Tesla Inc. (NASDAQ:TSLA) Faces Legal Challenges Amid Market Fluctuations

- Goldman Sachs updated its rating for Tesla Inc. (NASDAQ:TSLA) to Neutral amidst a class action lawsuit.

- The lawsuit seeks damages for violations of federal securities laws, affecting investors who acquired Tesla securities between April 19, 2023, and June 22, 2025.

- Tesla's stock experienced a decrease of approximately 1.50%, with significant trading volume indicating ongoing investor interest despite legal and market challenges.

Tesla Inc. (NASDAQ:TSLA), a leader in the electric vehicle industry, has recently been the subject of a class action lawsuit filed by Pomerantz LLP. The lawsuit alleges violations of federal securities laws, specifically targeting the period between April 19, 2023, and June 22, 2025. This legal challenge comes at a time when Tesla's stock has seen notable fluctuations, with a recent decrease of approximately 1.50%, shedding $5.02 from its value.

Despite these challenges, Tesla's market capitalization remains strong at approximately $1.07 trillion. The lawsuit aims to pursue remedies under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as well as Rule 10b-5, with a deadline for investors to request the Court to appoint them as Lead Plaintiff set for October 4, 2025. Amidst this backdrop, Tesla continues to attract significant investor interest, as evidenced by today's trading volume of 72.95 million shares. The company's strategic initiatives, including the introduction of $33/hour robotaxi jobs, continue to make headlines and may influence investor sentiment and stock performance in the coming months.

| Symbol | Price | %chg |

|---|---|---|

| 005389.KS | 214500 | 6.29 |

| 005385.KS | 217000 | 6.91 |

| 005387.KS | 220000 | 6.14 |

| 005380.KS | 290000 | 8.62 |

Tesla's Upcoming Earnings Report: A Glimpse into the Future of Electric Vehicles

- Wall Street analysts estimate an earnings per share (EPS) of $0.53 and project revenue to be around $26.7 billion for Tesla's upcoming quarterly earnings.

- The "Whisper number" suggests a higher EPS of $0.61, indicating more optimistic investor expectations.

- Tesla's financial health is highlighted by a price-to-earnings (P/E) ratio of approximately 233.65, a price-to-sales ratio of about 15.39, and a current ratio of 2.04.

Tesla (NASDAQ:TSLA) is a leading electric vehicle manufacturer known for its innovative approach to sustainable energy solutions. As the company prepares to release its quarterly earnings on October 22, 2025, Wall Street analysts estimate an earnings per share (EPS) of $0.53 and project revenue to be around $26.7 billion. Tesla's stock is currently experiencing a downturn as investors await the earnings report.

Despite the anticipated EPS of $0.53, analysts expect Tesla to surpass these estimates. The "Whisper number" suggests a higher gain of $0.61 per share, indicating that some investors have more optimistic expectations. However, the focus may shift to Tesla's management's outlook on future electric vehicle demand and upcoming product launches, which could significantly influence investor sentiment.

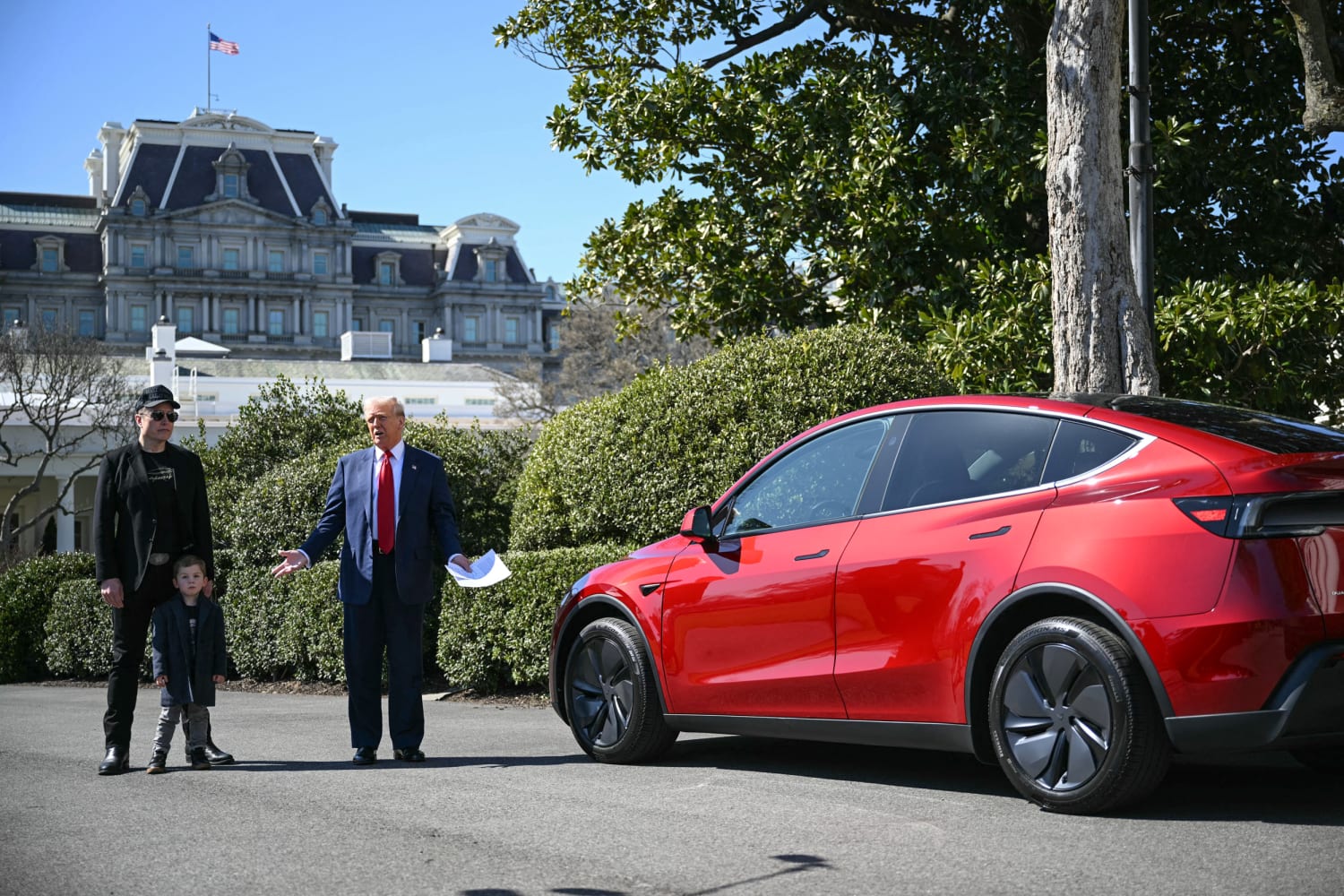

Tesla is coming off one of its strongest delivery periods, which could positively impact its earnings. However, the company faces questions about its future in autonomous vehicle technology. Investors are eager to see how Tesla plans to address these challenges and leverage its recent successes, especially with Elon Musk's renewed focus on the company after his return from involvement with D.O.G.E.

The stock, which reached a record high of $488.54 per share in December 2024, is now trading around $447. Historically, Tesla's stock is known for significant movements following earnings announcements. A strong earnings report could lead to a substantial increase in stock price, while disappointing results might cause a decline.

Tesla's financial metrics reveal a price-to-earnings (P/E) ratio of approximately 233.65, indicating high investor confidence in future growth. The price-to-sales ratio is about 15.39, and the enterprise value to sales ratio is roughly 15.37, both suggesting that investors are paying a premium for Tesla's sales. The company's debt-to-equity ratio of 0.17 shows a relatively low level of debt, and a current ratio of 2.04 indicates strong short-term financial health.

Tesla Inc. (NASDAQ:TSLA) Faces Potential Downside According to Evercore ISI

- Tesla Inc. (NASDAQ:TSLA) is a leading electric vehicle manufacturer with a recent price target set by Evercore ISI suggesting a potential downside.

- The stock showed resilience with a 3.5% rebound after a 5% decline, indicating renewed investor confidence despite the potential overvaluation concerns.

- With a market capitalization of approximately $1.39 trillion and a significant trading volume, Tesla maintains a strong presence in the automotive industry.

Tesla Inc. (NASDAQ:TSLA), renowned for its innovative electric vehicles and sustainable energy solutions, competes fiercely in the automotive sector against both traditional and electric vehicle manufacturers. Founded by Elon Musk, Tesla has established itself as a key player, challenging companies like Ford, General Motors, Rivian, and Lucid Motors.

On October 13, 2025, Evercore ISI issued a price target of $300 for Tesla, when the stock was trading at $428.23. This represents a potential downside of approximately -29.94%, suggesting concerns over Tesla's valuation or future market challenges. Despite this, Tesla's shares have demonstrated resilience, bouncing back by 3.5% to $428 after a 5% decline the previous week. This recovery is in line with broader market trends, with the S&P 500 and the Dow Jones Industrial Average experiencing gains of 1.3% and 1.1%, respectively.

Currently, Tesla's stock price stands at $431.30, marking a 4.31% increase or a $17.81 gain. The day's trading saw prices fluctuating between $419.70 and $431.50. Over the past year, Tesla's stock has fluctuated significantly, reaching a high of $488.54 and a low of $212.11, highlighting its market volatility.

With a market capitalization of approximately $1.39 trillion and a trading volume of 49.6 million shares, Tesla's substantial market presence is undeniable, despite the recent price target adjustment by Evercore ISI.

Goldman Sachs Updates Tesla (NASDAQ:TSLA) Rating to "Neutral"

- Goldman Sachs maintains a "hold" action on Tesla (NASDAQ:TSLA), with a price target increase from $300 to $395, reflecting confidence in Tesla's long-term growth potential.

- CEO Elon Musk's recent $1 billion stock purchase underscores his belief in Tesla's future, potentially mitigating downside risk.

- Tesla's ventures into full self-driving technology, robotaxis, and the Optimus robotics segment are poised to drive transformative growth, with a base-case estimate projecting Tesla's stock price to reach $530 by December 2026.

On September 18, 2025, Goldman Sachs updated its rating for Tesla (NASDAQ:TSLA) to a "Neutral" grade, maintaining a "hold" action. At the time, Tesla's stock price was $422.41. Goldman Sachs had previously raised Tesla's price target to $395 from $300. Tesla, Inc. is a leading company in the autonomous robotics sector, known for its innovative approach to electric vehicles and technology.

Tesla's stock is experiencing a rally, driven by insider buying activity from CEO Elon Musk. Despite a current stock price of $416.85, which reflects a decrease of 2.12% or $9.01, the stock is aligning with its long-term potential. Musk's recent $1 billion stock purchase indicates his strong conviction in the company's future, potentially limiting downside risk.

Goldman Sachs analyst Mark Delaney notes that Tesla's new compensation package for Musk could enhance investor sentiment. This, combined with Tesla's ventures into full self-driving (FSD) technology, robotaxis, and the Optimus robotics segment, positions the company for transformative growth. These initiatives could lead to market capitalizations in the multi-trillion dollar range.

Tesla's stock has fluctuated today between a low of $416.56 and a high of $432.22, with a trading volume of 87.2 million shares. Over the past year, the stock reached a high of $488.54 and a low of $212.11. The company's market capitalization is approximately $1.34 trillion, reflecting its status as a premium asset in the market.

A base-case estimate projects Tesla's stock price to reach $530 by December 2026, supported by a forward price-to-sales ratio of 12 and anticipated revenue of $150 billion in Fiscal 2027. Tesla's transformative growth potential in artificial intelligence and robotics is a key driver for its future value, as highlighted by the company's recent upgrades to a "Strong Buy" rating.

Tesla (NASDAQ:TSLA) Maintains "Market Perform" Rating Amidst CEO Compensation Plan News

- William Blair maintains a "Market Perform" rating for Tesla (NASDAQ:TSLA), with the stock price around $347.13.

- Tesla's stock experiences an upward trend, trading at $354, following the announcement of a groundbreaking pay package for CEO Elon Musk.

- The compensation plan could potentially value at $1 trillion, aiming to retain Musk and achieve significant company milestones.

On September 5, 2025, William Blair maintained its "Market Perform" rating for Tesla (NASDAQ:TSLA), advising investors to hold the stock. At the time, Tesla's stock price was around $347.13. This rating comes amidst significant developments for Tesla, including a proposed compensation plan for CEO Elon Musk that has captured investor attention.

Tesla's stock is currently experiencing an upward trend, trading at $354, a 4.5% increase for the day. This surge follows the announcement of a groundbreaking pay package for Musk, potentially valued at $1 trillion. The proposal aims to retain Musk as CEO for the next decade, with performance targets that include expanding Tesla's robotaxi business and increasing the company's market value to $8.5 trillion.

The compensation plan, detailed in Tesla's proxy filing, is structured around 12 tranches of stock awards. Musk will only receive these awards if Tesla achieves extraordinary milestones over the next decade. These targets include significant improvements in profitability, vehicle production, and the development of new business lines in artificial intelligence and robotics.

If successful, the plan would grant Musk over 423 million additional shares, increasing his ownership from about 13% to nearly 29%. This would significantly enhance his voting power. Notably, Musk will not receive any salary or cash bonuses; his entire compensation will be equity-based, as highlighted by Wedbush analysts.

Tesla's stock has fluctuated between a low of $344.68 and a high of $355.87 during the day. Over the past year, it has reached a high of $488.54 and a low of $210.51. The company's market capitalization stands at approximately $1.12 trillion, with a trading volume of 63,078,710 shares.

RBC Capital Maintains Overweight Rating on Tesla (NASDAQ:TSLA) Amid Expanding Ventures

- RBC Capital updates its rating for Tesla (NASDAQ:TSLA) to "Overweight" with a new price target of $325, highlighting the potential of non-automotive segments.

- Tesla's robotaxi service launch in Texas exceeds expectations, with plans for significant expansion, marking it as a key future growth catalyst.

- The company's full self-driving (FSD) technology is also seen as a significant driver for Tesla's future growth, alongside its humanoid robots project.

On July 29, 2025, RBC Capital updated its rating for Tesla (NASDAQ:TSLA) to "Overweight," maintaining its previous grade. At the time, Tesla's stock price was $321.46. The action associated with this update is "hold." According to Benzinga, an analyst suggests that Tesla's valuation could significantly surpass current levels, driven by two key segments that are not related to cars. Tesla Inc. is drawing significant attention from investors and analysts due to its ambitious ventures beyond electric vehicles, particularly in the fields of robotaxis and humanoid robots.

RBC Capital analyst Tom Narayan has maintained an Overweight rating on Tesla and has increased the price target from $319 to $325. Narayan believes that if Tesla achieves its goals, its valuation could greatly surpass current levels. Tesla's recent launch of its robotaxi service in Texas has exceeded expectations, and the company plans to expand this service to more cities, aiming to cover half of the US population by the end of the year, although this is considered an ambitious target.

The robotaxi initiative is seen as a major future catalyst for Tesla. Additionally, Tesla's full self-driving (FSD) technology is also highlighted as a significant driver for the company's future growth. Tesla Inc. is currently trading at $323.24 on the NASDAQ. The stock has experienced a decrease of 0.72%, with a price drop of $2.35. Today's trading has seen a low of $318.25 and a high of $326.25. Over the past year, the stock has reached a high of $488.54 and a low of $182. Tesla's market capitalization stands at approximately $1.04 trillion, with a trading volume of 71.59 million shares.

Tesla, Inc. (NASDAQ:TSLA): A Comprehensive Analysis

- The consensus price target for Tesla's stock has fluctuated, with a recent average target of $322.50, down from $399.29 three months ago.

- Analyst Colin Langan from Wells Fargo has set an optimistic price target of $960 for Tesla, focusing on the company's potential in robotaxis and affordable models.

- Tesla faces challenges such as competition, a shortage of new models, and geopolitical tensions affecting its energy storage business, leading to a "Hold" rating from Langan.

Tesla, Inc. (NASDAQ:TSLA) is a major player in the electric vehicle (EV) and renewable energy sectors. The company operates through two main segments: Automotive, which includes the design, manufacture, and sale of electric vehicles, and Energy Generation and Storage, focusing on solar energy products and energy storage solutions. Tesla is recognized for its direct sales model and extensive Supercharger network.

The consensus price target for Tesla's stock has seen notable changes over the past year. Last month, the average target was $322.50, reflecting analysts' expectations based on recent performance. However, three months ago, the target was higher at $399.29, indicating more optimism possibly due to anticipated product launches or favorable market trends.

Despite these fluctuations, Tesla's long-term prospects remain a point of interest. Analyst Colin Langan from Wells Fargo has set a price target of $960 for Tesla, suggesting a positive outlook for the company's future performance. This target reflects expectations for Tesla's advancements in robotaxis and more affordable models, as highlighted by recent discussions on Market Domination Overtime.

Tesla is facing challenges such as heightened competition and a shortage of new models. The company is expected to report its largest decline in quarterly revenue in over ten years. Despite these challenges, investors are keenly observing Tesla's future, particularly its AI strategy and Robotaxi initiatives, as noted by Doug Clinton from Intelligent Alpha.

Tesla's energy storage business is also under scrutiny due to geopolitical tensions and potential tariff impacts. These factors, along with domestic challenges like high interest rates, contribute to a cautious outlook. Analyst Colin Langan has downgraded Tesla to a "Hold" rating, citing recent poor performance and a risky short-term outlook.