Atkore Inc. (NYSE: ATKR) Financial Overview and Stock Sale by Executive

- Atkore Inc. (NYSE:ATKR) reported quarterly earnings of $1.63 per share, beating estimates but showing a decrease from the previous year.

- The company's revenue was $661.6 million for the quarter, missing estimates and showing a decline from the previous year.

- Atkore's valuation metrics indicate a low market valuation with a P/E ratio of 6.34 and strong cash generation ability with an enterprise value to operating cash flow ratio of 6.46.

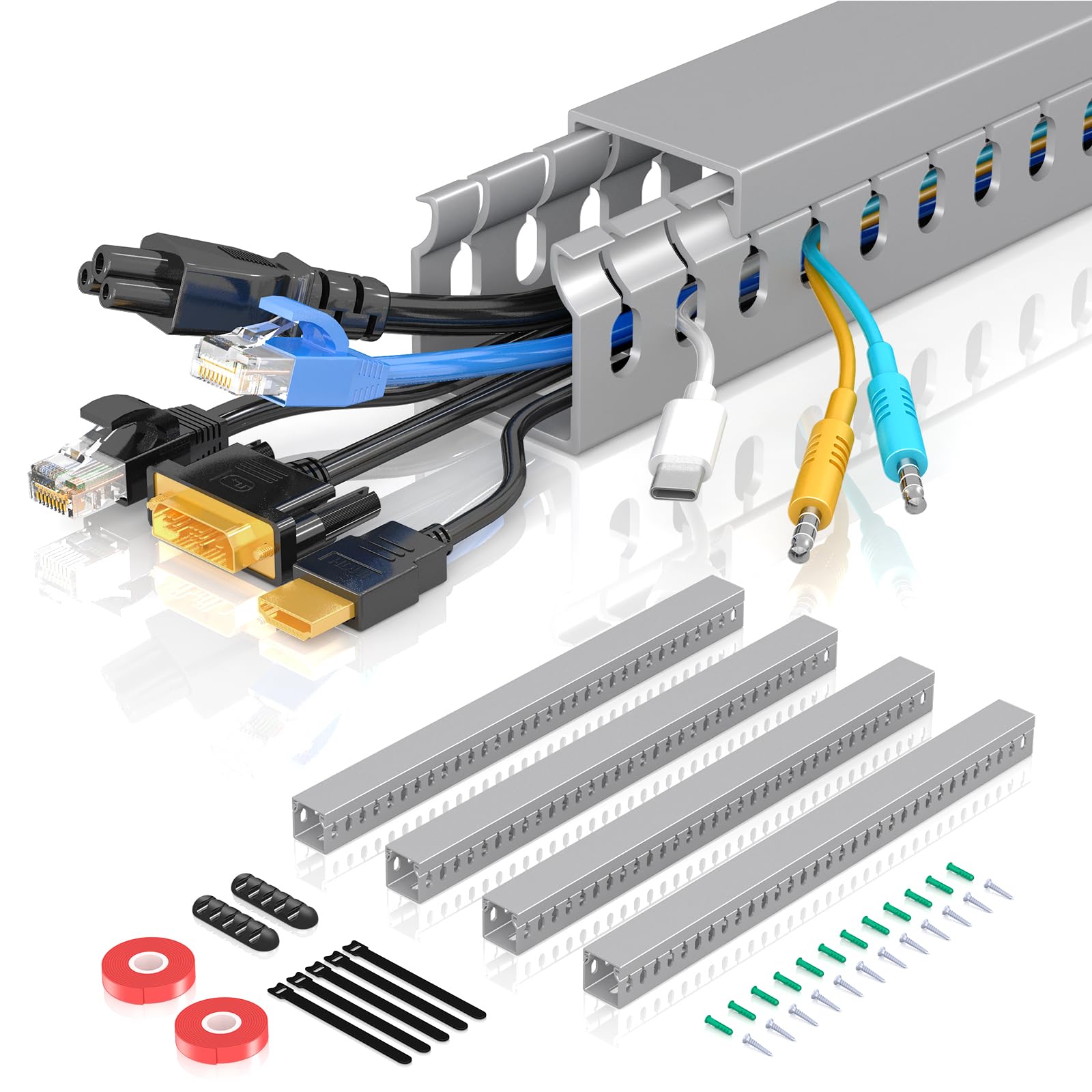

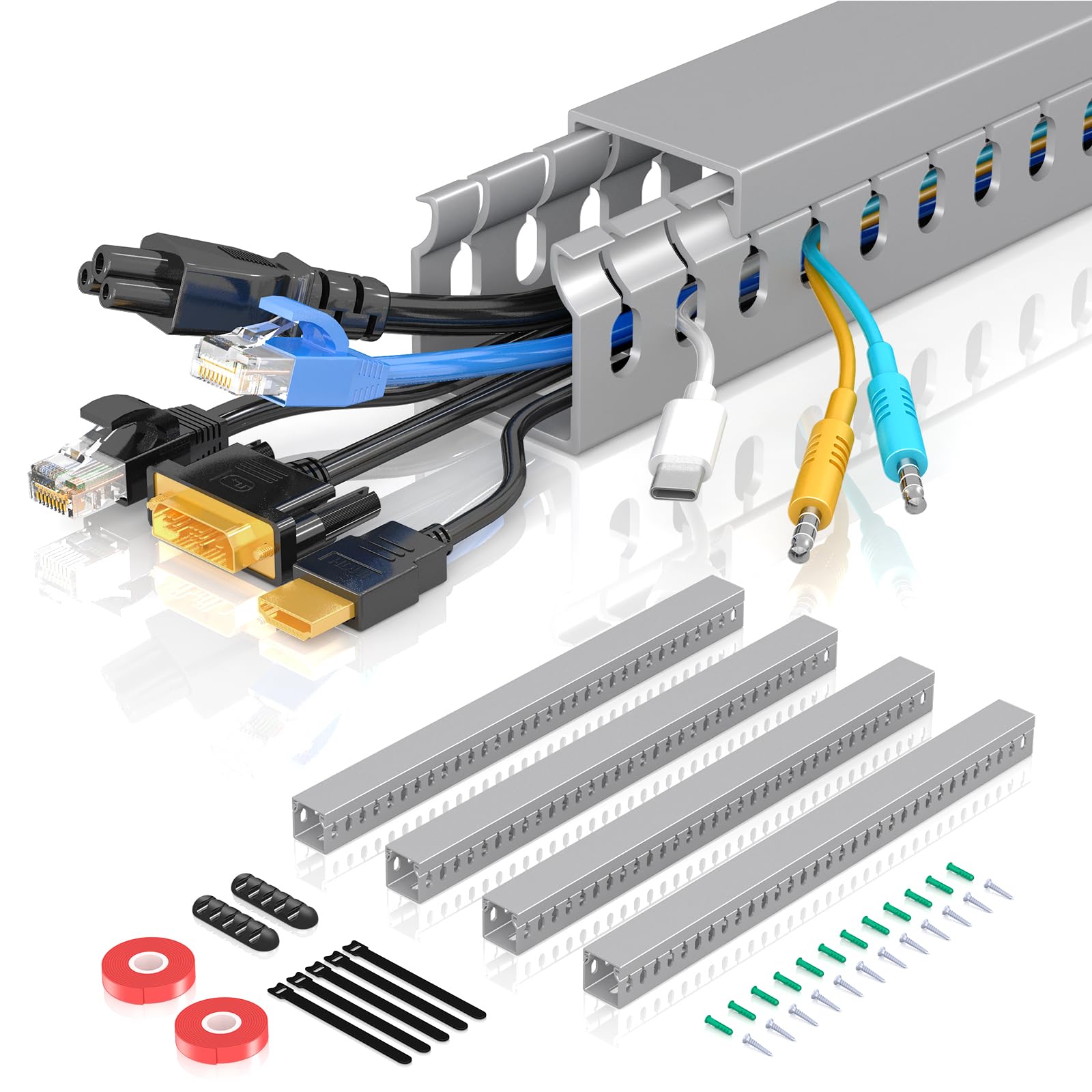

Atkore Inc. (NYSE:ATKR), a leading manufacturer of electrical raceway products, primarily serves the construction and industrial markets. The company operates in the Zacks Wire and Cable Products industry, competing with other key players in the sector. On February 10, 2025, Mark F. Lamps, President of Safety & Infrastructure at ATKR, sold 500 shares of the company's common stock at $65 each. This transaction, classified as an S-Sale, leaves Lamps with approximately 33,760 shares of ATKR.

Atkore's recent financial performance shows mixed results. The company reported quarterly earnings of $1.63 per share, surpassing the Zacks Consensus Estimate of $1.50, resulting in an earnings surprise of 8.67%. However, this is a significant decrease from the $4.12 per share reported in the same quarter a year ago. Despite this decline, the company has exceeded consensus EPS estimates twice in the last four quarters.

Revenue for the quarter ending December 2024 was $661.6 million, falling short of the Zacks Consensus Estimate by 2.52% and down from $798.48 million in the previous year. Despite this, Atkore's President and CEO, Bill Waltz, highlighted a mid-single-digit increase in net sales from their metal framing, cable management, and construction services product areas. Waltz remains optimistic about continued momentum in these segments over the next three quarters.

Atkore's valuation metrics suggest a relatively low market valuation. The company's price-to-earnings (P/E) ratio is approximately 6.34, and its price-to-sales ratio is about 0.78. The enterprise value to sales ratio is 0.98, slightly higher when considering debt and cash. The enterprise value to operating cash flow ratio is around 6.46, indicating a strong cash generation ability relative to its valuation.

The company's financial health is further supported by an earnings yield of approximately 15.76%, a debt-to-equity ratio of 0.61, and a current ratio of 3.03. These figures indicate a moderate level of debt, strong liquidity, and potential returns for investors. Atkore remains focused on executing its strategy and investing in growth initiatives, particularly in water and global construction services.

| Symbol | Price | %chg |

|---|---|---|

| 267260.KS | 875000 | 0.8 |

| 247540.KQ | 158000 | 0.06 |

| 010120.KS | 462500 | 2.38 |

| 6503.T | 4374 | 3.06 |

Atkore Inc. (NYSE:ATKR) Faces Investigation Amidst Stock Sale and Earnings Report

- Mark F. Lamps sold 1,000 shares of Atkore at $69.16 each, with the stock price currently at $67.96.

- Bronstein, Gewirtz & Grossman, LLC is investigating potential claims of corporate misconduct on behalf of Atkore shareholders.

- Atkore's Q2 2025 earnings report showed earnings of $2.04 per share and revenue of $701.73 million, indicating a decline from the previous year.

Atkore Inc. (NYSE:ATKR) is a leading manufacturer of electrical products and mechanical products for the construction and industrial markets. The company operates in the Wire and Cable Products industry and is known for its comprehensive range of products that include electrical raceway solutions, mechanical products, and safety infrastructure solutions. Atkore's competitors include companies like Southwire and Encore Wire.

On May 9, 2025, Mark F. Lamps, President of Safety & Infrastructure at Atkore, sold 1,000 shares of the company's common stock at $69.16 each. This transaction leaves Lamps with approximately 32,828 shares. The sale comes at a time when Atkore's stock price is $67.96, reflecting a 1.05% decrease. The stock has fluctuated between $67.81 and $69.81 today.

Bronstein, Gewirtz & Grossman, LLC is investigating potential claims on behalf of Atkore shareholders. The focus is on possible corporate misconduct by Atkore and its officers. Shareholders who bought securities before August 2, 2022, are encouraged to participate. The firm operates on a contingency fee basis, meaning no upfront costs for participants.

Atkore's Q2 2025 earnings call on May 6, 2025, featured key executives and analysts. The company reported earnings of $2.04 per share, slightly below the Zacks Consensus Estimate of $2.05. This is a significant drop from $4.08 per share in the same quarter last year, marking a negative surprise of 0.49%.

Revenue for the quarter ending March 2025 was $701.73 million, surpassing the Zacks Consensus Estimate by 0.26%. However, this is a decline from $792.91 million in the same period last year. Atkore has exceeded consensus revenue estimates twice in the last four quarters, indicating some volatility in its financial performance.

Atkore Inc. (NYSE:ATKR) Faces Investigation Amidst Stock Sale and Earnings Report

- Mark F. Lamps sold 1,000 shares of Atkore at $69.16 each, with the stock price currently at $67.96.

- Bronstein, Gewirtz & Grossman, LLC is investigating potential claims of corporate misconduct on behalf of Atkore shareholders.

- Atkore's Q2 2025 earnings report showed earnings of $2.04 per share and revenue of $701.73 million, indicating a decline from the previous year.

Atkore Inc. (NYSE:ATKR) is a leading manufacturer of electrical products and mechanical products for the construction and industrial markets. The company operates in the Wire and Cable Products industry and is known for its comprehensive range of products that include electrical raceway solutions, mechanical products, and safety infrastructure solutions. Atkore's competitors include companies like Southwire and Encore Wire.

On May 9, 2025, Mark F. Lamps, President of Safety & Infrastructure at Atkore, sold 1,000 shares of the company's common stock at $69.16 each. This transaction leaves Lamps with approximately 32,828 shares. The sale comes at a time when Atkore's stock price is $67.96, reflecting a 1.05% decrease. The stock has fluctuated between $67.81 and $69.81 today.

Bronstein, Gewirtz & Grossman, LLC is investigating potential claims on behalf of Atkore shareholders. The focus is on possible corporate misconduct by Atkore and its officers. Shareholders who bought securities before August 2, 2022, are encouraged to participate. The firm operates on a contingency fee basis, meaning no upfront costs for participants.

Atkore's Q2 2025 earnings call on May 6, 2025, featured key executives and analysts. The company reported earnings of $2.04 per share, slightly below the Zacks Consensus Estimate of $2.05. This is a significant drop from $4.08 per share in the same quarter last year, marking a negative surprise of 0.49%.

Revenue for the quarter ending March 2025 was $701.73 million, surpassing the Zacks Consensus Estimate by 0.26%. However, this is a decline from $792.91 million in the same period last year. Atkore has exceeded consensus revenue estimates twice in the last four quarters, indicating some volatility in its financial performance.

Atkore Inc. (NYSE: ATKR) Financial Overview and Market Position

- Atkore reported earnings per share (EPS) of $2.04, slightly below estimates but showcased revenue growth with $701.7 million, surpassing expectations.

- The company's price-to-earnings (P/E) ratio of 6.11 and price-to-sales ratio of 0.75 indicate a potentially attractive valuation for investors.

- Atkore demonstrates strong financial health with a debt-to-equity ratio of 0.63 and a current ratio of 3.03, indicating good short-term financial stability.

Atkore Inc. (NYSE: ATKR) is a leading manufacturer of electrical products and solutions, operating in a competitive market alongside companies like Eaton Corporation and Schneider Electric. The company's diverse portfolio has been a key strength, allowing it to effectively navigate dynamic market conditions.

On May 6, 2025, Atkore reported EPS of $2.04, slightly below the estimated $2.05. Despite this minor miss, the company's revenue reached approximately $701.7 million, surpassing the estimated $697.7 million. This revenue growth is supported by a 5% year-over-year increase in organic volume, as highlighted by Atkore's President and CEO, Bill Waltz.

Atkore's financial metrics indicate a strong position in the market. The company's price-to-earnings (P/E) ratio of 6.11 suggests a relatively low valuation compared to its earnings, making it potentially attractive to value investors. The price-to-sales ratio of 0.75 indicates that investors are paying 75 cents for every dollar of sales, which is considered favorable.

The enterprise value to sales ratio of 0.96 reflects Atkore's total valuation relative to its sales, while the enterprise value to operating cash flow ratio of 6.32 shows how many times the operating cash flow can cover the enterprise value. These metrics suggest that Atkore is efficiently managing its resources and generating cash flow.

Atkore's financial health is further supported by a debt-to-equity ratio of 0.63, indicating a moderate level of debt compared to equity. The company's strong current ratio of 3.03 demonstrates its ability to cover current liabilities with current assets, ensuring good short-term financial stability. The earnings yield of 16.36% represents a solid return on investment for shareholders.

Atkore Inc. (NYSE: ATKR) Financial Overview and Market Position

- Atkore reported earnings per share (EPS) of $2.04, slightly below estimates but showcased revenue growth with $701.7 million, surpassing expectations.

- The company's price-to-earnings (P/E) ratio of 6.11 and price-to-sales ratio of 0.75 indicate a potentially attractive valuation for investors.

- Atkore demonstrates strong financial health with a debt-to-equity ratio of 0.63 and a current ratio of 3.03, indicating good short-term financial stability.

Atkore Inc. (NYSE: ATKR) is a leading manufacturer of electrical products and solutions, operating in a competitive market alongside companies like Eaton Corporation and Schneider Electric. The company's diverse portfolio has been a key strength, allowing it to effectively navigate dynamic market conditions.

On May 6, 2025, Atkore reported EPS of $2.04, slightly below the estimated $2.05. Despite this minor miss, the company's revenue reached approximately $701.7 million, surpassing the estimated $697.7 million. This revenue growth is supported by a 5% year-over-year increase in organic volume, as highlighted by Atkore's President and CEO, Bill Waltz.

Atkore's financial metrics indicate a strong position in the market. The company's price-to-earnings (P/E) ratio of 6.11 suggests a relatively low valuation compared to its earnings, making it potentially attractive to value investors. The price-to-sales ratio of 0.75 indicates that investors are paying 75 cents for every dollar of sales, which is considered favorable.

The enterprise value to sales ratio of 0.96 reflects Atkore's total valuation relative to its sales, while the enterprise value to operating cash flow ratio of 6.32 shows how many times the operating cash flow can cover the enterprise value. These metrics suggest that Atkore is efficiently managing its resources and generating cash flow.

Atkore's financial health is further supported by a debt-to-equity ratio of 0.63, indicating a moderate level of debt compared to equity. The company's strong current ratio of 3.03 demonstrates its ability to cover current liabilities with current assets, ensuring good short-term financial stability. The earnings yield of 16.36% represents a solid return on investment for shareholders.

Atkore Inc. (NYSE: ATKR) Financial Overview and Stock Sale by Executive

- Atkore Inc. (NYSE:ATKR) reported quarterly earnings of $1.63 per share, beating estimates but showing a decrease from the previous year.

- The company's revenue was $661.6 million for the quarter, missing estimates and showing a decline from the previous year.

- Atkore's valuation metrics indicate a low market valuation with a P/E ratio of 6.34 and strong cash generation ability with an enterprise value to operating cash flow ratio of 6.46.

Atkore Inc. (NYSE:ATKR), a leading manufacturer of electrical raceway products, primarily serves the construction and industrial markets. The company operates in the Zacks Wire and Cable Products industry, competing with other key players in the sector. On February 10, 2025, Mark F. Lamps, President of Safety & Infrastructure at ATKR, sold 500 shares of the company's common stock at $65 each. This transaction, classified as an S-Sale, leaves Lamps with approximately 33,760 shares of ATKR.

Atkore's recent financial performance shows mixed results. The company reported quarterly earnings of $1.63 per share, surpassing the Zacks Consensus Estimate of $1.50, resulting in an earnings surprise of 8.67%. However, this is a significant decrease from the $4.12 per share reported in the same quarter a year ago. Despite this decline, the company has exceeded consensus EPS estimates twice in the last four quarters.

Revenue for the quarter ending December 2024 was $661.6 million, falling short of the Zacks Consensus Estimate by 2.52% and down from $798.48 million in the previous year. Despite this, Atkore's President and CEO, Bill Waltz, highlighted a mid-single-digit increase in net sales from their metal framing, cable management, and construction services product areas. Waltz remains optimistic about continued momentum in these segments over the next three quarters.

Atkore's valuation metrics suggest a relatively low market valuation. The company's price-to-earnings (P/E) ratio is approximately 6.34, and its price-to-sales ratio is about 0.78. The enterprise value to sales ratio is 0.98, slightly higher when considering debt and cash. The enterprise value to operating cash flow ratio is around 6.46, indicating a strong cash generation ability relative to its valuation.

The company's financial health is further supported by an earnings yield of approximately 15.76%, a debt-to-equity ratio of 0.61, and a current ratio of 3.03. These figures indicate a moderate level of debt, strong liquidity, and potential returns for investors. Atkore remains focused on executing its strategy and investing in growth initiatives, particularly in water and global construction services.

Atkore Reports Q2 EPS Beat But Revenues Miss Estimates

Atkore Inc (NYSE:ATKR) reported its Q2 earnings results on Tuesday, with EPS of $4.87 coming in better than the Street estimate of $4.27. However, revenue of $895.9 million missed the Street estimate of $909.38 million.

Analysts at RBC Capital said they remain positive on the story and attribute the tepid stock reaction to (1) while completely as expected, the optics of year-over-year declines in pricing/revenues/earnings are not inspiring, (2) there is still no clarity on normalized earnings, (3) slowing in the second derivative of outsized beats/guidance boosts.

Analysts lowered their price target to $163 from $177 while maintaining their Outperform rating.