Demystifying Bottom-Up Investing: Expert Insights & Plans

In the vast universe of investment strategies, "bottom-up" investing stands out as an approach that emphasizes the fundamental analysis of individual companies, rather than a top-down approach that starts with the broader economic or market environment. This method puts companies under the microscope, analyzing their strengths and weaknesses without initially taking the wider industry or economy into account. Lets dive deeper into this investment approach.

What is Bottom-Up Investing?

At its core, bottom-up investing is about individual companies and their intrinsic value. It's a method that involves evaluating a company's financials, business model, management, competitive positioning, value at risk, and other micro-level factors. If a company looks promising based on these criteria, it might be deemed a good investment, regardless of what's happening in the broader economy or its sector. While bottom-up investors start with the company and then might consider the industry or economy, top-down investors do the opposite. They first look at global macroeconomic trends, then industry sectors, and finally drill down to specific companies. For instance, if a top-down investor believes that the renewable energy sector is poised to grow, they might then look for individual companies within that sector to invest in.

While the principles of bottom-up investing are often applied to stock market investments, they can be applied to other asset classes. For instance, real estate investors might apply a bottom-up approach by focusing on the specifics of individual properties rather than the overall property market trend in a region. The strategy requires a hands-on approach and a willingness to delve deep into company specifics. Casual investors or those without the time or inclination to research might find this method challenging. However, for those with a passion for understanding businesses and an eye for detail, bottom-up investing offers an intellectually stimulating approach to the market, one that can be both fulfilling and potentially profitable.

Example of Bottom-Up Investing

To understand the essence of bottom-up investing, consider this scenario: you've analyzed the market and feel it's overpriced. However, upon deeper research, you stumble upon several companies that seem undervalued. You might opt to invest in these companies, anticipating the market will eventually recognize their real worth. Over a period, as the market acknowledges their undervaluation, their stock prices could climb, earning you a profit. Conversely, had you employed a top-down strategy, your reaction might have been to liquidate your assets and hold onto cash. This would shield your investments in the interim, but you'd risk missing the prospective profits as those undervalued firms potentially outshine the broader market trends.

Given the unpredictable nature of stock markets, giving the bottom-up (BU) strategy a shot can be rewarding. If your portfolio thrives, it's a nod to the efficacy of this method for you. However, if results are lackluster, consider revisiting your strategy. Every investment strategy will produce varying outcomes. But it's essential to intertwine individual company analysis with a holistic view of the market landscape. A comprehensive understanding of market dynamics can enhance your prospects for more substantial returns.

image: financestrategists.com

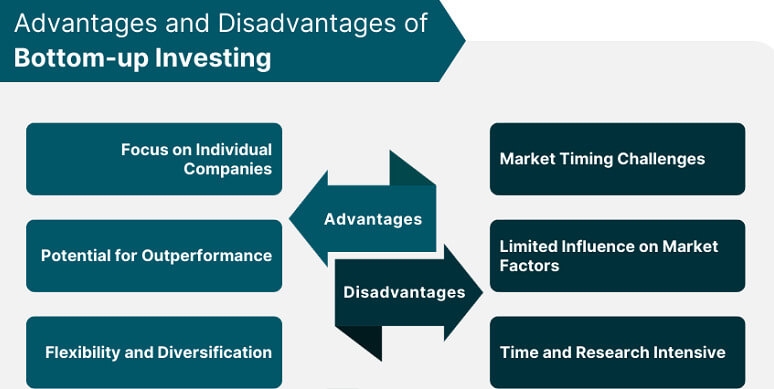

Advantages of Bottom-Up Investing

Focus on Value: Since this method focuses on individual companies, investors can often find stocks that are undervalued, offering potential for higher returns.

Diversification: Since the broader economic or industry trends aren't the primary focus, an investors portfolio might be spread across different sectors, naturally leading to diversification.

Less Macro Noise: Bottom-up investors are not overly concerned about predicting broad market trends or economic cycles. They are more insulated from the noise of macroeconomic headlines.

Challenges of Bottom-Up Investing

Time-Consuming: Thoroughly analyzing individual companies can be a lengthy process. It requires meticulous research and often, a deeper understanding of each business.

Potential Overlook of Broader Trends: While focusing on company-specific details, investors might miss out on broader sectoral or economic trends that could affect a company.

Requires Expertise: Effective bottom-up investing often requires a certain level of expertise in financial analysis to accurately judge a companys potential. This often requires the help of a financial advisor.

Keys to Success

If youre considering bottom-up investing, here are some keys to making the most of this strategy:

Continuous Learning: Given the deep dives required for individual companies, an investor should always be open to learning. This includes understanding evolving business models, technologies, and industry shifts.

Networking: Engaging with other investors, analysts, and industry experts can provide unique insights that might not be immediately apparent from company financials alone.

Discipline: Stay true to your analysis and convictions. The stock market can be volatile and sentiment-driven in the short term. Its essential not to be swayed by short-term noise and instead focus on long-term value.

Regular Reviews: While the initial analysis is crucial, regularly reviewing your investments with portfolio performance reports is equally important. Companies evolve, leadership can change, and unforeseen events can alter business trajectories.

Risk Management: No matter how thorough the analysis, investing always carries risks. Set stop-loss levels, diversify sufficiently, and be prepared to adjust your portfolio when necessary.

Conclusion

Bottom-up investing offers a unique way to approach the stock market, driven by the belief that individual companies can outperform irrespective of wider economic circumstances. While it requires considerable effort and expertise, many legendary investors, including Warren Buffett, have used this approach to achieve remarkable success. For those considering adopting a bottom-up strategy, it's essential to be prepared for intensive research. But if you have the patience and dedication to deeply understand a company, this approach might be a good fit, potentially paving the way for substantial returns on your investments.

This type of investing stands as a testament to the idea that understanding individual businesses, their strengths, vulnerabilities, and potential can lead to sound investment decisions. While it's not a one-size-fits-all strategy, for those with the inclination and patience, it can be a pathway to building a robust and resilient investment portfolio. Like any investment approach, it requires dedication, continuous learning, and a sprinkle of intuition. But for those up to the challenge, the rewards can be considerable.

This content was created by AI