ASML Holding N.V. (ASML) on Q4 2021 Results - Earnings Call Transcript

Operator: Thank you for standing by. Welcome to the ASML Q4 and Full Year 2021 Financial Results. Throughout today’s introduction, all participants will be in listen-only mode and after ASML’s introduction, there will be an opportunity to ask question. I would now like you to turn over to the conference call over to Mr. Skip Miller. Please go ahead, sir. Skip Miller: Thank you, Operator. Welcome, everyone. This is Skip Miller, Vice President of Investor Relations at ASML. Joining me today on the call are ASML’s CEO, Peter Wennink; and our CFO, Roger Dassen. The subject of today’s call is ASML’s 2021 fourth quarter and full year results. The length of this call will be 60 minutes and questions will be taken in the order that they are received. This call is also being broadcast live over the Internet at asml.com. A transcript of management’s opening remarks and a replay of the call will be available on our website shortly following the conclusion of this call. Before we begin, I’d like to just caution listeners that comments made by management during this conference call will include forward-looking statements within the meaning of the federal securities laws. These forward-looking statements involve material risks and uncertainties. For a discussion of risk factors, I encourage you to review the Safe Harbor statement contained in today’s press release and presentation found on our website at asml.com and in ASML’s annual report on Form 20-F and other documents as filed with the Securities and Exchange Commission. With that, I’d like to turn the call over to Peter Wennink for a brief introduction. Peter Wennink: Thank you, Skip. Welcome, everyone, and thank you for joining us for our fourth quarter and full year 2021 results conference call. Of course, I hope all of you and your families are still healthy and safe. Before we begin the Q&A session, Roger and I would like to provide an overview and some commentary on the fourth quarter and the full year 2021, and as well as provide our view of the coming quarters. And Roger will start with a review of our fourth quarter and full year 2021 financial performance with some added comments on our short-term outlook and I will complete the introduction with some additional comments on the current business environment and on our future business outlook. Over to you, Roger. Roger Dassen: Thank you, Peter, and welcome, everyone. I will first review the fourth quarter and full year financial accomplishments, and then provide guidance on the first quarter of 2022. Net sales came in within guidance at €5 billion. The effects of the logistics center startup and supply chain issues communicated during our Q3 results is a bit longer than expected to resolve, affecting some deep UV shipments in Q4. In order to address our customers’ need for additional capacity we completed an increased number of productivity upgrades in Q4 as a way to provide them with incremental productivity enhancement. We shipped 12 EUV systems and recognized €1.6 billion of revenue from 11 EUV systems this quarter. Net system sales of €3.5 billion was again more weighted towards Logic at 73% with the remaining 27% from Memory. Installed Base Management sales for the quarter came in at €1.5 billion, significantly above guidance, primarily due to the software upgrade. As just mentioned, in the strong demand environment, customers continue to use productivity upgrades to increase output of their installed base. Gross margin for the quarter was 54.2% and was above guidance, primarily driven by higher software productivity upgrades. On operating expenses, R&D expenses came in at €681 million and SG&A expenses at €203 million, which was slightly above guidance. In Q4, we had other income of €214 million related to the sale of the non-semiconductor businesses of Berliner Glas. Net income in Q4 was €1.8 billion, representing 35.6% of net sales and resulting in an EPS of €4.39. Turning to the balance sheet, we ended the fourth quarter with cash, cash equivalents and short-term investments at a level of €7.6 billion. Moving to the order book, Q4 net system bookings came in at €7.1 billion, including €2.6 billion for 0.33 NA EUV systems and €1.55 NAV system and EXE:5000 systems. Order intake was strong from both deep UV and EUV, largely driven by Logic, with 77% of the bookings and Memory accounted for the remaining 23%. For the full year, net sales grew 33% to €18.6 billion. EUV system sales in 2021 was €6.3 billion, which is a 41% increase from last year. We achieved 50% EUV growth margin systems on the systems in 2021 and continue to improve EUV service margin. Non-EUV system sales in 2021 was €7.4 billion, which is a 26% increase from last year. On the market segments for 2021, Logic system revenue was €9.6 billion, which is a 30% increase from last year. Memory system revenue was €4.1 billion, which is a 39% increase from last year. Installed Base Management sales was €5 billion, which is a 35% increase compared to previous year. In 2021, we had total bookings of € 26.2 billion, more than 2x increase year-on-year, reflecting customers’ strong demand for EUV and DUV technology. Our R&D spending increased to €2.5 billion in 2021, as we continue to invest in innovation across our product portfolio. Overall, R&D investments as a percentage of 2021 sales was about 14%. SG&A was about 4% of sales. Net income for the full year was €5.9 billion, 31.6% of net sales, resulting in an EPS of €14.36. Improvements in working capital contributed to a free cash flow generation of €9.9 billion for 2021, mainly driven by customer down payments following the very significant order intake this year. We continue to invest in support of our roadmap and planned capacity ramp. Excess cash will be returned as per our policy. With that, I would like to turn to our expectations for the first quarter of 2022. We expect Q1 total net sales to be between €3.3 billion and €3.5 billion. Lower guidance relative to Q4 is primarily due to a number of so-called fast shipments. These are shipments in the quarter for both EUV and deep UV that will not complete factory acceptance after. As we have discussed in prior quarters, fast shipments are in support of customer’s desire to bring systems into production as quickly as possible. By skipping some of these testing in our factory, we can shorten the cycle time. Final testing and formal acceptance then takes place at the customer side, at which time we will recognize revenue. The value of the Q1 shipment is expected to be between €5.3 billion and €5.5 billion, which means approximately €3 billion of revenue is expected to be deferred to subsequent quarters. We expect our Q1 Installed Base Management sales to be around €1.2 billion. Gross margin for Q1 is expected to be around 49%. The lower gross margin quarter-on-quarter is primarily due to the fast shipment impact of delayed revenues and lower upgrade business compared to last quarter. The expected R&D expenses for Q1 are around €760 million and SG&A is expected to command at around €210 million. Our estimated 2022 annualized effective tax rate is expected to be between 15% and 16%. Regarding our capital return, ASML paid total dividends of €1.4 billion in 2021, made up of the 2020 final dividend and the 2021 interim dividend. ASML intends declare a total dividend with respect to 2021 of €5.50 per ordinary share. Recognizing the interim dividend of €1.80 per ordinary share paid in November 2021, this leads to a final dividend proposal to the general meeting of €3.70 per ordinary share. Total 2021 dividend is a 100% increase compared to the 2020 dividend. The 2022 Annual General Meeting of Shareholders will take place on April 29, 2022, in Veldhoven. 2021 was a rather exceptional year in terms of share buyback. ASML acquired 14.4 million shares for a total amount of €8.6 billion as part of our current and previous program. With that, I would like to turn the call back over to Peter. Peter Wennink: Thank you, Roger. As Roger has highlighted, we have another record year of both sales and profit. We are seeing unprecedented customer demand across all market segments from both advanced and mature nodes, driving demand across our entire product portfolio. Looking to 2022, as we our lower Q1 revenue due to Q1 fast shipments, as highlighted by Roger, we expect a significant increase in revenue for the remaining quarters. For the full year, we expect a net sales increase of around 20% compared to 2021. And bear in mind that this 20% sales growth does not include revenue from six EUV fast shipments in Q4 2022 and if you would take the full shipment value of the six EUV fast shipments into account, the growth percentage would have been 25%. For our EUV business, we still expect to ship around 55 systems, of which we expect revenue from six systems to be the deployed in 2023 -- to 2023 due to fast shipments. This translates to an expected EUV system revenue of around €7.8 billion in 2022. In our deep UV and application business, we expect growth in both commercial and dry systems, as well as continued demand for petroleum and inspection systems. We are also planning fast shipments for some deep UV systems, but we do not expect this to impact our 2022 revenue due to inherently shorter installation times for deep UV. We expect revenue growth of over 20% to non-EUV system revenue. For Installed Base Management business, service revenue will continue to scale with the growing installed base systems and customers will continue to look at all methods to add wafer capacity, and although, we saw upgrades pulled into 2021 to improve wafer output capability at our customers, we expect those type of installed base options to also stay very much in demand this year. We currently expect 2022 installed base revenue to be up around 10% year-on-year. Looking at the market segments, given the very strong demand situation and our continued push to increase capacity, we see growth in both Logic and Memory in 2022. In Logic, we have talked for some time now about the digital transformation that is underway as we move to a more connected world. The growing application space and secular growth drivers translated very strong demand for both advanced and mature nodes. With this continued strong demand, we expect Logic system revenue to be up more than 20% year-on-year. In Memory, we also expect to see continued growth of our business this year. With customer expectations of DRAM bit growth in the high-teens this year and the property tool utilization, bringing at very high levels, customers need to add capacity in addition to planned technology transitions to meet demand. As DRAM customers migrate to more advanced nodes, we also expect to see an interest in EUV demand for Memory. We expect the 2022 Memory system revenue to be up around 25% year-on-year. With this unprecedented demand exceeding our capacity, we are ramping our output capability to meet the strong demand. Of course, this comes with challenges and we are even more vulnerable than running at maximum capacity as there is little room for recovery when things don’t turn out as planned and COVID, unfortunately, is not behind us and it impacts everyone including the workforce in our industry and in the supply chain. We also have to work through supply chain challenges of material and component shortages and COVID-related supply chain disruptions in our workforce, so we have hired a significant number of people throughout last year, and although, we are currently in our plant workforce FTE numbers, they still need to be trained and brought up to a learning curve. All of what I just mentioned needs maximum management retention and monitoring, creativity and flexibility of all our partners and stakeholder. We are working closely with our customers to address these challenges. We are doing fast shipments, skipping some of the testing and factory and completing the final acceptance testing at the customer side, which provides more capacity as quickly as possible. This reduces cycle time factory and frees up cabin space in our premium, so we can ramp up capacity more quickly. In addition, we continue to provide software upgrades, which will give our customers more capacity. As I said before, we are doing our utmost to respond as best as we can external challenges doing COVID-related absentees and material shortages in our supply chain. Also as we reported earlier in January, we had a fire just after the New Year inside a part of our factory in Berlin. The fire was extinguished during the night and fortunately no persons were injured during this incident. But the fire occurred in part of one production building on the site in Berlin and a smoke partly impacted an adjacent building. We have been able to resume production in parts of this building already and the other building on the site have not been affected and are fully operational. The manufacturing of deep UV components have been restarted. And although, there was some disruption regarding components for deep UV, we expect to remediate this in such a way that it will not affect our output and revenue plan for deep UV. And as to EUV, the fire affected part of the production area of the wafer plan, which is a module in our EUV systems. Based on our current insights, we believe we can manage the consequent certify without significant impact on our EUV system output in 2022. Overall, while it’s also a very unfortunate event, we are optimistic about the current situation and are very grateful for the enormous efforts and creativity of our Berlin staff. On High-NA EUV, we are currently building the first High-NA system in our new clean room in Veldhoven. We received an order for an EXE:5000 in Q4, the fifth order in total for the EXE:5000 model, which provides order coverage for planned High-NA shipments in 2024. In addition, at the beginning of this year, we received the first order for the EXE:5200. EXE:5200 is ASML’s next model High-NA system, which we intend to launch in 2024 after the introduction of our first High-NA system. EXE:5200 will provide the next step for electrographic performance and productivity. Demand continues to be extremely strong. Even to the point where we believe we are also this year following significantly short of the customer demand. Looking beyond 2022, global megatrends, we talked about at Investor Day, a broadening in the application space and fueling demand for advanced and mature nodes, growth in semiconductor end markets and increasingly higher lithography intensity, driving demand for our products and services. We along with our supply chain partners are actively adding and improving significant system build capacity to meet future customer demand. In short, we are more confident in our long-term growth opportunities. With that, we’d be happy to take your questions. Skip Miller: Thank you, Roger and Peter. The, Operator, will instruct you momentarily on the protocol for the Q&A session. Beforehand, I would like to ask that you kindly let yourself to one question with one short follow-up if necessary. This will allow us to get to as many callers as possible. Operator, can we have your final instructions and then the first question, please. Operator: Thank you. Our first question comes from Joe Quatrochi with Wells Fargo. Please go ahead. Joe Quatrochi: Yeah. Thanks for taking the question. I am curious on the DUV side, demand that you are forecasting for 2022 is maybe quite a bit stronger than we had initially anticipated. How do we think about the 20% growth in the context of the capacity that you and your supply chain are adding relative to, I think, in the past, you were talking about hopefully trying to build some inventory -- buffer inventory as well this year? Roger Dassen: Yeah. Joe, it’s a good question and I think it’s important to look at the full picture here, including what happened in the last quarter, because you might recall that in the last quarter we were expecting for the full year of deep UV or the non-EUV business, if you want to call it that way, approximately €8.2 billion, that was the expectation we had going into the quarter, and of course, we landed substantially below that. We landed at €7.4 billion. So there was about a €800 million shortfall that we then made up in Q4 with higher EUV sales and higher installed base sales. So what we are seeing now is that, that €800 million, we are now trying to get that into the plan for this year. And we can do that, because, of course, that’s the material in -- for that production was in fact already produced by the supply chain. So we have the material, so now it’s a matter for us within our manufacturing plans here in Veldhoven to get that done. And if you then do the math, right? So we told you last year that we believe we were going to be kind of flat year-on-year for deep UV. That was under the expectation that last year was going to be €8.2 billion. So it’s €8.2 billion this year plus the €800 million that you transitioned from last year. That gets you to about the €9 billion that you get to when you add the 20% to last year. So that’s the math. So, in fact, it’s the transition from the shortfall of €800 million that we had in Q4, we have the supply chain for that and now it’s a matter of us trying to squeeze that into the manufacturing capability here in Veldhoven. Joe Quatrochi: Got it. That’s helpful color. And then just a quick follow-up, on your Memory revenue growth expectations, I think, the other expectations for just total Memory WFE is more flat. So can you help us maybe understand just how much of that is being driven by EUV adoption? Roger Dassen: Yeah. I mean, well, at least what we can say on EUV adoption is that, about 20%, a little north of that even of the EUV sales that we are going to see this year, system sales, will be manually. So if you take about €8 billion, a little under €8 billion, if you look at the revenue number for EUV, 20% of that is related to Memory. So that’s already a substantial part, I would say, at that number. Joe Quatrochi: Very helpful. Thank you. Roger Dassen: You are welcome. Operator: Our next question comes from Krish Sankar with Cowen and Company. Please go ahead. Krish Sankar: Yeah. Hi. Thanks for taking my question. I have two of them. First one, Roger, for FY 2022, I got the revenue guidance on the tax rate. Did you give a gross margin and OpEx guidance for the full year? Roger Dassen: We didn’t, but I am happy to talk about it and give you a little bit of flavor as to where we see this land. And frankly, I think, we are going to see a gross margin for this year a little over the gross margin that we had for last year. So I would say, it’s around 53%. That would be my expectation for the year. And I guess, your next question -- your next implied question is going to be, so help me understand that. Of course, we start with a -- it’s 52.7% for last year, which we have to recognize is already helped by the very significant software upgrade packages revenue that is in there, and that, as we have said before, is very helpful to the gross margin. So if you neutralize the very high impact that that had on the gross margin for last year, I would say for the year, you probably take out about 0.7%. So that gets you to a base -- a normalized base of 52%. And then there’s a few things, first off, the MXZ pricing, which is primarily driven by the fact that we only have these in this year in comparison to the mix of last year. That would give you about 1.5%. And then we talked a little bit about the High-NA impact on the gross margin. That’s a little bit higher this year than it was last year. I would expect about 0.5% there. So if you do -- if you add it all up, then you get 53%. Then there’s a little bit of a swing factor as to the composition of deep UV in terms of drive versus emerging. At this stage, we expect both of them to grow about 20%. So I would say, it’s about neutral for the gross margin, but that’s the buildup to the 53%. In terms of OpEx, we have only guided the numbers for Q1, as we typically do, only for the quarter. But I think it’s safe to say that the 4% on SG&A and 14% on R&D, I think, those assumptions are safe assumptions for the full year. And then, obviously, on the basis of the €22.3 billion, that sort of implied in the 20% year-on-year growth for revenue. Peter Wennink: We actually gave you complete P&L. Krish Sankar: Thank you, Roger, you already helped me on my model. And I just had a quick follow-up for Peter or Roger. The 20% growth in deep UV this year, can you give some color into how much of that you expect DUV Memory to grow and how much would DUV for foundry growth this year? I think, Roger, you mentioned dry and emerging roughly split half at this year, is that correct? Roger Dassen: That is correct. That is what I said. I expect both to go up about -- with the same percentage, about 20%, yeah. And then we gave you the numbers for the increase in Memory and Logic… Krish Sankar: Yeah. Roger Dassen: …and I gave you the EUV number for Memory. So, frankly, I think that’s given you all the building blocks you need to come up with the right number there. Peter Wennink: Yeah. And just to remind you that Logic will be up more than 20% year-on-year and Memory up around 20%... Krish Sankar: Yeah. …year-on-year, so and then with the EUV numbers, you can probably figure it out. Krish Sankar: Yeah. Very helpful. Thank you folks. Thank you very much. Operator: Our next question comes from Aleksander Peterc with Societe Generale. Please go ahead. Aleksander Peterc: Yes. Hi. Hi. Good afternoon and thanks for taking my question. Just very briefly on fast shipments, do I understand it correctly that this will now become systematic for EUV going forward? And so this would then imply that you take the biggest hit from this kind of new practice in 2022 and from 2023 the impact should that be negligible as you have only a little more revenue deferred then what you recognized from the previous year, but it then cancels out, is that a correct way of looking at things? Thanks. Roger Dassen: Yeah. Aleksander, I think, you see it right. So and it’s not just energy, but we also do this for immersion. So it’s the combination of those two. And at least for this year, this will be the standard practice. And then if you look at this year, as we mentioned to you, there’s about €2 billion that falls into subsequent quarters as a result of this as it relates to Q1. What we are going to do is try and -- at least try and limit the installation time both for energy and for immersion tools as a result of which the impact by the end of the year should be a lot lower, because we try to make the delta between the shipment moment and the acceptance by the customer that made us more and we think we can squeeze out two maybe even three weeks in the install time in order to get there. So that’s what we are driving. And as a result of that, it is our expectation that the amount at the end of this year. I mean, we referenced the six EUV tools, so that would be about €1 billion. So that’s what we are trying to work towards. That the spillover, if you like, from the last quarter into the next quarter is going to be only about €1 billion. That’s what we are driving towards and then what we have done, so that means that during the year, we are going to gain, if you like, about €1 billion in the subsequent quarters and are only going to lose for the full year €1 billion into next year. Whether this will be the standard practice for years to come, we will just see how this works. If this works well as we anticipate for ourselves and also for the customers, if we can really prove as we have done in last year that we can do this without a quality impact, if you like on, in the field and we are pretty comfortable that we can do that. Then I think this will be appreciated by the customer and also leads to efficiency on our end. So then indeed also for subsequent years this will be the practice, and then indeed, you won’t have any impact anymore in the years to come I think. Peter Wennink: Yeah. And one small addition to that, this will apply to systems that we have a, whether it’s -- there is a significant enough level of confidence that we don’t run into acceptance problems in the field. So let’s say, the first type of a new tool, the first four or five systems you will probably do the traditional factory acceptance test in Veldhoven, just to make sure that if you run into any issue, that is a big R&D group that can actually help you solve the problem instead of moving that problem to the field. So I would have completely compare with what Roger said with the exception that on what we call new product introduction, the first couple of tools, we will probably do the traditional way. Aleksander Peterc: Okay. Thank you, very much. Operator: Our next question comes from C.J. Muse with Evercore. Please go ahead. C.J. Muse: Yeah. Good morning. Good afternoon. Thank you for taking the question. I guess first question on gross margins, if I take that 53% and what you guided Q1, it looks like you are going to exit the year at roughly 54%. Is that the right number to use? And as part of that, that is the low end of your 2025 target model? So, I guess, I’d love to hear your thoughts on what you are going to do here exiting calendar 2022 and the confidence that provides to you in terms of your future outlook? Roger Dassen: Yeah. C.J., so somewhere in the year, indeed, if we want to get to 53% for the full year and we start with 49%, somewhere in the year will have higher percentages. And also, as I mentioned, somewhere in the year, we will gain on the revenue side, right, on the sales side, because we lose €2 billion in the first quarter, only €1 billion for the year. So we are somewhat going to gain the building. So, and of course, those two are related. Whether that is going to be in Q4, I cannot tell you. So somewhere in the course of this year, we are going to see an improvement of the gross margin beyond the 53% that. Bear with me it’s a little bit too early to already start making predictions on the gross margin for 2023. C.J. Muse: That’s helpful. Thank you. I guess, maybe a bigger picture question for you, regarding visibility. I think this is the highest kind of backlog coverage you have ever had as a company, and I guess, obviously, part of that EUV related and obviously part of it’s the supply constraints out there. But just curious, how do you think about that and I guess how are you thinking about the capacity you need to add into, I think, you talked about a $1 trillion kind of semiconductor market and the confidence you have today on 2023 revenue growth? Peter Wennink: Yeah. I think it’s a very good number. It’s a very good question. I don’t give you -- I can’t give you the exact number. But one thing is for sure that, we will ship more systems, deep UV and EUV in 2020 as compared to 2021 and it’s my expectation the same thing will happen in 2023. And as a matter of fact, I also expect that in 2023, our EUV shipments will go over 60 systems. And part of it has to do with the cycle time reduction we talked about could be through fast shipments and to shortening the installation times. Yes, that will happen. And also for deep UV, I think, we can still squeeze, start squeezing and reducing cycle time in the supply chain, so we can do potentially more systems next year than we do this year. Having said that, I think we are still in a situation where, and I said it on the video, but also on several occasions today, that the demands for all our technology also specifically deep UVs so significantly higher than what we can currently make. When we look at our maximum capacity today, I think, the demand, which is not orders, but the demand, which customers would like to give us an order, but they don’t, because we don’t have the capacity, to be around 40% higher than what we can currently make. Everything moves out and so what we cannot ship today, we will move to 2023. So now what we cannot ship in 2023, we will move to 2024. That actually means that we need to add capacity beyond what we are currently planning and that is exactly what we are doing today. I think we had a capacity plan beyond 2023 that we are currently have decided on, but we haven’t had this internally, but we haven’t gone for that fully yet in the supply chain with our critical suppliers, which we will do this quarter, yeah. So, I think, we want to be in a situation that starting 2024, we will be able to meet whatever demand the customers have. I think we are in a situation where on leading-edge immersion and EUV, the customers know what to go and we don’t want to keep pushing excess demand being described as the demand over our maximum capacity to move -- constantly move into the next year. So this is what we are doing. I already gave you an indication on the EUV for 2023 that will be above 60, because of all the measures that we have taken. But I think we also -- we are -- we have taken internally the decision that we indeed need to increase our capacity beyond that and that will be something which we will be discussing with you all, probably, hopefully, when we get all the confirmation from our critical suppliers next quarter. C.J. Muse: Very helpful. Thank you. Operator: Our next question comes from Sandeep Deshpande with JPMorgan. Please go ahead. Sandeep Deshpande: Yeah. Hi. Thanks for having me on. I mean, my question is actually a sort of follow-up. When I look at your 2025 guidance, Peter, you have guided to €25 billion to €30 billion in sales. But when you look at your sales over the last four quarters, sorry, your orders over the last four quarters and add to that your Installed Base Management, you are already running at a four-quarter run rate of over €31 billion actually. So is the, well, does the 2025 guidance that we updated or do you think that this was a different sort of period we have been in or how should we looking at that 2025 guidance of ASML? Peter Wennink: Well, let’s do everything in the right order, yeah. And that’s, first, look at the customer demand and the demand curves and have very in-depth discussion, as you know, with our customers on their CapEx plans and their CapEx plans are driven by what they currently see as being short in customer demand, not only for this year and for next year, but longer term. And I can only remind you of the very, let’s say, confident messages that our President have given over the last few days on how they feel about the strength of the demand and we can also go into the details why we think the longer-term demand will be higher. And having said that, on top of that, there’s going to be a push by the drive for technological sovereignty, there will be incentives around the globe to actually build that capacity. That comes on top, which I don’t think will translate into significant fast capacity anywhere before 2024. I will be talking therefore at the earliest, probably, more like 2025, 2026. Now, having said that and going back to the previous question, I think, this is why we are looking at our maximum capacity for us and in the supply chain. And I gave the answer, I think this is the work that we are doing today. And when we have that confirmed that we can actually do that, then that would be the time also to relook at the guidance and to see whether we should indeed adjust some of the numbers that we gave you a quarter ago, but that in that order. We have to get ourselves comfortable with the demand situation vis-à-vis our customers. We are translating that into a capacity number, which we need to get confirmed with our key supplier scenario, the size and terms and VDLs of this world, yeah, that needs to be confirmed and that will lead to construction activities, where you are likely with add square meters, yeah. And that means if you have that confirmation, we can say, okay, when we have that, looking at the demand situation, what should we do with the 2025 range that we gave you and when we have concluded that, we will come back to you with that information. Sandeep Deshpande: Thanks, Peter. Just one quick follow-up on, I mean, you have indicated in your recent release that you have got the new e-beam tool shipping. Is this e-beam business now going to become much more significant in the next few years as these new tools shift, because I mean, clearly, your lithography business has flourished massively, but your e-beam business has been slower to take off. So can you make any comments on that? Peter Wennink: Yeah. I think the fact that I think the 5x5 beam the its close to a 1,100, I mean, this is definitely a tool, actually, I think it’s been packed today. So that will ship. We have high expectations of it. It looks good as when we ship to our first customer. And yes, when we get the qualification of that tool. I believe that’s going to be a driver to for higher sales numbers for our e-beam business. Next to the fact that our single beam business was also very strong Sandeep Deshpande: Thank you very much. Operator: Our next question comes from Francois Bouvignies with UBS. Please go ahead. Francois, if your phone is on mute, please unmute, so you may ask your question. Francois Bouvignies: Hi. Can you hear me now? Peter Wennink: Yes. I can hear you. Francois Bouvignies: Yeah. Yeah. Sorry about that. So my question actually was on High-NA and the release you did with Intel. And you disclosed four orders back in 2018, now you had an order last quarter, you were discussing another one with Intel today, and in addition, you changed your disclosure of the net bookings, including High-NA now. So my question is should, what should we expect going forward in terms of High-NA in terms of activity, should we see more and more High-NA going forward in the following quarters? And coming back to your 2025 guidance, with five sales of High-NA, you have 60 if I count correctly in your backlog now, so how should we think about this moving part and your forecast out of 2025? Peter Wennink: Yeah. I think on the 2025 number, we also said in my introductory comments that the EXE:5000, which is the R&D tool, which is the development tool. So there’s five of it that will be shipped starting in 2023 through 2024. So in 2025, it’s the High-NA tool. It’s the one that we -- that’s a 5200, yeah, the one that we received the first order for this quarter, the first quarter of 2022. I think, yes, so you will expect or you may expect. But given the long lead times of these tools, there is going to be more order activity for the High-NA 5200 going forward, I would expect that. But that’s driven by indeed the shipment plan 2025. Now, I think it was Sandeep that asked the question on the 2025 model, I think, that this is not a time to piecemeal, you give you that 2025 model, but we will work going back to that. But I think High-NA is not so much connected in 2025 to, let’s say, the size of the industry and the demands in the industry. It’s really technology transition. So the way it looks now, I think, we are still pretty solid on the plan. I think we said it in our last quarter, with the big evolutionary step from Low-NA to High-NA was the optics. Basically, bigger optics, very significant challenges in measuring the mirrors and we succeeded. It was a success. It is a success so we can execute. And this is what we are doing now. I mean, if we go to the Veldhoven factory now, you would see this massive tool. I mean we showed you the press conference at kind of a picture of some of our engineers, the production engineers is in front of to frame or you can just see the size of the thing we are executing. And I think receiving the first order for 5200, which is going to have, let’s say, new standards, setting new standards for lithographic performance in terms of imaging and overlay it also sets a new stance for productivity. So, like Roger said at the press conference, this is the tool that will go for a price very significantly over €300 million. Roger Dassen: Yeah. Francois, one additional comment on the five, as we also said at the Investor Day, the reason we have five there is not because of shipments, because I expect more shipments than 2025 and five. The reason we said in all scenarios five is because of revenue recognition because this is an entirely new product. Francois Bouvignies: Okay. Roger Dassen: And therefore, it’s hard to predict at this point in time how the installation is going to happen. How the testing is going to pan out, et cetera, et cetera. So that’s why we said very conservatively, just put five into any model. Francois Bouvignies: Okay. Roger Dassen: So it’s not related to volume or shipments. It’s just a pretty conservative estimate it might take a bit longer before these are actually recognized with reference. So that’s why we put in five. Francois Bouvignies: Yeah. That’s very clear. Thank you, both. And maybe just quick follow-up on the supply constraint, which was a highlight last quarter, I believe, and you don’t talk too much about supply concern anymore. So should we read that it’s improving and you see the risk less important now? I mean how should we think about the supply constraints that you had last quarter and how is it now? Peter Wennink: Yeah. I think it hasn’t eased. But the fact is, if life is tough, you just adjust to it. I mean, that’s what we are doing. So basically it’s a fact of life and it’s a daily battle of our sourcing people to make sure that we get guarantees on supply -- in the supply chain, because we don’t buy those components. Now those components are being bought by our suppliers. But what we do, we actually consolidate the shortages, which is especially components, microchips from different layers in the supply chain. So we actually consolidated and we bring it into what we call a scarcity center. And then we classify those components by semiconductor manufacturer. And then we get on the phone with them and then, say, can you help us, you can help us by what’s on stock giving it to us or helping us to manage that through the broker system or the distributor system or making sure that those particular chips get somewhere. And it’s not many, I mean, it’s a few hundred to a few thousand of a certain type, because we don’t make that many systems and that’s how we manage this. And we are able to do this day by day by day. But I don’t think the situation has gotten any better. It’s just that we got better at managing it. Francois Bouvignies: Okay. Make sense. Thank you very much. Operator: Our next question comes from Didier Scemama with Bank of America. Please go ahead. Didier Scemama: Hey. Good afternoon, gentlemen. Thank you. I just wanted to check or double check a couple of things on EUV for next year. So can you talk a little bit about what your capacity will be for low and high-NA? And then, what do you think could be the shipment number for 2023 versus the revenue, at least the unit, so because obviously you have got six units ship shifting from 2022 to 2023, so if you can help me understand that and I have got a quick follow-up for Roger on the cash flow? Thank you. Roger Dassen: Yeah. Didier, on the -- on -- what we expect for 2023, as Peter pointed out, we are working on a capacity over 60 for next year. So that’s on low-NA. We would get the benefit of the six going from 2022 into 2023. Frankly, we would also if we continue to do a fair ship have a few systems go from 2023 into 2024. So if we are able to continue to drive down installation time, we might gain one, maybe two systems. But, net-net, I think for next year, you should expect output in revenue to more and more at the same level. So I think the over 60 in terms of capacity that Peter referenced, I think, is probably the number to look at. In terms of High-NA, it’s going to be very, very small, right, into 2023, because we expect to have it the first shipment of the key modules in -- at the end of 2023, but I wouldn’t hold my breath whether that leads to revenue recognition in 2023. Didier Scemama: Understood. Very clear, Roger. So on the cash flow you had a sort of an exceptional working cap in Q4 and amazing free cash for the full year. I just wondered if you could help us understand effectively what’s your free cash flow expectations for fiscal year 2022 and when do you think the working cap normalizes in your cash flow statement roughly, is it first half, second half, that would be helpful? Thank you. Roger Dassen: Yeah. So you are right. So I think last year was a pretty spectacular year from a cash flow perspective. We had nothing from €5.9 million and free cash flow of €9.9 million. So that’s a pretty good conversion rate. But that was exceptional. I think it was exceptional, primarily driven by the huge order intake that we had this year and the huge contingent of EUV and that’s a primary source of down payments in there. I would expect for this year to more and more neutralize that. So we are never guiding free cash flow, but I would say, to have an expectation that in the steady state, we are going to look at somewhere around 100% or a little bit below that, because they are still growing, I think, it’s probably the same assumption for the free cash flow development in the years to come. Didier Scemama: Yeah. You mean longer term cash conversion rate? Roger Dassen: Cash conversion rate. Exactly. Yes. Didier Scemama: Excellent. Thank you. Operator: Our next question comes from Amit Harchandani with Citi. Please go ahead. Amit Harchandani: Thank you. Hello everyone. Amit Harchandani from Citi. Two questions if I may. My first question, Peter, goes back to the comments you have made about assessing your capacity and supply. As ASML continues to get bigger, obviously, there’s this whole top geopolitics in the background, how are you strategically thinking about bringing this capacity online? Are you going to pursue the way you have? Are you looking at doing more vertical integration? Is it more regional diversification? Just trying to get a sense of how you are looking at it in terms of strategically adding capacity as you look to build for the next five years to 10 years and I have a follow-up. Peter Wennink: Yeah. I think you have been at our Supervisory Board Meeting. I mean, this is, of course, the question that we are addressing not only asking ourselves, because we already did that, but we are addressing these questions. I think vertical integration, to answer that question, I don’t think that is something which we -- I would say, we try to avoid it. Sometimes we are forced to it. I mean, based on the Berliner Glas, vertical integration, we actually acquired a supplier. But that had some very clear reasons. I mean they had to do with succession planning at the supply. But also that the technology at that particular supply became more and more critical for the performance of the system. So it’s not an active, it is more, you could say that is more a reactive way of looking at growth. Geographical, clearly, but it’s -- but geographical and especially against the background of the geopolitical discussions that are ongoing, of course, is something which is highly sensitive. So, but, yeah, we actually look at if we need to build capacity, what’s the best place to go? What are the best conditions to add capacity, which is a number of issues that we will look at. It has to do with the availability of suppliers that can help us, workforce talent. Are we going somewhere where we know we will be heavily competing for workforce talent with some other major players or you could say, giants, that would, of course, put you into a -- into more difficult situation? It is incentives that can be provided by governments. I mean and that includes the -- where we currently have our manufacturing locations, but also we are looking at areas where we might not have significant manufacturing, but we could. So, I think, these are all things that we are looking at. It’s too early to give you. There is a finite answer and I think, whenever come to the conclusion and we need to go public, we will go public. But these are all the things that we are discussing right now in the company, in the management board and with the supervisory board, because you are right, we need to add significant capacity. I mean this is not 5% to 10% growth driver. Amit Harchandani: Thank you, Peter. And as an unrelated follow-up, you have talked about demand being unprecedented and significantly higher than capacity. Of course, you put forth your simulation scenarios at the CMD last year. Just in terms of trying to manage against the risk of over ordering, double ordering, what are you doing in terms of the checks discussion with your customers? We know the secular trends are positive and the industry will remain cyclical, but what are you doing from your side to minimize, if I may call it, the potential risk of oversupply once this capacity all comes online? Thank you. Peter Wennink: Yeah. One major thing is that, our build capacity, I mean, still, when you look at our cost of sales, and Roger can comment on that. The vast majority of our cost of sales is what we buy. So I think, for ASML to add build capacity is the minority of our cost of sales. Because we are basically outsourcing, which is one of the reasons why we are not actively pursuing vertical integration. We actually love the fact that we have suppliers that are better at what they do than what we do. So, having said that, we are not afraid of investing in capacity, nor is our supply chain, which is most of our critical suppliers are either, like, are exactly the same position as we have and some other supplies are more diversified. So they are able to grow. But it’s -- you are right. There is always this risk of looking at where we are today, listening to the CapEx expansion plans of our major customers in Asia and in the U.S., looking at the geopolitical situation and striving for more technological sovereignty, not complete, but more with incentive programs means that, yes, we will add capacity. Now we can have, look at our simulation model and looking at industry analysts, we have been blatantly wrong. So we can do this again or we can say, now let’s look forward, let’s have a longer term view. I do believe and I think we are not the only one, also our customers that, the compound annual growth numbers for the semiconductor industry will lead to $1 trillion business by the end of the decade. We are over €500 billion now, which means that that €500 billion was created in 40 years time. So we have less than 10 years to just double it again. So I think we will need that capacity, yeah. Now, your question is, will this create temporary overcapacity and it could very well be. These fabs are big, they are humongous. It’s all about scale, yeah. So, yes, when everything is timed in the same couple of years, you probably see overcapacity, but structurally and longer term, we need that capacity. So I am not that concerned, yeah, we should do it. And my last reason why I think we should do it is, on some of these technologies, we are unfortunately, for the industry, the sole source of supply. I don’t want to be in a situation, as I said it before, that we have to keep pushing the over demand, yeah, from one year to the other. We have to create a situation where we carry the responsibility together with our customers that we can supply what the market needs and that could indeed mean that there is potential, a bit of overcapacity. Given the fact that we are very bad at predicting the growth rate of this industry, I am okay with that. But that’s perhaps as an answer of an old man. Amit Harchandani: Thank you, Peter. Operator: Our next question comes from Stephane Houri with ODDO BHF. Stephane Houri: Yes. Thank you very much. Thank you. Good afternoon, everyone. I just want you have more color maybe on your Chinese business, what’s the size of your Chinese business? What was the growth for the last quarter and what the outlook… Peter Wennink: I mean, you are talking about the China business, I guess, in particularly China domestic business, I think, that’s what you are focus on it. Stephane Houri: Yeah. Peter Wennink: And then if you look at the China domestic business, last year, 2021, it was about €1.8 billion and our expectation is that, this will grow at the same base as company growth. So it will grow about 20% for this year, which in the supply constraints environment is exactly what you would expect that China would grow exactly at the same pace as the other deep UV business would be growing and that’s okay. So €1.8 million last year, expected to grow to approximately €2.1 million this year. Stephane Houri: Thank you very much. And a follow-up was the about the service margin of deep UV, I think you said that was improving. When do you think it will get at the corporate level? It is still -- are we still talking three years? Peter Wennink: Yeah. So last year it was about 30%. We expect it to get to about 40% this year. And then I think it will take until 25 this time same, I think, and so you really get it to corporate level. So I think we have made major steps in that becoming more efficient, obviously, also demand to machine hour very much improving simply because of the scale of EUV. But, ultimately, that’s the trajectory that we are on. So from this point onward the a lot smaller. But in 2025, I think, we will get to approximately corporate gross margin. Stephane Houri: Thank you very much. Peter Wennink: You are welcome. Skip Miller: All right. We have time for one last question. If you were unable to get through on this call and still have questions, please feel free to contact ASML Investor Relations Department with your question. Operator, may we have the last caller, please? Operator: So for our last question, we have Jerome Ramel with BNP Paribas. Please go ahead. Jerome Ramel: Yeah. Good afternoon. Maybe a last question for Roger to come back to the free cash flow in Q4, just on the short-term liabilities, it increased by €3 billion, which is well over doubled over Q4 last year. Is it purely the account payables and so can you give us a number of Q4 -- compared to Q4 last year? Thank you. Roger Dassen: No. No. It’s not the account payable. That would be a bit rough to our supply chain, right? So that’s not what it is. It is primarily -- it really is a down payment. So it’s down payments on new orders, orders for 2021 and even beyond that point. That’s what it said. That’s what it is on fiscal. Again, we were looking at an order intake this year of €26 billion and that’s really what it is. I mean you are looking at the end of this year. At the end of 2021, you are looking at €8.5 billion of down payment and a significant part of that came in Q4. Peter Wennink: For which we are going to spend that money on building the machines and investing in wafer this year. Roger Dassen: Yeah. Peter Wennink: I mean, we didn’t get that money from nothing. Roger Dassen: Yeah. Jerome Ramel: Okay. And so… Roger Dassen: Everyone… Jerome Ramel: … would it be fair to assume that most of the down payment has been done and gradually as you say normalized in the course of 2022? Roger Dassen: Yeah. Exactly. So that’s why I say this is a very special year, because we get all these down payments. Next year, you will still get down payments, but you would also do shipments where you only get a percentage, because you already received the down payments in the year and the year before. And that’s why I said that you will see cash conversion… Peter Wennink: Yeah. Roger Dassen: … to 100%, frankly, below 100%, because of the fact that this is still a growing company. So that’s why I think in the longer term, you would see cash conversion drop below the 100% at that point. Jerome Ramel: Thank you very much. Skip Miller: All right. Now on behalf of ASML, I’d like to thank you all for joining us today. Operator, if you could formally conclude the call, I would appreciate it. Thank you. Operator: This now concludes the ASML 2021 fourth quarter and full year financial results conference call. Thank you all for participating. You may now disconnect your lines.

ASML Holding N.V. (NASDAQ:ASML) Stock Update and Future Outlook

- Deutsche Bank reaffirms its "Buy" rating for ASML Holding N.V. (NASDAQ:ASML), increasing the price target from EUR 700 to EUR 900.

- ASML's stock performance outpaces broader market indices, with a significant 28.13% surge over the past month.

- Upcoming earnings report expected to show earnings of $6.36 per share and revenue of $8.81 billion, indicating continued strong performance.

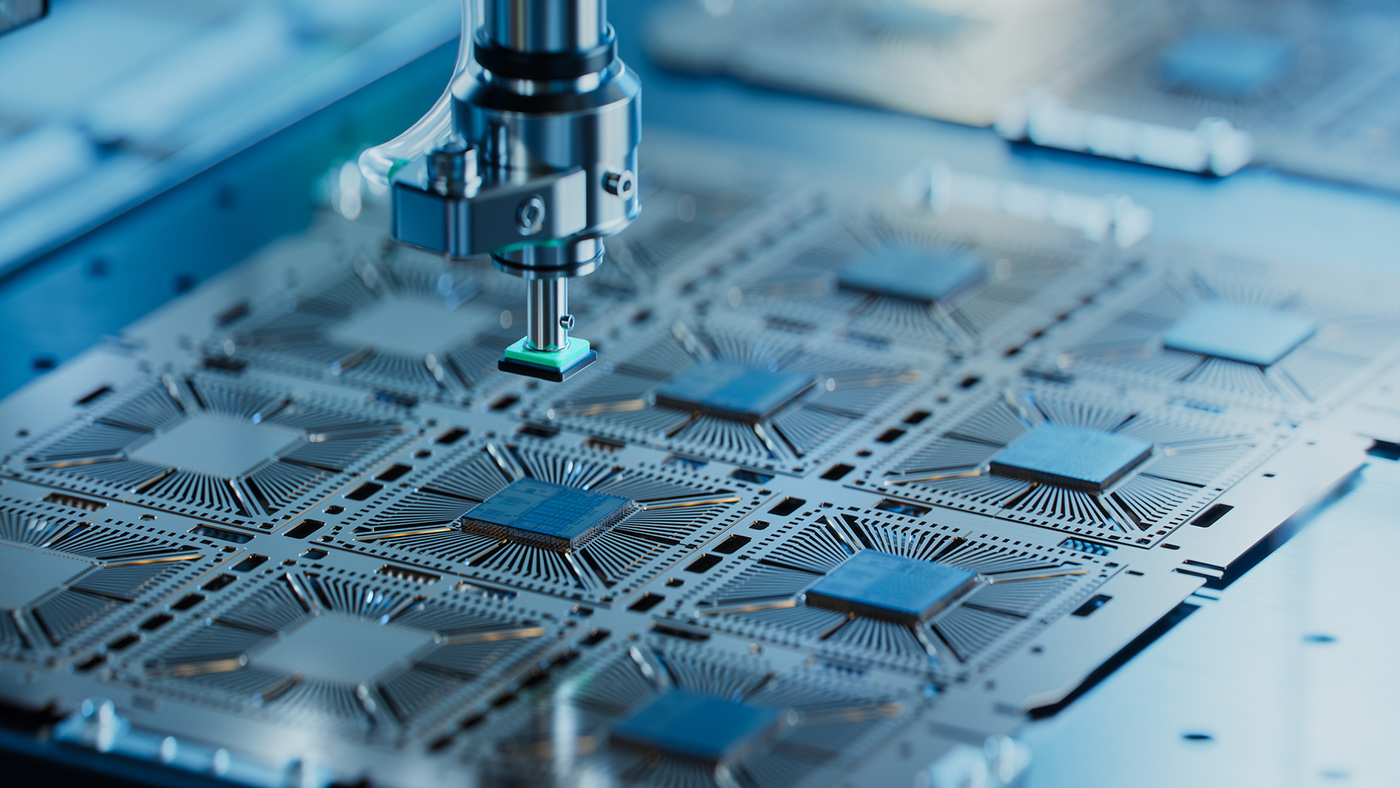

ASML Holding N.V. (NASDAQ:ASML) is a key player in the semiconductor industry, specializing in the development and manufacturing of photolithography machines used in the production of integrated circuits. As a leader in this niche, ASML competes with other major technology companies like Applied Materials and Lam Research. On September 30, 2025, Deutsche Bank reaffirmed its "Buy" rating for ASML, with the stock priced at $970.51. The bank also increased ASML's price target from EUR 700 to EUR 900, indicating strong confidence in the company's future performance.

ASML's recent stock performance has been impressive. The stock closed at $962.61, marking a 1.17% increase from the previous session. This gain outpaced the broader market indices, with the S&P 500, Dow, and Nasdaq showing smaller increases of 0.26%, 0.15%, and 0.48%, respectively. Over the past month, ASML's stock has surged by 28.13%, significantly outperforming the Computer and Technology sector's 7.4% gain and the S&P 500's 2.87% increase.

Investors are eagerly awaiting ASML's upcoming earnings report, set for release on October 15, 2025. Analysts expect the company to report earnings of $6.36 per share, reflecting a year-over-year growth of 9.66%. The consensus estimate also forecasts ASML's revenue to reach $8.81 billion, indicating a 7.34% increase compared to the same quarter last year. These projections suggest continued strong performance for ASML.

Currently, ASML is trading at approximately $973.93, with a price increase of about 1.18%, translating to a gain of $11.32. The stock has fluctuated between a low of $966.23 and a high of $975.64 during the day. Over the past year, ASML has reached a high of $977.48 and a low of $578.51. The company's market capitalization stands at approximately $382.95 billion, with a trading volume of 342,523 shares, reflecting strong investor interest.

ASML Holding N.V. (NASDAQ:ASML): A Pillar in the Semiconductor Industry

- Justin Patterson from KeyBanc sets a price target of $800 for ASML, indicating a potential increase of 6.04%.

- China's reliance on ASML's EUV technology underscores its critical role in the global chip ecosystem.

- Despite recent volatility and a stock price decrease of 8.33%, ASML's strategic importance and market position remain strong.

ASML Holding N.V. (NASDAQ:ASML) is a key player in the semiconductor industry, known for its advanced lithography machines. These machines are crucial for producing the latest generation of microchips. ASML's technology is essential for companies like Nvidia, which rely on it to maintain their competitive edge in the global market.

On July 17, 2025, Justin Patterson from KeyBanc set a price target of $800 for ASML. At that time, the stock was priced at $754.45, suggesting a potential increase of 6.04% to reach the target. This target reflects confidence in ASML's market position and technological advancements, particularly in its EUV technology.

Patrick Moorhead from Moor Insights & Strategy emphasizes China's reliance on ASML's EUV technology as a significant advantage for the company. This dependence highlights ASML's critical role in the global chip ecosystem, reinforcing its market strength. Despite a recent stock price decrease of 8.33%, ASML's strategic importance remains evident.

ASML's stock has shown volatility, with a daily range between $730.60 and $760.90. Over the past year, the stock has seen a high of $1,077.05 and a low of $578.51. This fluctuation reflects the dynamic nature of the semiconductor industry and the challenges it faces, including geopolitical tensions and supply chain disruptions.

ASML's market capitalization is approximately $296.65 billion, with a trading volume of 10.71 million shares. These figures underscore the company's significant presence in the market. As the semiconductor industry continues to evolve, ASML's role in shaping its future remains crucial, particularly in light of its technological innovations and strategic partnerships.

ASML Holding N.V. (NASDAQ:ASML) Receives "Overweight" Rating Amid Semiconductor Industry Developments

- KeyBanc upgraded ASML Holding N.V. (NASDAQ:ASML) to "Overweight," signaling a positive outlook for the company.

- ASML's EUV lithography technology is crucial for the global chip ecosystem, providing a competitive advantage.

- Despite the upgrade, ASML's stock experienced an 8.33% decrease, highlighting market volatility.

ASML Holding N.V. (NASDAQ:ASML) is a key player in the semiconductor industry, known for its advanced lithography machines used in chip manufacturing. On July 17, 2025, KeyBanc updated its rating for ASML to "Overweight," indicating a positive outlook on the stock. At that time, ASML's stock was priced at $754.45.

ASML's technology, particularly its EUV (Extreme Ultraviolet) lithography machines, is crucial for the global chip ecosystem. As highlighted by Patrick Moorhead from Moor Insights & Strategy, China's reliance on ASML's EUV technology is a significant advantage for the company. This dependence acts as a protective barrier, or "moat," for ASML in the competitive semiconductor market.

Despite the positive rating from KeyBanc, ASML's stock has seen a decrease of 8.33%, dropping by $68.57. The stock has fluctuated between a low of $730.60 and a high of $760.90 during the day. Over the past year, ASML's stock has reached a high of $1,077.05 and a low of $578.51, reflecting its volatility in the market.

ASML's market capitalization is approximately $296.65 billion, indicating its significant presence in the industry. The company's trading volume stands at 10.71 million shares, showing active investor interest. As the semiconductor industry continues to evolve, ASML's strategic position and technological advancements remain crucial for its growth and stability.

ASML Shares Plunge 10% as 2026 Growth Outlook Wavers Despite Strong Q2 Beat

ASML (NASDAQ:ASML) shares fell more than 10% intra-day today after the semiconductor equipment maker signaled uncertainty about its 2026 growth outlook, even as its second-quarter results exceeded expectations.

The company had previously projected back-to-back growth years for 2025 and 2026, but now says it can no longer confirm revenue growth for 2026 due to rising macroeconomic risks. While ASML did not formally withdraw guidance, the shift represents a notable change in tone and rattled investor confidence.

For the second quarter of 2025, ASML reported net sales of €7.69 billion, surpassing the €7.54 billion consensus. Gross margin came in at 53.7%, also ahead of estimates, while earnings per share were 14% higher than Jefferies' forecast.

New bookings reached €5.5 billion, beating expectations of €4.47 billion. Orders for low and high numerical aperture EUV systems accounted for €2.3 billion of the total. However, bookings for memory-related systems dropped 41% year-over-year, reinforcing concerns about softening DRAM demand.

Looking ahead to Q3 2025, ASML provided revenue guidance of €7.4 billion to €7.9 billion, below the consensus forecast of €8.18 billion. Gross margin is expected to land between 50% and 52%, roughly in line with market expectations.

For full-year 2025, ASML reaffirmed its 15% revenue growth target, implying €32.5 billion in sales, consistent with its previous guidance range and broadly aligned with consensus. The company narrowed its gross margin forecast for the year to around 52%, from an earlier range of 51% to 53%.

Despite delivering a strong second quarter, ASML’s cautious stance on 2026 has heightened concerns about the semiconductor industry's demand outlook and triggered a sharp sell-off in its shares.

ASML Holding NV (NASDAQ:ASML) Surpasses Earnings and Revenue Estimates

- ASML Holding NV reported earnings per share of $6.85, beating the estimated $5.94, with revenue reaching $8.94 billion, surpassing forecasts.

- The company's outlook for 2026 is cautious due to geopolitical and economic uncertainties, despite strong demand from artificial intelligence sectors.

- ASML's financial strength is evident with a net profit increase to €2.3 billion and a robust gross margin of 53.7%, alongside a healthy price-to-earnings ratio of 31.92 and a debt-to-equity ratio of 0.21.

ASML Holding NV, listed on the NASDAQ as ASML, is a leading supplier of semiconductor manufacturing equipment. The company is renowned for its advanced lithography machines, which are crucial for producing microchips. ASML's major clients include industry giants like TSMC and Intel. The company competes with other semiconductor equipment manufacturers, but its cutting-edge technology gives it a competitive edge.

On July 16, 2025, ASML reported impressive financial results, with earnings per share of $6.85, surpassing the estimated $5.94. The company's revenue reached approximately $8.94 billion, exceeding the forecasted $8.79 billion. This strong performance is attributed to the robust demand for semiconductor manufacturing equipment, driven by the artificial intelligence boom.

Despite the positive results, ASML has issued a warning about its outlook for 2026, citing geopolitical and economic uncertainties. Chief Executive Christophe Fouquet emphasized the challenges posed by macro-economic and geopolitical developments, which may impact the company's growth prospects. However, the demand from artificial intelligence customers remains strong, providing some optimism for the future.

In the second quarter of 2025, ASML's net profit surged to €2.3 billion, up from €1.6 billion in the same period last year. The company achieved total net sales of €7.7 billion, with a gross margin of 53.7%. ASML also reported a significant increase in new orders, reaching €5.6 billion, driven by the surge in demand for its chip-making machines.

Looking ahead, ASML anticipates third-quarter sales to be between €7.4 billion and €7.9 billion, with a gross margin between 50% and 52%. For the full year of 2025, the company expects total net sales growth of approximately 15% compared to 2024, maintaining a gross margin around 52%. Despite the challenges, ASML's financial metrics, such as a price-to-earnings ratio of 31.92 and a debt-to-equity ratio of 0.21, indicate a strong financial position.

ASML Holding N.V. (NASDAQ:ASML) Earnings Preview: A Look into the Semiconductor Giant's Financials

- ASML Holding N.V. (NASDAQ:ASML) is set to release its quarterly earnings with an anticipated EPS of $5.87 and revenue of approximately $8.84 billion.

- The company's EUV lithography technology positions it as a leader in the semiconductor industry, facing competition from Nikon and Canon.

- Despite geopolitical risks, ASML's financial metrics, including a P/E ratio of 31.14 and a debt-to-equity ratio of 0.21, highlight its strong market position and financial health.

ASML Holding N.V. (NASDAQ:ASML) is a key player in the semiconductor industry, specializing in the production of photolithography machines used in chip manufacturing. The company is renowned for its EUV lithography technology, which is crucial for producing advanced semiconductor chips. ASML's competitors include companies like Nikon and Canon, but its cutting-edge technology gives it a competitive edge.

On July 16, 2025, ASML is set to release its quarterly earnings, with Wall Street estimating an earnings per share (EPS) of $5.87 and revenue of approximately $8.84 billion. Analysts anticipate ASML will surpass these estimates, driven by strong demand for AI chips and its EUV lithography tools. The Zacks Consensus Estimate places revenue slightly lower at $8.55 billion, but still indicates a positive outlook.

ASML's anticipated earnings growth is supported by a 37.5% year-over-year increase in EPS, rising from $4.32 to an estimated $5.94. Revenue is expected to grow by 27.2%, reflecting the robust demand for AI chips. Despite challenges from export restrictions to China, demand for DUV systems provides some relief, highlighting ASML's resilience in the face of geopolitical risks.

The company's financial metrics reveal a strong market position. ASML's P/E ratio of 31.14 and price-to-sales ratio of 8.84 indicate a high market valuation, justified by its competitive advantage and growth prospects. The enterprise value to sales ratio of 8.67 and enterprise value to operating cash flow ratio of 23.43 further underscore its strong financial standing.

ASML maintains a healthy balance sheet with a debt-to-equity ratio of 0.21, indicating low debt levels. The current ratio of 1.52 suggests good liquidity, ensuring the company can cover its short-term liabilities. Despite potential risks from China's export controls, ASML's dominant position in the semiconductor market and strong demand for its technology support a positive outlook.

ASML Holding N.V. (NASDAQ:ASML) Earnings Report and Financial Health Overview

- ASML Holding N.V. (NASDAQ:ASML) reported an EPS of $6.80, surpassing the estimated $6.12.

- The company's revenue of $8.77 billion slightly missed the forecasted $8.78 billion.

- ASML's financial health remains solid with a P/E ratio of 31.21 and a low debt-to-equity ratio of 0.20.

ASML Holding N.V. (NASDAQ:ASML) is a prominent player in the semiconductor industry, specializing in the production of advanced chip-making equipment. As the world's largest supplier in this sector, ASML plays a crucial role in the global technology supply chain. The company faces competition from other major players like Applied Materials and Lam Research.

On April 16, 2025, ASML reported earnings per share (EPS) of $6.80, exceeding the estimated $6.12. However, its revenue of $8.77 billion slightly missed the forecasted $8.78 billion. Despite the positive EPS, ASML's stock has declined, as highlighted by Barrons, due to concerns over sales guidance affected by tariffs from the Trump administration.

ASML's sales guidance has been negatively impacted by the ongoing U.S. trade war, which has introduced uncertainty into its business operations. The company has warned about the volatility of tariffs, which could further affect its future projections for 2025 and 2026, as noted by Reuters. This uncertainty has led to a cautious outlook for the company.

The company's financial metrics provide insight into its current standing. ASML has a price-to-earnings (P/E) ratio of 31.21, indicating the price investors are willing to pay for each dollar of earnings. Its price-to-sales ratio is 8.36, reflecting the value placed on each dollar of sales. The enterprise value to sales ratio is 8.04, showing the company's total valuation relative to its sales.

ASML's financial health is further supported by a low debt-to-equity ratio of 0.20, indicating a conservative use of debt. The current ratio of 1.53 suggests a solid ability to cover short-term liabilities with short-term assets. Despite challenges, ASML's financial metrics demonstrate a stable foundation, providing some reassurance to investors amidst the current uncertainties.