar with the industry jargon, the tape-out means that we and our development partners complete the design of the ASIC. After four years of work and $45 million of investment, we have now formally handed over those designs to TSMC to produce the chip for the initial set of ASICs to enable the 2,400-square-foot next-generation Block 2 Bluebirds, which we’ll be expecting to receive later this year. I am extremely proud of the team’s effort to reach this critical milestone. Our ASIC, along with our large antenna, will enable up to 120 megabits per second data rates per bin on 40-megahertz channels and 10,000 megahertz of processing bandwidth. That, combined with our large space array, is the key enabler for true broadband from space to the phone that you have already in your pocket. I will now pass it to Scott to provide a brief regulatory update. Scott Wisniewski: Thank you, Abel. On page 8, I’ll take us through some of the important progress on the regulatory front. To provide a reminder for everyone, we made our first filings with the FCC back in 2020, and we’ve been in front of them regularly around direct-to-device using standard unmodified cellular phones from a very early stage. Importantly, the unanimous decision to adopt the new rules in March facilitates our FCC application to provide commercial service in the U.S. because it specifically enables over 200 megahertz of low-band frequencies for direct-to-device use. And just prior to this FCC vote, we also filed an updated application to reflect a licensing jurisdiction with the U.S. This represents a closer strategic alignment of AST SpaceMobile’s network build-out and future network operations in the United States. And internationally, Brazil announced an initial regulatory framework for direct-to-device as well. This framework enables us to test in Brazil with TIM Brazil and Claro, a subsidiary of American Mobile. And with that, I’ll hand it off to Sean for our financial update. Sean Wallace: Thanks, Scott, and good afternoon, everyone. The AST SpaceMobile business continued to make progress this quarter with a significant fundraising in January, continued work on the regulatory front, and a substantial level of activity in our assembly, integration, and testing facility in Midland, focusing on the production of 5 BB1 satellites. I would also like to point out that we have entered the tape-out phase of our custom ASIC chip. The ASIC chip will provide for increases in processing capacity that will significantly raise the inventory of gigabytes on future planned satellites we can sell through our M&O partners to end users. The ASIC design has been an almost four-year process supported by a large investment which we believe will be difficult for competing systems to develop from a standing start. As we get closer to the completion of the production of our 5 Block 1 satellites, I want to recognize and thank the hardworking team of engineers, technicians, and suppliers who are completing this incredible task. We believe our strategy of backward integration into the assembly, integration, and testing of satellites will enable us to build our constellation years ahead of an outsource strategy and at a lower cost. I want to move on to reviewing our key operating metrics for the fourth quarter that are displayed on slide nine. On the first chart, we see the fourth quarter of 2023, we had non-GAAP adjusted cash operating expenses of $38.6 million versus $37.3 million in the third quarter. Non-GAAP adjusted operating expenses excludes certain non-cash operating costs including depreciation and amortization and stock-based compensation. Our fourth quarter non-GAAP adjusted operating expenses increased by $1.3 million versus the third quarter. Our research and development expenses rose by $1.5 million this quarter due to increased expenditures on engineering models and prototypes in connection with our manufacturing process. Our R&D expenses consist primarily of non-recurring development activities for which we typically engage third-party vendors and payments are based on the completion of milestones. Our engineering services expenses increased by $0.5 million and our general administration expenses decreased by $0.6 million in the fourth quarter as compared to the third quarter. Turning towards the second chart on this page, our capital expenditures for the fourth quarter were $33.9 million versus $71.7 million for the third quarter. This figure was made up of some modest launch payments, capitalized direct materials for the Block 1 satellite, additional facility and production equipment for our assembly, integration, and test facility in Midland, and the delivery of commercial-grade software from Nokia. As of the end of the fourth quarter, we have spent over 90% of the expected amounts for the 5 Block 1 satellites. We are still projecting to spend approximately $115 million for the 5 BB1 satellites. And on the final chart on this slide, we ended the first quarter with $210.8 million in cash. We are continuing to pursue using the balance of our senior credit facility, which would add an amount of capital in the low 40s. Efforts around raising strategic capital may take precedence over the senior credit facility, and at a minimum, the deferment has reduced a bit of the negative carry we would have incurred if we had accessed the facility earlier. As we stated in our 10-K, we believe this cash, as well as our ability to raise capital through our existing facilities, is sufficient to support our expenditures for at least the next 12 months. As we have also discussed in our 10-K, our cost positions and capital plans are quite modular, and this characteristic provides us the flexibility to increase or decrease our rate of expenditures depending upon changes in our build-out plans and availability of capital. This flexibility provides us comfort that we can manage our liquidity profile dynamically, depending on our rate of raising capital. Earlier this year, we provided guidance on our expected operating expense levels. We have been supporting the development of efforts of our two critical satellite designs, Block 1 and Block 2, our ASIC chip design, and the construction of 5 BB1 satellites. The completion of this BB1 work and a significant portion of the BB2 and ASIC design work is expected to result in a material reduction in our adjusted operating expenses and future capital expenditures. This reduction in cash expenditures will be done without a material reduction in our employment headcount, as most of these reductions are related to the completion of third-party work. Overall, our adjusted operating expenses is expected to decline from an average of $38.7 million per quarter during 2023 to an average of $30 million per quarter for 2024 as the Block 1 design is completed and the Block 2 design approaches completion. These figures will vary depending upon manufacturing activity in each period. This guidance does not include the expected costs of approximately $15 million related to the tape-out and initial production of our ASIC chips. These ASIC-related costs will be recognized as an R&D expense in subsequent quarters in 2024 as the milestones are completed. We also plan to reduce our outlook for capital expenditures as we reach the final investment for BB1. The next three quarters we expect to spend in the aggregate approximately $50 million to $60 million in capital expenditures. Any increase beyond these levels will be in conjunction with the timing of the deployment of our Block 2 satellites, which could be either in late 2024 or the first quarter of 2025. Timing of the changes in our adjusted operating expenditures and capital expenditures, as I have just described, could be delayed or may not be realized due to a variety of factors. On a final note, I’d like to provide some additional detail on one of our additional funding strategies, which is a complement to our recent strategic round. Satellite and other infrastructure providers have historically utilized government and quasi-government institutions, which are known as export credit agencies, to source cost-effective, long-term debt funding of large projects. The key underpinning of these funding structures has been proven technology and the sale of significant capacity through long-term agreements to large credit-worthy entities. We have begun the process of approaching these funding institutions, which includes the hiring of an advisor and developing marketing materials. After preliminary discussions with a few of these agencies, we have received letters which indicate their willingness to evaluate this type of financing with us. We are in the very early stages of this process, and as we progress, I will provide updates on these potential financings. There can be no assurance that we will be successful in the pursuit of this type of financing and funding. And with that, this completes the presentation component of our earnings call, and I pass it back to Scott. Scott Wisniewski: Thank you, Sean. Before we go to the queue of analyst questions, we’d like to address a few of the questions submitted ahead of the call by our investors. Operator, could you please start us off with the first question? Operator: Q - Unidentified Analyst: Trevor [ph] from Colorado asks, where is the company on scaling up production to be able to meet the four satellites per month figures? Will that production begin immediately, or will there be a serious delay while the facilities are being built? Abel Avellan: Thank you, Trevor, for the question. So, first of all, let me report the facilities are fully built. We have all the testing facilities for our built-in house. We do not require in any step of the build of our satellites to be taken out of our facilities. We have 185,000-square-feet facility of manufacturing. Capability, we are with the addition of these two suppliers that cause us problems in Block 1, we are getting to a 95% vertically integrated all the way from the ASIC to all the structures and everything that is required to build and launch this spacecraft. So, we don’t anticipate any delays related to facility building or manufacturing building. Also, the other aspect is the same building block that we use for Block 1, that it took its time to get stabilized and to produce at pace, will be the same parts that we will use for Block 2 and for the satellites going forward. So, of course, our focus right now is putting the Block 1s in orbit. Again, we estimate that we will be at the launch pads around July or August. We’re already working on producing on the next launch that is on a window between December and March. Unidentified Analyst: Christian [ph] from Estonia asks, could you please give comments on $100 million stock offering early this year, reasoning why it was rushed and structured the way it was launched? Sean Wallace: Thank you for that. Taking the advice of our banks, we believe the offering structure we chose was the best route to raise additional capital to complement our strategic capital raise. At the end of the day, the transaction achieved our goal of providing a significant level of funding so that we can continue to pursue our business plan. Moving forward, we will continue to look to raise capital with strategic players in the wireless ecosystem like we did in January, and we are working to raise long-term, low-cost debt capital with export credit agencies as I described during my presentation. I’d also point out that most of the senior management team is aligned with the shareholders as most of their compensation is made up of restricted shares and options. Abel Avellan: So, complemented to Sean’s answer on why we needed to do that public equity deal, we needed to prioritize timing. We needed to complement the investment from AT&T, Google, and Vodafone to keep on target to our production plan and our build and our launches. And at the same time, we have continued and we’re very excited about the additional strategic support that we will continue to have and also the non-diluted funding that Sean and the team is working on in order to complement strategic financing with non-diluted financing, which is why we have commenced to receive a letter of interest on that regard in addition with prepayments from MNOs and government payments. Unidentified Analyst: Dennis [ph] from Chile asks, due to their larger size, do Bluebird satellites in Block 2 need a SpaceX Starship rocket to be launched? Abel Avellan: Thank you, Dennis, for the question. No, the answer is no. As a matter of fact, we’re launching five Bluebird 1s in the next launch. And we can launch also on Falcon 9. And other providers, including the one that we’ll be using for our next launch, past the launch for Block 1. So, we have built our satellites to be completely agnostic to what launch provider is used. We obviously count on Falcon 9, Ariane 6, ISRO, the up-and-coming new launchers, future New Glenn, and other launch providers that have medium-to-large-size vehicles. So, the answer to your question is no. We do not require or we’re not counting with the Starship [ph] for our Block 2 launches. Unidentified Analyst: Linden [ph] from New Zealand asks, how does Abel’s appointment as a commissioner of the ITU affect the ASTS mission? Abel Avellan: Thanks Linden. I mean, listen, our mission is to enable broadband globally, regardless where people live, work, and regardless of the phone that they had in their pocket. And the Broadband Commission had a single focus in making sure that the 2.6 billion people that remain unconnected get connected. Now, I do not know any other program that had a global scope that has truly the ability to make a significant dent in the amount of people that get connected to broadband through their phones than our program. So, this is an alignment with the Broadband Commission. In the Broadband Commission, we have great participants like Carlos [ph] Slim, the owner of Telmex in Mexico. We have the chairman of the FCC. We have the chairman of Verizon. We have the chairman of many of the large wireless ecosystem, including a very vibrant and full participation of governments, regulators, and people that core interest is making sure that the fact that connectivity is a human right get instituted on a global basis. So we see this as something that supports our mission. It is a program where we are proud to be part of it. In the Broadband Commissioner, we have many, many new initiatives and tasks, like low-cost funds for democratizing access to knowledge and information, a universal network available to everybody on a global basis. So, we think that this is supportive. It’s part of our work of making sure that everybody, regardless of where they live or work, have access to broadband in their phone. Scott Wisniewski: And with that, I’d like to thank our shareholders for submitting these questions. Operator, let’s open the call to analyst questions now. Operator: Thank you. [Operator Instructions] Our first question comes from the line of Chris Quilty with Quilty Analytics. Please proceed with your question. Chris Quilty: Thanks. Just a first question on the microns and bringing those in-house. When you look at the supply chain for the micron manufacturing, are there any elements of that that you view as particularly difficult or where you might have pricing issues relative to a vendor that might have had higher volumes associated with certain components in order to manufacture them? Abel Avellan: Hi, Chris. Thank you for the question. The micron part, which is, as you know, is the building block of the satellite, is all components are either designed or manufactured with us. We basically manufacture from the solar panel all the way to the -- all the electronics, batteries, structures, everything that goes into them. Currently, for this launch, the microns are based on FPGAs, so that’s why we’re buying those from an existing source. For the first block one, they will also be FPGAs. So, and then, as we move forward with the following launches are with the ASIC, with the AST-5000 [ph] launch. So, just as a clarification, the two suppliers that give us an issue, we’re not naming them. They were not in the micron. They were part of the -- of the control subsystem. Chris Quilty: Oh, perfect. Second question, with the redomiciling for regulatory purposes to the U.S., how does that impact your standing in any regulatory filings, or does it? Abel Avellan: We don’t see that impact, none of that. I think we are finding our opportunity with the U.S. government, potential fundings from the United States, and now that the FCC had a framework that we think will lead the rest of the world in how to regulate our product globally, we thought that it was the right time and the right process to actually move our satellites to a U.S. flag. So, we’re very proud of that, and we see that to be able to accelerate. We’re working very closely now with the FCC, and we are obviously very happy with the new regulatory framework that now we start seeing replicated in large countries through the process of basically reusing a spectrum that is used on terrestrial deployments from space, which is actually the core of our technology, reusing the existing phone that is already in the pockets of everybody, using it for connecting regardless where the people is, regardless where the phone is on a global basis. Chris Quilty: Very good. Thank you. I’ll circle back in the queue. Operator: Thank you. Our next question comes from the line of Mike Crawford with B. Riley Securities. Please proceed with your question. Mike Crawford: Thank you. I heard that you’re putting 5 Block 1 Bluebirds on a Falcon 9 at the end of the summer. How many Block 2s can you fit onto the launch that you’re looking for in December to the March time frame? And it sounds like that’s from a different launch provider, not SpaceX. Abel Avellan: Yes, the next provider is not SpaceX. It’s a large rocket, it’s a large vehicle. We’re not disclosing yet who is the provider, but it’s a contract that is already negotiated, and the launch window is already agreed between December and March 25. We’re putting one satellite on that launch. That’s also an FPGA base, but it’s the large 2,400 square feet Block 2 type of satellite. Mike Crawford: Okay, thank you. And then you previously disclosed intent to enable initial service in Japan in 2026. How many Block 2s need to be in service for you to be able to implement service in Japan? Abel Avellan: Around 45 satellites to have the initial service launch between 45 and 60. We are working very hard. Now, just as a clarification, the same Block 1 micron, the same type of micron that we’re producing now, are the ones that we continue to produce for Block 2. It took more than expected to stabilize that line. It’s a new micron with a new full capability with everything vertically integrated by ourselves. But the good news is that it’s past us, and we plan to continue to do that. To get to a cadence of 72 satellites per year later as we stabilize and have enough parts to be able to do that. Obviously, the first ones are the more difficult to get up into space. They are also the ones where you implement for the first time the changes and the upgrades that you do on them. Mike Crawford: Okay, thank you. And then a final question just relates to your new strategic partner, Google. So, I know your service works with just any phone that people already have, but are there certain things that Google could do to say Android operating system to make those phones connect even better with your network? Thank you. Abel Avellan: Yes, I mean, you’re absolutely right. Our network, our technology is completely open. It’s for any phone, 2G, 4G, 5G, in the future 6G. So we are completely independent of the phone manufacturer or actually the G on the phone. However, we believe and we’re super excited about the relationship with Google. Google is, as you know, the largest ecosystem provider for cellular phones with over 3.5 billion devices on a global basis. And we had agreed to collaborate in product development and implementation of features on the Google ecosystem that it is on the sole benefit of the MNO for our customers and the end users that use SpaceMobile. So, we’re very excited about this relationship. It’s super strategic for us and is to create value on the Android ecosystem for our customers and end users. Mike Crawford: All right, thank you very much. Operator: Thank you. Our next question comes from the line of Benjamin Soff with Deutsche Bank. Please proceed with your question. Benjamin Soff: Hey guys, thanks for taking the question. My first one is just on the government contract. Is there any additional color you can provide on the type of service you’re providing and just generally how do you think about the market opportunity to work with government agencies in the U.S. and abroad? And then I have a follow-up. Abel Avellan: Yes, I mean, we do see the government opportunity to be very, very large. I mean, obviously a technology that can deliver arrays, face arrays of this size, the power that they generate, and if you compare with the benchmark costing of that today for non-communications applications, we’re talking about several orders of magnitude higher cost that we can do despite the fact that we’re doing it. We had 185,000-square feet facility. We’re ramping up our production as we speak. So, the government is super interested in this. We do see these opportunities not only to be in the communication side, which is an obvious application, being able to connect any 3GPP, any cellular device that government use on a global basis or defense users use on a global basis, but also there are a multitude of applications of the same technology without any major changes to our technology to be used in the non-communications space, which we think is a very large market, a very large opportunity. And we see it also in combination of the prepayments that we expect to continue to get from MNOs, payments from governments, and the non-diluted funding that we see that the most efficient way to take our network forward and continue to build satellites based on these agreements that we’re starting to see. So we’re very excited about the government opportunity, and we think that we’re in the very, very early innings of that, of what we can do for our government with our technology. Benjamin Soff: Great. And then my second question is on the Block 2 satellites. Obviously, there’s been a lot of moving pieces over the last couple of years, and I’m just wondering what your latest thoughts are on the timing and costs for these Block 2 satellites, and if there have been any changes recently. Abel Avellan: Yes, we’re maintaining our guidance on costs for the Block 2. As I said, the parts, the building blocks are the same. We’re building for Block 1. So the line, our assembly line, our processes, they can maintain. We now control around 95% of our costs to build our satellites and also our supply chain, and that includes for Block 2. So, we had Block 2, we used these microns, which are the same for Block 1 and Block 2. They rely on the same solar system, same solar panels, same battery systems, structures, and software to maintain them. So, we have that done. So, we are very excited where we are on that, and we have taken an approach of incrementally add features to the satellite. So with Block 2, we reused that, but they obviously are larger. They are 2,400 square feet each, which is what makes it possible to get to 120 megabits of data rate on a 10,000 megahertz of processing bandwidth, which is really the only way to provide broadband directly to regular handsets. Benjamin Soff: Helpful. Thank you. Operator: Thank you. Our next question comes from the line of Chris Schoell of UBS. Please proceed with your question. Christopher Schoell: Great. Thank you. For the Block 1 satellites, can you just update us on how you’re thinking about initial use cases and expected revenue generation as you await more continuous coverage? And then once in orbit, can you also remind us the timeline for testing and calibrating those satellites, and what are the key milestones that you need to reach to commence commercial service? Thank you. Abel Avellan: Yes. I mean, the initial, the non-commercial usage is no constellation base. It’s basically a usage by satellite. So the revenue generation for that is incremental as we add satellites. For the MNOs, what we will be doing is immediately integrating that to the core system as we keep launching more satellites. So the days are, we disclose there is an initial payment by AT&T with the launch of Block 1. There is a pre-agreement with Vodafone to start using them in some of the core markets. And there is some revenue that we start generating initially also for non-continuous service as we build these satellites. But it is a combination of revenue for non-commercial. It is scaled on a satellite-by-satellite basis. And for commercial, it’s for non-continuous service type of applications. We start to see early revenue on that. But our plan is to rapidly ramp with the support of the government contracts, non-diluted revenue, and prepayment revenues to continue to build into the constellation. So, we’re doing that by region. And we’re doing that prioritizing the MNOs that are investors with us and continue to support on the build of the constellation. Christopher Schoell: That’s helpful. Thank you. And I appreciate your dialogue with potential MNO customers is likely ongoing. But any updates you can give on where your discussions stand? And are you seeing interest beyond the already announced set of partners that you have? Abel Avellan: Yes, the answer is yes, absolutely. We have approximately 48 operators that we had agreements or MOUs with them. We’re using the same formula that we used initially with AT&T and Vodafone. We’ll continue to do that. And in a way of prepayments or advance payments, and sometimes combined with strategic investment or not. So, we had a very, very vibrant ecosystem. We have now already AT&T, Vodafone, Google, Rakuten, Bell Canada, and American Tower. But we had all the 48 relationships that we are in constant dialogue. Everybody is super interested in seeing our constellation up as soon as possible. Everybody wants their regions and their customers to be prioritized. And we’re taking advantage of that relationship that’s very symbiotic between us and the operators. Christopher Schoell: Great. Thank you for all the color. Operator: Thank you. At this time, I’m showing no further questions. I would like to turn the call back over to management for closing remarks. Scott Wisniewski: Thank you, operator. We’re building a space-based cellular broadband network designed for the use of the phone in your pocket today. I want to thank everybody for joining, both shareholders and analysts, for their questions. I hope everybody has a great week. Thank you. Operator: And this concludes today’s conference. You may disconnect your lines at this time. Thank you and have a good day.

AST SpaceMobile's Market Position and Recent Downgrade

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.