AST SpaceMobile, Inc. (ASTS) on Q3 2023 Results - Earnings Call Transcript

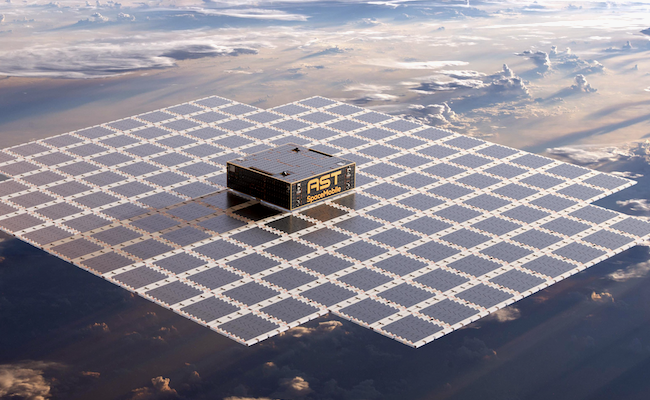

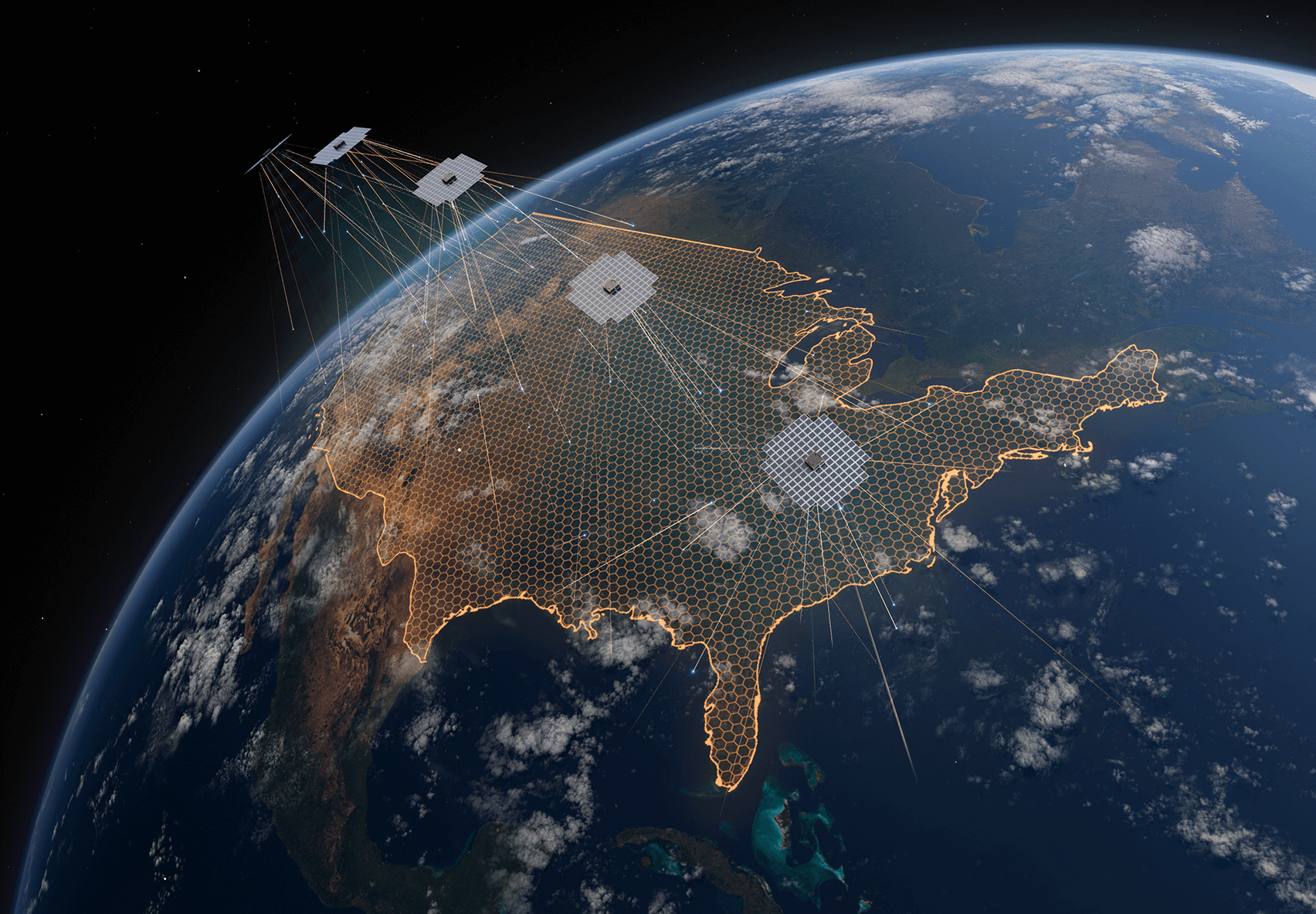

Operator: Good day, and thank you for standing by. Welcome to the AST SpaceMobile Third Quarter 2023 Business Update Call. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your host today, Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Please go ahead. Scott Wisniewski: Thank you, and good afternoon, everyone. Let me refer you to Page 2 of the presentation, which contains our safe harbor disclaimer. During today's call, we may make certain forward-looking statements. These statements are based on current expectations and assumptions, and as a result, are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST SpaceMobile's annual report on Form 10-K for the year that ended December 31, 2022, filed with the Securities and Exchange Commission and other documents filed by AST SpaceMobile with the SEC from time to time. Readers are cautioned not to put undue reliance on forward-looking statements, and the company specifically disclaims any obligation to update the forward-looking statements that may be discussed during this call. Also, after our initial remarks, we will be starting our Q&A section with questions submitted in advance by our shareholders. Now referring to Page 3. For those of you who may be new to our company and our mission, there are over 5 billion mobile phones in use today around the world, but many of us still experience gaps in coverage as we live, work, and travel. Additionally, there are billions of people without cellular broadband who remain unconnected to the global economy. The markets we are pursuing are massive, and the problem we are solving is important and touches nearly all of us. In this backdrop, AST Space Mobile is building the first and only global cellular broadband network in space to operate directly with everyday unmodified mobile devices and supported by our extensive IP and patent portfolio. It is now my pleasure to pass it over to Chairman and CEO, Abel Avellan, who will take you through our activities since the last public update. Abel Avellan: Thank you, Scott. I would like to welcome everybody to our Q3 2023 earnings call. Turning to Page 4. I would like to start off with our key highlights and updates. We recorded another historic first in the world of connectivity. The worker [indiscernible] demonstrated the first and only space-based 5G capabilities and 40 megabit per second data rates. This caps a highly successful testing program that include 2G, 4G, and 5G, with participation from partners, Vodafone, AT&T, Rakuten, and Nokia, validating AST SpaceMobile's satellite-design patented technology and manufacturing strategy. We also are moving full speed ahead with our plans to launch the first five satellites in Q1 2024. Manufacturing is at a full speed and progressing well in Midland. As a measure of progress to date, we have already incurred approximately 85% of the planned capital expenditure for these satellites, including launch costs. Transition to our cost profile, as we complete certain nonrecurring R&D initiatives and the first five commercial satellite, we expect adjusted operating expenses to be between $25 million to $30 million per quarter, beginning from Q1 2024 versus historical run rate of approximately $37 million to $40 million per quarter. And lastly, fundraising efforts with multiple strategic partners continue to advance and progress and the timing is in line with what we disclosed to you a few weeks ago in our interim business update press release. And let's turn to Page 5, I can provide some additional detail on how this is progressing. We're moving forward on definitive documentation and completion of diligence with multiple strategic partners. The strategic investment process is intended to result in new capital and establish new and incremental financial, commercial, and strategic relationship within the wireless ecosystem. This new investment is intended to fund the manufacturing, launch, and operation of additional BlueBird satellites beyond our first five commercial satellites. Overall, we're encouraged by where we are in this process, I hope to be able to share more at any time during November or December. Transitioning back to our technology on Page 6. For the third quarter in a row, we have made telecommunications history. In September, we accomplished another unprecedented leap in space-based cellular broadband by successfully making the first ever 5G connection for voice and data between, and every day we modified a smartphone and a satellite in space. The 5G call was placed on September 8 from an unmodified Samsung Galaxy S22 located in Hana, Hawaii in a wireless dead zone. The testing was completed with our partners, Vodafone, AT&T, and Nokia, chairing our collective success. In a separate tab, we brought previous space-based cellular broadband data sessions record by achieving a download rate of approximately 14 megabits per second. I would also encourage you to watch the video of the 5G connection and other testing milestones using BlueWalker 3 on our website. Turning to Page 7. Our historic achievement of 5G cellular broadband directly from the space comes at a time where United States has placed an emphasis on ensuring 5G broadband connectivity to all Americans. Today, less than half of the geographic United States have 5G coverage with download speeds greater than 7 megabits per second. This pace mobile network is the only space-based network design for cellular broadband, and we will be able to efficiently cover unconnected areas of the country to bring 5G connectivity to everyone. The SEC reopened comments to the 5G phone for rural America room-making process, which we participated in. We had encouraged the commission to make satellite network eligible for funding through this program and look forward to monitoring development in the rule-making process in the near term. This clear need that we are meeting is a key part of how we have been able to develop a strong wireless operator, partners over time. On Page 8, I want to give you a few examples of how our collaboration has been highlighted by our MNO partners. First, with a quick review from how Vodafone is thinking about offering our service to seamlessly amend their market-leading terrestrial network. They will use us the first and only phase-based cellular broadband network to offer voice calls, SMS tests, video calls, Internet browsing, e-mail, music streaming, social media anywhere where the Vodafone subscriber may be located. And with AT&T for the second quarter in a row, they have highlighted us from front to enter as a key milestone in their history, and on our earnings call, we are taking about the support from the work for Direct 5G voice call. The high-profile public support seriousness and the depth of these relationships. Of course, AT&T and Vodafone are key partners for us, but they are not the only ones. Turning to Page 8, 9. We're proud to have MOUs an agreement with over 40 of the largest mobile network operators around the world. represented over 2 billion subscribers that will become accessible to us as we deploy our network. These MNOs include Vodafone, Rakuten, AT&T, Bell, Canada, [indiscernible], Indosat, Liberty Latin America, LTC, MAXs, Micon, MTN, Muni, NISA, Optus, Orange, Salam, Safran, Smart, Smile Suntel FTC, Telecom Argentina, Telefonica, Telkomsel, Tetra team, Uganda Telecom, Jazz, San and others. Before I provide an update on our manufacturing progress, I want to take a minute to highlight the strength of our intellectual property on Page 10. Our IP portfolio continues to grow, now accounting to over 3,100 patents and patent-pending claims, over 30 patent families over 25 U.S. patent applications, and over 10 additional patents around the world. Our strategy since funding has been to patent key aspects of direct-to-device value chain on an end-to-end basis as well as key aspects of our manufacturing process. Turning to Page 11. We're pleased to report great progress on the manufacturing of our first five commercial satellites at our facilities in Midland, Texas, where in advanced stages of the production of key subsystems of the satellites and have a high level of vertical integration over the full process. All key components manufacturing have been brought in-house, we're running three shifts at our Midland facilities and had ramped to approximately 160 manufacturing employees with over 100 of them in the picture above. To the date, we have incurred 85% of planned capital expenditures, including launch costs. Lets turn to Page 12. I wanted to give you an update on manufacturing of our first five commercial satellites, which are which are in advanced stages in Midland, Texas. It is important to understand the high level of vertical integration in our manufacturing process. Being vertically integrated is very important for us as it allows us to maintain the unprecedented cost per unit delivered for our satellites with the power and capability to deliver broadband directly to everyday smartphones. These capabilities a very unique in the industry and will allow us to run the manufacturing capacity of six satellites per month and 72 satellites per year. This page outlines the key subsystems that are part of our microns, which are the building block of our face array. Our markets are designed to -- for mass production and are all identical. Our ability to mass-produce them is essential to the lost cost of our satellites. In order to mass produce microns effectively, we have vertically integrated systems of the micron, power system, power storage, electronics, and antennas. We had a solar panel production line in Midland and our own kick lines cover glass and interconnect sales as a supplier in order to lower our costs, extend life and modified performance of solar panels to survive in space. We also have battery pack production line in Midland, which then we get integrated into the micro. Both the solar panel and batteries were brought in-house after being externally sourced for BlueWalker 3. Our electronics are designed to last seven years to 10 years while also maintaining low cost. We produce our electronic for our first five utilizing FPGAs, field-programmable gate arrays, and our own PA LNAs to ensure performance in the harsh environment of space. For Block II, the FPGA will be upgraded with our own ASICs. Turning to the next page, our system is composed of a very large phase array, which is built out of micron that I explained in the previous page, a center control progress in unit, which is -- which we call our controls, which we will update you here as well. The ControlSat is also made in-house, including the structure that houses our Avionic flight software and Centres in beamformer, which is a unit that generate creating that turn into cellular cell for managing direct connectivity to devices. This is also made in-house. The key component of this has been completed and are being integrated in our Midland, Texas facility. The Fly compute is an essential part of our system and is where we hold our added to control system to manage a position this spacecraft and also where we run fly software, which talk to every sensor and actuator on board to control our spacecraft. This is all made in-house, including the wiring harness. The software and control system is architected and designed in our U.S. offices and get integrated and testing our Midland facilities. In this picture, you see the ControlSat component of the Avionics stack, the harness, and all of the ground and flight over, which is required to manage and control these satellites. It is important to remind you that all these systems and this level of vertical integration is only possible, thanks to the fact that we have BlueWalker 3 operating for over a year successfully. And that has given us all the learnings and all the required heritage in order to be able to integrate effectively and cost effectively all part of our new build of satellites. And with that, I would like to pass over to Sean to provide a financial update. Sean Wallace : Thanks, Abel, and good afternoon, everyone. It has been a little over a year since BlueWalker 3 was lifted into orbit in the night sky at Cape Canaveral. Since that time, AST continued to achieve a series of accomplishments and make progress towards the goal of building the AST SpaceMobile Constellation. We are now giving and defining the satellite to device industry, which is rapidly becoming 1 of the most exciting innovations in the mobile phone industry in the last 50 years. Since our last earnings call, the AST SpaceMobile team completed more groundbreaking test results, utilizing BlueWalker 3, made significant progress towards the expected launch of the 5 BB1 satellites and continue to focus on raising capital to fund the AST SpaceMobile Constellation. An exciting and tangible part of this advancement is watching our assembly integration and testing facility in Midland begin its production activity with dozens of technicians and engineers as well as highly specialized processes all contributed to the production of 5 BB1-1s for the targeted launch next year. As always, I want to recognize and thank the hard-working team of engineers, technicians, suppliers, and the support and confirmation by our partners who are some of the most sophisticated wireless companies in the world, including TNT, Vodafone, Rakuten and Nokia. I want to start by reviewing our key operating metrics for the second quarter that are displayed on Slide 14. On the first chart, we see that for the third quarter of 2023, we had non-GAAP adjusted cash operating expenses of $37.3 million versus $38.4 million in the second quarter. Non-GAAP adjusted operating expenses excludes certain noncash operating costs including depreciation and amortization and stock-based compensation, which totaled $21.6 million and $19.6 million for the third and second quarters, respectively. Our third quarter non-GAAP adjusted operating expenses decreased by $1.1 million versus the second quarter. Our research and development expenses fell this quarter as a result of reduced expenditures associated with our ASIC chip design as we continue to get closer to the completion of that work. Our R&D expenses consist principally of nonrecurring development activities for which we typically engage third-party vendors and payments are based on the completion of milestones. Our engineering services expenses fell and our general and administration expenses rose modestly in the third quarter. Turning towards the second chart, our capital expenditures for the third quarter were $71.7 million versus $26.8 million for the second quarter. As we had indicated on our last call, we expected our level of capital expenditures to increase substantially as we focused our efforts on procuring parts, materials, and systems for the BB1-1 satellites as well as to make payments to our provider of launch services. As to the end of the third quarter, we have spent over 85% of the expected amounts for these satellites. We are now projecting to spend approximately $150 million -- $115 million, that's 1-1-5 for the 5 BB1-1 satellite, up from our last estimate of $110 million. On a positive note, a good portion of the increase in cost was a result of a potential customer requesting a change in the inclination of the orbit so that our constellation could provide better coverage for their subscriber base. This change to the orbital location required an additional payment to our launch provider. And on the final chart on the slide, we ended the quarter with about $135 million in cash on hand. As we stated in our 10-Q, we believe this cash as well as our ability to raise capital through our existing facilities is sufficient to support our expenditures for at least the next 12 months. As we have also discussed in our 10-Q, our cost positions and capital plans are quite modular. And this characteristic provides us the flexibility to increase or decrease our rate of expenditures depending upon changes in our build-out plans and availability of capital. This flexibility provides us comfort that we can manage our liquidity profile dynamically depending on our rate of raising capital. As we head towards the next fiscal year, I wanted to provide guidance on our expected operating expense levels and capital expenditures as we flip towards Page 15. We have been supporting the development efforts of our 2 [indiscernible] satellite designs, Block 1 and Block 2, our ASIC chip design, and the construction of 5 BB1-1 satellites. The completion of this BB1-1 work and a significant portion of the BB1-2 and ASIC design work is expected to result in a material reduction in our adjusted operating expenses and future capital expenditures. This reduction in cash expenditures will be done without a material reduction in our employee headcount as most of these reductions are related to the completion of third-party work. Overall, our adjusted operating expenses should decline from a range of $37 million to $40 million per quarter to a range of $25 million to $30 million per quarter, with the full effect starting in the first quarter of 2024. We also plan to reduce our level of capital expenditures as we reach the final investments for BB1-1 and the material investments for BB1-2. Timing of the changes in our adjusted operating expenditures and capital expenditures, as I have just described, could be delayed or may not be realized to a variety of factors. And with that, this complete presentation component of our earnings call, and I pass it back to Scott. Scott Wisniewski : Thank you, Sean. Before we go to the queue of analyst questions, we'd like to address a few of the questions submitted ahead of the call by our investors. Operator, could you please start us off with the first question? Operator: Rolando from Paris Ask, can the company discuss the competitive landscape for DTV and differentiate the different offerings that are in the works. Abel Avellan : Thanks, Rolando. There have been a tremendous in about direct-to-device services. Over the past year, we have seen other companies pull their hands up on a me-too offering. But clearly, when you get into their details, they are not broadband scalable or compatible with today’s smartphones. This is a hard problem, which has a lot of different elements for success. And we have been entirely focused on development of these systems since the funding of our company in 2017. We had invested over $700 million to date in this effort, resulting in over 3,100 patent and patent-pending claims and our own vertically ready manufacturing capabilities for our satellites. AST SpaceMobile critical differentiation is that we are the first and only system designed for 5G cellular broadband. We have shown the ability to achieve 5G data rates as well 4G and 2G. Other systems today are far away from being able to achieve what we have and are primarily narrowband techs and emergency service offering. Our very large phase array antenna, combined with our own ASICs is unique in this space and is critical for achieving 5G directly to existing everyday smartphone to scale up to serve the needs of the 5 billion phones in circulation in partnership with the leading and largest MNOs on the planet. Operator: Anne from California asked how long from finalizing the ASIC design where you get the chip. Abel Avellan : Santander, the development of the ASIC was a four-year process with a cost in excess of $40 million that is mostly at this point behind us. The design is substantially complete. We expect we will be able to start getting the first units around three months to four months after the tape out, which is in the process where -- which is the process where the design gets produced by our foundry partner, TSMC. I want to remind everyone that the first 5 commercial side would be flying us in our current FPGAs, which is essentially the programmable version of the ASIC. The ASIC is expected to give us a 10 times improvement in processing bandwidth of 1 gigahertz to 10 gigahertz of available spectrum per suite, while reducing the power and consumption, and cost of these satellites. We believe that this significant barrier of entry for space-based cellular broadband, along with our large 2,400 square feet phase array. Operator: Wedin from New Zealand how much out-of-factory testing is AST reliant on? Can everything be tested at this point? Sean Wallace: Thank you, Wedin, and I'll take this one. You may recall with BlueWalker 3 that we had to move the satellite off-site several times. This included vibration and other testing. And right before we ship the satellite to keep Cape Canaveral, we actually had to go back to California testing, which, of course, is inefficient and introduced extra time to our schedule. Now for our first five commercial satellites, we will be able to conduct all of our out of factory testing in-house at our Site two facility in Midland, Texas. This testing includes component level and satellite level thermal vibration and RF testing. This is another great capability that we've brought in-house alongside the vertical integration that Abel discussed earlier. As a result of this, we expect to significantly shorten production times and increase our control of our process compared to BlueWalker 3. Operator: [indiscernible] from New Zealand asked, do you expect to enter into commercial agreements with MNOs prior or post launch as the company decided on which inclinations they attend to initially serve? Sean Wallace: As we discussed earlier, we've been continuing to grow the list of MNOs that we have MOUs and agreements with, and we're now at over 40 operators globally who collectively cover over 2 billion subscribers. Our plan is to sign some of these agreements prior to launch. And in fact, we recently changed the inclination for our first five satellites based on customer feedback. We're going to be at a 53-degree inclination and this orbit allows our satellites to cover anywhere in the globe up to 59-degrees latitude for both the Northern and Southern hemispheres. And with that, I'd like to thank our shareholders for submitting these questions. Operator, let's open up the call to analyst questions now. Operator: [Operator Instructions]. Our first question is from Benjamin Soff with Deutsche Bank. Please proceed with your question. Benjamin Soff: A couple for me. The first one is, is there any more color you guys can share on the strategic investment process. What it is you're looking for and what shape you think those partnerships could take? Thanks. Abel Avellan : Ben, I appreciate the question. I think we've put most of the latest information in this presentation already. This is an important phase for us because it lays out not funding but also commercial and strategic relationships that will be important for us. So, we're very encouraged where we are right now, and we look forward to more details during November and December. Benjamin Soff: Got it. And now that you've achieved 5G connectivity, what's the next major testing milestone you are looking for, if any? Abel Avellan : Well, we are turning our attention -- we're turning our attention to the build of the next five satellites. We continue testing with BlueWalker 3. But the major milestone required out of BlueWalker 3 have completed. Benjamin Soff: Okay. Got it. And then -- is there any more color you guys can give on the CapEx trajectory going forward? I heard the comment that it might decline, but just wondering at what pace and kind of to what magnitude? And that's it for me. Sean Wallace: Obviously, this last quarter, we've seen a pretty big bump up in our CapEx as a result of some final payments on BB1-1 and some other BB1-2 expenditures. We expect the number to come materially down from there. We don't give guidance on that, but it will be significantly lower than what we've seen in the last two quarters. Operator: Our next question is Griffin Boss with B. Riley Securities. Griffin Boss: So first for me is, are there any additional insights you can share that you might have learned over the past three months regarding capacity and ability to process multiple calls concurrently within a certain beam or so? Abel Avellan : Yes. I mean we have already given preliminary guidance of what the capacity per satellite is -- and what is the processing bandwidth that we can support. For Block 1 with the FPGA-based system is about 1 gigahertz of processing bandwidth. With the ASIC that is a 10-fold increment to 10 gigahertz processing bandwidths, and our testing support these assumptions. Griffin Boss: Okay. Got it. And then so -- but just with BlueWalker 3, have you -- have you been testing with multiple calls at once? I don't know that I've seen any test data running multiple calls at a single time or multiple video goals. Abel Avellan : Yes. We have done multiple and simultaneous. We also have opened up the pipes to let hundreds [indiscernible] of font ratching connecting to the system. So that also has been verified during the testing. Griffin Boss: Okay. Great. Appreciate that. And then stepping back, just regarding the U.S. national spectrum security that was released yesterday. Just curious if there was anything in that, that caught your eye as notable as it relates to supplemental coverage space? Or if there's anything in there that suggests to you that the FCC might now faster on developing such a framework? Abel Avellan : Yes. Well, as you know, we invented direct-to-device. And we are the first one to demonstrate it at a broadband, and we have the only system that support it. So, we are super encouraged by having a presidential notice where the first item, it is basically a system that replicates what we have invented. So yes, that caught our eyes. We're very happy. We're very encouraged about that. I think this will facilitate in the future how our service will be regulated in particularly in the United States. United States is also a reference for other countries. Together with our strategic investors, current strategic investors, we had achieved significant progress in around the world in getting this system regulated and to be variable to be used and we solve a big problem. So yes, we're very proud of being mentioned and be part of presidential strategies for spectrum, which is basically and expect use to support a system that we invented and where we are the only one that can provide broadband connectivity directly to regular devices. So, we are very happy, we're encouraged by that. Griffin Boss: Got it. Great. And then if I could just sneak one more in. There was a question earlier on the competitive landscape. I was wondering if you could share any of your opinions if you have any as to why you think Qualcomm walked away from Iridium recently? Abel Avellan : Yes. Listen, I mean, there's 5 billion phones in circulation. When we launched this design of this system, there was a prerequisite that is that you do not need any special chip and special frequency where especially nothing in your device because the moment that you do that, you take that 5 billion phones in circulation to a niche play. And anything that were to change or it's an SOS test, we believe that is limited and with a limited market opportunity compared with broadband directly to every day smartphone with the fund that you have in UC. So, we're not surprised by this. And I do believe -- we do believe that any solution that requires special terminal as we become a reality as we start launching our satellites as early as next quarter, next year, all those solutions become less and less relevant. So, we're not surprised by it. And -- and I think if anything, it supports our vision that -- these systems need to support any phone, every phone, everywhere, without regarding any change, any chip, any special ASIC or any special chipset or anything that is proprietary to the phone in order to make it available for all 5 billion phones in circulation. Operator: At this time, I'm showing no further questions. I would like to turn the call back over to management for closing remarks. Scott Wisniewski: Great. Thank you, operator. Our company is building a space-based cellular broadband network design for use of the phone in your pocket today. I want to thank everyone for joining both the shareholders and the research analysts for the questions. Have a great evening. Operator: This concludes today's conference. You may disconnect your lines at this time. Thank you for your participation.

AST SpaceMobile's Market Position and Recent Downgrade

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.