Creative Media & Community Trust Corporation (CMCT) Q3 2022 Earnings Call Transcript

-

Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q3 2022 Earnings Conference Call November 15, 2022 12:00 PM ET Company Participants Stephen Altebrando - VP, Equity Capital Markets David Thompson - CEO Shaul Kuba - Director Barry Berlin - CFO Conference Call Participants Gaurav Mehta - EF Hutton Eric Speron - First Foundation Advisors Operator Hello, and welcome to the Creative Media & Community Trust Third Quarter 2022 Earnings Conference Call. [Operator Instructions].11/15/2022

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q2 2022 Results - Earnings Call Transcript

-

Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q2 2022 Results Conference Call August 9, 2022 12:00 PM ET Company Participants Steve Altebrando - Shareholder Relations David Thompson - Chief Executive Officer Shaul Kuba - Co-Founder, CIM Group Nate DeBacker - Chief Financial Officer Conference Call Participants Craig Kucera - B. Riley Securities John Moran - Robotti& Company Operator Good day, and welcome to Creative Media & Community Trust Second Quarter 2022 Earnings Call.08/13/2022

Is Creative Media & Community Trust Corporation (CMCTP) a buy, sell, or hold?

Creative Media & Community Trust Corporation (CMCTP) can buy. Click on Rating Page for detail.

What is Creative Media & Community Trust Corporation's stock price?

The price of Creative Media & Community Trust Corporation (CMCTP) is 29.05 and it was updated on 2025-05-10 07:01:18.

Is Creative Media & Community Trust Corporation (CMCTP) overvalued or undervalued?

Currently Creative Media & Community Trust Corporation (CMCTP) is in undervalued.

| News |

|---|

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q1 2022 Earnings Call Transcript

|

Office REITs: The New Normal

|

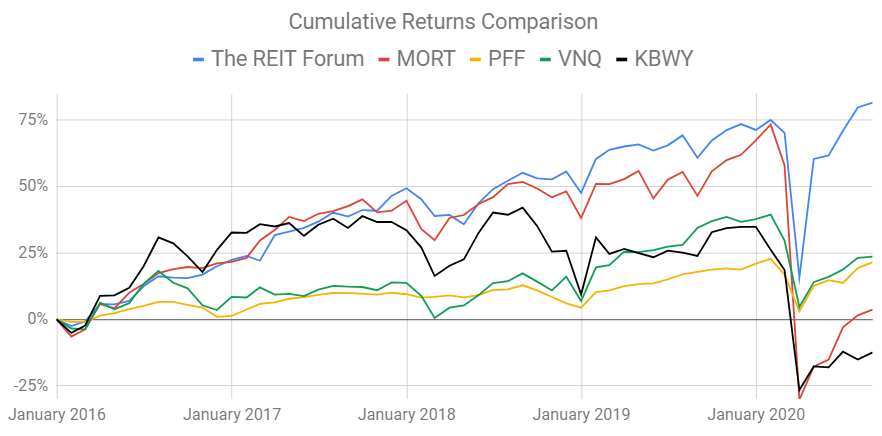

Here's Why My REITs Beat Your REITs

|

CIM Commercial Trust (CMCT) Reports Q2 Loss, Misses Revenue Estimates

|

CIM Commercial Trust Corporation Reports 2020 Second Quarter Results

|

| Transcipts Data |

|---|

Creative Media & Community Trust Corporation (CMCTP) on Q2 2024 Results - Earnings Call Transcript

|

Creative Media & Community Trust Corporation (CMCTP) on Q1 2024 Results - Earnings Call Transcript

|

| StockPrice Release |

|---|

| News |

|---|

Analysts Estimate CIM Commercial Trust (CMCT) to Report a Decline in Earnings: What to Look Out for

|

CIM Commercial Trust (NASDAQ:CMCT) Shares Have Generated A Total Return Of Negative 43% In The Last Year

|

Is CIM Commercial Trust Corporation (CMCT) A Good Stock To Buy?

|

CIM Commercial Trust Declares Common and Preferred Stock Dividends

|

CIM Commercial Trust Responds to Letter from Engine Capital

|

Engine Capital Issues Open Letter To Board Of CIM Commercial Trust

|

CIM Commercial Trust (CMCT) Reports Q1 Loss, Tops Revenue Estimates

|

CIM Commercial Trust Corporation Reports 2020 First Quarter Results

|

CIM Commercial Trust Corporation Reports 2019 Fourth Quarter Results

|