Intuitive Surgical Shares Down 4% on Preliminary Q4 Revenue Miss

Intuitive Surgical (NASDAQ:ISRG) shares dropped more than 4% on Wednesday following the company’s reported preliminary Q4 results, with revenue coming in at $1.66 billion, compared to the Street estimate of $1.68 billion.

According to the analysts at Deutsche Bank, the results presented no major surprises: continued broad-based recovery of surgery volumes across key global geographies (China being the notable exception) driving solid procedure growth but an increasingly challenging hospital capital spending environment yielding a 4% year-over-year decline in new da Vinci system installations.

The company’s initial 2023 procedure guide (up 12-16%) is encouraging particularly given management’s history of guiding conservatively to start the year and COVID-related challenges/uncertainties around the increasingly important China market.

| Symbol | Price | %chg |

|---|---|---|

| 7741.T | 24225 | 1.53 |

| OMED.JK | 194 | 0.52 |

| 4543.T | 2475 | -0.24 |

| MARK.JK | 715 | 0.7 |

Intuitive Surgical, Inc. (NASDAQ:ISRG) Quarterly Earnings Preview and Financial Analysis

- Intuitive Surgical is expected to report an EPS of $1.99 and revenue of approximately $2.41 billion for the upcoming quarter, driven by the adoption of the da Vinci 5 system.

- The company showcases robust revenue growth and high margins, with a 20.8% increase in revenue over the last twelve months and an operating margin of 28.8%.

- Despite facing challenges such as tariff risks and global capital expenditure constraints, Intuitive Surgical maintains a strong market position with a market capitalization of $156 billion and a current ratio of 5.17.

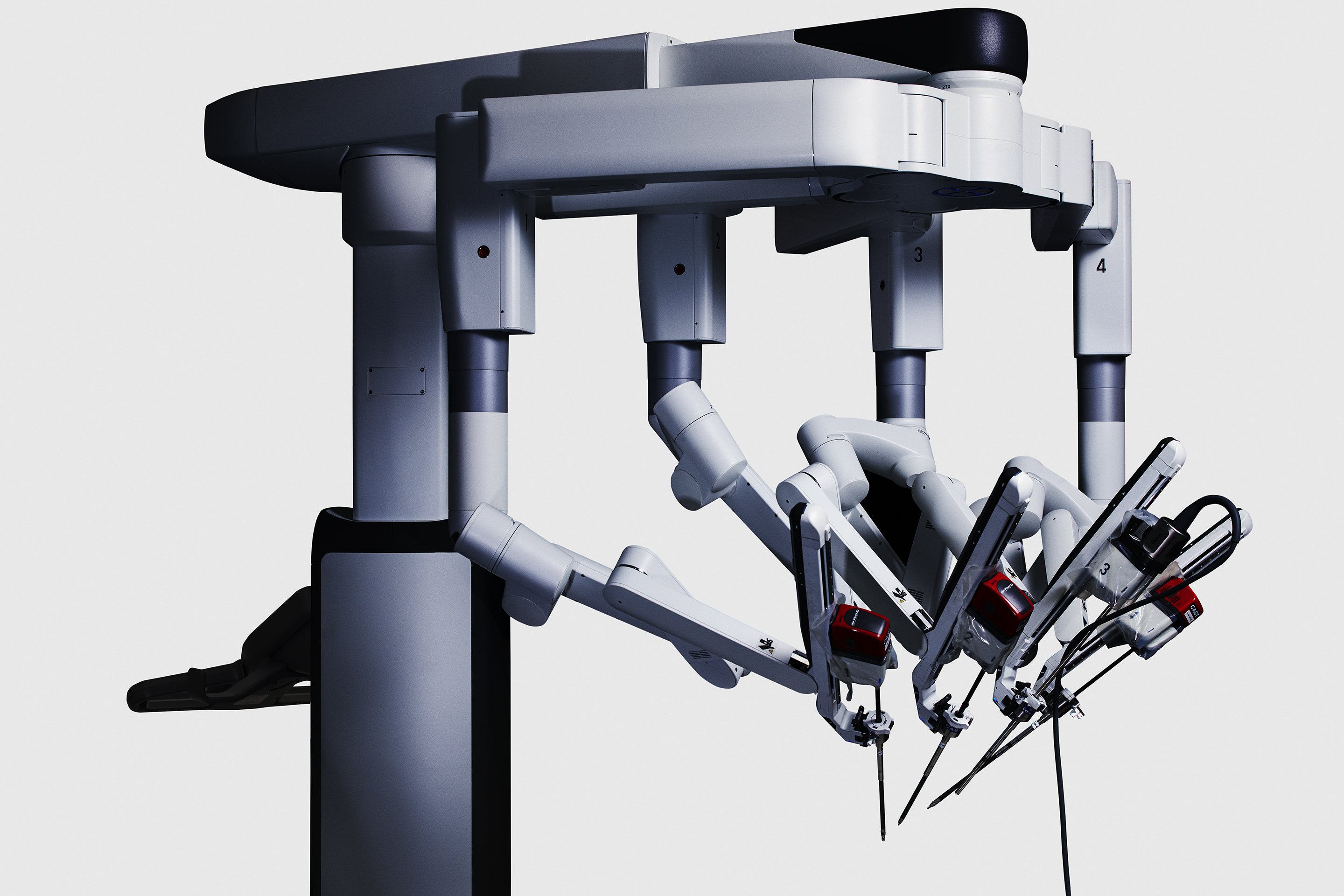

Intuitive Surgical, Inc. (NASDAQ:ISRG) is a leader in robotic-assisted surgery, known for its innovative da Vinci surgical systems. These systems allow surgeons to perform complex procedures with precision and minimal invasiveness, improving patient outcomes. The company faces competition from other medical device manufacturers but maintains a strong market position due to its advanced technology and continuous innovation.

As Intuitive Surgical prepares to release its quarterly earnings on October 21, 2025, analysts expect an EPS of $1.99 and revenue of approximately $2.41 billion. This growth is largely driven by the increasing adoption of the da Vinci 5 system and a projected 15.5-17% rise in worldwide da Vinci procedures in 2025. The company's strong fundamentals are evident in its robust revenue growth and high margins.

Despite these positive indicators, Intuitive Surgical faces challenges such as tariff risks and global capital expenditure constraints, which could limit its upside potential. Additionally, while the da Vinci 5 and Ion systems have contributed positively, weaknesses in the bariatric segment may offset some gains. Rising component costs and increased R&D expenditures may also pressure margins.

Intuitive Surgical's market capitalization stands at $156 billion, with a revenue of $9.1 billion and operating profits of $2.6 billion over the past year. The company has demonstrated impressive revenue growth, with a 20.8% increase over the last twelve months. Its operating cash flow margin is nearly 30.9%, and the operating margin is 28.8%, showcasing its profitability.

The stock is currently trading at a price-to-sales multiple of 17.1, a 26% discount compared to a year ago. This, combined with its high margins and pricing power, results in consistent profits and cash flows. Intuitive Surgical's strong liquidity, indicated by a current ratio of 5.17, further supports its financial stability and ability to reinvest capital effectively.

Intuitive Surgical Beats Q2 Estimates, But Margins Disappoint on Tariff and Cost Pressures

Intuitive Surgical (NASDAQ:ISRG) posted strong second-quarter results, beating Wall Street expectations on both revenue and earnings. The maker of da Vinci robotic surgical systems reported adjusted earnings of $2.19 per share, topping the $1.93 consensus and improving from $1.78 a year earlier. Revenue jumped 21% year-over-year to $2.44 billion, surpassing the $2.35 billion estimate.

Despite solid topline growth, the company lowered its 2025 non-GAAP gross margin forecast to 66%–67%, down from 69.1% in 2024. Management cited a 1% revenue drag from international tariffs and higher depreciation tied to recent infrastructure investments.

Looking ahead, Intuitive guided for da Vinci procedure growth of 15.5% to 17% this year, slightly lower than 2024’s 17% pace. Operating expenses are expected to rise up to 14% as the company continues to invest in innovation amid broader macroeconomic pressures.

Intuitive Surgical Beats Q1 Estimates But Expects Margin Compression

Intuitive Surgical (NASDAQ:ISRG) delivered strong first-quarter results that surpassed expectations on both earnings and revenue.

The company reported adjusted earnings of $1.81 per share, topping the consensus forecast of $1.74. Revenue reached $2.25 billion, beating estimates of $2.19 billion and reflecting continued demand for its da Vinci robotic surgery systems.

While procedure volumes remain a bright spot—projected to grow between 15% and 17% globally in 2025—this marks a slight slowdown from last year’s 17% growth rate. The real concern, however, lies in profitability expectations.

Intuitive Surgical anticipates gross margins to compress to a range of 65% to 66.5% of revenue, down from 69.1% in 2024. This includes an expected tariff-related drag of around 1.7% on revenue, plus or minus 30 basis points. Meanwhile, operating expenses are set to rise 10% to 14%, consistent with last year’s spending pace.

Intuitive Surgical Beats Q1 Estimates But Expects Margin Compression

Intuitive Surgical (NASDAQ:ISRG) delivered strong first-quarter results that surpassed expectations on both earnings and revenue.

The company reported adjusted earnings of $1.81 per share, topping the consensus forecast of $1.74. Revenue reached $2.25 billion, beating estimates of $2.19 billion and reflecting continued demand for its da Vinci robotic surgery systems.

While procedure volumes remain a bright spot—projected to grow between 15% and 17% globally in 2025—this marks a slight slowdown from last year’s 17% growth rate. The real concern, however, lies in profitability expectations.

Intuitive Surgical anticipates gross margins to compress to a range of 65% to 66.5% of revenue, down from 69.1% in 2024. This includes an expected tariff-related drag of around 1.7% on revenue, plus or minus 30 basis points. Meanwhile, operating expenses are set to rise 10% to 14%, consistent with last year’s spending pace.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Quarterly Earnings Preview

- Intuitive Surgical is expected to report an EPS of $1.71, marking a 14% increase year-over-year.

- Projected revenues are set to reach approximately $2.19 billion, a 15.4% growth from the previous year.

- Analysts have revised the consensus EPS estimate upward by 0.2%, reflecting optimism about the company's financial health.

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a leading company in the medical technology sector, known for its innovative robotic-assisted surgical systems. The company is set to release its quarterly earnings on April 22, 2025. Wall Street anticipates an earnings per share (EPS) of $1.71, with projected revenues of approximately $2.19 billion.

The expected EPS of $1.71 represents a 14% increase from the same period last year, as highlighted by the company's strong performance. This growth is supported by a projected revenue increase of 15.4% year-over-year, reaching $2.18 billion. Such positive financial metrics indicate a robust demand for Intuitive Surgical's products and services.

Over the past month, analysts have revised the consensus EPS estimate upward by 0.2%. This revision reflects a positive reassessment of the company's financial health and potential, which can influence investor sentiment and the stock's short-term price performance. Investors will closely watch the earnings release to see if the actual results align with these optimistic projections.

Intuitive Surgical's stock performance is closely tied to its earnings results. A positive earnings surprise could lead to an increase in the stock price, while a miss might result in a decline. The management's discussion during the earnings call will be crucial in evaluating the sustainability of any immediate price changes and future earnings projections.

The company's financial ratios provide additional insights into its valuation. With a price-to-earnings (P/E) ratio of approximately 74.08, investors are willing to pay $74.08 for every dollar of earnings. The price-to-sales ratio stands at about 20.71, and the enterprise value to sales ratio is around 20.47. These figures reflect the company's valuation in relation to its sales and earnings. Additionally, Intuitive Surgical has a strong current ratio of 4.07, indicating its ability to cover short-term liabilities with its short-term assets.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Quarterly Earnings Preview

- Intuitive Surgical is expected to report an EPS of $1.71, marking a 14% increase year-over-year.

- Projected revenues are set to reach approximately $2.19 billion, a 15.4% growth from the previous year.

- Analysts have revised the consensus EPS estimate upward by 0.2%, reflecting optimism about the company's financial health.

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a leading company in the medical technology sector, known for its innovative robotic-assisted surgical systems. The company is set to release its quarterly earnings on April 22, 2025. Wall Street anticipates an earnings per share (EPS) of $1.71, with projected revenues of approximately $2.19 billion.

The expected EPS of $1.71 represents a 14% increase from the same period last year, as highlighted by the company's strong performance. This growth is supported by a projected revenue increase of 15.4% year-over-year, reaching $2.18 billion. Such positive financial metrics indicate a robust demand for Intuitive Surgical's products and services.

Over the past month, analysts have revised the consensus EPS estimate upward by 0.2%. This revision reflects a positive reassessment of the company's financial health and potential, which can influence investor sentiment and the stock's short-term price performance. Investors will closely watch the earnings release to see if the actual results align with these optimistic projections.

Intuitive Surgical's stock performance is closely tied to its earnings results. A positive earnings surprise could lead to an increase in the stock price, while a miss might result in a decline. The management's discussion during the earnings call will be crucial in evaluating the sustainability of any immediate price changes and future earnings projections.

The company's financial ratios provide additional insights into its valuation. With a price-to-earnings (P/E) ratio of approximately 74.08, investors are willing to pay $74.08 for every dollar of earnings. The price-to-sales ratio stands at about 20.71, and the enterprise value to sales ratio is around 20.47. These figures reflect the company's valuation in relation to its sales and earnings. Additionally, Intuitive Surgical has a strong current ratio of 4.07, indicating its ability to cover short-term liabilities with its short-term assets.

Intuitive Surgical Inc. (NASDAQ: ISRG) Sees Strong Growth with da Vinci Systems

- Intuitive Surgical placed a record 493 da Vinci systems in the fourth quarter of 2024, marking a 19% increase from the previous year.

- The launch of the da Vinci 5 system contributed significantly to a 36.5% increase in System segment sales, reaching $655 million.

- Despite a high P/E ratio of 90.84 and a price-to-sales ratio of 25.93, Intuitive Surgical's strong financial performance and market position indicate potential for future growth.

Intuitive Surgical Inc. (NASDAQ:ISRG) is a leader in robotic-assisted surgery, known for its da Vinci Surgical System. The company has seen significant growth, driven by the strong performance of its da Vinci portfolio. In the fourth quarter of 2024, Intuitive Surgical placed a record 493 systems, a 19% increase from the previous year, highlighting the growing demand for its innovative surgical solutions.

The da Vinci 5 system, launched in March 2024, has been a key driver of this growth, with 174 systems placed in the fourth quarter alone. This system, along with the Ion and SP platforms, has contributed to a 36.5% increase in the System segment’s sales, reaching $655 million. The strong market uptake of these systems underscores Intuitive Surgical's robust market position and the increasing adoption of its technology.

Intuitive Surgical's financial performance in the fourth quarter of 2024 was impressive, with revenues reaching $2.4 billion and adjusted earnings per share of $2.21. These figures surpassed market expectations, driven by an 18% year-over-year increase in global da Vinci procedure volume. The company's revenue growth of 25% year-over-year further highlights its strong market presence and the success of its da Vinci systems.

Despite the positive financial results, ISRG's stock experienced a decline. The stock has a high price-to-earnings (P/E) ratio of 90.84 and a price-to-sales ratio of 25.93, indicating that it may be overvalued compared to its earnings and sales. However, the company's strong liquidity position, with a current ratio of 4.30, provides a buffer against potential financial challenges.

For investors seeking diversification, the High-Quality portfolio, which has consistently outperformed the S&P 500, may be worth considering. Intuitive Surgical's strong fourth-quarter results and the increasing adoption of its da Vinci systems position the company well for future growth, despite the challenges it faces in certain international markets.