Amkor Technology, Inc. (AMKR) on Q1 2021 Results - Earnings Call Transcript

Company Representatives: Giel Rutten - Chief Executive Officer Megan Faust - Chief Financial Officer Jennifer Jue - Head of Investor Relations Operator: Good day, ladies and gentlemen, and welcome to the Amkor Technology, First Quarter 2021 Earnings Conference Call. My name is Diego and I will be your conference facilitator today. At this time all participants are in a listen-only mode. After the speakers remarks we will conduct a question-and-answer session. As a reminder, this conference is being recorded. I would now like to turn the call over to Jennifer Jue, Head of Investor Relations. Ms. Jue, please go ahead. Jennifer Jue: Thank you, operator. Good afternoon everyone and thank you for joining us for Amkor's first quarter 2021 earnings conference call. Joining me today are Giel Rutten, our Chief Executive Officer; and Megan Faust, our Chief Financial Officer. Giel Rutten: Thank you, Jennifer. Good afternoon, everyone, and thank you for joining the call today. Today I will review our first quarter performance and will provide the outlook for the second quarter. I will also make a few comments on dynamics in markets and technologies that Amkor is well positioned for future growth. With continued strong demand in our advanced technology and steady progress in our mainstream business, we delivered solid financial results in the first quarter. Revenue of $1.33 billion was a Q1 record, increasing 15% year-over-year and declining only 3% sequentially over all-time record Q4, 2020. Continued momentum exiting the year resulted in sequential increases in all end markets with the exception of communications, where we saw a moderate seasonal decline. Profitability for the quarter was above the high end of guidance with a record Q1, EPS of $0.49. Within communications, the first quarter sequential decline of 15% was in line with expectations and was less than the past few years. Typically, we expect seasonal Q1 decline in the range of 25% to 30%. Year-on-year, our communications business grew 22%, representing 40% of total quarterly revenue. For full year 2021, we expect continued growth in our communications business, driven by strength in the smartphone market and a further proliferation of 5G technology. Market data forecasts smartphone volumes to increase 9% year-on-year and 5G penetration rate increasing to around 40% or 540 million units in 2021. First quarter revenue in the automotive and industrial end market was strong, recovering to pre-pandemic levels and setting a new quarterly record. We had sequential growth of 9% and year-on-year growth of 11% in the quarter, representing 22% of total revenue. We had continued strength in advanced products, as well as continued growth in our mainstream and automotive portfolio, most notably in Japan. Megan Faust: Thank you, Giel, and good afternoon everyone. Today, I will review our first quarter results and then provide some comments about our second quarter outlook. As Giel noted, first quarter sales of $1.33 billion was a quarterly record, up 15% year-on-year and a modest 3% sequential decline from an all-time record in the fourth quarter of 2020. In our memory business, we see an accelerating trend toward advanced SiP solutions in addition to multi-layer die stacking. Memory is now more dependent on advanced technology, and therefore starting this quarter we are reporting memory in our advanced products category. Previously it was in mainstream. For comparability purposes, we have recast prior periods. Advanced products have grown 16% year-on-year in the first quarter and represent approximately 70% of our business. Our mainstream products have recovered to pre-pandemic levels of over $400 million in the first quarter and now represent around 30% of our business. Strong demand through our end markets resulted in continued high utilization across our factories and product lines. This had a positive impact on our profitability. Operator: Thank you. Our first question comes from Randy Abrams with Credit Suisse. Please state your question. Randy Abrams: Okay. Yes, thank you on a good result. I wanted to ask the first question about the supply constraints for the two areas. First on substrate, is it mostly on the auto and leadframe or are you also seeing the substrate constraint extend to some of the high-end ABF substrate? Giel Rutten: Okay. Hi, Randy, this is Giel. Let me start with the first question on supply constraints, supply chain constraints. Now starting with the wafer supply chain, your question was related, is it only IDM factories or does it go deeper into the supply chain? Actually, it is both. Of course it started very much with IDM factories, both in Japan as well as in the U.S. that got constrained, industrial incidents like fire or the storm in Texas. But of course, most of these customers are also relying on the same technology, which are generally older technology nodes on supply from foundries. So, while the internal factories are ramping down, you see also constraints happening on the foundry side. So, we see that's definitely happening in the second and third quarter, but we see clear improvements going into the third quarter for the wafer supply. With respect to the substrates, it is indeed on the lead frame and the lower-end part of the substrate side that we see constraints, but also there on the same elements we see also pockets of constraints on the higher end substrates impacting some of the compute segment. So there are selective areas where we see constraints happening also on the higher end substrates. Does that answer your question, Randy? Randy Abrams: Yeah, that does. Maybe just a follow-up on the second half implication, like it sounds like the wafer substrate’s better, not sure on the leadframe, but if you expect it to be a limiter for the normal ramp or you see it actually better or good enough in both areas? Giel Rutten: Yeah, we consider being improved in both areas, Randy. Also, on the leadframe area, we see some improvement. It has to do with the special metal supply chain and we see that these companies are actually getting their volumes up for the second half of the year. So we see improvements across the board, definitely will start impacting the third quarter, and we hope that we see a more normalized supply chain in the fourth quarter. Now going back to your outlook for the second half of the year, normal seasonality, let me first comment on the second quarter outlook. I mean normal seasonality typically for us is a 5% increase over the first quarter. Currently, we see 1% increase and about more than 50% of that is attributable to direct impact of customers’ supply chain. Randy Abrams: Okay. And it's also higher based on the first quarter for the seasonal for Q1 and Q2. And the second question I have on the system and package, you talked a bit about this pipeline transition. Is there any headwind in the first quarter to second quarter seasonality or transition of product, and if you could give a view just on how the SiP overall is tracking for the full year or what you kind of see filling in the pipeline that could come through later this year on System in Package? Giel Rutten: Yes, in the consumer domain, let's say more broadly System-in-Package is driven by two market segments, I mean one is consumer, the other one is communication. In the consumer domain, we see change over one -- from one product generation and to other product generation, meaning one is ramping down the other this ramping up. We also see our customer base expanding and that shows, let's say a dynamic environment in the second quarter, but also going into the second half of the year. You know keep in mind that this product category is also to some extent impacted by the substrate and wafer supply. If you look to the wafer supply, it's all the nodes that heavily impacts power management products, so actually all areas in the industry are impacted by that. On the communications side for the second half of the year, we see a strong ramp with multiple products in line with the second half ramp for the mobile market. Randy Abrams: Okay. And a question on actually two sides, one is on equipment, if there is any constraint for the equipment? On your capacity is there limitation either on the advanced or on wirebonding where some of the stretching lead time on equipment is having much impact? Giel Rutten: Yes, I think on the equipment lead time, that's your question, lead times generally expanding for all equipment, whether it's wire bonders or wafer source or other equipment. We started to observe that actually in the latter part of 2020 and proactively let's say all of this, the anticipated capacity at that point in time we foresaw to meet in this year. I mean most notably, the lead time expansions are in wirebonds for example. I think we are currently able to get the numbers that we need, but they definitely are delayed into -- let's say into the second and third quarter when it comes to delivery. So far, I would say it's not the bottleneck. The bottleneck in the industry is currently, definitely on the material supply, and we don't expect that for Q3 and even Q4, that equipment availability will be the bottleneck for further ramps. Randy Abrams: Okay. And just last question, if you could talk on the pricing outlook where the Asian peers I think have been opportunistic to raise pricing. How you're seeing that pricing and also given the tightness in the industry if any customers are doing any kind of contracts, looking at further out lock-in supply and if that's coming-up pricing or wafer pricing? Giel Rutten: Yes, let me start with the first part of your question with respect to the pricing environment. In general, we see cost of our products going up. I mean, cost of materials going up and that's to partly let's say the result of the shortage of some of the materials, specifically on the substrate and leadframe sides. But also for example on gold wire and even copper wire prices are significantly increasing. So if we see cost increases, we work with our customers to adjust pricing versus these cost increases. I think that's a constructive dialog with our customers. Now in our part of the supply chain there, for example on the wirebond business we work mostly with automotive customers. We have longer-term contracts and we don't work on tactical pricing with our customers. So on very rare occasions we will do that, but in general, we don't tactically use price increases other than increases for material price increases. With respect to your second part of your question, longer-term contracts, yes, I think we see that. We see longer-term contracts in different parts of the business, to secure capacity and to secure supply. We also see different business models occur in there like co-investments in specific parts of the share, of the business, and that happened before, but clearly intensifies this part of the year. Randy Abrams: Okay, great. Thanks a lot for the color, Giel. Good luck. Giel Rutten: Thank you. Thanks, Randy. Operator: Ladies and gentlemen, there appears to be no additional requests for questions at this time. I would now like to turn the call back over to Giel for closing remarks. Thank you. Giel Rutten: Okay, thank you operator. Well, before closing the call, I would like to recap a few key messages. First, the first quarter of 2021, we delivered record Q1 revenue of $1.33 billion and EPS of $0.49. For Q2, 2021, we expect another solid quarter with revenue of $1.34 billion, a 14% year-on-year growth. Supply chain constraints will limit second quarter growth, especially in the automotive market. We expect the supply chain to gradually recover in the second half of 2021. We believe that the main growth drivers remain in place and with Amkor's position in key growth market, we expect to outgrow the semiconductor market in 2021. And last but not least, I would like to thank the global Amkor team for delivering another great quarter. Special thanks for the team's resilience to overcome the challenges we continue to face as a result of the ongoing pandemic and thank you for joining the call today. Operator: Thank you. Ladies and gentlemen this concludes today's conference call. You may now disconnect.

Amkor Technology, Inc. (NASDAQ:AMKR) Insider Sale and Financial Moves

- Rutten Guillaume Marie Jean, the director, President, and CEO of NASDAQ:AMKR, sold 10,000 shares at $30 per share, indicating potential insights into the company's future performance.

- Amkor Technology completed the sale of $500 million in 5.875% senior notes due in 2033 and announced a full redemption of its 6.625% senior notes due in 2027, showcasing its strategic financial management.

- The company's stock is currently priced at $29.58, with a market capitalization of approximately $7.31 billion, reflecting its significant role in the semiconductor industry.

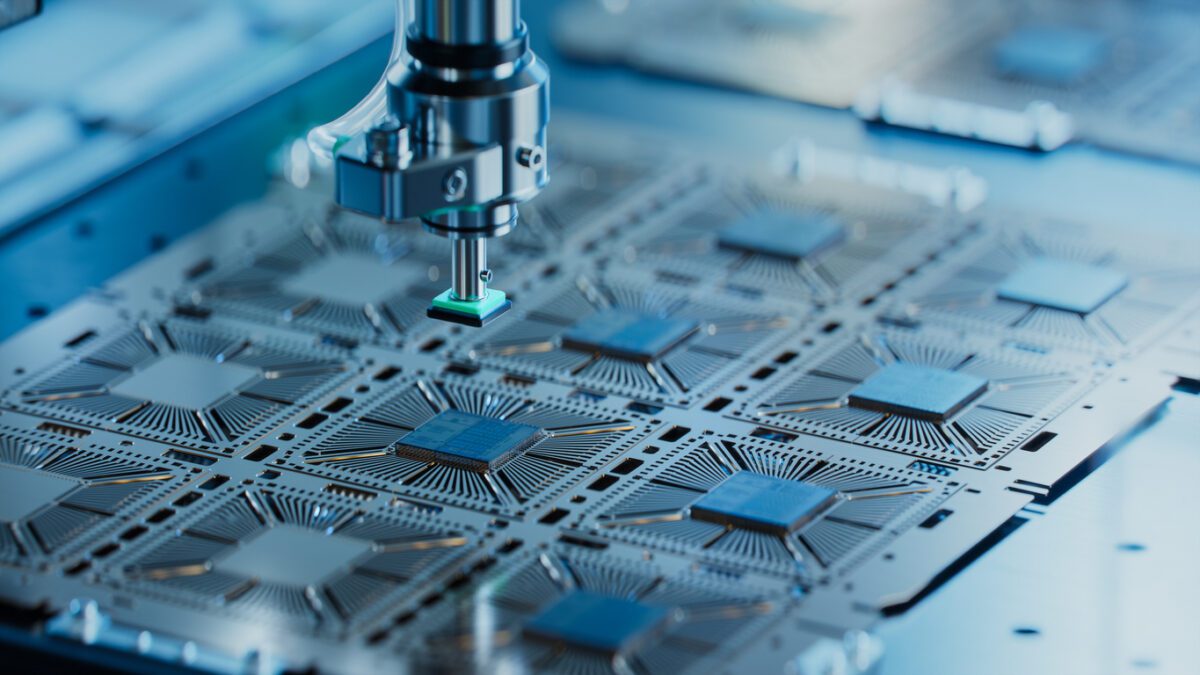

Amkor Technology, Inc. (NASDAQ:AMKR) is a leading provider of semiconductor packaging and test services. The company plays a crucial role in the electronics industry by offering advanced packaging solutions to semiconductor manufacturers. Amkor's competitors include companies like ASE Technology Holding Co., Ltd. and JCET Group Co., Ltd., which also provide similar services in the semiconductor sector.

On September 23, 2025, Rutten Guillaume Marie Jean, the director, President, and CEO of AMKR, sold 10,000 shares of the company's common stock at $30 per share. This transaction, classified as an S-Sale, leaves him with 358,007 shares of AMKR. Such insider transactions can sometimes signal the executive's perspective on the company's future performance.

Amkor Technology recently completed the sale of $500 million in 5.875% senior notes due in 2033. This move is part of the company's strategy to manage its debt effectively. Additionally, Amkor announced a full redemption of its 6.625% senior notes due in 2027, reflecting its commitment to optimizing its financial structure.

The stock for AMKR is currently priced at $29.58, showing a slight increase of 0.17% from the previous session. The stock has fluctuated between $29.45 and $30.35 today. Over the past year, AMKR's stock has seen a high of $32.47 and a low of $14.03, indicating significant volatility.

Amkor's market capitalization is approximately $7.31 billion, highlighting its substantial presence in the semiconductor industry. Today's trading volume for AMKR is 2,191,225 shares on the NASDAQ exchange, suggesting active investor interest in the company's stock.

Amkor Technology Inc (NASDAQ:AMKR) Overview and Financial Performance

- Amkor Technology Inc (NASDAQ:AMKR) surpasses Q2 earnings and sales expectations, with a 22 cents per share and $1.51 billion in sales, respectively.

- Morgan Stanley analyst sets a price target of $20, indicating a potential downside despite Amkor's strong performance.

- The company projects Q3 GAAP EPS between 34 cents and 48 cents, with sales ranging from $1.875 billion to $1.975 billion.

Amkor Technology Inc (NASDAQ:AMKR) is a leading provider of semiconductor packaging and test services. The company plays a crucial role in the electronics supply chain, offering solutions that enable the development of advanced semiconductor devices. Amkor's competitors include companies like ASE Technology and JCET Group, which also operate in the semiconductor packaging industry.

On July 29, 2025, Joseph Moore from Morgan Stanley set a price target of $20 for AMKR, while the stock was trading at $25.08. This suggests a potential downside of approximately -20.26% from the target. Despite this, Amkor's recent financial performance has been strong, with second-quarter earnings of 22 cents per share, surpassing the analyst consensus of 16 cents per share.

Amkor reported quarterly sales of $1.51 billion, exceeding expectations of $1.42 billion. The company projects third-quarter GAAP EPS between 34 cents and 48 cents, with sales ranging from $1.875 billion to $1.975 billion. This positive outlook has led to a 17.4% surge in Amkor's share price, reaching $24.92, as highlighted by Benzinga.

Giel Rutten, Amkor’s president and CEO, attributes the company's success to a 14% sequential increase in revenue and double-digit growth across all end markets. Amkor's strategic focus on AI, HPC, and transformative technologies, along with strong customer relationships and geographic reach, are key factors in its performance.

Currently, AMKR is priced at $25.08, reflecting an 18.13% increase with a change of $3.85. The stock has fluctuated between $24.38 and $26.31 today, with a 52-week high of $35.85 and a low of $14.03. Amkor's market capitalization stands at approximately $6.2 billion, with a trading volume of 9,372,582 shares on the NASDAQ exchange.

Amkor Technology, Inc. (NASDAQ:AMKR) Reports Impressive Q2 Financial Results

- Amkor Technology, Inc. (NASDAQ:AMKR) surpassed earnings per share (EPS) estimates, indicating higher profitability.

- The company's strong revenue performance and favorable market valuation ratios reflect its solid market position.

- Financial stability is demonstrated through moderate debt levels and the ability to cover short-term liabilities, ensuring financial flexibility.

Amkor Technology, Inc. (NASDAQ:AMKR) is a leading provider of semiconductor packaging and test services. The company operates globally, offering a wide range of services to semiconductor companies. Amkor's competitors include companies like ASE Technology Holding Co., Ltd. and JCET Group Co., Ltd. On July 28, 2025, Amkor reported impressive financial results for the second quarter, showcasing its strong market position.

Amkor reported earnings per share (EPS) of $0.22, surpassing the estimated $0.16. This indicates the company's ability to generate higher profits than expected. The company's price-to-earnings (P/E) ratio of 16.57 reflects the market's valuation of its earnings, suggesting that investors are willing to pay $16.57 for every dollar of earnings. This is a positive sign for the company's financial health.

The company achieved a revenue of approximately $1.51 billion, exceeding the estimated $1.42 billion. This strong revenue performance is supported by a price-to-sales ratio of 0.84, indicating that investors are willing to pay $0.84 for every dollar of sales. The enterprise value to sales ratio of 0.87 further highlights the company's total valuation relative to its sales, showcasing its strong market presence.

Amkor's financial stability is evident from its debt-to-equity ratio of 0.31, suggesting a moderate level of debt relative to equity. This indicates that the company is not overly reliant on debt to finance its operations. Additionally, the current ratio of 2.06 demonstrates Amkor's ability to cover its short-term liabilities with its short-term assets, ensuring financial flexibility.

The company's enterprise value to operating cash flow ratio of 5.75 reflects its valuation in relation to its cash flow from operations. This suggests that Amkor is efficiently converting its sales into cash flow. Furthermore, the earnings yield of 6.03% provides insight into the return on investment, indicating that the company is generating a healthy return for its investors.

Amkor Surges 6% On Earnings Beat And Upbeat Revenue Forecast

Amkor Technology (NASDAQ:AMKR) reported second-quarter earnings that exceeded expectations and issued strong forward guidance, lifting its shares more than 6% in after-hours trading.

The semiconductor packaging firm reported adjusted earnings of $0.22 per share for the quarter ended June 30, beating the $0.16 consensus by 37.5%. Revenue reached $1.51 billion, topping the $1.42 billion estimate and rising 3.4% year-over-year. Sequentially, revenue grew 14% across all end markets.

For the third quarter, Amkor projected revenue between $1.875 billion and $1.975 billion. The midpoint of $1.925 billion represents a 9.6% upside to consensus estimates of $1.757 billion.

The quarter included a $32 million net operating benefit from a contingency payment related to its 2017 acquisition of Nanium, contributing $0.07 per share to earnings.

As of June 30, Amkor held $2.0 billion in cash and short-term investments against $1.6 billion in debt. The company plans to repay $223 million in debt in July and paid a quarterly dividend of $0.08269 per share on June 25.

For the full year 2025, capital expenditures are expected to reach approximately $850 million, with investments focused on AI, high-performance computing, and other emerging technologies.

Melius Increases Amkor Technology Price Target to $55 Amid AI Packaging Demand, Shares Gain 2%

Amkor Technology (NASDAQ:AMKR) shares rose more than 2% pre-market today after Melius analysts raised their price target on the company to $55 from $41 while maintaining their Buy rating.

The analysts emphasized Amkor’s strong position in the semiconductor industry, noting its leadership in packaging and test services (OSAT). Despite a 32% rise this year, they believe Amkor's growth is just beginning. Amkor's top customer, Apple, accounts for over 25% of its sales, and increased iPhone 16 builds are expected to drive a multi-year supercycle with double-digit unit growth.

Additionally, Amkor is set to benefit from new Apple headphones and increased packaging revenue for AI chips from major players like Nvidia. Given the positive outlook for both Apple and Nvidia, the analysts raised their estimates for Amkor through 2026. They anticipate EPS approaching $4 with peak gross margins exceeding 20% within two years, leading to the new price target of $55.