3D Systems Corporation Earnings Preview and Breakthrough in 3D Printing Technology

- 3D Systems Corporation is set to release quarterly earnings with an estimated EPS of -$0.07 and revenue of $108.48 million.

- The company unveils the EXT 800 Titan Pellet, a significant advancement in 3D printing technology aimed at enhancing speed and cost-efficiency in manufacturing.

- The financial impact of the EXT 800 Titan Pellet could be substantial, potentially increasing revenue streams and improving profitability for 3D Systems.

On Monday, June 24, 2024, before the market opens, 3D Systems Corporation (NYSE:DDD) is scheduled to release their quarterly earnings. Wall Street estimates suggest an earnings per share (EPS) of -$0.07. The revenue for the quarter is estimated to be approximately $108.48 million. This earnings report comes at a crucial time for DDD, as the company has recently made significant advancements in 3D printing technology, which could potentially impact its financial performance and market position.

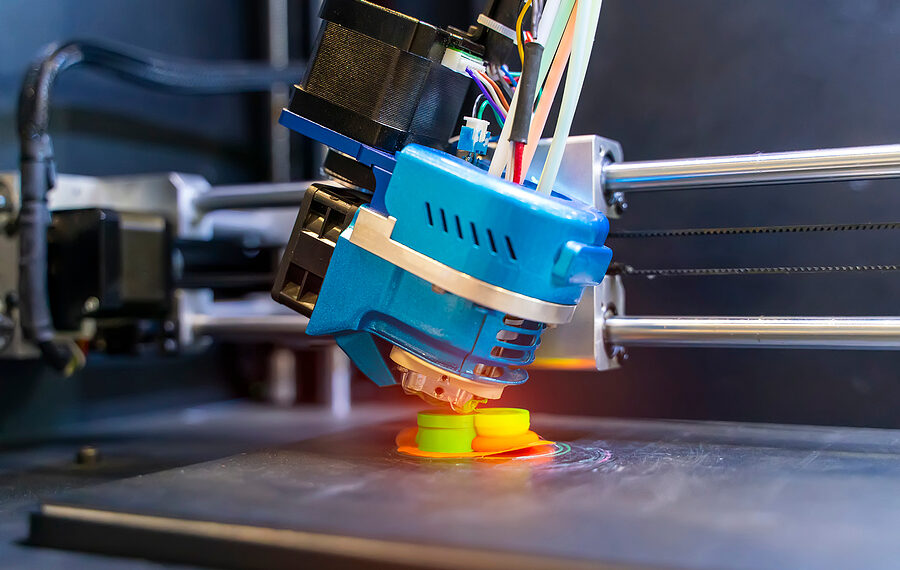

3D Systems has unveiled the EXT 800 Titan Pellet, a major breakthrough in 3D printing technology designed to revolutionize the industry with its enhanced speed and cost-efficiency. This new addition to the company's EXT Titan Pellet systems portfolio is aimed at a wide range of industrial applications, promising to transform manufacturing processes across various sectors. The EXT 800 Titan Pellet is notable for its compact pellet extrusion system, which boasts a build volume of 800 x 600 x 800 mm, combining the speed, reliability, and efficiency of its predecessors into a more compact and cost-effective package.

The introduction of the EXT 800 Titan Pellet is a significant step forward for 3D Systems in expanding its footprint in the 3D Printing industry. It targets diverse manufacturing needs and is capable of producing functional prototypes, tooling, fixtures, and end-use parts for industries such as aerospace, defense, prosthetics, and research. One of the key benefits of this system is its ability to print up to 10 times faster than traditional filament-based systems while also significantly reducing material costs. This makes it an ideal solution for both large shop floors and smaller labs and universities, aiming to streamline their manufacturing processes.

The financial implications of the EXT 800 Titan Pellet for DDD could be substantial. By offering a solution that is up to 10 times faster and reduces material costs by up to 10 times compared to traditional filament-based systems, 3D Systems is positioned to capture a larger market share in the rapidly growing 3D printing industry. This could potentially lead to increased revenue streams and improved profitability in the long term, which would be reflected in future earnings reports.

Currently, the stock of 3D Systems Corporation is trading at $3.52, experiencing a slight decrease of $0.03, which translates to a decline of approximately 0.85%. Today, the shares fluctuated between a low of $3.435 and a high of $3.615. Over the past year, the stock has seen a high of $11.09 and a low of $3.32. With a market capitalization of around $469.69 million, the company's shares are actively traded on the NYSE. The upcoming earnings report and the market's reaction to the new EXT 800 Titan Pellet could provide further insights into the company's financial health and growth prospects.

| Symbol | Price | %chg |

|---|---|---|

| 7751.T | 4433 | 0.43 |

| 005070.KS | 55500 | -1.8 |

| 2382.TW | 300.5 | -1.83 |

| 6669.TW | 4365 | 1.49 |

3D Systems Corporation (NYSE:DDD) Earnings Preview and Financial Health Analysis

- 3D Systems Corporation is set to release its quarterly earnings with an anticipated EPS of -$0.13 and projected revenue of $95.7 million.

- The company showcases a price-to-sales ratio of 0.56 and an enterprise value to sales ratio of 0.39, indicating potential undervalued opportunities for investors.

- Despite facing legal challenges, 3D Systems maintains strong liquidity with a current ratio of 2.79 and a moderate debt-to-equity ratio of 0.43.

3D Systems Corporation, listed on the NYSE under the symbol DDD, is a prominent player in the 3D printing industry. The company specializes in providing 3D printing solutions, including hardware, software, and materials. As a leader in the sector, 3D Systems faces competition from other major companies like Stratasys and HP. On August 11, 2025, DDD is set to release its quarterly earnings, with Wall Street estimating an earnings per share (EPS) of -$0.13 and projected revenue of approximately $95.7 million.

Despite the anticipated negative EPS, 3D Systems maintains a price-to-sales ratio of about 0.56. This suggests that the market values the company's sales at 56 cents for every dollar of sales, which is relatively low. The enterprise value to sales ratio is around 0.39, indicating a low valuation compared to its sales. These metrics may appeal to investors looking for undervalued opportunities in the market.

The company's financial health is further highlighted by its debt-to-equity ratio of approximately 0.43. This reflects a moderate level of debt relative to its equity, suggesting that 3D Systems is not overly reliant on borrowed funds. Additionally, the current ratio of about 2.79 indicates strong liquidity, meaning the company can cover its short-term liabilities nearly 2.8 times over. This financial stability is crucial for navigating potential challenges.

However, 3D Systems is facing legal challenges, as highlighted by Rosen Law Firm. Investors who purchased securities between August 13, 2024, and May 12, 2025, are urged to seek legal counsel due to a securities class action lawsuit. This lawsuit may impact investor sentiment and the company's reputation. Investors interested in joining the class action or serving as the lead plaintiff should act before the deadline of August 12, 2025.

Despite these challenges, 3D Systems continues to operate in a dynamic industry with potential for growth. The company's negative earnings yield and price-to-earnings ratio indicate financial difficulties, but its strong liquidity and moderate debt levels provide a foundation for potential recovery. As the earnings release approaches, investors will be keenly watching for any signs of improvement or further challenges.

3D Systems Corporation (NYSE:DDD) Earnings Preview: Key Financial Insights

- 3D Systems Corporation (NYSE:DDD) is anticipated to report a quarterly EPS of -$0.13 and revenue of approximately $99.46 million.

- The company might exceed Wall Street's earnings estimates, indicating a potential year-over-year increase in earnings despite lower revenues for the quarter ending March 2025.

- Financial metrics such as a price-to-sales ratio of 0.69 and a debt-to-equity ratio of 1.62 provide insights into 3D Systems' valuation and financial health.

3D Systems Corporation, listed as NYSE:DDD, is a prominent player in the 3D printing industry. The company is known for its innovative solutions in 3D printing, catering to various sectors such as healthcare, aerospace, and automotive. As the company prepares to release its quarterly earnings on May 12, 2025, Wall Street anticipates an earnings per share (EPS) of -$0.13 and revenue of approximately $99.46 million.

Despite the projected negative EPS, Zacks Investment Research suggests that 3D Systems might exceed these earnings estimates. The company is expected to report a year-over-year increase in earnings, even though revenues for the quarter ending March 2025 are lower. This potential earnings beat could positively impact the stock's movement, especially if the actual results surpass expectations.

3D Systems' financial metrics provide insight into its valuation and financial health. The price-to-sales ratio of 0.69 indicates that the stock is valued at about 69% of its sales, while the enterprise value to sales ratio of 0.95 suggests the company's total valuation, including debt, is slightly less than its sales. These ratios can help investors assess whether the stock is undervalued or overvalued.

The company's debt-to-equity ratio of 1.62 highlights a higher reliance on debt for financing, with $1.62 in debt for every dollar of equity. However, the current ratio of 3.08 reflects strong short-term financial health, as 3D Systems has over three times more current assets than current liabilities. This suggests the company is well-positioned to meet its short-term obligations.

The upcoming earnings call will be crucial in determining the sustainability of any immediate price changes and future earnings expectations. Management's discussion of business conditions will provide valuable insights into the company's strategy and outlook, influencing investor sentiment and stock performance.

3D Systems Corporation (NYSE:DDD) Earnings Preview: Key Financial Insights

- 3D Systems Corporation (NYSE:DDD) is anticipated to report a quarterly EPS of -$0.13 and revenue of approximately $99.46 million.

- The company might exceed Wall Street's earnings estimates, indicating a potential year-over-year increase in earnings despite lower revenues for the quarter ending March 2025.

- Financial metrics such as a price-to-sales ratio of 0.69 and a debt-to-equity ratio of 1.62 provide insights into 3D Systems' valuation and financial health.

3D Systems Corporation, listed as NYSE:DDD, is a prominent player in the 3D printing industry. The company is known for its innovative solutions in 3D printing, catering to various sectors such as healthcare, aerospace, and automotive. As the company prepares to release its quarterly earnings on May 12, 2025, Wall Street anticipates an earnings per share (EPS) of -$0.13 and revenue of approximately $99.46 million.

Despite the projected negative EPS, Zacks Investment Research suggests that 3D Systems might exceed these earnings estimates. The company is expected to report a year-over-year increase in earnings, even though revenues for the quarter ending March 2025 are lower. This potential earnings beat could positively impact the stock's movement, especially if the actual results surpass expectations.

3D Systems' financial metrics provide insight into its valuation and financial health. The price-to-sales ratio of 0.69 indicates that the stock is valued at about 69% of its sales, while the enterprise value to sales ratio of 0.95 suggests the company's total valuation, including debt, is slightly less than its sales. These ratios can help investors assess whether the stock is undervalued or overvalued.

The company's debt-to-equity ratio of 1.62 highlights a higher reliance on debt for financing, with $1.62 in debt for every dollar of equity. However, the current ratio of 3.08 reflects strong short-term financial health, as 3D Systems has over three times more current assets than current liabilities. This suggests the company is well-positioned to meet its short-term obligations.

The upcoming earnings call will be crucial in determining the sustainability of any immediate price changes and future earnings expectations. Management's discussion of business conditions will provide valuable insights into the company's strategy and outlook, influencing investor sentiment and stock performance.

3D Systems Sinks 15% on Weak Q4 and Slashed 2025 Outlook

3D Systems (NYSE:DDD) saw its shares drop over 15% intra-day today as the company reported a disappointing fourth quarter and issued a 2025 outlook that fell well short of expectations.

The 3D printing firm posted an adjusted loss of $0.19 per share, deeper than the $0.10 loss analysts had forecast, while revenue declined 3% year-over-year to $111 million, missing the $115.6 million consensus.

Looking ahead, 3D Systems expects full-year 2025 revenue between $420 million and $435 million, a guidance range that is significantly below the $462.4 million projected by analysts, fueling investor concern over the company’s growth trajectory.

The results reflect continued pressure on capital spending across its customer base, particularly in the Healthcare Solutions segment, which saw sales decline 21% to $40.4 million. Meanwhile, the Industrial Solutions division delivered an 11% increase, reaching $70.7 million, providing a modest offset.

In response to ongoing financial challenges, the company announced a cost-cutting initiative targeting over $50 million in annualized savings, with reductions to be implemented through the remainder of 2025 and into the first half of 2026. Management aims to reach break-even adjusted EBITDA by the fourth quarter of next year, positioning the company for improved profitability despite top-line headwinds.

3D Systems Sinks 15% on Weak Q4 and Slashed 2025 Outlook

3D Systems (NYSE:DDD) saw its shares drop over 15% intra-day today as the company reported a disappointing fourth quarter and issued a 2025 outlook that fell well short of expectations.

The 3D printing firm posted an adjusted loss of $0.19 per share, deeper than the $0.10 loss analysts had forecast, while revenue declined 3% year-over-year to $111 million, missing the $115.6 million consensus.

Looking ahead, 3D Systems expects full-year 2025 revenue between $420 million and $435 million, a guidance range that is significantly below the $462.4 million projected by analysts, fueling investor concern over the company’s growth trajectory.

The results reflect continued pressure on capital spending across its customer base, particularly in the Healthcare Solutions segment, which saw sales decline 21% to $40.4 million. Meanwhile, the Industrial Solutions division delivered an 11% increase, reaching $70.7 million, providing a modest offset.

In response to ongoing financial challenges, the company announced a cost-cutting initiative targeting over $50 million in annualized savings, with reductions to be implemented through the remainder of 2025 and into the first half of 2026. Management aims to reach break-even adjusted EBITDA by the fourth quarter of next year, positioning the company for improved profitability despite top-line headwinds.

Lake Street Reaffirms Buy Rating and $4 Target for 3D Systems Amid Improving Additive Manufacturing Outlook

Lake Street Capital Markets analysts maintained a Buy rating and a $4 price target on 3D Systems (NYSE:DDD), citing improving prospects for the additive manufacturing sector despite lingering challenges.

The analysts noted that while the sector benefits from favorable tailwinds, broader economic concerns, including recessionary pressures and tight lending conditions, have extended longer than anticipated, causing delays in system purchase decisions. However, the analysts highlighted a more optimistic outlook for the industry, supported by expected interest rate cuts and the potential for a pro-U.S. manufacturing administration following the upcoming election.

These factors were seen as contributing to a progressively positive environment for additive manufacturing, reaffirming the Buy rating and $4 target as 3D Systems positions itself to capitalize on improving industry conditions.

Lake Street Reaffirms Buy Rating and $4 Target for 3D Systems Amid Improving Additive Manufacturing Outlook

Lake Street Capital Markets analysts maintained a Buy rating and a $4 price target on 3D Systems (NYSE:DDD), citing improving prospects for the additive manufacturing sector despite lingering challenges.

The analysts noted that while the sector benefits from favorable tailwinds, broader economic concerns, including recessionary pressures and tight lending conditions, have extended longer than anticipated, causing delays in system purchase decisions. However, the analysts highlighted a more optimistic outlook for the industry, supported by expected interest rate cuts and the potential for a pro-U.S. manufacturing administration following the upcoming election.

These factors were seen as contributing to a progressively positive environment for additive manufacturing, reaffirming the Buy rating and $4 target as 3D Systems positions itself to capitalize on improving industry conditions.