Amkor Surges 6% On Earnings Beat And Upbeat Revenue Forecast

Amkor Technology (NASDAQ:AMKR) reported second-quarter earnings that exceeded expectations and issued strong forward guidance, lifting its shares more than 6% in after-hours trading.

The semiconductor packaging firm reported adjusted earnings of $0.22 per share for the quarter ended June 30, beating the $0.16 consensus by 37.5%. Revenue reached $1.51 billion, topping the $1.42 billion estimate and rising 3.4% year-over-year. Sequentially, revenue grew 14% across all end markets.

For the third quarter, Amkor projected revenue between $1.875 billion and $1.975 billion. The midpoint of $1.925 billion represents a 9.6% upside to consensus estimates of $1.757 billion.

The quarter included a $32 million net operating benefit from a contingency payment related to its 2017 acquisition of Nanium, contributing $0.07 per share to earnings.

As of June 30, Amkor held $2.0 billion in cash and short-term investments against $1.6 billion in debt. The company plans to repay $223 million in debt in July and paid a quarterly dividend of $0.08269 per share on June 25.

For the full year 2025, capital expenditures are expected to reach approximately $850 million, with investments focused on AI, high-performance computing, and other emerging technologies.

| Symbol | Price | %chg |

|---|---|---|

| AMD.BA | 38660 | -0.1 |

| 000660.KS | 559000 | 0 |

| LRCX.BA | 4242.5 | -0.41 |

| TXN.BA | 48700 | 0.41 |

Amkor Technology, Inc. (NASDAQ:AMKR) Insider Sale and Financial Moves

- Rutten Guillaume Marie Jean, the director, President, and CEO of NASDAQ:AMKR, sold 10,000 shares at $30 per share, indicating potential insights into the company's future performance.

- Amkor Technology completed the sale of $500 million in 5.875% senior notes due in 2033 and announced a full redemption of its 6.625% senior notes due in 2027, showcasing its strategic financial management.

- The company's stock is currently priced at $29.58, with a market capitalization of approximately $7.31 billion, reflecting its significant role in the semiconductor industry.

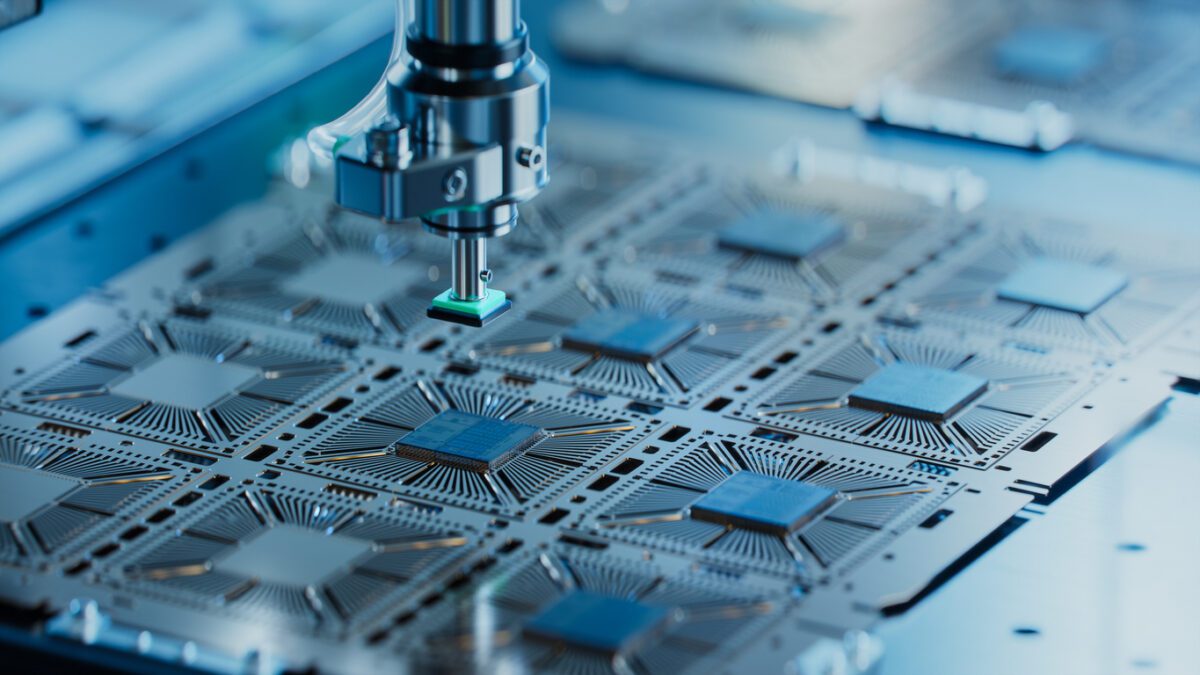

Amkor Technology, Inc. (NASDAQ:AMKR) is a leading provider of semiconductor packaging and test services. The company plays a crucial role in the electronics industry by offering advanced packaging solutions to semiconductor manufacturers. Amkor's competitors include companies like ASE Technology Holding Co., Ltd. and JCET Group Co., Ltd., which also provide similar services in the semiconductor sector.

On September 23, 2025, Rutten Guillaume Marie Jean, the director, President, and CEO of AMKR, sold 10,000 shares of the company's common stock at $30 per share. This transaction, classified as an S-Sale, leaves him with 358,007 shares of AMKR. Such insider transactions can sometimes signal the executive's perspective on the company's future performance.

Amkor Technology recently completed the sale of $500 million in 5.875% senior notes due in 2033. This move is part of the company's strategy to manage its debt effectively. Additionally, Amkor announced a full redemption of its 6.625% senior notes due in 2027, reflecting its commitment to optimizing its financial structure.

The stock for AMKR is currently priced at $29.58, showing a slight increase of 0.17% from the previous session. The stock has fluctuated between $29.45 and $30.35 today. Over the past year, AMKR's stock has seen a high of $32.47 and a low of $14.03, indicating significant volatility.

Amkor's market capitalization is approximately $7.31 billion, highlighting its substantial presence in the semiconductor industry. Today's trading volume for AMKR is 2,191,225 shares on the NASDAQ exchange, suggesting active investor interest in the company's stock.

Amkor Technology Inc (NASDAQ:AMKR) Overview and Financial Performance

- Amkor Technology Inc (NASDAQ:AMKR) surpasses Q2 earnings and sales expectations, with a 22 cents per share and $1.51 billion in sales, respectively.

- Morgan Stanley analyst sets a price target of $20, indicating a potential downside despite Amkor's strong performance.

- The company projects Q3 GAAP EPS between 34 cents and 48 cents, with sales ranging from $1.875 billion to $1.975 billion.

Amkor Technology Inc (NASDAQ:AMKR) is a leading provider of semiconductor packaging and test services. The company plays a crucial role in the electronics supply chain, offering solutions that enable the development of advanced semiconductor devices. Amkor's competitors include companies like ASE Technology and JCET Group, which also operate in the semiconductor packaging industry.

On July 29, 2025, Joseph Moore from Morgan Stanley set a price target of $20 for AMKR, while the stock was trading at $25.08. This suggests a potential downside of approximately -20.26% from the target. Despite this, Amkor's recent financial performance has been strong, with second-quarter earnings of 22 cents per share, surpassing the analyst consensus of 16 cents per share.

Amkor reported quarterly sales of $1.51 billion, exceeding expectations of $1.42 billion. The company projects third-quarter GAAP EPS between 34 cents and 48 cents, with sales ranging from $1.875 billion to $1.975 billion. This positive outlook has led to a 17.4% surge in Amkor's share price, reaching $24.92, as highlighted by Benzinga.

Giel Rutten, Amkor’s president and CEO, attributes the company's success to a 14% sequential increase in revenue and double-digit growth across all end markets. Amkor's strategic focus on AI, HPC, and transformative technologies, along with strong customer relationships and geographic reach, are key factors in its performance.

Currently, AMKR is priced at $25.08, reflecting an 18.13% increase with a change of $3.85. The stock has fluctuated between $24.38 and $26.31 today, with a 52-week high of $35.85 and a low of $14.03. Amkor's market capitalization stands at approximately $6.2 billion, with a trading volume of 9,372,582 shares on the NASDAQ exchange.

Amkor Technology, Inc. (NASDAQ:AMKR) Reports Impressive Q2 Financial Results

- Amkor Technology, Inc. (NASDAQ:AMKR) surpassed earnings per share (EPS) estimates, indicating higher profitability.

- The company's strong revenue performance and favorable market valuation ratios reflect its solid market position.

- Financial stability is demonstrated through moderate debt levels and the ability to cover short-term liabilities, ensuring financial flexibility.

Amkor Technology, Inc. (NASDAQ:AMKR) is a leading provider of semiconductor packaging and test services. The company operates globally, offering a wide range of services to semiconductor companies. Amkor's competitors include companies like ASE Technology Holding Co., Ltd. and JCET Group Co., Ltd. On July 28, 2025, Amkor reported impressive financial results for the second quarter, showcasing its strong market position.

Amkor reported earnings per share (EPS) of $0.22, surpassing the estimated $0.16. This indicates the company's ability to generate higher profits than expected. The company's price-to-earnings (P/E) ratio of 16.57 reflects the market's valuation of its earnings, suggesting that investors are willing to pay $16.57 for every dollar of earnings. This is a positive sign for the company's financial health.

The company achieved a revenue of approximately $1.51 billion, exceeding the estimated $1.42 billion. This strong revenue performance is supported by a price-to-sales ratio of 0.84, indicating that investors are willing to pay $0.84 for every dollar of sales. The enterprise value to sales ratio of 0.87 further highlights the company's total valuation relative to its sales, showcasing its strong market presence.

Amkor's financial stability is evident from its debt-to-equity ratio of 0.31, suggesting a moderate level of debt relative to equity. This indicates that the company is not overly reliant on debt to finance its operations. Additionally, the current ratio of 2.06 demonstrates Amkor's ability to cover its short-term liabilities with its short-term assets, ensuring financial flexibility.

The company's enterprise value to operating cash flow ratio of 5.75 reflects its valuation in relation to its cash flow from operations. This suggests that Amkor is efficiently converting its sales into cash flow. Furthermore, the earnings yield of 6.03% provides insight into the return on investment, indicating that the company is generating a healthy return for its investors.

Melius Increases Amkor Technology Price Target to $55 Amid AI Packaging Demand, Shares Gain 2%

Amkor Technology (NASDAQ:AMKR) shares rose more than 2% pre-market today after Melius analysts raised their price target on the company to $55 from $41 while maintaining their Buy rating.

The analysts emphasized Amkor’s strong position in the semiconductor industry, noting its leadership in packaging and test services (OSAT). Despite a 32% rise this year, they believe Amkor's growth is just beginning. Amkor's top customer, Apple, accounts for over 25% of its sales, and increased iPhone 16 builds are expected to drive a multi-year supercycle with double-digit unit growth.

Additionally, Amkor is set to benefit from new Apple headphones and increased packaging revenue for AI chips from major players like Nvidia. Given the positive outlook for both Apple and Nvidia, the analysts raised their estimates for Amkor through 2026. They anticipate EPS approaching $4 with peak gross margins exceeding 20% within two years, leading to the new price target of $55.