AST SpaceMobile, Inc. (ASTS) on Q4 2022 Results - Earnings Call Transcript

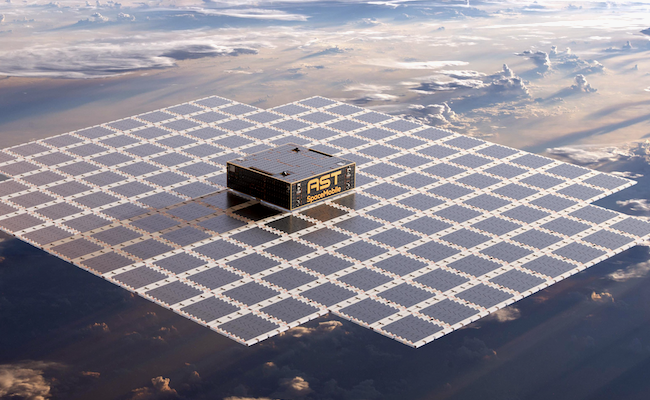

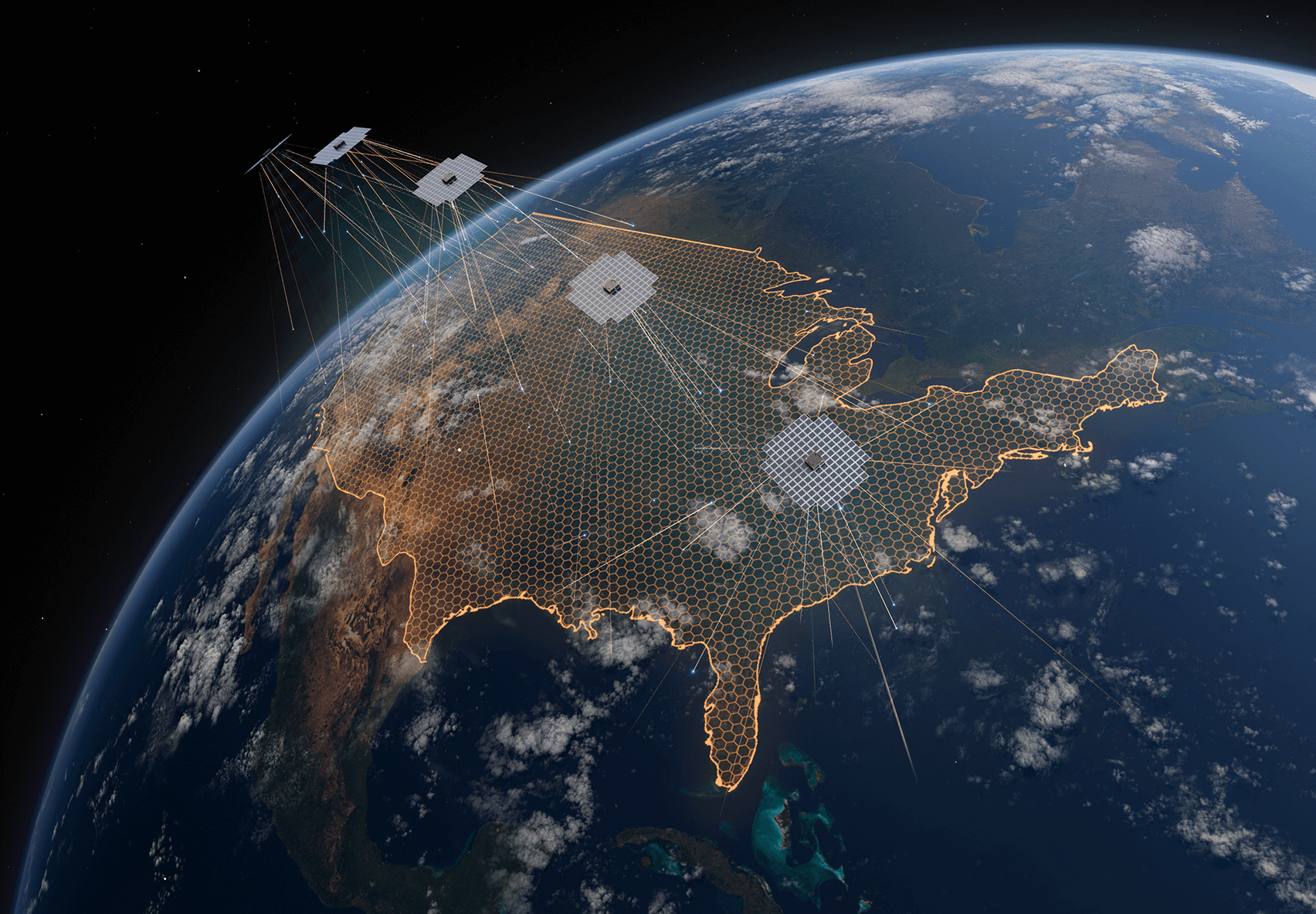

Operator: Good day, and thank you for standing by. Welcome to the AST SpaceMobile Fourth Quarter 2022 Business Update Call. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your host today, Scott Wisniewski, Chief Strategy Officer of AST SpaceMobile. Please go ahead. Scott Wisniewski: Thank you, and good morning, everyone. Let me refer you to Slide two of the presentation, which contains our safe harbor disclaimer. During today's call, we may make certain forward-looking statements, these statements are based on current expectations and assumptions, and as a result, are subject to risks and uncertainties. Many factors could cause actual events to differ materially from the forward-looking statements on this call. For more information about these risks and uncertainties, please refer to the Risk Factors section of AST SpaceMobile's annual report on Form 10-K for the year that ended December 31, 2022, with the Securities and Exchange Commission and other documents filed by AST SpaceMobile with the SEC from time to time. Readers are cautioned not to put undue reliance on forward-looking statements, and the company specifically disclaims any obligation to update the forward-looking statements that may be discussed during the call. Also, after our initial remarks, we will be starting our Q&A section with questions submitted in advance by our shareholders. Now, referring to Slide three. For those of you who may be new to our company and our mission, there are over five billion mobile phones in use today around the world, but many of us still experience gaps in coverage as we live, work in trouble. With this, AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard unmodified mobile phones based on our extensive IP and patent portfolio. Our engineers and Space scientists are on a mission to eliminate the connectivity gaps based by today's five billion mobile subscribers and finally bring broadband to the billion to remain unconnected. With that, it is my pleasure to now pass it over to Chairman and CEO, Abel Avellan. Abel Avellan: Thank you, Scott. Good morning, everybody. Very glad to be updating you or what has happened since our last call. Before I start, I want to remind everybody that we're currently operating the first and only satellite designed to deliver space-based cellular broadband, with the largest ever communication array deployed commercially in low Earth orbits. That's a monumental achievement. We're very proud of it. We're also currently testing BlueWalker 3, and we detail that we have on so far we have successfully validated key technologies to deliver cellular broadband directly to standard in modified phones. We also have took significant steps to further industrialize our technology with in-house manufacturing of key components and electronics and secured loan services for our next five satellites. We continue to progress the path to commercialize our services with customers, partners and regulators on a global basis. Let me take you to Page five. With BlueWalker 3 we have it in orbit, we had orbiters -- successfully more than 2,000 times. The pictures that you see here are the satellite, a fall before its launch. And then in the bottom, you see the satellite unfold on the air and then the satellite falls in the space. This is basically around 695 square feet structure flying around the earth and pointing to the ground at around 70,000 miles per hour. Our ability to manage it, control it, terminally controlled and flight is very important and that had been a major step in our technology. So where are we with testing BlueWalker 3? First of all, we are happy to announce that the initial test results indicate that the downlink signal strength necessary to reach 5G cellular broadband speed can be met with our technology. We also have demonstrated our ability to deploy the largest ever communication array deployed into low Earth orbit. We have demonstrated the satellite ability -- our ability to fly control and fly our satellite with the array fully deployed with a size of 693 square feet. We have demonstrated our patented technology to validate Doppler and delay compensation, a key component -- a key part of the component to be able to do 5G speed, and we continue to target to complete cellular broadband speed directly to standard modified phones. Page seven, update on the industrialization of our patented technology. We continue to invest in our facilities around the globe with a focus in our facilities in Texas. We have ramped up our initial manufacturing facility starting with the capability two satellites per month ramping up to six satellite per month. And we continue to have two main facilities in Texas in order to produce our flight techniques. Progress on key commercialization milestones, we continue our customer momentum. We have signed seven new MOUs, including Saudi Telecom and Zain in Saudi Arabia. We also have announced plans to explore potential opportunity to market our services to the military and defense market. We continue to formalize our constellation plans. We have signed an agreement with NASA in order to protect both of our assets by signing the Space Act agreement. We have secured our launch agreement for our next Block 1 satellite, but also we are in negotiations for our subsequent launches passing our first Block satellites. And we're also driving U.S. regulatory framework. We have participated in the initial FCC ruling related to Supplemental Coverage from the Space which will allow satellite operators to collaborate with terrestrial service provider to expand coverage to terrestrial licensees and subscribers. And with that, I want to pass it to Scott, who will talk about our next key milestones to reach a space cellular broadband commercial services. Scott Wisniewski: Thank you, Abel. Looking ahead, we want to summarize the key future milestones we're tracking ahead of initial space-based cellular broadband commercial service. First, we'll look to publish joint test results of BlueWalker 3s capabilities with our MNO customers and technology partners. We'll also be looking to manufacture and assemble the Block 1 Bluebird satellites at our Texas facilities. Alongside these steps, we will also be pursuing the completion of definitive commercial agreements with initial customers and regulatory approvals in key markets. For our Block 2 program, we'll be looking to finalize the design, including doing ASIC tape out, and then we'll be looking to launch our 5 Block 1 BlueBird satellites leading into initial commercial service using those Block 1 satellite. And with that, I'd like to hand the conversation over to our CFO, Sean Wallace. Sean Wallace: Thanks, Scott. Good morning, everyone. The fourth quarter was another busy three months for AST. Beyond operational execution, including and unfolding of the largest commercial communications array ever deployed in low Earth Orbit. We also continue to march forward with our plans to integrate -- become an integrated manufacturer, assembler integrator and tester of our own satellites. Our Site 2 facility in Texas has been transformed into a giant clean manufacturing space with an increasing set of sophisticated equipment and a growing team that will turn components into satellites. In the finance area, we were also active as we demonstrated continued access to capital by raising over $85 million in equity in the fourth quarter, where we welcomed new investors and raised important capital for the company. Overall, we remain focused on building a constellation designed to erase those mobile phone dead zones that we all suffer through and providing the productivity-enhancing technology of mobile communications to currently unconnected people across the globe. Let me move on to a discussion about some of our key operating metrics that are presented on Slide 10. Looking at the first chart, we see for the fourth quarter of 2022, we had non-GAAP adjusted operating expenses of $39.1 million versus $38.5 million in the third quarter. Non-GAAP adjusted operating expenses, excluding non-cash operating costs, including depreciation and amortization and stock-based compensation totaling $3.6 million for both the third and the fourth quarters. Our fourth quarter non-GAAP adjusted operating expenses increased by $0.6 million versus the third quarter. As expected, our research and development expenses increased again this quarter, mostly as a result of the achievement of certain milestones in our projects, which brought forward certain milestone payments. Our R&D expenses consist principally of non-recurring development activities for which we typically engage third-party vendors and payments are based on completion of milestones. Our other components of non-GAAP adjusted operating expenses namely engineering services and G&A are expected to remain at about the same range for the next two quarters and will trend up slightly over time as a result of our commercialization efforts. We currently expect that the level of non-GAAP adjusted operating expenses will remain in the high 30s for at least two more quarters as we continue to pursue important R&D projects for our BlueBird satellites and declined to the low 30s thereafter. Turning towards the second chart. Our capital expenditures for the fourth quarter were $10.4 million versus $11.3 million for the third quarter and $30.3 million for the full year. We expect that our levels of capital expenditures, which include direct material expenditures and launch costs for satellites as well as capital improvements for our manufacturing facilities and ground infrastructure will increase. As disclosed in our 10-K, we now estimate that our capital expenditures for our 5 Block 1 satellites will be between $100 million to $110 million. Our capital expenditures, which have been averaging around $10 million to $11 million per quarter, will begin to increase to fund the development of our Block 1 satellites, which we currently expect to launch in the first quarter of 2024. Our estimates for the capital cost of each of our Block 2 satellites, which includes materials and launch costs, is now $16 million to $18 million. The increase in Block 2 satellite costs versus our previous estimate reflects increases in material costs and a higher estimate for future launch costs. The projected cost of these satellites could be adversely affected by a number of factors, including inflation, supply chain disruptions, design changes and increases in the cost of electronic components, assembly equipment, watch costs, salaries and other aspects of our satellite design and assembly activities, could increase the cost of design, assemble and launch our satellites. These estimated cost trends are preliminary estimates based on certain assumptions and information currently available to us and are subject to change based on numerous factors described earlier as well as delays in the development of components and materials, launch costs and other factors. And on the final chart on the slide, we ended the fourth quarter just shy of $240 million in cash on hand, up from approximately $200 million at the end of the third quarter. As we stated in our 10-K, we believe this cash as well as our ability to raise capital through other existing facilities is sufficient to support our expenditures for at least the next 12 months. In addition, we continue to evaluate other sources of cash and liquidity to supplement our activities. We understand the capital-intensive nature of our project, and we are highly focused on exploring a wide range of options in order to fund our efforts. As described in our 10-K, a key strategy of AST is to develop our constellation on a modular basis, focusing our satellite capacity on the most attractive commercial markets in conjunction with our mobile network operator partners. I am encouraged by the progress that the team has made and I'm excited about the company's future as we transition from the development phase to commercial satellite production. Thank you for your continued support of the SpaceMobile mission. And with that, I'll turn it back to Scott. Scott Wisniewski: Thank you, Sean. Before we go to the queue of analyst questions, we'd like to address a few of the questions submitted ahead of the call by our investors. Operator, could you please start us off with the first question. Operator: Bob from Washington asked, are you satisfied with where testing progress and time lines are at right now? Abel Avellan: Thank you, Bob for the question. Well, we are never satisfied, but we're very, very encouraged by what we have learned so far during the testing. We have validated our architecture end-to-end, and we have validated our ability to provide satellite cellular broadband with our architecture. We have done something that nobody has done before. We have building infrastructure alongside with this capability, and we are also protected with IP, which is very significant, and we are also very advanced in our commercial listings of our satellites. So fundamentally, we're happy where we are at this point. Operator: Jay from California asked, where is AST SpaceMobile on the production of the 20 full size BlueBirds for a function and constellation? Will the 5 BW3 sized satellites to be launched later this year be included in that constellation? Scott Wisniewski: Thanks, Jay. That's right. The first block on BlueBird still not only offer initial services on our own, but we expect their capabilities will be incorporated into the overall constellation as we build it out. our Block 2 satellites, which will leverage our custom ASIC, they're going to offer significant upgrade to the RF capabilities versus Block 1, but a few networks are designed to be compatible. And in terms of timing, we currently plan to launch and deploy Block 2 BlueBird satellites in a phased approach beginning in 2024 after the launch of the Block 1 BlueBird satellite. Operator: Luke from Connecticut asks, how should we think about military use and potential revenue? Abel Avellan: Thank you, Luke for the question. First of all, I want to reiterate that our focus is providing cellular broadband globally for people that live work in places where there's not satellite connectivity that allow us to participate in the $1 trillion wireless market, and we think that that's our core business. Connecting those 5 billion phones that moving on connectivity every day. However, we have making considerations to also participate in large government-related opportunities for both security and defense opportunities, in particular in the United States. Operator: Jay from California asks, in our recent economic environment with VC money, capital constraints and higher interest rates, where does AST SpaceMobile expect to receive funding for the production of the 20 full-size BlueBirds and beyond? Sean Wallace: Thank you, Jay. As we have stated during our earnings presentation and disclosed in our 10-K, we believe we have enough cash on hand and other resources to fund the next 12 months of operations, including the construction launch of 5 Block 1 satellites, which are targeted to be launched in the first quarter of 2024. In addition to this liquidity, we have been working hard to develop other sources of cash and liquidity in order to supplement our future activities, including the construction of 20 BB1 satellites. This activity includes exploring a wide range of instruments, including structured debt, excellent government financing, the public debt markets, the potential to presell capacity to important customers and selling equity in both private and public transactions. We are optimistic that we have a window of many quarters to determine the best financing alternatives and are hopeful that our access to capital will continue to remain strong, especially if we're able to continue to execute our strategy. Scott Wisniewski: And with that, I'd like to thank our shareholders for submitting these questions. Operator, let's open the call to analyst questions now. Operator: Our first questions come from the line of Mike Crawford with B. Riley. Please proceed with your questions. Mike Crawford: Thank you for the update this morning. Regarding regulatory framework, what do you want to see from the final report and order from the FCC regarding supplemental coverage from space? Abel Avellan: Well, thank you for the question. Well, I think the step that the FCC has taken are very, very encouraging for our plants. First of all, facilitate the partnership between retail cellular providers cellular on the space base system like ours. So that would provide a framework that will be leading here in the United States. It will facilitate. It will streamline the process. That it is at least our expectation. And also, our expectation is that other country will follow the lead of the United States with what the FCC is doing here. So we're very pleased with that process. Of course, that process is ongoing. And actually, the actual final shape of that process remains to be seen, but we're very encouraged with the initiative of the FCC on the process at the forward to standardize and facilitate regulatory framework for systems like ours. Mike Crawford: Okay. And then do you have any greater understanding of what level of revenue you'll be able to generate with the first 5 Block 1 satellites and then separately once you have 20 satellites? Scott Wisniewski: Mike, it's Scott here. So we referenced on our milestones page, signing a definitive commercial agreement, and we've begun those discussions with initial customers and we're not going to provide guidance on revenue, of course. But the first 5 satellites, we do believe will have stand-alone revenue. It's not the focus, of course. We focused on that as a first phase, but we do believe there's revenue there, both for service and other related things we can sell to those MNO customers as -- and then there's also the government opportunities, which government market is quite often in the satellite world an early contributor to revenue in the overall company cycle. So between those two, we think there's revenue there. We don't give guidance on how much. And on the Block 2 BlueBirds, those are the ones that will get us to a near continuous service and profitability and cash flow positive. Operator: Our next question is come from the line of Chris Quilty with Quilty Analytics. Please proceed with your questions. Chris Quilty: Thank you, gentlemen. I was wondering if you could elaborate on the testing that you did and specifically, pretty encouraging that you're seeing the ability to get to 5G speed, maybe if you can add a little color on how you do that testing and draw that conclusion? Abel Avellan: Hey Chris. How are you. Thank you for the question. What we have done so far on our testing basically indicated that we will be able to get to 4G and 5G speeds. We have achieved that. We achieved to get to that conclusion by basically mentioning the signal strength that we're able to get in each direction to all the connection. We are there in the downlink. So we know that we will be able to get 5G speed in our system. More importantly, also, we have validated the whole architecture, including the doppler and delay compensation. So basically, at this point, the end-to-end architecture is validated. We're not done with the testing, continue steps to be taken. We plan to -- in due course, we plan to announce results in conjunction with our telco partners. Chris Quilty: And how would you make that announcement? Would there be a press release or sort of study release? Scott Wisniewski: Chris, we, of course, don't want to get ahead of that announcement, but we think it's -- this is an incredible milestone, not just for us, but kind of you saw our partner post us alongside Alexander Grand Bell. So we -- that's perhaps a little strong, but we think this is a very big moment in being able to demonstrate broadband from a satellite directly to and modified one of five billion in the world. We think that's a very big announcement, and that's one worthy of a big announcement, but we don't want to get ahead of that too much, Chris. Chris Quilty: Okay. Just to make sure I get the White House announcement. So the other question I had was concerning the agreement -- Space Act Agreement with NASA, which is surprised it slipped by those are not necessarily easy to process. When was that concluded? And was there any impact on operations or how you would operate based upon that agreement? Abel Avellan: Yes. The agreement with NASA, Chris, is basically an agreement to chair information of where our assets or our space assets are, where their space assets are. Basically had our procedure how to manage information between us. So basically simply to facilitate the operation or constellation. And we don't see any particular change in how we're planning to operate. There have been significant learnings of how to actually do this with successfully flying in one of the largest communication array ever deploying to LEO. And this is just simply one step into how to industrialize and continue to add satellites that we build them. Scott Wisniewski: And Chris, we put that press release out right before the holidays, December 16. Chris Quilty: Knock it out. Well, congratulations. And final question, can you elaborate what you're seeing in the launch market? Obviously, the big 83 launch order that Amazon placed last year has put some constraint on the heavy lift market. Are you still targeting Falcon Heavy as a primary launch vehicle waiting for Starship? Or are there other alternatives? Abel Avellan: Chris, as you probably know, we already secured our next launch with Falcon 9 for the next 5 satellites in a single launch. But we also announced that we're leaving our all options open and we had big data significant amount of new entries into the market that start coming up in 2024, 2025. And we are evaluating and we're working with basically all of them that has the ability to launch more than 10 tons into space with a single launch. Chris Quilty: Very good. Thank you. Operator: Our next questions come from the line of Mathieu Robiliard with Barclays. Please proceed with your questions. Mathieu Robiliard: Good morning, all. And congratulations on all the progress. I had a few questions. The first one is around regulation, and there was a question about the FCC, but I was also interested to know what progress you've been making in terms of getting regulatory approval in other markets? And there's also news about the German regulator reportedly asking you for cutting the signal once you cover the EC -- Europe at this stage. I don't know if there's any comment that you want to make about that? So that would be my first question. Scott Wisniewski: Great. Good morning, Mathieu. Scott here. On the global progress with regulatory, the U.S. has been the one that's had the most significant movement this quarter. Of course, that's why we've profiled it, and we think the U.S. is important market in the world and one that we're very happy is taking a constructive approach. Globally, we've had several licenses for both 3GPP and V-band in place for some time now in about half a dozen markets globally. And we have many other regulatory conversations going on. It's a little more traditional for markets to progress closer to service. So we expect more movement on that as the year progresses. But we've also been really focused on test licenses. Some of that's not public, some of it's done behind the scenes before it's granted. And so its been perfect test licenses, of course, so that we can continue our Block 3 test campaign through the course of the year. So that's good signals there, nothing's really changed. The receptivity we get from regulators is pretty positive based on the increased attention that non-terrestrial has got in the last couple of years. Others have kind of done that spade work for us. And then also the fact that this is just a great outcome for regulators, right? It's using existing assets more efficiently, connecting the unconnected. It's resolving political objective country by country by country. So I think globally, we still feel good. And in the second part of your question, Germany. So we were not contacted by the German regulator on that topic. So I don't think we have any other further comments that we've not filed for approval in Germany. Mathieu Robiliard: Great. That's very clear. Then I had a question about the testing, and I don't know how much you want or can share at this stage. But to understand a bit what the next milestone in terms of what you need to test and work on testing with BlueWalker 3, it'd be up leading. And I don't know if you can share any sense of timing in terms of how long could this take? Scott Wisniewski: Great. I think the key thing that we tried to emphasize was the validation of the end-to-end architecture, right? And that's key because the reason why this challenge has not been solved before and why we think others will struggle to solve it in a meaningful way because there's a lot of components to the architecture, being able to transmit and do that initial end-to-end testing was a real key validation for us as well as flying the satellite and mechanical unfolding. So having those in our back pocket and getting the initial signal strength test that Abel pointed to on the downlink was very encouraging for us. These things that are happening in real time. This is something that's never been done before. And pass by pass every 90 minutes, we make advancements. So we see the pieces and the testing continues for them. Mathieu Robiliard: Thank you. And then maybe a last question in terms of the CapEx specifically, the unit cost of the BlueBird satellites. I know you said in the past that the next batch of satellites could have something more origins and more scalable in terms of the production. And so I was wondering if that was still how you thought about it and future satellites you did cost could include be a bit lower than the one of BlueBird 5 -- sorry, BlueBird 1? Abel Avellan: Do you want to take that, Scott? Scott Wisniewski: Yes, please. So the range of our estimates for the first sets of satellites north from $15 million to $17 million to $16 million to $18 million, about a 6% increase. A lot of that increase is a function of some changes in some of our estimates of what we think our launch vehicle costs will be. Candidly, we have tried to be very conservative on what we think our material costs will be as well as our launch costs. And we have basically predicted our costs based on current costs for our materials and for launches. We agree with you that, overtime, we're going to continue to see, hopefully, very, very rapid reductions in the cost per kilograms for launch vehicles as well as the benefits of scale in our manufacturing and purchasing capabilities to bring that number down, but we are trying to be conservative. And so we're just using sort of near line of sight to provide you that estimate. Hopefully, will be good news if we get better scale and better cost and launch vehicles. Mathieu Robiliard: Great. Thank you very much. Operator: Thank you. Our next questions come from the line of Bryan Kraft with Deutsche Bank. Please proceed with your questions. Bryan Kraft: Hi, good morning. I had a few, if you don't mind. I guess, first, I wanted to just ask you what regions will the Block 1 and Block 2 satellites cover? I'm assuming that, that will be equatorial regions, but I wanted to see how you're thinking about that? Maybe I throw the second one in at the same time, which is, at this point, when do you expect revenue to really begin to ramp in a meaningful way? Is that maybe early 2025 after the first 25 satellites in orbit and operating? Or will it take longer before we start to see that ramp up? Scott Wisniewski: Thanks, Bryan. I'll jump in first. So in terms of initial markets for Block 1, we have not announced that. And the reason why -- believe it or not, you can actually change that. Where the satellites focus pretty late in the cycle because it's just a matter of inclination that you launch into. But of course, we have some pretty good sense and the U.S. market is the most valuable telecom market in the world. But that's a decision prioritization that just what we made with our partners and there'll be strategic considerations. But those initial markets for Block 1, we expect well service globally in some way. And yes, we expect revenue on those for sure. In terms of revenue ramp, the Block 1 revenue will be a 2024 event, and then Block 2 revenue will continue to ramp alongside it. For us, it's important that we're not selling services based on satellites, we're selling services based on capabilities and coverage. And so as we start to put agreements in place, they'll kind of -- they'll forecast the expectation of additional coverage and additional capabilities, and we'll be able to leg into that kind of automatic clear as we go. So really 2024 for initial revenue from Block 1 and Block 2 will chase as quickly as we can. Bryan Kraft: Well, maybe just -- I mean, without getting into specific markets, I guess one thing I just wanted to understand is there's really two types of markets, right? There's Western markets where you're providing fill in coverage for people primarily who are roaming off the grid. And then there are markets where you're providing primary broadband service, right, because there's not terrestrial service available, which I think is a big part of your mission. I guess I was just curious as to whether the first two blocks of satellites will focus on providing that primary broadband service? Or if it will be more in the developed markets like the U.S. where you're providing complementary service to terrestrial networks? Abel Avellan: Yes. We are taking a dramatic and strategic approach where we focus the satellites, and that depends on the agreements that we have. I mean, obviously, our ability to provide connectivity for both type of markets, developed markets where people, most of the time, have connectivity, but moving out of connectivity when it's hiking or in a row that do not have connectivity or simply driving between New York and the Hamptons and heat an area where there's no connectivity. And as you indicated, also developing countries where people work and live in places where there is no broadband connectivity at all. So we're approaching both. The ARPU of the developed market is higher. The U.S. market is the largest telco market in the world. And we are taking decisions of where we focus these initial assets as per the agreement that we are working and negotiating with our telco partners. So they will be -- to answer your question is, it will be driven by the commercial agreements that we're negotiating. Bryan Kraft: Got it. That makes sense. And then my other question is, on the financing side, what's the potential for securing financing through one or more of your MNO partners? I mean with so many large, well-funded partners, you wouldn't need a lot of participation among companies to make a modest investment to finish the build out or at least get you through the next phase on the Block 2 satellites. And I guess I was wondering how realistic that might be as an option and maybe that plays into some of the prioritization discussion, too, about where you focus first? Abel Avellan: No, I think you -- you're absolutely right. That the -- we were strategic for our telco partners. We actually partnered with them in solving a major problem for them, which is coverage, and specifically, the coverage has become more expensive for them, which is the last portion of their territories where there's no broadband services. We will explore that as much as we can. And we will work with them. We have been working since inception. So that's what we're working with our existing shareholders and strategic partners as part of our development of our constellation. Bryan Kraft: Do you want to add something there, Sean? It sounds like you're trying to jump in. Sean Wallace: No, I think Abel said it best. I mean, I think as we move along and derisk this business, it's very clear in our conversations with them and our MNO partners that this is a great -- this is a business that attacks their capital expenditure problems. They need to build fewer towers. They probably need to buy less spectrum and they're going to help their ARPU, which all drive their return on invested capital. So it's a very interesting business that's complementary to their existing platform and is going to be able to grow without having to spend a lot of money. So we do agree with you that over time, as we derisk prove the technology, that there's going to be a lot of -- we hope there would be a lot of companies to be very interested investing alongside this. Bryan Kraft: Okay. Thank you very much. Operator: Our next questions come from the line of Landon Park with Morgan Stanley. Please proceed with your question. Landon Park: Good morning, everyone. Thanks for taking the questions. I'm wondering if we can just start off on the testing you mentioned. Can you maybe just define what 5G speeds sort of means when you're talking about that? And is the testing indicating that you'll have a reliable enough connection for consistent voice services as well? Abel Avellan: Well, first of all, the -- when we refer to 5G, we refer to what the SEC basically state of 5G -- 5G or 4G speed. So that what we use as a reference. Landon Park: What, 30 megabits or... Abel Avellan: In that order, yes. So the -- in order to provide broadband directly to a handset, you need to have the ability to calibrate, being form, track, doppler and delay compensate, which we do with our patented approach to do that directly to a regular handset. So at this moment, we have all the evidence that we get enough signal strength to achieve that. As I said before, we are not completed, we still steps to finish to do that end-to-end connectivity to the phone, but we have basically validated the whole architecture at this point. And yes, this will support voice quality, text, data, video, video streaming and anything that you can do with a 5G device and the rest architecture. Of course, with the limitations of our wireless infrastructure and obviously, that capacity needs to be administrated carefully in order to maximize the number of users per satellite. But in principle, we estimate that we will be able to support all applications that you currently have on the terrestrial networks. Landon Park: Understood. And talking about the BlueBirds, I think you previously indicated that you expect the full size production satellites to have 9 to 13 gigabits of capacity. Has the testing given any indications of potential upside or downside versus those numbers that you had previously given? Abel Avellan: Well, we indicated -- I mean, the first block, they are the same size of BlueWalker 3, they are FPGA base. The next generation, the Block 2s are our ASIC base. We have done a tremendous amount of progress on that. We will be taking out that ASIC pretty soon, and we estimate a tenfold increase in capacity per satellite when we incorporate the ASIC into our technology. Our testing at this point have been mostly focused in BlueWalker 3 and basically enabling end-to-end connectivity with all the impairment that a LEO system will have, which is the core of our technology. Landon Park: Understood. So is the 9 to 13 gigabits for the full-size ASIC-based satellites. Is that still the right range we should be thinking about? Abel Avellan: Yes. Landon Park: Okay. And then just last one for me. I'm wondering if you've had any discussions with MSS spectrum license holders for potential partnership. I think there's certain obvious benefits to having a global unified band that can potentially be embedded in smartphones moving forward. Have you given any thoughts to potentially pursuing a partnership along those lines? Abel Avellan: Well, what I can say at this moment, our satellite has the ability to support both 3GPP and MSS spectrum. We have designed that from the very beginning, both our ASIC, our antennas, our transmitters, our receivers, which take years to develop, they already incorporate a capability for a multitude of bands, no one in particular. But our view is that the real business and the biggest potential, it is reducing the spectrum from the MNO, for a very, very simple reason. There is gigahertz capacity or spectrum allocated to cellular and the very few 10s of megahertz allocated to MSS. So our view is focus on 3GPP spectrum that we reuse front terrestrial in a chair matter or in a dedicated matter in order to assure a weaker connectivity per country. But having said that, that doesn't discard our capacity and our ability to also overlay MSS spectrum to what we believe is the core and the most important market, which is reuse in 3GPP spectrum. Landon Park: So just a follow-up there. So when we think about use cases in terms of potentially being fringe use cases and populated suburban areas where there are fill dead spots, but they're relatively small. Would you be able to use carrier spectrum in small dead spots like that? Or will it create interference issues with the terrestrial networks? Abel Avellan: Yes. We had an approach with the 3GPP spectrum, which is shared with terrestrial that one of the big advantages of having a very large array allowed us to geographically distinct and reuse the spectrum. So we don't need dedicated spectrum on a national basis. We can parse it out by regions, by sales, by beans. And then we work with the operators in basically a frequency plan that allowed us to cover the very small holes in the network as of the very large holes in the network. So that's the way how we do it. Of course, we do this in complete coordination and with the cellular operator, which is at the end, beholder of the spectrum. Landon Park: How small -- I mean, are those -- because I mean, some of these gaps are very, very small and in relatively populated suburban areas. So how tight can you get your beams in terms of filling in some of those gaps? Abel Avellan: Yes. It is not only by separating through the beams. So our beams get to around 24 kilometers, and that's a matter of 24/12 depending on demand. And then easy gaps are smaller than that, then basically, it's a frequency plan coordination that is done together with the operator. So it's basically tonal spectrum into those areas. So when we think about it, we think about it 3GPP dedicated spectrum on 3GPP, non-dedicated of chair spectrum, but both 3GPP spectrum already owned and operated by the operators. Landon Park: So under that scenario, the operator would have to vacate certain frequencies in those small pockets on a wider basis in order to allow you to operate, right? Is that allow under the way FCC rules are being written? Abel Avellan: Yes. Landon Park: That's how it would it function? Abel Avellan: Yes, that's our expectation. Our expectation is that that the operators with our system, they will be able to, in the most efficient way that exists today, given the size of our arrays, we'll be able to chair spectrum in a dedicated or a chair matter in order to cover every single gap in their correspondent territory. Operator: Thank you. At this time, I'm showing no further questions. I would now like to turn the call back over to Scott Wisnewski for any closing remarks. Scott Wisniewski: Thank you, everyone. And our company is building the first and only space-based cellular broadband network and is designed for use of the phone in your pocket today. We're very excited for the path ahead for AST SpaceMobile. Thank you to our shareholders and analysts for their questions, and have a great weekend, everybody. Operator: Thank you. This does conclude today's teleconference. We appreciate your participation. You may disconnect your lines at this time. Enjoy the rest of your day.

AST SpaceMobile's Market Position and Recent Downgrade

AST SpaceMobile (NASDAQ:ASTS), a company focused on providing space-based mobile broadband services, aims to connect mobile phones directly to satellites, offering coverage in remote areas. However, the company faces stiff competition from industry giants like SpaceX, which is rapidly expanding its satellite constellation.

On September 9, 2025, UBS downgraded ASTS from a Buy to a Neutral rating. At the time, the stock price was $40.77. This downgrade came amid a challenging period for ASTS, as highlighted by a 5.42% drop in its share price following SpaceX's announcement of a new spectrum acquisition deal. This move by SpaceX positions it as a more direct competitor to AST SpaceMobile.

The current price of ASTS is $40.77, reflecting a decrease of 3.87% or $1.64. The stock has seen fluctuations today, with a low of $36.50 and a high of $40.94. Over the past year, ASTS has experienced a high of $60.95 and a low of $17.50, indicating significant volatility in its stock performance.

AST SpaceMobile's market capitalization stands at approximately $12.18 billion. The company's trading volume today is 20.18 million shares, suggesting active investor interest despite recent challenges. The competitive pressure from SpaceX's rapid expansion could potentially impact AST SpaceMobile's market position and growth prospects.

AST SpaceMobile's Strategic Moves in the Satellite Communications Industry

- AST SpaceMobile (NASDAQ:ASTS) is expanding its satellite network to enhance global mobile connectivity.

- The CFO and CLO, Johnson Andrew Martin, sold 20,000 shares, yet the company's stock has risen by 39.4% over the past year.

- Despite a negative P/E ratio of -34.58 and challenges in generating positive cash flow, ASTS plans to deploy 45 to 60 satellites by 2026.

AST SpaceMobile, trading under NASDAQ:ASTS, is a company focused on revolutionizing mobile connectivity through space-based solutions. The company aims to deploy a network of satellites to provide mobile coverage, enhancing communication capabilities globally. ASTS competes in the satellite communications industry, where innovation and technological advancements are key to gaining a competitive edge.

On August 26, 2025, Johnson Andrew Martin, the CFO and CLO of ASTS, sold 20,000 shares of Class A Common Stock at $52.48 each. Despite this sale, he still holds 397,485 shares. This transaction is part of the company's ongoing developments, as AST SpaceMobile plans to deploy 45 to 60 satellites by 2026 to enhance its space-based mobile network.

AST SpaceMobile has already launched five BlueBird satellites, each with a 693 square feet communication array, the largest in commercial use. These satellites are crucial for the company's goal to provide non-continuous service across the U.S. by late 2025. The stock has risen by 39.4% over the past year, outpacing the industry's 25.6% growth, reflecting investor confidence in these advancements.

Despite the positive stock performance, ASTS faces financial challenges. The company has a negative P/E ratio of -34.58, indicating a lack of profitability. The high price-to-sales ratio of 3,079 and enterprise value to sales ratio of 2,895 suggest investors are paying a premium for future growth potential. The negative enterprise value to operating cash flow ratio of -105.77 highlights difficulties in generating positive cash flow.

ASTS maintains a low debt-to-equity ratio of 0.02, showing minimal reliance on debt. The strong current ratio of 8.23 indicates a solid ability to meet short-term liabilities. However, the negative earnings yield of -2.89% underscores the company's current financial struggles. Despite these challenges, AST SpaceMobile's ambitious satellite deployment plan aims to strengthen its market position.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Earnings Preview: A Critical Look at Financial Performance

AST SpaceMobile, Inc. (NASDAQ:ASTS) is a trailblazer in the telecommunications industry, known for its unique space-based cellular broadband network. This innovative service allows everyday smartphones to connect directly to the network, serving both commercial and government sectors. As ASTS prepares to release its quarterly earnings on August 11, 2025, investors are keenly watching the company's financial performance. Wall Street projects ASTS to report an earnings per share (EPS) of -$0.08, with revenue expected to be around $6.02 million.

However, the consensus outlook anticipates a more significant quarterly loss of $0.19 per share. This discrepancy in expectations could lead to notable stock price movements. If ASTS surpasses these projections, it might experience a positive stock trend. Conversely, falling short could result in a decline.

ASTS's financial metrics reveal some challenges. The company has a negative price-to-earnings (P/E) ratio of -32.03, indicating it is not currently profitable. Additionally, the price-to-sales ratio is extremely high at 3,519.55, suggesting investors are paying a premium for each dollar of sales. These figures highlight the market's high expectations for ASTS's future growth. Despite these challenges, ASTS maintains a strong liquidity position with a current ratio of 10.62, indicating its ability to cover short-term liabilities.

The debt-to-equity ratio stands at 0.84, reflecting a moderate level of debt compared to its equity. These metrics suggest that while ASTS faces profitability issues, it has the resources to manage its short-term obligations. The upcoming earnings call on August 11th will be crucial for investors. Management's discussion will provide insights into the sustainability of any immediate price changes and future earnings expectations. The call will also allow retail and institutional shareholders to engage with the company, potentially influencing investor sentiment and stock performance.

AST SpaceMobile, Inc. (NASDAQ:ASTS) COO Sells Shares Amidst Company's Growth Phase

- Gupta Shanti B., COO of AST SpaceMobile, sold 10,000 shares at $41.84 each, still holding 305,667 shares.

- The company, a leader in the low-Earth orbit satellite industry, reported a $63 million operating loss in Q1 2025 but secured a term sheet for long-term resource access.

- AST SpaceMobile's stock price fluctuated, reaching a yearly high of $42.93, with a market capitalization of approximately $13.75 billion.

On June 16, 2025, Gupta Shanti B., the Chief Operating Officer of AST SpaceMobile, Inc. (NASDAQ:ASTS), sold 10,000 shares of Class A Common Stock at $41.84 each. After this transaction, Gupta Shanti B. still holds 305,667 shares. AST SpaceMobile is a Texas-based company focused on creating a space-based cellular network to provide global internet access directly to smartphones.

AST SpaceMobile's stock is currently priced at $38.50 as of mid-June, which some may view as overvalued given the company's modest revenue of $0.7 million. However, the company has reached a significant turning point in the first quarter of 2025, positioning itself for rapid growth and profitability within two years. This potential for growth is reflected in the stock's current price of $41.91, marking a 9.23% increase.

The company is a key player in the low-Earth orbit satellite industry, which aims to provide global Internet and mobile services. This industry is part of a mobile service market estimated to be worth nearly $235 billion in 2025, with an expected compound annual growth rate of 5%. AST SpaceMobile is among the leaders in this multi-billion-dollar sector, capturing attention with its ambitious vision despite the market's focus on artificial intelligence and quantum computing.

In the first quarter of 2025, AST SpaceMobile reported a $63 million operating loss, mainly due to significant investments in research and development and manufacturing. However, the company has secured a term sheet granting it long-term access to necessary resources for over 80 years. This development is crucial for AST SpaceMobile as it continues to pursue its high-risk, high-reward strategy in the space industry.

AST SpaceMobile's stock has experienced fluctuations, with a low of $38.76 and a high of $42.93 today, the latter being its highest price over the past year. The stock's lowest price in the past year was $9.32. With a market capitalization of approximately $13.75 billion and a trading volume of 17.51 million shares today, AST SpaceMobile is gaining attention on social media, indicating a positive trend for the stock.

AST SpaceMobile Inc (NASDAQ:ASTS) Stock Performance and Market Movements

- AST SpaceMobile Inc (NASDAQ:ASTS) sees significant stock price growth, partly due to external factors affecting the industry.

- President Scott Wisniewski sold 50,000 shares, yet the company's stock surged by 33.9% this week, outperforming major indexes.

- Speculation about a potential partnership with Blue Origin and social media hints contribute to an 11.64% increase in ASTS's stock price.

AST SpaceMobile Inc (NASDAQ:ASTS) is a company that focuses on providing space-based cellular broadband networks. It aims to connect people globally by deploying a network of satellites. ASTS competes with other companies in the space exploration and satellite communication sectors, such as Rocket Lab USA Inc (NASDAQ:RKLB) and SpaceX.

On June 9, 2025, Scott Wisniewski, the President of ASTS, sold 50,000 shares of Class A Common Stock at $35.65 each. Despite this sale, Wisniewski still holds 545,595 shares in the company. This transaction comes at a time when ASTS is experiencing significant stock price growth, partly due to external factors affecting the industry.

The ongoing conflict between SpaceX CEO Elon Musk and President Donald Trump has indirectly benefited ASTS. As highlighted by Schaeffer's Research, the disagreement over a tax and spending bill has led to threats of cutting government contracts with Musk. This situation has drawn attention to ASTS, contributing to a 14.1% surge in its stock price, reaching $35.58.

ASTS's stock performance has been impressive, with a 320.4% increase year-to-date. This week alone, the stock surged by 33.9%, outperforming the S&P 500's 1.5% gain and the Nasdaq-100's 2.2% rise. Speculation about a potential partnership with Jeff Bezos' Blue Origin has fueled this growth. A social media post by AST board member Adriana Cisneros hinted at exciting developments between AST & Science and Blue Origin.

Currently, ASTS's stock is priced at $34.82, reflecting an 11.64% increase. The stock has fluctuated between $32.25 and $36.66 during the trading day. Over the past year, it reached a high of $39.08 and a low of $8.09. With a market capitalization of approximately $11.43 billion, ASTS continues to attract investor interest, as evidenced by today's trading volume of 33.7 million shares.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.

AST SpaceMobile, Inc. (NASDAQ: ASTS) Quarterly Earnings Insight

AST SpaceMobile, Inc. (NASDAQ: ASTS) is set to unveil its quarterly earnings on March 3, 2025, drawing significant attention from investors for its pioneering space-based cellular broadband network. This network is designed to connect smartphones directly, catering to both commercial and governmental sectors. As the earnings date approaches, the financial community is closely monitoring ASTS's performance indicators.

Wall Street analysts have forecasted an earnings per share (EPS) of approximately -$0.18 for ASTS. This anticipated negative EPS is in line with the company's current negative price-to-earnings (P/E) ratio of -14.25, signaling that ASTS is not yet profitable. Despite these figures, the innovative nature of ASTS's technology continues to garner investor interest.

The company's expected revenue for the quarter stands at around $2.38 million. ASTS's high price-to-sales ratio of 3,141.89 indicates that investors are willing to pay a substantial premium for each dollar of sales, reflecting confidence in the company's future growth prospects despite its present financial hurdles.

Further financial metrics such as an enterprise value to sales ratio of 3,020.72 and an enterprise value to operating cash flow ratio of -61.60 underscore ASTS's valuation and cash flow challenges. Nonetheless, a moderate debt-to-equity ratio of 0.69 and a robust current ratio of 5.80 demonstrate the company's balanced debt management and strong liquidity position, essential for sustaining innovation and network expansion.

- ASTS is anticipated to report an EPS of approximately -$0.18, reflecting its current unprofitability.

- The company's high price-to-sales ratio suggests strong market confidence in its future growth potential.

- ASTS's solid liquidity position, indicated by a current ratio of 5.80, supports its ongoing innovation and expansion efforts.