Keysight Technologies, Inc. (KEYS) on Q1 2021 Results - Earnings Call Transcript

Operator: Good day, ladies and gentlemen, and welcome to the Keysight Technologies' Fiscal First Quarter 2021 Earnings Conference Call. My name is Sedaris and I'll be your lead operator today. After the presentation, we will conduct a question-and-answer session. Please note that this call is being recorded today, Thursday, February 18, 2021, at 1:30 pm Pacific Time. Jason Kary: Thank you and welcome, everyone, to Keysight's First Quarter Earnings Conference Call for Fiscal Year 2021. Joining me are Ron Nersesian, Keysight's Chairman, President and CEO; and Neil Doherty, our CFO. Joining us in the Q&A session will be Satish Dhanasekaran, Chief Operating Officer and Mark Wallace, Senior Vice President of Global Sales. You will find a press release and information to supplement today's discussion on our website on investor.keysight.com. While there, please click on the link for quarterly reports under the Financial Information tab. There you will find an investor presentation along with Keysight segment results. Following this conference call, we will post a copy of the prepared remarks to the website. Today's comments by Ron and Neil will refer to non-GAAP financial measures. We will also make references to core growth, which excludes the impact of currency movements and acquisitions or divestitures completed within the last 12 months. You will find the most directly comparable GAAP financial metrics and reconciliations on our website. All comparisons are on a year-over-year basis unless specifically noted otherwise. We will make forward-looking statements about the financial performance of the company on today's call. These statements are subject to risks and uncertainties and are only valid as of today. The company assumes no obligation to update them. Please review the company's recent SEC filings for a more complete picture of our risks and other factors. Lastly, I would note that management is scheduled to participate in upcoming virtual investor conferences in March, hosted by Susquehanna, Credit Suisse and UBS. And now I will turn the call over to Ron. Ron Nersesian: Thank you, Jason, and thank you, everyone, for joining us. Keysight delivered another outstanding quarter. Our consistent performance illustrates the strength of our differentiated solutions, broad-based momentum across diverse end markets and the durability of our business model. Today, I'll focus my comments on three key headlines. First, we achieved record first quarter orders driven by growth across all regions despite China trade headwinds. Second, strong execution by the Keysight team delivered revenue and earnings growth above guidance. And third, we entered the year with solid momentum across multiple end markets and confidence in our revenue and earnings growth trajectory for the year. Despite a short term expectation of elevated expenses from variable compensation, which is due to the high near term revenue growth, we expect to achieve mid to high teens earnings growth in Fiscal 2021. Neil Dougherty: Thank you, Ron, and hello, everyone. As Ron mentioned, the Keysight team delivered an outstanding first quarter as continued economic recovery drove a steady improvement in demand across all major regions. First Quarter revenue of $1,180 billion was above the high end of our guidance range and grew 8% or 6% on a core basis. Q1 revenue growth was driven by broad strength across multiple end markets and geographies. Total Keysight orders again exceeded revenue in Q1 with a boat to build just over one. We achieved first quarter orders of $1,223 billion, of 7% or 5% on a core basis, successfully overcoming increased trade restrictions. Turning to operational results for Q1. Reported gross margin of 64% and operating expenses of $439 million were well-managed, resulting in an operating margin of 27%, an increase of 210 basis points year-over-year. We achieve net income of $270 million and delivered $1.43 in earnings per share, which is well above the high end of our guidance. Our weighted average share count for the quarter was 188 million shares. Jason Kary: Thank you, Neil. Sideris, will you please give the instructions for the Q&A? Operator: Yes. And your first question comes from the line of Rick Eastman with Baird. Richard Eastman: Yes, good afternoon. Could you perhaps maybe just kind of walk through a little bit of the operating leverage that we really saw in both Commercial Communication Solutions Group? But I'm kind of looking at the out profit number of 170. Is that with the gross margin maybe down? Is that primarily all mix or maybe give us a little bit of a feel for that. And maybe the same question around EISG. Just significant operating leverage there. I'm curious how much of this mix versus volume. That's a new word for it? Neil Dougherty: Yes, Rick, This is Neil. I think you've hit on it right. Q4 was a very favorable -- if you're looking sequentially -- Q4 was a very favorable gross margin quarter for us as we really significantly ramped production after the COVID disruptions of Q2 and Q3. And I think just the nature of us responding to immediate customer demand for urgent delivery, kind of shifted the mix in a favorable direction in the fourth quarter. I think what we saw in the first quarter was the return to more normalized mix. It aligns with kind of the quarters leading it up to Q4 as well as slightly lower volume. And I think that that comment is basically true across both the Communications Group as well as EISG. There's nothing really specific in either one of the two businesses. Ron Nersesian: And you also look at the long-term model that we outlined at analysts day for FY 2023, obviously, our performance shows very strong against that and we have no doubt that we'll be able to deliver to that level going forward. Richard Eastman: Great. And then just a quick question, maybe if I could. I'm surprised to see the order growth and it basically looks like you held your backlog up, kind of in the low 20s year-over-year -- 20% year-over-year. I think my math quickly says 23% year-over-year on the backlog side. I know you spoke to orders being strong across geographies, across product lines. Is there any particular place that you might flag whether it be geography, or between the two business segments where you were pleasantly surprised with your order growth in the quarter? Ron Nersesian: I'll mention a couple and then I'll let Mark chime in with a little more detail. First of all, if you look at China, our China orders were down 6% and we expected them to be down much more because of the effects of the China trade restrictions with Huawei. If you were to strip out Huawei, we had 19% order growth from our other Chinese customers. And as Huawei comes out of the compare in the past, we're very, very pleasantly surprised and pleased with that performance. Our Chinese salesforce was redeployed from the accounts where they cannot sell into other accounts within the geography and we were to do that almost instantaneously to produce the type of the type of results that we did do. So that was clearly one. India was also very strong. Japan was very strong -- both of those well into double digits, as well as Europe, which also hit double digit performance. Mark, you may want to add a couple more regional comments? Mark Wallace: Sure. Ron covered it really well, Rick, but I would just add that about half our growth in China overcoming the headwinds was from new customers. Again, showing how we're executing and rotating to both new opportunities and new customers and we want additional business with our existing customers, whether that be around 5G to some of the long tail of customers, 400-gigabit Tier 2 customers. And I was very pleased with semiconductor, very strong growth again, both from existing large customers, as well as acquiring two new fabulous semiconductor customers in the quarter in China. Very strong results in Japan for 5G and aerospace defense. And then if you look at Europe, it really was a story of this very broad demand across multiple end markets. We had growth across most of our countries across Europe. And it really goes to show the strength of our portfolio and the depth of our penetration into all these end markets. Ron Nersesian: Let me add just a couple more comments, Rick. One, our general electronics business was up in orders over 20% and that's a really good sign. That talks about the macro environment in the industrial markets. So, we're very pleased to see that and also our overall corporate strategy and moving to more software-centric solutions, which requires more software and more services. Both software and services. Both grew double digits in orders again this quarter. Richard Eastman: Very good. Congrats. Thank you. Ron Nersesian: Thank you. Operator: Your next question comes from the line of Jim Suva from Citigroup Investment. Your line is open. Jim Suva: Thank you very much and really good job on the results in an unclear uncertain environment. My question is a little bit more, just to help us out looking forward. Not so much on the trade and tariff stuff, but recently the supply chain with the freezing in Texas and chip shortages, can you talk to us a little bit about do you have some buffer chips that you're okay for the next three to six months? Or are you tempering your outlook a little bit? I'm just kind of a little bit concerned about the procurement cycle. Seems to have this additional variable. And then my second question is on OpEx. How should we be thinking about that as hopefully COVID becomes behind us at some point? Thank you so much. Ron Nersesian: Sure, I'll cover the procurement piece and then I'll let Neil talk a little bit more on the OpEx formula going forward. As far as procurement we have taken into account the long lead time cycles that we're seeing from semiconductor providers, as well as the other environmental impacts that we're seeing around the world. As a matter of fact, we have just put out guidance for the midpoint is at $1.2 billion for the next quarter and that takes into account the semi-cycles. We do hope though, that things don't get worse from the standpoint of COVID -- another surge, although we feel very confident that we are in good shape to come out with this guidance, which was above the street consensus for the next quarter. Neil Dougherty: Yes, and, Jim, your second question was kind of forward-looking as are related to OpEx. And I made some comments in my prepared remarks. Certainly I think our underlying investment levels are stable and are likely to be stable, going forward. But we do expect some short-term increases over the course of the next couple of quarters -- well, not the only impact, by far the biggest driver of that increase is our variable pay program. As I mentioned in my prepared remarks last quarter, Q2 expenses are expected to be seasonally higher than all other quarters this year. The principal drivers the bounce back of variable compensation relative to last year. That variable compensation is a function of both organic revenue growth and operating margin and in quarters where we have soft revenue comps and therefore higher revenue growth like we will see in Q2 and in Q3 of this year. Our variable compensation is going to be materially higher. So, as you saw we guided very strong revenue growth of 34% in Q2 and expect the sequential increases results in our variable compensation program of more than $30 million relative to Q1. And since all of our non-executive employees are participants in that variable pay program, that increase is split roughly equally between cost of sales, R&D, and SG&A. Specifically impacting the OpEx lines that you asked about. But again, important to note that the underlying investment level is stable and once we get past Q3, our variable pay and our expense levels are going to return to more normalized levels. Jim Suva: Thank you, and congratulations again, to you and your team. Thank you. Ron Nersesian: Thanks, Jim. And just to finish that up, if you take a look at our overall model, we think it's a short-term effect and that's why for one of the few times we've guided out for the whole year producing EPS growth in the teens as we had mentioned in our prepared remarks. Operator: Your next question comes from a line of John Marchetti with Stifel. Your line is open. John Marchetti: Thanks very much. I was wondering if you could just take a moment and talk about some of the strength that you continue to see in 5G? How much of that maybe is coming from new customers, as you sort of hinted at in the comment about the older strength? And how much of it is maybe moving into different variants of 5G? Whether it's standalone, versus non, or Millimeter Wave versus sub-6G? Ron Nersesian: Satish, feel free to answer this question. Satish Dhanasekaran: Yes, I'll take that, Ron. I think one of the effects in 5G that we're seeing as deployments of scaling is the broader interest in deploying this technology across different end market verticals. And that as a result of expanding the ecosystem, as we have talked about this quarter, we added over 100 new customers to our 5G platform. So that's that continues to be strong. At the highest level, I think we've stated its growth across all regions, for 5G and all parts of the ecosystem. So, it is broad and we see sort of four teams. Right? You look at the R&D investment cycle, there's new teams such as and O-RAN that are capturing interest, manufacturing opportunities, scale as 5g deploys, and it's profitable manufacturing as we have talked about as select manufacturing strategy. And -- is the interest in this technology from new verticals such as aerospace, defense, automotive, and industrial. And finally we see this long term steady push to commercialize Millimeter Wave as we've talked about is a long term dynamic for our business, which has got an upgrade pattern and to feed this momentum, we've just announced over 30 new product introductions this quarter and we feel confident about the projections based on everything we see in the industry. John Marchetti: And maybe just as a follow up there, Satish, you guys have mentioned in the past, you think this market sort of peaked out in 2022 or 2023 for you. I'm curious if that's still the case, or if you think with some of these newer things coming on, that actually extends it out a little bit? Satish Dhanasekaran: Yes, I think based on what we have seen in the past, I think we've sort of seen an industry CapEx projected to peak due to the Millimeter Wave parts of 5G being deployed. However, for our business, in comms, we have a broad portfolio of both wired and wireless and the end-to-end portfolio that we have created, not only has sort of a poor incident effect, but as Ron referenced, higher software content, higher services, so we're much more plugged in and able to monetize the lifecycle value from our early, lead. John Marchetti: Thank you. Operator: Your next question comes from one of Samik Chatterjee with J.P. Morgan, your line is open. Unidentified Analyst: Hi, this is Joker on for Samik. So my first question is just around aerospace, and electronic industrial business again. Obviously, you had two great quarters of execution in a row. I guess how should we think of the sustainability, the momentum in both those segments? And what is driving your content? Mark Wallace: Ron, should I take… Ron Nersesian: Sure. Satish Dhanasekaran: As far as aerospace, defense is concerned, very pleased record orders and record revenues. And as we mentioned before, the strength is coming across all the regions, tracking the COVID recovery or macro recovery. And that's probably a common dynamic between our aerospace, defense business and the general electronics business in our industrial segment. Specifically, on the aerospace defense, our portfolios focus on defense modernization, in particular around these new teams continue to position us well. The passage of the NDAA or the budget in the United States in December, we feel cautiously optimistic about the outlook for that business as we look forward. And we also have a pretty healthy, healthy backlog into the business. So, we continue to expect strong growth the next couple of quarters. As far as the EISG business is concerned, again, broad strength from our general electronics business, but also semiconductor where we're seeing increased investments driven by the advanced nodes and the China IC investment that Mark referenced earlier. Unidentified Analyst: Got it. Ron Nersesian: I would also comment that different form factors are contributing to that such as our modular solutions, had a very strong quarter, as well as software and services that have been mentioned earlier, all play into this general electronics market and the overall EISG market. Unidentified Analyst: I appreciate the color. And then just a quick follow up. You, guys kind of went into detail about the 5G and the momentum that you're seeing there. I'm just curious, can we get an update on how you're seeing the declines play out on the 4G side? I know last year, because COVID, there was obviously a big impact there, but are we seeing declines starting to moderate on the 4G side? Mark Wallace: Yes, sequentially. 4G has been flat quarter-over-quarter for us and we're very pleased with the uptake in 5G as I referenced. It was a record quarter and was and if you include 5G and 4G together, we've grown at year-over-year and sequentially quarter-over-quarter. We feel we feel good about the portfolio and I did mention that we've launched 30 new products this quarter to feed that momentum in the market. Unidentified Analyst: Got it. Appreciate the color, guys. Congrats on the results. Ron Nersesian: Thank you. Operator: Your next question comes from the line of Mehdi Hosseini with SIG. Your line is open. Mehdi Hosseini: Yes. Thanks for taking the question. One follow with Satish. Can you please help me understand the mix of a 400-gig and 800-gig ethernet as a mixer for overall communication sector group? And how do you see that trending especially as the volume brand for 400-gig plays out in the second half? And for Neil, it would be great if you could give us some reference. I think there was a mention of software and services accounting for one-third of the revenue. Can you give us a qualitative or quantitative assessment of what the mix of software is? Where was it a year ago? And how should we be thinking about the software mix looking forward? Satish Dhanasekaran: Yes, I'll maybe start with the 400-gig question, Mehdi. As we have really done very well with the wireline technology evolutions over the number of years and last year was a pretty strong year for 400-gig, I think we've referenced it on calls. And what we saw this quarter was a broader adaption of 400-gig technologies, still heavily driven by data center demand, which is adapting, I should say, the 400-gig at scale. We saw increased spend from Tier 2 and long tail customers in Asia in particular and we expect as the 400-gig economies of scale and maturity occur, that more of that demand will start to shift in the telco or Metro opportunities. So, we're still on the frontend of that. I would also say that on 800-gig, the investments are in early R&D, which we expect to play out in in production in 18 to 24 months. So, we're engaged early. Just this quarter, we announced the full suite of R&D offerings for 800-gig as well, which positions us well to benefit from not only the wireless on the 5G side, but also from the wireline opportunities in our commercial communications business. As far as the software, I'll kick it off, and maybe Neil can make a comment. We see for our double-digit growth in software coming from our pathway design franchise and from the 5G solutions, which as we have referenced before, have a higher percentage of software content with them. We're also seeing renewals for subscription contracts become important to our 5G growth, which I think helps us with the ARR. I'll just pass it off to Neil. Neil Dougherty: Just in terms of the relative size of software, we've said previously that software is approximately 20% of total revenues. And as the Satish has mentioned, it continues to outgrow the broader business, growing double digits again this quarter. So that mix is increasing slowly over time and we expect that it will continue to do so as we continue this migration towards more complete solutions with higher software content. Mehdi Hosseini: If I may, just a quick follow up for Neil here. If you execute and deliver the software growth above the top line, could that be potentially a source of gross margin upside that could potentially drive EPS growth this year towards the mid to high teens? Neil Dougherty: Certainly, over the long run, we see increasing software content as a driver of gross margin. I think you've seen that over the past couple of years as we've added software to our portfolio, as well as taking other actions to drive our gross margins northward. You know, the, the mix shift, it's not dramatic. It's slow and steady over time. So, hard for me to draw a direct link between a mixed shift over the next couple of quarters and immediate EPS increases, there's a lot of things that are going to go into -- they're going to play a role in determining that level over the course of the next several quarters. But generally speaking, yes, our software growth is absolutely contributing to our gross margin improvement over time. Mehdi Hosseini: Thank you. Ron Nersesian: Well also, so if you're looking for the short term, or big orders, where to go ahead and where to exceed our projections, when you take a look at our incrementals, we have delivered to our model and then some pretty much consistently over the last five years. And we expect to continue to do so. Ms: Yes. And I was just trying to understand how conservative is that method, high-teen EPS growth? And how should we think about upsides from there? Satish Dhanasekaran: I think you can see in our guide that we're very encouraged by the market and our performance in the business on the top line. We do have some short term expense pressures over the couple of quarters that will put some pressure on EPS relative to normal incremental, over the quarter or where the incrementals would otherwise have been over the course of the next several quarters. But by Q4, we're kind of lapped those comps than the impact that they have on our business where we return to kind of more normalized levels. Mehdi Hosseini: Okay, thanks, guys. Ron Nersesian: Thank you. Operator: Your next question comes Mark Delaney with Goldman Sachs, your line is open. Mark Delaney: Yes. Good afternoon, and thanks for taking the question. I was hoping to dig more into the full-year EPS growth commentary of mid to high teens in recognizing the very good or that the company just reported for the quarter. If my math is right, the implied second half EPS growth is relatively flattish to slightly higher, year-over-year, 5% or 10% or so. And yes, I understand the higher variable comp, which makes a lot of sense and is good news. But is there anything else besides the variable comp that you're trying to factor into the implied EPS growth guidance that you're discussing today? Thanks. Neil Dougherty: The only thing I mentioned earlier is that, our Q4 gross margins in last year were extraordinarily favorable. Right? Not only do we have the highest revenue quarter we'd had by a pretty significant margin, we had significantly higher gross margins than we'd ever had previously. So, we are going to have a tough year-over-your comp in the fourth quarter that is going to factor into that ultimate equation as well. Mark Delaney: That's helpful and make sense. My question was on the 5G order strength and the strength that the companies have seen within Millimeter Wave. Can you describe to what extent you're seeing some increased adaption of Millimeter Wave in different geographies and perhaps the opportunity for Millimeter Wave deployments to help your business in China? Thank you. Ron Nersesian: Yes, thank you. I think as we have referenced before, the Millimeter Wave opportunity is a long term one for us. We see a very steady increase in interest from our customers. At this point, heavily driven by the U.S. bans. You can think of 20 gigahertz to 40 gigahertz sort of spectrum. And with new spectrum coming online, the 66 gigahertz to 90 gigahertz range, I think that tends to sow the seeds for the runway. We're talking about China's 2022 Winter Olympics, we expect it to be a push with a showcase of Millimeter Wave. So those are clearly drivers. And then if you look even further out, you start thinking about some early research occurring the terahertz space. So again, this is a very long-term opportunity. Keysight's got a competitive differentiation. We have talked about this and we're well-positioned to address this. Currently, we're working with customers to solve some critical challenges in commercializing Millimeter Wave like in advanced beam management, peak higher data rates, 10 gigabits per second and above. It's a long term dynamic and we are well-positioned there. Mark Delaney: Thank you. Operator: Your next question comes from the line of Tim Long from Barclays. Your line is open. Unidentified Analyst: Good afternoon. This is Peter on for Tim. Congratulations on the results. On CSG, just again, as we see the 400G cycle coming closer, could you help us parse out what that has meant for you between your wireline hardware business versus the network and ability side and the essence of what inning we are in that cycle from that testing measure perspective? And then also on A&D. How should we think about what this very strong Q1 here implies for Q2 seasonality out? Just going off this very strong pace? Ron Nersesian: I didn't hear your question. Could you please repeat it? Unidentified Analyst: I'm sorry. Is this better? Neil Dougherty: Yes. If you could slow down just a touch. That would help. Unidentified Analyst: Sure. I was just asking on CSG. Just as we see the 400G cycle coming closer, I was wondering if you could help us parse out what that has meant for you between the wireline hardware side versus the network visibility side? And do you have a sense of what inning we are in that cycle from a test measurement perspective? And then just a follow up on A&D, was wondering how we should think about Q2 seasonality, given the starting strong Q1 base? Satish Dhanasekaran: Yes. I'll take the aerospace, defense first. Again, record orders and given the comps from the favorable comms, we have for the next couple of quarters. We expect strong revenue performance in the business and our focus areas around defense modernization are also aligned with some of the strategic priorities of the governments around the world. So we feel good about where we are in the business. With regard to your question on wireline, the entire portfolio of wireline involves the focus in three areas if you think of it. The focus on high speed evolutions, 400-gig, 800-gig, terahertz and terabit ethernet and beyond. And security as a second theme, which is gaining customer interest. And the third area is on visibility. Clearly, we're the drivers for the business right now are 400-gig and 800-gig. In terms of the visibility business, we expect or we're everything we hear and we see the pipeline building towards it is a recovery in enterprise IT span, which would be a good peg. And that to occur as folks return back to work or in a hybrid mode later on in the year. So that's probably a driver for that part of the business. But overall, we're pleased with the synergies we're seeing and you see that reflected in the strength of our commercial communications business this quarter. Unidentified Analyst: Great, thank you for the color. Operator: Your next question comes from the line of David Ridley-Lane from Bank of America. Your line is open. David Ridley-Lane: Thank you. Good evening. Since you've done the math on the impacts from trade restrictions on both orders and revenue, what was the estimated headwind for both of those? Ron Nersesian: It was roughly six to seven points at the Keysight level. Obviously heavily skewed to CSGs specifically to commercial comm. So, I think if you get to the commercial comms level, it was a double digit headwind for the commercial communications business. David Ridley-Lane: Got it. Ron Nersesian: Putting the record orders for commercial comms in contact, we were extraordinarily pleased with that result given the China trade headwinds on that business. David Ridley-Lane: Got it? Okay. And then, since no one else has picked up on it, I'll ask. Can you tell us a little bit more on the acquisition that you closed. I think it was about $100 million or so from cash flow revenue. How it fits into the portfolio? And it seems like it's in a very fast-growing part of the market. So, kind of what's your near-term revenue expectations as well? Satish Dhanasekaran: Yes, maybe I'll start by saying, it's a smaller acquisition. Roughly half point to the Keysight revenue as an estimate, and it's highly profitable, and it aligns with our M&A strategy of focusing on software-centric product categories, and more importantly, enables us to complete the customer workflow -- plays into the interoperability testing space, which enables customers to resolve complex system issues. And given that the 5G deployments are taking place at scale at new trends, like Open RAN are disaggregating more of what used to be a monolithic block. We believe this acquisition will really help us continue our momentum within the commercial comms business. David Ridley-Lane: Got it. And then last one for me. You're now in a net cash position. How do you think about Keysight's ability to be more aggressive on share repurchase? Is being in a net caps position aligned for you? Neil Dougherty: Go ahead, I'm sorry. Ron Nersesian: Yes. Our first objective, obviously, is to grow the business and provide a great return above our wax. So we continue to look for M&A opportunities that can further our strategy. But again, if we can't go ahead and produce you know an hourly , we're not going to spend it. So, you can see we're very deliberate and we're very focused and we will not go ahead and go after things that are too speculative. So that is our first priority. The second thing if we had excess funds, at the end of the day, we would rather do that through opportunistic share repurchases. As you saw, not this quarter, but as you saw on Q4, where average price was below $100 in the shares that we did repurchase. And then third would be to do something like a dividend that we're far from that at this point. But still, first, we're going ahead and making sure after organic growth is funded through over $700 million in R&D. Second, it's to look for M&A that could go ahead and enhance our growth and produce a higher return on invested capital. Third, clearly is to look for opportunistic share buybacks. which we have done and we plan to make sure we're at least anti-diluted, like we've stated before, but we will get a little bit more aggressive if we see a very big opportunity. Operator: Your next question comes from a line of Adam Thalhimer from Thomas Davis. Your line is open. Adam Thalhimer: Close enough. Hi, guys. Great quarter. Neil Dougherty: Thanks, Adam. Ron Nersesian: Thanks, Adam. Adam Thalhimer: Shoot, this might be a waste of question, but I got to ask about the Biden administration and Huawei. There have been some early indications that maybe some of their restrictions get eased. I'm just curious if you have any thoughts on that? Ron Nersesian: Well, we don't have any particular insight as to what the Biden administration will do. But I'm very pleased that we were concerned about having to have that in our compare and to go ahead and seeing what that would do to our top line when we had to go ahead and stop selling, according to the government laws. And we're very, very pleased that we reported double-digit quarter growth and revenue growth outside at our other accounts in order to basically smooth right over that. So, if things were to change at Huawei or with any other government restrictions, that would certainly be significant upside for us. Adam Thalhimer: Okay, thank you. Ron Nersesian: Thanks, Adam. Operator: Your next question comes from a lot of Chris Snyder from UBS. Your line is open. Chris Snyder: Thank you. So, just following up on the capital allocation. The company finished the quarter with $1.9 billion of cash, which is certainly well above historical levels. What do you view to be the optimal level of cash to keep on hand? And is there a willingness to go after larger acquisition targets? Because while there's been a steady stream of bolt-on type acquisitions, it feels like that is a little bit difficult to kind of right-size, the cash balance with these just bolt-ons alone? Ron Nersesian: Sure, well, I'll just say this, that we have looked at over 300 different acquisitions. And again, we're very selective. We've made about a dozen at this point and you're right, most of them have been smaller, except for two of them. And we continue to look for a large and small things that fit into our strategy. But there is a very high hurdle for the large acquisitions, obviously, the upside, is much as much more significant. But when you look at the premium and the amount of dollars that you have to make up in the premium you pay for a company, we want to make sure that pays off for the shareholders. We have more cash than we need to run the company right now. But we are aggressively looking at M&A and unfortunately, we can't share much more than that. Neil, you may have something else you want to add? Neil Dougherty: Yes, the only thing I was going to add is that the optimal level of cash -- I would agree with Ron, we have we have more cash than we currently need. But the optimal level of cash is a lot of things that go into that and it fluctuates over time. And we're looking to put that cash to work either through value creating M&A or looking for opportunities to return it in a favorable fashion, like we did in the Q4 of last year. So, we'll continue to continue to do that. Chris Snyder: Thank you for that. And then just for the second question, can you talk about the pricing environment, both for CSG and EISG? And what level of positive pricing, if any, is baked into the company's mid-single digit long term core growth targets? Ron Nersesian: We always look at pricing depending on what's going on in the market and how much our differentiation is in a particular segment. So clearly, if there's a lot of competition, we don't have differentiation that it's that great, we cannot go ahead and utilize too much pricing power. But what we're doing in 5G is certainly unique. We're on the leadership end and not only in different products, but when you look across the workflow and we look for opportunities to do so but we're not going to gouge our customers. We want to make sure that we have a good long-term environment and they stick with us. So, we review our pricing at a minimum twice a year and we look for opportunities for price increases and we will continue to do so to drive our margins higher or to offset inflation. But as far as what the amount is, that's something that we do not state publicly. Chris Snyder: Thank you. Ron Nersesian: Thanks, Chris. Operator: Your next question comes from a line of Brandon Couillard from Jefferies. Your line is open. Brandon Couillard: Hey, thanks. Good afternoon. Most of my questions have been covered. But, Ron, I don't think you mentioned any call on the auto market specifically yet. Curious, latest thoughts there? And if there has been kind of any turn perhaps in the order trends in that market? Thanks. Ron Nersesian: Yes. Well, I'll let Satish answer this. We've been focusing certainly on the battery test and the overall infrastructure for EV. We have mentioned a nice the win that we had in the prepared remarks earlier, and we continue to be in good position in that space. Also, as we look at autonomous vehicles, it's the same thing. But as far as the market, we've seen the market a little bit more depressed, as we all know, in auto and I'll let Satish get a chance to comment on where he sees that going. Satish Dhanasekaran: Yes. And thanks, Ron. We're seeing signs of slow recovery in the auto market. The business is definitely stabilizing, the manufacturing parts of the business have depressed a strong reference. But there is a steady focus on next gen R&D with AV and EV applications. Definitely the push around the world for more electrification, we view as a long-term opportunity and we're focused on creating value to help extend the ranges, help with interoperability needs by implementing global standards, including in China and focusing on bidirectional charging applications. With 5G in particular, we have a differentiated position on C-V2X technology that we're continuing to progress. So, this may be a market where as the as the auto end market recovers, we start to see even bigger traction, especially in EV and AV. That's our expectation, but our portfolio is strong and we continue to be engaged with customers. Brandon Couillard: Thanks. And, Neil, would you remind us just what the China trade headwind is on a year-over-year basis to the top line in the second quarter? That a similar sort of 6% to 7%? Neil Dougherty: Yes, what we said what we said before was that it was 5% on the half, obviously skewed towards Q1. We've just told you Q1 was 6%, so Q2 is in the 3% to 4%-ish range. Brandon Couillard: Got you. Thank you. Operator: Thank you. That concludes our question-and-answer session for today. I would now like to turn the conference back to Jason Kary for any closing comments. Jason Kary: Hi. Thanks, Sedaris. no further comments. I just like to thank everyone for joining us today and wish you all a great day. Operator: This concludes our conference call. You may now disconnect.

Keysight Technologies Inc. (NYSE: KEYS) Overview: A Look at Its Market Position and Investor Interest

- Jefferies set a price target of $180 for NYSE:KEYS, indicating a potential upside of 6.21%.

- Institutional investors are increasing their stakes, reflecting confidence in KEYS's growth prospects.

- KEYS's current stock price is $169.47, with a year's trading range between $121.43 and $186.20, highlighting its market volatility and growth potential.

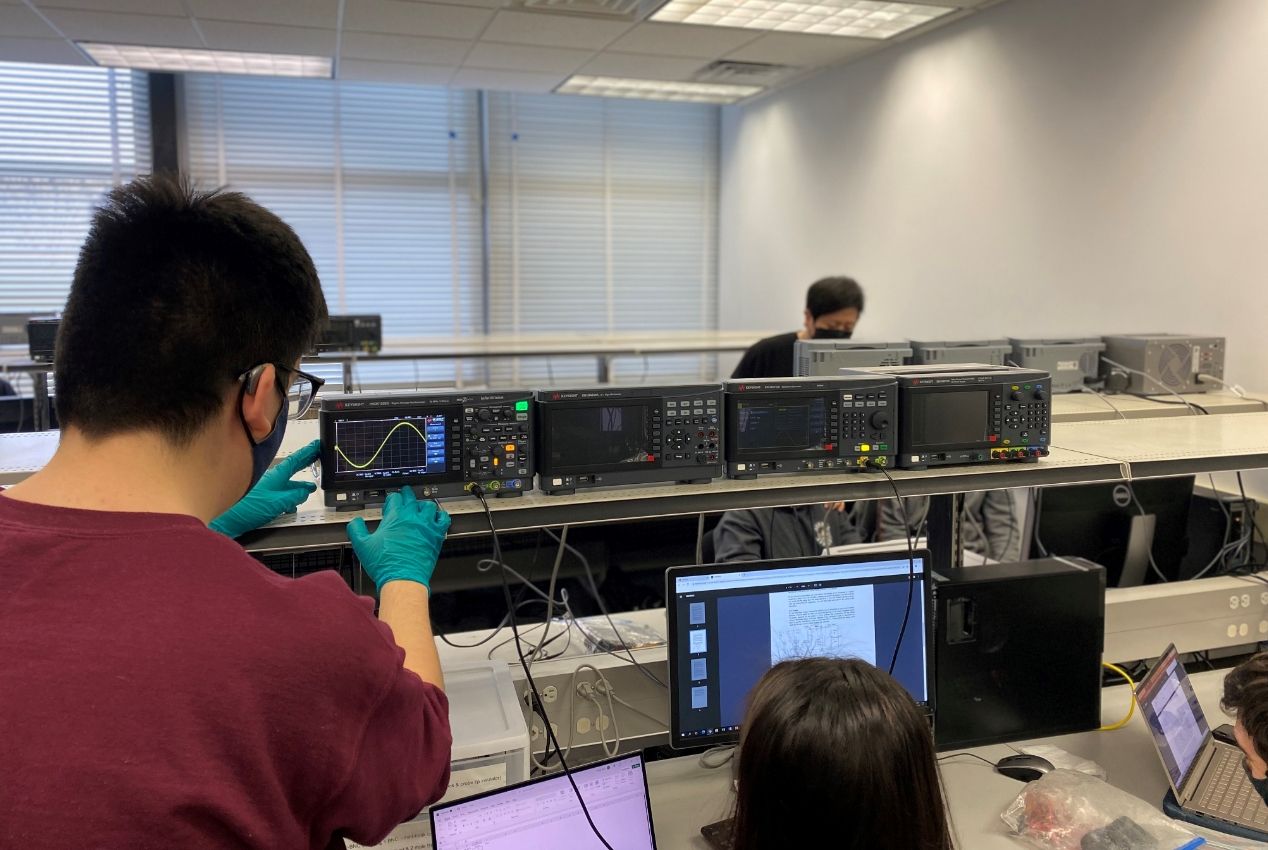

Keysight Technologies Inc. (NYSE: KEYS) is a prominent player in the scientific and technical instruments sector. The company is known for its innovative solutions in electronics measurement, providing essential tools for industries like telecommunications and aerospace. As of October 27, 2025, Jefferies set a price target of $180 for KEYS, while the stock was trading at $169.47, indicating a potential upside of 6.21%.

Institutional investors are showing increased interest in KEYS. Stephens Inc. AR, for instance, boosted its stake by 9.4% in the second quarter, now holding 3,253 shares valued at $533,000. This move reflects confidence in the company's growth prospects. Similarly, Accent Capital Management LLC acquired a new position valued at $28,000, and Manchester Capital Management LLC increased its stake by 85% in the first quarter.

The current stock price of KEYS is $169.47, marking a slight increase of 0.65% or $1.09. During the trading day, the stock fluctuated between $169.39 and $171.16. Over the past year, KEYS has seen a high of $186.20 and a low of $121.43, showcasing its volatility and potential for growth.

Keysight Technologies has a market capitalization of approximately $29.13 billion, reflecting its significant presence in the market. The trading volume for KEYS today is 666,546 shares, indicating active investor interest. As the company continues to innovate, it remains a key player in its industry, attracting both institutional and individual investors.

Keysight Technologies, Inc. (NYSE: KEYS) Quarterly Earnings Preview

- Earnings per Share (EPS) is expected to be $1.65 for the quarter ending April 2025, marking a 17% increase from the previous year.

- Projected revenue of $1.28 billion represents a 5% rise compared to the same quarter last year.

- Despite positive growth indicators, consensus EPS estimate has been slightly revised downward by 0.3% over the past month.

Keysight Technologies, Inc. (NYSE: KEYS) is a prominent player in the electronic design and test solutions industry. The company, headquartered in Santa Rosa, California, provides innovative solutions to accelerate the development of electronic products. KEYS operates in a competitive landscape, with rivals like Tektronix and Rohde & Schwarz. The company is set to release its quarterly earnings on May 20, 2025.

Wall Street anticipates KEYS to report earnings per share (EPS) of $1.65 for the quarter ending April 2025. This represents a 17% increase from the previous year, highlighting the company's growth trajectory. Revenue is projected to reach $1.28 billion, a 5% rise compared to the same quarter last year. These figures underscore the company's ability to generate higher earnings through increased revenue.

Despite the positive outlook, analysts have slightly revised the consensus EPS estimate downward by 0.3% over the past month. This adjustment reflects a reassessment of initial projections, indicating some skepticism about KEYS' ability to exceed expectations. Such revisions are important as they often influence investor behavior and can impact the stock's short-term price performance.

Keysight's management is actively pursuing strategic collaborations to drive business expansion. A notable partnership in the reported quarter is with Coherent Corp., focusing on advanced illumination solutions for 3D sensing applications. This collaboration aims to enhance Coherent's new laser technology, supporting higher data rates and facilitating the deployment of Artificial Intelligence and other advanced applications.

Financially, KEYS has a price-to-earnings (P/E) ratio of approximately 46.17, indicating investor confidence in its earnings potential. The company's price-to-sales ratio is about 5.62, reflecting the market's valuation of its revenue. With a debt-to-equity ratio of 0.39, KEYS maintains a moderate level of debt, showcasing financial stability. The current ratio of 2.95 further indicates a strong ability to cover short-term liabilities.

Keysight Technologies (NYSE:KEYS) Faces Third Quarter Challenges but Beats Earnings Expectations

- Keysight Technologies reported a decrease in revenue year over year due to weakened demand across its sectors.

- The company outperformed earnings expectations for the quarter, indicating effective cost control and operational efficiency.

- Goldman Sachs set an optimistic price target of $181 for KEYS, suggesting confidence in its long-term growth prospects.

Keysight Technologies (NYSE:KEYS), a prominent player in the electronic measurement industry, faced a challenging third quarter in fiscal 2024. The company, known for its contributions to wireless communications, aerospace and defense, and semiconductor markets, reported a decrease in revenue year over year. This downturn was primarily due to weakened demand across its diverse sectors, reflecting broader market challenges.

Despite the dip in revenue, Keysight Technologies managed to outperform earnings expectations for the quarter. This achievement suggests that the company has effectively controlled its costs or found ways to operate more efficiently amidst declining sales. Such resilience in earnings, despite lower revenues, is noteworthy and indicates a robust underlying business model.

In light of these developments, Mark Delaney of Goldman Sachs has set an optimistic price target of $181 for KEYS. This target, reported by StreetInsider, represents a significant potential upside of 18.16% from the stock's trading price of approximately $153.19 at the time of the announcement. Goldman Sachs' reiteration of a Buy rating on KEYS underscores confidence in the company's long-term growth prospects, despite the short-term revenue challenges.

The contrast between the company's revenue decline and the positive outlook from analysts like those at Goldman Sachs highlights the complex dynamics at play in the valuation of tech companies. While current performance may show volatility, the long-term perspective based on the company's market position, technological advancements, and strategic initiatives can paint a more optimistic picture. This duality is a common theme in the tech sector, where future potential often drives investment decisions as much as current performance.

Keysight Technologies (NYSE:KEYS) Faces Third Quarter Challenges but Beats Earnings Expectations

- Keysight Technologies reported a decrease in revenue year over year due to weakened demand across its sectors.

- The company outperformed earnings expectations for the quarter, indicating effective cost control and operational efficiency.

- Goldman Sachs set an optimistic price target of $181 for KEYS, suggesting confidence in its long-term growth prospects.

Keysight Technologies (NYSE:KEYS), a prominent player in the electronic measurement industry, faced a challenging third quarter in fiscal 2024. The company, known for its contributions to wireless communications, aerospace and defense, and semiconductor markets, reported a decrease in revenue year over year. This downturn was primarily due to weakened demand across its diverse sectors, reflecting broader market challenges.

Despite the dip in revenue, Keysight Technologies managed to outperform earnings expectations for the quarter. This achievement suggests that the company has effectively controlled its costs or found ways to operate more efficiently amidst declining sales. Such resilience in earnings, despite lower revenues, is noteworthy and indicates a robust underlying business model.

In light of these developments, Mark Delaney of Goldman Sachs has set an optimistic price target of $181 for KEYS. This target, reported by StreetInsider, represents a significant potential upside of 18.16% from the stock's trading price of approximately $153.19 at the time of the announcement. Goldman Sachs' reiteration of a Buy rating on KEYS underscores confidence in the company's long-term growth prospects, despite the short-term revenue challenges.

The contrast between the company's revenue decline and the positive outlook from analysts like those at Goldman Sachs highlights the complex dynamics at play in the valuation of tech companies. While current performance may show volatility, the long-term perspective based on the company's market position, technological advancements, and strategic initiatives can paint a more optimistic picture. This duality is a common theme in the tech sector, where future potential often drives investment decisions as much as current performance.

Keysight Technologies Shares Plummet 13% Following Q3 Results

Shares of Keysight Technologies (NYSE:KEYS) experienced a more than 13% decline intra-day today due to the company's provided guidance that came in worse than expected.

The earnings per share (EPS) for the third quarter were $2.19, surpassing the Street estimate of $2.04. The company's revenue for the quarter remained unchanged year-over-year, amounting to $1.38 billion, aligning with the Street predictions.

Looking ahead to the fourth quarter of 2023, Keysight Technologies anticipates revenue to fall within the range of $1.29 billion to $1.31 billion, falling short of the Street figure of $1.39 billion. The projected non-GAAP EPS for the same period is expected to be between $1.83 and $1.89, which is lower than the analysts' expectation of $1.99.

For the entire fiscal year, the company anticipates its revenue to reach $5.45 billion and its EPS to be $8.19. This compares to the Street estimates of $5.55 billion in revenue and an EPS of $8.18.

Keysight Technologies Shares Plummet 13% Following Q3 Results

Shares of Keysight Technologies (NYSE:KEYS) experienced a more than 13% decline intra-day today due to the company's provided guidance that came in worse than expected.

The earnings per share (EPS) for the third quarter were $2.19, surpassing the Street estimate of $2.04. The company's revenue for the quarter remained unchanged year-over-year, amounting to $1.38 billion, aligning with the Street predictions.

Looking ahead to the fourth quarter of 2023, Keysight Technologies anticipates revenue to fall within the range of $1.29 billion to $1.31 billion, falling short of the Street figure of $1.39 billion. The projected non-GAAP EPS for the same period is expected to be between $1.83 and $1.89, which is lower than the analysts' expectation of $1.99.

For the entire fiscal year, the company anticipates its revenue to reach $5.45 billion and its EPS to be $8.19. This compares to the Street estimates of $5.55 billion in revenue and an EPS of $8.18.

Keysight Technologies Shares Jump 7% Following Q2 Earnings

Keysight Technologies (NYSE:KEYS) shares surged more than 7% yesterday after the company reported its Q2 earnings, with EPS of $2.12 coming in better than the Street estimate of $1.95. Revenue was $1.39 billion, beating the Street estimate of $1.38B.

For Q3, the company expects revenue in the range of $1.34-$1.39B, compared to the Street estimate of $1.38B, and EPS in the range of $2.00-$2.06, compared to the Street estimate of $1.96.

According to the analysts at Deutsche Bank, investor sentiment has been leaning incrementally negative in recent months, despite a more positive Analyst Day in March where management laid out better than expected multi-year targets.