Bilibili Inc. (NASDAQ:BILI) Q2 Financial Performance Highlights

- Bilibili Inc. (NASDAQ:BILI) reported a Q2 loss of $0.09 per share, beating the Zacks Consensus Estimate by $0.01.

- The company showcased a significant revenue of approximately $6.13 billion, indicating a strong business model.

- Despite a net income loss of around $609 million, Bilibili's strategic investments in content and technology highlight its growth potential.

Bilibili Inc. (NASDAQ:BILI), a prominent player in the Chinese online entertainment sector, recently disclosed its financial outcomes for the second quarter, showcasing a loss of $0.09 per share. This figure slightly outperformed the expectations set by the Zacks Consensus Estimate, which had predicted a loss of $0.10 per share. This performance is a notable improvement compared to the same period last year, where Bilibili reported a loss of $0.33 per share. Such an improvement is a clear indicator of Bilibili's strengthening financial health and its potential trajectory towards profitability.

The company's financial report highlighted a quarterly revenue of approximately $6.13 billion, underlining a robust business model despite the reported losses. This revenue figure is crucial as it demonstrates Bilibili's ability to generate significant sales from its diverse range of services, including mobile gaming, live broadcasting, and video hosting. The gross profit of about $1.83 billion further emphasizes the company's efficient cost management and operational effectiveness.

However, Bilibili faced a net income loss of around $609 million and an operating income loss of approximately $585 million. These figures, although indicative of current financial challenges, must be viewed in the context of the company's growth strategy and investment in content and technology to capture a larger market share. The reported EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of roughly $97.46 million provides a glimpse into the company's underlying operational performance, excluding non-cash expenses and tax considerations.

The cost of revenue, standing at about $4.29 billion, reflects the significant investment Bilibili makes in content creation and licensing, a critical component of its business model. Despite these substantial costs, the company's strategic focus on content diversification and user engagement continues to drive its revenue growth. The earnings per share (EPS) of -1.46, although indicating a loss, must be interpreted in the light of the company's long-term growth potential and ongoing investments in expanding its user base and content portfolio.

In summary, Bilibili's latest financial report reveals a company in the midst of a strategic expansion, investing heavily in content and technology to solidify its position in the competitive online entertainment industry. Despite the reported losses, the positive trend in its financial performance and the substantial revenue generation point towards a promising future for Bilibili as it continues to evolve and adapt in a rapidly changing digital landscape.

| Symbol | Price | %chg |

|---|---|---|

| 7974.T | 13045 | 0 |

| 259960.KS | 276000 | 0 |

| 251270.KS | 54100 | 0 |

| 036570.KS | 220500 | 0 |

Bilibili Inc. (NASDAQ:BILI) Financial Performance Overview

- Bilibili reported an EPS of $0.18, surpassing the estimated $0.17, indicating a positive surprise for investors.

- The company's revenue of approximately $1.02 billion fell short of the estimated $7.33 billion, highlighting a significant gap in anticipated sales performance.

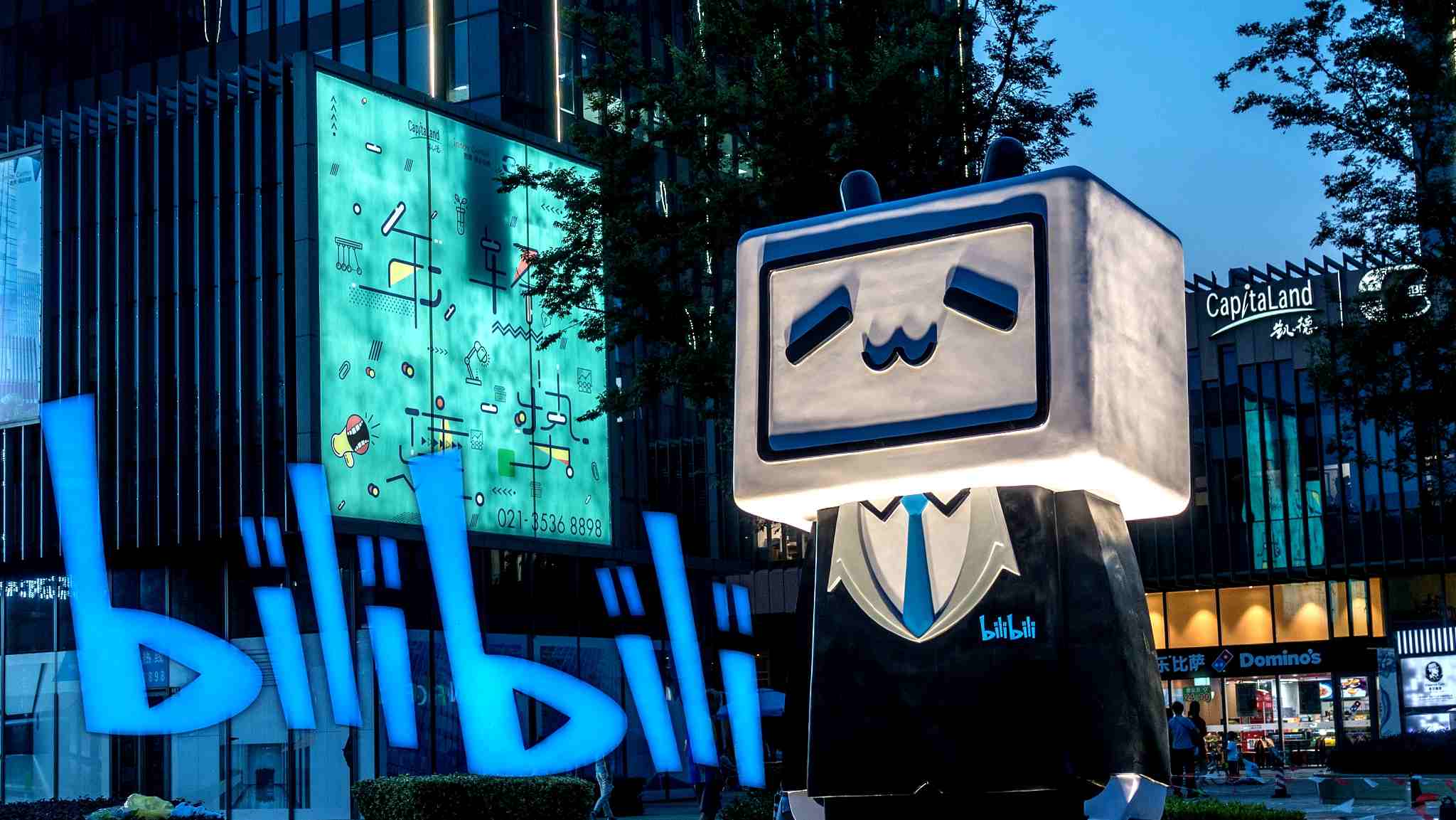

Bilibili Inc. (NASDAQ:BILI) is a leading video community platform in China, catering primarily to young audiences. The company is listed on both the Nasdaq and the Hong Kong Stock Exchange, and it has established itself as a significant player in the digital entertainment sector. Bilibili's financial performance is closely watched by investors, given its influence in the market.

On August 21, 2025, Bilibili reported earnings per share (EPS) of $0.18, slightly above the estimated $0.17. This indicates a positive surprise for investors, as the company managed to exceed expectations. However, the revenue of approximately $1.02 billion fell short of the estimated $7.33 billion, highlighting a significant gap in anticipated sales performance.

Bilibili's price-to-sales ratio is about 2.69, showing that investors are willing to pay $2.69 for every dollar of sales. The enterprise value to sales ratio is slightly lower at 2.54, reflecting the company's valuation, including its debt. This suggests that while the company is valued for its sales potential, its debt is a factor in its overall valuation.

The company's debt-to-equity ratio is approximately 0.37, indicating a moderate level of debt compared to its equity. This suggests that Bilibili is managing its debt levels reasonably well. Additionally, the current ratio of about 1.36 shows that the company has enough liquidity to cover its short-term liabilities, providing some financial stability amidst its earnings challenges.

Bilibili Rallies 6% After Strong Q1 Beat on Earnings, Revenue, and User Growth

Bilibili (NASDAQ:BILI) surged over 6% intra-day today after reporting first-quarter results that exceeded expectations across the board, fueled by robust user engagement and accelerating revenue from advertising and mobile gaming.

The Chinese video-sharing platform posted earnings per share of RMB0.85, handily beating the RMB0.52 analyst forecast. Revenue jumped 24% year-over-year to RMB7 billion, also topping the RMB6.91 billion consensus.

User metrics reached new highs, with daily active users (DAUs) climbing to 107 million and monthly active users (MAUs) rising to 368 million, signaling continued platform momentum.

Advertising revenue grew 20% to RMB2 billion (US$275.3 million), while mobile gaming revenue soared 76% to RMB1.73 billion (US$238.6 million), reflecting successful game launches and monetization improvements.

Bilibili Inc. (NASDAQ:BILI) Q2 Financial Performance Highlights

- Bilibili Inc. (NASDAQ:BILI) reported a Q2 loss of $0.09 per share, beating the Zacks Consensus Estimate by $0.01.

- The company showcased a significant revenue of approximately $6.13 billion, indicating a strong business model.

- Despite a net income loss of around $609 million, Bilibili's strategic investments in content and technology highlight its growth potential.

Bilibili Inc. (NASDAQ:BILI), a prominent player in the Chinese online entertainment sector, recently disclosed its financial outcomes for the second quarter, showcasing a loss of $0.09 per share. This figure slightly outperformed the expectations set by the Zacks Consensus Estimate, which had predicted a loss of $0.10 per share. This performance is a notable improvement compared to the same period last year, where Bilibili reported a loss of $0.33 per share. Such an improvement is a clear indicator of Bilibili's strengthening financial health and its potential trajectory towards profitability.

The company's financial report highlighted a quarterly revenue of approximately $6.13 billion, underlining a robust business model despite the reported losses. This revenue figure is crucial as it demonstrates Bilibili's ability to generate significant sales from its diverse range of services, including mobile gaming, live broadcasting, and video hosting. The gross profit of about $1.83 billion further emphasizes the company's efficient cost management and operational effectiveness.

However, Bilibili faced a net income loss of around $609 million and an operating income loss of approximately $585 million. These figures, although indicative of current financial challenges, must be viewed in the context of the company's growth strategy and investment in content and technology to capture a larger market share. The reported EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of roughly $97.46 million provides a glimpse into the company's underlying operational performance, excluding non-cash expenses and tax considerations.

The cost of revenue, standing at about $4.29 billion, reflects the significant investment Bilibili makes in content creation and licensing, a critical component of its business model. Despite these substantial costs, the company's strategic focus on content diversification and user engagement continues to drive its revenue growth. The earnings per share (EPS) of -1.46, although indicating a loss, must be interpreted in the light of the company's long-term growth potential and ongoing investments in expanding its user base and content portfolio.

In summary, Bilibili's latest financial report reveals a company in the midst of a strategic expansion, investing heavily in content and technology to solidify its position in the competitive online entertainment industry. Despite the reported losses, the positive trend in its financial performance and the substantial revenue generation point towards a promising future for Bilibili as it continues to evolve and adapt in a rapidly changing digital landscape.

Bilibili Started With Buy Rating at Mizuho Securities

Mizuho analysts initiated a Buy rating for Bilibili (NASDAQ:BILI) with an $18 price target, citing the company's potential to more than double its total addressable market through product transitions.

The analysts anticipate Bilibili to accelerate its revenue growth to double digits and achieve profitability by fiscal 2024. The analysts also highlighted Bilibili's efforts in enhancing ad monetization and expanding into live streaming.

Despite Bilibili's stock dropping 43% in 2023, Fang finds the valuation compelling, noting it trades at a similar EBITDA multiple to peers but with a 50% faster estimated revenue growth rate from 2023 to 2026.

Bilibili Started With Buy Rating at Mizuho Securities

Mizuho analysts initiated a Buy rating for Bilibili (NASDAQ:BILI) with an $18 price target, citing the company's potential to more than double its total addressable market through product transitions.

The analysts anticipate Bilibili to accelerate its revenue growth to double digits and achieve profitability by fiscal 2024. The analysts also highlighted Bilibili's efforts in enhancing ad monetization and expanding into live streaming.

Despite Bilibili's stock dropping 43% in 2023, Fang finds the valuation compelling, noting it trades at a similar EBITDA multiple to peers but with a 50% faster estimated revenue growth rate from 2023 to 2026.