Intuitive Surgical, Inc. (ISRG) on Q1 2021 Results - Earnings Call Transcript

Operator: Ladies and gentlemen, thank you for standing by. And welcome to the Intuitive Q1 2021 Earnings Release. At this time, all participants are in a listen-only mode. Later there will be time for questions. As a reminder, this conference is being recorded. I would now like to turn the conference over to our host, Philip Kim, Head of Investor Relations. Please go ahead. Philip Kim: Good afternoon. And welcome to Intuitive’s first quarter earnings conference call. With me today, we have Gary Guthart, our CEO; Marshall Mohr, our Chief Financial Officer; and Jamie Samath, our Senior Vice President, Finance. Gary Guthart: Thank you for joining us today. Our first quarter of 2021 was a step in the right direction. In the quarter, we saw a healthy recovery of surgery and use of our products. Strong capital placements continued in Q1 2021 and utilization of installed systems increased through the quarter, indicating a need by our customers to return to surgery. We are in the early innings of commercialization of two new platforms for Intuitive, while advancing digital enablement of our ecosystem. Our teams are making good progress in all three areas. Overall, we are seeing some pandemic recovery, but improvement has been uneven with significant regional variation. Our experience shows that our business rebounds as COVID drops. Starting with procedures, general surgery in the United States was a source of strength in the quarter, driven by bariatric surgery, cholecystectomy and other procedures. Bariatric surgery has been on a multi-quarter gross trajectory, the result of a line development in commercial activities, starting with a capable systems, using Advanced Instruments and combined with a focused commercial team. Ventral hernia surgery is recovering with inguinal hernia tracking behind, aligned to hospital and patient prioritization. Marshall Mohr: Good afternoon. I would describe the highlights of our performance on a non-GAAP or pro forma basis. I will also summarize our GAAP performance later in my prepared remarks. A reconciliation between our pro forma and GAAP results is posted to our website. Key business metrics for the first quarter were as follows. First quarter 2021 procedures increased approximately 16% compared with the first quarter of 2020, was approximately the same as last quarter. On a day adjusted basis, procedures grew 18% year-over-year. First quarter system placements of 298 systems increased 26%, compared with 237 systems for the first quarter of 2020 and decreased 9%, compared with 326 systems last quarter. We expanded our installed base of da Vinci systems over the last year by 8% to approximately 6,142 systems. This growth rate compares with 11% last year and 7% last quarter. Utilization of clinical systems in the field measured by procedures per system increased approximately 8%, compared with last year and decreased 2% compared with last quarter. Philip Kim: Thank you, Marshall. Our overall first quarter procedure growth was 16% year-over-year, compared to 10% growth during the first quarter of 2020 and 6% growth last quarter. Our Q1 procedure growth was driven by 14% year-over-year growth in the U.S. and 23% growth OUS. Procedures in the U.S. recovered steadily after January as COVID cases declined and the associated impact on hospital resources improved. In the U.S. within general surgery, bariatric, cholecystectomy and hernia were the largest contributors to procedure growth within the quarter. Bariatrics growth remained strong with positive customer feedback on our Advanced Instrument portfolio. Cholecystectomy growth was driven by the continued expansion of robotic procedures by general surgeons throughout their total practice. Inguinal hernia growth trailed ventral growth in the quarter. With respect to our more mature procedure categories in the U.S., Q1 gynecology procedures grew double-digit against the prior year growth comparison that was negative due to COVID. While dVP in the U.S. stabilized in Q1 from previous declines, it remains unclear when patients who have been impacted from delays in diagnosis and treatment will ultimately come back. In aggregate, on a worldwide basis, prostatectomy in the first quarter largely stabilized. More broadly OUS procedure growth was driven by urology, earlier stage growth in general surgery, gynecology and thoracic procedures. With respect to OUS markets, China procedure growth was strong and benefited from the severe first quarter of 2020 impact of COVID-19 and an increase in the installed base over the past year. China had broad-based growth in all procedure categories. In Japan, procedure growth moderated somewhat due to restrictions associated with COVID. Procedure growth in South Korea was encouraging, with SP utilization continuing to be above Xi. In Europe, France had a solid quarter, with broad-based strength in a wide range of procedure categories. The U.K. remained challenged due to COVID. Now turning to the clinical side of our business, each quarter on these calls we highlight certain recently published studies that we deem to be notable. However, to gain a more complete understanding of the body of evidence, we encourage all stakeholders to thoroughly review the extensive detail of scientific studies that have been published over the years. A recent article by Dr. Mohamed A Abd El Aziz, Fabian Grass and David Larson with colleagues from the Mayo Clinic published in Surgical Endoscopy provided results from a real world study aimed to analyze national trends of conversion during elective colectomies in addition to MIS utilization trends. Using the ATF national surgical quality improvement program database for elective laparoscopic or robotic-assisted colectomy between January 2013 and December 2018, a total of 66,652 patients were identified. Overall conversion rates from MIS to open were approximately 42% lower for robotic-assisted procedures when compared to laparoscopic procedures, 4.9% versus 8.5%. The rate was also lower for obese patients with a BMI greater than or equal to 30, 6% versus 10.3%. The authors concluded in part, quote, this large scale study identified a decreasing trend in conversion rates over the six-year inclusion period, both overall and in patients with obesity paralleling increased utilization of the robotics platform. Given the potential negative impact of conversion on patient outcomes, individual institutions should consider a review of their own conversion data, as this may represent an opportunity for quality improvement, unquote. In February of this year, Dr. Amir Bastawrous of the Swedish Cancer Institute in Seattle Washington and Dr. Robert Cleary of St. Joseph Mercy Hospital in Ann Arbor, Michigan, published a real-world observational study, which compared the rates of long-term opioid prescriptions for patients who underwent minimally invasive and open colectomies. This study utilized the IBM market scan research database and analyzed 14,887 eligible patients who underwent the colon resection via the open laparoscopic or robotic-assisted approach between 2013 and 2017. In the one-to-one propensity score matched analysis comparing the MIS and open approaches with over 5,000 patients in each arm, the MIS approach has significantly lower incident rates of long-term prescriptions of any opioid by approximately 36%, 13.3% versus 20.9%, Schedule 2 and 3opioids by approximately 39%, 11.7% versus 19.2%, and high-dose opioids by approximately 44%, 4.3% versus 7.7% from 90 days to 180 days postoperatively. Looking at the matched analysis between robotic-assisted surgery and laparoscopy with overall 1,100 subjects in each group, the robotic-assisted approach demonstrated approximately 45% lower long-term prescription rates of high-dose opioids, 2.1% versus 3.8% when compared to the laparoscopic approach. Furthermore, in subgroup analyses, the robotic-assisted approach showed significant lower rates of long-term prescriptions in any opioids, Schedule 2 and 3 opioids, and high-dose opioids compared to the laparoscopic approach for subjects undergoing a colectomy for nonmalignant conditions. The authors concluded in part, quote, choosing an MIS option in robotic-assisted surgery for some colorectal operations is a modifiable factor that may contribute to less long-term opioid use, unquote. And with that, I’d like to turn it over to Jamie who will review our financial outlook. Jamie Samath: Good afternoon. While there continues to be uncertainty regarding the ongoing impact of COVID-19, given moderating COVID-19 hospitalization trends and vaccination progress particularly in the U.S. which accounted for approximately 70% of our 2020 procedures, we are reestablishing our financial guidance. In providing this guidance, we know that there are emerging supply constraints in our supply chain, for example, in the semiconductor industry. The outlook we are providing does not reflect any potential significant disruption or additional costs related to the supply constraints. Our financial outlook for 2021 is as follows. Starting with procedures, total 2020 da Vinci procedures grew approximately 1% to roughly 1,243,000 procedures performed worldwide. For 2021, we anticipate full year procedure growth within a range of 22% to 26%. We expect 2021 procedure growth to continue to be driven by U.S. general surgery and procedures outside the United States where we were at earlier stages of adoption. The high end of the range assumes that COVID cases and their impact on da Vinci procedures to continue to decline throughout the year, the vaccine rollouts continue at the level currently expected by governments around the world and that recovery of patient backlogs will progress. Modeling quarterly results is difficult, given the impact that COVID had on 2020 procedures. Therefore, with respect to seasonality, we expect similar quarterly patterns to 2019. With respect to capital, system placements are generally driven by procedure demand, prompting hospitals to establish or expand robotic system capacity. System placement demand is also the result of customers standardizing our fourth generation technology through trade-ins. Capital sales can vary substantially from period to period based upon many factors, including government healthcare policies, hospital capital spending cycles, reimbursement and government quotas, product cycles, economic cycles and competitive factors. Within this framework, we expect 2021 capital placements to generally be driven by procedures and the adequacy of existing capacity in the installed base. During the first quarter of 2021, 43% of system shifts were under operating leases. We expect that the proportion of systems placed under operating leases will vary from quarter-to-quarter and could continue to trend up in the future. Turning to gross profit, our full year 2020 pro forma gross profit margin was 68.4%, reflecting the impact of fixed -- higher fixed overhead costs relative to revenue, higher excess and obsolete inventory charges and the customer relief program that was implemented in the second quarter of 2020. Our full year 2019 pro forma gross profit margin was 71.7%. In 2021, we expect our pro forma gross profit margin to be within a range of between 70% and 71% of revenue. Our actual gross profit margin will vary quarter-to-quarter depending largely on product, regional and trade-in mix, the impact of current cost reductions and manufacturing efficiencies and competitive pricing pressure. With respect to operating expenses, in 2019, our pro forma operating expenses grew 27%, and in 2020, given the impact of the pandemic they grew 3%. In 2021, we expect pro forma full-year operating expense growth to be between 18% and 22%, reflecting increases in investments in our digital ecosystem, Ion, SP, OUS expansion, higher regulatory-related costs and infrastructure investments to allow us to scale. 2021 spending also expected to be impacted by a return over the course of the year to higher rates of travel, increased customer training and a greater proportion of marketing events being held in-person and by a variable compensation. We expect our non-cash stock compensation expense to range between $450 million and $470 million in 2021, compared to $396 million in 2020. We expect pro forma other income, which is comprised mostly of interest income to total between $45 million and $55 million in 2021, reflecting lower interest rates relative to 2020. With regard to income tax, in 2020, our pro forma income tax rate was 22.5%. As we look forward, we estimate our 2021 pro forma tax rate to be between 20% and 21% of pretax income. Our 2021 outlook for the pro forma tax rate does not reflect any potential change in U.S. tax rates. That concludes our prepared comments and we will now open the call to your questions. Operator: First, we are going to the line of Amit Hazan. Please go ahead. Amit Hazan: Thanks very much. Can you hear me okay? Gary Guthart: We can. Amit Hazan: Great. I will maybe burn the first question on just the guide. Obviously appreciate that just given all the uncertainty on the procedure side. And so given that you gave that number, we will see if you would go a step further and just give us a little bit more color as to how you got there. We are obviously all kind of trying to figure out recovery back to normal, but also these potential buckets of recapturing backlog of procedure categories for you, particularly in prostate I’d suspect. Can you just talk to how you thought about those backlog of patients and that return to normal as you developed this guide for the rest of the year on the procedure side? Jamie Samath: Yeah. So maybe I will start with -- this is Jamie. I will start with the low end of the procedure guidance. So we considered three factors in the low end. We see the possibility of extended impact of COVID in certain OUS geographies, with slower vaccine rollouts and resurgences in some of these geographies. We see that in parts of Europe currently. Secondly, we embedded in the lower end of the procedure guidance a slower recovery of diagnostic pipelines that have been impacted during the pandemic. And then the third item in the low end of the guidance is the possibility of regionalized resurgence of COVID in the U.S. as we race towards the rollout of vaccines and ultimately at some point achieve herd immunity in the U.S. With respect to the backlog, the backlog has accumulated really for three factors, lower diagnostic pipelines, deferred elective surgery as hospital systems get inundated with COVID cases and patient reluctance to undergo surgery during COVID resurgences. These subcomponents we think get recovered over different periods of time. The backlog is actually constantly netting between increases and recovery. So the total accumulated backlog is difficult to predict. The rate of recovery is also difficult to predict, but we expect it to go through into 2022. And so -- the 2021 procedure guidance that we provided reflects our best estimate of the range of the impact of backlog in the year. Amit Hazan: Okay. I appreciate that. And I want to come back with the second question just to a topic that’s been discussed before, but I figured in light of COVID to bring it up again, which is just this question of ambulatory surgery centers and lower acuity procedures generally. I mean, especially given COVID, it just seems like there’s just never been more of an optimal time for Intuitive to discuss and go after this part of the market? And we still don’t hear you talking about it that much. It just -- it begs the question of what’s holding you back and we know that the reflex answers -- reflex kind of answer seemed to be on the reimbursement side and that it may not be optimal. When I think about your advantages that you pitch to hospitals on the marketing side, the surgeon benefit, frankly the outcomes, that seems to be a lot more important and potentially beneficial than wherever reimbursement lies. So help us out here. Why are ambulatory surgery centers not a bigger opportunity for you right now? Gary Guthart: Yeah. This is Gary. We are already in ambulatory surgery environments with our customers, different types and we see healthy programs there. I don’t think we are struggling from the point of view of having a product that can help them or services that can help them or a way to have a conversation. I think all those things are in place. I do believe that over time reimbursement matters, particularly in customers that operate in both environments, hospitals and ASCs. For them, reimbursement matters. If they are going to move a patient, but they get a big difference in the revenue, then they are going to make those decisions. It may change over time and that what payers ultimately decide to do and whether they want to create some incentives to help things move into ASCs, we will be ready. Long-term, I am bullish on that. I think the environment makes sense, but economics and incentives really matter. It doesn’t clear up your question, it reinforces our position. Amit Hazan: Okay. Thank you for that. I will step back in queue. Operator: Thank you. And next we will go to the line of Larry Biegelsen. Please go ahead. Larry Biegelsen: Good afternoon. Thanks for taking my question. Gary, can you please provide more color on the Intuitive telepresence feature that you mentioned on this call? It’s the first time I’d heard you talk about it and that 45% of procedures was a pretty impressive number. Is that through your agreement with InTouch? How is it being used by customers? What are the benefits And how do you see that playing out post-COVID And I have one follow-up? Gary Guthart: Yeah. So, you are right, it is the result of the technology and a collaborative agreement we signed with InTouch many years ago. We brought a team over, as well as some of the technology and have put it in our hands. The use case I was talking about there is the ability for people who are interested in observing a case by an expert to log in online through a secure network, high speed streaming and view that case on da Vinci accounts. And that’s an important part of both knowledge transfer from those high volume accounts, as well as an introductory exposure for surgeons who are thinking about it. So that has been great. There are other use cases for streaming connections, video streaming connections, into our products that I won’t detail now. It’s pretty neat and so prior we had started that, I was a believer, or we as a company were believers that those kinds of access, think of it as kind of surgical FaceTime or surgical Skype over a distance. That kind of access would be important to folks, and the pandemic really accelerated it. So we had the technology infrastructure in place and as people started to be more open to the use of digital tools to do their learning and exposure and wanted to stay off of planes and out of cars, we saw it really accelerate and that’s what we have been touching on there. Larry Biegelsen: That’s very helpful. And then lastly, what response are you getting from the Extended Use Program you introduced in Q4 2020, any changes to kind of the impact that we could see from that and any color yet on demand elasticity? Thanks for taking the questions. Marshall Mohr: Yeah. Sure. So we introduced Extended Use Instruments into Europe and into the U.S. in Q4. We did see increased usage of Extended Use Instruments. They still have some level of inventory of shorter life used instruments and they are burning that off. We also had commented last quarter that we saw stocking orders of Extended Use Instruments and we are seeing some adjustment of their buying patterns to recognize the increased number of uses per instrument. So, this quarter, as I called out, instrument and accessory revenue per procedure was lower than last quarter and that primarily reflects those factors, like the turn of use of Extended Instruments and adjustments of inventory buying patterns. I don’t think it’s exhausted the whole impact and 130 if you go back to our previous script, you see that we said that had you implemented this in 2019, it would have affected total revenue by about $150 million to $170 million or about 7% of INA per procedure and we have only seen a part of that so far. When the rest of it will hit is questionable. It will roll out over time as they continue to use those instruments and as we roll it out to other countries. Larry Biegelsen: Thanks, Marshall. Operator: Thank you. And next we are going to the line of Bob Hopkins. Please go ahead. Bob Hopkins: Great. Thank you and good afternoon. I wanted to ask a question or a few questions on just the first quarter procedure volume numbers that you provided, because it was obviously a lot stronger than consensus estimates. And so, Gary, I was just wondering, a couple quick things. Is it safe to assume that the end of the quarter was materially stronger than the beginning and middle of the quarter in terms of procedure growth? And then I was just wondering what stood out to you, Gary, either geographically or by procedure type in the quarter that you think is worth calling out? Gary Guthart: To your -- thanks for the question. To the first one, we definitely saw growth through the quarter, which was encouraging. In terms of procedure types, I think, there’s this interesting mix, the prioritization that folks are making as they come back into hospitals. I think is a mixture of patient desire depending on what they think their condition might be, for example bariatrics, and the hospital and surgeons prioritization around urgency, for example diagnosed cancers and changes that are challenges to the diagnostic pipeline. I was pleased by U.S. general surgery. I think that that has shown some resilience, a lot of that is benign procedures and I think that that has been kind of on the upside of our models. So so far so good. Bob Hopkins: And then one follow-up just on that also to get a little bit of a better flavor for procedure volumes in the quarter by geography, I am just curious on Europe, what’s your take on, how bad are things there in your view and just curious maybe how far below 16% was Europe in the quarter? Gary Guthart: I won’t quantify it for you but just to give you a little bit of qualitative color and Marshall, please jump in and help. In the U.K., we have seen NHS make priority decisions firmly and that reflects what we see in the procedure performance itself, which has been suppressed. That said, we are also seeing commitments to MIS in the form of capital acquisition and other things that indicate to us that they are rotating toward it. So there is kind of a mixed conversation. France and Germany have been surprisingly good despite complexity with regard to the way COVID is rolling out. And then as we look at Spain and Italy, we see it really just follow as COVID eases surgery comes back and we come back with it. Overall, we feel like we have really good leadership teams in place in country. We feel like we are in good connection with the healthcare systems. I think we are being agile and adaptable to meet their needs, which is really controlling what we can control. And in that sense, I think the company is doing all right. Marshall, anything you would add? Marshall Mohr: I think that was great color. I think the only other thing I would add is the, we have talked about in the past that a lot of the procedures we are performing are urologic and we are in the process in certain countries of pivoting. And we are starting to see some adoption in GYN and general surgeries in some countries but we still have work to do. Bob Hopkins: Great. Thank you. Operator: Thank you. And next we are going to the line of Tycho Peterson. Please go ahead. Tycho Peterson: Hey. Thanks. A couple follow-ups. I am curious what’s baked into guidance on utilization given the Extended Use Instruments in the commentary before. What are you kind of modeling for utilization for the year? Gary Guthart: Yeah. I think I would refer, Tycho, back to 2019 patterns in terms of utilization. Obviously, we knew capital was going to be driven by procedure performance. So I think I would just refer to seasonal patterns in 2019 as a starting point. Tycho Peterson: Okay. And then you have commented a couple times on this call and other calls on the diagnostic pipelines being under pressure. Can you just talk a little bit about how are they are looking as a leading indicator to some of the more mature procedures, dVP in particular? Gary Guthart: Yeah. Jamie, why don’t you jump in? Jamie Samath: Yeah. We have -- so we have some market data actually for the U.S. What we see is -- and that’s through February 2021, what we see is most of the diagnostic tests, PSA testing, for example, CT scans and lung cancer. We see that those have been suppressed during this period. So we haven’t seen them start to recover at least in the data that we have seen so far. And we see that reasonably correlated to the associated procedures, so PSA dVP has been relatively weak during that period, so as lobectomy. So so far we haven’t seen any evidence of a recovery in diagnostic testing at least in the U.S. Gary Guthart: There are some anecdotes that it’s starting to get better in March. We will see as it plays out. Even after the diagnostic gets done there is a workup pipeline that has to be done. That said, I don’t feel like we have any evidence that it’s moving away from surgery. So it appears in those kind of cases that it’s building a backlog that ultimately will flow through. If PSA testing back in 2012 is a guide, it will take several quarters for that to work its way out. Tycho Peterson: Okay. And then last one on SP, two quick ones actually. Can you confirm you started the IDE trial for colorectal in the quarter? And then, Gary, you mentioned thoracic surgery and other disciplines, I am just curious if you could talk a little bit about the roadmap other areas you might go after with SP? Gary Guthart: Sure. On the SP side, on the IDEs, the first cases are scheduled. We have got all the paperwork done in our research institutions that we are working through, at least the first starting ones and we expect that to happen. The first cases have not yet gone through. They should have it here in the next few weeks. Thoracic, that’s the first time we been telling you that we think that’s interesting. There are single port opportunities for thoracic surgery and we are excited by them. We are working through what those trials look like and having conversations with regulatory bodies to get it going and given the current environment, we will have concurrent trials for the colorectal and then thoracic. There are a couple more indications beyond that. For competitive and other reasons, we are not yet ready to guess what those are going to be for us. But SP is a platform, and we are excited by it. So as we get closer and those things get closer to being filed as IDEs and trials then we will describe them more fully. Tycho Peterson: Okay. Thank you. Operator: Thank you. And next we are going to the line of Rick Wise. Please go ahead. Rick Wise: Good afternoon, everybody. I was hoping we could talk a little bit more, Gary, about Ion. We would get a bunch of physician calls a month or so ago and heard really fantastic feedback that doctors are telling us about early signs of higher diagnostic yields, best in complex cases, noticeable functional benefits and features. All that left me optimistic about the PRECISE trial. So a couple things, are you optimistic and hopeful about PRECISE? I think you said it would be wrapped up -- I just want to make sure I understand by midyear. When might we see the data, all the docs are anxious to see the data? And with some of the logistical issues resolved, could we, should we expect an acceleration, is it reasonable to think about anticipate the acceleration Ion uptake in the second half and into 2022? Thanks. Gary Guthart: Sure. On the issue of the PRECISE trial, Philip, I will turn to you in terms of timing. Philip Kim: Sure. So we confirmed that we expect enrollment to end this quarter in Q2 and then you would have final data readout in the back half of next year, 2022. Gary Guthart: On the issue of, you had said, how are we feeling about it. I think we are reading and hearing what you are reading and hearing also in terms of talking to our customer about the ability of Ion to deliver on its promises, to reach into the lung to get to diagnostic yields that folks have not seen with other technologies and to work in complex cases. So I am feeling enthusiastic and bullish on it. With regard to ramp, we are expecting Ion to continue to ramp through the year and into next year. I don’t see a step function change. I think it’s a sequential ramp as we go and that’s because it’s been interesting and sophisticated technology. So a lot of what we are working on is making sure that we can get the manufacturability to where we need it, getting supply chain stability, quality and predictability where we need it, iterating our design for manufacturing and working on additional indications because it’s a platform and we are doing all four of those things. But I don’t think investors, because of the way these things work, should expect that you flip a switch and it just goes to the next level. I think that it will climb each quarter and that’s what we are working on. That beats our expectation and our experience in these kind of function. Rick Wise: Thanks very much. Gary Guthart: Sure. Operator: Thank you. And next we are going to the line of Richard Newitter. Please go ahead. Richard Newitter: Hi. Thanks for taking the question. Just one on operating expense guidance. Thanks for the full year outlook. Just could you give us an extent of the quarterly pacing or would it be safe to assume the 2019 cadence commentary for procedures applies to OpEx too? Marshall Mohr: Yeah. I think you should see sequentially operating expenses generally increase across the rest of the year. It’s really going to be a function of the extent to which COVID continues to impact our ability to travel, accelerate customer training and hold marketing events in person. But generally, I would expect it to radically increase across the balance of the year. Richard Newitter: Got it. And just same kind of topic here, on geographic investment and expansion that you started to get more aggressive on pre-pandemic, especially in India, just in light of what’s been going on in that region specifically with the COVID problem. Should we be thinking of some of those initiatives postponed even further out to 2022 and beyond or are those things that could resume as early as this year? Thanks. Gary Guthart: Yeah. I am sorry. I had a little bit of a hard time hearing you with regard to the referenced trial. So go ahead and re-ask the question, if you would. Richard Newitter: Sorry. My connection is off. But just India, should we think of reinvestment in that region starting now or in light of COVID and the situation there something 2022 and beyond? Is that part of the spending and geographic expansion you referred today? Gary Guthart: Yeah. So with regard to India, clearly, the current situation there is such that current procedures are impacted. That said, I think that the long-term commitment we have to market is intact. Our teams are making really nice progress building a footprint in relationships to hospital systems. And so I expect as COVID starts to become managed there a little bit more forcefully and it starts to recover we will see a recovery on our side. It has not had a retreat. Other places around the world, whether it’s Japan or China or Europe, we continue to be interested and committed, so not just India, but others as well. And if you have just asked your last question then we will go from there. Rich, any follow-ups or Operator, one more question please. Operator: Okay. Next we are going to the line of Matt Taylor. Please go ahead. Matt Taylor: Hi. Yeah. Thank you very much for taking the question. I guess it was good to see the strong return of capital spending. You are talking about customers looking forward to prepare for volumes and commitment to robotic surgeries. Do you think that there was a little bit of a bolus of kind of pent-up spending that came through in Q1 or do you think this is the start of a new pattern of purchasing based on your backlog and what you are seeing with your orders? Gary Guthart: That is a subject of fearsome debate amongst us as a company. Marshall, why don’t you share your opinion? Marshall Mohr: Well, I give you a few different dynamics to consider as we go forward. It’s always hard to project out based on one quarter results. I guess we have had a couple quarters that have been decent. Is there -- was there -- I think part of your question was, is there pent-up spending? I would just say, I don’t know if it was pent-up spending, but I would say, that clearly the hospitals had more capital to spend than we had anticipated. And as a -- and what’s really driving them, their spending on da Vinci procedure -- on da Vinci capital is procedure growth. Procedure growth is the number one thing that drives capital. But also the trade-in cycle and the desire to access fourth generation product, including the Extended Use Instruments we mentioned earlier. And then, finally, I think that, you also have them getting ready for the post-pandemic environment and just a general recognition that da Vinci Surgery meets their quadruple aim objectives better than other approaches now. Matt Taylor: Great. Okay, guys. Thanks. I will leave it there. Appreciate it. Gary Guthart: All right. Well, thank you. Okay. Well, that was our last question. In closing, we continue to believe there’s a substantial and durable opportunity of fundamentally improved surgery and acute interventions. Our teams continue to work closely with hospitals, physicians and care teams in pursuit of what our customers have termed the quadruple aim, better, more predictable patient outcomes, better experiences for patients, better experiences for their care teams and ultimately, a lower total cost of care. We believe value creation in surgery and acute care is foundationally human. It follows from respect for and understanding of patients and care teams, their need and their environments. Thank you for your support on this extraordinary journey and we look forward to talking with you again in three months. Operator: And that does conclude our conference for today. Thank you for your participation and for using AT&T Conferencing Service. You may now disconnect.

Intuitive Surgical, Inc. (NASDAQ:ISRG) Quarterly Earnings Preview and Financial Analysis

- Intuitive Surgical is expected to report an EPS of $1.99 and revenue of approximately $2.41 billion for the upcoming quarter, driven by the adoption of the da Vinci 5 system.

- The company showcases robust revenue growth and high margins, with a 20.8% increase in revenue over the last twelve months and an operating margin of 28.8%.

- Despite facing challenges such as tariff risks and global capital expenditure constraints, Intuitive Surgical maintains a strong market position with a market capitalization of $156 billion and a current ratio of 5.17.

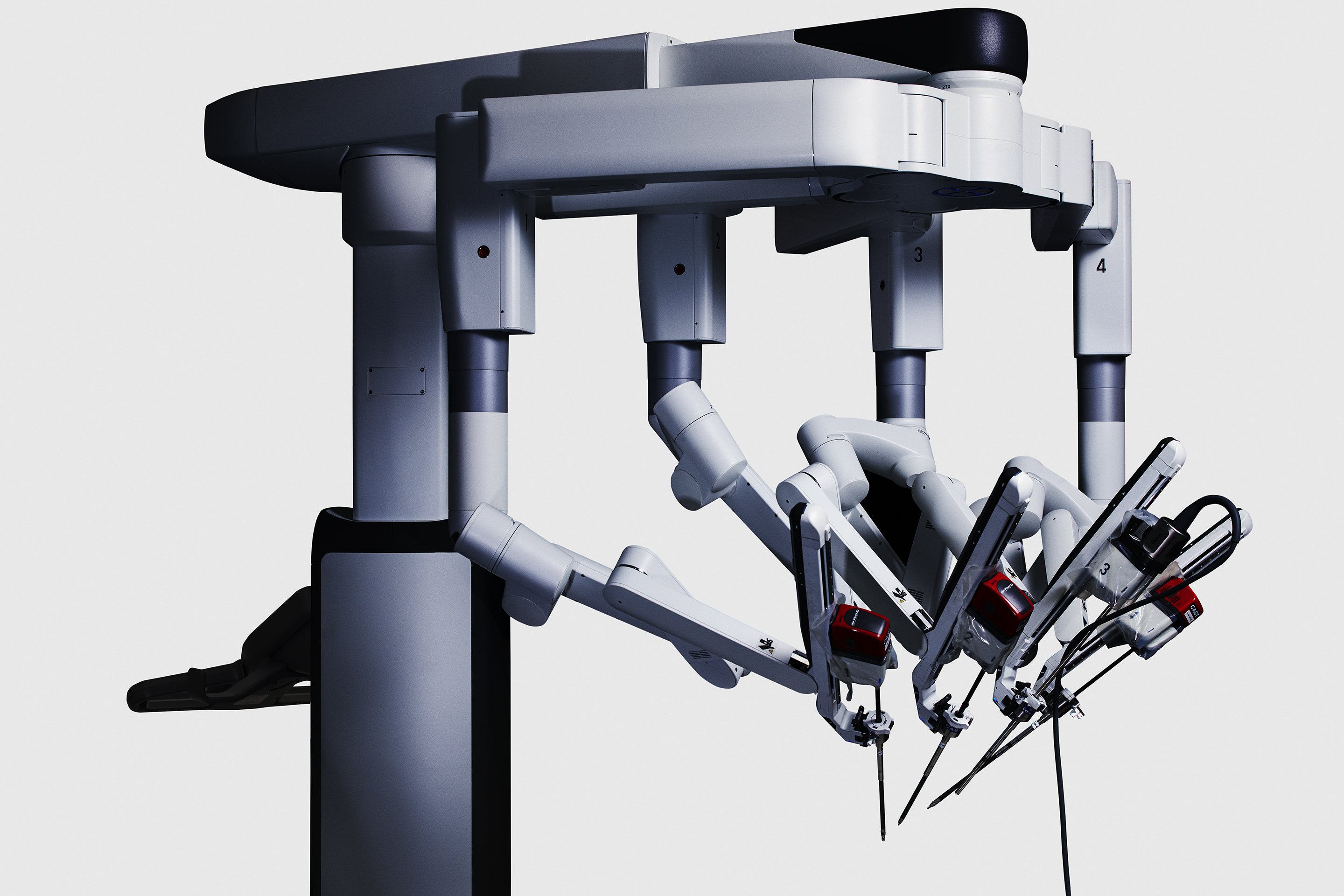

Intuitive Surgical, Inc. (NASDAQ:ISRG) is a leader in robotic-assisted surgery, known for its innovative da Vinci surgical systems. These systems allow surgeons to perform complex procedures with precision and minimal invasiveness, improving patient outcomes. The company faces competition from other medical device manufacturers but maintains a strong market position due to its advanced technology and continuous innovation.

As Intuitive Surgical prepares to release its quarterly earnings on October 21, 2025, analysts expect an EPS of $1.99 and revenue of approximately $2.41 billion. This growth is largely driven by the increasing adoption of the da Vinci 5 system and a projected 15.5-17% rise in worldwide da Vinci procedures in 2025. The company's strong fundamentals are evident in its robust revenue growth and high margins.

Despite these positive indicators, Intuitive Surgical faces challenges such as tariff risks and global capital expenditure constraints, which could limit its upside potential. Additionally, while the da Vinci 5 and Ion systems have contributed positively, weaknesses in the bariatric segment may offset some gains. Rising component costs and increased R&D expenditures may also pressure margins.

Intuitive Surgical's market capitalization stands at $156 billion, with a revenue of $9.1 billion and operating profits of $2.6 billion over the past year. The company has demonstrated impressive revenue growth, with a 20.8% increase over the last twelve months. Its operating cash flow margin is nearly 30.9%, and the operating margin is 28.8%, showcasing its profitability.

The stock is currently trading at a price-to-sales multiple of 17.1, a 26% discount compared to a year ago. This, combined with its high margins and pricing power, results in consistent profits and cash flows. Intuitive Surgical's strong liquidity, indicated by a current ratio of 5.17, further supports its financial stability and ability to reinvest capital effectively.

Intuitive Surgical Beats Q2 Estimates, But Margins Disappoint on Tariff and Cost Pressures

Intuitive Surgical (NASDAQ:ISRG) posted strong second-quarter results, beating Wall Street expectations on both revenue and earnings. The maker of da Vinci robotic surgical systems reported adjusted earnings of $2.19 per share, topping the $1.93 consensus and improving from $1.78 a year earlier. Revenue jumped 21% year-over-year to $2.44 billion, surpassing the $2.35 billion estimate.

Despite solid topline growth, the company lowered its 2025 non-GAAP gross margin forecast to 66%–67%, down from 69.1% in 2024. Management cited a 1% revenue drag from international tariffs and higher depreciation tied to recent infrastructure investments.

Looking ahead, Intuitive guided for da Vinci procedure growth of 15.5% to 17% this year, slightly lower than 2024’s 17% pace. Operating expenses are expected to rise up to 14% as the company continues to invest in innovation amid broader macroeconomic pressures.

Intuitive Surgical Beats Q1 Estimates But Expects Margin Compression

Intuitive Surgical (NASDAQ:ISRG) delivered strong first-quarter results that surpassed expectations on both earnings and revenue.

The company reported adjusted earnings of $1.81 per share, topping the consensus forecast of $1.74. Revenue reached $2.25 billion, beating estimates of $2.19 billion and reflecting continued demand for its da Vinci robotic surgery systems.

While procedure volumes remain a bright spot—projected to grow between 15% and 17% globally in 2025—this marks a slight slowdown from last year’s 17% growth rate. The real concern, however, lies in profitability expectations.

Intuitive Surgical anticipates gross margins to compress to a range of 65% to 66.5% of revenue, down from 69.1% in 2024. This includes an expected tariff-related drag of around 1.7% on revenue, plus or minus 30 basis points. Meanwhile, operating expenses are set to rise 10% to 14%, consistent with last year’s spending pace.

Intuitive Surgical Beats Q1 Estimates But Expects Margin Compression

Intuitive Surgical (NASDAQ:ISRG) delivered strong first-quarter results that surpassed expectations on both earnings and revenue.

The company reported adjusted earnings of $1.81 per share, topping the consensus forecast of $1.74. Revenue reached $2.25 billion, beating estimates of $2.19 billion and reflecting continued demand for its da Vinci robotic surgery systems.

While procedure volumes remain a bright spot—projected to grow between 15% and 17% globally in 2025—this marks a slight slowdown from last year’s 17% growth rate. The real concern, however, lies in profitability expectations.

Intuitive Surgical anticipates gross margins to compress to a range of 65% to 66.5% of revenue, down from 69.1% in 2024. This includes an expected tariff-related drag of around 1.7% on revenue, plus or minus 30 basis points. Meanwhile, operating expenses are set to rise 10% to 14%, consistent with last year’s spending pace.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Quarterly Earnings Preview

- Intuitive Surgical is expected to report an EPS of $1.71, marking a 14% increase year-over-year.

- Projected revenues are set to reach approximately $2.19 billion, a 15.4% growth from the previous year.

- Analysts have revised the consensus EPS estimate upward by 0.2%, reflecting optimism about the company's financial health.

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a leading company in the medical technology sector, known for its innovative robotic-assisted surgical systems. The company is set to release its quarterly earnings on April 22, 2025. Wall Street anticipates an earnings per share (EPS) of $1.71, with projected revenues of approximately $2.19 billion.

The expected EPS of $1.71 represents a 14% increase from the same period last year, as highlighted by the company's strong performance. This growth is supported by a projected revenue increase of 15.4% year-over-year, reaching $2.18 billion. Such positive financial metrics indicate a robust demand for Intuitive Surgical's products and services.

Over the past month, analysts have revised the consensus EPS estimate upward by 0.2%. This revision reflects a positive reassessment of the company's financial health and potential, which can influence investor sentiment and the stock's short-term price performance. Investors will closely watch the earnings release to see if the actual results align with these optimistic projections.

Intuitive Surgical's stock performance is closely tied to its earnings results. A positive earnings surprise could lead to an increase in the stock price, while a miss might result in a decline. The management's discussion during the earnings call will be crucial in evaluating the sustainability of any immediate price changes and future earnings projections.

The company's financial ratios provide additional insights into its valuation. With a price-to-earnings (P/E) ratio of approximately 74.08, investors are willing to pay $74.08 for every dollar of earnings. The price-to-sales ratio stands at about 20.71, and the enterprise value to sales ratio is around 20.47. These figures reflect the company's valuation in relation to its sales and earnings. Additionally, Intuitive Surgical has a strong current ratio of 4.07, indicating its ability to cover short-term liabilities with its short-term assets.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Quarterly Earnings Preview

- Intuitive Surgical is expected to report an EPS of $1.71, marking a 14% increase year-over-year.

- Projected revenues are set to reach approximately $2.19 billion, a 15.4% growth from the previous year.

- Analysts have revised the consensus EPS estimate upward by 0.2%, reflecting optimism about the company's financial health.

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a leading company in the medical technology sector, known for its innovative robotic-assisted surgical systems. The company is set to release its quarterly earnings on April 22, 2025. Wall Street anticipates an earnings per share (EPS) of $1.71, with projected revenues of approximately $2.19 billion.

The expected EPS of $1.71 represents a 14% increase from the same period last year, as highlighted by the company's strong performance. This growth is supported by a projected revenue increase of 15.4% year-over-year, reaching $2.18 billion. Such positive financial metrics indicate a robust demand for Intuitive Surgical's products and services.

Over the past month, analysts have revised the consensus EPS estimate upward by 0.2%. This revision reflects a positive reassessment of the company's financial health and potential, which can influence investor sentiment and the stock's short-term price performance. Investors will closely watch the earnings release to see if the actual results align with these optimistic projections.

Intuitive Surgical's stock performance is closely tied to its earnings results. A positive earnings surprise could lead to an increase in the stock price, while a miss might result in a decline. The management's discussion during the earnings call will be crucial in evaluating the sustainability of any immediate price changes and future earnings projections.

The company's financial ratios provide additional insights into its valuation. With a price-to-earnings (P/E) ratio of approximately 74.08, investors are willing to pay $74.08 for every dollar of earnings. The price-to-sales ratio stands at about 20.71, and the enterprise value to sales ratio is around 20.47. These figures reflect the company's valuation in relation to its sales and earnings. Additionally, Intuitive Surgical has a strong current ratio of 4.07, indicating its ability to cover short-term liabilities with its short-term assets.

Intuitive Surgical Inc. (NASDAQ: ISRG) Sees Strong Growth with da Vinci Systems

- Intuitive Surgical placed a record 493 da Vinci systems in the fourth quarter of 2024, marking a 19% increase from the previous year.

- The launch of the da Vinci 5 system contributed significantly to a 36.5% increase in System segment sales, reaching $655 million.

- Despite a high P/E ratio of 90.84 and a price-to-sales ratio of 25.93, Intuitive Surgical's strong financial performance and market position indicate potential for future growth.

Intuitive Surgical Inc. (NASDAQ:ISRG) is a leader in robotic-assisted surgery, known for its da Vinci Surgical System. The company has seen significant growth, driven by the strong performance of its da Vinci portfolio. In the fourth quarter of 2024, Intuitive Surgical placed a record 493 systems, a 19% increase from the previous year, highlighting the growing demand for its innovative surgical solutions.

The da Vinci 5 system, launched in March 2024, has been a key driver of this growth, with 174 systems placed in the fourth quarter alone. This system, along with the Ion and SP platforms, has contributed to a 36.5% increase in the System segment’s sales, reaching $655 million. The strong market uptake of these systems underscores Intuitive Surgical's robust market position and the increasing adoption of its technology.

Intuitive Surgical's financial performance in the fourth quarter of 2024 was impressive, with revenues reaching $2.4 billion and adjusted earnings per share of $2.21. These figures surpassed market expectations, driven by an 18% year-over-year increase in global da Vinci procedure volume. The company's revenue growth of 25% year-over-year further highlights its strong market presence and the success of its da Vinci systems.

Despite the positive financial results, ISRG's stock experienced a decline. The stock has a high price-to-earnings (P/E) ratio of 90.84 and a price-to-sales ratio of 25.93, indicating that it may be overvalued compared to its earnings and sales. However, the company's strong liquidity position, with a current ratio of 4.30, provides a buffer against potential financial challenges.

For investors seeking diversification, the High-Quality portfolio, which has consistently outperformed the S&P 500, may be worth considering. Intuitive Surgical's strong fourth-quarter results and the increasing adoption of its da Vinci systems position the company well for future growth, despite the challenges it faces in certain international markets.