Tesla, Inc. (TSLA) on Q1 2021 Results - Earnings Call Transcript

Operator: Good day, ladies and gentlemen, and thank you for standing by, and welcome to the Tesla First Quarter 2021 Results and Q&A Webcast. At this time, all participants are in a listen-only mode. After the presentation, there will be a question-and-answer session. Please be advised that today’s conference is being recorded. I will now hand the conference over to your speaker today, Martin Viecha, Senior Director of Investor Relations. Martin Viecha: Thank you, Carmen, and good afternoon, everyone, and welcome to Tesla’s first quarter 2021 Q&A webcast. I am joined today by Elon Musk; Zachary Kirkhorn, and a number of other executives. Our Q1 results were announced at about 1 p.m. Pacific Time in the update deck we published at the same link as this webcast. Elon Musk: Great. Thank you. So Q1 2021 was a record quarter on many levels. Tesla achieved record production, deliveries and surpassed $1 billion in non-GAAP net income for the first time. We have seen a real shift in customer perception of electric vehicles and our demand is the best we have ever seen. So this is – if you talk about, we are used to seeing a reduction in demand in the first quarter and we saw an increase in demand that exceeded the normal seasonal reduction in demand in Q1. So Model 3 became the best-selling mid-sized premier sedan in the world. In fact, I should say, the best-selling luxury sedan of any kind in the world. The BMW 3 Series was for the longest time best-selling premium sedan. It’s been exceeded by the Tesla Model 3, and this is only three-and-a half years into production and with just two factories. For Model 3 to be out selling its combustion engine competitors, I think, this is quite remarkable. In the past couple of quarters, we delivered roughly $0.25 million Model 3s, so -- which translates in an annualized rate of $0.5 million per year. When it comes to Model Y, we think Model Y will be the best-selling car or vehicle of any kind in the world, and probably, next year. So I am not 100% certain next year, but I think it’s quite likely. I’d say more likely than not that in 2022 Model Y is the best-selling car or truck of any kind in the world. Then with regard to Full Self-Driving, Full Self-Driving beta continues to make great progress. This is definitely one of the -- I think, one of the hardest technical problems that exists, that has maybe ever existed. And really, in order to solve it, we basically need to solve a pretty significant part of artificial intelligence, simply real-world artificial intelligence. And that sort of AI, the neural net needs to be compressed into a fairly small computer, a very efficient computer that was designed, but nonetheless, a small computer that’s using on the order of 70 watts or 80 watts. Martin Viecha: Thank you very much. We have some remarks from Zachary Kirkhorn as well. Elon Musk: Okay. Zachary Kirkhorn: Yeah. Thanks, Martin. Thanks, Elon. So congratulations to the Tesla team on breaking multiple records in the first quarter of 2021, as Elon had mentioned, which is typically the most difficult of the year for many reasons. A - Martin Viecha: Thank you very much. And we will first take a retail questions from, say, our website. The first question is, how is how is Dojo coming along? Could Dojo unlock an AWS-like business line for Tesla over the next few years? Zachary Kirkhorn: I will jump in here. So with respect to… Elon Musk: Sorry about that. My apologies. I was on mute. Zachary Kirkhorn: Go ahead, Elon. Elon Musk: So, yeah, so it’s basically saying that the, like, right now people think of Tesla has -- a lot of people think Tesla is a car company or perhaps an energy company. I think long-term people will think of Tesla as much as an AI robotics company as we are a car company or an energy company. I think we are developing one of the strongest hardware and software AI teams in the world and so we appear to be able to do things with Self-Driving that others cannot. So and if you look at the evolution of what technologies we have developed, we developed them in order to solve the problem of Self-Driving. Martin Viecha: Thank you very much. Let’s go to the second question from retail investors. The recent price changes on Solar Roof have been a bit discouraging for customers and investors. Could Tesla share more about Solar Roof challenges and if the outlook has changed at all, i.e. 1,000 roofs per week? Elon Musk: Yeah. First of all, I should say, the demand for the Solar Roof remains strong. So despite raising the price, the demand is still significantly in excess of our ability to meet the demand to install the Solar Roofs. So production has gone fine, but we are choked at the installation point. We did find that we basically made some significant mistakes in assessment of difficulty of certain roofs, but the complexity of roofs varies dramatically. Some roofs are literally two times or three times easier than other roofs. So, you just can’t have a one size fits all situation. If a roof has a lot of protuberances or if the roof sort of the core structure of the roof is rotted out or is not strong enough to hold the Solar Roof, then the cost can be double, sometimes three times what our initial quotes were. So in those cases, what we obviously have to do is to refund customers their deposit. What we cannot do is go and just lose a massive amount of money. We have just got to provide a refund of the deposit. But what is I think most important about the Solar Roof situation, which I tweeted about this past week, is that we are shifting the whole solar situation, the solar power, basically the solar factory situation to, there’s only one product basically, there’s only one configuration every house, but we will not sell a house solar without a Powerwall. That solar could either be solar retrofit with conventional panels put on the roof or it can be the Tesla Solar Glass Roof. But in all cases, it will have the Powerwall to temporary this -- and this is essentially the Powerwall to a plus if you will, the plus refers to a higher peak power capability. So basically, all Powerwalls made since roughly November of last year have a lot more peak power capability than the specification on the website. They are about twice the power capability, roughly. It depends on how you count power, but about twice the peak power and about oddly twice the steady-state power of the specification on the website. The energy is the same but the power is roughly double. And all installations will have a Powerwall and the difficult the installation will dramatically increase -- or the difficulty of the installation will be much less, it will be much easier, because the power from the Solar Roof, the Solar Glass Roof, or the solar panels, will only ever go directly into the Powerwall. And the Powerwall will only ever go between the utility mains, right, between the utility and the main power panel of the house, which means you never need to touch the main circuit breakers of the house. You never need to touch the house circuit breakers. Effectively almost every house, therefore, looks the same electrically instead of being a unique work of art and requiring exceptional ability to rewire the main panel. So this is extremely important for scalability. It’s the only way to do it, really. And this also means that every solar Powerwall installation that the house or apartment or whatever the case may be, will be its own utility. And so even if all the lights go out in the neighborhood, you will still have power. So that gives people energy security. And we can also, in working with the utilities, use the Powerwalls to stabilize the overall grid. So let’s say like if there was a -- like there was in Texas. There was a peak power demand and that peak power demand, because the grid lacked the ability to buffer the power, they had to shutdown power. There’s no power in storage. No good form of power storage. However, with a whole bunch of Powerwalls at houses, we can actually buffer the power. So if the grid needs more power, we can actually then with the consent, obviously, of the homeowner and the partnership with the utility, we can then actually release power on to the grid to take care of peak power demand. So, effectively, the Powerwalls can operate as a giant distributed utility. This is profound. I am not sure how many people will actually understand this. This is extremely profound and necessary, because we are headed towards a world where, as we just talked about earlier, where people are leaning towards electric vehicles. This will mean that the power needs in -- at homes and businesses will increase significantly. We will need -- there will need to be a bunch more electricity coming somewhere. In fact, if you go full renewable electricity, we need about three times as much electricity as we currently have. So these are rough numbers, but you roughly need twice as much electricity if all transport goes electric and then you need three times as much electricity if all heating goes electric. So basically, this is a prosperous future, I think, both for Tesla and for the utilities, because -- and in fact -- and this will be very -- if this is not done, utilities will fail to serve their customers. They won’t be able to do it. They won’t be able to react fast enough. And we are going to see more and more of what we see in California and Texas of people seeing brown-outs and black-outs, and the utilities not being able to respond, because there’s a massive change going on with the transition to electric transport and we are seeing more extreme weather events. This is a recipe for disaster. So it is very important to have solar and batteries at the local level at the house. In addition, it is important to have large battery storage at the utility level so that solar and wind, which are the main forms of renewable electricity can be -- that electricity can be stored because sometimes the wind doesn’t blow. Sometimes it blows a lot. Sometimes it blows too much and at times it doesn’t blow enough. But if you have a battery, you can store the energy and provide the energy to the grid as needed. The same goes for solar because, obviously, the sun does not shine at night and sometimes it is very cloudy. And so by having battery storage power with solar and wind, this gives the long-term solution to a stable energy future, and as I said, especially each both at the local level and at the utility level. If it doesn’t occur at the local level, what will actually be required is a massive increase in power lines, in power plants, as they would have to put long distance and local power lines all over the place. They will have to increase the size of the substations. It’s a nightmare. This must occur. There must be solar plus battery. It’s the only way. So, yeah. Martin Viecha: Thank you very much. And the next retail question is, Master of Coin, can you tell us anything about Tesla’s future plans in digital currency space? Or when any such major developments might be revealed? Zachary Kirkhorn: Sure. Thanks, Martin. So as I noted in our opening remarks and we have announced previously, so Tesla did invest $1.5 billion into Bitcoin in Q1 and then we subsequently sold a 10% stake in that. We also allow customers to make vehicle deposits and final vehicle purchases using Bitcoin. And so where our Bitcoin story began, maybe just to share a little bit of context here. Elon and I were looking for a place to store cash that wasn’t being immediately used, trying to get some level of return on this but also preserve liquidity. Particularly as we look forward to the launch of Austin and Berlin, and uncertainty that’s happening with semiconductors and port capacity, being able to access that cash very quickly is super important to us right now. And there aren’t many traditional opportunities to do this or, at least, that we found and in talking to others that we could get good feedback on, particularly with yields being so low and without taking on addition risk or sacrificing liquidity. And Bitcoin seemed, at the time, and so far has proven to be a good decision, a good place to place some of our cash that’s not immediately being used for daily operations or maybe not needed until the end of the year and be able to get some return on that. And I think one of the key points that I want to make about our experiences in the digital currency space is that there’s a lot of reasons to be optimistic here. We are certainly watching it very closely at Tesla, watching how the market develops, listening to what our customers are saying. But thinking about it from a corporate treasury perspective, we have been quite pleased with how much liquidity there is in the Bitcoin market. So our ability to build our first position happened very quickly. When we did the sale later in March, we also were able to execute on that very quickly. And so as we think about kind of global liquidity for the business and risk management, being able to get cash in and out of the markets is something that I think is exceptionally important for us. So we do believe long-term in the value of Bitcoin. So it is our intent to hold what we have long-term and continue to accumulate Bitcoin from transactions from our customers as they purchase vehicles. Specifically, with respect to things we may do, there are things that we are constantly discussing. We are not planning to make any announcements here. We are watching this space closely. So when we are ready to make an announcement on this front, if there’s one to come, we will certainly let you all know. Martin Viecha: Thank you. And the fourth question from retail investors is, does Tesla have any proactive plans to tackle main stream media’s imminent massive and deceptive click bait headline campaigns on safety of Autopilot or FSD, perhaps a specialty PR job of some sort? Lars Moravy: Well, I will take this one, guys. From the safety side, I continue to say, he is driving on too. Elon Musk: Yeah. Lars Moravy: Go ahead, Elon. Elon Musk: No. Please go ahead. I think, just with -- just going through the facts of what I mean, specifically, there were -- there was an article regarding a tragedy where there was a high speed accident in Tesla and it was really just extremely deceptive media practices where it was claimed to be Autopilot, which is completely false and those journalists should be ashamed of themselves. Please go ahead, Zach. Lars Moravy: Yeah. Thanks, Elon. So I was just saying, we are committed to safety in all our designs and that’s number one in what we do here. Regarding the crash in Houston, specifically, we worked directly with the local authorities and NTSB, so wherever applicable and whenever they reach out to us for help directly on the engineering level and whatever else we can support. In that vein, we did a study with them over the past week to understand what happened in that particular crash and what we have learned from that effort was that Autosteer did not and could not engage on the road condition that as it was designed. Our adaptive cruise control only engaged when the driver was buckled and above 5 miles per hour, and it only accelerated to 30 miles per hour with the distance before the car crashed. As well, adaptive cruise control disengaged the car fully to complete to a stop when the driver’s seat belt was unbuckled. Through further investigation of the vehicle and the accident remains, we instructed the car with NTSB and we saw in the local police and were able to find that the steering wheel was indeed deformed, so it was leading to a likelihood that someone was in the driver’s seat at the time of the crash and all seat belts post-crash were found to be unbuckled. We were unable to recover the data from the SD card at the time of impact, but the local authorities are working on doing that and we await their report. As I said, we continue to hold safety in a high regard and look to improve our products in the future through this kind of data and other information from the field. Martin Viecha: Okay. Thank you very much. Let’s go to the next question from institutional investors. The first question is, proponents of alternative grid storage technologies claim that lithium ion is unsuited to long-term storage at scale due to vampire drain. Could 4680 cells address this limitation? Is the limitation even relevant for changing the energy equation? Lars Moravy: Yeah. Just let me jump in on the vampire drain. That’s definitely not the issue. Good lithium ion cell self-discharges less than 0.001% of its energy per day, so the vampire drain is maybe not… Elon Musk: Myth. Lars Moravy: Yeah. Elon Musk: As mythical as vampires. Lars Moravy: Yeah. I think the challenge with seasonal storage is, your value proposition drops from hundreds of utile full cycles per year to less than maybe 10 or less maybe even less than five cycles per year. So it’s just a different type of technology altogether that would make sense, given that it’s more than an order of magnitude different use case. Elon Musk: Yeah. We have got a long way to go before we are dealing with seasonal technology issues. But certainly a way to deal with seasonal technology would be to have wind and solar already on the site of more southerly latitudes and the -- but then across a variety of longitudes. So essentially, let’s say in the U.S., for example, if there was -- I am not sure if Phil understands that you can actually power the entire United States with just sort of a hundred, roughly 100 mile -- by 100-mile grid of solar. Sometimes people don’t quite understand, how much solar is needed to power the United States? Almost nothing of these can be substantially required by this and it is true of almost any country in the world. The solar incidence is a gigawatt per square kilometer. This is insane. In fact, if you took the clear area, just the area, say, for nuclear power plants, the area that is considered not useable because a nuclear power plant is there. In most cases, if you just put solar there it would generate more power than the nuclear power plant, because they typically have pretty wide clear areas. And --so it really -- so if you have say 25% efficient solar panels and then those are 80% efficient in how they are laid out, you are going to do about 200 megawatts per square kilometer. Therefore, 5 square kilometers is a gigawatt, which might be typical sort of power plant. It’s really not much area at all and a lot of places can have wind and solar put in place. So anyway, it’s entirely possible to power all of earth with a small percentage of earth’s area and then to transfer that power through high voltage DC lines. No new technology. No -- you don’t need like room temperature super conductors. This is a total also another myth. Room temperature super conductors almost irrelevant, in my opinion, almost irrelevant. Low cost, long distance power lines using copper or aluminum is very important. So heating is I square R. So that’s current squared to times resistance. So as you increase voltage, you can drop the current dramatically and drop the heating dramatically to a point where it is of minor relevance. Like maybe you lose 5% to 7% with a high voltage DC power line. Something like that. So I want to be clear. No, this is not certain. No new materials are necessary. We just need to scale this thing up. We -- the technology exists today to solve renewable energy. And some people say, well, why don’t we do it? That’s because the energy basis of the earth is gigantic, super mega insanely gigantic. So you can’t just go and do a zillion terawatts overnight. You have got to build the production capacity for the cells, for the battery cells, for solar cells. You have got to put that into vehicles. You have got to put that into stationary storage packs. You have got to put that it into solar panels and Solar Glass Roofs and you have got to deploy all of this stuff. But it’s certainly the case that we can accelerate this and we should try to accelerate it. And the right thing to do I think from an economic standpoint and I think almost any economist would agree is to have a carbon tax, just as we have a tax on cigarettes and alcohol, which we think are more likely to be bad than good and we tend to tax fruit and vegetables less. But the same should be true. We should tax energy that we think is probably bad and support energy that we think is probably good. Just like cigarettes and alcohol. Just like fruits and vegetables. It’s just common sense. And on the plus side, I am not suggesting anyone be complacent. But sustainable energy, renewable energy, will be sold. It is being sold, but it matters how fast we sell this and if we sell it faster, that’s better for the world. Martin Viecha: Thank you very much. Elon Musk: There’s no question in my mind whatsoever that the energy storage problem can be solved with lithium-ion batteries, zero. I want to be clear, zero. I think the bias will tend to be towards iron-based, lithium-ion cells. I will say, lithium-ion, people think lithium must be a big constituent of the cells. It’s more like 1% to 2% of the cell is lithium. The main part of the cell is the cathode. The main mass and cost in the cell is the cathode. For high energy cells, like, for example, what we use in most Teslas, have nickel-based lithium-ion cells, which have higher energy density, longer range than iron-based cells. However, stationary storage, the energy density is not as important because it’s just staying on the ground and so I think the vast majority of stationary storage will be iron-based lithium-ion cells with an iron phosphate cathode, technically. But the phosphate part is unnecessary. It’s really just the iron or nickel. I am assuming the terminology. Just think of it as iron and nickel and there’s an insane amount of iron in the world, more iron than we could have possibly used and there’s also more lithium than we could possibly use. Basically, there is no shortage of anything whatsoever in iron phosphate lithium-ion cells. Martin Viecha: Thank you very much. Let’s go to the next question from institutional investors which is, you have suggested that between a 5x to 10x improvement is achievable in automotive production versus the first Model 3 line on a first-principles physics analysis. Where does Berlin sit relative to that limit? Elon Musk: I think we are still quite far away from it. I mean, the thing to bear in mind with production is for those who have never done production, they just don’t understand how insanely hard production is. I want to really be very, very emphatic here. Prototypes are trivial. They are child’s play. Production is hard. It is very hard. Now you say production at large scale with higher liability and low-cost, insanely difficult. But what Tesla achieved on the automotive side was not to create an electric car. The truly profound thing on the car side is that Tesla was the first American car company to achieve volume production of a car in 100 years and not go bankrupt. So this is -- this -- basically myself and NIO and Tesla had to basically have several aneurysms to get this done. It was so hard. You have no idea. So anyway, and the thing about making a large complex manufactured object is let’s say that you have a closer approximation 10,000 unique items. If even one of those items is slow, that sets your rate, just one. Isn’t that so trivial? We have had a production stop because of carpet in the trunk. We had a production stop because of a USB cable. At one point for the Model S, the -- we literally raided every electronics store in the Bay Area for a few days there. Nobody could buy a USB cable in the Bay Area because we went and bought them all to put them in the car, literally. And there are like hundreds of stories like that. So anyway, solving that, those constraints, and a logistics problem that makes World War II look trivial. I am not kidding. Like the scale is insane. We are talking millions of cars, massive global supply chain, 50 countries, dozens of regulatory regimes. It’s insane, so yeah. Martin Viecha: Thank you. And the last question from institutional investor is, Master Plan Part Deux talks about an urban transport vehicle that is smaller than a traditional bus with greater areal density achieved by removing the central aisle. Do you have any update to share on that goal? Elon Musk: Not at this time. Martin Viecha: Okay. Thank you very much. So let’s move to analyst Q&A. Operator: Thank you. First question is from Pierre Ferragu with New Street Research. Your line is open. Pierre Ferragu: Hi, guys. Thanks so much for taking my question. I’d love to get actually based on what you presented on the Battery Day. In the last six, seven months, I was wondering how much progress you have made on that front, first in terms of process development. So how are things coming together on your pilot line? Are you getting to the kind of production throughput you are aiming for? And second, actually on your production ramp. So I was wondering in which size you are ramping production capacity for the 4680 cell and where you stand on ramping up that capacity as well? And I have a quick follow-up on energy as well if that’s possible. Elon Musk: Well, so we have the – and Drew can add to this. But we have the - a small sort of pilot plant, which is still big by normal standards. We expect to have like a 10-gigawatt-hour per year capability in Fremont, California. And we made quite a few cells. We are not quite yet at the point where we think the cells are reliable enough to be shipped in cars, but we are getting close to that point. And then we have already ordered most of the equipment for battery production in Berlin and then much of it for Austin as well. So we really don’t flick the nitty-gritty elements. But overall, I think, we still feel quite optimistic about achieving volume production of the 4680 next year. What do you think? Zachary Kirkhorn: Yes. I think… Pierre Ferragu: Thank you. Zachary Kirkhorn: Yes. I think, Pierre, just one thing I’d add is, there’s been a lot of questions about yield. Actually, I noticed people asking about that. The yield progress isn’t really strong every day and we were really still in commissioning phases. We were really still in commissioning phases with most of the tools to the point where we were confident that the yield trajectory aligns with our internal cost projections. We did talk about yield also at Battery Day, which is one of the reasons why it’s useful to check in on that. It takes a while, as Elon just mentioned, to go from prototype to production and it’s not just parts, it’s processes, it’s equipment. But as we have matured the process equipment, we have gotten to where we need to be on the yield side. Elon Musk: Yes. And basically, this is just a guess because we don’t know for sure, but it appears as though we are about 12, probably, not more than 18 months away from volume production of the 4680. Now at the same time, we are actually trying to have our cell supply partners ramp up their supply as much as possible. So this is not something that is to the exclusion of suppliers. It is in conjunction with suppliers. Zachary Kirkhorn: Yes. Elon Musk: So we want to be super clear about that. This is not about replacing suppliers. It is about supplementing suppliers. So -- and we have a very strong partnership with JBL, with Panasonic and LG. And we would -- our request to our strategic partners for cell supply is, please supply us – please supply us with as much as you possibly can. Provided the price is affordable, we will buy everything that they can make. Zachary Kirkhorn: Yes. Yes. And specific to that, we are on track to more than double the supplier capacity over the next 13. Elon Musk: Yes. We -- exactly. We do expect from suppliers willing to receive double the cell output next year versus this year. Pierre Ferragu: Okay. And I had a quick follow-up on – maybe, Zach, for you on your Energy business. So I understand like the negative gross margin with Solar Roof ran. But I was wondering, what do gross margin look like there when you look at the Storage business and where are you -- what’s your ambition in terms of gross margin in that business? I guess it’s going to grow in the mix in coming years, so it’s important for long-term modeling. Zachary Kirkhorn: Yes. We are seeing a lot of… Elon Musk: We are aiming for comparable margins in storage as in vehicles. But it is important to bear in mind that vehicle is more mature than storage. So we are already are at good margins with the Powerwall, but some additional work is needed for the Megapack to achieve good margins. Yes, Drew, what do you think? Operator: Thank you. Andrew Baglino: Yes. Sorry. Just jumping in, Elon. Absolutely agree. Yes. Powerwall is mature. We have been producing Powerwall 2 for three years now and we are at good margins there, but Megapack has more room to go to achieve our targets. Elon Musk: We have a clear runway for improving the cost for the megawatt hours for the Megapack. Andrew Baglino: Absolutely. Yes, we do. Martin Viecha: Thank you. Let’s go to the next question, please. Operator: From Rod Lache with Wolfe Research. Please go ahead. Rod Lache: Hi, everybody. I was hoping maybe just first, you could talk a little bit about how you are thinking about the rollout of version 9 of FSD and the transition of the subscription models. It sounds like some of this is about to roll out next month. I am not sure if that’s just a subscription model. But maybe you could just spend a little time talking about how impactful you expect that to be? Elon Musk: So go ahead, Zach. Zachary Kirkhorn: Yes. We are working on getting FSD subscription out. There’s a couple of internal technical dependencies. But from a business model perspective that’s aligned and we are hoping to roll that out soon. The key thing that I say here, there’s a lot of potential for recurring revenue based on a FSD subscription. The -- if you look at the size of our fleet and you look at the number of customers who did not purchase FSD upfront or on a lease and maybe want to experiment with FSD, this is a great option for them. One of the things we will need to keep an eye on is a potential transition from cash purchases of FSD subscription over to cash purchases of FSD who may move over to FSD subscription. And so there could be a period of time in which cash reduces in the near-term and then as the portfolio of subscription customers builds up, then that becomes a pretty strong business for us over time. But we are hoping to get this launched pretty soon and see what the response is to it. Rod Lache: Okay, great. And I was hoping, Zach, maybe you could just talk a little bit about OpEx. It was a noticeable increase, even excluding SBC, obviously, a lot going on this quarter. But can you maybe just talk a little bit about how we should be thinking about that going forward? Zachary Kirkhorn: Sure. On the R&D side, you know what we are seeing, as I mentioned in my opening remarks, is kind of a convergence of a series of programs that are happening and our R&D OpEx spend kind of correlates to where we are in the product lifecycle in different programs. And so we are kind of at the tail end of investments in what we call internally Paladium, which is the new Model S and Model X. And so we expect that to decrease over time, but it was high in Q1 for a lot of the reasons that Elon had mentioned. We are also getting very heavy into 4680 development that Drew and team are working on and the associated structural battery pack that goes along with that. And so these are new technologies, not only new to Tesla, but new to the industry. And so we are investing heavily there on an R&D side to work out those kinks. And spend along in those areas should continue over time as we continue to work through the development cycle of those. Then I also mentioned, and Elon talked a bit about, Dojo and the potential there. So from neural net investments and custom silicon investments, these continue to be areas that we spend on and make investments in. On the SG&A side, the business is pivoting very quickly to be global and China is ramping quite quickly. And we are trying to make sure that we are staying ahead of the volume, so that we have the right sales capacity, store capacity there, local investments and IT and others to manage the growth, such that as the growth comes, the execution challenges are smaller than maybe in similar periods of growth that we have seen in the past and so we are making investments there ahead of the growth. And overall, as we look at OpEx as a percentage of revenue over the course of the year, we do expect to see a substantial drop from 2020 to 2021 as the volumes in the latter part of the year pick up. Martin Viecha: Thank you. Let’s go to the next question, please. Operator: Thank you. We have Dan Levy with Credit Suisse. Your line is open. Dan Levy: Hi. Good evening. Thanks. Two questions. One is on COGS, I think, you have gotten from Battery Day a pretty good feel about the potential for COGS reduction related to Powertrain. But I’d like to get a sense of the path to reducing COGS ex-Powertrain as you would still need a meaningful reduction on that front to make the math work on a $25,000 vehicle. So what levers do you have to reduce in your cost ex-Powertrain, is it just more scale, better supply pricing or is it just based on ongoing cost reductions? Elon Musk: I think all of the above. Zachary Kirkhorn: Yes. I mean, on the vehicle side, there’s plenty of opportunity as well. Obviously, building a car like a Model S is quite complex and has various moving parts. Model 3 and Model Y were steps of improvement in that. But when you look at some of the other advancements that we are including in the Model Y, factories into Austin and Berlin, we have reduced the body pound by as much 60%. And the part costs money. So we continue to find optimizations there as well as we get economies of scale. When we start to talk about the volumes, we are considering worldwide with four factories building the same vehicle. So both of those things on the vehicle side will improve our COGS as well and the Powertrain continues to be integrated into that. Dan Levy: Great. And then just related, as we see Berlin and Austin ramp, I’d like to just get a sense on the comparison of Fremont versus the new capacity, obviously, Fremont is non-optimized because you bought the old NUMMI facility. You had to retrofit that to your need. So maybe you can give us a sense of how your new capacity is going to differ versus Fremont. What are the areas that you have efficiencies that you previously didn’t have and maybe how much does that add up to improved COGS over time to help you achieve that $25,000 vehicle? Elon Musk: Yes. We always talk too much about future product development. Earnings calls are not the right place for us to make a major product announcement, so yes. We will get there. We will provide it later. Martin Viecha: All right. Thank you very much. Unfortunately, this is all the time we have for today. Thank you very much for dialing in and for listening, and we will speak to you again in about three months. Thank you. Elon Musk: Thanks. Thanks, everyone. Operator: This concludes today’s conference call. Thank you for participating. You may now disconnect.

Tesla's Upcoming Earnings Report: A Glimpse into the Future of Electric Vehicles

- Wall Street analysts estimate an earnings per share (EPS) of $0.53 and project revenue to be around $26.7 billion for Tesla's upcoming quarterly earnings.

- The "Whisper number" suggests a higher EPS of $0.61, indicating more optimistic investor expectations.

- Tesla's financial health is highlighted by a price-to-earnings (P/E) ratio of approximately 233.65, a price-to-sales ratio of about 15.39, and a current ratio of 2.04.

Tesla (NASDAQ:TSLA) is a leading electric vehicle manufacturer known for its innovative approach to sustainable energy solutions. As the company prepares to release its quarterly earnings on October 22, 2025, Wall Street analysts estimate an earnings per share (EPS) of $0.53 and project revenue to be around $26.7 billion. Tesla's stock is currently experiencing a downturn as investors await the earnings report.

Despite the anticipated EPS of $0.53, analysts expect Tesla to surpass these estimates. The "Whisper number" suggests a higher gain of $0.61 per share, indicating that some investors have more optimistic expectations. However, the focus may shift to Tesla's management's outlook on future electric vehicle demand and upcoming product launches, which could significantly influence investor sentiment.

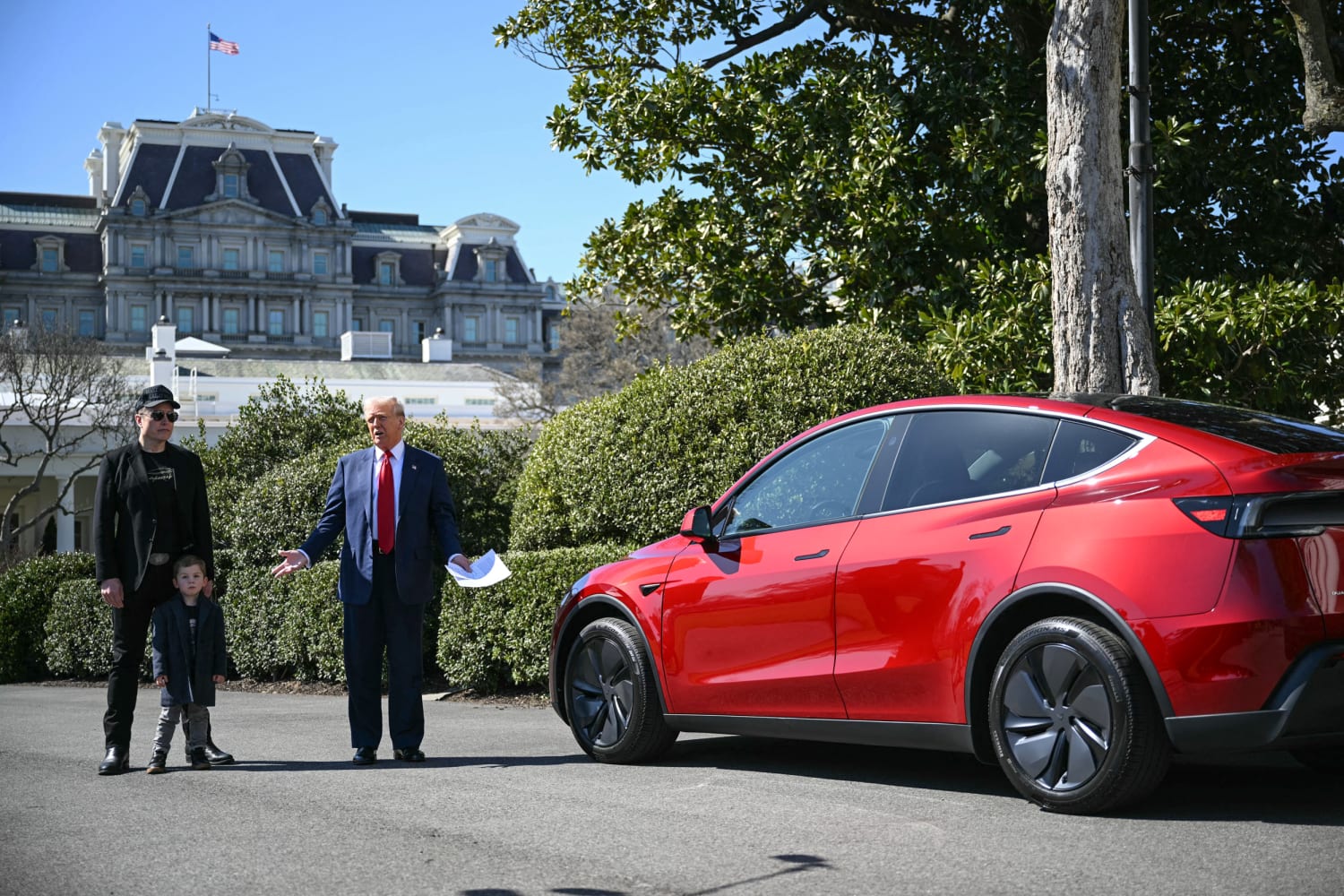

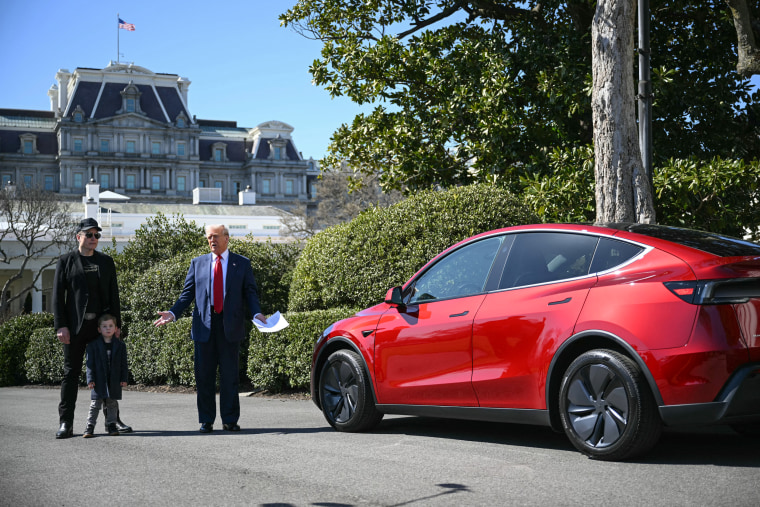

Tesla is coming off one of its strongest delivery periods, which could positively impact its earnings. However, the company faces questions about its future in autonomous vehicle technology. Investors are eager to see how Tesla plans to address these challenges and leverage its recent successes, especially with Elon Musk's renewed focus on the company after his return from involvement with D.O.G.E.

The stock, which reached a record high of $488.54 per share in December 2024, is now trading around $447. Historically, Tesla's stock is known for significant movements following earnings announcements. A strong earnings report could lead to a substantial increase in stock price, while disappointing results might cause a decline.

Tesla's financial metrics reveal a price-to-earnings (P/E) ratio of approximately 233.65, indicating high investor confidence in future growth. The price-to-sales ratio is about 15.39, and the enterprise value to sales ratio is roughly 15.37, both suggesting that investors are paying a premium for Tesla's sales. The company's debt-to-equity ratio of 0.17 shows a relatively low level of debt, and a current ratio of 2.04 indicates strong short-term financial health.

Tesla Inc. (NASDAQ:TSLA) Faces Potential Downside According to Evercore ISI

- Tesla Inc. (NASDAQ:TSLA) is a leading electric vehicle manufacturer with a recent price target set by Evercore ISI suggesting a potential downside.

- The stock showed resilience with a 3.5% rebound after a 5% decline, indicating renewed investor confidence despite the potential overvaluation concerns.

- With a market capitalization of approximately $1.39 trillion and a significant trading volume, Tesla maintains a strong presence in the automotive industry.

Tesla Inc. (NASDAQ:TSLA), renowned for its innovative electric vehicles and sustainable energy solutions, competes fiercely in the automotive sector against both traditional and electric vehicle manufacturers. Founded by Elon Musk, Tesla has established itself as a key player, challenging companies like Ford, General Motors, Rivian, and Lucid Motors.

On October 13, 2025, Evercore ISI issued a price target of $300 for Tesla, when the stock was trading at $428.23. This represents a potential downside of approximately -29.94%, suggesting concerns over Tesla's valuation or future market challenges. Despite this, Tesla's shares have demonstrated resilience, bouncing back by 3.5% to $428 after a 5% decline the previous week. This recovery is in line with broader market trends, with the S&P 500 and the Dow Jones Industrial Average experiencing gains of 1.3% and 1.1%, respectively.

Currently, Tesla's stock price stands at $431.30, marking a 4.31% increase or a $17.81 gain. The day's trading saw prices fluctuating between $419.70 and $431.50. Over the past year, Tesla's stock has fluctuated significantly, reaching a high of $488.54 and a low of $212.11, highlighting its market volatility.

With a market capitalization of approximately $1.39 trillion and a trading volume of 49.6 million shares, Tesla's substantial market presence is undeniable, despite the recent price target adjustment by Evercore ISI.

Goldman Sachs Updates Tesla (NASDAQ:TSLA) Rating to "Neutral"

- Goldman Sachs maintains a "hold" action on Tesla (NASDAQ:TSLA), with a price target increase from $300 to $395, reflecting confidence in Tesla's long-term growth potential.

- CEO Elon Musk's recent $1 billion stock purchase underscores his belief in Tesla's future, potentially mitigating downside risk.

- Tesla's ventures into full self-driving technology, robotaxis, and the Optimus robotics segment are poised to drive transformative growth, with a base-case estimate projecting Tesla's stock price to reach $530 by December 2026.

On September 18, 2025, Goldman Sachs updated its rating for Tesla (NASDAQ:TSLA) to a "Neutral" grade, maintaining a "hold" action. At the time, Tesla's stock price was $422.41. Goldman Sachs had previously raised Tesla's price target to $395 from $300. Tesla, Inc. is a leading company in the autonomous robotics sector, known for its innovative approach to electric vehicles and technology.

Tesla's stock is experiencing a rally, driven by insider buying activity from CEO Elon Musk. Despite a current stock price of $416.85, which reflects a decrease of 2.12% or $9.01, the stock is aligning with its long-term potential. Musk's recent $1 billion stock purchase indicates his strong conviction in the company's future, potentially limiting downside risk.

Goldman Sachs analyst Mark Delaney notes that Tesla's new compensation package for Musk could enhance investor sentiment. This, combined with Tesla's ventures into full self-driving (FSD) technology, robotaxis, and the Optimus robotics segment, positions the company for transformative growth. These initiatives could lead to market capitalizations in the multi-trillion dollar range.

Tesla's stock has fluctuated today between a low of $416.56 and a high of $432.22, with a trading volume of 87.2 million shares. Over the past year, the stock reached a high of $488.54 and a low of $212.11. The company's market capitalization is approximately $1.34 trillion, reflecting its status as a premium asset in the market.

A base-case estimate projects Tesla's stock price to reach $530 by December 2026, supported by a forward price-to-sales ratio of 12 and anticipated revenue of $150 billion in Fiscal 2027. Tesla's transformative growth potential in artificial intelligence and robotics is a key driver for its future value, as highlighted by the company's recent upgrades to a "Strong Buy" rating.

Tesla (NASDAQ:TSLA) Maintains "Market Perform" Rating Amidst CEO Compensation Plan News

- William Blair maintains a "Market Perform" rating for Tesla (NASDAQ:TSLA), with the stock price around $347.13.

- Tesla's stock experiences an upward trend, trading at $354, following the announcement of a groundbreaking pay package for CEO Elon Musk.

- The compensation plan could potentially value at $1 trillion, aiming to retain Musk and achieve significant company milestones.

On September 5, 2025, William Blair maintained its "Market Perform" rating for Tesla (NASDAQ:TSLA), advising investors to hold the stock. At the time, Tesla's stock price was around $347.13. This rating comes amidst significant developments for Tesla, including a proposed compensation plan for CEO Elon Musk that has captured investor attention.

Tesla's stock is currently experiencing an upward trend, trading at $354, a 4.5% increase for the day. This surge follows the announcement of a groundbreaking pay package for Musk, potentially valued at $1 trillion. The proposal aims to retain Musk as CEO for the next decade, with performance targets that include expanding Tesla's robotaxi business and increasing the company's market value to $8.5 trillion.

The compensation plan, detailed in Tesla's proxy filing, is structured around 12 tranches of stock awards. Musk will only receive these awards if Tesla achieves extraordinary milestones over the next decade. These targets include significant improvements in profitability, vehicle production, and the development of new business lines in artificial intelligence and robotics.

If successful, the plan would grant Musk over 423 million additional shares, increasing his ownership from about 13% to nearly 29%. This would significantly enhance his voting power. Notably, Musk will not receive any salary or cash bonuses; his entire compensation will be equity-based, as highlighted by Wedbush analysts.

Tesla's stock has fluctuated between a low of $344.68 and a high of $355.87 during the day. Over the past year, it has reached a high of $488.54 and a low of $210.51. The company's market capitalization stands at approximately $1.12 trillion, with a trading volume of 63,078,710 shares.

Tesla Inc. (NASDAQ:TSLA) Faces Legal Challenges Amid Market Fluctuations

- Goldman Sachs updated its rating for Tesla Inc. (NASDAQ:TSLA) to Neutral amidst a class action lawsuit.

- The lawsuit seeks damages for violations of federal securities laws, affecting investors who acquired Tesla securities between April 19, 2023, and June 22, 2025.

- Tesla's stock experienced a decrease of approximately 1.50%, with significant trading volume indicating ongoing investor interest despite legal and market challenges.

Tesla Inc. (NASDAQ:TSLA), a leader in the electric vehicle industry, has recently been the subject of a class action lawsuit filed by Pomerantz LLP. The lawsuit alleges violations of federal securities laws, specifically targeting the period between April 19, 2023, and June 22, 2025. This legal challenge comes at a time when Tesla's stock has seen notable fluctuations, with a recent decrease of approximately 1.50%, shedding $5.02 from its value.

Despite these challenges, Tesla's market capitalization remains strong at approximately $1.07 trillion. The lawsuit aims to pursue remedies under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as well as Rule 10b-5, with a deadline for investors to request the Court to appoint them as Lead Plaintiff set for October 4, 2025. Amidst this backdrop, Tesla continues to attract significant investor interest, as evidenced by today's trading volume of 72.95 million shares. The company's strategic initiatives, including the introduction of $33/hour robotaxi jobs, continue to make headlines and may influence investor sentiment and stock performance in the coming months.

RBC Capital Maintains Overweight Rating on Tesla (NASDAQ:TSLA) Amid Expanding Ventures

- RBC Capital updates its rating for Tesla (NASDAQ:TSLA) to "Overweight" with a new price target of $325, highlighting the potential of non-automotive segments.

- Tesla's robotaxi service launch in Texas exceeds expectations, with plans for significant expansion, marking it as a key future growth catalyst.

- The company's full self-driving (FSD) technology is also seen as a significant driver for Tesla's future growth, alongside its humanoid robots project.

On July 29, 2025, RBC Capital updated its rating for Tesla (NASDAQ:TSLA) to "Overweight," maintaining its previous grade. At the time, Tesla's stock price was $321.46. The action associated with this update is "hold." According to Benzinga, an analyst suggests that Tesla's valuation could significantly surpass current levels, driven by two key segments that are not related to cars. Tesla Inc. is drawing significant attention from investors and analysts due to its ambitious ventures beyond electric vehicles, particularly in the fields of robotaxis and humanoid robots.

RBC Capital analyst Tom Narayan has maintained an Overweight rating on Tesla and has increased the price target from $319 to $325. Narayan believes that if Tesla achieves its goals, its valuation could greatly surpass current levels. Tesla's recent launch of its robotaxi service in Texas has exceeded expectations, and the company plans to expand this service to more cities, aiming to cover half of the US population by the end of the year, although this is considered an ambitious target.

The robotaxi initiative is seen as a major future catalyst for Tesla. Additionally, Tesla's full self-driving (FSD) technology is also highlighted as a significant driver for the company's future growth. Tesla Inc. is currently trading at $323.24 on the NASDAQ. The stock has experienced a decrease of 0.72%, with a price drop of $2.35. Today's trading has seen a low of $318.25 and a high of $326.25. Over the past year, the stock has reached a high of $488.54 and a low of $182. Tesla's market capitalization stands at approximately $1.04 trillion, with a trading volume of 71.59 million shares.

Tesla, Inc. (NASDAQ:TSLA): A Comprehensive Analysis

- The consensus price target for Tesla's stock has fluctuated, with a recent average target of $322.50, down from $399.29 three months ago.

- Analyst Colin Langan from Wells Fargo has set an optimistic price target of $960 for Tesla, focusing on the company's potential in robotaxis and affordable models.

- Tesla faces challenges such as competition, a shortage of new models, and geopolitical tensions affecting its energy storage business, leading to a "Hold" rating from Langan.

Tesla, Inc. (NASDAQ:TSLA) is a major player in the electric vehicle (EV) and renewable energy sectors. The company operates through two main segments: Automotive, which includes the design, manufacture, and sale of electric vehicles, and Energy Generation and Storage, focusing on solar energy products and energy storage solutions. Tesla is recognized for its direct sales model and extensive Supercharger network.

The consensus price target for Tesla's stock has seen notable changes over the past year. Last month, the average target was $322.50, reflecting analysts' expectations based on recent performance. However, three months ago, the target was higher at $399.29, indicating more optimism possibly due to anticipated product launches or favorable market trends.

Despite these fluctuations, Tesla's long-term prospects remain a point of interest. Analyst Colin Langan from Wells Fargo has set a price target of $960 for Tesla, suggesting a positive outlook for the company's future performance. This target reflects expectations for Tesla's advancements in robotaxis and more affordable models, as highlighted by recent discussions on Market Domination Overtime.

Tesla is facing challenges such as heightened competition and a shortage of new models. The company is expected to report its largest decline in quarterly revenue in over ten years. Despite these challenges, investors are keenly observing Tesla's future, particularly its AI strategy and Robotaxi initiatives, as noted by Doug Clinton from Intelligent Alpha.

Tesla's energy storage business is also under scrutiny due to geopolitical tensions and potential tariff impacts. These factors, along with domestic challenges like high interest rates, contribute to a cautious outlook. Analyst Colin Langan has downgraded Tesla to a "Hold" rating, citing recent poor performance and a risky short-term outlook.