AST SpaceMobile, Inc. (ASTS) on Q2 2023 Results - Earnings Call Transcript

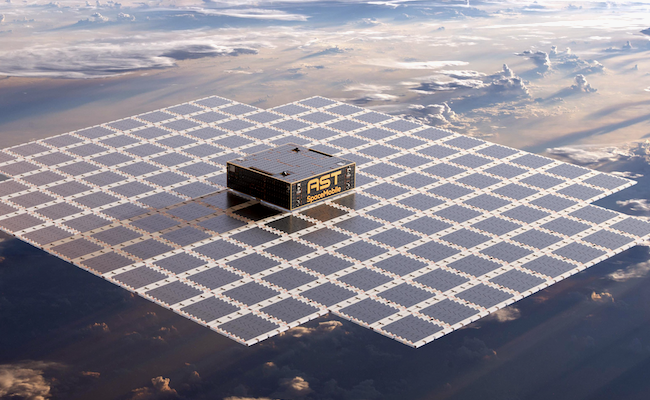

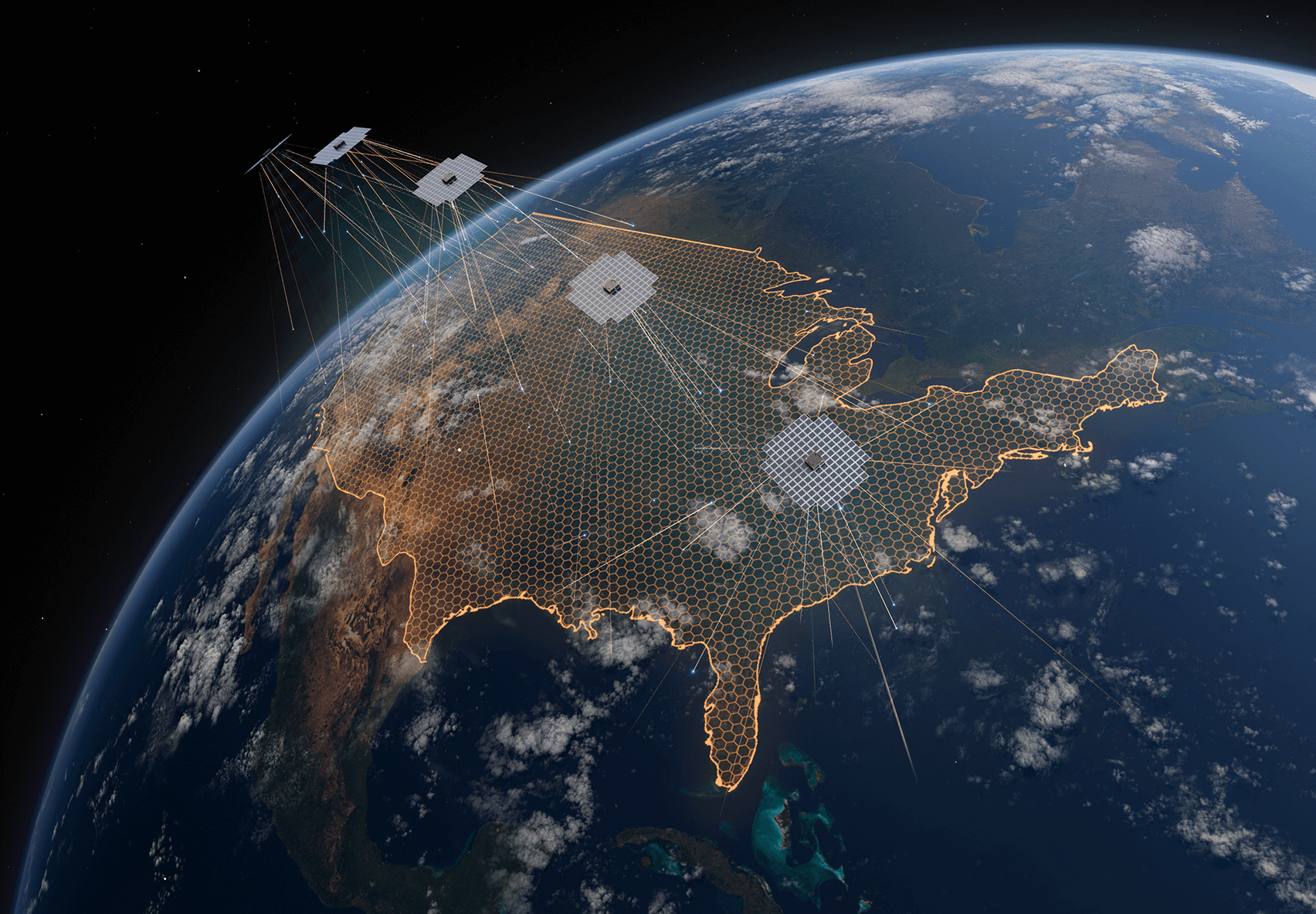

Operator: Good day, and thank you for standing by. Welcome to the AST SpaceMobile Second Quarter 2023 Business Update Call. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your host today, Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Please go ahead. Scott Wisniewski: Thank you, and good afternoon, everyone. Let me refer you to Slide 2 of the presentation, which contains our safe harbor disclaimer. During today's call, we may make certain forward-looking statements. These statements are based on current expectations and assumptions, and as a result, are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST SpaceMobile's annual report on Form 10-K for the year that ended December 31, 2022, with the Securities and Exchange Commission and other documents filed by AST SpaceMobile with the SEC from time to time. Readers are cautioned not to put undue reliance on forward-looking statements, and the company specifically disclaims any obligation to update the forward-looking statements that may be discussed during this call. Also, after our initial remarks, we will be starting our Q&A section with questions submitted in advance by our shareholders. Now referring to Slide 3. For those of you who may be new to our company and mission, there are over 5 billion mobile phones in use today around the world, but many of us still experience gaps in coverage as we live, work and travel. In this backdrop, AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with everyday smartphones based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gap faced by today's 5 billion mobile subscribers and finally bring broadband to the billions who remain unconnected. The markets we are pursuing are massive, and we have a significant first mover advantage. It has been an extremely active and productive few months since the last quarterly update call. As our Chairman and CEO, Abel Avellan, will discuss, we have continued to make significant progress on technology, manufacturing, commercial and regulatory fronts and, very importantly, with regards to funding our growth strategy. It is my pleasure to now pass the presentation over to Abel. Abel Avellan: Thank you, Scott. I would like to welcome everybody to our Q2 2023 earnings call. We have had a very busy quarter, and I would like to provide you with an update on our progress. On our BlueWalker 3 program, we made history again in June with the first-ever, space-based cellular broadband 4G LTE connection directly to everyday smartphones, with speeds above 10 megabits per second. This was done in collaboration with AT&T, Vodafone and Nokia and follows this historic announcement in April of the first-ever voice call directly from the space. We also continue to advance our commercial initiatives, now having over 40 MOUs and agreements in place with MNOs globally that have around 2.4 billion subscribers. On the manufacturing front, we're focused on our efforts to build and launch our first 5 commercial BlueBird satellites and are ramping production in our Midland, Texas facility. This satellite program is fully funded and is planned to launch in Q1 2024. On the financing front, I'm happy to announce that we have closed 2 interim nondilutive debt financing alongside our efforts to raise capital from players in the wireless ecosystem as we discussed in our last quarter. Lastly, on the back of the progress of our company, technically, commercially and industrially, we have received multiple indications of interest from a strategic investment with both equity-linked and nondilutive commercial payments. Proceeds from this capital raise is intended to fund our operations through the launch of our initial Block 2 satellite target for 2024 and 2025. Now moving to Page 5. We have made history again on our 4G capabilities, and we continue to define the direct-to-device industry. And we are the first and only company that planned and has demonstrated the capability to offer a space-based cellular broadband that can scale in the future. Thanks to our comprehensive portfolio of IP with over 2,600 patents and patent pending claims, the size of our satellites and our vertically integrated manufacturing strategy that includes one of the largest manufacturing facilities for satellites in United States. Again, I am humbled to see the public statements by our partners, who represent the largest and some of the most important and sophisticated companies in the telecommunication industry, celebrating with us these historic achievements. AT&T, Vodafone and Nokia were our partners on our own 4G testing this quarter and we're greatly appreciative of their continued support. We're chasing a very large opportunity based on the fact that there are more than 5 billion phones in circulation today. Our testing has demonstrated the ability to connect with every phone from all major brands, which maximize our access to this very large market. Moving to Page 6. Now turning to our commercial and regulatory process -- progress. We now have over 40 MOUs and agreements with MNOs globally that have around 2.4 billion subscribers. Our MNO partners are working closely with us, sharing in our collective success. The telcos we are working with globally representing leaders in the wireless industry, and we are proud to have established our footprint with such a great partners. We also continue to advance our regulatory efforts updating our SEC application to reflect the spectrum lease ongoing with AT&T. Our conversation with the FCC continue to be constructive and supportive of our plan. Moving to manufacturing on Page 7. We're ramping the manufacturing of our first 5 Block 1 satellites in our facilities in Texas. We have completed construction of our 185,000 square foot manufacturing facility, which will be -- which we believe has one of the largest commercial clean rooms in the United States. We recently conducted a full manufacturing readiness review due to some of this activity in the video we released early this month, which you could find on our web page or YouTube channel. And let me summarize some of the progress we review. Nearly all the equipment in our state-of-the-art clean room manufacturing facility in Midland, Texas is delivered and installed. Our manufacturing process and production lines are completed and fully implemented for Block 1, with many opportunities for further automation as we progress into Block 2 program. We have set up a new production line from solar panels, power systems, mechanical structures and antennas, implementing our strategy of being vertically integrated manufacturer. We also have installed additional test equipment to our Texas facilities, which will improve our timing from assembly to launch when compared to BlueWalker 3. Lastly, in our Texas facility, we have completed a part-by-part traceability system for quality control, as every part on the build to [start-up] can be tagged and tracked. On a separate note, I'm we're happy to announce that we have inaugurated a new space technology development center, an R&D center in our hub facility in Hyderabad, India. They will help us access one of the largest wireless markets globally and provide access to an incredible engineering talent, including the 1.5 million engineers that graduate every year in India. With that, I want to pass it on to Sean. Sean Wallace: Thanks, Abel, and good afternoon, everyone. Since our last call, AST has continued to make significant progress and continues to define the satellite-to-device industry as one that will offer broadband cellular service using existing MNO spectrum and working on widely available smartphones and devices. Integrating the ubiquitous coverage of a satellite constellation into the terrestrial wireless infrastructure will be one of the most exciting innovations in communications in the last 25 years. We could not be able to define this new industry without our hard-working team of engineers, technicians and suppliers and without the support and confirmation by our partners who are some of the most sophisticated wireless companies in the world, including AT&T, Vodafone and Nokia. Beyond defining this new segment in the wireless industry, we also continue to drive our plan of execution in the second quarter. Specifically, as Abel outlined, we made progress around our commercial, regulatory and manufacturing milestones and we remain on target for the launch of 5 BlueBird commercial satellites in the first quarter of next year and the initiation of commercial service in 2024. Let's spend some time discussing a couple of our key operating metrics for the second quarter that are displayed on Slide 8. Looking at the first chart, we see for the second quarter of 2023, we had non-GAAP adjusted cash operating expenses of $38.4 million versus $40.3 million in the first quarter. Non-GAAP adjusted operating expenses exclude certain noncash operating costs, including depreciation and amortization and stock-based compensation, which totaled $4.2 million and $19.6 million for the first and second quarters, respectively. Most of the increase in our noncash operating expenses reflect the initiation of noncash amortization of our BlueWalker 3 satellite, which we disclosed in the last quarter. Our second quarter non-GAAP adjusted operating expenses decreased by $1.9 million versus the first quarter. Our research and development expenses fell this quarter as a result of the timing of certain milestones, which reduced the level of payments. Our R&D expenses consist principally of nonrecurring development activities for which we typically engage third-party vendors and payments are based on the completion of milestones. Conversely, our engineering services and general administration expenses rose modestly in the second quarter. We currently expect that the level of non-GAAP adjusted operating expenses will remain in the mid- to high 30s for at least 2 more quarters as we continue to pursue important R&D projects for our BlueBird satellites and execute the construction and planned launch of our first 5 BlueBird commercial satellites in the first quarter of 2024. Turning towards the second chart. Our capital expenditures for the second quarter were $12.1 million versus $14.4 million for the first quarter. These capital expenditures were directly related to the completion of many of the expenditures we have made around our Site 2 manufacturing facility. We expect that our levels of capital expenditures, which include direct material expenditures and launch costs for satellite as well as capital improvements for our manufacturing facilities and ground infrastructure, will increase in the third and fourth quarter. We expect that our capital expenditures, which have been averaging around $10 million to $15 million per quarter, will begin to increase to nearly $15 million to $20 million in the last 2 quarters of the year in order to fund the manufacturing and assembly of our first 5 BlueBird commercial satellites. In addition to these figures, we also expect to pay $45 million to $50 million for launch services and related equipment and services, all in the third quarter. Once these payments are completed, we will have made well over 90% of the projected expenditures for our first 5 commercial BlueBird satellites. And on the final chart on the slide, we ended the second quarter just shy of $192 million in cash on hand. As we stated in our 10-Q, we believe this cash as well as our ability to raise capital to our existing facilities is sufficient to support our expenditures for at least the next 12 months. As we have also discussed in our 10-Q, our cost positions and capital plans are quite modular. And this characteristic provides us the flexibility to increase or decrease our rate of expenditures depending upon changes in our build-out plans and the availability of capital. This flexibility provides us comfort that we can manage our liquidity profile dynamically depending on our rate of raising capital. Let's turn to the next page outlining our capital raising efforts. As I've mentioned in our last earnings call, we continue to explore a variety of ways to fund our business plan. I am pleased to report that during the second quarter through today, we have completed a comprehensive financing plan, which will provide us $179 million of gross cash and liquidity. These activities include $64 million in equity proceeds, including our common stock offering in late June. We also closed 2 debt facilities. These facilities include a $15 million equipment loan facility and a $48.5 million draw on a $100 million senior secured credit facility. The equipment facility arranged by Lone Star Bank in Midland, Texas will enable us to leverage the portfolio of equipment and the building at our Site 2 manufacturing facility. The senior credit facility is structured such that we have drawn close to $50 million at close and have an additional ability to draw up to another $50 million over the next 12 months, subject to certain conditions, should we desire. These new facilities represent our growing ability to access a diverse set of capital sources, including debt providers. I also wanted to comment on Abel's discussion on our efforts around raising strategic capital from key players in the wireless ecosystem on the bottom half of this page. After hiring financial advisers, we approached a number of large, sophisticated players with the explicit desire to develop financial and strategic ties that will help fund our business plan and support the development of our commercial efforts in markets around the world. We are making progress. We have received multiple indications of interest from several parties that we believe represent the right strategic partners for us as we move towards commercial service. We also believe that the structure of these transactions will enable us to fund the business with a combination of debt and equity securities, thereby reducing our reliance on selling equity. We are negotiating the terms of these nonbinding indications of interest and the counterparties are performing due diligence. The size, complexity and commercial and strategic nature of these negotiations require significant time to complete and may require certain regulatory approvals in order to close. As of this time, we cannot guarantee that any agreement will be reached, nor can we disclose the name of the parties and the type of their potential commitment. As these discussions evolve, we will provide more detailed information. And with that, this completes the presentation component of our earnings call, and I pass it back to Scott. Scott Wisniewski: Thanks, Sean. Before we go to the queue of analyst questions, we would like to address a few of the questions submitted in advance by our investors. Operator, could you please start us off with the first question? Operator: Tim from California asked, "What is the overall test plan? Where are you at in accomplishing that plan? What are the key successes and challenges?" Abel Avellan: Thank you, Tim, for the question. And first of all, I want to emphasize that now we are turning our attention to the build of our next 5 operational satellites. BlueWalker 3 has delivered all the knowledge we needed to look up our design, learn how to fly the largest commercial communication array that have been ever deployed into orbit, how to implement and use our patented doppler and delay compensation, how to integrate with network operators like AT&T and Vodafone to serve their customers in -- the future customers in 2G, 4G and 5G. And these have been essential. It has been a long process to incorporate all this knowledge into our company. And this positioned very well to move to the next phase, which is basically the launch of the next 5 satellites to start commercial services. Now that all these lessons are being incorporated in our IP, that will translate to a faster rollout of these first 5 satellites. And we are very, very happy with everything that we had accomplished with BlueWalker 3. We have made the first-ever phone call directly from space to a standard cellphone device. We have made the first-ever broadband connection, LTE connection, ever done from the space directly to a device. And we also -- something that is extremely important for us is the demonstration that we can scale and that we can access the vast majority of those 5 billion phones that are in circulation, which is also regardless of the manufacturer, regardless of the type of phone that is in the market. So we're very happy with the results, the significant amount of learnings that have been incorporated into our IP and to our design. But with BlueWalker 3, basically, we were able to look at our design and basically move to manufacturing, which is what we're doing now. Operator: Dennis from Chile asked, "Considering that BlueWalker 3 took months for opening, positioning and testing the satellite before operation, when will the first BlueBird satellite become fully operational?" Abel Avellan: Thank you, Dennis, for the question. We are still on track to launch our first 5 Block 1 satellites, our first 5 commercial satellites in Q1 2024, and they have been -- they are in the process of being manufactured and tested in Midland. We have several coming milestones with SpaceX, which will narrow the launch window and provide more clarity to the exact timing of the launch. With that said, once we launch, we will expect to spend around 3 months to test and calibrate these satellites in orbit that will be significantly faster than what we did for BlueWalker 3 as well BlueWalker 2 and the first satellite. And as I said earlier, there were a lot of lesson learned to how to do it, how to fly, how to calibrate it, how to connect directly to the phones. I mean all that lessons are already part of what we know, we know how to do. So we estimate approximately 3 months, it may take longer, but that's what we're estimating. And both that in-orbit testing, we are preparing to start being ready for commercial service with these 5 satellites. The commercial services that we're anticipating on these satellites are not only broadband, had other governmental and other type of applications that we anticipate to be using with Block -- with the first 5 operational satellites. Operator: Leedin [ph] from New Zealand asked, "Has the FCC been supportive during the meetings where ASTS and FCC met? Scott Wisniewski: I'll take that one. Thank you, [Leedin]. Absolutely, we have continued to have very encouraging meetings with the FCC over the last quarter, and you'll see multiple new filings in support of our planned service. We believe that enabling technology like ours, which the FCC calls supplemental coverage from space, we believe this is a priority for them. And this is informed by the fact that they've created a new space division focused entirely on satellite communications, the initiative of a new rule-making process with tight public comment periods and also their responsiveness with us. So going forward, we look forward to further engagement with the FCC alongside AT&T in the U.S. And while we cannot comment on near-term timing, of course, we're confident we'll be able to begin commercial service in the U.S. once the space-based network is ready. Operator: [Eduardo] from London asked, "A senior DoD Officer commented about testing integrated commercial service with military applications next year. Is there anything that can be shared on this regard?" Abel Avellan: Thank you, [Eduardo], for the question. Listen, we continue to believe that there are very strong governmental applications for our space array technology. This is basically thanks to our IP, but in particular, because of the size and the power capabilities of our satellite in low Earth orbit. We're evaluating various opportunities on the government side, while we continue to progress and maintain our focus on several broadband. We're planning to start commercialization on using our first 5 operational satellites, which we expect to launch in Q1 for application of interest to the U.S. government. Scott Wisniewski: And with that, I'd like to thank our shareholders for submitting these questions. Operator, let's open the call to analyst questions now. Operator: [Operator Instructions] And the first question comes from the line of Griffin Boss with B. Riley Securities. Griffin Boss: So I just want to start off, Samsung just, I think it was yesterday, talked about how it's Galaxy S24 could feature an emergency SOS feature via satellite similar to what Apple and Globalstar are doing. And that's also expected to launch in the first quarter of '24. I'm just curious if you are looking at that as an opportunity for your early services? Abel Avellan: Listen, I mean, we -- well, thank you for the question. We are really focusing in broadband. I mean we believe that -- I mean with this announcement that we did this quarter, where we announced speeds of 10 megabits. If you can do 10 megabits, you can do SOS, you can do voice, you can do basically every application that you have in your phone when you are in a connected area through terrestrial normal means. So our focus is being completely agnostic to the manufacturer. Our [indiscernible] phone calls, a few phones calls were done on Samsung, but we have also basically tested every major device. That's the way that we position ourselves. That's the way that the technology it is -- design is just to support broadband and all the other applications that you are capable of doing when you are in terrestrial means. Griffin Boss: Okay. Got it. And then just one for Sean on the credit facility. Is that interest payable in kind or in cash? Sean Wallace: A portion of it, it's almost like a synthetic 0 portion of it was set aside. So it will be set in escrow and, fortunately, will be funded with cash on hand. Operator: [Operator Instructions] And the next question comes from the line of Chris Quilty with Quilty Analytics. Chris Quilty: Just wanted to ask a question about where you are in terms of potential customer decisions on that first batch of satellites. Scott Wisniewski: Thanks, Chris, Scott here. So we've -- as you know, we continue to grow the list of logos. We're now over 40 MNOs globally that we have MOUs and agreements with and over 2.4 billion subscribers among them. So we have had a great list of potential sources. I think as we think about where to launch service first, it's obviously driven by a number of considerations: one is who are our close partners; and two, which markets are most interesting to us. So I think as we look at that list, the U.S. is a pretty obvious choice as an attractive first market, but there's several around the world, and you can look to our partners for candidates for those. But at this stage, I think we're focused on the technology road map and believe all commercial, regulatory and other major milestones fit within that. So I think as you think about timing, it will be within that time frame. But we're pretty happy with the partners that we have at the table with us now. Chris Quilty: Got you. And then a question on the manufacturing basis. It sounds like you've gotten most of your production equipment in place and ready to roll. Assuming that all that is applicable to a larger build, what are you looking at in terms of time to ramp up the production capability for building at a high rate, the next batch of satellites? Abel Avellan: Yes, Chris. I mean the way that we have set up ourselves, given enough number of parts and components, the facility that we have, 185,000 square feet of facility, it can support up to 6 satellites per month. We're obviously not there yet. And that ramp-up is planned to take the next 6 to 12 months. But that's what we're aiming, it's having the manufacturing capability in Midland to do 6 satellites per month. Chris Quilty: Got you. And I guess just in the last year, we've had Rivada come online with 600 satellites; last Friday, Telesat, 300 satellites. When you look at your supply chain, are there any particular areas where you have concern about the supply base or the fact that you brought so much vertically in-house, you're in good shape? Abel Avellan: Right, Chris. I mean, I think, listen, first of all, different than any other constellations, I mean, our number of total satellites needs for having global broadband connectivity is around 90 satellites. We're not talking about thousands or tens of satellites. We're talking about 90 satellites to get to broadband capability on a global basis. The other factor for us is that we are substantially -- very, very substantially vertically integrated. I mean we literally start with aluminum and composite material, and we build most of all our parts. So we integrate all our antennas, structures, batteries, solar panels, all the [indiscernible] structures, literally every major part of our satellite, we do it by ourselves not only to manage and control cost of each of these parts, but also to control supply chain. Chris Quilty: Got you. And final question, just I know it's a long road on the FCC waiver, but at a high level, what are the sort of next steps we should expect coming out of the FCC for approval? Abel Avellan: Well, I think the way that we see the FCC, we're very, very bullish about the new processes that the FCC has set up and where we are in our current regulatory process. We do not see the FCC delaying our initial commercial services next year. We are confident. I mean, however, we are dependent on them to make sure that they will be on time in order to support our services in 2024. The immediate step was -- the first immediate step was the leasing with AT&T for spectrum. And then the -- continue with the experimental satellite licenses that we have now active with BlueWalker 3 and the following satellites that we're launching. Scott Wisniewski: Yes. I would add, Chris, the key differentiator is that we have a satellite on orbit, right, to show data and to show information of the FCC for both paths because remember, we have 2 parallel paths to a commercial license in the U.S. One is the rule-making process, which the FCC has been a leader on and has been very fast. The public notice period for comments was only 30 days, which is pretty short for a big rule-making like this. So they clearly are interested in speed on the rule-making. And then on the other process where we filed the lease with AT&T for substantially all of their low-band licenses over 1,000 individual licenses, that's another process that like I said earlier, we have the data and the information to back it up. So we don't view this as a limiting factor on our overall time line. Operator: And the next question comes from the line of Benjamin Soff with Deutsche Bank. Benjamin Soff: I've got a couple here. So obviously, today versus the initial business plan, a lot has changed in terms of the timing and some of the costs. But I'm wondering, if you sort of go back to the beginning, if you think the commercial assumptions as far as the -- like the revenue per satellite and the timing to ramp from when you launch, if those inputs still hold and still makes sense? Or if you think maybe some of those factors may have changed as well? Abel Avellan: Thank you for the question. Listen, the completion of BlueWalker 3 testing, the lean budget confirmations, the number of types of devices that we're able to interoperate with our technology, that confirms basically all the fundamentals of our business plan. Benjamin Soff: Okay. And would you anticipate that the Block 1 commercial satellites would be sufficient to generate free cash flow on their own, if you weren't going to make the additional investments in other satellite launches? Would those alone be able to like fund the business? Scott Wisniewski: Yes. I think part of the reason for the announcement we had today with the comprehensive interim financing package and the status update on the strategic capital raise, we've kind of reached a point with technology, manufacturing, commercial and regulatory. We've reached a point where we see visibility to revenue on those first 5 commercial satellites. We don't think that that's not the business we're looking to build. As Abel said, very clearly, we're looking to build cellular broadband. And to do that, you need more than 5 satellites. But based on market feedback and things you can clearly read in the press as well, we think that even those first 5 satellites will be interesting in terms of revenue. So we don't predict it will be cash flow positive, but we do believe there will be revenue opportunities on those first 5 satellites, whether you look at government applications or other services that benefit from -- or they can take advantage of noncontinuous service like IoT or monitoring. So we think there's interesting opportunities there, not cash flow positive, but definitely interesting opportunities and ones that we plan to commercialize fully. Benjamin Soff: Okay. And then last one for me. Just -- I appreciate the color on the U.S. being one of the early markets, you said that there might be others. I'm just curious if you could talk about some of the factors that you look for when deciding whether or not to go into one market or another, for example. Abel Avellan: Well, we obviously -- we had a loan lease on that 40 operators that we had announced where we have MOUs or agreements. There is obviously interest in having the markets first. I mean we will prioritize then according to size of the market, but also to their participation and how closely they are working with us, supporting us technically financially or otherwise. So it is a multi -- we had a lot of interest to start using our services, and we will prioritize according to the support that we get from the MNOs. Operator: At this time, I'm showing no further questions. And now I'd like to turn the call back over to management for their closing remarks. Scott Wisniewski: Thank you, operator. Our company is building a space-based cellular broadband network design for use of the phone in your pocket today. I want to thank everyone for joining, both the shareholders and the analysts for their questions, and I hope everybody has a great week. Thank you. Operator: Ladies and gentlemen, that does conclude today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

AST SpaceMobile's Market Position and Recent Downgrade

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.