Skillsoft Corp. (NYSE: SKIL) Surpasses Earnings Expectations but Faces Revenue Shortfalls

- Skillsoft Corp. (NYSE:SKIL) reported earnings per share of $0.92, significantly beating the expected loss.

- Despite the earnings beat, SKIL's revenue of $128.8 million fell short of the estimated $136 million.

- The company's financial metrics indicate challenges, including a negative price-to-earnings (P/E) ratio and a high debt-to-equity ratio.

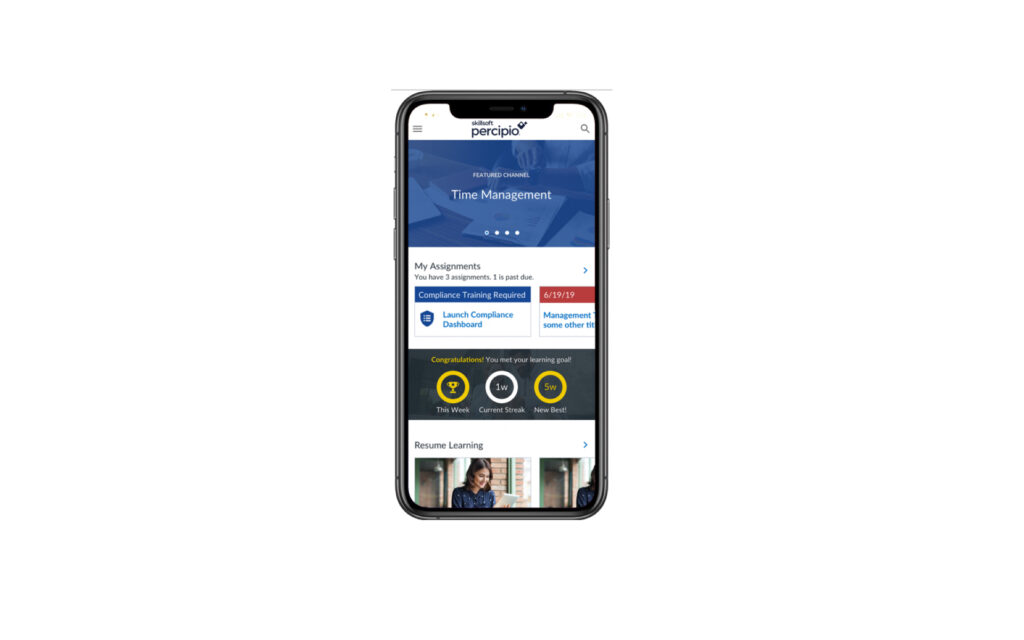

Skillsoft Corp. (NYSE:SKIL) is a leading provider of digital learning, training, and talent management solutions, competing in a dynamic industry alongside companies like LinkedIn Learning and Coursera. On September 9, 2025, SKIL reported an earnings per share of $0.92, marking a significant improvement over the expected loss of $2.10 per share and a notable turnaround from the previous year's loss of $2.4 per share.

Despite the impressive earnings, SKIL's revenue of $128.8 million fell short of the analysts' expectations of $136 million and represents a 3% decrease compared to the previous year. Revenue from Talent Development Solutions (TDS) remained steady at $101 million, showing no change from the prior year.

The company has a price-to-sales ratio is 0.24, suggesting that the market values the company's sales at about 24 cents for every dollar of sales. The enterprise value to sales ratio is 1.17, reflecting the company's total valuation relative to its sales.

The enterprise value to operating cash flow ratio stands at 20.58, indicating that SKIL is valued at over 20 times its operating cash flow. Additionally, the debt-to-equity ratio is high at 6.28, suggesting a heavy reliance on debt financing. The current ratio is 0.88, indicating potential challenges in covering short-term liabilities with short-term assets.

| Symbol | Price | %chg |

|---|---|---|

| 215200.KQ | 45000 | 0 |

| 019685.KS | 1253 | 0 |

| 019680.KS | 2100 | 0 |

| POOL.JK | 50 | 0 |

Skillsoft Corp Reported Strong Q3 Results

Skillsoft Corp. (NYSE:SKIL) reported Q3 results, with adjusted total revenue of $178.9 million ( up 6% year-over-year), beating the consensus estimate of $165.9 million.

Both Q3 results and guidance were good, though there were a lot of moving pieces in the reported results as the Skillsoft business model is overly complex. Positively, the company grew bookings and revenue in all segments, raised its growth guidance (though the raise was at a lower magnitude than the upside in Q3), and generated a 101% dollar revenue retention rate for Percipio and dual deployment.

Skillsoft Corp Reported Strong Q3 Results

Skillsoft Corp. (NYSE:SKIL) reported Q3 results, with adjusted total revenue of $178.9 million ( up 6% year-over-year), beating the consensus estimate of $165.9 million.

Both Q3 results and guidance were good, though there were a lot of moving pieces in the reported results as the Skillsoft business model is overly complex. Positively, the company grew bookings and revenue in all segments, raised its growth guidance (though the raise was at a lower magnitude than the upside in Q3), and generated a 101% dollar revenue retention rate for Percipio and dual deployment.