AST SpaceMobile, Inc. (ASTS) on Q3 2021 Results - Earnings Call Transcript

Operator: Good day, ladies and gentlemen, and welcome to the AST SpaceMobile Third Quarter 2021 Business Update call. At this time, all participants are in a listen-only mode. Later, we will conduct a question-and-answer session. The instructions will follow at that time. . As a reminder, this conference call is being recorded. I would like to turn today's call over to Scott with Company. Thank you. Please go ahead. Scott Wisniewski : and good afternoon, everyone. This is Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Let me refer you to slide two of the presentation, which contains our Safe Harbor disclaimer. During today's call, we may make certain forward-looking statements. These statements are based on current expectations and assumptions, and those results are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST space levels Form S1, filed in June with the Securities and Exchange Commission, as well as Form 10-Q for the third quarter of 2021 and other documents filed by AST SpaceMobile with the SEC from time-to-time. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company specifically disclaims any obligation to update the forward-looking statements that may be discussed during this call. With that, I would like to introduce Chairman and CEO Abel Avellan and Chief Financial Officer, Tom Severson, to the call as well. Abel, over to you. Abel Avellan: Thank you, Scott. I am really happy to be back with all of you again for our quarterly business update. But before I take you through our technology progress and industrialization, I wanted to spend few minutes to explain the market opportunity, the tech, for those who are new to the AST SpaceMobile. Starting with the market opportunity on page three, as I said before, we're chasing a huge market opportunity to connect people everywhere at airline at SEA. There are over 5.2 billion mobile phones worldwide, an approximately half of the world population do not have similar roadmap on their phones. Turning to page 4, here they stick with more over billion space-based similar robust network that will allow you to connect your regular cellphone, the one that you have in your pocket, directly to space. We are not building this alone; we're building this with industry leading strategic partners like Vodafone, American Tower and Rakuten. Our services designed for use by nearly all cellular subscribers as an add-on, also on their main service, from existing wireless plans. Now I want to move to an update on the utilization of our technology and also on how we're doing with Blue Rocker 3. There are a lot of exciting things going on with our Company and I'm eager to take you through our progress on both Blue Rocker 3 and on the industrialization of our technology. I also want to present to you how we're targeting 6 satellites per month by mid-2020. Today, for the first time, we're going to take you through detailed photos of our technology and Blue Rocker 3. Starting with our headquarter, we're very proud to be in Midland. We had invested a lot of time and money in preparing our facilities to be ready for the production of global country and our production satellites. Our headquarter is 80, some 85,000 persons facility located in Midland, Texas, where we do engineering, testing and manufacturing for our space grow. With all the investment that we have done, and the headcount that we have placed at this facility we expect this facility to be able to produce up to two satellites per month. And with the extension of a new facility, we were able to hit our target of six satellites per month. So turning to page seven, I wanted to use our new extension facility, in second facility, Midland, Texas, which is under contract, and with this facility where we have the capability to produce six satellites per month on a highly automated process for satellite manufacturer. So today we're pleased to announce that we have entered into an agreement to purchase an additional 100,000 equipment facility in Midland. In addition to the other capacity, we also have plans to make the facility highly-automated. With additional investment, the facility will provide us the potential capacity to reach our production goal of 6 spacecraft per month, and this is a big, big deal for us. The two facilities are a couple of miles apart, both connected by train to provide us a lot of options for ground transportation and component of the assembled satellites. Altogether, the two facilities will provide us access to 185,000 total equip footage of manufacturing capacity in Texas. I want to show you a picture of our final assembly integration on testing, where we are actually building our global country and also we plan to use it as a facility to build our BB1. Here, it's a recent photo of our maintenance run in Midland, where we will do our final assembly, integration and testing of our satellites. Currently, this facilities youthful integration on the Global country and then next year where we use it for BlueBird 1, BB1, next year. On page nine, you will see finest assembly, integration, testing and delivery of our satellites. In addition to the maintenance room, there's a lot of other interesting activities going on at our manufacturing facilities. Starting from the top left, you will see the LVA, Launch Vehicle Adapter that hold the satellite during launch, prior to deployment in a space. This is the equipment that hold the microns, which is the modular system that we use to build our phased array, and then deploy in a space to unfold the service. Middle top of the page is preparing for the assembly-line. Top right is where we do a full satellite radio frequency testing. On the bottom left, it is the satellite SDM, SDM means System Thermal Mechanical, basically being tested and verified. And on the bottom right, the satellite keeps in container volume into Midland, which will take the satellite to Cape Canaveral for our launch with SpaceX on a Falcon 9. So a lot of pieces are coming together nicely and there have been lot of lessons learned and we're prepared to pro -- in parallel for our production cycles. As we've been doubling capacity to produce 6 satellites every month. Page 10, shifted to assembly of the microns. The microns it is the building block of our satellite that represent approximately 90% of the costs of then. This is where the magic of connectivity directly with cellular phones happen. Inside identical parts that form the space array and are the model of components that make the large phased array of BlueWalker 3 and our production satellite. Importantly, we have all components now on-hand, either our old purchase or manufactured by us. The picture on the top page show components commonly to the micro assembly line and several staging areas. We are vertically integrated, with nearly all components assembled by us. This is a significant -- very, very significant competitive advantage, as we control the technology with 1600 patent and patent claims, but we'll also control our costs by being able to assemble completely our technology by ourselves. Moving to page 11, Blue Walker3 micro-testing. So testing and automation of our facilities is extremely important, so the ability to verify on the ground that Blue Walker3 will be able to connect directly to handset. It's a prerequisite for us to launch on the assumption that we have passed. We would be launching BlueWalker 3 on a Falcon 9 from Cape, Canaveral. And then it would be followed -- after satellite launch, it will be followed at Tesla. The first part of the plan is the deployment, basically to demonstrate that we have deployed sources that we have test on the ground for over a year and a half. We will also have the ability to record the deployment, and verify that all the testing that we have done on the ground match with what we see in a space. Lastly, after the deployment is exercised and recorded by the cameras onboard, we will be doing network integration testing with our network operators. The first thing will be to calibrate the array, to transmit it to the ground, and then interconnect to our operators in U.S., Europe, Japan, Africa over a period that will be approximate 6 months. Not only to interconnect our network to theirs, but also to test the service for voice, text, data, and high-speed connectivity of 4G and 5G speed. The size of BlueWalker 3 is 693 square-foot phased array. We believe that we will be one of the largest phased array antennas deployed into orbit ever. The satellite will be located at 400 kilometers. It's in an orbital inclination of 53 degrees. It moves on a speed of 70,000 miles per hours and it circles the earth in less than 90 minutes. BlueWalker 3 is the finalization of our R&D, basically demonstrate everything that we already have tested and verified on the ground, the ability to deploy a phased array of this size, the ability to connect directly to a handset, and the ability to perform broadband connectivity of 4G, 5G speeds directly from the space on timing for BlueWalker 3. We have these costs. We're using SpaceX as a launch provider for BlueWalker 3, and the current launch window with the SpaceX run from March 2022 through April 2022. We had the option to pick an alternate launch window. It will give us SpaceX notice by December 1st, 2021 on day of revoke and see -- We have not yet determined if we will revoke. If we determined that we are going to exercise our right to remove the launch, which is likely we plan to target a little more country launch within a month of the original launch window. However, any alternately launch will be so due to mutual agreement and coordination with SPAC. We have made significant progress on Blue Walker3 and our team had invested genius and effort to get to this point. And we want to make sure that we have fully completed our test program for Blue Walker3 before we go to the launch site. Then, let's talk about with who we will partner to launch our satellites. For BlueWalker 3, we are planning to launch on Falcon 9 out of Cape Canaveral, but we have the signing, BB1 and all our satellites be multi launch. In other words, we can use many of the leading launch providers to accommodate our satellites, up to 15 of them in a single launch. Before I pass it to Scott, I want to talk about the business. I want to basically remind everybody, especially for those that are new to SpaceMobile, the difference between our approach and any other approach to space. The first one is the way we launch, build, and use satellites. We are the only satellite system that connect directly to handset for regular cell phones. Connectivity to -- and if, that is a very large opportunity. As I explained before, 90% of the Earth's surface do not have access to cellular connectivity. In that 90% of the Earth's surface, there is five billion people that moving on another connectivity. There is half of the world population that don't have broadband into their phone and it's approximately a quarter of a billion people that do not have any access whatsoever. So we're the only space systems that have direct connectivity to regular cellphones. That make us very different than other approaches. Other approaches are very valid, but their business, you have direct to proprietary mobile phones. These subsystems have been called special phone. If honesty, became very expensive on low capacity. And despite all those impairments, those systems generate approximately $2 billion of annual revenue. And then, you have also broadband connectivity into an antenna, which is also something more similar to Wi-Fi or broadband connectivity to a terminal. So if we were to -- if we were talking about a planet where everything comes from space, the connection to antennae is like the Wi-Fi that you have in your home, and we will be equivalent to the cellular service that you have today with your cellular provider but everywhere in the planet. So we this, I want to pass it to Scott. He will talk about a little bit more in detail the differentiations of our product and some of the packages that we're expecting to offer to -- in conjunction with our network partners and operators. Scott Wisniewski : Great. Thank you, Abel. Starting on Page 16, I'm really excited to cover a few topics with everyone today. First, like many of you, we have watched the steady increase in activity, public attention, and investment in the space tech over the past year, and with this backdrop, AST SpaceMobile is the only pure-play for investors in LEO broadband. And as Abel highlighted, but it's worth repeating, we are playing in a very large market, with a solution that is applicable to over 5 billion mobile phones and a related 1 trillion addressable market. We're jointly going to market with industry giants. These are leading mobile network operators who have hundreds of millions of subscribers, and importantly, we're not competing with them. We have a revenue share of business models designed to allow users to sign up with a simple text message, and we have approximately $360 million in cash on hand to fund business operations in the first phase of our production satellite. With that basis, let's spend a moment on how we plan to go-to-market on Page 17. Recall, our customers will be the mobile network operators who will make our services available to their subscribers under a revenue share business model. Based on country and subscriber mix, we have a lot of flexibility on how to monetize our service. The framework options you see on this page are some of the packages we're discussing with the mobile network operators, and are designed to not only provide a highly valuable service for their subscribers, but also limit friction of adoption. First, you can see our data's option illustrated on the phone on the right side of the page. When a subscriber's out of coverage, that moment when they've lost connectivity and need at most, that's precisely when they would receive a text from their phone. And you may have experienced something like from your current operator when you travel abroad, this is a very low friction customer acquisition process linked to an immediate payment, it's a very efficient way to drive adoption of our service, and it's also great marketing. Over time, we expect that many subscribers will see this as useful service and want to have it as a monthly add-on to their plan. This would create our recurring revenue stream on a monthly add-on basis. And enterprise packages for corporate or power users may also have a lot of interest in some markets. Lastly, we think a standalone plan can makes sense, particularly in areas where there's no real cellular coverage today. We see these use cases as the biggest opportunities, but given the flexibility of our technology, there are a lot of other services that can be built around the SpaceMobile network, including emergency connectivity during natural disasters when brown networks are overwhelmed. Now, before I hand it off to Tom, on Page 18, I want to take you through a handful of other business updates. On the commercial side, we are happy to announce the signing of three additional MOUs this quarter, including MTN Group, YTL in Malaysia, and Somcable in Somaliland. For those of you who don't know, MTN Group is one of the top 10 mobile network operators globally, with nearly 300 million subscribers, including a Number 1 position in Nigeria, a country with a population of over 200 million. With many of our other mobile network operator partners, we're focused on cusp plan to use BlueWalker 3, to configure their infrastructure for commercial grid air connection with our network. On the organizational side, a few further updates building on what an Abel took you through in Midland, We've also signed a lease to expand our technology center in Maryland. This site has 16,000 square feet for engineering offices and will be the future home of our satellite operation center, and network operations center. In terms of people, we continued to grow, and our employee hiring plans as sport scaled production and network operations, added 40 new full-time employees in the third quarter. This brings the total AST SpaceMobile team to over 500 people. This includes 301 full-time employees, as well as other full-time contractors and third-party engineering service providers. Lastly, as Abel mentioned, we remain active safeguarding our technology advantage, increasing our patent and patent pending claims to over 1600. This represents the competitive mode around our tech. Now with that, it is my pleasure to hand it off to Tom. Tom Severson : Thank you, Scott. First, I would like to also welcome everyone to our Third Quarter Business Update call. As a reminder, we became a public Company on April 6th of this year and raised $416 million from new investors and our pre -transaction investors, including Rakuten, Vodafone, American Tower, and Cisneros. We ended the quarter with $360.4 million in cash and the Company is currently debt-free. Now to turn to the financial highlights for the third quarter. As you may recall, when we compare our operating results on a sequential quarter-over-quarter basis, it allows us to better discuss current trends and provide a baseline for future trends. During the third quarter, our cash operating expenses, including engineering services, R&D, and G&A, decreased to $22.2 million, a decrease of $2.3 million compared to the prior quarter. This decrease was primarily due to R&D expenses which decreased $4.7 million, compared to the prior quarter. Our R&D costs primarily relate to our agreements with third-party technology partners, and will fluctuate quarter-to-quarter as milestones are achieved. We expect our future quarterly R&D costs to be on average in the $9 to $10 million range, through the end of 2022. During the third quarter, our G&A costs were $9.3 million and remained relatively flat compared to the prior quarter. We expect that our quarterly G&A cost will remain in this range through the end of 2022. Engineering services increased by $2.2 million during the third quarter, and we expect to continue to see our quarterly engineering costs increase as we ramp up our assembly integration and testing team in preparation for full-scale manufacturing at our facilities in Midland, Texas. The headcount of our engineering and the AIT employees and full-time consultants grew from 193 at the end of Q2, to 241 at the end of Q3, and we expect this to grow to approximately 300 by the end of 2022 as we near the completion of the R&D phase and prepare for full-scale manufacturing of our production satellites. In terms of our CapEx, to date, we've invested $56.7 million in the construction of the BlueWalker 3 satellite and we expect to incur an additional $10 to $12 million to bring the project to completion. A significant portion of the total cost of BlueWalker 3 is largely comprised of nonrecurring engineering development, and to a lesser extent, satellite componentry launch costs. Total investments in our property and equipment were $19.9 million through the end of the third quarter. And we're happy to report that the build-out of our AIT facility in Midland, Texas is complete. Now, with 35,000 square-feet of production-ready ISO 8 clean room, we're currently utilizing our Midland, Texas facility to assemble, integrate, and test the BlueWalker 3 satellite. In addition, in October, we entered into an agreement to purchase an additional facility located just a few miles from our existing facility in the Midland. This new facility has an ideal footprint to accommodate the assembly and integration of our production satellites and will provide an additional 75,000 square feet of ISO 8 clean room manufacturing capacity. The new facility purchase is $8 million and we expect to close on the purchase in Q4. We estimate that we will invest in additional $3-4 million to get the facility production ready, and we plan to complete this build out during the first half of 2022. Once completed, we will have a total of 110 thousand square feet of ISO clean room space in Midland, Texas. We believe these facilities will be sufficient to support our manufacturing goal to complete six production satellites per month, by mid-23'. Finally, we continue to ramp up the procurement process for our BlueBird 1 production satellites. As we progress in the procurement process, we reaffirm our cost estimates to build and launch the first 20 satellites with an average cost in the $13 to $15 million range per satellite, and for the full constellation of 168 satellites, our average cost per satellite is currently expected to be in the $10 to $11.5 million range per satellite. As we prepare the Company for full-scale manufacturing over the next few quarters, we remain ever confident in the ability of our amazing team to execute our plan and deliver our technology. And with that, Operator, let's open the call to questions. Thank you. Operator: Thank you. Please stand by while we compile the Q&A roster. Your first question comes from the line of Bryan Kraft from Deutsche Bank your line is now open. Bryan Kraft: Hey guys, this has been on for Bryan, thanks for taking the question. Just wondering if you could provide a little bit more color on the construction and development process for BlueWalker 3, relative to your expectations. And just curious if there's anything that changed this quarter around how you think about the timing for that build-out and eventual launch? And then I've got a follow-up. Thanks. Abel Avellan: Hey, Bryan. How are you? We basically progressing as per expectations. We are in the final stage of building, assembling, and testing BlueWalker 3. We have all parts on hand. We had an ability to revoke the launch in December. We have not made the determination if we will do that. However, we think if we do have an exercise to that option, will be within a few months or more or the original date, however, that is contingent to agreement with SpaceX and coordination with SpaceX. But the satellite, we had to spend a significant amount of time testing the satellite, particularly to deployment. We're very, very confident at this point on the deployment mechanism for the satellite. And we're working very hard to be on time. However, we will not launch, if we'll have full confident that we have passed all tests. We made your test, which is, Do we know if the satellite would connect directly to handset, have been passed in thermal? That with main modules, which will go micros. I don't want to be performing satisfaction yet they are -- we are -- it will be followed up as we speak. Bryan Kraft: Got it. And then just around the testing. Can you give us a little bit more detail around the timing for when those tests will take place and when we'll receive them, and how much cushion do you guys need between receiving those test results and then finalizing the commercial satellites and then launching them? Thanks. Abel Avellan: Are you referring to BlueWalker 3 or you talking in general? Bryan Kraft: Well, I'm saying for the BlueWalker 3 tests, when can we expect to get updates on that? And then, when you're building in the test results from BlueWalker 3 for the commercial satellites, I assume that there's a certain amount of time you need to build in the results from the test and to tweak that. Abel Avellan: Sure. Well, if you're referring to when we launch, the first thing that will happen is we will verify the deployment, so basically the satellite deploys, that will happen within weeks of the launch. We have to determine the appropriate time to do the deployment, but when we will initiate the deployment, that will be very quick and that will be recorded in our cameras. After that, we start a testing campaign with our network operators in the Americas, Africa, Europe, and Japan, where we test and integrate the satellite capability with their networks, and that is a process that take approximate 6 months. But at that point, we are very fine, not only the functionality of the satellite, but we're also integrating our satellite architecture to the network operators. And that's kind of the process that we follow after we launch for testing of the spacecraft. Bryan Kraft: Thanks, guys. Operator: Your next question comes from the line of Chris Quilty from Quilty Analytics. Your line is now open. Chris Quilty: Hi, Abel. I wanted to follow-up on that test schedule. I believe BlueWalker 3 is using FPGAs and I think the testing data eventually gets fed into the development of an ASIC, which would come, I'm assuming, is that at the end of the 6-month testing campaign, and if you can verify that? And then, what would be your expectations for how long it would take to begin manufacturing those ASICs in volume, and I guess, given current supply chain issues, how sure are you or assured of your supply chain? Abel Avellan: Yes. Hey Chris. So, we will contain based on FPGA. That allowed us to incorporate the learning's of the operation of BlueWalker 3 into our subsequent satellites. Our first initial subsequent satellites are going to be also based on an FPGA. Even though that will run in parallel with two programs, the FPGA program, and the ASIC program. We are very advanced on the ASIC, however, we're not dependent on it for initial satellites. And the reason on the FPGA is basically to be able to reprogram the technology even when the satellites are flying. Obviously, something that you cannot do with the ASIC. So we're taking our time with the ASIC. The gain of the ASIC will be obviously the cost of the particular component and also power. But we will be initially operating based on FPGA architecture that we are using or a very similar architecture to the FP architecture that we are using on BlueWalker 3. Chris Quilty: Got it. And that would presumably account for why the early satellites cost more, in addition to learning curve for latter satellites. Abel Avellan: Absolutely. So you see in our business plan, initial satellite costs more than the latter part of the satellite but by the functionality will be equivalent. Chris Quilty: And sticking with the supply chain issues and the setup of the new facility, are there any specialized machine tools or equipment that you might need for the facility that would slow your ability to bring it into operation or are you dealing with primarily standardized equipment? Abel Avellan: Primarily standardized equipment. We are automating a lot the production line. So BlueWalker 3, you see the way of assembly and testing is very manual, since our first experimental satellite. The subsequent satellites are all fully-automated. And well, not fully-automated with every step, but the main steps of the assembly are automated. We are in the process -- we just closed on the facility, we're in the process of basically sourcing those equipment. We will be able to report on those in the next quarter or two, but we don't see any major problem with that. And regarding the supply chain, as I said before, we have all parts on hand at this point for BlueWalker 3, and we're already purchasing the long lead items and the -- for BB1 part of the process of launching the first production satellites. Chris Quilty: Great. And I guess for Scott, I think you mentioned three new MOUs and I just wanted to confirm that's now up to 22? And I think you gave last time also a sense of what sort of population is covered by that, as well as how many licenses you hold and population covered. Scott Wisniewski : Sure, by way of update, we're not number --giving the exact number, but that's the general area. Adding these 3 new MNOs does continue to grow our subscriber ounce with M&A as we have agreements with, but that number is now $1.5 billion. And in terms of regulatory approvals, we continue to work approvals globally and that depends as when it's fully approved with $360 million pop covered. Chris Quilty: Great. Thank you. And what does the pipeline look like or what sort of activity are you doing internally in terms of number of people reaching out to potential new MNOs? How does that process look like? How aggressively do you have to reach out to those customers and are you growing the actual staff to do that or do you wait until you get further down the demonstration and operation path? Abel Avellan: Yes. Great. 1.5 million subscribers represent approximately 20% of the operational market, which is addressed through agreements of MOUs that we have. So our sales -- we are mostly scientists and engineers building satellites, it's not that we need a battalion of people to continue to increase the numbers of MNOs. This is a service when one MNO in a country has it, the other MNO need to get it, as it's something that greatly differentiate one MNO from another. So the way that we had approached it is over the last ones in each of the regions, partner with them to test our service and integrated to our service, establish cautions with them when appropriate about the packages that they will be used to promote the services to the end-users. We believe in low friction to getting access to our service for that is something very important. The MNO, you get committed to basically advertise our service through a text message, when people get out of service and make it part of the packages. So that's why we're concentrating on more in quality rather than quantity. We believe that we have taken a significant part of the market very early on in our life cycle. Chris Quilty: Great. Thanks for the update. Operator: . There are no further questions at this time. I would now like to turn the call over to the Company. Abel Avellan: Thank you, Operator. Our Company is building a space-based cellular broadband network designed for use with the phone in your pocket today, extending cellular coverage beyond what was ever thought possible. I want to thank everyone for joining today, and hope you have a great rest of the week. Bye. Operator: This concludes today's conference call. You may all disconnect.

AST SpaceMobile's Market Position and Recent Downgrade

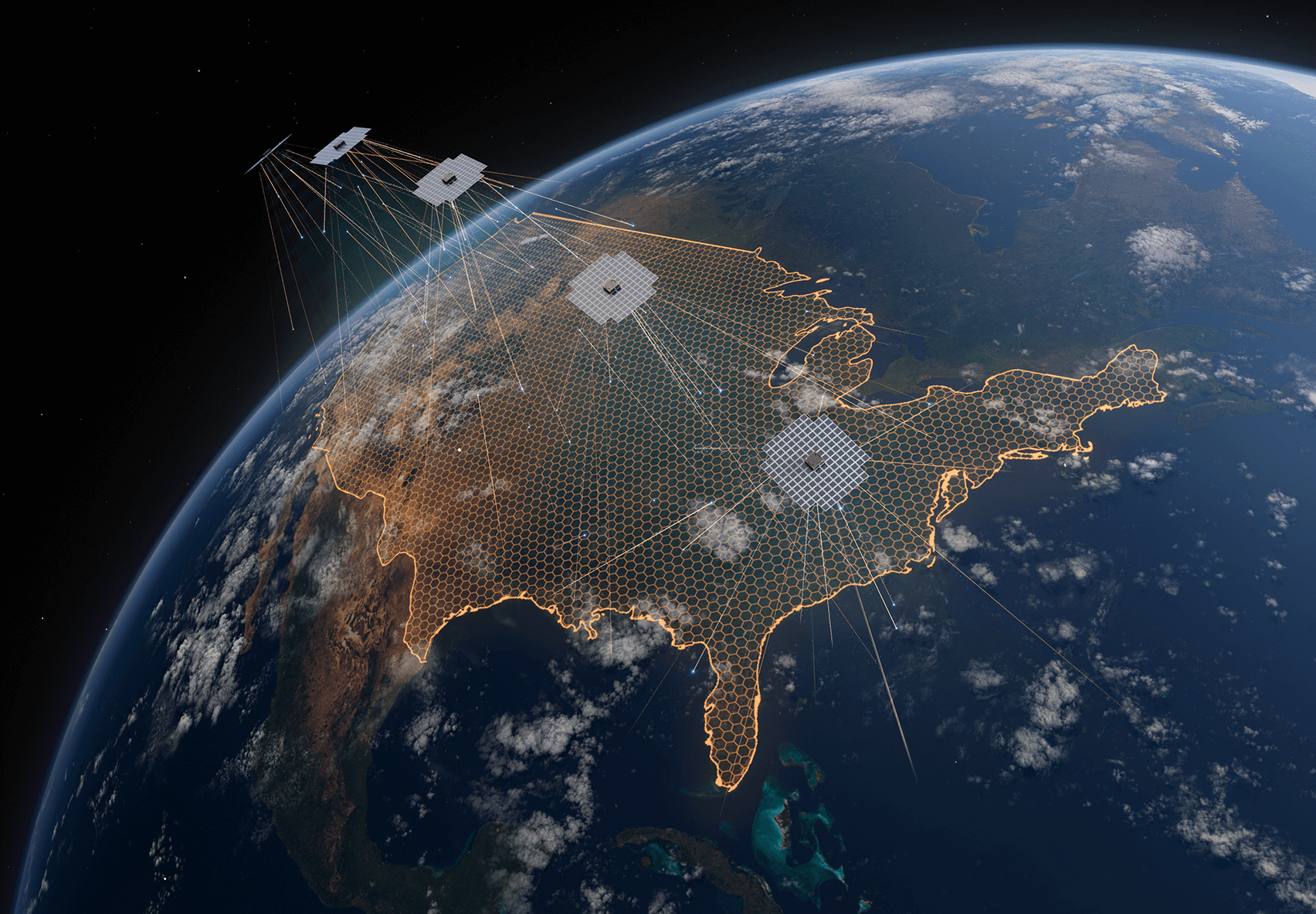

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

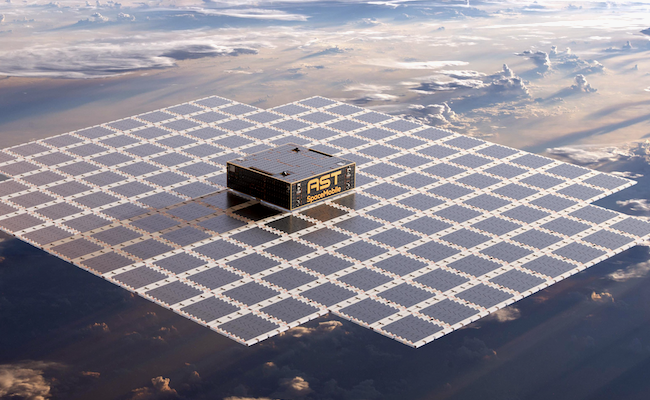

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.