Intuitive Surgical, Inc. (ISRG) on Q2 2021 Results - Earnings Call Transcript

Operator: Ladies and gentlemen, thank you for standing by. Welcome to the Intuitive Q2 2021 Earnings Conference Call. At this time, all participants are in a listen-only mode. Later, we will have a question-and-answer session. As a reminder, this conference is being recorded. And at this time, I would like to turn the conference over to our host, Senior Director of Finance, Investor Relations for Intuitive, Mr. Calvin Darling. Please go ahead, sir. Calvin Darling: Thank you. Good afternoon, and welcome to Intuitive's second quarter earnings conference call. With me today, we have Gary Guthart, our CEO; Marshall Mohr, our CFO; and Jamie Samath, our Senior Vice President of Finance. Philip Kim, our Head of Investor Relations, will not be joining on today's call as he is currently on paternity leave following the birth of his daughter. Before we begin, I would like to inform you that comments mentioned on today's call may be deemed to contain forward-looking statements. Actual results may differ materially from those expressed or implied as a result of certain risks and uncertainties. These risks and uncertainties are described in detail in our Securities and Exchange Commission filings, including our most recent Form 10-K filed on February 10, 2021 and Form 10-Q filed on April 21, 2021. Our SEC filings can be found through our website or at the SEC's website. Investors are cautioned not to place undue reliance on such forward-looking statements. Please note that this conference call will be available for audio replay on our website at intuitive.com on the latest Events section under our Investor Relations page. Today's press release and supplementary financial data tables have been posted to our website. Today's format will consist of providing you with highlights of our second quarter results as described in our press release announced earlier today, followed by a question-and-answer session. Gary will present the quarter's business and operational highlights. Marshall will provide a review of our financial results. Jamie will discuss procedure and clinical highlights and provide an update of our financial outlook. And finally, we will host a question-and-answer session. With that, I'll turn it over to Gary. Gary Guthart: Thank you for joining us today. Our second quarter 2021 performance was encouraging with use of our systems for procedures growing beyond pre-pandemic levels and healthy capital placements. Looking at the past eight quarters in context, our compound annual growth rate for procedures for the period Q2 2019 through Q2 2021 of 16.5% is approximately the growth we would have expected absent the pandemic. The pandemic has reordered the quarter in which procedures were performed, and we believe it has delayed some procedures that are likely to return in the future and may cause a small number of patients to permanently forgo surgery. To understand our system placement and capital performance over this period, we look to annual system utilization trends, which have recovered to utilization rates at the high-end of our historical averages. Taken together, this combination of a recovery in procedures and healthy utilization supports our solid capital placement trends and rounds out a healthy commercial recovery year-to-date. Marshall Mohr: Good afternoon. I will describe the highlights of our performance on a non-GAAP or pro forma basis. I will also summarize our GAAP performance later in my prepared remarks. A reconciliation between our pro forma and GAAP results is posted on our website. Jamie Samath: Good afternoon. Our overall second quarter procedure growth was 68% compared to a decline of 19% during the second quarter 2020, which reflected a significant adverse impact from the COVID-19 pandemic. The compound annual growth rate between the second quarter of 2019 and the second quarter of 2021 was 16.5%. In Q2, U.S. procedures grew 77% year-over-year, which equates to 16% on a two-year compound annual growth rate basis. OUS markets grew 51% year-over-year or 19% on a two-year compound annual growth rate basis. In the U.S., Q2 procedure results were positively impacted by a continuing recovery from COVID-19, including we believe a number of procedures that had been previously deferred. Q2 growth was driven by particular strength in benign procedures, including bariatrics, hernia repair, cholecystectomy and benign hysterectomy, reflecting in part, we believe a partial catch-up in these procedures related to the previous deferral of elective surgeries. General surgery growth in the U.S. was strong. In addition to the positive impact from patient backlogs, reflected increasing access for surgeons to our fourth-generation technology. In the U.S., procedures that are dependent on diagnostic pipelines also grew albeit a lower rates as compared to benign procedures. Colorectal growth was strong with solid growth in malignant hysterectomy, thoracic and prostatectomy procedures. Based on market data, we believe that diagnostic pipelines in the U.S. began to recover from the impact of the pandemic in March with a lag in the recovery of associated procedures. Second quarter OUS procedure volume grew approximately 51% compared with a 7% decline for the second quarter of 2020 and 23% growth last quarter. Second quarter 2021 OUS procedure growth was driven by growth in prostatectomy procedures and earlier-stage growth in kidney cancer procedures, general surgery, gynecology and thoracic. China procedure growth remain strong and broad-based as a result of continued expansion of the installed base under the current quota. Growth in Japan was solid, but it was impacted by a relatively slow rollout of vaccines and the impact of localized lockdowns as a result of ongoing efforts to prevent resurgences of COVID-19. In Europe, procedure growth varied by country based on the relative impact of and recovery from the pandemic. Growth in the UK was strong with a slower recovery in France, Italy and Germany. Now turning to the clinical side of our business. Each quarter on these calls, we highlight certain recently published studies that we deemed to be notable. However, to gain a more complete understanding of the body of evidence, we encourage all stakeholders to thoroughly review the extensive detailed scientific studies that have been published over the years. During the quarter, a group from the ChangZheng Hospital Navy Medical University in China published a meta-analysis in BMC cancer comparing robotic-assisted thoracic surgery versus video-assisted thoracic surgery or VATS, for lung lobectomy, or segmentectomy in patients with non-small cell lung cancer. The meta-analysis combined 18 studies across different countries containing over 11,000 patients, of which just over 5,000 received da Vinci robotic-assisted thoracic surgery and just over 6,000 received VATS. -: In May of this year, Dr. Karl LeBlanc from our Lady of the Medical Center in Baton Rouge, Louisiana published results from a multi-center study comparing short-term outcomes for Incisional hernia. Published in the Hernia Journal entitled Robotic-Assisted Laparoscopic and Open Incisional Hernia Repair Early Outcomes from the Prospective Hernia study. The study contains 371 patients that underwent an incisional hernia repair procedure across 17 institutions within the United States between May, 2016 and September, 2019. Of those patients, 43% were in the da Vinci robotic cohort, 35% in the laparoscopic cohort and 22% in the open cohorts. In reporting the results, adjusted using a propensity-weighted approach, the authors noted that during the two to four weeks standard of care visit period, fewer patients reported the need to take prescription pain medication for the robotic cohort as compared to the laparoscopic and open cohorts. 65.2% for the robotic cohort as compared to 78.8% for the laparoscopic cohort compared to 79.8% for the open cohort. Conversion rates to open surgery were lower in the robotic group compared to the laparoscopic group, 0.6% as compared to 4.9%, and reoperation rates in the 30 days post-procedure were comparable between robotic and laparoscopic and lower for robotic as compared to open 0.6% as compared to 3.1%. The authors concluded in part “when compared to open, the robotic-assisted surgery group is associated with a comparable operative time, shorter length of stay and lower reoperation rate through 30 days. The difference in the number of subjects reporting the need for prescription pain medication favored the robotic-assisted group in both comparisons”. I will now turn to our financial outlook for 2021. We continue to operate in a challenging supply chain environment and have experienced longer lead times and delayed deliveries from our suppliers. While they did not have a material impact to our operating results in Q2, the outlook we are providing does not reflect any potential significant disruption or additional costs related to supply constraints. We also note the increasing number of COVID-19 cases in certain geographies associated with the Delta variant, the outlook we are providing on today's call does not reflect risks associated with a significant increase in COVID-related hospitalizations in relation to the Delta variant or other potential new variants. Starting with procedures. Last quarter, we forecast 2021 procedure growth of 22% to 26%. Given the stronger recovery of procedures we have experienced so far, particularly in the U.S. and strength in U.S. general surgery, we are now increasing our forecast and expect full-year 2021 procedure growth of 27% to 30%. The high-end of the range assumes strength in U.S. general surgery, returned to normalized diagnostic pipelines, the vaccines are effective against any new COVID-19 variants and the vaccine rollouts in OUS markets continuous currently expected by governments around the world. Turning to gross profit. On our last call, we forecast our 2021 full-year pro forma gross profit margin to be within 70% and 71% of revenue. We are now slightly increasing our forecast and expect full-year gross profit margin to be between 70.5% and 71.5% of revenue. Our actual gross profit margin will vary quarter-to-quarter, depending largely on product, regional and trade-in mix, the impact of product cost reductions and manufacturing efficiencies and pricing pressure. With respect to operating expenses, on our last call, we forecast to grow full-year pro forma 2021 operating expenses between 18% and 22% above 2020 levels. We are refining our estimate and expect our full-year pro forma operating expense growth to be between 17% and 21%. Consistent with last quarter's forecast, we expect our non-cash stock compensation expense to range between $450 million and $470 million in 2021. We expect pro forma other income, which is comprised mostly of interest income to total between $50 million and $55 million in 2021. With regard to income tax, we expect the range of our second half 2021 pro forma tax rate to be between 21% and 22% of pre-tax income, slightly higher than the range we provided on the last call, reflecting a higher mix of U.S. income. That concludes our prepared comments. We will now open the call to your questions. Operator: And for our first question we will go to Tycho Peterson. Please go ahead. Tycho Peterson: Hey. Thanks. Congrats on the quarter, I guess, first question on guidance. Obviously, you've made some comments about variants and not factoring in kind of an increase in – I know, case rises have been largely decoupled from hospitalizations. But can you maybe just talk through the thought process there, and how you're thinking about any potential risks in the back half of the year from the variant cases? Gary Guthart: Thanks, Tycho. From the top, I think you said the right thing, which is, there's a little bit of a decoupling thus far of infection from hospitalization. The number we're watching closely is hospitalization. Jamie, I'll let you take it from there. Jamie Samath: Yes. Tycho, we kind of outlined what was assumed in the high-end of the procedure guidance. From the low-end perspective, the 27% reflected there is greater summer seasonality that reflects the possibility of an impact due to pent-up demand for vacation, especially for healthcare workers that worked extensively during this period with COVID. It also reflects lower diagnostic pipelines and perhaps some reluctance for patients to visit hospitals. OUS markets continued to be choppy given the – in many cases, those markets are behind the U.S. for example, in their vaccination rollouts, and that leaves the possibility of continued resurgences and localized lockdowns. That low-end also reflects some impact of a resurgence in the U.S., but as you heard in our prepared comments, a significant increase in hospitalizations is not reflected in the guidance range. Tycho Peterson: Okay. That's helpful. Shifting to the extended use program, you've been out for around six months, smaller rollout in Europe in the fourth quarter. Can you talk about kind of next steps to the program here, particular geographies you're targeting? And then has the elasticity relative to the extended use program and the pricing adjustments played out relative to your expectations or any color you can provide on that? Gary Guthart: Yes, sure. We rolled out the extended use instruments in Europe and the U.S. back in the fourth quarter. And then now we've rolled it out to most other markets in the first six months of this year, except for China, where there are longer regulatory timelines. It's a short period, but we believe that there is elasticity and we've seen elasticity in markets where reimbursements are very low. And we've received feedback, positive feedback from surgeons who've indicated that system access has been a key driver for increased procedures, and we think that the extended use instruments lowers barriers for purchases of systems. Having said all of that, it's been a short period since they've had extended use instruments. Even though we've seen growth in the procedures that were specifically targeted by extended use instruments, it's hard to discern what is COVID-related versus what is not. And so, we'll see over time, we'll be able to measure a little bit better over time, and we'll monitor it. Tycho Peterson: Okay. And last one on SP. I know last quarter you’ve kind of brought up the concept of going after thoracic and some additional other areas. Can you maybe just talk a little bit about the roadmap, and I think you've alluded to adding additional instruments and accessories, so can you talk on the hardware side as well? Gary Guthart: Sure. So right now we talked in the script about adding our work or IDE around colorectal. We're excited about that. That'll play out over the next several quarters as we accrue patients. And then given that it's cancer procedure, in some cases, it's a little bit longer follow-up, so that's a multi-quarter conversation. We're doing what we call the procedure development and the trial development around other indications. We think there'll be an opportunity in thoracic as well, as well as other ones beyond it. The instrumentation updates, there are other things imaging updates and software updates that are really all focused around right instruments, right features for the right extension or right expansion. So, the customers are asking us for advanced instrumentation, so energy and stapling and other things, we think that is possible as we're making those investments to move that forward. We think we can bring some outstanding imaging capabilities, including florescence imaging into that space, and we're building into the broader digital ecosystem for SP. Our focus right now is, is not rapid expansion of the installed base. Our focus is in clinical capability and productivity of the installed base we have. In other words, happy, very satisfied customers, and sequential growth in what they can do with the system remains our focus on SP for now. Tycho Peterson: Okay. Thank you. Operator: Next we'll go to Bob Hopkins with Bank of America. Please go ahead, Mr. Hopkins. Robert Hopkins: Great, and good afternoon. So first question for me is just trying to dissect your procedure results a little bit more because some really interesting comments that you saw strength in benign cases, some catch-up cases. And then on a two-year compounded basis, you're kind of where you thought you might be pre-pandemic. I'm just curious from what you see out there, is this broadly reflective of what you think is going on in the marketplace for surgical procedures or is this simply and primarily just something about the pandemic accelerating the use of da Vinci and robotic surgery broadly? Gary Guthart: I'll speak to my impression, but I'll caveat it, it's one person's impression. So it's not a scientific study, just my view. I think what we're seeing is that the longer diagnostic pipelines have had this kind of double effect from the pandemic, partly it's – delays in getting in and getting tested and starting the journey and then getting in and having a procedure or a treatment, whatever that might be. So from a core demand point of view or disease state, that's clearly out there and accumulating, and it has to get processed through. On the benign side, often the diagnostic pipelines are shorter, if you go from an issue to identification to closure more quickly. And I suspect that's most of what we're seeing at least in the United States in terms of that, but I don't have scientific evidence. I think that's anecdotal. Jamie anything… Jamie Samath: I would just add, Bob, as you saw the COVID hospitalization rates in the U.S. come down in March and into Q2, that freed hospital resources to increase the level of surgery that we do. And we also see, I think increased patient confidence as a function of the improving vaccination rates and those two things come together. They also allow hospitals to start to address the backlog that’s accumulated. And I think for a subset of the benign procedures that have been kind of deferred elective procedures, hospitals can recover those pretty quickly. Robert Hopkins: Okay. And then just one quick follow-up, and thanks for those comments. Just to be clear on your answer to Tycho's question. Just on the recent spread of COVID invariance and the potential impact on demand and hospital's ability to do procedures. Are you starting to see that impact now? Or is it too early and you're just saying that might happen in the future? Jamie Samath: Yes. We've seen that in some OUS markets. We're clearly seeing that in markets like India, Taiwan, there's been an impact in terms of how they've handled that from a healthcare system perspective and the resulting impact on our procedures. And from a U.S. perspective, I think it's early and I think we're simply acknowledging the risk. I think the thing that we'd call out is it's not the case rates per se to monitor. It's the impact on hospitalizations. Gary Guthart: Lockdowns decrease patient mobility and willingness to go get their tests. And then hospitalization diminishes ICU capacity. Those are the drivers we launched. Robert Hopkins: Okay. Thank you. Operator: Next we will go to Amit Hazan with Goldman Sachs. Please go ahead. Amit Hazan: Thanks. Hey, maybe start with Marshall on the first one and then go to Gary for the second one. Marshall, the operating margin coming in at the 43%, I'm just wondering how much we can extrapolate here. We heard your comments, but just kind of thinking a little bit longer term than just the next couple of quarters. You’ve got COVID. I'm just curious what the net effect there is from the savings and expense perspective in R&D, whether this is maybe the beginning of you starting to see some leverage off of the 10% you've been at for the last couple of years. And then SG&A kind of same kind of question. You've been spending a lot there. Are we starting to see leverage potentially that could enable a little bit better margins as we think about next year, the year after? Marshall Mohr: I think there's elements of our spending have been restrained because of – restricted because of COVID and it's impacting that. I kind of articulated with those were travel and so forth. And we expect us to come back as COVID goes away and the restrictions on travel and the restrictions on other activities go away. The business came back faster than we had anticipated. And so we have some catch-up to do in terms of infrastructure and support necessary to support the overall business. And so we'll spend there. And so I think you're going to see this quarter was extraordinary in terms of the operating profit margin and that it'll be lower in future quarters given what I just described. In addition to that, we still think this is a great opportunity to continue to invest in ecosystem of products and capabilities at this point in time before a competition really gets any kind of toehold. And so we're going to continue to invest. So I wouldn't start building lots of leverage into your models. I think that would be a mistake. Gary Guthart: I’ll add one bit of color to that. I think that when you think about our product cycles, I would just have you look back earlier in the da Vinci experience in that. These are long development cycles. The time market penetration rates there are significant. And that is both a painful and an opportunity. The painful part is the investment troughs are deep in the early and middle years of those product cycles. And we're early in the Ion product cycle, and we're early in the SP or early, mid in SP. So that takes a while, but once you develop a really capable ecosystem and then it has a lot of platform use and that investment can be recovered over time. So it's hard to time it out and it doesn't time out over one or two quarters, it times out over years. Amit Hazan: Gary, just thinking through the My Intuitive and what you're doing at the surgeon level. And I'm actually curious more what's going on with service and software at the hospital-wide kind of department of surgery level, I don't know how much of an update you can give us, which is something on what's happening at that level in terms of software tools and services. You're developing, trying to increase efficiency, duty costs, that kind of thing. How close we are to maybe seeing something that you can monetize it? Anything you could talk through there would be helpful. Gary Guthart: We think about digital as enabling and accelerating a lot of different parts of the ecosystem. So when we talk about My Intuitive, that really is putting the power of interaction and data at the surgeon level in their hands or at the robotics coordinator level in their hands. So we're excited about that because it gives them fast and easy access. It links into some of the other things you're talking about. We are building tools and capabilities that allow hospital departments and departments of surgery to manage their program and look across programmatics for efficiency, for learning, for outcomes and these things in a link. So short answer, there is just kind of a reminder of what we're trying to do. We think there's an opportunity to accelerate learning and to drive increased insight for a surgeon into their own progress. We're doing that. That’s a combination of My Intuitive plus some of the simulation work that we do, plus some of the machine learning and video analysis work that we do. We think there's an opportunity to look at correlations between surgeon performance and outcomes, and that has implications for the kind of imaging we do, that has implications for task analysis and training, and we're doing those things and those can be aggregated across the surgical platform. And there's a lot of opportunities for OR efficiencies and standardization, controlling operating costs, controlling consumables costs. Those things are ongoing now. So several of those things are in the markets, the very first kind of Gen 1, some of them are on Gen 2. Some of them are included in our service contracts, some of them are on a per use basis. Some of them are fully included because we feel like they make us more efficient and to make them more efficient. So we don't really call them out as individual revenue lines. I think they are ecosystem enablers and can result in very high customer satisfaction. Amit Hazan: Thank you. Operator: Next we go to Larry Biegelsen with Wells Fargo. Please go ahead. Lawrence Biegelsen: …on a nice quarter. One on procedures, one on competition. So I apologize for the short-term oriented question, but you're the first large cap company to report here. So I'd be curious to hear from you on any procedure trends through the quarter in the U.S. and international. And regarding the backlog, how do you know there was catch-up and why won't that continue for the next few quarters? And I had one follow-up? Gary Guthart: Yes. Just in terms of intra-quarter procedure trends, if you're asking, Larry month-by-month, there was nothing notable actually that we would call out. There was the usual impact of seasonality from vacations like Easter, but nothing notable within the quarter. In terms of procedure categories, bariatrics continued the strength that we've seen for some time, China continued the strength that we've seen over the last couple of quarters and U.S. general surgery, in particular, performed well. So I think those are the key kind of procedure highlights. What was the second part of your question again, Larry? Lawrence Biegelsen: Yes. I mean, how do you know there was catch-up from the backlog in Q2, and I guess, why won't that continue? It doesn't seem like the backlog would be exhausted just after one quarter? Jamie Samath: Yes. So here's kind of where we stand with backlog. We don't actually know how much backlog was resolved in the quarter, how much backlog is left or the timing of the recovery of that might be. We have a broad range of estimates, frankly, the lack of precision in that estimate is such that it's probably not useful for us to share. And so we have some indications that we saw backlog reflected in the Q2 results, but at this point, it's just too difficult to estimate and therefore kind of give you any additional color on. Gary Guthart: Yes. I hear your question is asking us how much is left, how much of the catch-up is left? There appears to be some. It's hard to have a precise measure on it. And I think we're going to have to let it play for another few quarters to see. Add to that, the uncertainty of wave 4, possibility of wave 4 it makes it tough to put a number on it for now. Lawrence Biegelsen: That's helpful, Gary. And just on competition, it does seem like the noise is increasing, we could see one large competitor approved in the second half of this year. How are you thinking about competition? Are you seeing any impact thus far? Thanks for taking the question. Gary Guthart: Yes. A couple of things. I think all of us know, and we as consumers know that customers like choice perfectly fair. We've seen a few teams come out in field systems that are alternatives to ours. Transitory was out a few years ago, and CMR has been out and now Medtronic. A couple of things I'd say, one is we are focused on making sure that our ecosystem, our products, our systems, and everything goes around it, really delivers against the quadruple lane all the way through. It's not just a robot. Building a great robot is a hard first step. You have to do it. But right now I think that remains to be seen how strong those other systems are. Even then, it's not enough. Instruments and accessories, training programs, support staff, analytics capability, publications, scientific publications demonstrating what you've done, the analytics and evidence-based build are all, I think important. So I encourage those folks on the call that it's likely to be a comparison of ecosystems in delivering the quad aim over time. That said, other teams are out. They’re calling on customers. They're giving their PowerPoints about what they think is going to happen next and some other things. And our posture to that has been – it may delay some sales as we may have some competitive conversations and tenders, and we'll lose some. What we've seen, though, is that what happens to the PowerPoints and what happens a year later is different. And that if it hasn't delivered against the quad aim, if these systems can do some cases as well, but not all cases well, or they have stability issues or other things, that wears in pretty quickly. We also find that our economic offerings with da Vinci X and EUP, we have choices that we ourselves can offer our customers. So I think all of you on the call, you should expect increased alternatives for the customer base. I think the noise levels will go up. I think our customers will take their time to evaluate new things as they go. We're okay. We're not. We're not frightened of that. We think we stand up pretty well to those comparisons and we're ready to help them pursue their aims as it proceeds. Lawrence Biegelsen: Thanks so much. Operator: Next we go into the line of Rick Wise with Stifel. Please go ahead, sir. Frederick Wise: Hi. Good afternoon, everybody. Hi, Gary. Maybe just – at the beginning of your comments, I was struck that you emphasized that da Vinci utilization rates are, if I understood you correctly at the high-end of historical averages. Gosh, that's awfully encouraging sounding. Just wondered, are you suggesting, or should we be thinking that we could be in the front of a new wave of capital acquisition, again, capital released because of the need to add additional systems to accommodate the expanding number of procedures? Gary Guthart: The reason I mentioned it early is I think when we've had pretty strong capital quarters, the last few, one of the things we want to look for is, are we building unused capacity into the field that were procedures softer that would stall us out. And so we watched that number because we know it's highly sensitive. And we're pleased that again, if you look across that two-year period, try to look through the pandemic kind of ups and downs. What we're seeing is that procedure demand is there. And the capital to support that demand has not run ahead of the procedure demand. In fact, our commentary is a little bit the opposite that these are being highly utilized. That's great. That says that we're not putting out more capital than folks need, even though it's been healthy capital quarters, it means our customers are getting good benefit out of what they're using those systems for. Jamie in his commentary said that a lot of those procedures are benign procedures. Many of them are shorter duration than a longer or more complex disease states. That means that utilization will go up kind of naturally that that mix moves toward a higher utilization mix. All of that to me indicates that the business feels in balance. I’ll caution that what the next couple of quarters or next four quarters looks like in terms of hospital access to capital and their decision-making. Capital is always lumpy. It has been – just so, so I'm really speaking backward looking, so far so good. Frederick Wise: Got you. Gary, a separate topic. I've had the privilege of seeing Intuitive develop the use of robotics in multiple clinical indications over the years. And recently, we had a series of very encouraging conversations on the adoption bariatrics is very encouraging. And basically still under penetrated, big opportunity, doctors talking to us about further expansion of utilization. And I'd just be curious to – since you're all are calling it out repeatedly as important incremental growth driver. Where are we now in your view in that, I'm sure multi-year long-term adoption process? What's left to do for maybe a product or procedure or instrument point of view, where are we going with this one? Thank you. Gary Guthart: Let me start with why I think it's adopting and I'm going to turn to Jamie as to where are we and what inning of the baseball game are we in, I'll let Jamie take that. On the wire side, bariatrics has been a little different than other procedure for us. It's a highly penetrated laparoscopic indication in the United States. Having said that, it's a difficult brief procedure for surgeons to perform, it's physically demanding. And as we've said in the past, if we can bring the right system with the right instruments, the right imaging in the right usability, in the right ease-of-use, we think that surgeons will care and we've seen both good clinical outcomes, but also high surgeon satisfaction and better ergonomics. I think that's what's been driving our success in the early market. It's taking getting the advanced instruments together as a set, getting our workflows in our clinical pathways, right. And I think that's been powerful to-date. And Jamie, as to kind of where we are. Jamie Samath: Yes. Just a couple of comments. So bariatrics obviously has been highly laparoscopically penetrated historically from a market perspective about 60%-ish or so sleeves, about 15% are revisions. In terms of our underlying numbers, we’re growing at a little faster rate in the revision section, sleeves and bypass grow about the same rate. I think the product ecosystem with Xi with a 60-millimeters stapler is in good shape, and we're getting good feedback from surgeons in that regard. It is a physically taxing procedures, as Gary described. And so we see that as a benefit also with respect to feedback from surgeons. In terms of penetration or adoption, we're in the early to mid innings kind of ranges what I'd say in the U.S. market. Frederick Wise: Got it. Thank you very much. Gary Guthart: Okay. Well, thank you. And moderator, that was our last question. In closing, we continue to believe there's a substantial and durable opportunity to fundamentally improve surgery and acute interventions. Our teams continue to work closely with hospitals, physicians and care teams in pursuit of what our customers have turned to quadruple lane. Better, more predictable patient outcomes, better experiences for patients, better experiences for their care teams and ultimately a lower total cost of treatment. We believe value creation in surgery and acute care is foundationally human. It flows from respect for and understanding of patients and care teams, their needs and their environment. Thank you for your support on this extraordinary journey. We look forward to talking with you again in three months. Operator: Ladies and gentlemen, that does conclude your conference for today. Thank you for your participation and for using AT&T event conferencing. You may now disconnect.

Intuitive Surgical, Inc. (NASDAQ:ISRG) Quarterly Earnings Preview and Financial Analysis

- Intuitive Surgical is expected to report an EPS of $1.99 and revenue of approximately $2.41 billion for the upcoming quarter, driven by the adoption of the da Vinci 5 system.

- The company showcases robust revenue growth and high margins, with a 20.8% increase in revenue over the last twelve months and an operating margin of 28.8%.

- Despite facing challenges such as tariff risks and global capital expenditure constraints, Intuitive Surgical maintains a strong market position with a market capitalization of $156 billion and a current ratio of 5.17.

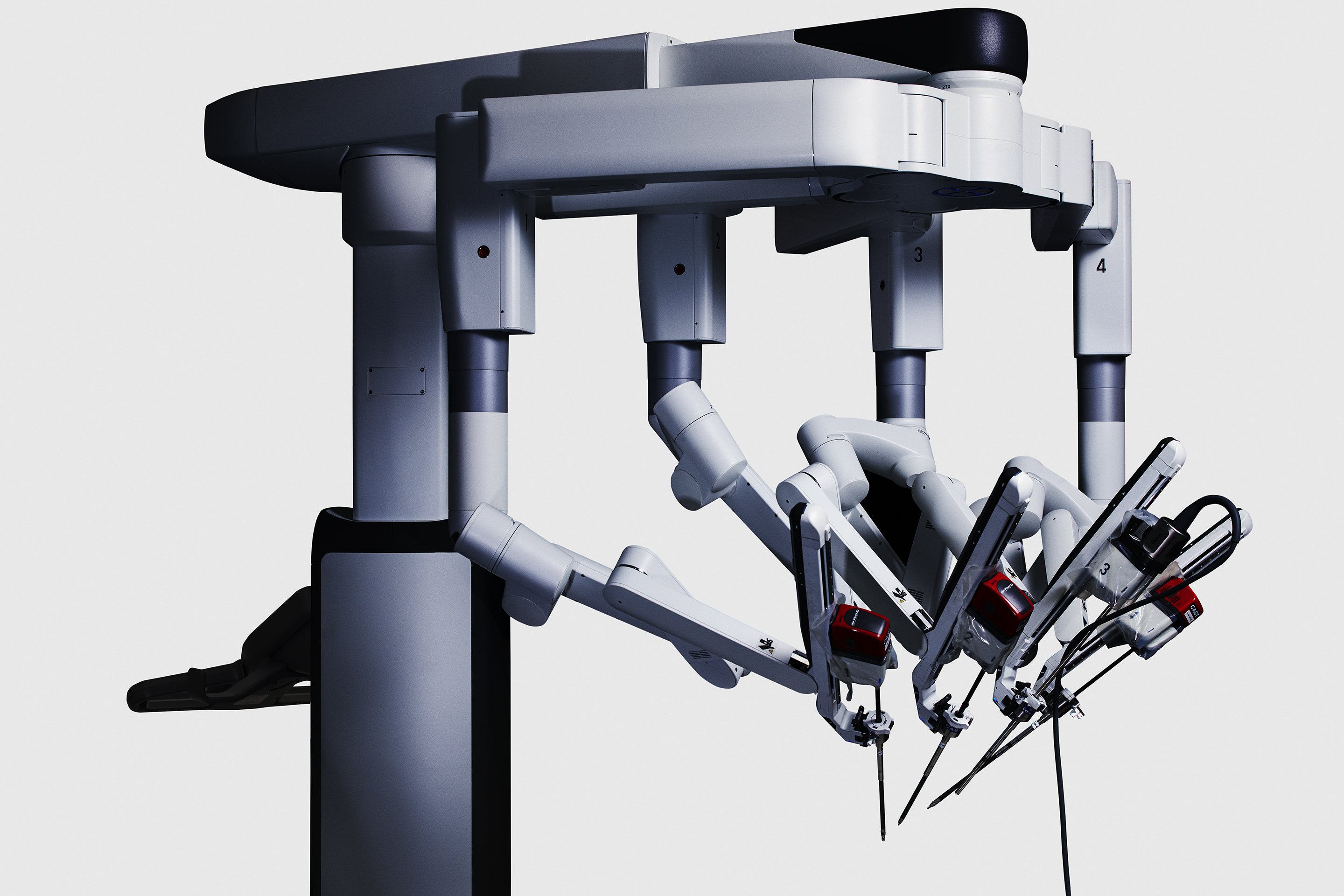

Intuitive Surgical, Inc. (NASDAQ:ISRG) is a leader in robotic-assisted surgery, known for its innovative da Vinci surgical systems. These systems allow surgeons to perform complex procedures with precision and minimal invasiveness, improving patient outcomes. The company faces competition from other medical device manufacturers but maintains a strong market position due to its advanced technology and continuous innovation.

As Intuitive Surgical prepares to release its quarterly earnings on October 21, 2025, analysts expect an EPS of $1.99 and revenue of approximately $2.41 billion. This growth is largely driven by the increasing adoption of the da Vinci 5 system and a projected 15.5-17% rise in worldwide da Vinci procedures in 2025. The company's strong fundamentals are evident in its robust revenue growth and high margins.

Despite these positive indicators, Intuitive Surgical faces challenges such as tariff risks and global capital expenditure constraints, which could limit its upside potential. Additionally, while the da Vinci 5 and Ion systems have contributed positively, weaknesses in the bariatric segment may offset some gains. Rising component costs and increased R&D expenditures may also pressure margins.

Intuitive Surgical's market capitalization stands at $156 billion, with a revenue of $9.1 billion and operating profits of $2.6 billion over the past year. The company has demonstrated impressive revenue growth, with a 20.8% increase over the last twelve months. Its operating cash flow margin is nearly 30.9%, and the operating margin is 28.8%, showcasing its profitability.

The stock is currently trading at a price-to-sales multiple of 17.1, a 26% discount compared to a year ago. This, combined with its high margins and pricing power, results in consistent profits and cash flows. Intuitive Surgical's strong liquidity, indicated by a current ratio of 5.17, further supports its financial stability and ability to reinvest capital effectively.

Intuitive Surgical Beats Q2 Estimates, But Margins Disappoint on Tariff and Cost Pressures

Intuitive Surgical (NASDAQ:ISRG) posted strong second-quarter results, beating Wall Street expectations on both revenue and earnings. The maker of da Vinci robotic surgical systems reported adjusted earnings of $2.19 per share, topping the $1.93 consensus and improving from $1.78 a year earlier. Revenue jumped 21% year-over-year to $2.44 billion, surpassing the $2.35 billion estimate.

Despite solid topline growth, the company lowered its 2025 non-GAAP gross margin forecast to 66%–67%, down from 69.1% in 2024. Management cited a 1% revenue drag from international tariffs and higher depreciation tied to recent infrastructure investments.

Looking ahead, Intuitive guided for da Vinci procedure growth of 15.5% to 17% this year, slightly lower than 2024’s 17% pace. Operating expenses are expected to rise up to 14% as the company continues to invest in innovation amid broader macroeconomic pressures.

Intuitive Surgical Beats Q1 Estimates But Expects Margin Compression

Intuitive Surgical (NASDAQ:ISRG) delivered strong first-quarter results that surpassed expectations on both earnings and revenue.

The company reported adjusted earnings of $1.81 per share, topping the consensus forecast of $1.74. Revenue reached $2.25 billion, beating estimates of $2.19 billion and reflecting continued demand for its da Vinci robotic surgery systems.

While procedure volumes remain a bright spot—projected to grow between 15% and 17% globally in 2025—this marks a slight slowdown from last year’s 17% growth rate. The real concern, however, lies in profitability expectations.

Intuitive Surgical anticipates gross margins to compress to a range of 65% to 66.5% of revenue, down from 69.1% in 2024. This includes an expected tariff-related drag of around 1.7% on revenue, plus or minus 30 basis points. Meanwhile, operating expenses are set to rise 10% to 14%, consistent with last year’s spending pace.

Intuitive Surgical Beats Q1 Estimates But Expects Margin Compression

Intuitive Surgical (NASDAQ:ISRG) delivered strong first-quarter results that surpassed expectations on both earnings and revenue.

The company reported adjusted earnings of $1.81 per share, topping the consensus forecast of $1.74. Revenue reached $2.25 billion, beating estimates of $2.19 billion and reflecting continued demand for its da Vinci robotic surgery systems.

While procedure volumes remain a bright spot—projected to grow between 15% and 17% globally in 2025—this marks a slight slowdown from last year’s 17% growth rate. The real concern, however, lies in profitability expectations.

Intuitive Surgical anticipates gross margins to compress to a range of 65% to 66.5% of revenue, down from 69.1% in 2024. This includes an expected tariff-related drag of around 1.7% on revenue, plus or minus 30 basis points. Meanwhile, operating expenses are set to rise 10% to 14%, consistent with last year’s spending pace.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Quarterly Earnings Preview

- Intuitive Surgical is expected to report an EPS of $1.71, marking a 14% increase year-over-year.

- Projected revenues are set to reach approximately $2.19 billion, a 15.4% growth from the previous year.

- Analysts have revised the consensus EPS estimate upward by 0.2%, reflecting optimism about the company's financial health.

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a leading company in the medical technology sector, known for its innovative robotic-assisted surgical systems. The company is set to release its quarterly earnings on April 22, 2025. Wall Street anticipates an earnings per share (EPS) of $1.71, with projected revenues of approximately $2.19 billion.

The expected EPS of $1.71 represents a 14% increase from the same period last year, as highlighted by the company's strong performance. This growth is supported by a projected revenue increase of 15.4% year-over-year, reaching $2.18 billion. Such positive financial metrics indicate a robust demand for Intuitive Surgical's products and services.

Over the past month, analysts have revised the consensus EPS estimate upward by 0.2%. This revision reflects a positive reassessment of the company's financial health and potential, which can influence investor sentiment and the stock's short-term price performance. Investors will closely watch the earnings release to see if the actual results align with these optimistic projections.

Intuitive Surgical's stock performance is closely tied to its earnings results. A positive earnings surprise could lead to an increase in the stock price, while a miss might result in a decline. The management's discussion during the earnings call will be crucial in evaluating the sustainability of any immediate price changes and future earnings projections.

The company's financial ratios provide additional insights into its valuation. With a price-to-earnings (P/E) ratio of approximately 74.08, investors are willing to pay $74.08 for every dollar of earnings. The price-to-sales ratio stands at about 20.71, and the enterprise value to sales ratio is around 20.47. These figures reflect the company's valuation in relation to its sales and earnings. Additionally, Intuitive Surgical has a strong current ratio of 4.07, indicating its ability to cover short-term liabilities with its short-term assets.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Quarterly Earnings Preview

- Intuitive Surgical is expected to report an EPS of $1.71, marking a 14% increase year-over-year.

- Projected revenues are set to reach approximately $2.19 billion, a 15.4% growth from the previous year.

- Analysts have revised the consensus EPS estimate upward by 0.2%, reflecting optimism about the company's financial health.

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a leading company in the medical technology sector, known for its innovative robotic-assisted surgical systems. The company is set to release its quarterly earnings on April 22, 2025. Wall Street anticipates an earnings per share (EPS) of $1.71, with projected revenues of approximately $2.19 billion.

The expected EPS of $1.71 represents a 14% increase from the same period last year, as highlighted by the company's strong performance. This growth is supported by a projected revenue increase of 15.4% year-over-year, reaching $2.18 billion. Such positive financial metrics indicate a robust demand for Intuitive Surgical's products and services.

Over the past month, analysts have revised the consensus EPS estimate upward by 0.2%. This revision reflects a positive reassessment of the company's financial health and potential, which can influence investor sentiment and the stock's short-term price performance. Investors will closely watch the earnings release to see if the actual results align with these optimistic projections.

Intuitive Surgical's stock performance is closely tied to its earnings results. A positive earnings surprise could lead to an increase in the stock price, while a miss might result in a decline. The management's discussion during the earnings call will be crucial in evaluating the sustainability of any immediate price changes and future earnings projections.

The company's financial ratios provide additional insights into its valuation. With a price-to-earnings (P/E) ratio of approximately 74.08, investors are willing to pay $74.08 for every dollar of earnings. The price-to-sales ratio stands at about 20.71, and the enterprise value to sales ratio is around 20.47. These figures reflect the company's valuation in relation to its sales and earnings. Additionally, Intuitive Surgical has a strong current ratio of 4.07, indicating its ability to cover short-term liabilities with its short-term assets.

Intuitive Surgical Inc. (NASDAQ: ISRG) Sees Strong Growth with da Vinci Systems

- Intuitive Surgical placed a record 493 da Vinci systems in the fourth quarter of 2024, marking a 19% increase from the previous year.

- The launch of the da Vinci 5 system contributed significantly to a 36.5% increase in System segment sales, reaching $655 million.

- Despite a high P/E ratio of 90.84 and a price-to-sales ratio of 25.93, Intuitive Surgical's strong financial performance and market position indicate potential for future growth.

Intuitive Surgical Inc. (NASDAQ:ISRG) is a leader in robotic-assisted surgery, known for its da Vinci Surgical System. The company has seen significant growth, driven by the strong performance of its da Vinci portfolio. In the fourth quarter of 2024, Intuitive Surgical placed a record 493 systems, a 19% increase from the previous year, highlighting the growing demand for its innovative surgical solutions.

The da Vinci 5 system, launched in March 2024, has been a key driver of this growth, with 174 systems placed in the fourth quarter alone. This system, along with the Ion and SP platforms, has contributed to a 36.5% increase in the System segment’s sales, reaching $655 million. The strong market uptake of these systems underscores Intuitive Surgical's robust market position and the increasing adoption of its technology.

Intuitive Surgical's financial performance in the fourth quarter of 2024 was impressive, with revenues reaching $2.4 billion and adjusted earnings per share of $2.21. These figures surpassed market expectations, driven by an 18% year-over-year increase in global da Vinci procedure volume. The company's revenue growth of 25% year-over-year further highlights its strong market presence and the success of its da Vinci systems.

Despite the positive financial results, ISRG's stock experienced a decline. The stock has a high price-to-earnings (P/E) ratio of 90.84 and a price-to-sales ratio of 25.93, indicating that it may be overvalued compared to its earnings and sales. However, the company's strong liquidity position, with a current ratio of 4.30, provides a buffer against potential financial challenges.

For investors seeking diversification, the High-Quality portfolio, which has consistently outperformed the S&P 500, may be worth considering. Intuitive Surgical's strong fourth-quarter results and the increasing adoption of its da Vinci systems position the company well for future growth, despite the challenges it faces in certain international markets.