Nio Reports Wider Loss as Revenue Drops Amid Intense EV Competition in China

Nio (NYSE:NIO) reported a larger-than-expected net loss for the third quarter as declining revenue and reduced selling prices weighed on its performance in China’s fiercely competitive electric vehicle (EV) market. The company posted a net loss of 5.14 billion yuan ($710 million), compared to 4.63 billion yuan in the same period last year, missing analysts’ expectations of a 4.75 billion yuan loss.

Revenue fell by 2.1% to 18.67 billion yuan, falling short of the Street consensus estimate of 19.14 billion yuan. The decline was attributed to lower average selling prices, driven by shifts in the product lineup and intensified pricing competition among Chinese automakers aiming to capture market share.

Despite the revenue drop, Nio showed signs of improving profitability. The company’s gross margin rose to 10.7% from 8.0% a year earlier, while vehicle margins increased to 13.1% from 11.0%. These gains were attributed to lower material costs per unit, which helped offset the impact of reduced selling prices.

Looking ahead, Nio projected deliveries of 72,000 to 75,000 vehicles in the fourth quarter, representing a year-over-year growth of 44% to 50%. Revenue for the quarter was expected to range between 19.68 billion yuan and 20.38 billion yuan.

| Symbol | Price | %chg |

|---|---|---|

| 005380.KS | 220000 | 0 |

| 005389.KS | 166200 | 0 |

| 005387.KS | 169100 | 0 |

| 005385.KS | 166700 | 0 |

NIO Inc. (NYSE:NIO) Maintains Positive Momentum with Citigroup's Endorsement

- Citigroup maintains a "Buy" grade for NIO Inc. (NYSE:NIO), signaling strong confidence in the electric vehicle manufacturer's future prospects.

- NIO's stock reaches a new 52-week high of $7.71, indicating a significant recovery and positive market trend.

- Analyst endorsements and operational results boost NIO's stock performance, with a notable increase in market capitalization and trading volume.

NIO Inc., listed on the NYSE under the symbol NIO, is a Chinese electric vehicle manufacturer known for its innovative designs and technology. The company competes with other electric vehicle giants like Tesla and BYD. On September 23, 2025, Citigroup maintained its "Buy" grade for NIO, with the action being "hold," as highlighted by TheFly. At that time, NIO's stock price was $7.07.

NIO's stock has recently experienced a significant surge, reaching a new 52-week high of $7.71. This marks a notable recovery from a previous low of $3.02, indicating a positive trend for the company. The rally in NIO's stock price is supported by substantial improvements in the company's outlook, including strong endorsements from analysts and record-breaking operational results.

The recent wave of positive analyst endorsements from Wall Street has played a crucial role in boosting NIO's stock performance. Citigroup's decision to increase NIO's target and initiate a '30-day upside catalyst watch' reflects growing confidence in the company's future prospects. This has prompted investors to consider whether this is an opportune moment to invest.

NIO's current stock price on the NYSE is $7.07, reflecting an increase of approximately 2.33% or $0.16. Today, the stock has traded as low as $6.77 and as high as $7.17. The company's market capitalization stands at approximately $15.87 billion, with a trading volume of 48.72 million shares. These figures highlight the growing interest and activity surrounding NIO's stock.

NIO Inc. (NYSE:NIO) Quarterly Earnings Preview and Stock Surge

- NIO Inc. (NYSE:NIO) is set to release its quarterly earnings with an anticipated EPS of -$0.30 and revenue around $19.7 billion.

- The stock has surged 122% since April, reflecting growing investor confidence and potential strategic advancements.

- Despite a negative P/E ratio of -3.91, NIO's price-to-sales ratio is about 1.40, indicating investor willingness to pay for its sales.

NIO Inc. (NYSE:NIO), a leading player in China's electric vehicle (EV) market, known for its innovative approach to electric mobility, is set to release its quarterly earnings on Tuesday, September 2, 2025. Wall Street analysts project an earnings per share (EPS) of -$0.30 and anticipate revenue to be around $19.7 billion for this period.

NIO's stock has experienced a remarkable surge, climbing 122% since its lowest point in April. This surge reflects growing investor confidence and potential strategic advancements within the company. As highlighted by 24/7 Wall Street, the stock's recent performance indicates a significant turnaround, despite previously lagging behind in the competitive EV sector.

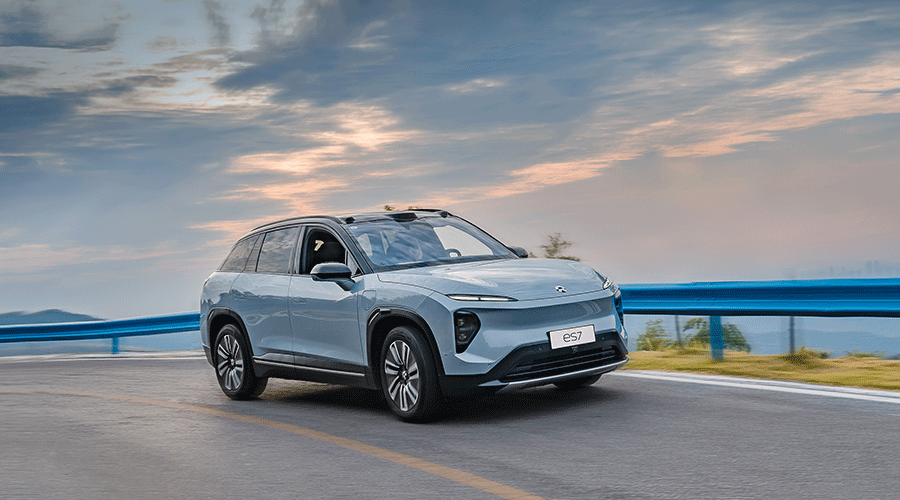

The company's recent stock rally, including an 11% increase during Tuesday's trading session, is largely attributed to strong investor enthusiasm surrounding NIO's newly launched ES8 SUV. Morgan Stanley's reaffirmation of its bullish outlook on NIO further supports this positive sentiment, despite the stock's significant gains in recent months.

NIO is demonstrating faster growth, stronger forecasts, and a more attractive valuation compared to its competitor, Li Auto. While Li Auto delivered more vehicles in the second quarter, NIO's growth rate of 25.6% significantly outpaced Li's 2.3% increase. This reflects a shift in investor sentiment favoring NIO, as evidenced by a 27% rise in NIO's shares over the past six months.

Despite a negative price-to-earnings (P/E) ratio of -3.91, NIO's price-to-sales ratio stands at about 1.40, suggesting that investors are paying $1.40 for every dollar of NIO's sales. However, the company's debt-to-equity ratio is significantly negative at -82.96, indicating a high level of debt compared to equity. Additionally, NIO's current ratio is approximately 0.84, suggesting potential liquidity challenges in covering short-term liabilities.

NIO Inc. (NYSE:NIO) Sees Positive Outlook from Macquarie with "Outperform" Rating

- Macquarie upgraded NIO Inc. (NYSE:NIO) to "Outperform" on July 31, 2025, indicating a positive future performance expectation.

- The launch of the Onvo L90 SUV significantly boosted NIO's stock, with the first batch of 10,000 units selling out in three hours.

- Despite recent success, NIO's stock remains 37% below its 52-week high, suggesting potential for growth.

NIO Inc. (NYSE:NIO) is a prominent player in the electric vehicle (EV) industry, known for its innovative approach to sustainable transportation. The company, based in China, focuses on designing and manufacturing electric vehicles, with a strong emphasis on performance and technology. NIO competes with other EV manufacturers like Rivian Automotive and Lucid Group, which are also striving to capture market share in the rapidly growing EV sector.

On July 31, 2025, Macquarie upgraded NIO's stock to "Outperform," reflecting a positive outlook on the company's future performance. At the time, NIO's stock price was $4.87, a figure that aligns with the recent 8% rise in its stock price. This increase was driven by the successful launch of NIO's mass-market sub-brand, Onvo's L90 SUV, which saw impressive initial sales.

The Onvo L90 SUV's launch was a significant catalyst for NIO's stock, as the first batch of 10,000 units sold out within three hours. This strong demand highlights the market's positive reception of NIO's new model. Despite this success, NIO's shares remain approximately 37% below their 52-week high of $7.71, indicating room for potential growth.

NIO's recent stock performance stands out, especially when compared to broader market trends. While the S&P 500 and Nasdaq Composite experienced slight declines, NIO's stock rose, showcasing its resilience. In contrast, competitors like Rivian Automotive and Lucid Group faced declines, with Rivian's stock falling by 1.2% and Lucid's by 1.6%, as highlighted by concerns over delivery numbers and market conditions.

Currently, NIO's stock price is $4.87, with a market capitalization of approximately $10.21 billion. The stock has traded between $4.46 and $4.98 today, reflecting investor interest and market activity. With a trading volume of 130.59 million shares, NIO continues to capture attention in the EV market, driven by its innovative products and strategic market positioning.

NIO Inc. (NYSE:NIO) Faces Financial Challenges Amid Growth in the EV Market

- NIO reported an earnings per share (EPS) of -$0.45, missing the estimated EPS of -$0.22, indicating a widening net loss due to increased operating expenses and competition.

- The company's actual revenue was $1.66 billion, significantly below the estimated $1.72 billion, highlighting financial pressures in the competitive EV market.

- Despite challenges, NIO's vehicle deliveries increased by 40.1% year-over-year.

NIO Inc. (NYSE:NIO) is a prominent player in the electric vehicle (EV) market, known for its innovative approach to smart electric vehicles. The company operates in the highly competitive Chinese EV market, which is the largest in the world. NIO offers a range of vehicles under its premium brand, NIO, and its family-oriented brand, ONVO. Despite its strong market presence, NIO faces challenges in maintaining profitability.

On June 3, 2025, NIO reported an earnings per share (EPS) of -$0.45, falling short of the estimated EPS of -$0.22. This reflects a widening net loss, primarily due to increased operating expenses and intense competition. The company's actual revenue for this period was approximately $1.66 billion, significantly below the estimated $1.72 billion, highlighting the financial pressures NIO faces.

NIO's vehicle deliveries for the first quarter of 2025 totaled 42,094 units, marking a 40.1% increase compared to the first quarter of 2024. However, this was a 42.1% decrease from the fourth quarter of 2024, indicating fluctuating demand. Vehicle sales reached approximately RMB 9.9 billion (around $1.37 billion), an 18.6% increase from the same period in 2024, but a 43.1% decline from the previous quarter.

Financially, NIO's negative price-to-earnings (P/E) ratio of approximately -2.29 indicates the company is not currently profitable. The price-to-sales ratio of about 0.81 suggests investors are paying $0.81 for every dollar of NIO's sales. The enterprise value to sales ratio is approximately 1.03, reflecting the company's valuation relative to its revenue.

NIO's debt-to-equity ratio is notably high at approximately 5.67, indicating a significant amount of debt compared to its equity. The current ratio is just under 1 at approximately 0.99, suggesting potential challenges in covering short-term liabilities with short-term assets.

NIO Inc. (NYSE:NIO) Earnings Preview: A Glimpse into the Future of Electric Vehicles

NIO Inc. (NYSE:NIO), a leading electric vehicle manufacturer based in China, known for its innovative approach to smart electric vehicles, is set to release its fourth-quarter 2024 earnings on March 21, 2025. Analysts predict a loss of $0.42 per share, with revenue expected to reach $20.19 billion. This release comes after a challenging year for NIO, marked by a 10% decline in stock price and fierce competition in the electric vehicle market.

Investors are keenly watching NIO's performance, especially the new ONVO model and the budget-friendly Firefly vehicle. These models are crucial for NIO's strategy to capture a larger market share. Despite the challenges, NIO is considered undervalued, trading at 0.9 times its next twelve months (NTM) sales. This presents an opportunity for potential growth, especially with the bullish sentiment in China.

NIO's financial metrics reveal a complex picture. The company has a negative price-to-earnings (P/E) ratio of -3.64, indicating current negative earnings. The price-to-sales ratio is 1.27, meaning investors pay $1.27 for every dollar of NIO's sales. The enterprise value to sales ratio is 1.43, reflecting the company's valuation relative to its revenue.

The company's debt-to-equity ratio is high at 2.99, showing significant debt compared to equity. However, the current ratio of 1.04 suggests a modest level of liquidity, with slightly more current assets than liabilities. Despite these challenges, NIO's projected revenue growth of 46.3% for 2025 indicates potential for recovery and expansion in the coming years.

NIO Inc. (NYSE:NIO) Earnings Preview: A Glimpse into the Future of Electric Vehicles

NIO Inc. (NYSE:NIO), a leading electric vehicle manufacturer based in China, known for its innovative approach to smart electric vehicles, is set to release its fourth-quarter 2024 earnings on March 21, 2025. Analysts predict a loss of $0.42 per share, with revenue expected to reach $20.19 billion. This release comes after a challenging year for NIO, marked by a 10% decline in stock price and fierce competition in the electric vehicle market.

Investors are keenly watching NIO's performance, especially the new ONVO model and the budget-friendly Firefly vehicle. These models are crucial for NIO's strategy to capture a larger market share. Despite the challenges, NIO is considered undervalued, trading at 0.9 times its next twelve months (NTM) sales. This presents an opportunity for potential growth, especially with the bullish sentiment in China.

NIO's financial metrics reveal a complex picture. The company has a negative price-to-earnings (P/E) ratio of -3.64, indicating current negative earnings. The price-to-sales ratio is 1.27, meaning investors pay $1.27 for every dollar of NIO's sales. The enterprise value to sales ratio is 1.43, reflecting the company's valuation relative to its revenue.

The company's debt-to-equity ratio is high at 2.99, showing significant debt compared to equity. However, the current ratio of 1.04 suggests a modest level of liquidity, with slightly more current assets than liabilities. Despite these challenges, NIO's projected revenue growth of 46.3% for 2025 indicates potential for recovery and expansion in the coming years.