Insights from Morgan McGarvey's Trade in Trump Media Stock

- Morgan McGarvey's trade in Trump Media stock (NASDAQ:DJT) occurred during a politically sensitive period, raising questions about the timing.

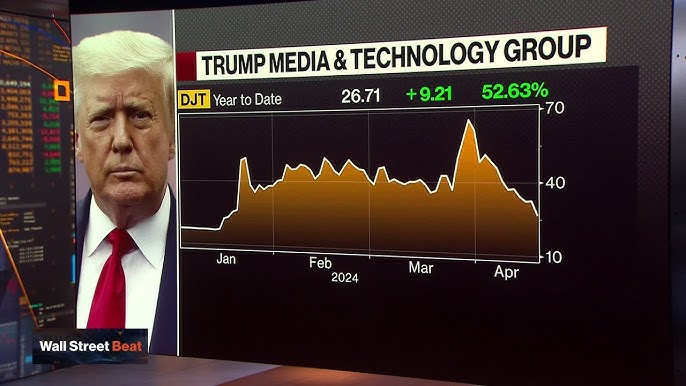

- DJT stock has experienced volatility, with recent performance not matching the post-election rallies seen in other equities.

- The stock's future growth potential is tied to its ability to align with underlying fundamentals amidst insider and institutional sell-offs.

Democratic Representative Morgan McGarvey recently made headlines with a trade involving Trump Media stock (NASDAQ:DJT), a company linked to President-elect Donald Trump. The trade occurred on November 6, 2024, just after the presidential election. This timing was notable as it coincided with provisional results indicating Trump's re-election. McGarvey, known for opposing Trump's policies, claimed the purchase was made without his or his spouse's knowledge and sold the stock two days later at a 7% loss.

DJT stock, currently priced at approximately $37.90, has seen a decrease of about 1.57%, with a $0.60 drop today. The stock has fluctuated between $37.02 and $38.83 during the trading day. Despite a recent rally of over 2% in the past 24 hours, DJT's performance has not matched the significant rallies seen in other equities post-election, with only a 4% increase over the past month.

The stock's performance is heavily influenced by sentiment surrounding Trump, which may not be sustainable long-term. Over the past year, DJT has experienced a high of $79.38 and a low of $11.75. Key insiders and institutional investors have been liquidating their stakes, affecting its price movement. Despite this, DJT's market capitalization stands at approximately $8.22 billion, with a trading volume of 5,678,184 shares, indicating potential for growth if the stock aligns with its underlying fundamentals.

McGarvey's disclosure was part of a series of trades, including transactions in major companies like Nvidia (NASDAQ: NVDA), Tesla (NASDAQ: TSLA), and Shell. Notably, he made a significant investment in Tesla shares just before the election, purchasing them at prices between $232 and $260 per share on October 25, 2024, ahead of a post-election rally.

| Symbol | Price | %chg |

|---|---|---|

| 035420.KS | 267500 | 0 |

| 035720.KS | 65100 | 0 |

| 0700.HK | 629 | 0 |

| 80700.HK | 578 | 0 |

Trump Media Expands into FinTech with Truth.Fi Launch

- Trump Media is venturing into the financial services sector with Truth.Fi, focusing on cryptocurrency and ETFs, in partnership with Charles Schwab.

- The initiative is part of Trump Media's strategy to protect American values and includes crypto-related projects like a meme coin.

- The launch is timely, aligning with a shift in the U.S. government's pro-crypto stance and a more favorable environment for blockchain innovation.

Trump Media, known for its media ventures, is expanding into the financial services and FinTech sector with the launch of Truth.Fi. This platform will focus on cryptocurrency and customized exchange-traded funds (ETFs). It will offer separately managed accounts, ETFs, and bitcoin investments. Charles Schwab will provide advisory services on investments and strategy. Trump Media plans to invest up to $250 million of its $750 million assets with Schwab.

The launch of Truth.Fi aligns with Trump Media's broader strategy to create an ecosystem that protects American patriots from threats like cancellation and censorship. CEO Devin Nunes emphasizes this initiative as part of a series of crypto-related projects, including a meme coin accepted by some Trump-branded product sellers. This move reflects a growing interest in digital assets and their potential to offer financial freedom.

The timing of Truth.Fi's launch coincides with a shift in the White House's stance towards digital asset regulation. The administration is adopting a more pro-crypto approach, influenced by significant corporate donations from crypto companies during the last election. An executive order mandates a comprehensive draft of federal regulations for crypto, exploring a national digital asset stockpile while banning central bank digital currencies (CBDCs).

This change in policy has impacted investment firms, with Andreessen Horowitz closing its U.K. office to focus on the American crypto sector. This reflects a belief that the U.S. is becoming a more favorable environment for blockchain innovation. Trump Media's move into the financial sector with Truth.Fi is timely, as the U.S. becomes more supportive of digital assets.

On the NASDAQ:DJT, the current price is $31.62, showing a slight increase of 0.06% or $0.02. The stock has fluctuated between $31.31 and $31.99 during the trading day. Over the past year, DJT has seen a high of $79.38 and a low of $11.75. The company has a market capitalization of approximately $6.86 billion, with a trading volume of 1,427,705 shares.

Trump Media Expands into FinTech with Truth.Fi Launch

- Trump Media is venturing into the financial services sector with Truth.Fi, focusing on cryptocurrency and ETFs, in partnership with Charles Schwab.

- The initiative is part of Trump Media's strategy to protect American values and includes crypto-related projects like a meme coin.

- The launch is timely, aligning with a shift in the U.S. government's pro-crypto stance and a more favorable environment for blockchain innovation.

Trump Media, known for its media ventures, is expanding into the financial services and FinTech sector with the launch of Truth.Fi. This platform will focus on cryptocurrency and customized exchange-traded funds (ETFs). It will offer separately managed accounts, ETFs, and bitcoin investments. Charles Schwab will provide advisory services on investments and strategy. Trump Media plans to invest up to $250 million of its $750 million assets with Schwab.

The launch of Truth.Fi aligns with Trump Media's broader strategy to create an ecosystem that protects American patriots from threats like cancellation and censorship. CEO Devin Nunes emphasizes this initiative as part of a series of crypto-related projects, including a meme coin accepted by some Trump-branded product sellers. This move reflects a growing interest in digital assets and their potential to offer financial freedom.

The timing of Truth.Fi's launch coincides with a shift in the White House's stance towards digital asset regulation. The administration is adopting a more pro-crypto approach, influenced by significant corporate donations from crypto companies during the last election. An executive order mandates a comprehensive draft of federal regulations for crypto, exploring a national digital asset stockpile while banning central bank digital currencies (CBDCs).

This change in policy has impacted investment firms, with Andreessen Horowitz closing its U.K. office to focus on the American crypto sector. This reflects a belief that the U.S. is becoming a more favorable environment for blockchain innovation. Trump Media's move into the financial sector with Truth.Fi is timely, as the U.S. becomes more supportive of digital assets.

On the NASDAQ:DJT, the current price is $31.62, showing a slight increase of 0.06% or $0.02. The stock has fluctuated between $31.31 and $31.99 during the trading day. Over the past year, DJT has seen a high of $79.38 and a low of $11.75. The company has a market capitalization of approximately $6.86 billion, with a trading volume of 1,427,705 shares.

Trump Media & Technology Group's Market Activity Amid Political Changes

- Trump Media & Technology Group (NASDAQ:DJT) experiences a 10% decline in share prices following political shifts, trading around $36.

- The stock shows resilience with a year-to-date increase, despite falling from January highs above $40 and pre-election peaks over $50.

- Market adjusts with "Trump Trades," showing optimism in certain sectors while cautioning against inflation and specific industries.

Trump Media & Technology Group (NASDAQ:DJT), known for its ownership of the Truth Social platform, is experiencing notable market activity. The company, which has been a focal point for investors due to its association with former President Donald Trump, is navigating a volatile stock environment. Despite recent fluctuations, DJT remains a significant player in the media and technology sector.

In the wake of President Trump's return to office, DJT shares have seen a 10% decline, trading around $36. This drop is part of a broader trend, with prices falling from January highs above $40 and pre-election peaks over $50. However, the stock remains up for the year, significantly above its fall lows, indicating some resilience in the market.

Currently, DJT is priced at $34.39 on the NASDAQ, marking a 2.50% increase or $0.84 gain. The stock has fluctuated between $33.63 and $34.64 today, reflecting ongoing volatility. Over the past year, DJT has seen a high of $79.38 and a low of $11.75, showcasing its dynamic price range.

The market is adjusting to the new administration, with "Trump Trades" emerging. These trades show optimism in oil shares, financial institutions, and companies with pending deals, while caution is observed towards inflation, vaccine manufacturers, and government contractors. U.S. indexes are generally higher, and cryptocurrencies like bitcoin and memecoins are attracting investor interest.

Despite a market capitalization of approximately $7.46 billion and a trading volume of 4,098,895 shares, DJT's stock is a smaller part of the broader market narrative. Analysts from VandaTrack have warned of potential "sell-the-news" actions post-inauguration, suggesting that institutional investors might be using retail traders as exit liquidity, potentially leading to muddled prices.

Trump Media & Technology Group's Market Activity Amid Political Changes

- Trump Media & Technology Group (NASDAQ:DJT) experiences a 10% decline in share prices following political shifts, trading around $36.

- The stock shows resilience with a year-to-date increase, despite falling from January highs above $40 and pre-election peaks over $50.

- Market adjusts with "Trump Trades," showing optimism in certain sectors while cautioning against inflation and specific industries.

Trump Media & Technology Group (NASDAQ:DJT), known for its ownership of the Truth Social platform, is experiencing notable market activity. The company, which has been a focal point for investors due to its association with former President Donald Trump, is navigating a volatile stock environment. Despite recent fluctuations, DJT remains a significant player in the media and technology sector.

In the wake of President Trump's return to office, DJT shares have seen a 10% decline, trading around $36. This drop is part of a broader trend, with prices falling from January highs above $40 and pre-election peaks over $50. However, the stock remains up for the year, significantly above its fall lows, indicating some resilience in the market.

Currently, DJT is priced at $34.39 on the NASDAQ, marking a 2.50% increase or $0.84 gain. The stock has fluctuated between $33.63 and $34.64 today, reflecting ongoing volatility. Over the past year, DJT has seen a high of $79.38 and a low of $11.75, showcasing its dynamic price range.

The market is adjusting to the new administration, with "Trump Trades" emerging. These trades show optimism in oil shares, financial institutions, and companies with pending deals, while caution is observed towards inflation, vaccine manufacturers, and government contractors. U.S. indexes are generally higher, and cryptocurrencies like bitcoin and memecoins are attracting investor interest.

Despite a market capitalization of approximately $7.46 billion and a trading volume of 4,098,895 shares, DJT's stock is a smaller part of the broader market narrative. Analysts from VandaTrack have warned of potential "sell-the-news" actions post-inauguration, suggesting that institutional investors might be using retail traders as exit liquidity, potentially leading to muddled prices.

Trump Media & Technology Group Corp. (NASDAQ: DJT) Stock Volatility Ahead of Inauguration

- The stock of Trump Media & Technology Group Corp. (NASDAQ: DJT) is experiencing volatility as the inauguration of President-elect Donald Trump approaches.

- DJT's stock price has shown significant fluctuations, with a current price of $41, indicating investor uncertainty.

- The company's market capitalization stands at approximately $8.89 billion, with a trading volume of 5,798,100 shares, highlighting active investor interest.

Trump Media & Technology Group Corp. (NASDAQ: DJT) is the company behind the Truth Social social media network. As the inauguration of President-elect Donald Trump nears, DJT's stock is experiencing notable volatility. The stock initially saw a strong upward movement earlier this week, but has since started to decline. This fluctuation is closely tied to the political climate surrounding the upcoming inauguration.

Currently, DJT's stock price on the NASDAQ is $41, marking a slight change of $0.17 or 0.4164% from the previous session. The stock has shown a range of movement today, with a low of $40.01 and a high of $42.85. This indicates a level of uncertainty among investors as they react to the political developments.

Over the past year, DJT has experienced significant highs and lows, with a peak of $79.38 and a low of $11.75. This wide range reflects the stock's volatility and the market's response to various events related to the company and its political associations. The company's market capitalization is approximately $8.89 billion, highlighting its substantial presence in the market.

The trading volume for DJT is 5,798,100 shares, suggesting active investor interest and engagement. This level of trading activity can contribute to the stock's price fluctuations, as investors buy and sell shares in response to news and market conditions. As the inauguration approaches, DJT's stock is likely to continue experiencing volatility.

Trump Media & Technology Group Corp. (NASDAQ: DJT) Stock Volatility Ahead of Inauguration

- The stock of Trump Media & Technology Group Corp. (NASDAQ: DJT) is experiencing volatility as the inauguration of President-elect Donald Trump approaches.

- DJT's stock price has shown significant fluctuations, with a current price of $41, indicating investor uncertainty.

- The company's market capitalization stands at approximately $8.89 billion, with a trading volume of 5,798,100 shares, highlighting active investor interest.

Trump Media & Technology Group Corp. (NASDAQ: DJT) is the company behind the Truth Social social media network. As the inauguration of President-elect Donald Trump nears, DJT's stock is experiencing notable volatility. The stock initially saw a strong upward movement earlier this week, but has since started to decline. This fluctuation is closely tied to the political climate surrounding the upcoming inauguration.

Currently, DJT's stock price on the NASDAQ is $41, marking a slight change of $0.17 or 0.4164% from the previous session. The stock has shown a range of movement today, with a low of $40.01 and a high of $42.85. This indicates a level of uncertainty among investors as they react to the political developments.

Over the past year, DJT has experienced significant highs and lows, with a peak of $79.38 and a low of $11.75. This wide range reflects the stock's volatility and the market's response to various events related to the company and its political associations. The company's market capitalization is approximately $8.89 billion, highlighting its substantial presence in the market.

The trading volume for DJT is 5,798,100 shares, suggesting active investor interest and engagement. This level of trading activity can contribute to the stock's price fluctuations, as investors buy and sell shares in response to news and market conditions. As the inauguration approaches, DJT's stock is likely to continue experiencing volatility.

Trump Media and Technology Group's Stock Volatility Amid Political Developments

- Notable stock volatility is observed in Trump Media and Technology Group (NASDAQ:DJT) due to political statements by President-elect Donald Trump.

- The stock price of DJT is currently $34.30, experiencing a decrease of 2.61% or $0.92.

- Over the past year, DJT's stock has had a high of $79.38 and a low of $11.75, indicating significant market sensitivity to political events.

Trump Media and Technology Group, listed on the NASDAQ as DJT, is experiencing notable stock volatility due to political developments involving President-elect Donald Trump. The company's stock is highly sensitive to Trump's political statements, such as his recent comments on Greenland and the Panama Canal. These events have led to significant fluctuations in DJT's share price.

Currently, DJT's stock price is $34.30, marking a decrease of 2.61% or $0.92. The stock has shown volatility today, with a low of $33.89 and a high of $34.87. This reflects the market's reaction to Trump's political statements, which can cause rapid changes in investor sentiment and stock performance.

Over the past year, DJT's stock has experienced a wide range, reaching a high of $79.38 and a low of $11.75. This indicates the stock's susceptibility to external factors, particularly political events. The company's market capitalization is approximately $7.44 billion, highlighting its significant presence in the market despite the fluctuations.

The trading volume for DJT is 1,051,277 shares, suggesting active investor interest and engagement. This level of trading activity can amplify the stock's sensitivity to political developments, as investors react quickly to news and statements from Trump.